AC Electric Motor Market Size, Share & Industry Analysis, By Power Output (Fractional Horsepower (Upto 1HP) and Integral Horsepower (Above 1HP)) By Voltage (Upto 1kV, 1kV-6.6kV, and Above 6.6kV), By Application (Industrial Machinery, Motor Vehicles, HVAC Equipment, Electrical Appliances, and Others), By End-User (Industrial, Commercial, Residential, Agriculture, and Transportation), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

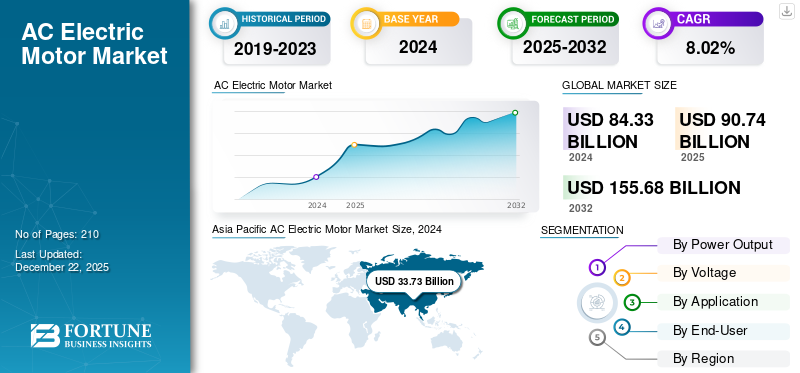

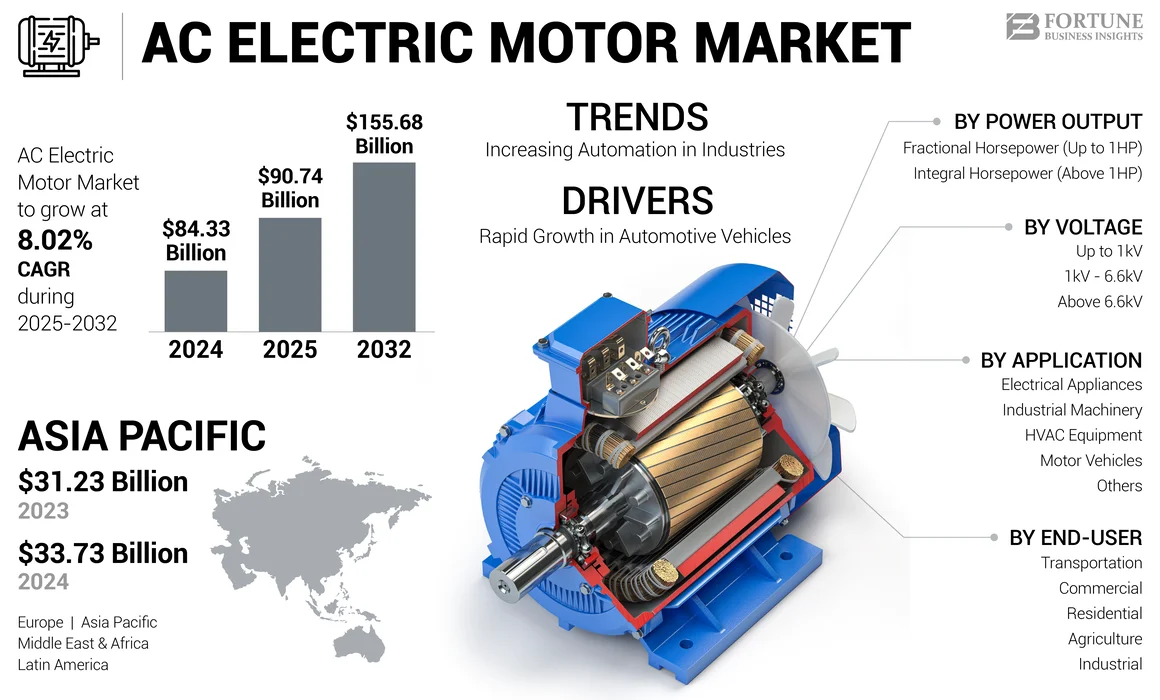

The global AC electric motor market size was valued at USD 84.33 billion in 2024. The market is projected to grow from USD 90.74 billion in 2025 to USD 155.68 billion by 2032, exhibiting a CAGR of 8.02% during the forecast period. Asia Pacific dominated the ac electric motor market with a share of 39.57% in 2024.

