Waste Oil Market Size, Share & Industry Analysis, By Source (Industrial Oil, Used Cooking Oil, Animal Fat, and Others), By Application (Biofuels, Industrial Lubricants, Automotive, Bio-based, Chemicals, and Others) and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

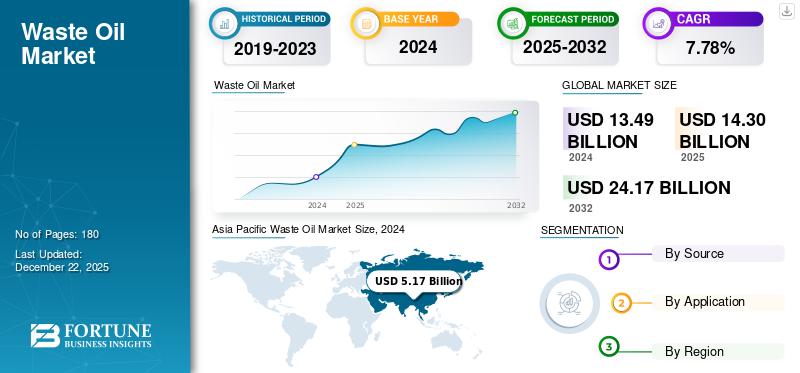

The global waste oil market size was valued at USD 14.30 billion in 2025. The global market is projected to grow from USD 15.22 billion in 2026 and is expected to reach USD 26.58 billion by 2034, exhibiting a CAGR of 7.22% during the forecast period. Asia Pacific dominated the waste oil market with a market share of 38.54% in 2025.

Waste oil is any petroleum-based or synthetic oil or fat that loses its original qualities, becomes contaminated, or becomes unfit for its intended purpose. It comprises used cooking oil (UCO), industrial waste oil, and other waste oils.

The market for waste oil is increasing due to increased government regulations on fuel regeneration, waste disposal, and refining, as well as the growing demand for sustainable practices and waste management.

Safety Kleen is the leading player in the market. The company has decades of experience in this industry and offers integrated services for automotive, manufacturing, and government sectors, building long-term contracts. With more than 190 service locations, the company collects and treats more than 200 million gallons of waste oil in North America and returns it as motor oil and associated products.

MARKET DYNAMICS

MARKET DRIVERS

Stringent Environmental Regulations and Circular Economy Initiatives Drives Market Growth

Globally, governments are enforcing more stringent laws regarding the disposal of industrial waste and encouraging resource reuse to lower pollution and accomplish the objectives of the circular economy. If improperly handled, waste oil poses significant environmental hazards due to its potential to contaminate soil and water. For instance, in September 2023, India's Ministry of Environment, Forests, and Climate Change issued a notice on the Hazardous Other Wastes (Management and Transboundary Movement) Second Amendment Rules, 2023. This regulation adds the extended producer responsibility (EPR) for used oil to the Hazardous and Other Wastes (Management and Transboundary Movements) Regulations of 2016. Producers, importers, bulk generators, collectors, and recyclers of used oil, base oils, and lubricants will all be subject to additional requirements under the EPR. Meanwhile, importers and producers can offset their recycling responsibilities by introducing an EPR certificate transaction system.

Increasing Demand for Biofuels, especially Renewable Diesel, is Driving Demand for Waste Oil Collection

Waste oils, especially UCO, are in high demand as feedstocks for advanced biofuels such as Hydrotreated Vegetable Oil (HVO), Renewable Diesel or Biodiesel, and Sustainable Aviation Fuel (SAF). Compared to conventional fossil fuels, these biofuels provide notable decreases in greenhouse gas emissions, supporting international targets and initiatives to reduce carbon emissions. Significant investments in SAF and HVO production capacity are driven by the intense pressure on the aviation and heavy-duty transportation industries to lower their carbon footprints.

For instance, in July 2025, Neste and DHL Express, the top international express service provider in the world, announced that they would deliver 7,400 tons (9.5 million liters) of unblended Neste MY Sustainable Aviation FuelTM to DHL Express at Singapore Changi Airport. Neste's SAF is produced entirely from renewable waste and raw materials, including leftover animal fat and used cooking oil (UCO). This accelerates the collaborations to reduce greenhouse gas emissions from air cargo shipments and ranks among Asia's largest SAF transactions by volume in the air cargo sector.

