Wireless Infrastructure Market Size, Share & Industry Analysis, By Connectivity Type (5G, 4G & LTE, 3G, 2G, and Satellite), By Infrastructure (Small Cells, Mobile Core, Macro-Cells, Radio Access Networks, Distributed Antenna System, Cloud RAN, Carrier Wi-Fi, Backhaul, and SATCOM), By Platform (Government & Defense and Commercial), and Regional Forecast, 2026-2034

Wireless Infrastructure Market Size & Trends

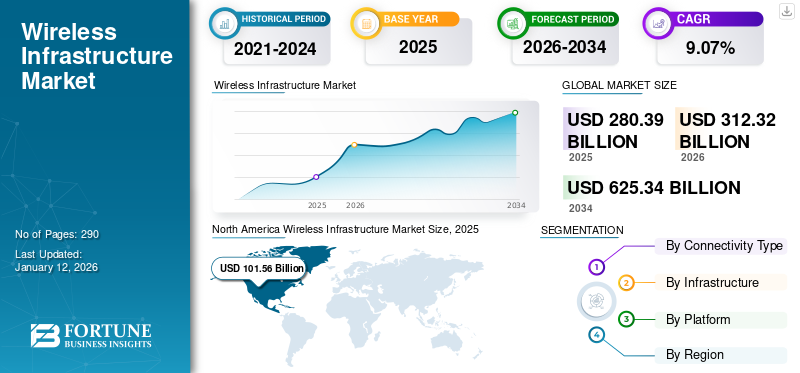

The global wireless infrastructure market size was valued at USD 280.39 billion in 2025 and is projected to grow from USD 312.32 billion in 2026 to USD 625.34 billion by 2034, exhibiting a CAGR of 9.07% during the forecast period. North America dominated the wireless infrastructure market with a market share of 36.22% in 2025.

Wireless network infrastructure encompasses connections such as 5G, 4G & LTE, 3G, and 2G, primarily serving mobile subscribers. Bring Your Own Device (BYOD) and Wear Your Own Device (WYOD) are becoming more popular, surging the demand for high-speed data and speedier connectivity in the commercial communication industry. Additionally, increased use of satellite-based connectivity in the defense and marine industries is expected to drive the market growth during the forecast period.

The infrastructure comprises small cells, macro-cells, RAN, distributed antenna systems, cloud RAN, carrier Wi-Fi, mobile core, front-haul, backhaul, and satellite connection. With increased connectivity in countries, such as the U.S. and the U.K., the scope of equipment technology has been expanding in recent years, particularly in small-cell equipment. The infrastructure consists of antennas along with supporting hardware and software components.

The wireless infrastructure market is highly dynamic and competitive, driven by rapid adoption of 5G technology, increasing mobile data traffic, and expanding IoT connectivity. Key players in this market are global telecommunications and technology companies that provide a broad range of wireless infrastructure solutions including network equipment, 5G base stations, fiber backhaul, and virtualized radio access networks (RAN). The market is led by a mix of telecommunications giants and technology innovators, with Huawei, Samsung, Ericsson, Nokia, and Cisco among the foremost players driving 5G network expansion and next-generation wireless technologies worldwide.

The COVID-19 pandemic caused unprecedented challenges to numerous corporate operations due to the economic downturn and other associated problems. Delays in 5G hardware production and supply chain disruptions, led to short-and-medium term setbacks for 5G deployment, potentially hindering the global market’s progress in the near term. Conversely, manufacturers globally are implementing digital transformation strategies to deliver essential business value in aspects such as competitive superiority, enhanced operational efficiency, and market differentiation. The deployment of 5G and private wireless networks can satisfy business automation needs and essential connectivity demands. These factors are expected to speed up the advancement of wireless network infrastructure in the years ahead.

RUSSIA-UKRAINE WAR IMPACT

Military-Driven Technological Advancements To Amplify Product Demand

The Russia-Ukraine war led to the growing use of wireless services across Europe, especially in the NATO countries. Defense forces have relied on advanced telecommunication equipment and internet services for military communication and navigation.

In the recent ongoing Russia and Ukraine war, SpaceX’s Starlink antenna project has amplified the effectiveness of GPS and anti-detection systems. The rise in military conflicts has given rise to the demand for secure transmission systems, along with the agility for accurate operations.

