Airborne SONAR Market Size, Share & Industry Analysis, By Application (Commercial and Defense), By Solution (Hardware (Transmitter, Receiver, Control Units, Displays, Sensors (Ultrasonic Diffuse Proximity Sensors, Ultrasonic Retro-Reflective Sensors, Ultrasonic Through-Beam Sensors, VME-ADC, and Others), and Others) and Software), By End-user (Line Fit and Retrofit), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

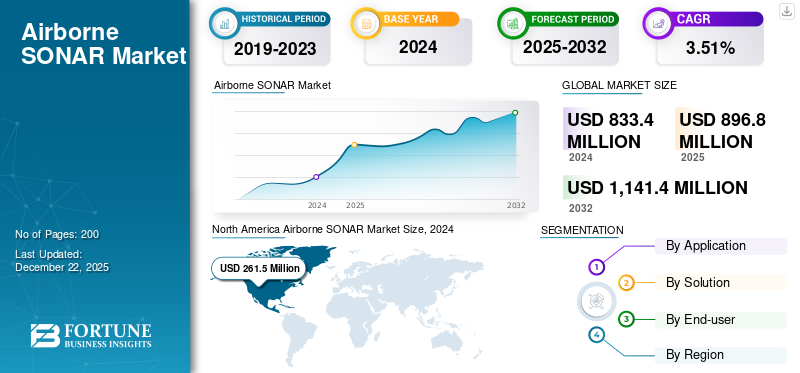

The global airborne SONAR market size was valued at USD 833.4 million in 2024. The market is projected to grow from USD 896.8 million in 2025 to USD 1,141.4 million by 2032, exhibiting a CAGR of 3.51% during the forecast period. North America dominated the airborne sonar market with a market share of 31.38% in 2024.

Airborne SONAR is a SONAR system on airborne vehicles such as helicopters, fixed-wing aircraft, and UAVs for detecting, locating, and mapping submarines submerged in the sea. It reflects sound waves over the sea surface and analyzes the reflected waves to detect submarines, mines, fish, the seabed, etc. Uses include defense (anti-submarine warfare, naval defense), scientific exploration (oceanography surveying, hydrography charting), and trade (fisheries, offshore petroleum). The main weapons are sonars (returnable air-suspended sensors) and sonobuoys (one-shot acoustic sensors), with technologies such as synthetic aperture sonar (SAS) and AI-aided data processing that increase accuracy and resolution.

The market is expanding with growing geopolitical tensions and increased seaborne security defense spending, i.e., anti-submarine warfare. Emerging technologies such as multi-beam sonar, UAV-compatible, and AI integration improve detection range and data quality, driving demand. Increased maritime commerce demands underwater hazard mapping to maintain safe passage, and observation of the environment demands improved applications in science. North America leads due to huge defense spending, and expansion in Asia Pacific is spurred by modernization drives. Emerging markets are low-cost UAV items and hybrid sensor solutions for naval defense for civilian use.

Atlas Elektronik, Kongsberg Gruppen, Lockheed Martin, and Raytheon Technologies dominate the airborne sonar segment, each leveraging legacy defense and maritime expertise to build advanced acoustic payloads for aerial platforms.

These players are doubling down on innovation pushing for lighter, more accurate sensors, streamlined AI‑enabled processing, and rapid deployment capabilities to meet rising demands in maritime surveillance, naval operations, and environmental monitoring

MARKET DYNAMICS

MARKET DRIVERS

Rising Defense Budgets and Geopolitical Tensions Among Countries to Lead Substantial Growth

Airborne SONAR demand rises as defense spending and geopolitical tensions among countries grow, especially for Anti-Submarine Warfare (ASW) and naval protection. The U.S., China, and India are countries putting money into building naval capabilities, with the U.S. Navy covering over USD 20 million in R&D into technology. Technological advancements in synthetic aperture and multi-beam sonar enhance detection and range, machine learning and artificial intelligence enhance processing to mitigate false alarms, and real-time decision-making.

The evolution of the unmanned aerial vehicle (UAV) using light and cheap sonar systems enhances operating effectiveness and availability. Expansion in seaborne trade requires seafloor risk mapping to ensure safe traveling and scientific application-from oceanographic exploration and monitoring of the environment. This, in turn, acts as the main driver for threat detection, thereby leading to market growth.