MARKET RESTRAINTS

High Collection and Logistics Costs & Fragmented Supply Chain Expected to Hamper Market Share

Waste oils come from various scattered sources, including small industrial enterprises, individual restaurants, auto repair shops, and other industrial sectors. Collecting relatively small volumes from these numerous points requires extensive infrastructure, specialized transportation to prevent leaks and contamination, and significant labor, leading to high per-unit costs. This highly fragmented collection system makes it difficult to efficiently and economically aggregate enough volumes to feed large-scale reprocessing facilities.

Moreover, the waste oil is expensive to transport, particularly in rural areas. Collection and transfer due to cumbersome transportation make recycling more challenging and expensive. Additionally, it is challenging to regulate the used engine oil recycling sector, to establish a cohesive and efficient oversight mechanism due to the involvement of numerous departments and stakeholders. Waste oil recycling plants turn used oil into useful items such as lubricants or gasoline, which eliminates disposal costs. Reusable oil is recovered by modern distillation systems, converting a financial burden into income.

MARKET OPPORTUNITIES

Diversification into Higher-Value Products and Integrated Biorefineries Expected to Create Growth Opportunities

The development of integrated bio-refineries and diversification into higher-value products presents a substantial opportunity beyond the conventional re-refining into basic biodiesel or base lubricants. Utilizing cutting-edge technologies such as hydrotreatment, pyrolysis, and gasification to transform waste oils into SAF and Renewable Diesel, as well as into specialty chemicals, bio-lubricants, and even bioplastic precursors, is part of this process.

A greater variety of waste oil types may be processed by integrated bio-refineries, which can also co-produce several high-value products, increasing their economic viability and cutting waste. For instance, in September 2020, Total, a large French oil company, announced an investment of USD 583 million to transform its Grandpuits refinery in France into a zero-crude platform for bioethanol and bioplastics. It will largely utilize waste and residue feedstocks, including waste oils, underscoring the shift toward multi-product bio-refineries.

MARKET CHALLENGES

Quality, Consistency, and Contamination Management Pose Major Challenge for Market

The collecting of used cooking oil and industrial lubricating oil presents many difficulties. One major challenge is contamination, where used oil often gets mixed with other substances, such as oily rags or food particles, complicating recycling. For recycling to be effective and eco-friendly, businesses must separate waste oil from mineral and crude oil. Similarly, UCO contains water, food particles, and a high concentration of free fatty acids (FFA), which can differ greatly depending on the source. Extensive and expensive pre-treatment procedures such as de-watering, filtration, and de-metallization are required for these impurities to prevent damage to processing equipment, guarantee effective conversion, and satisfy the exacting quality requirements of the final re-refined product or biofuel.

WASTE OIL MARKET TRENDS

Digitalization and Enhanced Traceability for ESG Compliance and Supply Chain Optimization are Latest Market Trends

Increasing use of advanced traceability technologies and digitization is the latest trend in the waste oil industry. Major players use blockchain technology for total supply chain transparency, GPS tracking to optimize oil collects routes, and IoT (Internet of Things) sensors for real-time volume and quality monitoring. Improved operational efficiency and lower logistical costs, fulfilling end users' and investors' strict Environmental, Social, and Governance (ESG) reporting requirements, which call for verifiable evidence of sustainable sourcing and waste management practices, are the main drivers of this trend.

In May 2022, Neste and Netherlands-based startup Circularise announced a partnership to bring Circularise’s traceability software into circular polymers and chemical supply chains. The companies are collaborating in establishing digital solutions to trace renewable and recycled material flows, providing increased transparency along the value chain. Implementing blockchain-based solutions for tracking waste streams, including oils, to ensure ethical sourcing and reduce fraud, with pilot programs gaining traction across various supply chains.

Download Free sample to learn more about this report.

IMPACT OF TARIFFS ON THE GLOBAL WASTE OIL MARKET

Trump’s tariff announcements are expected to impose more than 40% duties on Chinese used cooking oil (UCO) imports and baseline around 20% tariffs on the oil and biofuel feedstock landscape. According to the U.S. government, the U.S. imported around 2.8 billion pounds of waste cooking oil from China in 2024, up from 1.5 billion the year before, and almost half of the U.S.'s foreign purchases last year came from shipments from the Asian nation.

