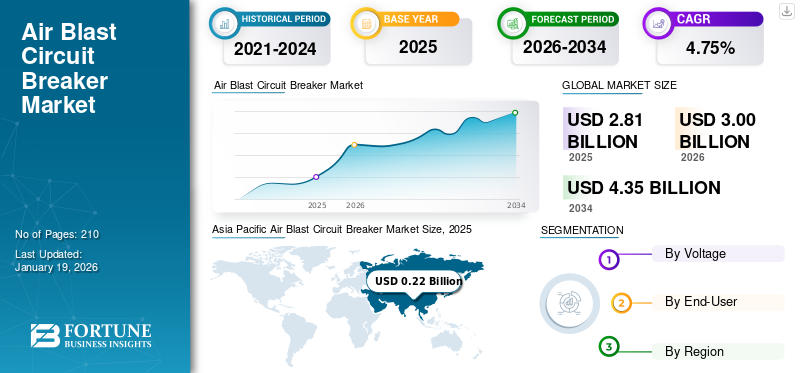

Air Blast Circuit Breaker Market Size, Share & Industry Analysis, By Voltage (Low Voltage and Medium Voltage), By End-User (Utility, Industrial, Commercial, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global air blast circuit breaker market size was valued at USD 2.81 billion in 2025. The market is projected to grow from USD 3.00 billion in 2026 to USD 4.35 billion by 2034, exhibiting a CAGR of 4.75% during the forecast period. Asia Pacific dominated the air blast circuit breaker market with a market share of 32.26% in 2025.

An Air Blast Circuit Breaker (ABCB) is a type of circuit breaker that uses a high-pressure air blast to extinguish an electrical arc when interrupting a circuit. This blast of air, cools the arc and removes ionized particles, preventing the arc from restriking and ensuring the circuit is safely interrupted.

- In June 2025, the Government of Malaysia announced an investment of USD 10.1 billion in national grid modernization with a focus on the integration of AI-driven services and battery energy storage systems.

Moreover, according to the International Energy Agency, smart grid digitalization is expected to reduce renewable energy curtailment by 25% by 2030, which is expected to result in cost-effective and efficient energy systems.

The primary drivers for the increasing demand for ABCB include the expansion and upgradation of power grids, integration of renewable energy sources, and need for a reliable and safe power supply in various sectors. Other factors including urbanization, industrial growth, and government initiatives also contribute to this demand.

ABB has a significant presence and prominence in the market, particularly with its Emax series of low-voltage air circuit breakers. They offer a range of features and functionalities in their ACB (Air Circuit Breakers), including high breaking capacity, various protection settings, and options for customization. ABB's focus on safety, reliability, and performance has contributed to its dominance in the air circuit breaker market, especially in industrial and utility applications.

MARKET DYNAMICS

MARKET DRIVERS

Growing Demand for Reliable Power Supply to Drive Market Growth

The demand for air blast circuit breakers is rising, largely driven by the increasing need for a reliable power supply and the expansion of power infrastructure globally. This growth is further fueled by the integration of renewable energy sources, push for smart grid technologies, and modernization of electrical grids.

- According to the International Energy Agency, the Government of Canada announced plans to invest USD 100 million to deploy smart grid technologies and smart integrated power transmission and distribution systems.

ABCBs are crucial for maintaining a stable power supply by quickly interrupting faults and preventing damage to equipment. Moreover, the expansion of renewable energy sources such as solar and wind power introduces fluctuating loads onto the grid. ABCBs are well-suited to handle these fluctuations and ensure grid stability.

Many countries are investing in upgrading their power transmission and distribution networks. This modernization includes the replacement of aging equipment with more efficient and reliable air blast circuit breakers.

MARKET RESTRAINTS

High Maintenance and Infrastructure Requirements to Restrain Market Growth

ABCBs, while known for high-speed switching and arc quenching in high-voltage applications, face limitations due to high maintenance and infrastructure requirements. The need for frequent maintenance, including checking for leaks, sealing leaks, and inspecting components, can increase operational costs and deter some users, especially in cost-sensitive markets. ABCBs require frequent checks for air leaks, which can be time-consuming and require specialized personnel.

Hence, ABCBs offer advantages in terms of high-speed switching and arc quenching, but the high maintenance and infrastructure costs associated with them present significant challenges to market growth. Addressing these challenges through innovation and cost-effective solutions will be crucial for sustained market expansion.