Sonar and radar, or optics sensor array sensor systems, also supply global situational awareness, fueling market growth. Cost and technology inhibitors still exist, but new civilian maritime security opportunities coupled with systems sensitive to the Arctic emerge as key drivers of growth.

MARKET RESTRAINTS

Surge in High Cost and Regulatory Compliance Issues to Limit Market Expansion

The market is confronted with high costs of development and operation, such as costs for cutting-edge materials, AI, and trained personnel, which restrict adoption in small organizations. Technical complications continue, for instance, acoustic impedance mismatches at air-water boundaries, resulting in 65 dB signal loss, compromising detection reliability under real-world conditions. Operational challenges involve environmental conditions such as ocean surface waves and turbidity, which reduce system performance and limit deployment in coastal or turbulent waters.

Standardization and regulatory challenges also hamper expansion, with divergent global policies making compliance and entry into markets difficult. Privacy concerns regarding data emerge from AI-powered analytics, while constraints in skilled labor availability hold up system maintenance and innovation. These issues, in combination, limit market expansion despite increased defense and commercial demand.

MARKET OPPORTUNITIES

UAV-Compatible Systems, AI-Driven Analytics, and Environmental Monitoring to Propel Market Growth

UAV-optimized airborne SONAR systems, such as SPH Engineering's EchoLogger ECT D24S mounted on DJI Matrice M350 RTK drones, enable cost-effective underwater mapping through the utilization of light, dual-frequency sonar installed on drones for high-resolution bathymetry.

AI-based analytics enhance such systems by processing sonar data in real-time to reduce false alarms and improve detection rates, such as in defense systems where AI filters noise from beam-formed sonar arrays to identify submarine signatures. Environmental monitoring is supported by UAV-SONAR hybrids, such as Stanford's 2020-developed Photoacoustic Airborne SONAR System (PASS), which employs lasers and sound waves to image underwater targets with drones, with ongoing lab-to-field scaling efforts.

Recent developments comprise SPH Engineering's September 2024 trial in Latvia, where UAV-SONAR echo sounders covered shallow lakes with USVs, proving UAV maneuverability in eutrophic waters, while AI platforms feature corresponding advancements in sensor data optimization. For instance, Vueling Airlines in June 2023 and Philippine Airlines in November 2024 embraced AI models to anticipate aircraft component failures, diminishing downtime. Additionally, AI optimizes SONAR data processing, e.g., filtering noise from sonobuoys or predicting underwater risks utilizing historical acoustic patterns. Such combinations feature UAV-SONAR as a factor for sustainable marine exploration and defense, based on the ability of AI to convert raw acoustic information into usable insights.

Download Free sample to learn more about this report.

AIRBORNE SONAR MARKET TRENDS

Emergence of Artificial Intelligence (AI) and Machine Learning (ML) to Lead to Substantial Market Growth

The four new technologies are transforming the airborne SONAR business. Machine learning and artificial intelligence applications, for instance, are transforming target recognition and classification through the automatization of feature extraction and improved accuracy due to the ability of neural networks to classify complex sonar signatures with or without human intervention.

Furthermore, miniaturization and adaptation to sonar usage with UAVs allow the use of sonars on small unmanned aerial vehicles, which is more economical and convenient. Thirdly, using multi-beam and synthetic aperture sonar technology provides more resolution and better-quality pictures of larger survey areas and more scientific and military applications.

Lastly, mod system and hybrid technology-whose sonar is coupled with radar, LiDAR, or optical sensors-all enable wide-area situational awareness and seamless networked defense platform integration. All of these technologies combined are making airborne Sonar precise, flexible, and cost-effective in many applications.

Segmentation Analysis

By Application

Increasing Demand for Sophisticated Protection Drives the Defense Segment

Based on application, the market is classified into commercial and defense.

The defense segment accounted for the largest airborne SONAR market share in 2024 and is expected to grow at the highest CAGR in the forthcoming years. The primary impetus for the creation of defense airborne SONAR is the increasing need for cutting-edge maritime defense and anti-submarine warfare (ASW) technology in response to rising geopolitical tensions and heightened submarine activity globally. Countries are spending more on defense budgets to upgrade their aircraft and naval defense equipment, driving demand for high-performance airborne sonars, which offer increased situation awareness, support rapid detection and tracking of sea targets, and support a large range of missions from reconnaissance to search and rescue.

