Airborne Radar Market Size, Share, Russia-Ukraine War & Industry Analysis, By Platform (Military Aircraft, Helicopters, UAVs, Urban Air Mobility, Aerostats), By Application (Defense & Border Security, Commercial & Civil), By Range (Very Short & Short range, Medium Range, Long range, & Very Long range), By Frequency Band (HF/VHF/UHF, L/S/C/X band, K/Ka/Ku band), By Antenna Type (PESA, Digital AESA, Hybrid AESA, AESA Tile, Mechanical), By Solution (Line & Retro Fit), Regional Forecast, 2025-2034

KEY MARKET INSIGHTS

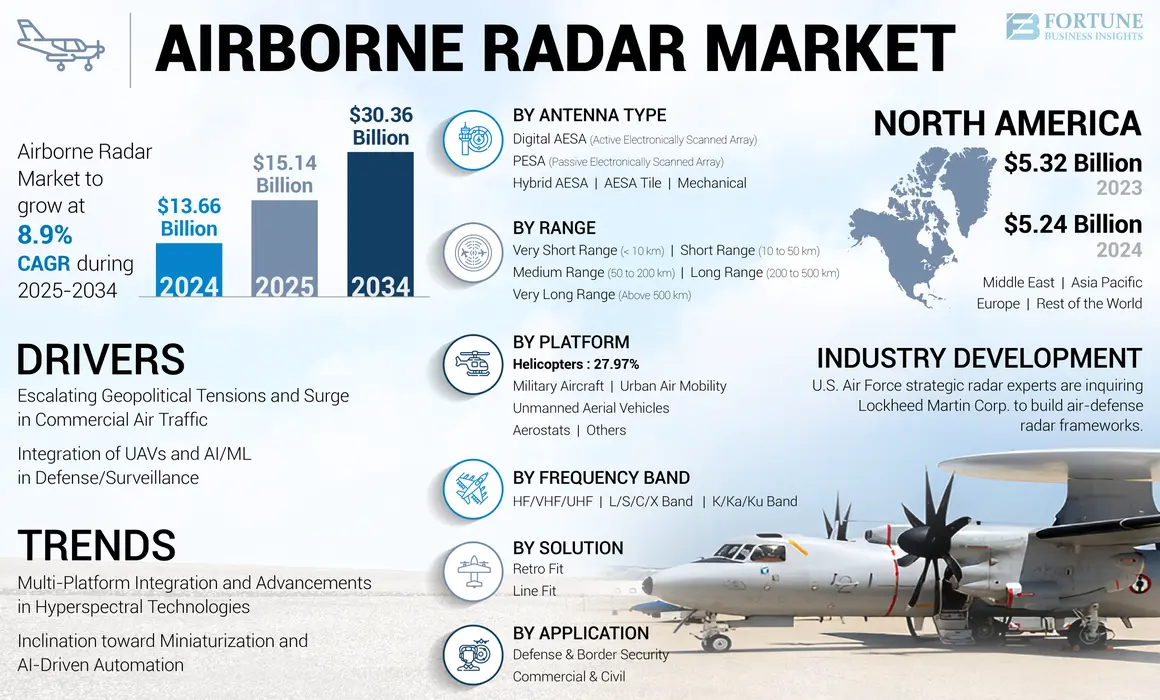

The global airborne radar market size was valued at USD 13.66 billion in 2024. It is projected to grow from USD 15.14 billion in 2025 to USD 30.36 billion by 2034, exhibiting a CAGR of 8.9% over the forecast period. North America dominated the airborne radar market with a market share of 38.36% in 2024.

The global airborne radar market is projected for robust expansion, with a CAGR of 8.9%. This growth is primarily fueled by heightened geopolitical tensions and consequent global military modernization programs, emphasizing air superiority, advanced combat aircraft (including 6th gen development), and enhanced ISR capabilities. Airborne radar remains central to these strategic investments across fighter jets, bombers, AWACS, UAVs/UCAVs, and maritime patrol platforms.

Active Electronically Scanned Array (AESA) radar technology will solidify its dominance, valued for its multi-functionality, resilience, and performance. Key innovation factors include the integration of Artificial Intelligence/Machine Learning (AI/ML) for automated target recognition and cognitive electronic warfare, the proliferation of Gallium Nitride (GaN) semiconductors for greater power and efficiency, advanced digital processing, and relentless miniaturization (SWaP-C optimization). While military applications dominate, significant growth is also expected in commercial sectors such as weather radar, terrain avoidance, and particularly Urban Air Mobility (UAM)/eVTOL sense-and-avoid systems.

Regionally, North America (led by US DoD spending) will remain the largest market, while Asia-Pacific (driven by China, India, and regional security concerns) experiences the fastest growth. Europe witnesses steady investment in collaborative programs (FCAS, Tempest), and the Middle East continues significant procurement. The competitive landscape is dominated by established defense giants (RTX, Northrop Grumman, Lockheed Martin, Thales, and others.), though niche players may emerge in components, AI software, or cost-effective solutions. Challenges include high development costs, stringent export controls, supply chain vulnerabilities, and evolving electronic warfare threats, but the market's trajectory remains strongly positive due to enduring defense needs and emerging civil applications.

Global Airborne Radar Market Overview

Market Size & Forecast

- 2024 Market Size: USD 13.66 billion

- 2025 Market Size: USD 15.14 billion

- 2034 Forecast Market Size: USD 30.36 billion

- CAGR: 8.9% from 2025–2034

Market Share

- North America led the global airborne radar market with 38.36% share in 2024, driven by U.S. defense spending, large-scale modernization programs (NGAD, AWACS replacement), and adoption of advanced AESA and GaN-based radar technologies for military and civil applications.

- By platform, military aircraft dominated due to ongoing fleet upgrades, 6th-generation fighter development, and high ISR (Intelligence, Surveillance, Reconnaissance) demand. UAV-based radars are projected to grow fastest owing to rising drone deployments and miniaturization of radar systems for multi-domain operations.