The war has demonstrated the deployment of multi-platform anti-jamming antennas to prevent detection and intrusion. Multi-platform anti-jamming antennas can be mounted on UAVs and vehicles and are suitable for ground and aviation applications. Such undiscoverable systems are anticipated to boost market growth in the coming years.

In addition, most telecom providers have provided free international calls to Ukraine or are scrapping roaming charges with the country. European telecom ETNO Group offered SIM cards to refugees in neighboring countries, activated the 'SMS donation' programs to help different organizations aiding refugees, offered free Wi-Fi in refugee camps, and provided Ukrainian channels in IPTV packages for free.

Wireless Infrastructure Market Key Takeaways

Market Size & Forecast

- 2025 Market Size: USD 280.39 billion

- 2026 Market Size: USD 312.32 billion

- 2034 Forecast Market Size: USD 625.34 billion

- CAGR: 9.07% from 2026–2034

Market Share

- North America dominated the wireless infrastructure market with a 36.22% share in 2025, supported by aggressive 5G deployment, a large consumer base, and strong investments from both public and private sectors. The U.S. market leads the region, fueled by demand for high-speed connectivity in telecommunications, defense, and IoT applications.

- By connectivity type, the 5G segment is expected to witness the fastest growth, driven by next-generation network rollouts, low latency, and broader connection capabilities. Meanwhile, macro cells continue to hold the largest infrastructure share, providing extensive coverage in urban and semi-urban areas.

Key Country Highlights

- United States: Rapid expansion of 5G services by operators like AT&T and Verizon, coupled with rising mobile data traffic and government-backed initiatives for secure wireless networks in defense applications.

- China: Leading the adoption of 5G and advanced wireless technologies with over 1.3 million base stations and a vast subscriber base exceeding 700 million, supporting IoT and industrial automation.

- India: Experiencing exponential growth in mobile subscribers and smartphone adoption, driving demand for upgraded wireless infrastructure and high-speed internet connectivity.

- Europe: Presence of key manufacturers like Ericsson, Nokia, and Inmarsat, focusing on next-generation wireless solutions and supporting network densification across urban centers.

WIRELESS INFRASTRUCTURE MARKET TRENDS

Growing Need for Edge Data Centers and DAS is Propelling the Market Growth

Current trends in 4G, 5G, and beyond-5G networks encompass densification and coverage enhancement strategies, spectrum developments, network personalization and smart features, virtualization, and cloud integration. These trends offer service providers greater opportunities for network customization, deployments, and optimization. Major participants in the market are concentrating on OpenRAN technology, which instigates a transformation in the industry by encouraging open interfaces within the mobile network, leading to a greater diversity of industry players and suppliers. Moreover, the rise of multi-tenant edge data centers supports rising demand from OEMs for personalization services in augmented reality/virtual reality, Artificial Intelligence (AI), and IoT applications. Spectrum offers radio interface assets for wireless communication. The spectrum is reallocated and traditional technologies are substituted with new technologies in a specific frequency band. For instance, the spectrum of 850 MHz and 1900 MHz that was initially utilized by 2G and 3G technologies has been repurposed to support 5G technologies.

- North America witnessed wireless infrastructure market growth from USD 82.79 Billion in 2023 to USD 92.05 Billion in 2024.

Additionally, Distributed Antenna System (DAS) are commonly deployed in wireless infrastructure as they enhance coverage in large places such as stadiums, skyscrapers, and convention centers. DAS boosts the downlink analog RF signal and delivers it to passive antennas through a network of taps, coaxial cables, and splitters, enhancing signal quality and ensuring reliable communications.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET OPPORTUNITIES

Increasing Focus on Aviation Safety and Situational Awareness is Propelling the Market Growth

The demand for aircraft interface devices has risen in recent years due to several factors, including an increased focus on enhancing flight safety and situational awareness. To achieve better flight safety and situational awareness, it is essential to integrate data from various aircraft systems, such as navigation, weather, and engine metrics. The aircraft interface device serves as a central hub for data exchange, facilitating communication among different avionics systems and enabling efficient information sharing. By promoting seamless data integration, these devices enhance situational awareness and assist pilots in making well-informed decisions, ultimately contributing to improved flight safety. Additionally, aircraft interface devices allow for real-time monitoring of critical aircraft parameters, including engine performance, fuel efficiency, and overall system health.

