Aberrometer & Topography Systems Market Size, Share & Industry Analysis, By Type (Aberrometer {Hartmann-Shack Aberrometer, Tscherning Aberrometer, and Ray-Tracing Aberrometer} and Topography Systems {Placido Disc Reflection System, Scheimpflug Imaging System, and Scanning-Slit System}), By Indication (Hyperopia, Myopia, Astigmatism, and Others), By End-user (Hospitals, Ophthalmic Clinics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

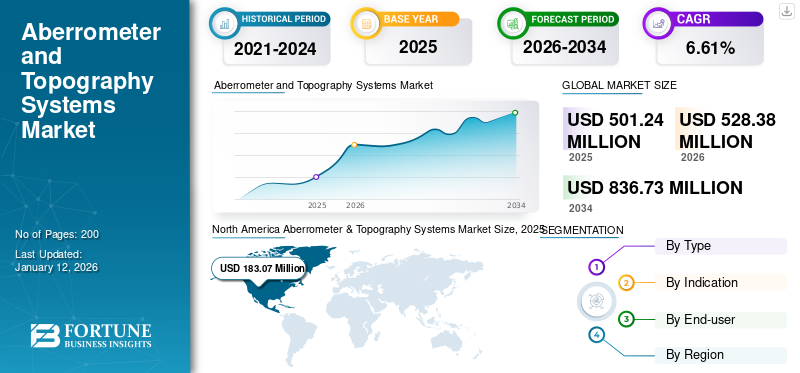

The global aberrometer & topography systems market size was valued at USD 501.24 million in 2025. The market is projected to grow from USD 528.38 million in 2026 to USD 836.73 million by 2034, exhibiting a CAGR of 6.61% during the forecast period. North America dominated the aberrometer and topography systems market with a market share of 17.59% in 2025.

Aberrometer and corneal topography are critical technologies in ophthalmology, providing essential data for diagnosing and treating various visual impairments. Aberrometer is used to measure optical aberrations in the eye, imperfections in the way light is refracted by the eye's optical system, including the cornea and crystalline lens, that can affect the quality of vision. Corneal topography, also referred to as photokeratoscopy or videokeratography, is a sophisticated, non-invasive imaging technique used to map the curvature and shape of the cornea to diagnose and manage various eye conditions.

The growth of the aberrometer & topography systems market is driven by the rising prevalence of vision impairments and eye diseases such as astigmatism and cataracts. This growing burden is driving the demand for diagnostic solutions such as aberrometers & topography systems.

- For instance, according to the article published by the National Center for Biotechnology Information (NCBI) in February 2023, astigmatism accounted for an estimated pooled prevalence of 40.0% in adults across the World Health Organization regions, including the Americas, Southeast Asia, Africa, Europe, Eastern Mediterranean, and West Pacific.

Key players in the market include Carl Zeiss Meditech AG, Topcon Corporation, Alcon Inc., and others, focusing on implementing various growth strategies to increase their product demand globally.

Global Aberrometer & Topography Systems Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 501.24 million

- 2026 Market Size: USD 528.38 million

- 2034 Forecast Market Size: USD 836.73 million

- CAGR: 6.61% from 2026–2034

Market Share:

- Region: North America dominated the market with a 17.59% share in 2025. This is due to a rising number of individuals undergoing eye surgeries and a strong emphasis on adopting advanced diagnostic technologies in the region.

- By Type: The Aberrometer segment is expected to hold a major market share. The segment's growth is driven by recent innovations in aberrometry technology, which have significantly improved the accuracy and functionality of these devices for diagnosing and treating visual impairments.

Key Country Highlights:

- Japan: As a key country in the fastest-growing Asia Pacific region, Japan's market is driven by an increasing focus from key players on expanding their presence and introducing innovative diagnostic technologies to meet the needs of a large patient population.

- United States: Market growth is supported by a significant number of ophthalmic technicians, though a shortage still exists. The market is also fueled by a high prevalence of vision impairments, including diabetes-related eye conditions, with around 38.4 million people living with diabetes in the U.S.

- China: The market is expanding with the establishment of strategic distribution partnerships, such as HAAG-STREIT GROUP's collaboration with Gaush Medical Corporation, which aims to improve the availability of advanced ophthalmic diagnostic products in the country.