MARKET OPPORTUNITIES

Electricity Grid Retrofit Projects to Create Market Opportunities

ABCBs are expected to witness increased demand due to electricity grid modernization and expansion projects, particularly those focused on renewable energy integration. These breakers are vital for protecting electrical infrastructure from faults, especially in systems handling high voltages and currents. Growing energy storage needs and decentralized power generation are also driving air blast circuit breaker market growth, as these breakers are crucial for managing the complexities of modern power networks.

- In March 2025, Power Grid Corporation of India Limited (PGCIL) announced plans to develop two large-scale power transmission projects with the aim of strengthening India’s grid infrastructure.

Investments in upgrading and expanding electricity grids, especially with the integration of renewable energy sources, are creating a strong demand for reliable and efficient ABCBs. Moreover, the trend toward distributed generation, where power is generated closer to the point of use, also necessitates the use of such circuit breakers for managing the increased complexity and potential fault currents in these systems.

AIR BLAST CIRCUIT BREAKER MARKET TRENDS

Adoption of Efficient Air Handling and Noise Reduction Technologies

The market is experiencing growth due to increasing investments in reliable electricity distribution infrastructure and the need for advanced circuit protection. A key trend is the adoption of efficient air handling and noise reduction technologies, which enhance the performance and safety of these breakers. ABCBs are favored for their ability to handle high voltages and currents, and their role in preventing equipment damage from electrical faults.

ABCBs utilize compressed air to interrupt electrical arcs, making them a safer and more environmentally friendly alternative to oil or SF6-based breakers. This technology is constantly being improved to enhance arc quenching and minimize post-arc effects. The noise generated during operation is a concern in densely populated areas. Manufacturers are developing technologies to reduce noise levels, which will be crucial for wider adoption in urban environments.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Voltage

Medium Voltage Segment to Dominate Owing to Robust Demand in End-Use Industries

The market, by voltage is segmented into low voltage and medium voltage.

The medium voltage (MV) segment is expected to dominate the market. These MV air blast circuit breakers are primarily driven by the need for a reliable electricity supply, expansion of renewable energy, and modernization of electrical infrastructure. Key factors include increasing electricity demand, safety regulations, and the growth of industrial and commercial sectors.

Moreover, the low-voltage segment growth is driven by the increasing demand in small-scale industrial and commercial sectors. Other key factors include the expansion of smart grids and the need to replace aging electrical infrastructure. The increasing global demand for electricity, especially in rapidly urbanizing and industrializing areas, necessitates more efficient and reliable power distribution and protection systems, leading to higher demand for circuit breakers in the coming years.

By End-User

Utility Segment will be the Leading End-user Due to Growing Adoption of Smart Grids

The market by end-user is segmented into utility, industrial, commercial, and others.

The utility segment is expected to dominate the market. Utilities rely on ABCBs for reliable power transmission and distribution, particularly in smart grids and renewable energy integration. Industrial segment, comprise manufacturing and processing plants, utilize them for high-current applications and to minimize downtime.

- In October 2024, Schneider Electric launched smart grid solutions to cater sustainable energy demands. The company will provide a new Digital Grid Sustainability Service Net Zero Dashboard with key net-zero measures and KPIs to enhance grid operations.

However, ABCBs find significant industrial applications in high-voltage systems, particularly in areas where rapid fault interruption and high interrupting capacity are crucial. They are used to protect electrical equipment such as transformers, generators, and motors in power stations, substations, and various industrial settings. Furthermore, commercial buildings, data centers, and retail spaces also benefit from ABCBs due to their compact design and ease of installation. Other applications include transportation systems and specialized infrastructure.

Air Blast Circuit Breaker Market Regional Outlook

The market has been studied geographically across five central regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

Asia Pacific Air Blast Circuit Breaker Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America’s market is experiencing strong growth, fueled by investments in grid modernization, renewable energy infrastructure, and the need for reliable power distribution. The expansion of industrial and commercial sectors, particularly in the U.S., is driving the need for reliable and safe electrical infrastructure, leading to greater demand.

- In August 2024, the U.S. Department of Energy announced an investment of USD 2.2 billion to upgrade power grids in the country to meet increasing load demand from the data center and manufacturing industry.

Moreover, the U.S. is investing heavily in upgrading its power infrastructure, including substations and transmission lines, which require advanced air blast circuit breakers to ensure reliable and efficient power delivery.

Europe

Europe’s market is experiencing steady growth, driven by the need to upgrade aging electrical infrastructure and the increasing adoption of renewable energy. This demand is further fueled by investments in smart grid technologies, electric vehicle infrastructure, and supportive government policies promoting sustainable transportation. The market is also benefiting from the modernization of power infrastructure and the integration of renewable energy sources, creating a need for reliable and efficient circuit protection solutions.