Key Country Highlights

- United States: Massive investments in AESA/GaN radar systems for F-35, F-16, and next-gen fighters; modernization of AWACS to Boeing E-7A platforms; deployment of radar-equipped drones for border and wildfire monitoring.

- China & India: Accelerating radar development for indigenous fighters (e.g., Tejas MK-1A, J-20) and UAVs; heightened border tensions drive demand for long-range detection and counter-drone solutions.

- Europe (France, U.K., Germany): Collaborative programs like FCAS and Tempest propel quantum radar and AI-enabled systems; upgrades to Eurofighter and Rafale fleets enhance multi-domain combat readiness.

- Middle East (UAE, Saudi Arabia): Focus on localized radar production (Edge Group, SAMI) and integration with advanced fighter fleets; deployment for missile defense and energy infrastructure security.

- Latin America & Africa: Moderate growth from radar-equipped UAVs for anti-poaching, border surveillance, and agricultural monitoring; Brazil and South Africa invest in localized solutions.

MARKET DYNAMICS

Market Drivers

Escalating Geopolitical Tensions and Surge in Commercial Air Traffic to Drive Investment in Next-Gen Airborne Radar Modernization

Escalating Geopolitical Tensions Fuels Defense Radar Upgrades: Rising conflicts in Ukraine, the Indo-Pacific, and the Middle East drive countries to prioritize air defense modernization. NATO’s Allied Future Surveillance and Control program and the European Sky Shield Initiative, involving 24 countries, highlight multi-billion dollar investments in integrated radar networks. Advanced threats, including hypersonic missiles and drone swarms, necessitate next-gen systems, such as India’s AI-driven Akashteer system and Raytheon’s AN/TPY-2 radar. Strategic partnerships, including the EDGE Group-Leonardo collaboration, are accelerating radar development in the market.

Surge in Commercial Air Traffic Encourages ATC Modernization: The January 2025 Reagan National midair collision underscored the need for enhanced radar coverage, with initiatives including the Surface Awareness program aimed at expanding 200+ airports.. The FAA’s transition to IP-based networks by 2028 aims to enhance data reliability and cybersecurity.

Active Electronically Scanned Array (AESA) radars, such as Leonardo’s Osprey 30, enable multi-functionality for surveillance and threat detection. Dual-use advancements, including National Center for Atmospheric Research (NCAR’s) USD 91.8 million authorized program analysis reports (APARs), support military and weather forecasting applications. Strategic collaborations, including Lockheed Martin-Rheinmetall’s joint venture and the BAE Systems-Hensoldt merger, are reducing costs and enhancing radar capabilities. AI and machine learning integration, as observed in the U.S. Air Force’s Cognitive Algorithm Deployment System, tends to improve real-time threat analysis. These innovations are poised to meet rising defense and civilian demands, thus driving significant airborne radar market growth.

Integration of UAVs and AI/ML in Defense/Surveillance to Propel Increased Demand for Compact and High-Precision AI-integrated Systems

Source: Fortune Business InsightsThe rapid proliferation of UAVs in defense and surveillance, driven by escalating geopolitical conflicts, is increasing the demand for compact, high-precision AI-integrated systems. The U.S., China, and Iran, are deploying drones for reconnaissance, precision strikes, and asymmetric warfare, with examples including Iran’s Shahed-136 and Russia’s Lancet reshaping battlefield tactics. Cost-effective drones (USD 1,000–50,000) threaten high-value assets, prompting investments in countermeasures such as the U.S. Army’s AN/APR-39E(V)2 radar and L3Harris’ AMORPHOUS software for controlling drone swarms. The FAA’s USD 18.5 Billion Air Traffic Control Modernization Plan integrates AI to manage rising drone and air traffic, while Iran’s Shahid Baqeri carrier emphasizes swarm tactics. These advancements highlight the need for enhanced detection and response capabilities in modern warfare and surveillance.

AI and machine learning integration transforms UAV operations by enabling autonomous threat response and precision targeting. Systems, including Shield AI’s Hivemind, allow drones to navigate GPS-denied environments, while the U.S. Army’s Leonidas and BlueHalo’s METIS systems use AI for drone swarm neutralization and threat detection. The Anduril-OpenAI partnership enhances real-time situational awareness and dual-use AI vision systems, such as Teledyne’s projected USD 9.29 billion market, serving defense and commercial sectors. Strategic collaborations, such as Lockheed Martin-Rheinmetall’s GaN radar venture and AUKUS AI trials, drive innovation and cost efficiencies. Regulatory advancements, including the FAA’s BVLOS mandate and ANRA Technologies’ U-Space platform, further accelerate AI-driven UAV systems' market growth.

Market Restraints

Power-Intensity of AESA Radars and Legacy Aircraft Compatibility Issues to Increase Operational Limitations in Small UAVs and MALE Platforms

Power and Compatibility Challenges AESA Radars in UAVs: AESA radars that consume 3–5 kW significantly reduce small UAV endurance, as demonstrated by the MQ-1C Gray Eagle’s 25% flight time reduction with the AN/APY-8 Lynx radar. Retrofitting AESA onto legacy platforms such as the RQ-4 Global Hawk adds 15–20% weight and costs over USD 12 million per unit. Thermal management in compact UAVs requires complex liquid cooling, delaying projects such as Baykar’s Akıncı UAV by eight months in 2024. Recent efforts, such as BAE Systems’ Ultra-Low-Power AESA in September 2024, cut power use by 30% but compromised the range for ISR roles. General Atomics’ retrofit of AN/APG-79 AESA on Predator B drones also faced USD 200 million cost overruns in June 2024.

Cost and Complexity Barriers to Fleet-Wide Modernization: Upgrading large fleets such as the F-16V with AESA radars costs USD 4–6 billion, covering retrofits, training, and maintenance. Supply chain issues, particularly GaN semiconductor shortages in 2024–2025, delay production, impacting programs including Lockheed Martin’s Sniper ATP. As observed in India’s Tejas Mk1A delayed to 2026, software interoperability challenges with legacy mission computers further complicate integration. For instance, the U.S. Air Force canceled an RQ-4 Global Hawk AESA upgrade in January 2025 after costs surged to USD 3.2 billion. L3Harris-Thales’ NovaRadar, launched in October 2024, aims to reduce F-16 upgrade costs by 20% through modularity.