- Europe: The market is advanced by a strong presence of skilled professionals, with the U.K. having 3,377 ophthalmologists on the specialist register. The region also benefits from strategic partnerships, such as Visionix's alliance in Italy, which is delivering innovative solutions to the market.

MARKET DYNAMICS

Market Drivers

Increasing Incidence of Ophthalmic Diseases to Boost Market Growth

Over the past few years, the global burden of ocular diseases has been escalating due to various lifestyle changes, rising diabetes rates, and a growing aging population. Conditions, including astigmatism, hyperopia, and myopia, require detailed corneal mapping (topography) and wavefront analysis (aberrometry) for accurate diagnosis and effective treatment planning. This has led to a rising demand for advanced ophthalmic diagnostic technologies.

- For instance, according to the data published by NCBI in September 2023, the prevalence of myopia is increasing worldwide and around half of the world’s population is projected to be myopic by 2050, with nearly 10.0% highly myopic.

Moreover, healthcare agencies, governments, and providers are increasingly prioritizing early diagnosis and regular eye examinations to better manage and mitigate vision-related diseases. This focus on preventive care is expected to further fuel the demand for diagnostic devices, thereby boosting the global aberrometer & topography systems market growth in the forthcoming years.

Market Restraints

High Cost of Advanced Devices and Limited Awareness in Emerging Regions May Limit Market Expansion

Despite technological advancements in ophthalmology that have introduced numerous innovative instruments, the substantial costs of many of these devices may create significant challenges for their widespread adoption, especially in developing countries. The high prices of advanced equipment, such as aberrometers, can be prohibitive for several healthcare facilities, particularly smaller clinics and hospitals.

- For instance, as of 2025, the Nidek OPD-Scan III Wavefront Aberrometer can cost around USD 15,000.

Additionally, limited awareness regarding the importance of regular eye examinations remains a major issue in many low- and middle-income countries. This lack of awareness often results in delayed access to essential eye care services, consequently diminishing the demand for diagnostic devices and potentially hindering market growth.

- For instance, according to the data published by the World Health Organization (WHO) in March 2023, around 2.2 billion individuals globally suffer from some form of vision impairment or blindness, with at least 1.0 billion of these cases being preventable. This highlights a critical gap in public awareness about early disease diagnosis and timely treatments among the population.

Market Opportunities

Increasing Strategic Alliances Among Prominent Players to Amplify Product Demand

In recent years, the increasing demand for diagnostic devices has prompted leading companies to concentrate on creating innovative products. This trend has led to new clinical studies and research initiatives for eye conditions, often driven by collaborations, mergers, and acquisitions, aimed at accelerating product innovation.

- For instance, in April 2024, Carl Zeiss Meditech AG acquired D.O.R.C. (Dutch Ophthalmic Research Center), which may enhance its portfolio of ophthalmic solutions and digitally integrated workflow options.

Additionally, partnerships between companies are becoming increasingly common, facilitating the sharing of expertise and resources that support the development of next-generation diagnostic tools such as corneal topography systems. These collaborative efforts are anticipated to drive new product launches, creating fresh opportunities for market growth during the forecast period.

Market Challenges

Shortage of Skilled Professionals May Hamper Market Growth

The shortage of skilled professionals in the ophthalmology sector presents a significant challenge that could impede the growth of the aberrometer and topography systems market. This shortage may restrict the effective deployment and utilization of advanced diagnostic technologies, which are crucial for the accurate diagnosis and treatment of ocular diseases.

Additionally, the lack of adequately trained personnel can reduce patient access to essential diagnostic services, potentially hindering market growth despite the rising demand for ophthalmic examinations.

- For instance, according to a report by the American Academy of Ophthalmology (AAO) in February 2024, there were fewer than 60,000 ophthalmic technicians available to support over 19,000 practicing ophthalmologists in the U.S., creating a substantial imbalance between supply and demand.

This trend may impact the patient diagnosing capability of healthcare providers, resulting in delayed diagnostic procedures, which may hamper the utilization of the aberrometer and topography systems.

