Aerospace Foam Market Size, Share & Industry Analysis, By Type (Polyurethane Foam, Polyethylene Foam, Melamine Foam, and Others), By Application (Commercial Aviation, Military & Defense, and General Aviation), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

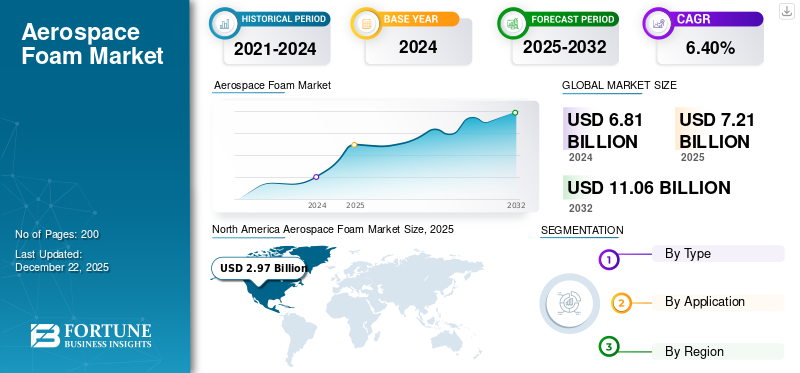

The global aerospace foam market size was valued at USD 7.21 billion in 2025. The market is projected to grow from USD 7.65 billion in 2026 to USD 12.52 billion by 2034 at a CAGR of 6.40% during the 2026-2034 forecast period. North America dominated the aerospace foam market with a market share of 22% in 2025.

Aerospace foams are lightweight materials utilized in aircraft and spacecraft for a variety of purposes, including thermal insulation, sound dampening, and structural support. They provide an excellent balance of strength, low weight, and insulation properties, making them essential in applications where weight and performance are crucial.

The market is experiencing a growing demand for sustainable, high-performance, and multifunctional foams. This demand is driven by an increased focus on reducing aircraft weight, enhancing fuel efficiency, and improving passenger comfort. Some of the key players in the market are BASF SE, Evonik Industries AG, Solvay, Boyd Corporation, UFP Technologies, and others.

The COVID-19 pandemic had a significant impact on the aerospace industry, which severely hindered market growth. The lockdown measures and disrupted supply chains halted manufacturing and transportation operations in various regions.

Global Aerospace Foam Market Key Takeaways

Market Size & Forecast

- 2025 Market Size: USD 7.21 billion

- 2026 Market Size: USD 7.6 billion

- 2034 Forecast Market Size: USD 12.52 billion

- CAGR: 6.40% from 2026–2034

Market Share

- Regional Share: North America dominated the aerospace foam market with a 41% share in 2025, supported by advanced aerospace infrastructure, strong defense spending, and the presence of major OEMs such as Boeing and Lockheed Martin.

- By Type, Polyurethane (PU) foam held the largest market share in 2025, driven by its versatility, durability, and suitability for seating, insulation, and interior components in aircraft.

- By Application, Commercial aviation dominated the market due to rising global passenger traffic, continuous fleet upgrades, and increasing demand for lightweight, fuel-efficient aircraft materials.

Key Country Highlights

- United States: Leads the global aerospace foam consumption due to significant commercial and military aircraft production, high defense budgets, and strong presence of aerospace OEMs and suppliers.

- Germany, France & U.K.: Europe’s growth is driven by robust aerospace manufacturing, sustainability initiatives under the EU Green Deal, and increasing adoption of eco-friendly, lightweight foams.

- China & India: Asia Pacific growth is fueled by expanding aircraft manufacturing, rising MRO operations, and increasing air travel demand. India is witnessing strong domestic production of aircraft components, including foam-based materials.

- Brazil: Supports Latin America’s growth due to its strong regional aerospace ecosystem, particularly with Embraer’s production capabilities.

- Middle East: Market growth is boosted by rising investments in airport infrastructure, fleet modernization, and government-backed aviation development programs.

AEROSPACE FOAM MARKET TRENDS

Eco-friendly Formulations in Aerospace Foam for Various Applications to Lead Market Growth

The aerospace industry innovates with sustainable foam materials in response to escalating environmental concerns. Manufacturers are increasingly focusing on creating foam variants that are not only recyclable but also non-toxic and free from halogens, adhering to stringent environmental regulations. These eco-friendly foams are designed to minimize ecological impact while maintaining the performance qualities essential for aerospace applications. By utilizing advanced materials and technologies, companies aim to offer a greener alternative, supporting regulatory compliance and environmental stewardship in the aviation industry.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Automation and Digital Manufacturing Techniques Drive Market Growth

The aerospace foam production process is undergoing a significant transformation due to the integration of advanced automation and digital manufacturing technologies. Techniques such as CNC foam cutting, which utilizes computer-controlled machinery to achieve precise and intricate shapes, are enabling manufacturers to create high-quality foam components with remarkable accuracy. Additionally, 3D foam shaping is revolutionizing the way foam materials are designed and crafted, allowing for complex geometries that were previously difficult to achieve. Furthermore, the implementation of AI-driven quality assurance systems ensures that each piece meets stringent aerospace standards by continuously monitoring and analyzing production parameters. This combination of cutting-edge technologies enhances the consistency of foam products and significantly improves the overall performance, leading to the development of lightweight, durable materials that are crucial in the aerospace industry. This is expected to boost the aerospace foam market growth in the coming years.