Militaries prioritize new UAVs, such as the MQ-20 Avenger over costly retrofits, slowing legacy fleet modernization. NATO’s 2025 STANAG 7023 update failed to standardize AESA interoperability, hindering multinational fleets. LiDAR and EO/IR sensors are gaining traction due to low-cost ISR alternatives. Strategic responses include Lockheed Martin’s 2025 OpenRadar Initiative, targeting 35% integration cost cuts, and Turkey’s Baykar-Aselsan Pact in July 2024 for a hybrid AESA-SAR radar, reducing power use by 40% for TB3 UAVs. Additionally, Elbit Systems-IAI’s AESA Solutions Division, formed in November 2024, commits USD 500 million to R&D for legacy platform retrofits.

Budget Constraints in Emerging Economies and Stringent Regulatory Compliance to Hinder Adoption of Cutting-Edge Radar Technologies

Emerging economies face significant budget constraints that hinder the adoption of advanced radar technologies. Limited defense budgets, with countries such as India allocating only USD 1.2 billion for radar upgrades in 2024, prioritize basic infrastructure over modernization, relying on outdated systems including the Rohini 3D. Currency depreciation, such as Brazil’s 40% cost overrun for the FX-2M radar upgrade due to BRL devaluation, delays projects to 2027. Dependence on foreign loans, including Egypt’s USD 500 million IMF loan in 2025, restricts tech imports by mandating domestic spending. Examples including South Africa canceling the Umkhonto Radar Program and Indonesia halting Thales radar procurement highlights the financial pressures force reliance on refurbished or less advanced systems.

Stringent regulatory compliance further complicates radar technology adoption by increasing costs and initiating delays. New 2025 FAA/EASA DO-365C standards, requiring AI-driven radar redundancy, extend certification timelines by 12–18 months, as witnessed with Leonardo’s Osprey 50 AESA radar missing its FAA deadline. Export controls, such as U.S. ITAR restrictions blocking Turkey’s access to RTX’s AN/APG-82 radar in 2024, force reliance on less capable alternatives including Aselsan systems.

Additionally, cybersecurity mandates under the EU’s 2025 Cyber Resilience Act impose costly firmware audits, delaying programs including the Hensoldt’s TwInvis by 10 months and costing USD 8–12 million per system. In India, RTX abandoned AN/SPY-6(V)4 naval radar certification in 2025 due to stringent DAP-2024 liability clauses, illustrating the regulatory hurdles intensifying the development challenges. These combined financial and regulatory barriers significantly slow down the deployment of cutting-edge radar systems in emerging markets.

Market Opportunities

Emergence of Quantum Radar R&D to Provide Opportunities in Countering Hypersonic/Stealth Threat Detection

Quantum Radar’s Breakthrough Capabilities: Quantum radar leverages quantum entanglement to detect stealth and hypersonic threats, outstanding traditional radar limitations. It excels at identifying low-observable targets, with DARPA’s 2023 tests displaying a 40% tracking improvement for F-35 analogs. The technology also tracks hypersonic glide vehicles at Mach 10+ by filtering noise, as demonstrated by China’s Wukong Quantum Radar with a 200km range. Its resistance to jamming, due to safe quantum signals, was a major focus of NATO’s 2024 Quantum Sensing initiative. By 2026, collaborations including Lockheed Martin and Xanadu aim to deploy field-ready quantum illumination radar.

Global R&D and Strategic Investments: The U.S. National Quantum Initiative Act drives quantum radar with USD 1.2 billion allocated by 2026, including USD 300 million for defense applications. China’s advancements, including the SC-19 Quantum Radar with a 500km range, intensify the technological race, countered by U.S. and EU projects such as the EuroQCI Initiative. Strategic partnerships, including the BAE Systems with IBM and Northrop Grumman’s acquisition of Quantum Valley, bolsters innovation. Civilian applications in weather and air traffic control attract private funding, with Quantum Diamond Technologies raising USD 75 million in 2024. These efforts aim to maintain strategic edges in global defense and dual-use markets.

Quantum radar’s market is poised for disruption, with early movers including Raytheon and CETC targeting high-value defense contracts, backed by the Pentagon’s USD 850 million 2025 budget. Cost reductions are projected to lower system prices from USD 50 million to USD 12 million by 2030, driven by silicon photonics. Niche applications, such as DARPA’s Blackjack for space-based hypersonic tracking, represent a USD 4 billion opportunity by 2030. Japan and India are advancing with systems such as Mitsubishi’s QRC-1 and INDRA-Q for regional security. Australia’s 2023 tests with Quantum Brilliance on the Jindalee network highlights the global adoption of quantum radar for stealth detection.

AIRBORNE RADAR MARKET TRENDS

Rise of Hypersonic Missile Threats and Adoption of Software-Defined Radar Architectures to Stimulate Prioritization of Ultra-Wideband Radar Development, and Scalable and Future-Proof Systems for Dynamic Warfare

Hypersonic Missile Threats Demand Ultra-Wideband Radar Capabilities

- Hypersonic Speed & Maneuverability: Missiles such as Russia’s Avangard (Mach 20) and China’s DF-17 (Mach 10+) require radars with Ultra-Wideband (UWB) frequencies (2–18 GHz) to detect subtle plasma signatures and track erratic trajectories.

- Plasma Sheath Penetration: UWB’s multi-frequency pulses bypass ionization interference, enabling continuous tracking. For instance, in 2023, DARPA’s Glide Breaker program demonstrated a 60% improvement in hypersonic detection using UWB.

- Multi-Domain Integration: UWB radars fuse data from space-based sensors such as, SDA Tracking Layer, and ground systems for seamless hypersonic defense.

- For instance, in March 2024, Raytheon secured a USD 500 million contract from the U.S. Missile Defense Agency (MDA) to develop AN/SPY-6(V)4 UWB radar for hypersonic tracking.