MARKET DRIVERS

Increase in Demand for High-speed Internet Connectivity to Drive Market Growth

Wireless technology is experiencing tremendous growth owing to the introduction of technologically advanced solutions across the globe. The rapid expansion of mobile network coverage has reached remote areas. An increase in demand for wireless technologies results in reduced data usage charges due to growing competition in the industry. Continuous rise in network traffic, deployment of infrastructure, and rising demand for wireless connections due to numerous advantages drive the growth of the market. Additionally, the growing demand for 5G services and advanced high-speed internet connectivity is further propelling market growth.

- For instance, the U.S. launched 5G services in 2019, and accelerated network connectivity in 2021. Key players, such as AT&T and Verizon introduced their C-BAND spectrum in 2021, with both companies collectively investing USD 68.8 billion in spectrum acquisition.

European operators have also been building out their 5G networks. China’s biggest operators, such as China Unicom, China Mobile, and China Telecom, have aggressively added new 5G customers monthly. The Chinese MIIT reports state that the country has over 700 million 5G subscribers and over 1.3 million 5G base stations. An increase in demand for fast internet services and better connectivity continues to fuel innovations in wireless technologies. Rising technological advancements and growing network traffic are key drivers of the wireless infrastructure market growth.

Growing Adoption of IoT Boosts the Growth of the Market

Rapid growth in data usage on advanced electronic devices such as smartphones, defense electronics, and rugged desktops is majorly driving the necessity of wireless networks across the globe. Over the past few years, the number of smartphone users and mobile data traffic has witnessed exponential growth.

According to an Ericsson report, there were nearly 1.9 billion Internet of Things (IoT) connected devices in use across the globe in 2024. The number of IoT-connected devices will reach 38.6 billion by 2025 globally. The rising use of these devices creates a huge demand for components such as sensors, transmitters, receivers, and processors. Thus, the growing demand for such infrastructure systems and components drives market growth.

- In October 2021, COMSovereign, a U.S.-based developer of 5G Communication Systems and 4G LTE, entered into a partnership with Total Network Solutions (TNS) to explore how blockchain technology could enhance wireless network security in the U.S. Under the project, the companies will develop and incorporate eSIM, advanced multi-factor authentication, and a tokenized Mobile Equipment Identifier (MEID), also known as Enhanced MEID (E-MEID), to securely record network security data on a blockchain.

Furthermore, the rising demand for advanced electronic devices to support digitalization in the aerospace and defense sector is further increasing the use of Internet and network services. In response, network operators are expanding their capabilities by deploying advanced wireless infrastructure across different countries, thereby driving market growth.

MARKET RESTRAINTS

Complexities Associated with the Development of Wireless Infrastructure Systems and Design Architecture to Hinder Market Growth

Ensuring effective distribution and connectivity remains a top priority for manufacturing firms. The progress in technology and the introduction of new products are expected to drive the need for robust wireless infrastructure. However, several issues impede market growth, including connectivity challenges, and delays in standardization. The swift growth of wireless networks also raises concerns such as network breaches and violations of data privacy, further hindering market development. Wireless signals are often obstructed by various barriers such as gates, walls, and people, leading to communication inefficiencies and occasional connectivity loss. Signal strength relies on the distance and positioning of the receivers.

The significant expenses related to designing and developing different wireless infrastructure components such as sensors, transmitters, receivers, and processors, obstruct the growth of the market. Moreover, wireless transmission may be slower and less efficient compared to wired networks, which can hinder the growth of the market.

SEGMENTATION ANALYSIS

By Connectivity Type

Rapid Adoption of 5G Technology to Boost 5G Segment’s Growth

The market is divided into 5G, 4G & LTE, 3G, 2G, and satellite, based on connectivity.

The 5G segment is expected to increase at the quickest rate during the forecast period. The global demand for 5G technology is being fueled by the next-generation technology's high speed, broader connection, and low latency. Customers' needs may not be met by 4G technology, which consumes a considerable amount of data and necessitates effective wireless internet service. With the increased use of wireless services and smart devices, networks with more capacity, such as 5G technology, are required. The satellite segment accounted for 39.75% of the total market share in 2026.

