Ophthalmic Diagnostic Devices Market Size, Share & Industry Analysis, By Product Type (Optical Coherence Tomography, Aberrometer & Topography Systems, Fundus Camera, Ophthalmic Ultrasound, and Other Devices), By End-user (Hospitals, Ophthalmic Clinics, and Others) and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

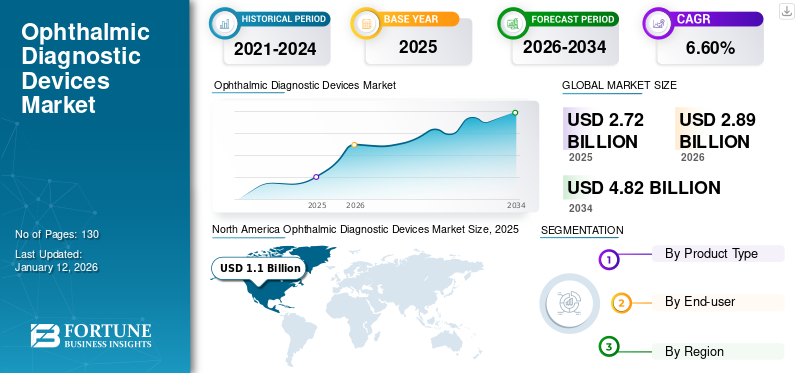

The global ophthalmic diagnostic devices market size was valued at USD 2.72 billion in 2025. The market is projected to grow from USD 2.89 billion in 2026 to USD 4.82 billion by 2034, exhibiting a CAGR of 6.60% during the forecast period. North America dominated the ophthalmic diagnostic devices market with a market share of 38.20% in 2025.

Ophthalmic diagnostic devices encompass a range of instruments that are used to detect, diagnose, and monitor ocular diseases and conditions. These devices include monitoring instruments, such as optical coherence tomography, aberrometer & topography systems, fundus camera, ophthalmic ultrasound, slit lamps, ophthalmoscopes, tonometer, and others.

The market is anticipated to experience steady growth during the forecast period due to the increasing prevalence of eye disorders, technological advancements, and a growing geriatric population that is susceptible to ocular conditions. Carl Zeiss Meditec AG, Topcon Corporation, and NIDEK CO., LTD are some of the key players operating in the ophthalmic diagnostic devices market.

Global Ophthalmic Diagnostic Devices Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 2.72 billion

- 2026 Market Size: USD 2.89 billion

- 2034 Forecast Market Size: USD 4.82 billion

- CAGR: 6.60% from 2026–2034

Market Share:

- Region: North America dominated the market with a 38.20% share in 2025. This leadership is driven by an increasing number of individuals undergoing eye surgeries, a high volume of new product launches, and a strong focus on adopting advanced technological devices for diagnosis.

- By Product Type: The Optical Coherence Tomography segment held the largest market share in 2024. The segment's growth is attributed to the increasing prevalence of eye diseases globally, wide adoption of digital technologies, and innovations in OCT technology, such as the development of portable devices.

Key Country Highlights:

- Japan: The market is driven by technological innovation from major local companies. For example, Topcon Corporation continues to be a key player, announcing plans to launch new devices such as the TEMPO Perimeter, which helps to maintain a competitive edge.

- United States: Growth is fueled by a high volume of ophthalmic procedures and a strong demand for advanced diagnostics. However, the market also faces challenges such as a significant shortage of skilled professionals, with less than 60,000 ophthalmic technicians available to support over 19,000 practicing ophthalmologists.

- China: The market is expanding as a key part of the fast-growing Asia Pacific region, driven by an increasing number of surgical procedures, improving healthcare infrastructure, and rising awareness about the importance of early diagnosis for various eye diseases.

- Europe: The market is advanced by a well-established healthcare infrastructure and a high number of patient visits. For example, Germany had a total of 1,887 hospitals that facilitated 17.7 million cases in 2021, indicating a high potential for diagnostic procedures. Strategic partnerships, such as Visionix's collaboration in Italy, are also expanding access to innovative solutions.

IMPACT OF COVID-19 ON THE MARKET

The COVID-19 pandemic significantly impacted the ophthalmic diagnostic devices market growth by causing a sharp decline in the demand for examination and diagnostic tools. This downturn was primarily due to the reduced patient volumes as many individuals postponed their routine eye checkups amid health concerns. As the healthcare facilities were focused on managing the pandemic, many elective procedures and non-urgent care visits were postponed.