- In June 2024, Japan’s JAXA and Mitsubishi Electric tested a 30 GHz UWB prototype on F-15Js, achieving Mach 12 target detection.

- In September 2023, AUKUS launched a USD 1 Billion joint initiative to deploy UWB radars in Australia’s Northern Territory for Indo-Pacific hypersonic defense.

Software-Defined Radar (SDR) Architecture Enables Scalability & Future-Proofing

- Adaptive Threat Response: SDRs use FPGA/GPU-driven waveforms to adjust frequencies, countering jamming and stealth. For instance, in 2024, Lockheed Martin’s SDR-3000 updated algorithms in <10 seconds vs. 30+ minutes for legacy systems.

- Cost-Effective Upgrades: Cloud-based SDRs such as Thales’s RSM-NG, reduce hardware dependency, cutting modernization costs by 40%.

- AI/ML Integration: For instance, in 2024, Northrop Grumman’s HAMMER AI optimized UWB-SDR performance, improving threat classification accuracy by 55%.

- For instance, in January 2024, Lockheed Martin launched Skynode, a modular SDR for F-35s, enabling in-flight waveform updates via 5G links.

- In May 2024, Thales partnered with NVIDIA to embed Jetson Orin processors in Ground Fire 450 radars, tripling processing speed.

- In August 2024, Saab’s Giraffe 4A SDR won a USD 300 million NATO contract for rapid deployment in Eastern Europe.

Market Growth Fueled by Dynamic Warfare Requirements

- Multi-Role Scalability: UWB-SDR systems such as Leonardo’s KRONOS Grand serve naval, airborne, and ground roles, reducing fleet complexity.

- Export Market Surge: For instance, in April 2024, India’s USD 2.1 billion deal with Israel’s IAI for ELM-2090 UWB radars highlights demand in emerging economies.

- GaN Technology Breakthroughs: For instance, in 2025, Gallium Nitride (GaN) amplifiers extend UWB range by 70%, as observed in BAE Systems’ APG-85 radar for F/A-XX.

- For instance, in July 2024, BAE Systems-Elbit merger formed NextGen Radar Solutions, targeting USD 5 billion in SDR-UWB contracts by 2027.

- In October 2023, Northrop Grumman’s AN/ZPY-5 SDR secured USD 1.2 billion for the U.S. Army’s LTAMDS hypersonic defense network.

- In April 2024, Hensoldt and Rheinmetall’s Jupiter Program delivered TwInvis UWB-SDR to Germany, countering Russian Kinzhal threats.

Nano-electronics Breakthroughs and Integration of EW and Radar Systems to Encourage Proliferation of Miniaturized Radars in Swarm Drone Networks and Convergence Toward Multi-Function RF Sensor Suites

Nanoelectronics Breakthroughs Enable Miniaturized Radar Systems for Swarm Drones

- GaN-on-SiC & MEMS Innovations: Gallium nitride (GaN) and Micro-Electromechanical Systems (MEMS) reduce radar size/power by 70%, enabling integration into nano-UAVs. For instance, in 2023, DARPA’s Microsystems Technology Office (MTO) achieved 10W/mm² power density, critical for swarm radar nodes.

- SWaP-C Optimization: Nanoelectronics cut radar weight to <500g (vs. 5kg legacy systems), allowing drones such as Shield AI’s V-BAT to carry radar, EW, and comms in a single package.

- Mass Production Scalability: 3D-printed RF components such as Raytheon’s micro-RF modules, reduce costs to USD 1,500/unit (vs. USD 15,000), enabling swarm deployments.

- For instance, in March 2023, Raytheon launched Micro-SAR, a 200g Ku-band radar for Switchblade 600 drones, tested in Ukraine.

- In September 2023, DARPA’s MTO funded BAE Systems USD 22 million to develop MEMS-based phased arrays for nano-UAVs.

- In June 2024, Israel’s RADA Electronic Industries unveiled MiniRADAR-ESM, combining radar/EW in a 400g package for swarm networks.

EW-Radar Convergence Drives Multi-Function RF Sensor Suites

- Cognitive Electronic Warfare: AI-driven systems such as Lockheed Martin’s SPY-7 dynamically switch between radar imaging and jamming, confusing adversarial sensors.

- Spectrum Efficiency: Multi-function RF suites such as Thales’s CONTACT, use software-defined apertures to perform radar, SIGINT, and EW simultaneously, reducing platform payload by 60%.

- Counter-Swarm Capability: Integrated systems detect/jam hostile drone swarms at 10km+ ranges. For instance, in 2024, Northrop Grumman’s VAMPIRE system neutralized 50+ drones in a single test.

- For instance, in April 2024, Thales-Intel partnership launched RFSoC-based sensor suite, merging radar/EW on a single chip for NATO’s drone fleets.

- In January 2024, Lockheed Martin’s SPEAR EW-Radar Pod entered production, chosen for the U.S. Army’s FTUAS program.

- In August 2024, SAIC acquired WhiteFox Defense for USD 320 million to integrate anti-drone radar/EW systems into swarm networks.

- North America witnessed airborne radar market growth from USD 5.32 Billion in 2023 to USD 5.24 Billion in 2024.

Download Free sample to learn more about this report.

Swarm Drone Networks and Market Growth

- Distributed Sensing: Swarms such as Anduril’s WISP use mesh-linked mini-radars for persistent surveillance, covering 1,000km² vs. 50km² for single UAVs.

- AI-Driven Autonomy: Shield AI’s Hivemind enables 100+ drones to share radar data in GPS-denied environments, tripling mission success rates in 2024 tests.

- Export Demand: India’s 2024 Drone Policy mandates 60% indigenous mini-radar procurement, fueling partnerships such as BEL-Elbit’s USD 500 million JV.

- For instance, in June 2024, Anduril launched WISP Swarm Radar, a UWB system for 1,000+ drone networks, adopted by U.S. SOCOM.

- For instance, in November 2023, Northrop Grumman-Shield AI collaboration deployed 100+ V-BAT swarms with mini-radars in Pacific exercises.

- For instance, in May 2024, Turkey’s Baykar signed a USD 1.2 billion deal with Pakistan for Akıncı drones with Aselsan’s integrated RF suites.

