Agriculture Sensors Market Size, Share & Industry Analysis, By Type (Temperature and Humidity Sensor, Electrochemical Sensor, Location Sensor, Soil Moisture Sensor, Airflow Sensor, Water Sensor, Mechanical Sensor, Optical Sensor, and Others), By Application (Crop Monitoring, Irrigation and Water Management, Livestock Management, Soil Management, Climate Monitoring, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

The global agricultural sensors market size was valued at USD 2.63 billion in 2025. The market is projected to grow from USD 2.95 billion in 2026 to USD 7.27 billion by 2034, exhibiting a CAGR of 11.95% during the forecast period.

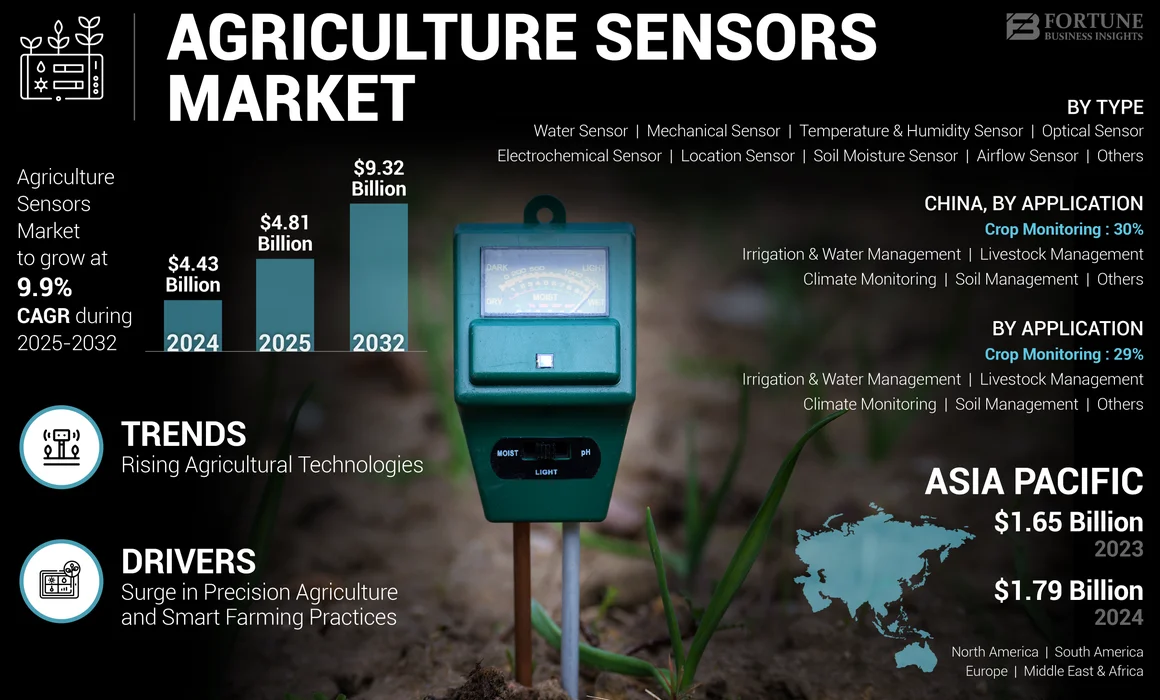

The global agriculture sensors market size was valued at USD 4.43 billion in 2024. The market is projected to grow from USD 4.81 billion in 2025 to USD 9.32 billion by 2032, exhibiting a CAGR of 9.9% during the forecast period.

An agriculture sensor is a device that detects and measures environmental factors and crop characteristics, converting this information into useful data for farmers. They play a crucial role in modern farming by providing real-time data that helps optimize crop management and improve productivity.

The agriculture sensors market growth is expected to be majorly driven by the rise in precision agriculture and smart farming practices. These sensors are becoming more popular among farmers due to the growing demand for efficient production using available resources, thereby accelerating the market’s growth. According to the United Nations Development Programme in 2024, precision agriculture and smart farming help farmers use insights more efficiently and save on labor costs by up to 30 to 40%. Furthermore, shifting weather patterns resulting from global warming have necessitated the use of advanced sensors to enhance productivity and crop yields. By utilizing these sophisticated sensors, farmers can keep track of their fields and weather predictions while meeting ideal field conditions. Agricultural sensors enable farmers to boost yields with reduced human labor and less waste.

