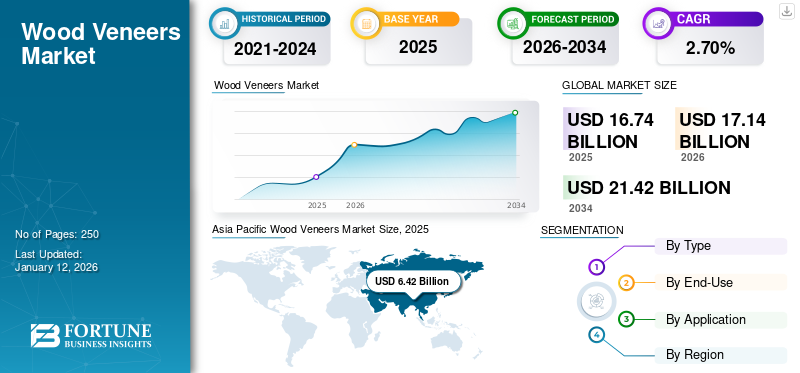

Wood Veneers Market Size, Share & Industry Analysis, By Type (Raw Veneer, Paper Backed Veneer, Phenolic Backed Veneer, Laid Up Veneer, Reconstituted Veneer, and Others ), By End-Use (Residential and Non-Residential), By Application (Interior Design, Cabinets, Wood Furniture, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global wood veneers market size was valued at USD 16.74 billion in 2025. The market is projected to grow from USD 17.14 billion in 2026 to USD 21.42 billion by 2034 at a CAGR of 2.70% during the forecast period. Asia Pacific dominated the wood veneers market with a market share of 38% in 2025.

Wood veneers are thin slices of wood, usually less than 1/8 inch thick, that are glued onto a substrate to create a finished wood look. They are made from several wood types such as anigre, ash, beech, birch, butternut, cedar, cherry, fir, hickory, holly, makore, maple, oak, pine, poplar, sapele, sycamore, and walnut. These veneers are the thin slices of wood bonded onto core panels, such as fiberboard or plywood, to manufacture flat panels used in tabletops, doors, and parquet flooring, cabinets, and furniture parts. The growing product demand in interior designing along with furniture is expected to drive the market. This demand is driven by the increasing preference for sustainable and aesthetically pleasing wood products across several industries. The leading companies operating in the market include Oakwood Veneer, Herman Miller, Inc., Tesha group, Timber Products Company, and BC Veneer Products Ltd.

Global Wood Veneers Market Key Takeaways

Market Size & Forecast:

- 2025 Market Size: USD 16.74 billion

- 2026 Market Size: USD 17.14 billion

- 2034 Forecast Market Size: USD 21.42 billion

- CAGR: 2.70% from 2026–2034

Market Share:

- Asia Pacific dominated the wood veneers market with a 38% share in 2025, driven by rapid urbanization, booming construction activities, and growing demand for eco-friendly interior design and furniture solutions across China, India, and Southeast Asia.

- By type, raw veneers are expected to retain the largest market share in 2025, supported by increasing demand for natural, high-end furniture and decorative finishes in residential and commercial spaces.

Key Country Highlights:

- United States: Demand is driven by growing home renovation projects and adoption of sustainable, premium wood products in residential and commercial interior design.

- India: Rapid urbanization and strong growth in the furniture and construction sectors are fueling demand for eco-friendly, customizable veneer solutions.

- China: Leading market in Asia Pacific, supported by large-scale infrastructure development and demand for cost-effective, high-quality interior materials.

- Germany: Growth is backed by strict sustainability regulations and preference for FSC-certified materials in furniture and construction applications.

- UAE: Ongoing infrastructure development and luxury real estate projects are driving veneer usage in interior finishes aligned with green building practices.