Impact of Russia-Ukraine War

Russia-Ukraine War Significantly Influences Demand for Advanced Surveillance and Reconnaissance Technologies

Surge in Defense Spending & Modernization Priorities:

- Increased NATO Budgets: European NATO members pledged to raise defense spending to 2% of GDP by 2024, accelerating radar modernization. For example:

- Germany approved a USD 114.72 billion defense fund in 2022, prioritizing Eurofighter Typhoon AESA radar upgrades in 2023.

- For instance, in March 2023, Poland signed a USD 1.4 billion contract with Saab for Erieye AEW&C systems to counter Russian air threats.

- Eastern European Demand: Countries bordering Russia, such as Finland and the Baltics states, fast-tracked procurements:

- For instance, in 2023, Finland acquired F-35s with AN/APG-81 AESA radars to replace legacy MiG-21s.

Accelerated Innovation to Counter Emerging Threats:

- Drone & EW Challenges: The war highlighted vulnerabilities to low-cost drones such as Iranian Shahed-136 and Russian electronic warfare such as Krasukha-4. Responses include:

- AI-Driven Counter-Drone Radars: For instance, in 2023, Thales’s Ground Fire 450 integrated AI to detect mini-UAVs at 30km.

- Multi-Function RF Systems: For instance, in 2023, Lockheed Martin’s SPY-7 combines radar and EW for F-35s.

- Hypersonic Missile Defense: Russia’s use of Kinzhal hypersonic missiles spurred demand for UWB radars:

- For instance, in 2023, Raytheon’s AN/SPY-6(V)4 secured USD 500 million from MDA for hypersonic tracking.

Supply Chain Disruptions & Material Shortages

- Semiconductor Bottlenecks: Sanctions on Russia disrupted neon gas supplies (critical for laser lithography), affecting GaN chip production.

- For instance, in 2023, Wolfspeed and Qorvo pivoted to U.S.-based neon recycling, mitigating shortages.

- Rare Earth Dependencies: For instance, in 2023, Export controls on Russian titanium (used in radar structures) forced OEMs such as Northrop Grumman to source from Japan and Kazakhstan.

Geopolitical Realignment & Domestic Production Push

- Reduced Reliance on Russia: NATO countries phased out Russian-made systems such as Nebo-M radar, in favor of Western/NATO-compatible solutions.

- For instance, in 2023, Ukraine replaced Soviet-era radars with AN/TPQ-49 systems donated by the U.S.

- Localized Manufacturing: For instance, in 2023, EU’s EDIRPA initiative funded USD 573.6 million for dual-use radar projects, including Indra’s Spanish AESA facility in 2024.

Sanctions & Export Controls Reshaping Trade Dynamics

- Restrictions on Russia: Banned from advanced Western radar tech, Russia accelerated indigenous projects:

- For instance, in 2024, NIIP’s FGA35 AESA radar for Su-57, though plagued by GaN shortages.

- Secondary Sanctions Risk: Companies such as Thales halted component sales to third parties supplying Russia such as Belarus, rerouting supply chains.

Operational Lessons Driving Requirements

- Survivability Needs: Ukrainian AN/TPQ-48 radars faced high attrition, prompting demand for mobile, rapidly deployable systems:

- For instance, in 2023, Leonardo’s KRONOS LAND: Truck-mounted AESA with 10-minute setup time.

- Interoperability: In 2023, NATO’s Joint All-Domain Command and Control (JADC2) prioritized radar data fusion, as seen in Lockheed’s TPY-4 integration.

Long-Term Strategic Shifts

- Space-Based Surveillance: Starlink’s role in Ukraine accelerated interest in LEO satellite-linked radars:

- For instance, in 2024, Northrop Grumman’s HAMMER AI uses Starlink for real-time hypersonic tracking.

- AI/ML Proliferation: Lessons from Ukrainian Delta OSINT system (2023) drove demand for AI-enabled predictive maintenance in radars.

SEGMENTATION ANALYSIS

By Platform

Defense Modernization, Geopolitical Tensions, and Technological Advancements Leads to Dominance of Military Aircraft

By platform, the market is divided into military aircraft, helicopters, Unmanned Aerial Vehicles (UAVs), Urban Air Mobility (UAM), aerostats, and others.

The military aircraft segment dominated the market in 2024 with the largest market share. Geopolitical tensions and defense modernization, technological advancements in radar systems, long-term contracts and fleet upgrades are the few factors driving the segmental growth during the forecast period.

- The Helicopters segment is expected to hold a 27.97% share in 2024.

- For instance, in March 2024, Northrop Grumman Corporation secured a contract worth USD 1.2 billion to supply AN/APG-83 AESA radars for F-16 upgrades across NATO allies. Additionally, in January 2024, Lockheed Martin launched the Legion Pod with IRST21 radar for F-15s, enhancing long-range detection capabilities.

Unmanned Aerial Vehicles (UAVs) is anticipated to be the fastest-growing segment and grow at the highest CAGR in the forecast period. Surge in military and commercial UAV adoption, miniaturization of radar systems, and cost-effective asymmetric warfare are expected to drive the segment’s growth over the forecast period.

For instance, in April 2024, General Atomics launched the Lynx Multi-Domain Radar for MQ-9B drones, enabling maritime and land surveillance. In February 2024, Elbit Systems introduced the Micro Compact Radar (MCR) for small tactical UAVs, featuring AI-driven target classification. L3Harris acquired Aerojet Rocketdyne for USD 4.7 billion to bolster UAV radar and propulsion synergies, in September 2023.

To know how our report can help streamline your business, Speak to Analyst

By Application

Radar Modernization, Weather and Environmental Monitoring and Tracking, and Infrastructure Development Dominated Commercial and Civil Segmental Growth

The market is divided by application into defense and border security and commercial and civil.

The commercial and civil segment dominated the market in 2024 with the largest market share. Radar modernization for congested skies, storm and flood tracking, wildfire/flood mapping, and infrastructure development are few factors driving the segmental growth.