The COVID-19 pandemic highlighted vulnerabilities within the agriculture sector while simultaneously creating opportunities for technological integration through agricultural sensors. These sensors not only help mitigate immediate challenges, but also pave the way for a more resilient and sustainable agricultural future. The ongoing evolution of sensor technology will be crucial in supporting farmers as they navigate post-pandemic recovery and adapt to new market conditions.

IMPACT OF GENERATIVE AI

Collaboration of Generative AI with Agriculture Sensors to Enhance Latter’s Capabilities and Fuel Market Growth

The collaboration between generative AI and agriculture sensors is reshaping the future of farming. By enhancing decision-making capabilities, optimizing resource use, managing pests effectively, and supporting economic viability, this integration holds potential for the creation of a more efficient and sustainable agricultural sector. As technology continues to evolve, its impact on agriculture will likely expand further, addressing both current challenges and future demands in food production.

AGRICULTURE SENSORS MARKET TRENDS

Rising Agricultural Technologies to Emerge as Key Market Trend

The primary factors influencing the advancement of agricultural sensors are as follows: growth of agro-based systems in developing countries, rising labor costs, heightened pressure on global food resources brought about by population increase, notable cost efficiencies with techniques involving agricultural sensors, and governmental efforts to promote adoption of sophisticated agricultural technologies. The popularity of agriculture sensors has surged among farmers due to the increasing demands they encounter to boost crop yields while reducing their expenditures.

MARKET DYNAMICS

Market Drivers

Surge in Precision Agriculture and Smart Farming Practices to Aid Market Growth

The function of agricultural sensors in precision agriculture is to deliver real-time information regarding soil characteristics, crop health, and weather conditions. Through the collection of this information, farmers can make educated choices about irrigation and fertilization and can identify pests and diseases early on. This approach aids them in enhancing crop quality and maximizing harvests. Additionally, smart farming techniques greatly minimize environmental effects by ensuring that resources are applied with precision. By using sensors to track the health of crops and soil, farmers can deliver only the required amounts of water and nutrients, which helps decrease waste and lessen environmental stress.

Market Restraints

Lack of Rules, Regulations, and Skilled Workers to Hinder Market Expansion

Numerous obstacles and challenges need to be addressed, both of which could slow down the overall growth of the market. Several factors are restricting the market’s expansion, such as a shortage of skilled workers and the lack of relevant protocols and standards. Furthermore, farmers can collect agricultural data through various sensors that utilize different software and hardware. As a result, the complex integrated systems of agricultural sensors could hinder the market’s growth.

The unaffordability of the technology, limited awareness among farmers regarding the advantages of agricultural sensors, especially in developing nations, and fluctuating agricultural crop prices are potential barriers to the overall development of the global agriculture sensors market. Additionally, the advancement of the market may face setbacks in the global arena.

Market Opportunities

Development of Affordable and Higher-Quality Sensors and Government Initiatives to Create Lucrative Market Opportunities

The expansion of the market for agricultural products is facilitated by the introduction of more cost-effective and higher-quality sensors, as well as government initiatives that encourage smart agricultural practices in developing nations. For example, the development of materials that can produce fluorescence and the use of a confocal laser scanning microscope to capture images are advanced methods for identifying root colonization by organisms in potatoes. This has led to the creation of a bio-acoustic sensor designed with a probe to capture sounds, enabling early detection of palm weevils for effective pest management. Additionally, favorable socioeconomic and demographic trends, such as increasing urbanization, growing population, rising disposable incomes, and improved living standards are expected to drive the expansion of the global agriculture sensors market share. Consequently, these factors will generate numerous opportunities within the market.

SEGMENTATION ANALYSIS

By Type

Exceptional Capabilities of Temperature & Humidity Sensors Boosted Their Demand

Based on type, the market is segmented into temperature and humidity sensor, electrochemical sensor, location sensor, soil moisture sensor, airflow sensor, water sensor, mechanical sensor, optical sensor, and others.

In terms of share, the temperature & humidity sensor segment dominated the market in 2024. Temperature and humidity sensors play a crucial role as IoT devices in agriculture, facilitating the monitoring and management of environmental conditions. They supply important data that assists farmers in making educated choices regarding crop development, irrigation, ventilation, and pest management. These devices have transformed farm management, allowing farmers to tailor their practices to the unique conditions affecting their crops. With the help of agriculture sensors, they can observe temperature, humidity, and other essential soil metrics in real-time, enabling them to make knowledgeable decisions and enhance yields. This factor is promoting sustainable agricultural practices.