Asia Pacific

Asia Pacific is dominating region in the air blast circuit breaker market share and experiencing strong growth due to rising electricity demand, industrial expansion, and infrastructure development, particularly in China and India. Asia Pacific dominated the market with a valuation of USD 0.22 billion in 2025 and USD 0.23 billion in 2026.

- In January 2022, the Government of India announced an investment of USD 1.61 billion for the grid integration of renewable energy projects with a capacity of 20 GW to support the country’s net-zero targets.

This growth is fueled by the need for reliable electrical distribution systems, especially in the face of increasing renewable energy adoption and upgradation of power grids. The market is expected to continue to expand, driven by ongoing urbanization, industrialization, and investments in power generation and transmission infrastructure.

Latin America

Latin America is experiencing significant growth, fueled by increasing demand for reliable power distribution and protection systems in the region's expanding energy infrastructure. This growth is driven by the need to safeguard electrical equipment, ensure a stable power supply in industrial and commercial settings, and manage high-voltage transmission lines effectively.

Middle East & Africa

The Middle East & Africa is experiencing significant growth in the market, driven by investments in infrastructure development, renewable energy projects, and performance enhancement solutions of electrical grids. Increased demand for reliable and efficient circuit breakers, particularly in the context of smart grid technologies and expansion of renewable energy sources, is further boosting market expansion.

Additionally, regional initiatives aimed at enhancing grid stability and reducing carbon emissions are contributing to the adoption of advanced circuit breakers such as non-puffer SF6 models.

COMPETITIVE LANDSCAPE

Key Market Players

Key Market Players are engaged in Product Launches and Innovations to Gain Edge over Competitors

The market is characterized by a fragmented nature among major players such as Siemens, Schneider Electric, ABB, Eaton, and Mitsubishi Electric, who are constantly innovating and focusing on energy efficiency, product longevity, and advanced features. For instance, in March 2024, Siemens launched a circuit protection device, “SENTRON ECPD (Electronic Circuit Protection Device)”, which electronically switches off the circuit faults in case of a short circuit. The market is also witnessing increased participation from regional players and emerging companies, leading to a dynamic and evolving competitive landscape.

List of Key Air Blast Circuit Breaker Companies Profiled

- ABB (Switzerland)

- Siemens (Germany)

- Schneider Electric (France)

- GE (U.S.)

- Hyundai Electric & Energy Systems Co., Ltd. (South Korea)

- Eaton (Ireland)

- Mitsubishi Electric (Japan)

- Fuji Electric (Japan)

- Terasaki Electric Co., Ltd (Japan)

- Legrand (France)

- Larsen & Toubro (India)

- WEG (Brazil)

- Hitachi Industrial Equipment Systems Co., Ltd. (Japan)

- CBI-electric Group (U.S.)

KEY INDUSTRY DEVELOPMENTS

- In July 2025, ABB launched the SACE Emax 3 air circuit breaker, designed to enhance energy security and resilience of power systems for critical electricity infrastructure such as data centers, airports, hospitals, and industrial facilities.

- In February 2025, CNC Electric launched the VSli-12 Intelligent Vacuum Circuit Breaker with medium voltage range capacity, designed for operational flexibility in electrical systems and networks through the combination of traditional vacuum circuit breaker technology with intelligent monitoring capacities.

- In August 2023, Siemens announced a partnership with APS to manufacture and adapt Siemens’ air circuit breakers and critical technology, which reduced the availability of product delivery time by 50% to the energy industries.

- In July 2023, Siemens announced the expansion of the Air Circuit Breakers (ACBs) series, named as 3WA circuit breaker series 3WA1 (IEC), 3WA2 (UL489), and 3WA3 (UL1066+IEC), compatible with numerous voltage ranges utilized in critical electricity infrastructure.

- In June 2023, Eaton Corporation announced manufacturing expansion with the development of 40,000 square feet of manufacturing lines to produce plain air circuit breakers and molded case circuit breakers for the electrical industry.

REPORT COVERAGE

The report provides a detailed market analysis and focuses on key aspects such as leading companies, product/service process, and competitive landscape. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.75% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

|

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 2.81 million in 2025.

In 2025, the market value in Asia Pacific stood at USD 0.22 billion.

The market is expected to exhibit a CAGR of 4.75% during the forecast period.

Utility was the leading end-user segment in the market.

Growing demand for reliable power supply is a crucial factor boosting market growth.

Some of the top players in the market are ABB, Siemens, Schneider Electric, and GE, among others.

Asia Pacific dominated the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us