Aberrometer & Topography Systems Market Trends

Technological Advancements to Fuel Market Growth

Advancements in aberrometer and topography systems are currently transforming the landscape of ocular diagnostics. These technologies are increasingly integrating sophisticated algorithms and high-resolution sensors to enhance the precision of refractive error measurements and aberration analysis. Aberrometry has evolved significantly, with devices such as the COAS-VR utilizing dynamic wavefront measurements to produce detailed maps of the eye's optical system. This innovation allows for improved intraocular lens (IOL) power calculations.

- In March 2023, Wavefront Dynamics launched the WaveDyn Vision Analyzer, a dynamic aberrometer that captures video footage of the eye's optical system to provide accurate objective refractions and ocular surface analysis. The WaveDyn Vision Analyzer offers nine ocular measurements to streamline workflow, incorporating dynamic wavefront aberrometry and corneal topography.

Topography systems have also advanced, with new dynamic aberrometers capable of measuring high-order aberrations and providing comprehensive data to support treatment planning. These instruments assess corneal topography and also integrate subjective refractive assessments, allowing for a holistic view of visual function. Furthermore, the integration of artificial intelligence (AI) and Internet of Things (IoT) technologies has led to improved efficiency and enhanced performance of corneal topographers. By combining these technologies, practitioners can deliver personalized care that addresses both common and complex visual impairments, marking a significant trend in modern ophthalmic diagnostics.

Development of Portable Devices: Manufacturers are increasingly focusing on the development of compact and portable aberrometers to meet the needs of clinics with limited space and to facilitate remote eye care services. This trend is driven by advancements in technology and the growing demand for efficient, user-friendly diagnostic tools.

Download Free sample to learn more about this report.

Impact of COVID-19

The COVID-19 pandemic significantly disrupted market growth, leading to a sharp decline in demand for examination and diagnostic tools. Factors contributing to this downturn included reduced patient volumes, supply chain disruptions, and the reallocation of healthcare resources. As a result, major companies in the sector experienced notable revenue declines during the pandemic.

- For instance, Carl Zeiss Meditech AG reported a -7.0% decline in ophthalmic device sales, totaling USD 991.0 million in 2020 due to decreased diagnostic rate in the market.

Moreover, during the pandemic, several patients avoided healthcare facilities for ocular examinations, which led to decreased usage of the aberrometer and topography systems. For instance, as per the survey published by the National Center for Biotechnology Information (NCBI) in May 2021, the American Academy of Ophthalmology (AAO) released a statement in March 2020 urging U.S. ophthalmologists to halt non-urgent care due to the COVID-19 pandemic crisis.

However, the relaxation of restrictions in 2021 and subsequent increase in patient visits to eye care settings helped the market regain momentum throughout 2021 and 2022. Looking ahead, the market is expected to grow significantly during the forecast period due to the increasing burden of ophthalmic disorders.

Segmentation Analysis

By Type

Aberrometer Segment to Lead due to Rising Innovations

Based on type, the market is classified into aberrometer and topography systems.

The aberrometer segment is further subdivided into Hartmann-Shack aberrometer, Tscherning aberrometer, Ray-Tracing aberrometer, and others. The topography systems segment is further sub-categorized into the Placido disc reflection system, Scheimpflug imaging system, and scanning-slit system.

The aberrometer segment is expected to hold a major market share during the forecast period. The segment’s growth is attributable to recent innovations in aberrometry technology, which have greatly improved the accuracy and functionality of these devices. High-resolution wavefront aberrometers and advanced techniques such as Hartmann-Shack and Ray-Tracing have enhanced diagnostic capabilities, allowing for more precise measurements of optical aberrations.

- For instance, in February 2023, Tracey Technologies launched iTrace Prime, an upgraded software for the iTrace Ray Tracing aberrometer and Corneal topographer.

The topography systems segment is expected to witness notable growth in the forecast period. The growth of the segment can be attributed to the increasing focus of key companies on integrating new software that enhances the features of topography systems, thereby improving diagnostic outcomes.

By Indication

Rising Prevalence of Hyperopia to Boost Hyperopia Segment Growth

Based on indication, the aberrometer & topography systems market is divided into hyperopia, myopia, astigmatism, and others.

The hyperopia segment is anticipated to account for a substantial market share in the forthcoming years. The segment’s growth can be attributed to the increasing prevalence of hyperopia among both adults and children, which may boost the demand for effective diagnostic solutions such as aberrometer and topography systems.