- For instance, in May 2025, Thales launched the Trac Sigma radar, a multi-mission surveillance radar designed for approach and long-range air traffic control, according to Airspace World. In May 2024, the FAA awarded Thales Group a contract worth USD 150 million to upgrade the U.S. weather radar network.

The defense and border security is anticipated to be the fastest-growing segment and will depict the highest CAGR during the forecast period. Border conflicts such as India-China and Eastern Europe tensions, requires neutralizing UAV threats, hypersonic tracking, and secure radar network needs, which also supports the segment’s growth.

For instance, in August 2024, the U.S. Army awarded a contract worth more than USD 2 billion to Raytheon Technologies Corporation for LTAMDS radars, including a Foreign Military Sale (FMS) to Poland, marking Poland as the first international customer to adopt LTAMDS. The contract covers the U.S. Army and Polish requirements, with Raytheon currently producing eight LTAMDS radars annually and aiming to increase it to 12 units annually. Deliveries for radars are scheduled seven and eight later from 2025. For instance, in January 2024, Israel announced that it invested in radar modernization of Iron Dome for enhanced detection range by 30%.

By Range

ICBM Tracking, Military Reconnaissance, Orbital Coordination, and Quantum Radar-Based Detection Drives Growth of Airborne Radars with Very Long Range

By range, the market is divided into very short range (< 10 km), short range (10 - 50 km), medium range (50 - 200 km), long range (200 - 500 km), and very long range (above 500 km).

Very long range is anticipated to be the fastest-growing segment with the highest CAGR over the forecast period. ICBM tracking for national defense, global reconnaissance for military activities, orbital coordination, stealth detection through quantum radar are few factors driving the segmental growth. For instance, in October 2023, DARPA had conducted Quantum radar trials which are capable of detecting stealth drones.

Medium range segment dominated the global market in 2024 with the largest share. Demand for smuggling interdiction, aviation safety, SAR operations, and coastal monitoring for drug trafficking are the factors driving the segmental growth. For instance, in July 2023, Saab AB was selected for integration of its Sea Giraffe 1X radar with Canadian Coast Guard patrol helicopters.

By Frequency Band

Missile Guidance, SATCOM Links Demand, Infrastructure Planning, and Hyperspectral Analysis Influence the K/Ka/Ku Frequency Band

By frequency band, the market is divided into HF/VHF/UHF, L/S/C/X band, and K/Ka/Ku band.

The K/Ka/Ku band segment is anticipated to grow at the highest CAGR during the forecast period. High adoption rate for Missile Guidance and SATCOM links, demand for infrastructure planning, and hyperspectral analysis are few factors driving the segmental growth. For instance, in August 2023, the U.S. Air Force (USAF) is reported to have upgraded targeting systems for the F-22 Raptor, potentially with Lockheed Martin's Ku-Band radar. This upgrade, alongside the integration of a new Infrared Defensive System (IRDS), aimed to enhance the aircraft's ability to detect, track, and counter threats in the infrared spectrum, improving its overall survivability and lethality.

The L/S/C/X band segment dominated the global market in 2024 by accounting for the largest share. Demand for precision storm tracking, fire control systems, crop health monitoring boosts the segmental growth. For instance, in December 2024, ICEYE launched two Synthetic Aperture Radar (SAR) satellites for a mid-inclination orbit. These satellites were launched as part of the "Banding on the Wave 2" mission with SpaceX. This expanded ICEYE's Earth observation capabilities.

By Antenna Type

Demand for Multi-Function Radars, and AI-Integrated Smart Targeting Contributed to the Segmental Growth of Digital AESA

By antenna type, the market is segmented into PESA, digital AESA, hybrid AESA, AESA tile, and mechanical.

Digital AESA segment dominated the global market in 2024 with the largest share and is anticipated to be the fastest-growing segment during the forecast period. Demand for multi-function radars, dynamic beam steering, AI-integrated smart targeting, stealth compatibility and others are few factors driving the segmental growth. For instance, in May 2024, Northrop Grumman was awarded a contract worth USD 300 million for SABR AESA Radar retrofitting for F-16s.

PESA was the second-largest segment in 2024 and is anticipated to grow at a significant rate during the forecast period. Cost-effective legacy upgrades, proven reliability, EW resistance, and rapid integration are some factors propelling the segment’s growth. For instance, in February 2024, India had awarded a contract worth USD 80 million to Rosoboronexport for PESA Upgrade for MiG-29.

By Solution

Medium Wavelength Infrared Solution Leads due to its Key Role in Military Applications

By solution, the market is divided into line fit and retro fit.

Line fit segment dominated the airborne radar market share in 2024 and accounts for the largest market share. Demand for integration of seamless aircraft design, aviation compliance, next-generation platforms are few factors driving the segment’s growth. For instance, in March 2024, Boeing’s T-7A Radar announced the integration of Raytheon’s AESA radar for USAF trainers.

Retro fit is anticipated to be the fastest-growing segment. The segment’s growth is driven by fleet modernization, cost-effective upgrades, latest technological insertion capabilities, and mission-specific customizations. For instance, in November 2023, South Korea’s F-15K Retrofit announced a USD 450 million upgrade with AESA radars.

Supply Chain Analysis

- Raw Material Suppliers

- Role: Provide critical inputs for radar components, including:

- Semiconductors: Gallium Nitride (GaN) and Silicon Carbide (SiC) for high-power RF modules.

- Rare Earth Elements: Neodymium for magnets, gallium for semiconductors.

- Metals: Aluminum, titanium, and copper for structural and thermal management.

- Challenges & Developments:

- GaN Shortages: Wolfspeed’s USD 1 billion DoD contract (2023) aimed to address GaN supply gaps for U.S. defense projects.

- Ethical Sourcing: Companies such as Raytheon now audit rare earth suppliers to comply with ESG standards (e.g., avoiding conflict minerals).

- Role: Provide critical inputs for radar components, including:

- Component Manufacturers

- Role: Produce specialized parts such as:

- Antennas: AESA (Active Electronically Scanned Array) panels.

- Transceivers: GaN-based RF modules for signal transmission.

