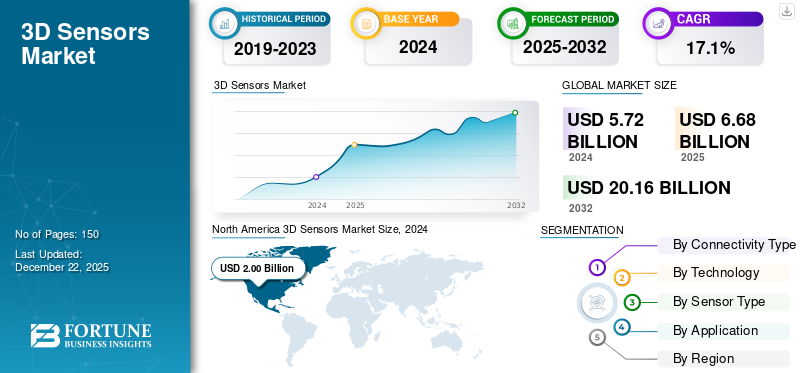

3D Sensors Market Size, Share & Industry Analysis, By Connectivity Type (Wired and Wireless), By Technology (Time-of-Flight (ToF), Structured Light, Stereoscopic Vision, Ultrasound, Laser Triangulation, and Others), By Sensor Type (Image, Position, Acoustic, Proximity, Temperature, and Others), By Application (Consumer Electronics, Automotive, Healthcare, Industrial, Aerospace & Defense, Media & Entertainment, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

The global 3D sensors market size was valued at USD 6.68 billion in 2025. The market is expected to grow from USD 7.81 billion in 2026 to USD 25.57 billion by 2034, demonstrating a CAGR of 16.00% over the forecast period. North America dominated the global market with a share of 35.30% in 2025.

The market refers to the sector that focuses on developing, manufacturing, and deploying sensors that capture 3D imaging data about objects and environments. These sensors use technologies such as time-of-flight, structured light, stereoscopic vision, ultrasound, laser triangulation, and others to measure depth, shape, and movement in real-time.

Major players in the market include Infineon Technologies, Microchip Technology Inc., Omnivision Technologies, Qualcomm Technologies, Inc., Texas Instruments Inc., Samsung, LMI Technologies Inc., ifm electronic GmbH, Keyence Corporation, and Cognex Corporation. These companies focus on strategic partnerships, product innovation, mergers, and acquisitions to reinforce their market presence. The growing demand for advanced imaging solutions in consumer electronics, increasing adoption in automotive safety systems, and rising applications in industrial automation and healthcare diagnostics are the key drivers of the market.

The impact of COVID-19 pandemic on the market led to supply chain disruptions and delays in product development. However, it also increased demand for contactless technologies. In addition, reciprocal tariffs have elevated production costs and created supply chain challenges, affecting the pricing and availability of sensor components, which have hindered market growth in different regions.

3D SENSORS MARKET TRENDS

Rising Adoption of Advanced Driver Assistance Systems (ADAS) and Autonomous Vehicles Fuels Market Growth

The rising adoption of Advanced Driver Assistance Systems (ADAS) and autonomous vehicles is one crucial market trend, as the ADAS technologies rely heavily on accurate environmental perception. These sensors provide real-time data on the vehicle's surroundings, facilitating collision avoidance, lane-keeping assistance, and adaptive cruise control. Different automakers prioritize safety and automation, making 3D sensing technologies increasingly essential in the integration.

In addition, developing and deploying autonomous vehicles further amplify the demand for high-resolution 3D sensors. For instance,

- According to Next Move Strategy Consulting, the autonomous vehicle market was estimated at around 17,000 units in 2022. The market is likely to expand considerably, reaching a projected 127,000 units by 2030.

Self-driving vehicles require a constant and detailed understanding of their environment to make informed navigation decisions. The automotive industry's investments in sensor technology innovation and scalability are accelerating the adoption of these systems. Therefore, the growing importance of intelligent mobility solutions is expected to drive sustained growth in the market.