MARKET DYNAMICS

WOOD VENEERS MARKET TRENDS/OPPORTUNITIES

Inclination Toward Sustainable Materials to Fuel Product Demand

The rising consumer preference for sustainable materials is fueling the adoption of veneers as they offer the beauty of natural wood while minimizing waste. Additionally, certification programs such as the Forest Stewardship Council (FSC) ensure that the raw materials are harvested responsibly, minimizing deforestation and promoting biodiversity. By using only sustainably sourced wood, the product reduces the environmental impact associated with timber extraction and supports the long-term health of global forests. Furthermore, contribute to green building certifications such as LEED, where the use of eco-friendly materials is essential. As part of green building practices, natural wood veneers contribute to energy-efficient and environmentally responsible structures while providing aesthetic value in interiors. Moreover, the increasing focus on interior aesthetics in commercial and residential spaces particularly in paneling and furniture coupled with innovations in veneer manufacturing, including engineered wood veneers, have improved product performance and expanded design possibilities. Hence, adherence to sustainable practices along with continuous innovation would be key to capitalizing on emerging trends in this evolving market landscape.

MARKET DRIVERS

Growth of Construction and Real Estate Industries to Surge the Demand for Wood Veneers

The growth of the construction and real estate industries plays a crucial role in driving the product demand. As a key end-use sector, the expansion of construction and real estate directly impacts the product adoption in various applications such as residential buildings, commercial structures, and infrastructure projects. As the global population continues to rise, particularly in emerging economies, urbanization is accelerating. Cities are expanding, increasing the need for new housing, commercial buildings, and infrastructure to accommodate growing populations. This urban growth drives higher demand for construction materials, including wood veneers. Moreover, as urban areas become more populated, there is a push for sustainable and efficient construction materials, which makes the product an appealing choice for both residential and commercial developments.

MARKET RESTRAINTS

Complex Manufacturing Process to Restrain Market Growth

The process of producing wood veneers involves complex techniques such as slicing, drying, and pressing. These processes require specialized equipment and skilled labor, which can drive up manufacturing costs. Additionally, while wood veneers are more affordable than solid wood, they may still be considered expensive compared to alternatives such as laminates and composite materials. Hence, high costs of production and complex manufacturing processes can limit the competitiveness of wood veneers in price-sensitive markets.

MARKET CHALLENGES

Fluctuating Raw Material Prices Poses Challenge to Wood Veneers Market

Fluctuations in raw material prices can impact production costs and profit margins for veneer manufacturers. The cost of raw wood materials, including logs and timber, is subject to variations due to factors such as supply chain disruptions, changes in weather patterns, and regulations on logging practices. These price variations can impact the cost of producing wood veneers, making them more expensive for manufacturers and consequently, affecting its affordability for end-users. Furthermore, stringent environmental policies on wood sourcing and deforestation, coupled with the availability of alternative materials, such as synthetic surfaces and laminates that offer consumers a range of choices, further pose challenges to market growth. Asia Pacific witnessed a growth from USD 6.00 billion in 2022 to USD 6.09 billion in 2023.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The COVID-19 pandemic caused significant supply chain disruptions in the wood veneers market. Lockdowns and movement restrictions hindered logging operations and raw material transportation, resulting in shortages of timber. Global trade faced delays due to port closures and labor shortages, while rising shipping costs and container shortages further strained supply chains, increasing operational challenges for manufacturers. However, in the post-pandemic period, the market has experienced a recovery driven by increased home renovation projects, as people spent more time at home.

IMPACT OF TRADE PROTECTIONISM

Trade protectionism significantly impacts the market by altering the dynamics of global supply chains and influencing market accessibility. International trade policies, including tariffs on wood products, significantly affects the supply chain and pricing of wood veneers globally. Furthermore, compliance with import and export regulations and varying international standards, is crucial for market players operating in cross-border trade, impacting the trade of veneers.

SEGMENTATION ANALYSIS

By Type

Raw Veneers Segment Dominated the Market Owing to High Demand from End-use Industries

Based on type, the market is segmented into raw veneer, paper backed veneer, phenolic backed veneer, laid up veneer, reconstituted veneer, and others.

Raw venner held the highest wood veneers market share 33.26% in 2026. Raw veneer refers to thin slices of wood cut directly from timber without any backing or treatment. Known for its natural aesthetic, raw veneer showcases the unique grain and texture of the wood, making it highly sought after for high-end furniture, cabinetry, and decorative applications. The growing demand for natural materials, sustainable design, and luxury, customized furniture is driving its popularity, especially in markets that value authentic, handcrafted finishes.