An AC electric motor is a component of a whole machine that alters alternating current (AC) power into mechanical energy in the form of rotational motion. This is done by through the principle of electromagnetic induction. It is generally used in different types of industrial machines, commercial equipment, and automotive vehicles.

The growing demand for electric vehicles is one of the major factors driving the AC electric motor market. Moreover, the need to switch from fossil fuel-based efficiency motors to electric motors by considering the environmental impact is boosting the market growth for AC electric motors. These factors are anticipated to drive the market share in the coming years.

Global AC Electric Motor Market Overview

Market Size:

- 2024 Value: USD 84.33 billion

- 2025 Value: USD 90.74 billion

- 2032 Forecast Value: USD 155.68 billion, with a CAGR of 8.02% from 2025–2032

Market Share:

- Regional Leader: Asia Pacific held the largest market share in 2024 at USD 33.73 billion, driven by rapid industrialization, EV adoption, and government initiatives promoting energy efficiency in countries like China, India, and South Korea.

- End-User Leader: The transportation segment led the market in 2024, fueled by the increasing demand for electric vehicles and investments in modern mobility solutions.

- Fastest-Growing Application: Industrial machinery is witnessing the highest growth rate due to automation, Industry 4.0 integration, and demand for high-efficiency motors.

Industry Trends:

- EV Integration: Rising electric vehicle production and investments are boosting demand for AC motors with high efficiency and torque control.

- Industrial Automation: Adoption of smart factories, robotics, and flexible manufacturing systems is driving the need for precision-controlled AC motors.

- Energy-Efficient Designs: Technological innovations, including variable-speed drives and synchronous reluctance motors, are improving efficiency and sustainability.

- Home Appliance Innovation: Modernization of appliances such as washing machines and HVAC units is pushing demand for compact, low-voltage AC motors.

Driving Factors:

- EV Market Expansion: Shift from internal combustion engines to electric mobility is a major driver.

- Environmental Regulations: Global push to reduce carbon emissions favors the adoption of electric motors over fossil fuel alternatives.

- Smart Infrastructure Growth: Increasing demand in residential, commercial, and agricultural sectors for efficient, automated systems.

- Technological Advancements: Players like ABB and Siemens are developing next-gen motors with reduced energy loss and smarter performance features.

- Government Policies & Incentives: Regulatory support for carbon-neutral goals and clean energy initiatives fuels market demand.

ABB is a prominent player in the market, known for its wide range of products, focus on energy efficiency, and commitment to innovation, particularly in areas such as synchronous reluctance motors and condition monitoring solutions. Presence of such large organizations in the market fosters the technological advancements in the industry which is expected to drive the market growth over forecast period.

MARKET DYNAMICS

Market Drivers

Rapid Growth in Automotive Vehicles to Boost the Demand for AC Electric Motor

Automotive is one of the major key sectors that is influencing the market. This is owing to the rapid advancements in the recently launched vehicles associated with AC electric motors. In addition, the shift of end-users from old-style vehicles to modern and technologically advanced vehicles is influencing the AC electric motor market growth. For instance, in October 2024, AC Cars- one of Britain’s oldest active car manufacturers and service providers is planning to go all-electric by replacing all old, outdated, burly V8 from sports car with a silent 225 kW electric motor and battery pack.

AC ELECTRIC MOTOR MARKET TRENDS

Increasing Automation in Industries to Propel the Market Growth

With the evolution of Industry 4.0, factories are integrating smart technologies such as robotics, programmable logic controllers, and industrial IoT devices, many of which rely on precise motion control provided by AC motors. South Korea has emerged as the global frontrunner in industrial robot adoption, with over 10% of its workforce now supplemented by robotic systems. The country leads the world in robot density, recording 1,012 robots for every 10,000 employees, which is further providing a positive impact on the demand for AC electric motors. Moreover, these motors power a wide range of equipment, including conveyors, robotic arms, compressors, pumps, and fans, all essential for automated processes. Furthermore, the trend toward flexible manufacturing systems, where production lines must quickly adapt to different product types and volumes, favors the use of variable-speed AC motors that can be easily controlled via drives.