- For instance, the American Academy of Ophthalmology urged the U.S. ophthalmologists to halt non-urgent care in March 2020, which resulted in a drastic reduction in patient visits.

Additionally, the pandemic caused widespread supply chain disruptions and forced the reallocation of healthcare resources, further complicating the situation for ophthalmologists and other eyecare professionals.

However, as pandemic restrictions began to ease and healthcare facilities reopened, there was a noticeable rebound in the demand for ophthalmic diagnostic devices. The gradual increase in patients seeking eye checkups and the resumption of elective surgical procedures contributed to a recovery in the product’s sales throughout 2021. In 2022 and 2023, the market witnessed considerable growth driven by a rising number of ophthalmic diseases that require these diagnostic procedures. This resurgence was fueled by an increased awareness of eye health and a growing prevalence of ophthalmic disorders as more individuals returned to regular healthcare routines. In the future, the ophthalmic diagnostic devices market is anticipated to continue its upward trajectory during the forecast period.

MARKET DYNAMICS

Market Drivers:

Rising Prevalence of Eye Disorders to Augment Market Growth

The rising incidence of ocular diseases is being increasingly recognized as a major global health concern, influenced by factors, such as an aging population, unhealthy lifestyles, and the growing prevalence of diabetes. These elements contribute to a higher risk of various eye conditions, including Age-Related Macular Degeneration (AMD), cataracts, Diabetic Retinopathy (DR), glaucoma, refractive errors, and overall vision impairment.

- According to a 2023 report from the World Health Organization (WHO), around 2.2 billion people worldwide experience some form of vision impairment. The increasing prevalence of these ocular conditions imposes a significant social and economic burden.

In response, healthcare agencies, governments, and medical service providers are prioritizing early diagnosis and regular eye examinations to manage these diseases effectively. Initiatives, such as reimbursement policies for ophthalmic surgeries and diagnostic procedures are increasing the demand for diagnosis. Therefore, surge in ocular diseases, coupled with increased demand for diagnostic procedures for various application areas including cataract surgeries, indicates robust market growth during the forecast period.

Market Restraints:

Shortage of Skilled Personnel to Deter Market Growth

The shortage of skilled professionals in ophthalmology poses a significant challenge that can hinder the growth of the ophthalmic diagnostic devices market. As the global population ages and the prevalence of ocular conditions rises, the need for qualified ophthalmologists and technicians is growing sharply. However, there exists a considerable gap between the demand for and supply of these professionals across the world.

- For instance, according to an American Academy of Ophthalmology (AAO) report in February 2024, currently, there are less than 60,000 ophthalmic technicians available to support over 19,000 practicing ophthalmologists in the U.S. These statistics indicate a significant imbalance between supply and demand. This lack of trained personnel limits the effective deployment and utilization of advanced diagnostic technologies, which can significantly affect the market’s growth.

Market Opportunities:

Emphasis on Development of Innovative Devices to Provide Opportunities for Market Growth

The increasing demand for ophthalmic diagnostic devices has prompted key market players to concentrate on developing more efficient products. This focus has led to a surge in clinical studies and research & development initiatives, often achieved through collaborations, mergers, and acquisitions. These strategic efforts are expected to pave the way for advanced product launches, significantly transforming the eye care landscape.

Moreover, partnerships and collaborations are becoming increasingly common in the industry, allowing companies to pool their expertise and resources to accelerate the development of next-generation diagnostic tools. For instance, in November 2023, CANON MEDICAL SYSTEMS CORPORATION teamed up with Cleveland Clinic to innovate imaging and healthcare IT technologies aimed at improving diagnosis, care, and outcomes for patients with ophthalmic conditions. These initiatives are poised to drive new product launches within the ophthalmic diagnostic devices market and create fresh opportunities for growth.

Market Challenges:

Complex Regulatory Landscape May Pose Challenges to Market Growth Potential

The ophthalmic diagnostic devices market is experiencing significant growth, driven by an increase in the prevalence of ocular diseases and advancements in technology. However, there are challenges, such as the high cost of advanced devices and stringent regulatory procedures, which can impede the market’s expansion. Sophisticated equipment, such as Optical Coherence Tomography (OCT) scanners and advanced fundus cameras can be quite expensive, particularly for healthcare providers in low-resource settings. In addition to high costs, navigating the complex regulatory landscape poses another significant challenge for the ophthalmic diagnostic devices market. Stringent regulations and lengthy approval processes can delay the introduction of new technologies.