MARKET RESTRAINTS

Raw Material Price Volatility May Hinder Market Growth

The costs of essential raw materials such as polyurethane, polyvinyl chloride, and polyethylene are highly susceptible to variations caused by the volatility of oil prices and challenges within the supply chain. These fluctuations can significantly affect manufacturing expenses, leading to unpredictable pricing for producers. For instance, when oil prices surge due to geopolitical tensions or production cuts, the prices of these core inputs often rise. Additionally, disruptions in the supply chain—whether from natural disasters, logistical delays, or regulatory changes—further exacerbate these cost surges, ultimately influencing the final pricing of manufactured products across various industries.

MARKET OPPORTUNITIES

Expansion of Defense Sector Provides Lucrative Opportunities for Market Growth

Amid rising geopolitical tensions and uncertainties, countries including the U.S., China, and India are responding with a significant increase in defense budgets. This surge in military spending is directly fueling a growing demand for sophisticated military-grade foams. These advanced materials are critical for a variety of applications, including insulation for naval vessels and aircraft, safety features in armored vehicles, and structural components that enhance durability and efficiency. As countries prioritize national security and modernize their armed forces, the strategic importance of high-performance foams in defense technology becomes increasingly evident.

MARKET CHALLENGES

Stringent Regulatory Compliance Poses Risk to Market Growth

Aerospace foams are required to meet stringent fire, smoke, and toxicity (FST) standards established by the Federal Aviation Administration (FAA), the European Union Aviation Safety Agency (EASA), and various other international aviation safety organizations. These standards are critical to ensure passenger safety and prevent hazardous situations during flight. As a result, manufacturers face significant research and development (R&D) expenses, as well as increased compliance costs associated with testing and certifying their materials. This rigorous process involves extensive evaluations to verify that the materials perform safely and effectively under extreme conditions, ultimately influencing the cost and timeline of product development in the aerospace industry.

SEGMENTATION ANALYSIS

By Type

Polyurethane Foam Held a Major Market Share Due to Its Versatility

Based on type, the market is segmented into polyurethane foam, polyethylene foam, melamine foam, and others.

Polyurethane (PU) foam accounted for the largest aerospace foam market with a share of 40.52% in 2026. It is widely used in aircraft for various applications, including seating, insulation, and aircraft interior components. Its versatility, durability, and ability to be customized make it a suitable material for a range of aircraft needs.

Polyethylene (PE) foam is likely to grow significantly during the forecast period. It is frequently used in aircraft applications, particularly in seating, insulation, and packaging, due to its lightweight, durable, and shock-absorbing properties. It is a common choice for flotation and buoyancy aids. Specific grades of PE foam, including ETHAFOAM™ 4101 FR, are designed to meet aircraft fire retardant standards.

By Application

To know how our report can help streamline your business, Speak to Analyst

Commercial Aviation Segment Dominates Market Due to Rise in Air Passenger Traffic

By application, the market is segmented into commercial aviation, military & defense, and general aviation.

Commercial aviation is the leading segment in the market with a share of 67.71% in 2026. Aerospace foams play a crucial role in commercial aviation, providing several benefits such as weight reduction, improved fuel efficiency, and enhanced safety and comfort. These foams are utilized in various applications, including interior panels, seating, insulation, and vibration damping, due to their unique properties. Additionally, this sector is still seeing strong demand due to the worldwide growth of commercial air travel, which includes fleet upgrades and new airplane deliveries.

The general aviation segment is anticipated to experience steady growth during the forecast period on account of its lightweight, durable, and versatile characteristics. These features provide insulation, shock protection, and sound dampening, which enhance the performance and survivability of military aircraft and equipment.

AEROSPACE FOAM MARKET REGIONAL OUTLOOK

The global market has been segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Aerospace Foam Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the global market, with a value of USD 2.97 billion in 2025. The growth of the region can be attributed to its advanced aviation infrastructure, significant defense spending, and the presence of key original equipment manufacturers (OEMs) and aerospace suppliers. The U.S. leads in both the commercial and military aerospace sectors. In 2026, the U.S. aerospace market was valued at USD 2.54 billion, with continued expansion observed in both commercial and military segments. The presence of major aircraft manufacturers such as Boeing and Lockheed Martin, combined with a robust manufacturing infrastructure, ensures a steady demand in the industry.