MARKET DYNAMICS

Market Drivers

Increasing Incorporation of 3D Sensing Technology in Consumer Electronics Pushes Market Growth

Modern smartphones, tablets, and wearable devices are increasingly equipped with 3D sensing capabilities for facial recognition, augmented reality, and advanced photography applications. This trend is driven by consumer demand for enhanced user experiences and higher device functionality. Therefore, consumer electronics manufacturers invest in 3D sensing solutions to gain a competitive advantage. For instance,

- Industry experts state that the consumer electronics market produced total revenue of USD 987 billion in 2022, showcasing a 4.4% decrease compared to the preceding year.

Furthermore, developing compact and cost-effective 3D sensing components has accelerated their adoption in mass-market consumer devices. Major technology companies collaborate with sensor manufacturers to integrate 3D technologies seamlessly into their products. The expanding use of these sensors in gaming consoles, smart home devices, and virtual reality systems further supports the market growth. Subsequently, the rising demand from the consumer electronics sector is expected to significantly contribute to expanding the global 3D sensors market share.

Market Restraints

High Costs and Technical Complexity Hinder Market

The high cost of technology development and integration is one of the factors hindering market growth. Advanced 3D sensing components require significant investment, making them less accessible for budget-conscious manufacturers. This cost factor limits the adoption, especially in developing regions and small-scale applications.

Additionally, the technical complexity of sensor standardization and environmental adaptability hampers market growth. These sensors may face performance limitations in low-light, high-reflective, or variable temperature conditions, affecting accuracy and reliability. Additionally, concerns over data privacy in biometric and surveillance applications may lead to stricter regulations, further slowing the 3D sensors market growth.

Market Opportunities

Expanding Applications of Augmented Reality (AR) And Virtual Reality (VR) Technologies Present Significant Opportunities for Market

AR and VR experiences rely heavily on precise spatial awareness and real-time environmental mapping. These sensors enhance user interaction by providing accurate motion tracking, object recognition, and depth perception. Gaming, retail, healthcare, and education industries adopt AR/VR solutions, increasing the demand for integrated 3D sensing capabilities. For instance,

- According to industry experts, the combined market for augmented reality (AR), virtual reality (VR), and mixed reality (MR) is anticipated to exceed USD 250 billion by 2028. This projection reflects the growing adoption of immersive technologies across various industry verticals.

Moreover, the proliferation of AR/VR in enterprise and consumer applications accelerates innovation in 3D sensing technologies. Companies are investing in compact, high-performance sensors that can be embedded in headsets, smartphones, and other wearable devices to improve usability and performance. This trend creates revenue flow for sensor manufacturers and fosters partnerships across the technology ecosystem. As a result, the growing relevance of AR and VR creates a robust demand for 3D sensors in the coming years.

SEGMENTATION ANALYSIS

By Connectivity Type

Need for Flexibility Among Various Applications Fuels Wireless Segment Growth

Based on connectivity type, the market is separated into wireless and wired.

The wireless segment holds the highest market with a share of 69.61% in 2026. These sensors are expected to grow at the highest CAGR due to their flexibility, ease of installation, and increasing demand for various consumer electronics, healthcare, and industrial automation applications. Adopting wireless sensors in IoT-enabled devices and smart systems further boosts their market penetration.

Wired sensors are expected to grow at a lower rate compared to wireless sensors as they require physical connections, limiting their deployment in mobile and space-constrained environments. The increased preference for wireless, more versatile solutions is reducing the demand for wired options in various applications.

By Technology

Demand for Superior Features Boosts Time-of-Flight (ToF) Segment Growth

Based on technology, the market is segmented into Time-of-Flight (ToF), structured light, stereoscopic vision, ultrasound, laser triangulation, and others.

The Time-of-Flight (ToF) segment dominates the market with a share of 56.40% in 2026. It is also expected to grow at the highest CAGR due to its high precision, fast processing time, and increasing use in applications such as smartphones, automotive, and AR/VR technologies. ToF sensors are more cost-effective as the technology matures, contributing to their broad adoption. For instance,

- In November 2024, TOPPAN Holdings Inc. introduced its first-generation 3D Time-of-Flight (ToF) sensor for robotics in 2023, utilizing hybrid ToF technology. This sensor enables long-range measurements, tolerance to outdoor environments, high-speed sensing, and the simultaneous use of multiple devices.