OPHTHALMIC DIAGNOSTIC DEVICES MARKET TRENDS

Technological Advancements and Digitalization to Witness Surge in Market

The integration of Artificial Intelligence (AI) in ophthalmic diagnostic devices is transforming the landscape of eye care by enhancing the accuracy and efficiency in diagnosing various ocular conditions. This technological advancement is particularly crucial as it addresses the increasing demand for timely and precise diagnostics in a field where early detection can significantly impact patient outcomes.

- A recent study published in the Japan Medical Association in September 2024 highlighted that AI models can analyze retinal images with remarkable accuracy, identifying and grading the severity of diabetic retinopathy. This capability allows for quicker processing of large volumes of images, thereby alleviating the workload on ophthalmologists and improving screening coverage.

Additionally, the rise of telehealth is reshaping the ophthalmic diagnostics landscape, making eye care more accessible and efficient than ever before. With ongoing technological advancements, increasing acceptance among both patients and providers is being witnessed in the market.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Product Type

Optical Coherence Tomography Segment Dominated Market Due to Technological Advancements

Based on product type, the market is segmented into optical coherence tomography, aberrometer & topography systems, fundus camera, ophthalmic ultrasound, and other devices.

The optical coherence tomography segment dominated the market with a share of 30.80% in 2026. The growth of the segment is attributed to the increasing prevalence of eye diseases across the globe. Additionally, growth in disease diagnostics and wide adoption of digital technologies are the factors expected to further drive the segment’s growth. Moreover, innovations in OCT technology, such as the development of handheld and portable devices are making it easier for healthcare providers to perform imaging in various settings, including remote locations and bedside care. These advancements enhance accessibility and convenience, driving the market’s growth.

- For instance, in September 2024, Visionix announced the addition of a new feature to its next-generation Optovue Solix FullRange and Solix Essential Optical Coherence Tomography (OCT) to enhance its capabilities and outcomes. Such advancements are expected to boost the adoption rate of this product across the globe.

The fundus camera segment is expected to grow significantly in the future. The growth of the segment is attributed to the rising healthcare expenditures, along with favorable reimbursement policies for eye care services, which are encouraging investments in these devices. Additionally, collaborative efforts between healthcare providers, new product launches, and awareness campaigns are further propelling the segment’s growth.

The other devices segment, including slit lamps, tonometers, perimeters, and others, are expected to witness growth due to the increasing number of ophthalmic clinics across the globe.

To know how our report can help streamline your business, Speak to Analyst

By End-user

Hospitals Segment Dominates Market Due to Higher Number of Procedures in These Settings

Based on end-user, the market is classified into hospitals, ophthalmic clinics, and others. The hospitals segment holds the largest global ophthalmic diagnostic devices market share contributing 46.37% globally in 2026. The factors driving the segment’s growth include the higher volume of diagnostics performed in hospitals compared to clinics, widespread availability of advanced instruments, and increasing adoption of cutting-edge diagnostic tools within hospital facilities.

The ophthalmic clinics segment is expected to experience a higher CAGR during the forecast period. This growth is driven by the rising number of specialty clinics and increase in the availability of diagnostic services in these settings.

- For instance, in December 2022, UC Davis Health opened a state-of-the-art eye care facility in Sacramento. Such launches are expected to fuel the demand for ophthalmic devices.

Additionally, other segments, such as telehealth and academic clinics are projected to see significant growth in the coming years. This is largely due to an increase in strategic initiatives aimed at expanding access to eye care services.

OPHTHALMIC DIAGNOSTIC DEVICES REGIONAL OUTLOOK

North America:

North America Ophthalmic Diagnostic Devices Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The North America dominated the market with a valuation of USD 1.04 billion in 2025 and USD 1.1 billion in 2026. In North America, particularly the U.S., the market is projected to grow significantly due to an increasing number of individuals undergoing eye surgeries, new product launches, and a strong focus on adopting advanced technological devices for diagnosis. These factors are significantly accelerating the demand for sophisticated ophthalmic diagnostic tools in this region. The U.S. market is projected to reach USD 1.02 billion by 2026.