To know how our report can help streamline your business, Speak to Analyst

Europe

Europe is anticipated to experience significant market growth during the forecast period. Europe has a robust aerospace manufacturing sector, which necessitates the use of various materials, including foams. Moreover, the growth is driven by aircraft production in Germany, France, and the U.K., combined with the increasing adoption of sustainable manufacturing processes aligned with the EU Green Deal. This, coupled with other environmental regulations, is pushing for eco-friendly technologies, including lightweight foams, in the aerospace industry. The UK market is projected to reach USD 0.5 billion by 2026, while the Germany market is projected to reach USD 0.93 billion by 2026.

Asia Pacific

The Asia Pacific region is likely to grow significantly, propelled by booming aircraft manufacturing in China and India, growing MRO (Maintenance, Repair & Overhaul) activities, and rising air passenger traffic. India, in particular, is expected to see significant growth in the market due to the manufacturing of aircraft components, including those using foams, within the country. Companies are strategically expanding their market presence through partnerships and collaborations to capitalize on the growing demand for aerospace products in the Asia Pacific region. The Japan market is projected to reach USD 0.17 billion by 2026, the China market is projected to reach USD 0.7 billion by 2026, and the India market is projected to reach USD 0.26 billion by 2026.

Latin America

Latin America is expected to experience gradual growth over the forecast period. Brazil's significant domestic flight demand and its large aerospace industry, particularly with Embraer, contribute to the regional market's growth.

Middle East & Africa

The Middle East & Africa region is noticing potential growth with rising airport infrastructure investments, increasing fleet modernization programs, and favorable government aviation policies. Governments in the Middle East are investing in aviation infrastructure and supporting the industry, which further promotes the demand for aerospace foams.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Joint Ventures and Capacity Expansion are Key Strategic Initiatives Implemented to Increase Market Share

Key players operating in the industry are BASF SE, Evonik Industries AG, Solvay, Boyd Corporation, UFP Technologies, and others. These companies are involved in capacity improvement, product innovation, acquisition, mergers, and collaboration, thus gaining a competitive edge in the global market. For instance, in April 2025, UFP Technologies entered a multi-year supply agreement with a U.S. aircraft OEM for advanced seating foam composites.

LIST OF KEY AEROSPACE FOAM COMPANIES PROFILED

- BASF SE (Germany)

- Evonik Industries AG (Germany)

- Solvay (Belgium)

- Boyd Corporation (U.S.)

- UFP Technologies (U.S.)

- Dupont (U.S.)

- SABIC (Saudi Arabia)

- Armacell (Luxembourg)

- ERG Aerospace Corp. (U.S.)

- FoamPartner (Switzerland)

KEY INDUSTRY DEVELOPMENTS

- April 2025: Zotefoams, a world leader in supercritical foams, introduced Ecozote PE/R LD24 FR, the latest addition to its Ecozote Sustainability+ foams range, at this year’s AIX show on stand 5E36.

- September 2024: L&L Products launched InsituCore foaming materials for lightweight composite manufacturing. These materials are made to produce lightweight, robust components with specific density and strength, making them a cost-effective and efficient option for aerospace foam applications.

- December 2021: Boyd Corporation, a leader in engineered materials and thermal management, acquired Grando, a company in Belgium that specializes in rubber, foam, and plastic science for the rail and industrial technology industries. This acquisition enhances Boyd’s material science offerings and expands its European manufacturing capabilities. It also increases Boyd’s market presence in Belgium and improves access to markets in France, Italy, and Spain.

REPORT COVERAGE

The market research report provides a detailed analysis of the market and focuses on crucial aspects such as leading companies, types, and applications. Also, the report offers insights into market trends and highlights vital industry developments. In addition to the factors mentioned above, the report encompasses various factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-20234 |

|

Unit |

Value (USD Billion), Volume (Kiloton) |

|

Growth Rate |

CAGR of 6.40% from 2026 to 2034 |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 7.65 billion in 2026 and is projected to reach USD 12.52 billion by 2034.

Increasing at a CAGR of 6.40%, the market will exhibit steady growth over the forecast period (2026-2034)

The commercial aviation application segment leads the market.

Development of eco-friendly formulations is the latest market trend in the global market.

BASF SE, Evonik Industries AG, Solvay, Boyd Corporation, and UFP Technologies are a few of the leading players in the global market.

North America dominated the aerospace foam market with a market share of 22% in 2025.

The defense sectors expansion and technological innovation will drive product demand.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us