These tariffs raise feedstock prices, reduce profit margins for U.S. re-refiners, and boost demand for domestic collection and re-refined base oil and other end products of waste oil treatment. If this tariff holds on ethanol imports, the result is a higher-cost SAF product that is produced in the U.S. as U.S. demand for Chinese oil imports declines, China is redirecting millions of tons of waste oil to European markets, where demand is high for biofuels such as SAF. These imports are expected to lower the prices of SAF in Europe and also to impact domestic production. Overall, the tariffs are expected to destabilize the global pricing and cause competition for high-quality waste oil, reshaping trade for waste imports and exports.

SEGMENTATION ANALYSIS

By Source

Used Cooking Oil Dominates Market Due to Easy Process of Collection and Processing

Based on the type, the market is segmented into industrial oil, used cooking oil, animal fat, and others.

The used cooking oil (UCO) dominance is primarily driven by its increased demand as a feedstock for renewable fuels, specifically hydrotreated vegetable oil (HVO), renewable diesel, and biodiesel. The Used Cooking Oil segment is projected to dominate the market with a share of 42.94% in 2026. Moreover, global decarbonization targets and policy mandates for sustainable aviation fuel (SAF) significantly boost its value and collection efforts. Collecting and processing are also relatively easier and safer than many industrial oils.

In May 2023, Neste, a leading producer of renewable fuels, expanded its Singapore refinery, significantly increasing its capacity for renewable diesel and SAF production, primarily utilizing waste and residue feedstocks such as UCO.

The industrial oil is the second dominant segment, which includes lubricants, hydraulic fluids, metalworking fluids, and others. Refining industrial waste oils into premium base oils is becoming increasingly popular as the circular economy and resource efficiency gain traction. Additionally, stringent environmental regulations on industrial waste disposal encourage appropriate collection and treatment.

The animal fat segment, similar to UCO, is also increasingly sought as a feedstock for renewable diesel (HVO) and biodiesel production, especially in regions where UCO supply might be limited or for specific biofuel blending requirements. They offer a cost-effective and sustainable alternative to virgin vegetable oils.

By Application

To know how our report can help streamline your business, Speak to Analyst

Biofuels dominate Market Due to Low Cost of Waste Oil as Feedstock for Biofuel Production

Based on application, the market is segmented into biofuels, industrial lubricants, automotive, bio-based chemicals, and others.

Biofuels hold a major waste oil market share of 51.21% in 2026, as used cooking oil (UCO) and other waste oils are inexpensive feedstock for biofuel and renewable diesel. Globally, domestic and regional biofuels production, which includes biomass-based diesel and renewable diesel, is increasing. For instance, in 2022-2023, according to reports of the U.S. Department of Agriculture, Alaska alone generates more than 250,000 gallons of biodiesel a year using used cooking oil collected from nearby eateries. The American Soybean Association also highlighted that used cooking oil imports, which grew from less than 300 million pounds in 2021 to over 3 billion pounds in 2023, represent the biggest rise in the feedstock used to make biomass-based diesel.

Industrial lubricants hold the second highest market share due to significant demand for lubricants in manufacturing, heavy machinery, and industrial processes, coupled with growing corporate sustainability initiatives, driving the adoption of re-refined base oils. These re-refined products offer comparable performance to virgin oils but with a reduced environmental impact of waste oil.

The automotive sector is growing due to the continuous demand for engine oils, transmission fluids, and other automotive lubricants. Consumer and industry awareness of environmental issues has led to the acceptance and demand for re-refined motor oils (RMOs).

Bio-based Chemicals are the second fastest-growing application segment. Waste oils, especially used cooking oil and animal fats, contain triglycerides and fatty acids, which are valuable building blocks for surfactants, bioplastics, and lubricants production.

The other segment includes applications, such as using waste oils in some asphalt products, dust suppressants, or as supplemental fuel for industrial boilers where the oil is not converted into a refined fuel product.

WASTE OIL MARKET REGIONAL OUTLOOK

The market has been studied geographically across four main regions: North America, Europe, Asia Pacific, and the Rest of the World. Asia Pacific dominates the market due to the availability of a high volume of used cooking oil in the region, and it is also the fastest-growing region due to increasing government incentives to collect the majority of waste oil for treatment under waste management programs.

Asia Pacific

Asia Pacific Waste Oil Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Availability of High Volume of UCO in Region Drives Market Demand

Asia Pacific dominated the market with a valuation of USD 5.51 billion in 2025 and USD 5.9 billion in 2026 & holds a dominant market share due to the massive amount of used cooking oil (UCO) produced by its quickly urbanizing population and environmental regulations and policies encouraging biofuel production for energy security and emission reduction. With extensive collection programs and industrial investments, several countries in Asia are actively working to efficiently transform waste streams as domestic feedstocks, lowering dependency on imports of fossil fuels and promoting the circular economy. The Japan market is projected to reach USD 0.79 billion by 2026, and the India market is projected to reach USD 1.04 billion by 2026.