- The 4G & LTE segment is expected to hold a 26.1% share in 2024.

To know how our report can help streamline your business, Speak to Analyst

By Infrastructure

Increase in the Installation of Satellite Devices with Macro Cells in Commercial Applications to Propel Growth Potentials

By infrastructure, the market is divided into SATCOM, macro cell, Radio Access Network (RAN), small cells, Distributed Antenna System (DAS), cloud RAN, carrier Wi-Fi, mobile core, and backhaul.

The macro cell category held the largest share of the wireless infrastructure market in 2026, accounting for 21.37% of the total market share. Macro-cell sites provide wide-area network coverage and support diverse connectivity needs, including 4G and 5G devices. It is also utilized to boost smartphone, mobile device, and IoT device coverage to support 4G and 5G technology. The wireless infrastructure comprises multiple macro-cells, each covering a radius of approximately 20 to 30 kilometers in urban and suburban areas. Existing infrastructure modernization is a lengthy process that often requires government permissions for the construction and deployment of well-distributed consumer networks. The infrastructure also necessitates the growth of antenna sites in other countries to meet consumer demand. The market is likely to grow in the next few years as demand for wide coverage facilities grows in the urban and semi-urban areas.

By Platform

Growing Need for Military Communication Devices to be Upgraded to Wireless Connectivity to Propel the Market

By platform, the market is divided into commercial and government & defense.

The government & defense segment accounted for the majority of the market share in 2024, and it is predicted to increase at a substantial rate over the forecast period. Due to growing government expenditure to enhance the military and maritime sector to a considerable capability, the government & defense segment is predicted to rise at a quick rate. The commercial segment accounted for 23.80% of the total market share in 2026.

WIRELESS INFRASTRUCTURE MARKET REGIONAL OUTLOOK

The global market is segmented, based on region, into North America, Europe, Asia Pacific, the Middle East, and the Rest of the World.

North America

North America Wireless Infrastructure Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America captured the highest market share, with the market size valued at USD 101.56 billion in 2025 and increasing to USD 112.33 billion in 2026, driven by the strong presence of manufacturers and service providers in the region. This dominance is further ascribed to the huge consumer base and significant demand from the defense sector during the forecast period. The U.S. wireless infrastructure market is a critical and rapidly growing segment of the global wireless infrastructure industry. It is driven by aggressive 5G deployment, high consumer demand for fast connectivity, and strong investments from both private and public sectors. The US market is projected to reach USD 95.96 billion by 2026.

Europe

Europe held the second-largest wireless infrastructure market share in 2024, due to the presence of key manufacturers and technology leaders in this region, such as Inmarsat plc, Ericsson, Three UK, and Deutsche Telekom. The UK market is projected to reach USD 24.54 billion by 2026, while the Germany market is projected to reach USD 22.01 billion by 2026.

Asia Pacific

Asia Pacific is expected to witness rapid growth in the next few years, owing to considerable increases in commercial mobile subscribers and internet users in developing nations such as India and China. The Japan market is projected to reach USD 13.29 billion by 2026, the China market is projected to reach USD 28.62 billion by 2026, and the India market is projected to reach USD 16.94 billion by 2026.

Middle East

The market in the Middle East is expected to grow at a considerable CAGR due to a large number of mobile users and the expanding tourism sector, which contributes to the demand for robust wireless infrastructure.

Rest of the World

The market in the rest of the world is expected to grow rapidly due to the rise in the adoption of global wireless communication devices.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Players Focus on Acquisitions and Collaborations to Strengthen their Market Position

The competitive landscape of the market highlights the dominance of several major players, such as Huawei Technologies Co., Ltd., Qualcomm Technologies Inc., ZTE Corporation, and NEC Corporation. The prevalence of these companies can be linked to their comprehensive portfolios of wireless hardware, software solutions, and equipment, along with significant investment in R&D and strategic acquisitions.

These prominent companies are exploring different growth strategies, such as mergers, joint ventures, and acquisitions. They are also focused on launching new products, forging long-term agreements with service providers, and establishing strategic partnerships with OEMs efforts that are anticipated to enhance their position in the wireless infrastructure sector.