Paper-backed veneer consists of a thin wood veneers adhered to a paper backing, making it more flexible and easier to handle. Its growing use in applications such as furniture, cabinetry, and wall panels, particularly in designs that require flexibility or curved surfaces will augment segment growth.

With the increased demand for materials that can withstand harsh environments and meet stringent safety standards, phenolic veneer is gaining traction, especially in the construction and architecture sectors, while focusing sustainability and long-lasting performance.

On the other hand, the increasing adoption of customized, high-end furniture and the ability to create unique, seamless designs are driving the popularity of laid-up veneer, especially in markets focused on premium, decorative wood products.

By End-Use

Residential Segment to Hold Largest Market Share Due to Surge in Consumer Demand for Sustainable and Luxurious Home Interiors

Based on end-use, the market is segmented into residential and non-residential.

The residential segment holds the dominating share 74.62% globally in 2026. The growth is driven by increasing consumer demand for sustainable, customizable, and luxurious home interiors. In this segment, wood veneer is widely used in furniture, cabinetry, flooring, doors, and wall panels, offering an affordable yet high-quality alternative to solid wood. Additionally, it provides the aesthetic appeal of natural wood while being more versatile and cost-effective. As homeowners embrace eco-friendly designs and the trend toward minimalist, contemporary aesthetics, wood veneer has become a popular choice in residential applications due to its ability to achieve sophisticated looks while reducing environmental impact.

In the non-residential segment, wood veneer is widely utilized in commercial spaces such as offices, hotels, retail environments, and restaurants for furniture, wall paneling, and architectural features. Its growth is attributed to its ability to enhance the ambiance of large-scale projects while maintaining a luxurious appearance, making it an ideal choice for high-end commercial interiors.

By Application

To know how our report can help streamline your business, Speak to Analyst

Interior Design Segment to Hold Major Share Owing to Rising Demand from Sustainable and Customizable Materials

Based on application, the market is segmented into interior design, cabinets, wood furniture, and others.

Interior design holds the leading share 27.89% in 2026. In interior designing, wood veneer plays a crucial role as a versatile material for creating aesthetic and functional spaces. It is used in wall panels, ceilings, flooring, and other architectural features, providing the beauty of natural wood with the flexibility for unique designs. The growth of the product in this segment is driven by the increasing demand for sustainable and customizable materials and the rising popularity of modern, eco-conscious design trends.

- The cabinets segment is expected to hold a 7.9% share in 2023.

On the other hand, in cabinetry, the product is widely used for both residential and commercial applications, providing a high-end look at a fraction of cost of solid wood. It is commonly applied to cabinet doors, drawer fronts, and panels, offering a wide range of designs and finishes.

In wood furniture, veneer is a popular material in the production of tables, chairs, cabinets, and office furniture, due to its aesthetic appeal and cost-effectiveness. The increasing demand for high-quality furniture along with rising adoption of eco-friendly options that combine luxury and affordability will fuel product demand.

In other applications, veneers are majorly used in decorative panels, automotive interiors, musical instruments, and architectural elements, where its aesthetic appeal and functionality are highly valued. Additionally, its ability to offer premium wood finishes in applications that require flexibility, lightweight materials, and cost efficiency is driving its demand.

WOOD VENEERS MARKET REGIONAL OUTLOOK

Based on region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Wood Veneers Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific region stood at USD 6.09 billion in 2023 and holds the leading share in the market. The wood veneers market growth is fueled by rapid urbanization, booming construction activities, and increasing demand for eco-friendly materials. With the rising awareness of sustainability and environmental concerns, wood veneers has become a popular choice in both residential and commercial applications. The demand for wood veneers in furniture, cabinetry, and interior design is growing, especially as consumers seek affordable, high-quality materials with natural aesthetics. Moreover, growth in the construction industry and rapid urbanization, particularly in countries such as China and India, are further augmenting market expansion. The Japan market is projected to reach USD 0.99 billion by 2026, the China market is projected to reach USD 2.97 billion by 2026, and the India market is projected to reach USD 0.73 billion by 2026.