- Cooling Systems: Liquid cooling units for thermal management.

- Key Players & Innovations:

- Qorvo: Supplies GaN amplifiers for AN/SPY-6 radars (Raytheon’s USD 500 million MDA contract, 2024).

- Renesas: Developed low-power FPGA chips for software-defined radars (SDRs), used in Saab’s Giraffe 4A (2024).

- Role: Produce specialized parts such as:

- Subsystem Integrators

- Role: Assemble components into functional subsystems (e.g., radar arrays, signal processors).

- Examples:

- Elbit Systems: Integrates AI-powered signal processing units for IAI’s ELM-2090 radar (India’s USD 2.1 billion deal, 2024).

- L3Harris: Produces modular radar backends for Northrop Grumman’s HAMMER AI system.

- Trend: Shift toward open-architecture designs (e.g., Lockheed’s OpenRadar Initiative, 2025) to enable plug-and-play upgrades.

- OEMs (Original Equipment Manufacturers)

- Role: Design, integrate, and deliver complete radar systems.

- Key Players:

- Raytheon: AN/SPY-6(V)4 UWB radar for hypersonic defense (2024).

- Thales: RBE2-AA AESA for Rafale fighters (NATO contract, 2024).

- BAE Systems: APG-85 radar for F/A-XX program (GaN breakthroughs, 2025).

- Strategies:

- Vertical Integration: Northrop Grumman’s in-house GaN production to mitigate supply risks.

- M&A: BAE-Elbit merger (2024) to streamline subsystem sourcing.

- Software Providers

- Role: Develop algorithms for threat detection, AI/ML integration, and cybersecurity

- Innovations:

- Shield AI’s Hivemind: Enables autonomous drone swarms with real-time radar data fusion (2024).

- NVIDIA Jetson Orin: Embedded in Thales’s Ground Fire 450 radar (2024) for AI-driven processing.

- Challenges & Developments:

- Compliance with DO-178C aviation software standards, which delayed Leonardo’s Osprey 50 certification (2025).

- Testing & Certification Bodies

- Role: Ensure compliance with safety and performance standards (e.g., FAA, EASA, MIL-STD)

- Recent Issues:

- FAA’s DO-365 ITAR Restrictions: Blocked Turkish Baykar’s integration of U.S. radar tech, forcing reliance on Aselsan (2024)

- Logistics & Distribution

- Role: Manage global transportation, warehousing, and customs.

- Challenges:

- Geopolitical Risks: U.S.-China trade wars disrupted GaN shipments in 2023.

- Just-in-Time (JIT) Vulnerabilities: COVID-19 lockdowns delayed Lockheed’s F-35 radar deliveries (2023).

- Solutions: Regional hubs (e.g., Thales’s Singapore facility) for Asia Pacific distribution.

- End Users

- Primary Segments:

- Military: major market share, driven by hypersonic threats (e.g., AUKUS’s USD 1 billion UWB initiative, 2023).

- Commercial Aviation: FAA’s BVLOS waiver program (2024) accelerated adoption of AI radars for drones.

- Procurement Trends:

- India’s 2024 Drone Policy: Mandates 60% indigenous procurement, boosting BEL-Elbit JV (2024).

- Primary Segments:

AIRBORNE RADAR MARKET REGIONAL OUTLOOK

By region, the market is segmented into North America, Europe, Asia Pacific, Middle East, and rest of the world.

North America

North America Airborne Radar Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America remains the dominant region and accounted for the largest airborne radar market share in 2024. It is anticipated to grow at a significant CAGR during the forecast period. U.S. Air Force’s Next-Generation Air Dominance (NGAD) program drives the demand for advanced AESA/GaN radars, radar upgrades to detect and track hypersonic missiles, enhanced target recognition for F-35 and F/A-18 fleets. Other factors driving the regional growth are Customs and Border Protection (CBP) deploying MQ-9B drones with SAR radars, FAA Part 107 regulations requiring collision-avoidance radars, U.S. Army’s Skyborg program for autonomous UAVs with GMTI radars, and radar-equipped drones for real-time fire mapping in California.

For instance, in October 2023, Boeing’s F/A-XX Radar Prototype, AI-driven radar for the U.S. Navy’s next-gen fighter was introduced. In January 2024, General Atomics’ MQ-9B SeaGuardian Sale announced worth USD 400 Million for CBP contract for maritime surveillance. In August 2023, Shield AI’s V-BAT Deployment was announced in which it partnered with U.S. DoD for radar-equipped swarm drones.

In May 2025, the US Air Force had a contract with Booz Allen to design upgraded communications for E-3 AWACS radar surveillance aircraft. In this contract, Airborne Warning and Control System (AWACS) will be replaced by the Boeing E-7A airborne early warning and control (AEW&C) radar aircraft. Moreover, the U.S. is upgrading aircraft with advance systems such as airborne radar.

Asia Pacific

The Asia Pacific region was the second-largest region by market share in 2024. It will witness the second-highest CAGR in the market during the forecast period. Rising defense budgets in India, Japan, and Australia to counter China’s military expansion, shift to advanced radars for 5th-gen fighters, India’s Tejas MK-1A and South Korea’s KF-21 Boramae integrating domestically developed radars are few factors stimulating the regional growth. Monitoring South China Sea and India-Pakistan borders, Radar-equipped drones for Philippines’ counter-insurgency ops, agricultural monitoring in Australia and Indonesia, and Sub-10kg SAR radars for small UAVs such as India’s SWITCH are the factors driving the market growth.

Europe

Europe is anticipated to be the fastest-growing region and is estimated to grow at the highest CAGR during the forecast period. Development of 6th-gen fighters (FCAS by Airbus/Safran/Dassault; Tempest by BAE/Leonardo) driving AESA/GaN radar demand, upgrading Eurofighter Typhoon radars to detect adversarial stealth platforms, upgrading Eurofighter Typhoon radars to detect adversarial stealth platforms, and integrating radar-EW fusion for multi-domain combat are few factors driving market growth. ISR-focused radar integration for the EU’s MALE RPAS, Radar-equipped drones tracking wildfires in Southern Europe, deploying UAVs with GMTI radars for urban security, enhancing data fusion for Eastern European border surveillance are the few other factors driving the market growth across the region.