Market Restraints

High Investment and Maintenance Cost to Hinder Market Growth

AC electric motors are costly owing to their complex mechanism that helps to deliver efficiency and performance at the same time. Electric motors also come with supportive equipment which are highly expensive. Equipment such as an electronic switching controller, speed controller (ESC), and other devices are required to set up an AC electric motor, which increases the overall initial cost. Apart from this, challenges related to the maintenance cost required on a daily basis is also an restraint to the market. This is owing to the continuous run time of the motor, without taking a break.

Market Opportunities

Growing Environmental Concerns is Boosting AC Electric Motor Market

In recent years, government and private bodies are focusing on the reduction of CO2 emission. This is owing to the agenda of having carbon-free environment all over the world. AC electric motors are energy-efficient products that do not produce carbon and hence are promoted by private businesses in multiple industries. Automotive industry is creating new opportunities for the manufacturers as governments are pushing them to create fully electric vehicles by implementing strict policies considering climate change.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Power Output

Fractional Horsepower (Up to 1HP) Segment is Dominating the Market Owing to its Growing Use in Wide Applications

By power output, the market is segmented into fractional horsepower (Up to 1HP) and integral horsepower (Above 1HP).

Fractional Horsepower (Up to 1HP) is considered as the dominating segment owing to the demand for compact and effective motors in household appliances, and consumer electronics. Their wide applications in commercial and residential appliances and devices are influencing the market growth globally.

Integral horsepower (Above 1HP) is the fastest-growing segment driven by the advancements in industrial equipment. Heavy machinery and equipment in industrial applications are boosting the AC electric motor market globally.

By Voltage

Up to 1Kv Segment is Holding the Maximum Share in the Market Owing to its Use in Home Appliances

By voltage, the market covers Up to 1kV, 1kV - 6.6kV, and Above 6.6kV segment.

Up to 1kV is the dominating segment owing to the majority of the use in small devices and equipment such as fans, home appliances, and others. The growing advancements in modern home appliances in driving the demand for this segment in the market.

1kV-6.6kV is considered the fastest-growing segment due to the rising investments from the industrial and agricultural sectors. Medium voltage machinery are influencing the market growth of motors in recent years.

By Application

Motor Vehicles to Lead the Market Due to its Growing Adoption in Automotive Sector

By application, the market is categorized into industrial machinery, motor vehicles, HVAC equipment, electrical appliance, and others.

AC electric motor is majorly serving the automotive industry due to the high demand for electric vehicles. Hence, motor vehicle is the dominating segment in the global AC electric motor market.

Industrial machinery has been the fastest-growing segment in recent years, influenced by the advancement in industrial machinery and HVAC equipment. For instance, in March 2022, Kirloskar Oil Engines Limited (KOEL), an industry leader in engines, has launched high-efficiency voltage electric motors that will supremacy machinery in all applications across industries.

By End-User

Transportation Segment to Dominate Market Influenced by Growing Industrialization and Urbanization

By end-user segment, the market covers industrial, commercial, residential, agriculture, and transportation.

The transportation sector is continuously grown in recent years, driven by multiple factors such as the rising population in emerging countries and economic growth that is pushing commercial transportation activities globally. Moreover, expansion in urbanization and sudden growth in infrastructure are fueling the demand for safe transportation. The advanced products in automotive industry such as electric vehicles, drive the segmental growth. For instance, Tata Motors- An International car manufacturer has planned to launch Nano Electric with a 300km range in India. It will also come with new features such as boasting a 72V power pack, 6-speaker sound system, power steering, power windows, 7-inch touchscreen infotainment system and others.

The commercial sector accounted for significant market size in the AC electric motor owing to its affordability, durability, and versatility. These features are crucial in commercial sector and industrial settings as these motors offer high torque, reliability, and simple maintenance. AC motors, especially induction motors, have a simple design with fewer moving parts, resulting in greater reliability and a longer lifespan. Their rugged design allows them to withstand demanding industrial environments.

AC ELECTRIC MOTOR MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific

Asia Pacific AC Electric Motor Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific is the dominating region in the AC electric motor market share owing to the growing demand for the EV in emerging countries including India, China, and South Korea. Governments push for energy-efficient products to control climate change is influencing the market growth. Automotive sector is showing significant growth in recent years driven by the change in consumer preferences while buying products. For instance, in November 2024, Scooter India (HMSI) & Honda Motorcycle officially entered into EV two-wheelers market in India as it introduced the electric variety of its iconic Activa scooter called the Activa E & Activa QC1. Such product launches associated with the electric motor drives the market growth.