- For instance, according to the data published by Cleveland Clinic in March 2023, hyperopia may affect around 4.6% of children and 30.9% of adults globally.

The myopia segment is anticipated to grow notably during the forecast period. This growth is attributed to various factors, including the aging population and increased screen time due to rising digital device usage. Such conditions increase the incidence of myopia and are boosting the demand for effective diagnostic tools such as aberrometers globally.

The astigmatism segment is projected to witness substantial growth in the forthcoming years. The growth can be attributed to the increased availability of modern topography systems, such as Scheimpflug imaging, allowing for direct measurement of both the anterior and posterior corneal surfaces. Moreover, newer systems, such as the Cassini topographer, utilize multicolored LED spot reflections to create true elevation maps of the cornea. This method provides more accurate data regarding corneal shape and curvature, which is crucial for precise astigmatism measurement.

The others segment is expected to witness stagnant growth due to the increasing burden of keratoconus, cataracts, corneal scars, and other conditions that may require frequent diagnosis.

By End-user

Increase in the Number of Ophthalmic Diagnostic Procedures Encouraged Hospitals Segment Growth

Based on end-user, the market is segmented into hospitals, ophthalmic clinics, and others.

The hospitals segment dominated the market in 2024 attributed to the increased volume of ophthalmic diagnostic procedures conducted in hospitals compared to other settings. This is due to hospitals’ widespread access to advanced equipment and the integration of cutting-edge diagnostic technologies within these settings.

The ophthalmic clinics segment is projected to expand at the highest CAGR during the projection period. The growing number of ophthalmic clinics worldwide and the increasing availability of diagnostic solutions in these facilities are contributing to the large number of diagnostic procedures performed in these settings.

- For instance, in December 2022, UC Davis Health inaugurated a cutting-edge eye care facility in Sacramento.

The others segment, including telehealth and academic clinics, are anticipated to grow significantly during the forecast timeframe due to increasing strategic initiatives such as partnerships by these settings to enhance the diagnostic scenario.

- For instance, in September 2023, Visionix formed a strategic alliance with 20/20NOW to provide affordable, in-office synchronous tele-optometry eye exams and ocular telemedicine services to a broader patient base throughout the U.S.

ABERROMETER & TOPOGRAPHY SYSTEMS MARKET REGIONAL OUTLOOK

By geography, the market is studied across North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

North America

North America Aberrometer & Topography Systems Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America accounted for the largest market share in 2024. The aberrometer & topography systems market in North America stood at USD 183.07 million in 2025. The rising number of individuals undergoing eye surgeries, along with the region's emphasis on adopting advanced diagnostic technologies tools, are key factors driving the demand for advanced diagnostic products, thereby fueling regional market growth.

In the U.S., the increasing number of eye disorders due to the higher burden of diabetes is contributing to an increase in patient visits to eye care settings. This trend is anticipated to boost the adoption of advanced diagnostic products and support the country’s market growth.

- For instance, as of May 2024, the Centers for Disease Control and Prevention (CDC) reported that around 38.4 million people were living with diabetes in the U.S.

In Canada, the growing incidence of ocular conditions such as irregular astigmatism, keratoconus, and other vision problems is driving the adoption of aberrometers for diagnosis, further contributing to the country’s market expansion.

Europe

The market in Europe held a substantial share in 2024 due to the significant presence of leading companies in the region, along with their strategic growth efforts. Moreover, the rising number of ophthalmologists supporting the increasing diagnosis rates for eye disorders among adults, further propelling the regional market growth.

- For instance, in December 2023, the Royal College of Ophthalmologists (RCOpth) reported that there were 3,377 ophthalmologists on the specialist register in the U.K.

Asia Pacific

Asia Pacific is expected to showcase the highest CAGR during the forecast period. The growth is attributed to the increasing focus of key market players on expanding their presence in developing countries such as Japan, China, and India, which is anticipated to fuel regional market growth.

- For instance, in March 2023, HAAG-STREIT GROUP formed a distribution partnership with Gaush Medical Corporation to enhance its exclusive distribution efforts in China. This collaboration aimed to improve the availability of products in the region.