- In China, the cabinets segment is estimated to hold a 6.7% market share in 2023.

To know how our report can help streamline your business, Speak to Analyst

Europe

The growth of wood veneer in the Europe is primarily driven by the country’s strong focus on sustainability and eco-friendly materials in both construction and interior design. Countries such as Germany would lead the European Union in environmental regulations and green building standards, contributing to rising product demand in residential, commercial, and furniture applications. Moreover, a strong emphasis on eco-friendly materials coupled with stringent environmental regulations will further contribute to market growth. The UK market is projected to reach USD 0.51 billion by 2026, while the Germany market is projected to reach USD 1.31 billion by 2026.

North America

The market growth of wood veneer in North America is being driven by rising demand in the construction and furniture sectors, with a focus on high-quality and sustainable wood products. Moreover, the trend toward biophilic design, which integrates natural materials into interior spaces, is further fueling the demand for wood veneer in both residential and commercial projects. The U.S. market is projected to reach USD 4.1 billion by 2026.

Latin America

The market in Latin America and Middle East & Africa is on the rise, driven by the growing demand for sustainable materials in construction and interior design. In Latin America, the region's rich timber resources support veneer manufacturing, with increasing applications in interior design and furniture.

Middle East & Africa

In the Middle East & Africa, the boom of construction industry and development in infrastructure are creating opportunities for wood veneer applications in interior finishes. Additionally, the increased focus on green building practices and the use of renewable resources in the construction sector is further accelerating the wood veneers market growth.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Players Are forging Collaborations to Diverse Consumer Needs

Oakwood Veneer, Herman Miller, Inc., Tesha group, Timber Products Company, and BC Veneer Products Ltd. are some of the major manufacturers operating in the market. The collaborations between producers and interior designers are leading to customized veneer solutions for specific projects. Additionally, many companies are obtaining certifications and adopting sustainable sourcing practices to appeal to environmentally conscious consumers.

Manufacturers in the market also introducing multifunctional veneer products, such as phenolic-backed veneers and paper-backed, to cater to diverse consumer needs. For instance, Oakwood Veneer began manufacturing flexible wood veneers from raw materials in 2007, enhancing its capabilities as both a manufacturer and wholesaler. The company offer over product varieties available for immediate delivery.

LIST OF KEY WOOD VENEERS COMPANIES PROFILED

- Timber Products Company (U.S.)

- Flexible Materials (U.S.)

- Precision Veneer Products Ltd. (Canada)

- Columbia Forest Products (U.S.)

- BC Veneer Products Ltd. (Canada)

- Oakwood Veneer (Japan)

- Wausau Coated Products, Inc (U.S.)

- Herman Miller, Inc. (U.S)

- Cummings Veneer Products, Inc. (U.S.)

- Tesha group (Singapore)

KEY INDUSTRY DEVELOPMENTS

- July 2021: Herman Miller completed its acquisition of Knoll in a significant USD 1.8 billion deal, which was finalized on July 19, 2021. This merger was designed to create a leading entity in modern design, combining the strengths of both companies and expanding their portfolio of brands.

REPORT COVERAGE

The report provides a detailed analysis of the market, focuses on key aspects, such as leading companies and segments such as types, application, and end-use industries. Besides this, it offers insights into the current industry trends and highlights key industry developments. In addition to the factors mentioned above, it encompasses several factors contributing to the market's growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) & Volume (Million Square Foot) |

|

Growth Rate |

CAGR of 2.70% from 2026 to 2034 |

|

Segmentation |

By Type

|

|

By End-Use

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 16.74 billion in 2025 and is projected to record a valuation of USD 21.42 billion by 2034.

Recording a CAGR of 2.70%, the market is slated to exhibit steady growth during the forecast period.

By application, the interior design held the leading market share in 2025.

Growth of construction and real estate industries are key factors driving market growth.

Oakwood Veneer, Herman Miller, Inc., Tesha group, Timber Products Company, and BC Veneer Products Ltd. are the major players in the global market.

Asia Pacific held the leading share in the market in 2025.

The rising adoption of sustainable products and rapid infrastructure developments is expected to drive the product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us