North America

North America is the second dominating region globally, owing to the availability of the motor manufacturers in the region. Further, advancements in the AC electric motor are mostly influenced by North America as it is a hub for technology.

U.S. is the dominating country in North America driven by the growing demand for electric vehicles. The electric motors portfolio available by companies is driving the market growth. For instance, in March 2025, multiple manufacturers, including Lucid, Canoo, and Rivian, are launching their electric vehicles in upcoming months, driven by the rising demand for EVs in the U.S.

Europe

Europe is growing rapidly owing to the region's focus on energy-efficient products. The major focus of companies on modern home appliances such as washing machines, fans, water pumps, and refrigerators is fueling the electric motor market in the EU. In addition, the government's agenda to reduce the use of energy and achieve climate goals set under the 2021 European Green Deal is driving the market growth.

Latin America

Latin America has witnessed steady growth in recent years, driven by the government's focus on electric vehicles. This is owing to the advancements in the automotive and transportation sectors. Electric motors are mostly being used in the EVs and the market for EVs in Latin America is scattered, creating new opportunities in the market for manufacturers.

Middle East & Africa

The Middle East & Africa demonstrated higher growth due to the adoption of technological developments and advancements in industrial equipment. For instance, in February 2025, The Auto Care Association and MEMA Aftermarket Suppliers welcome associates to an exclusive webinar presenting global strategy consulting business Strategy, as it reveals estimates for the electric vehicle (EV) market and its impact on the automotive aftermarket.

Such developments in the Middle East to drive the demand for AC electric motors in forecast years driven by climate change concerns.

COMPETITIVE LANDSCAPE

Key Industry Players

Advancements in AC Electric Motor to Deliver Efficient Performance Can Push Market Growth

Manufacturing companies are compiling modern technologies to deliver sustainable products to end-users through a strong product portfolio. This is driven by the rising environmental concerns that are pushing companies to make energy-efficient products. The goal of inventions in motor design is to reduce losses, counting bearing losses, stray load losses, and losses in the stator and rotor. For instance, In March 2021, a Mumbai-based electric vehicle startup launched the entry-level three-wheeler named Strom R3, has received orders worth over USD 1 million in just 4 days.

List of Key AC Electric Motor Companies Profiled

- ABB (Switzerland)

- AMETEK (U.S.)

- Johnson Electric (China)

- Siemens (Germany)

- Rockwell Automation (U.S.)

- GE (U.S.)

- Nidec Motor Corporation (Japan)

- WEG (Brazil)

- Toshiba Corporation (Japan)

- Hitachi (Japan)

- Mitsubishi Heavy Industries (Japan)

- TECO-Westinghouse Motor Company (U.S.)

KEY INDUSTRY DEVELOPMENTS

- In December 2024, Danfoss Power Solutions introduced its Editron EM-PMI375 690-volt electric motor. The motor works with the Editron EC-C1700B inverter, delivering solutions for 690-V AC and 1,050-V DC applications such as marine vessels, winches, cranes, and mining and material handling machinery.

- In November 2024: Inovance - The Chinese automation company has entered the European market for industrial AC motors with an IE5-efficiency that uses a hairpin technology adapted from the automotive sector.

- In August 2024, Yamaha Motor launched new five-seater electric golf cars - G30es and G31eps in Japan. Further, introduces new in-house battery technology and a high-performance AC Motor with superior speed and torque control.

- In August 2024 - Tata Motors- A car manufacturer, announced its tactics to invest between USD 1,900 million to USD 2,000 million into its electric vehicle (EV) division until 2029–2030.

- In June 2024, TVS Motor is planning to launch a new electric two-wheeler in upcoming months driven by an energy-efficient motor. Further, TVS Motor's iQube series also has four variants with 2.2 kWh and 3.4 kWh battery capacity.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service process, competitive landscape, and leading source of the electric motor. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 8.02% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Power Output

|

|

By Voltage

|

|

|

By Application

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 84.33 Billion in 2024.

In 2024, the Asia Pacific market value stood at USD 33.73 billion.

The market is expected to exhibit a CAGR of 8.02% during the forecast period.

The Transportation segment led the market by end-user.

Rapid growth in automotive vehicles to boost AC electric motor.

Some of the top major players in the market are ABB, Rockwell Automation, and GE.

Asia Pacific dominated the market in 2024.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us