The structured light segment holds the second-highest share due to its proven effectiveness in applications such as 3D scanning, face recognition, and industrial inspection. Although highly relevant, structured light sensors are limited by environmental factors such as ambient light and distance, which restricts their growth compared to ToF technology.

By Sensor Type

Growing Need Across Numerous Applications to Fuel Image Segment Growth

By sensor type, the market is classified into image, position, acoustic, proximity, temperature, and others.

Image 3D sensors hold the highest share contributing 61.63% globally in 2026 and are expected to witness the highest CAGR due to their widespread use in applications such as facial recognition, AR/VR, and autonomous vehicles. The advancements in image processing and machine learning also enhance the capabilities of image-based 3D sensors.

Position 3D sensors hold the second highest share due to their extensive use in applications requiring precise positioning and motion tracking. However, their growth is slower compared to image sensors due to their niche applications.

By Application

To know how our report can help streamline your business, Speak to Analyst

Widespread Product Adoption in Consumer Electronics Propels Segment Growth

By application, the market is divided into consumer electronics, automotive, healthcare, industrial, aerospace & defense, media & entertainment, and others.

The consumer electronics segment dominates the market due to the widespread use of these sensors in smartphones, tablets, wearables, and other devices, driving massive demand for enhanced user experiences. The continuous innovation in AR/VR and biometric technologies further supports the dominance of this segment.

The automotive segment is expected to grow at the highest CAGR in the coming years as the industry increasingly adopts ADAS and autonomous vehicle technologies, which rely heavily on 3D sensing for environment mapping and navigation. The need for enhanced safety features and the development of self-driving vehicles contribute to the segment's rapid growth. For instance,

- In October 2024, Sonair closed a funding round led by Skyfall Ventures to advance robotics with new 3D sensing technology, improving safety and reducing costs by 50-80%. The company's Early Access Program now includes AMR manufacturers, automakers, and global distributors.

3D SENSORS MARKET REGIONAL OUTLOOK

By geography, the market is categorized into North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

North America

North America 3D Sensors Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 2.36 billion in 2025 and USD 2.77 billion in 2026. North America dominates the market due to the presence of leading technology companies, high adoption rates of advanced technologies, and significant investments in research and development. The region is a home to major industries such as automotive, consumer electronics, and healthcare, driving the demand for 3D sensing solutions. Its focus on innovation and early adoption of new technologies further strengthens its market leadership.

Download Free sample to learn more about this report.

The U.S. dominates the North American market due to its advanced technological infrastructure and strong presence of key industry players. Additionally, high investment in research and development and rapid adoption of innovative applications contribute significantly to market leadership. The U.S. market is projected to reach USD 1.62 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

The Asia Pacific market is expected to grow at the highest CAGR due to the rapidly expanding electronics and automotive industries, specifically China, Japan, India, and South Korea. The region's large manufacturing base, coupled with increasing demand for consumer electronics, AR/VR devices, and automotive safety systems, is fueling the market growth. Its ongoing technological advancements and lower manufacturing costs also contribute to its high growth potential. The Japan market is projected to reach USD 0.43 billion by 2026. The China market is projected to reach USD 0.54 billion by 2026. The India market is projected to reach USD 0.35 billion by 2026. For instance,

- According to EY statistics, India is likely to register the highest real GDP growth rate among all countries, with a projected average of 6.5% from 2024 to 2029. This robust growth viewpoint highlights India's position in the global competitive landscape during the forecast period.

Europe

Europe holds a noteworthy share due to its robust automotive and industrial sectors, which heavily rely on 3D sensing technologies for applications such as ADAS, automation, and quality control. Countries such as Germany and the U.K. are leaders in automotive innovation, driving demand for sensor solutions. Furthermore, the region's commitment to digital transformation and smart manufacturing bolsters the adoption of these sensors. The UK market is projected to reach USD 0.5 billion by 2026. The Germany market is projected to reach USD 0.43 billion by 2026. For instance,

- According to the European Union, the number of battery-only electric passenger cars in European Union countries exceeded 4.4 million in 2023. This figure signifies an upsurge of around 88 times, as associated with 2013, and 12 times, compared to 2018.