Middle East

The Middle East is anticipated to witness moderate growth during the forecast period. Modernizing fleets to counter Iran’s missile/drone capabilities and non-state actors, upgrading F-15SA, F-16 Block 70, and Rafale radars for multi-role superiority, UAE’s Edge Group and Saudi SAMI developing localized radar solutions, and collaborations with U.S./European OEMs are few factors driving the regional market growth. Monitoring Houthi activities in Yemen and Syrian conflict zones, Turkish Bayraktar TB2 radars used by UAE and Libya, Radar-equipped drones for pipeline security in Saudi Aramco fields, and Edge Group’s Hunter 2-S UAV with lightweight SAR radar are factors stimulating the market growth.

Rest of the World

The rest of the world is expected to experience significant growth during the forecast period. Modernizing fleets to counter insurgencies, radar upgrades for tracking illicit air trafficking in Latin America, Brazil’s Embraer and South Africa’s Denel developing localized radar solutions and procuring refurbished fighters are factors driving the market growth. Radar-equipped drones for anti-poaching in Kenya and Botswana, monitoring groups such as Boko Haram and FARC dissidents, crop health surveillance in Brazil and Argentina, and lightweight SAR radars for small drones are other factors propelling the market growth.

COMPETITIVE LANDSCAPE

Key Market Players

Leading Players are Focusing on Integrating Advanced Technologies and Quantum Radar R&D

The airborne radar market is fragmented and niche, with key players specializing in defense, commercial aviation, and advanced surveillance technologies. The top five players in the industry are RTX Corporation, Lockheed Martin Corporation, Thales Group, Northrop Grumman Corporation, and Saab AB. These companies are leveraging Advanced AESA radars for military aircraft and missile defense, Advanced AESA radars (electronic scanning) for military aircraft and missile defense, Airborne surveillance (RBE2-AA for Rafale), AESA/GaN radars for NGAD and quantum radar R&D, and Airborne Early Warning (Erieye ER). The market is expected to experience significant growth due to the increasing focus on technological integration with UAVs, modernization in materials, and sensor miniaturization used in airborne radars.

LIST OF KEY AIRBORNE RADAR COMPANIES PROFILED

- Lockheed Martin Corporation (U.S.)

- Raytheon Technologies Corporation (U.S.)

- Northrop Grumman Corporation (U.S.)

- Thales Group (France)

- Saab AB (Sweden)

- Leonardo S.p.A. (Italy)

- Israel Aerospace Industries Ltd. (Israel)

- Indra Sistemas S.A. (Spain)

- Honeywell International Inc. (U.S.)

- Hensoldt AG (Germany)

- BAE Systems plc (U.K.)

KEY INDUSTRY DEVELOPMENTS

- April 2025: Sweden signed an agreement with Thales to secure the Ground Master 200 Multi-Mission Compact radar (GM200 MM/C). Under a contract valued at USD 93 million, the first deliveries are planned for 2026. The GM200 MM/C medium-range radar is set to strengthen the Swedish Armed Forces' discuss and surface surveillance capabilities, replacing the country's obsolete PS-871 radar system.

- January 2025: U.S. Air Force strategic radar experts are inquiring with Lockheed Martin Corp. to build air-defense radar frameworks to detect, recognize and track enemy missiles as well as manned and unmanned aircraft. Authorities of the Air Force Life Cycle Administration Center at Hanscom Air Force Base, Mass., reported a USD 118.4 million order to the Lockheed Martin Corporation.

- November 2024: The U.S. Air Force aerial warfare experts requested additional modern Active Electronically Scanned Array (AESA) radar for F-16 jet fighter aircraft under terms of an USD 30 million order. Authorities of the Air Force Life Cycle Management Center, Fighter Bomber Directorate, F-16 Division, at Wright Patterson Air Force Base, Ohio, are inquiring about the Northrop Grumman Corp. Mission Systems segment in Linthicum Heights, Md., for generation radars for the F-16. This order brings the total esteem of this AESA radar contract to USD 1.7 billion.

- October 2024: Raytheon, an RTX business, in association with the Office of the Secretary of Defense (OSD), U.S. Air Force Research Laboratory Strategic Development Planning and Experimentation office, and the U.S. Naval force, illustrated the multi-mission GhostEye MR advanced medium-range sensor during a joint test event called Gray Flag 2024. GhostEye MR tracked targets over water, displaying the sensor's readiness to discourage current and future dangers.

- October 2024: The U.S. State Division endorsed Romania's request to purchase four AN/MPQ-64 F1 Sentinel radar systems, valued at an estimated USD 110 million. This Foreign Military Sale (FMS) points to strengthen Romania's air defense capabilities and support NATO's collective security efforts. The Defense Security Cooperation Agency (DSCA) has delivered the fundamental certification to Congress for review.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on important aspects, such as key players, products, applications, and platforms depending on various countries. Moreover, it offers deep insights into the market trends, competitive landscape, market competition, pricing of radar systems, and market status and highlights key industry developments. In addition, it encompasses several direct and indirect factors that have contributed to the expansion of the global market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2034 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2034 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 8.9% from 2025 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation

|

By Platform

|

|

By Application

|

|

|

By Range

|

|

|

By Frequency Band

|

|

|

By Antenna Type

|

|

|

By Solution

|

|

|

By Region

|

Frequently Asked Questions

According to the Fortune Business Insights study, the global market was valued at USD 13.66 billion in 2024 and is anticipated to reach USD 30.36 billion by 2034.

The market is likely to grow at a CAGR of 8.9% during the forecast period (2025-2034).

The top key players in the industry are Lockheed Martin Corporation, Raytheon Technologies Corporation, Northrop Grumman Corporation, Thales Group, and BAE Systems plc.

In 2024, North America dominated the global airborne radar market.

Integration of UAVs and AI/ML in defense/surveillance to propel demand for compact and high-precision AI-integrated systems is a key market driver.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us