LIST OF KEY WIRELESS INFRASTRUCTURE COMPANIES PROFILED

- Capgemini Engineering (France)

- Ciena Corporation (U.S.)

- Cisco Systems, Inc. (U.S.)

- D-Link Corporation (Taiwan)

- Fujitsu (Japan)

- Huawei Technologies co., Ltd. (China)

- NEC Corporation (Japan)

- NXP Semiconductor (Netherlands)

- Qualcomm Technologies Inc. (U.S.)

- ZTE Corporation (China)

- Nokia (Finland)

- SAMSUNG (South Korea)

KEY INDUSTRY DEVELOPMENTS

- May 2023 - NPPGov, a prominent cooperative purchasing organization serving public safety agencies, announced a partnership with TESSCO Technologies Incorporated, a key value-added distributor in the wireless infrastructure construction sector. Through this agreement, TESSCO provided information technology (IT) services, associated equipment, and support to NPPGov members.

- March 2023 - Cisco and the Telenor Group revealed an expansion of their partnership via the fifth iteration of their Joint Purpose Agreement (JPA). This collaboration focuses on advancing strategic priorities in the regions where both companies operate, including Environmental, Social, and Governance (ESG), automation and as-a-service innovations, multi-cloud solutions, and cybersecurity enhancements.

- April 2022 - Cisco and the Telenor Group strengthened their partnership with the signing of the fourth version of their JPA. This collaboration emphasized joint efforts in digital transformation, business cyber security, and the digital divide.

- July 2021 - Ericsson and Verizon finalized a multi-year 5G deal valued at USD 8.3 billion to enhance and expand Verizon's top-tier 5G network. Moreover, Ericsson would implement cutting-edge 5G technologies, featuring Massive MIMO, Ericsson Cloud RAN, and software.

- June 2021 - Vodafone chose Capgemini Engineering to create the initial commercial deployment of the Open Radio Access Network in Europe. This is significant as Vodafone would transition into a "brownfield" telecom company, contrasting with greenfield telecoms such as Rakuten Mobile and Dish Network, which are constructing 4G/5G Open radio access networks (RANs).

REPORT COVERAGE

The market report provides a detailed analysis of the market and focuses on key aspects, such as product launching, networking technologies, hardware, software systems, market players, and growth opportunities. Moreover, the research report offers insights into key market trends, competitive landscape, market competition, product pricing, market status, and key industry developments. In addition to the factors mentioned above, the report encompasses several direct and indirect factors that have contributed to the growth of the global market growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.07% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation

|

By Connectivity Type

|

|

By Infrastructure

|

|

|

By Platform

|

|

|

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global wireless infrastructure market was valued at USD 280.39 billion in 2025 and is projected to grow from USD 312.32 billion in 2026 to USD 625.34 billion by 2034, at a CAGR of 9.07% during the forecast period.

Registering a CAGR of 9.07%, the market will exhibit rapid growth during the forecast period.

The growth is driven by rapid 5G adoption, rising mobile data traffic, increasing IoT device connectivity, and demand for high-speed internet in commercial and defense sectors worldwide.

North America dominated the market with a 36.22% share in 2025, fueled by aggressive 5G rollouts, a large mobile subscriber base, and significant investments in telecommunications and defense infrastructure.

Wireless infrastructure comprises small cells, macro cells, radio access networks (RAN), distributed antenna systems (DAS), cloud RAN, mobile core, carrier Wi-Fi, backhaul, and satellite connectivity.

The conflict has accelerated military communication needs in Europe, with increased deployment of secure wireless systems, Starlink antennas, and anti-jamming technologies to support defense operations.

5G drives market expansion by offering ultra-low latency, high bandwidth, and broader connection capabilities for mobile subscribers, IoT applications, AR/VR, and private networks in commercial and defense sectors.

Leading companies include Huawei, Samsung, Ericsson, Nokia, Cisco, Qualcomm, and ZTE, focusing on 5G base stations, fiber backhaul, OpenRAN solutions, and next-generation wireless technologies.

Key trends include network densification with small cells, edge data centers, virtualization, OpenRAN adoption, and integration of AI for smart network management.

The market is expected to grow rapidly, supported by expanding 5G rollouts, rising IoT demand, and increasing investments in advanced wireless solutions across telecom, defense, and enterprise sectors.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us