Middle East & Africa and South America

South America and the Middle East & Africa are expected to grow at an average growth rate due to the relatively slower adoption of advanced technologies compared to North America and Asia Pacific. The regions face economic and infrastructure challenges that may hinder rapid market growth. However, increasing investments in technology and infrastructure development are likely to drive moderate growth in the coming years. For instance,

- In February 2025, Lumotive partnered with E-Photonics to advance 3D sensing technologies and LiDAR manufacturing in Saudi Arabia. The announcement, made at LEAP 2025 in Riyadh, signifies a major milestone in developing LiDAR technology within the region.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Launch New Products to Strengthen Their Market Positioning

Key players in the market launch new products to improve their position by addressing diverse consumer needs and technological advancements, and staying at the forefront of the competition. They emphasize portfolio enhancement and strategic collaborations, partnerships, and acquisitions to reinforce product offerings. These strategic product launches help businesses uphold and grow their market share in a fast-growing industry.

List of Key 3D Sensor Companies Profiled

- Infineon Technologies AG (Germany)

- Microchip Technology Inc. (U.S.)

- Omnivision Technologies (U.S.)

- Qualcomm Technologies, Inc. (U.S.)

- Texas Instruments Inc. (U.S.)

- Samsung (South Korea)

- LMI Technologies Inc. (Canada)

- ifm electronic GmbH (Germany)

- Keyence Corporation (Japan)

- Cognex Corporation (U.S.)

- Zebra Technologies Corp. (U.S.)

- VIAVI Solutions Inc. (U.S.)

- Allegro MicroSystems, Inc. (U.S.)

- Teledyne Digital Imaging Inc. (Canada)

- Automation Technology GmbH (Germany)

- SmartRay GmbH (Germany)

KEY INDUSTRY DEVELOPMENTS

- In March 2025, SK Keyfoundry introduced a new 3D Hall-effect sensor technology. This advanced technology enables measuring speed and direction by detecting 3D magnetic fields and is now available to the company's foundry customers.

- In March 2025, Ouster, Inc. presented on-sensor 3D Zone Monitoring. This new feature enables the detection of surrounding objects within user-specific zones and triggers real-time alerts. It is expected to broaden Ouster's addressable market, streamline customer development, and enhance overall product usability.

- In September 2024, Structure launched the Structure Sensor 3, its advanced precision 3D scanning platform. The new sensor delivers three times its predecessor's battery life, performance, and durability, enabling higher-quality scans for customized 3D applications.

- In May 2024, Lattice Semiconductor introduced a 3D sensor fusion design to accelerate autonomous application development. The design enhances perception and decision-making in automotive, robotics, and smart cities.

- In May 2024, Zebra Technologies Corporation launched the 3S Series and FS42 fixed industrial scanner 3D sensors. These innovations aim to enhance operational efficiency in the manufacturing industry by supporting secure technology advancements in AI and industrial automation.

REPORT COVERAGE

The report focuses on key aspects such as leading companies, product/service types, and leading product applications. Besides, the report offers insights into the market trends and highlights vital industry developments. In addition to the factors above, the report encompasses several factors that contributed to the market's growth in recent years. The market segmentation is mentioned below:

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

|

Study Period |

2021-2034 |

|

|

Base Year |

2025 |

|

|

Estimated Year |

2026 |

|

|

Forecast Period |

2026-2034 |

|

|

Historical Period |

2021-2024 |

|

|

Unit |

Value (USD Billion) |

|

|

Growth Rate |

CAGR of 16.00% from 2026 to 2034 |

|

|

Segmentation |

By Connectivity Type

By Technology

By Sensor Type

By Application

By Region

|

|

|

Companies Profiled in the Report |

Cognex Corporation (U.S.) |

|

Frequently Asked Questions

The market is projected to reach USD 25.57 billion by 2034.

In 2025, the market size stood at USD 6.68 billion.

The market is projected to grow at a CAGR of 16.00% during the forecast period.

The consumer electronics segment leads the market.

The increasing incorporation of 3D sensing technology in consumer electronics drives market growth.

Infineon Technologies, Microchip Technology Inc., Omnivision Technologies, and Qualcomm Technologies, Inc. are the top players in the market.

North America holds the highest market share.

Asia Pacific is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us