- In October 2022, TOPCON CORPORATION launched NW500 Non-Mydriatic Retinal Camera globally, including in the U.S. This fully automated device uses innovative slit scan illumination and a rolling shutter mechanism to image smaller pupils effectively. Such launches will facilitate the adoption of advanced products across the region.

Europe:

Europe holds the second-largest share of the market. The presence of major players in the region, along with their strategic expansion initiatives, is contributing to this growth. Additionally, the rising number of ophthalmologists and an increase in adults seeking diagnoses for various eye disorders are key factors expected to propel the regional market. Germany and the U.K. lead the region’s market. Moreover, increasing investment by the governments to modernize the healthcare infrastructure in these countries is expected to further boost the growth of this market in the region during the forecast period.

The UK market is projected to reach USD 0.13 billion by 2026, while the Germany market is projected to reach USD 0.23 billion by 2026.

- For instance, according to the Federal Statistical Office, in 2021, Germany had a total of 1,887 hospitals, facilitating 17.7 million cases during the year. Such a high number of visits for diagnostics and procedures is anticipated to drive the country’s market growth.

Asia Pacific:

Factors, such as an increase in surgical procedures, adequate reimbursement policies, and growing prevalence of eye diseases are fueling the demand for these devices. The increasing focus of key players on the implementation of strategic initiatives, such as acquisitions, new product launches, and conducting events may contribute to the high adoption of ophthalmic diagnostic devices in the region.

The Japan market is projected to reach USD 0.18 billion by 2026, the China market is projected to reach USD 0.16 billion by 2026, and the India market is projected to reach USD 0.12 billion by 2026.

- For instance, in November 2023, Topcon Corporation announced its plan to launch the new TEMPO Perimeter at the American Academy of Ophthalmology (AAO) meeting in San Francisco, California. Such initiatives are expected to promote ophthalmic diagnostic devices in the country, driving market growth.

Latin America:

The market’s growth in Latin America can be attributed to the growing aging population in the region that is susceptible to several eye conditions and rising demand for ophthalmic diagnostic solutions, such as fundus cameras, OCT, biometers, tonometers, and more. These products are being widely demanded due to rising awareness of various eye diseases, including glaucoma, cataract, and others.

Middle East & Africa:

The growth of the Middle East & Africa market can be attributed to the increasing focus of key companies on expanding the distribution network for ophthalmic diagnostic devices, including fundus cameras in emerging countries of the region. Moreover, the growing awareness of eye diseases in the region is also expected to fuel the market’s growth.

TRADE PROTECTIONISM AND REGULATORY LANDSCAPE

Trade policies and variations in regulations significantly impact the market by influencing the import and export of ophthalmic diagnostic devices. For instance, tariffs and restrictions on medical devices can increase costs for companies that want to bring innovative solutions to the market, ultimately limiting access for healthcare providers and patients. Additionally, regulatory bodies, such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) play a crucial role in overseeing the safety and efficacy of these devices. Their stringent regulations necessitate that market players navigate complex compliance landscapes to ensure that their products meet safety standards. This can delay market entry and increase operational costs.

RESEARCH AND INNOVATIONS

The ophthalmic diagnostic devices market is witnessing significant innovation through the integration of Artificial Intelligence (AI), expansion of teleophthalmology, and development of portable diagnostic devices. For instance, tools, such as IDx-DR and Google’s Automated Retinal Disease Assessment (ARDA) utilize deep learning techniques to evaluate retinal scans and provide diagnostic assessments. Additionally, innovation in portable diagnostic devices is also enhancing point-of-care diagnostics in ophthalmology. These compact tools allow for quick and efficient assessments in various settings, from rural clinics to emergency rooms. For instance, portable fundus cameras are facilitating point-of-care diagnostics and treatment decisions.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Carl Zeiss Meditech AG, and Topcon Corporation Held Significant Market Shares Due to Their Strong Product Portfolios

The global market is consolidated with key companies, such as Carl Zeiss, Meditech AG, Topcon Corporation, Alcon Inc., and NIDEK CO., LTD.

The dominance of these players is attributable to their strong direct and indirect presence across the world with diversified and advanced products in their portfolios. These market players are focusing on product launches to penetrate new markets and increase their focus on the development of technologically advanced products. In addition, they are constantly focusing on strategies, such as expansion of their product offerings through collaborations, partnerships, and other initiatives.