China

China’s Large-Scale Manufacturing & Growing Biodiesel Initiatives Drive Market in Country

In China, the significant industrial waste oil from its manufacturing sector and the country’s extensive food service industry produces a huge domestic supply of UCO. Building a strong local biofuel economy is a priority to satisfy strict environmental goals, improve energy security, and lessen dependency on imported fossil fuels. Redirecting previously exported UCO for domestic usage entails a substantial investment in expansive, cutting-edge processing facilities and research into sophisticated conversion technologies. In December 2023, Sinopec, China's largest oil refiner, announced the successful production of its first batch of Sustainable Aviation Fuel (SAF) from Used Cooking Oil (UCO) at its Zhenhai Refining & Chemical Company, marking a significant step toward commercializing UCO-based SAF in China. The China market is projected to reach USD 3.25 billion by 2026.

North America

Advanced Recycling & Regulations Drive Market in North America

The North American waste oil market is highly incentivized by lucrative federal and state-level clean fuel policies and tax credits, most notably the U.S. Renewable Fuel Standard (RFS) with its Renewable Identification Numbers (RINs) and California's Low Carbon Fuel Standard (LCFS) credits. In order to support domestic energy production and lower carbon intensity, these market-based mechanisms offer collectors and refiners a strong economic incentive to transform waste oils into high-value renewable diesel and biodiesel.

In June 2023, the U.S. EPA finalized Renewable Fuel Standard (RFS) renewable volume obligations (RVOs) for 2023-2025, maintaining strong support and volume requirements for advanced biofuels, including those derived from waste oils.

U.S.

Existing Infrastructure to Re-refine and Strict Regulations Drive Demand in Region

The existing infrastructure significantly drives the U.S. waste oil market growth, and the strong demand for low-carbon fuels in heavy-duty transportation and aviation is driving the rapid expansion of renewable diesel production capacity across the country. Moreover, the federal Renewable Fuel Standard (RFS) and certain state-level Low Carbon Fuel Standards (LCFS) in states offer robust and complementary incentives. Additionally, the competitive environment among refineries retooling for renewable fuels and the strategic significance of converting agricultural waste into valuable resources encourages efficiency and innovation. The U.S. market is projected to reach USD 2.79 billion by 2026.

In March 2023, Vertex Energy announced the successful commissioning and commercialization of its renewable diesel production unit at its Mobile, Alabama refinery. Its planned capacity of 14,000 barrels per day primarily uses feedstocks such as used cooking oil and unrefined waste oils.

Europe

Circular Economy Policies in Region Boost Market Growth

Europe's market is primarily propelled by strict and ambitious decarbonization goals, especially those outlined in the Renewable Energy Directive (RED II/RED III), which requires transportation to use a greater proportion of renewable energy and gives preference to advanced biofuels made from waste feedstocks such as UCO. Moreover, strong carbon pricing mechanisms and a well-established waste collection and processing infrastructure further encourage the high-value valorization of waste oils to manufacture biodiesel and Sustainable Aviation Fuel (SAF).

In April 2023, the Europe Union agreed on the ReFuelEU Aviation regulation, and this agreement sets ambitious mandates for increasing shares of SAF, explicitly listing used cooking oil as a key eligible feedstock, creating strong demand for waste oil conversion. Moreover, the European Commission's Renewable Energy Directive (RED II, soon RED III) strongly promotes advanced biofuels from waste and residues, including UCO, for meeting transport decarbonization targets. The UK market is projected to reach USD 0.98 billion by 2026, while the Germany market is projected to reach USD 1.43 billion by 2026.

Rest of World

Emerging Waste Oil Market Demand to Drive Demand in Region

In the Rest of the World, which includes regions including Latin America, the Middle East, and Africa, the market is driven from national energy security agendas aiming to diversify fuel sources and reduce import dependency, emerging environmental consciousness addressing localized pollution, and the pursuit of circular economy principles through pilot projects and foreign direct investment in waste-to-energy technologies.