The soil moisture sensor segment is anticipated to register the highest CAGR during the forecast period. Agriculture sensors are transforming agricultural practices by providing precise, real-time data that helps farmers make informed decisions about irrigation and resource management. Their ability to enhance crop yields while conserving water makes them a vital component of sustainable farming practices.

By Application

To know how our report can help streamline your business, Speak to Analyst

Crop Monitoring Segment Dominated With Growing Implementation of Precision Agriculture Methods

Based on application, the market is categorized into crop monitoring, irrigation and water management, livestock management, soil management, climate monitoring, and others.

In terms of share, in 2024, the crop monitoring segment dominated the market due to the growing implementation of precision agriculture methods and the need for immediate information regarding crop health and productivity. By analyzing this data, farmers can better understand the environmental conditions affecting their crops and adjust their management practices accordingly.

The soil management segment is expected to record the highest CAGR during the forecast period. Soil management evaluates essential factors, such as moisture content, nutrient levels, pH, and temperature through the use of sophisticated sensor technologies. It delivers real-time information that enables farmers to make educated choices to improve crop production and maximize resource use. A significant benefit of soil management is its role in precision agriculture. By having precise data on soil conditions, farmers can customize their irrigation and fertilization methods to cater to the unique demands of their crops.

AGRICULTURE SENSORS MARKET REGIONAL OUTLOOK

Asia Pacific

Asia Pacific Agriculture Sensors Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific held a major market share in 2024. Due to growing awareness of soil moisture sensors among farmers, their usage is on the rise. Additionally, the extensive agricultural areas in China and India are likely to boost the adoption of soil moisture sensors. The rising concern for soil health in these countries is positively influencing the market’s expansion. India, Japan, and China are predicted to generate significant revenue through supportive government initiatives and an increase in farmers' disposable income.

Download Free sample to learn more about this report.

The integration of various technologies, such as remote sensing, Internet of Things (IoT), and cloud computing is revolutionizing agriculture in China. Companies like RIKA SENSOR are at the forefront of developing intelligent agricultural monitoring systems that utilize a range of sensors to track environmental conditions, soil health, and crop status. These systems enable real-time data collection and analysis, allowing farmers to make informed decisions regarding irrigation, fertilization, and pest management.

To know how our report can help streamline your business, Speak to Analyst

South America

Agricultural sensors are becoming an essential tool in South America, enhancing productivity, sustainability, and efficiency in farming. Given the region's importance as a global food producer, countries are increasingly adopting sensor technologies to address challenges related to climate change, resource management, and crop health.

Europe

Europe is estimated to record the highest growth rate during the forecast period, driven by the need to improve efficiency, reduce environmental impact, and comply with regulations. As sensor technologies become more affordable and accessible, their role in European agriculture will continue to expand, helping farmers navigate the challenges of modern agriculture while promoting sustainability.

Middle East & Africa

The Middle East & Africa is projected to register a substantial growth rate during the forecast period due to the region's challenges, such as water scarcity, climate change, and the need for enhanced food security. Agriculture sensors help optimize the use of resources, increase productivity, and promote sustainability in farming practices. The adoption of agricultural sensor technologies varies across countries within the region, with some of them leading the way in innovation while others still being in the early stages of implementation.

North America

North America is anticipated to depict the second-highest CAGR over the analysis period. Agricultural sensors are becoming increasingly integral to modern farming practices in the region, helping optimize productivity, manage resources efficiently, and promote sustainability. With its large-scale, high-tech farming operations, North America, particularly the U.S. and Canada, is at the forefront of adopting sensor technologies in agriculture. These technologies are critical in addressing challenges, such as climate change, water scarcity, and the need for higher crop yields in an environmentally responsible manner.

The U.S. is adopting agricultural technology with a wide range of sensors used across various farming sectors. Key areas of sensor adoption include precision agriculture in the Midwest (corn and soybean farming), irrigation management in California (almond and grape farming), and crop health monitoring for cotton and wheat production in the South. The U.S. also leads the development of sensor-based solutions for large-scale livestock management.

COMPETITIVE LANDSCAPE

Key Industry Players

Leading Players Focus on Heavy Investments and Acquisitions to Expand Global Reach

Industry participants are offering cutting-edge agriculture sensors that offer high accuracy and lower energy wastage. Furthermore, market giants are also concentrated on acquiring regional companies to expand their business activities. In addition to the above factors, collaborations, M&As, and substantial funding for the development of agriculture sensors will assist in the market’s development over the estimated timeframe.