Alcon Inc., Bausch + Lomb Incorporated, NIDEK CO., LTD., and other medium-sized players are focusing on various strategic developments, such as partnerships, collaborations, and introduction of new products.

FUTURE OUTLOOK

Ophthalmic diagnostic devices are witnessing substantial growth, driven by several key factors, including technological advancements, increasing prevalence of eye disorders, and growing aging population. As the demand for effective eye care solutions rises, the market is poised to expand significantly in the coming years. Additionally, technological advancement accelerates the diagnostic process by improving accuracy. These innovations and digitalization in the market are expected to surge the demand for precise diagnostics, further driving the market growth.

LIST OF KEY OPHTHALMIC DIGNOSTIC DEVICES COMPANIES PROFILED:

- Carl Zeiss Meditech AG (Germany)

- Alcon Inc. (U.S.)

- EssilorLuxottica (France)

- CANON MEDICAL SYSTEMS CORPORATION (Canon Inc.) (Japan)

- Bausch + Lomb (Canada)

- NIDEK CO., LTD. (Japan)

- Topcon Corporation (Japan)

- Ziemer Ophthalmic Systems AG (Switzerland)

- Haag-Streit Group (Switzerland)

- Visionix (U.S.)

KEY INDUSTRY DEVELOPMENTS

- May 2024: Bausch + Lomb announced the launch of SeeNa, an ophthalmic diagnostic system designed for refractive cataract practices that is integrated with the Eyetelligence surgical planning software, in the U.S. This product launch expanded the company’s footprint in the global market.

- April 2024: Visionix and Espansione Group entered a strategic partnership to deliver innovative ophthalmic solutions in the Italian market. This expanded the company’s brand presence in the European region.

- March 2024: Visionix and Insight Medical Technologies entered a distribution partnership for Visionix’s refraction and screening platforms, Optovue OCT and OCT-A, as well as Briot and Weco finishing systems in Canada. This improved the company’s market position in North America.

- February 2024: Topcon Corporation launched Topcon Korea Medical Co., Ltd. to strengthen and expand its eye care business in South Korea.

- April 2023: NIDEK CO., LTD. launched the NT-1/1e non-contact tonometer to facilitate smooth measurement of the eye position. This advanced product meets the customers' needs by improving clinical care.

- September 2022: EssilorLuxottica launched SL650+ digital slit lamp to support diagnosis with high-definition images and videos and allow for an easy and time-saving everyday practice for ophthalmologists. This launch enhanced the company’s portfolio of ophthalmic diagnostics.

REPORT COVERAGE

The global ophthalmic diagnostic devices market research report provides an in-depth analysis of the market. It focuses on market segments, such as product type, end-user, and region. Besides, it offers forecast in relation to the current market dynamics, impact of COVID-19, and latest market trends. Additionally, the report consists of the global ophthalmic diagnostic devices market share held by various segments and the factors driving the market’s growth. It also provides the competitive landscape of the market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.60% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Product Type, End-user, and Region |

|

Segmentation |

By Product Type · Optical Coherence Tomography · Aberrometer & Topography Systems · Fundus Camera · Ophthalmic Ultrasound · Other Devices |

|

By End-user · Hospitals · Ophthalmic Clinics · Others |

|

|

By Region · North America (By Product Type, End-user, and Country) o U.S. o Canada · Europe (By Product Type, End-user, and Country/Sub-region) o U.K. o Germany o France o Spain o Italy o Scandinavia o Rest of Europe · Asia Pacific (By Product Type, End-user, and Country/Sub-region) o Japan o China o India o Australia o Southeast Asia o Rest of Asia Pacific · Latin America (By Product Type, End-user, and Country/Sub-region) o Brazil o Mexico o Rest of Latin America · Middle East & Africa (By Product Type, End-user, and Country/Sub-region) o GCC o South Africa o Rest of the Middle East & Africa |

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 2.72 billion in 2025 and is projected to reach USD 4.82 billion by 2034.

In 2025, the market value stood at USD 1.04 billion.

The market will exhibit a steady CAGR of 6.60% during the forecast period of 2026-2034.

By product type, the optical coherence tomography segment led the market in 2025.

Carl Zeiss Meditech AG, Topcon Corporation, and NIDEK CO., LTD. are the major players in the market.

North America is expected to hold the highest share in the market.

North America dominated the market in 2024 by holding the largest share.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us