COMPETITIVE LANDSCAPE

Key Industry Players

Competitive Landscape is Fragmented and Capital Intensive, Driven by Collaborations

The competitive landscape for the waste oil industry is fragmented within the broader waste management and circular economy landscape. It consists of a mix of large players, regional specialists, and local waste oil collectors. Some of the global key players include Safety-Kleen, Veolia, and Neste, among others, which operate large-scale collection networks as part of vertically integrated waste oil services. These players in the waste oil market are poised to invest significantly in large-scale bio-refineries that transform waste oils into higher-value products such as Sustainable Aviation Fuel (SAF) and Renewable Diesel (RD). SAF and RD are created from waste oils/fats and biomass generated from agricultural wastes, using complex technologies.

For instance, in June 2025, Quatra, the European market leader in the collection and recycling of used cooking oil, signed a 15-year agreement with TotalEnergies for supplying 60,000 tons a year of European used cooking oil to TotalEnergies’ bio-refineries. This agreement is expected to begin in 2026, and it will secure the feedstock to produce biodiesel and sustainable aviation fuel (SAF) in TotalEnergies bio-refineries.

List of the Key Waste Oil Companies Profiled

- Neste (Finland)

- Darling Ingredients (U.S.)

- Valero Energy Corporation (U.S.)

- Safety-Kleen (U.S.)

- Chevron Renewable Energy Group (U.S.)

- Archer Daniels Midland (ADM) (U.S.)

- TotalEnergies (France)

- Repsol (Spain)

- Eni (Italy)

- Veolia (France)

- Suez (France)

- Argent Energy (U.K.)

- Olleco (U.K.)

KEY INDUSTRY DEVELOPMENTS

- October 2023 - Repsol commenced operations at Spain's first advanced biofuels plant in Cartagena, designed to produce 250,000 tons of advanced biofuels annually from various waste raw materials, including used cooking oil and agricultural waste, which can be used to produce renewable diesel and SAF.

- September 2023 – TotalEnergies announced the start-up of France's first large-scale sustainable aviation fuel (SAF) unit at its Grandpuits biorefinery, which exclusively processes waste and residues, such as used cooking oil, to produce up to 285,000 tons of SAF annually.

- May 2023 - Eni announced the completion of the conversion of its Livorno refinery in Italy into a biorefinery, which will process biogenic waste raw materials, including used cooking oil and animal fats, to produce 300,000 tons per year of hydrogenated biofuels, including SAF, starting in 2026.

- September 2022- Archer Daniels Midland (ADM) announced a strategic partnership with Gevo, Inc. to produce sustainable aviation fuel (SAF) and renewable diesel, with ADM leveraging its existing infrastructure to process corn oil, which is a co-product of ethanol production and a type of waste oil, as a feedstock for Gevo's operations.

- June 2022- Shell, a U.K.-based oil and gas company, announced that it will start a used oil management service to streamline India's waste oil disposal system and boost the rate of re-refining in an effort to meet the objectives of the circular economy while cutting waste. The company has partnered with used oil refiners to start collecting and re-refining spent oil throughout India.

Investment Analysis and Opportunities

- In the waste oil industry, investments present significant opportunities, primarily driven by global decarbonization mandates and the growing demand for sustainable fuels including biodiesel, Sustainable Aviation Fuel (SAF), and other bio-based products.

- Government investment, exemplified by the EU's revised Renewable Energy Directive (RED II targets strengthened for 2030, implemented Jan 2021, and further under RED III) pushes for higher renewable transport fuel adoption and SAF blending mandates, alongside the US Inflation Reduction Act, which was signed in August 2022, offers substantial tax credits for clean fuel production. All these are creating a favorable policy landscape.

- Moreover, key investment areas include advanced collection processes and pre-treatment technologies, construction of new bio-refineries, and R&D into more efficient conversion processes, all aimed at secure and scalable feedstock supply.

REPORT COVERAGE

The market report delivers a detailed insight into the market and focuses on key aspects such as leading companies in waste oil. Besides, the report offers insights into the waste oil market trends & technology and highlights key industry developments. In addition to the factors above, the report encompasses several factors and challenges that contributed to the growth and downfall of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.22% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Source

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 15.22 billion in 2026.

The market is likely to grow at a CAGR of 7.22% over the forecast period (2026-2034).

The biofuels segment of the end-user leads the market.

The market size of the Asia Pacific stood at USD 5.51 billion in 2025.

Stringent environmental regulations and circular economy initiatives drive demand for waste oils, which are the key factors driving market growth.

Some of the top players in the market are Safety-Kleen, Neste, and Veolia, among others.

The global market size is expected to reach USD 26.58 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us