Latin America

The Latin American market is expected to grow at a significant CAGR during the forecast period. Growth in the region is attributed to the high incidence of visual impairments and the relatively large number of ophthalmologists in the region, which is expected to increase demand for diagnosis through aberrometers.

- For instance, in a 2021 study by the Conselho Brasileiro de Oftalmologia, it was highlighted that São Paulo, despite having the highest number of ophthalmologists in Brazil, faces a significant issue in addressing untreated visual impairments.

Middle East & Africa

Middle East & Africa is anticipated to register a noteworthy CAGR during the forecast period. The growth of the region is primarily attributed to the increasing awareness about ophthalmic conditions and expanding healthcare infrastructure in GCC countries that may contribute to increasing penetration of aberrometer and topography systems in the region.

- For instance, in January 2024, the International Trade Administration reported that the Saudi Arabian government planned to invest over USD 65.0 billion to develop the country’s healthcare infrastructure under Vision 2030.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Companies Focus on Strategic Alliances and Introduction of New Products to Boost their Market Share

The global aberrometer & topography systems market is consolidated with companies such as Carl Zeiss Meditech AG, Topcon Corporation, and Alcon Inc., accounting for a majority of the aberrometer & topography systems market share in 2024.

The dominance is attributed to a robust global presence both direct and indirect, along with a diverse portfolio of innovative products. Companies in this market are concentrating on launching new products to enter untapped markets, signing agreements, and prioritizing the development of technologically advanced products.

- For instance, in December 2023, Carl Zeiss Meditech AG announced that it had signed an agreement to acquire 100.0% of the shares in Dutch Ophthalmic Research Center (International) B.V. (D.O.R.C.) from Eurazeo SE, an investment firm in France.

Other companies operating in the global market include NIDEK CO., LTD., Haag-Streit Group, and other small & medium-sized players. These companies are focusing on various strategic initiatives such as partnerships, collaborations, and others to improve their market presence.

LIST OF KEY ABERROMETER & TOPOGRAPHY SYSTEMS COMPANIES PROFILED:

- EssilorLuxottica (France)

- Carl Zeiss Meditech AG (Germany)

- Topcon Corporation (Japan)

- Alcon, Inc. (U.S.)

- NIDEK CO., LTD. (Japan)

- Haag-Streit Group (Switzerland)

- Rexxam Co., Ltd. (Japan)

- Schwind eye-tech-solutions GmbH (Germany)

- Mediworks (China)

KEY INDUSTRY DEVELOPMENTS

- April 2025: Haag-Streit Group announced its participation at American Society of Cataract and Refractive Surgery (ACRS) to showcase its latest products in ophthalmology

- December 2024: Alcon Inc. announced its participation at the 2025 Annual J.P. Morgan Healthcare Conference to showcase its diagnostic devices, including an aberrometer for ophthalmic conditions.

- July 2024: EssilorLuxottica acquired an 80.0% stake in Heidelberg Engineering, a company specializing in diagnostic solutions, healthcare IT, and digital surgical technologies for clinical ophthalmology.

- October 2023: Haag-Streit announced the establishment of Haag-Streit Japan K.K. to further strengthen its regional presence following recent expansions into Singapore and China.

- March 2023: Visionix announced a new multimodal device update with its second-generation VX 650 at Vision Expo 2023.

REPORT COVERAGE

The global aberrometer & topography systems market analysis provides market size & forecast by type, indication, and end-user segment included in the report. It includes details on the market dynamics and market trends projected to drive the market during the forecast period. It offers information on the prevalence of various eye diseases in key regions/countries, key industry developments, an overview of regulatory scenarios, and COVID-19's impact on the market. The report covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.61% from 2026-2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Type

|

|

By Indication

|

|

|

By End-user

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 501.24 million in 2025 and is projected to reach USD 836.73 million by 2034.

In 2025, the market value stood at USD 183.07 million.

The market is expected to exhibit a CAGR of 6.61% during the forecast period.

By end-user, the hospital segment led the market.

The key factors driving the market are the increasing burden of ophthalmic disorders and technological advancements in diagnostic products.

Carl Zeiss Meditech AG, Topcon Corporation, and Alcon Inc. are the top players in the market.

North America held the largest market share in 2024.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us