List of Key Agriculture Sensors Companies Studied

- Decagon Devices (METER Group) (U.S.)

- Caipos GmbH (Austria)

- Teralytic (U.S.)

- Sentera (U.S.)

- dol-sensors A/S (Denmark)

- Pycno (U.K.)

- Monnit Corporation (U.S.)

- Changsha Zoko Link Technology Co., Ltd. (China)

- Hunan Rika Electronic Tech Co., Ltd (China)

- Honde Technology Co., Ltd. (China)

- Sensoterra (Netherlands)

- Lindsay Corporation (U.S.)

- Texas Instruments Incorporated (U.S.)

- Sensaphone (U.S.)

- Bosch Sensortec (Germany)

- Shandong Renke Control Technology Co.,Ltd. (China)

- Acclima, Inc. (U.S.)

- Aker Technology Co., Ltd. (Taiwan)

- Handan Yantai Import and Export Co., Ltd (China)

- auroras Srl Cso Piera Cillario (Italy)

And more…

KEY INDUSTRY DEVELOPMENTS

- November 2024: Honde Technology Co., LTD. introduced groundbreaking soil sensors to facilitate the digital transformation of agriculture, assisting farmers in enhancing crop growth and offering effective solutions for sustainable farming.

- August 2024: The Institute for Connected Sensor Systems at the NC State University, the N.C. Plant Sciences Initiative and the Kenan Institute were established to support two agricultural sensor initiatives. One initiative aims to improve solar energy production in crop fields, whereas the other employs field robots and sensors to identify and assess underground vegetables.

- May 2023: Growlink launched terralink soil moisture sensor to enhance and provide smart farming with precision at a reasonable price.

- January 2023: CropX, Inc. acquired Tule Technologies, a precision irrigation firm. This acquisition introduced new data collection technologies to the CropX Agronomic Farm Management System while broadening its reach in California's specialty crops that rely on drip irrigation.

- August 2022: CropX, Inc. introduced a device for monitoring soil nitrogen and salt levels, which was included in its range of farm management systems. This device utilized soil sensors and analytical algorithms to measure these substances accurately.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Investing in agricultural sensors presents a promising opportunity due to the sector's rapid growth and technological advancements. Stakeholders should consider focusing on crop monitoring solutions and indoor farming technologies to maximize their returns. As global food security challenges intensify, the demand for smart farming solutions will likely continue to rise, making this an attractive area for investment. For instance,

- In February 2024: NSF led a USD 35 million federal investment in future agricultural technologies and solutions.

- In June 2023: Croptix, a precision agricultural technology platform focused on early in-field recognition of crop health, revealed the initial closing of its Series Seed funding round, spearheaded by regenerative agriculture advocate and strategic investor Advancing Eco Agriculture (AEA). Ongoing contributions were seen from 1855 Capital and Ben Franklin Technology Partners. This funding enabled Croptix to expedite the advancement and implementation of its patented in-field sensing technology.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product types, and leading applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

To gain extensive insights into the market, Download for Customization

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 9.9% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Application

By Region

|

|

Companies Profiled in the Report |

Decagon Devices (METER Group) (U.S.) Caipos GmbH (Austria) Teralytic (U.S.) Sentera (U.S.) dol-sensors A/S (Denmark) Pycno (U.K.) Monnit Corporation (U.S.) Changsha Zoko Link Technology Co., Ltd. (China) Hunan Rika Electronic Tech Co., Ltd (China) Honde Technology Co., Ltd. (China) |

Frequently Asked Questions

The market is projected to reach a valuation of USD 9.32 billion by 2032.

In 2024, the market was valued at USD 4.43 billion.

The market is projected to record a CAGR of 9.9% during the forecast period.

The temperature & humidity sensor segment led the market in 2024.

The surge in precision agriculture and smart farming practices will aid the market’s growth.

Decagon Devices (METER Group), Caipos GmbH, Teralytic, Sentera, dol-sensors A/S, Pycno, Monnit Corporation, Changsha Zoko Link Technology Co., Ltd., Hunan Rika Electronic Tech Co., Ltd, and Honde Technology Co., Ltd. are the top players in the market.

Asia Pacific held the highest market share in 2024.

By application, the soil management segment is expected to record the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us