The commercial segment accounted for a significant market share in 2024, fueled mainly by the growing demand for effective underwater mapping, navigation, and environmental surveillance to facilitate rising maritime commerce, offshore exploration, and scientific inquiry. Commercial airborne SONAR technology has extensive uses in seabed mapping, exploration of resources, pipeline and cable inspection, management of fisheries, and marine biodiversity research. The technology supports fast, large-scale surveys using helicopters or UAVs and is of enormous use in commercial applications where quick and accurate underwater information is needed. Further, advances in SONAR technology, such as multi-beam and synthetic aperture sonar, have enhanced detection and imaging resolution, which has witnessed greater usage in commercial applications.

By Solution

Rising Need for Sophisticated SONARs to Boost Hardware Segment Growth

Based on the solution, the market is divided into hardware and software.

The hardware segment accounted for the largest share of the market in 2024 and is expected to grow at the highest CAGR in the coming years. The increasing need for sophisticated sonars to enable naval security, surveillance, and anti-submarine warfare has driven investment in highly advanced sensors, transducers, and processing units that enable higher detection accuracy and greater coverage under operation. Advancements such as synthetic aperture and multi-beam sonar have also driven high-performance hardware that could enable such sophisticated functionalities.

The software segment will continue to account for a considerable share of the market. On the software side, the union of machine learning and artificial intelligence (AI) is revolutionizing airborne SONAR by being able to process data in real-time, automatically detect targets, and make more informed decisions. Sophisticated software platforms facilitate simple integration with other onboard platforms, remote downloading, and sophisticated signal processing, yielding maximum operational effectiveness and responsiveness to evolving mission requirements. This dual push in hardware and software is called for to counteract the expanding requirements of contemporary naval operations and seaborne security threats.

By End-User

Demand to Retrofit Old Fleets with Advanced Technology Boosted Segment Growth

Based on the end-user, the market is divided into line fit and retrofit.

The retrofit segment accounted for the largest share of the market in 2024 due to the ongoing need to retrofit old fleets with advanced detection and surveillance technology. Several naval and Coast Guard operators keep aging aircraft in service by rebuilding them. In most instances, this is rebuilding sophisticated growth of the SONAR systems market to stay one step ahead of future maritime threats and for compliance reasons. Retrofitting gives the older platforms an advantage in the better detection of the targets, the data handling, and integration into new command and control networks without money investments in the new planes' purchase. It most strongly appeals to the low-budget operations and big fleets served, thus allowing the operational capability to be strong and up-to-date within an ever-changing security environment.

The line fit segment is expected to grow at the highest CAGR in the coming years. The growth of the line fit segment is driven by rising demand for new naval aircraft and maritime patrol planes with cutting-edge, integrated SONAR equipment at initial production. Modern defense doctrine emphasizes delivering enhanced anti-submarine warfare and maritime surveillance capability, prompting procurement agencies to insist on SONAR as an option in new-production aircraft. The expansion is driven by increasing defense expenditures and the acquisition of next-generation aircraft, while other onboard platforms implement SONAR to offer enhanced operation efficiency and situational awareness. Original equipment manufacturers are then partnering with SONAR technology providers such that new systems are being delivered "mission-ready" to help support rapid deployment and cost savings throughout their entire lifecycle by avoiding likely future retrofitting requirements.

Airborne SONAR Market Regional Outlook

By region, the market is categorized into North America, Europe, Asia Pacific, and the Rest of the World.

North America

North America Airborne SONAR Market Size, 2024 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America dominates the global market with a major share. The North American market is growing with a strong surge, fueled by enormous defense expenditure, technological advancements, and the presence of leading defense contractors and research facilities. The growth driver in the region is the U.S. through sustained investment in naval and air anti-submarine warfare (ASW) capability, mine detection, and undersea surveillance. The offshore oil and gas exploration-commercial segment also fuels the airborne SONAR market growth. The area's emphasis on defining maritime boundaries and safeguarding crucial underwater resources also fuels the demand for sophisticated airborne SONAR systems.

The U.S. dominates the global airborne SONAR industry, fueled by its need to provide naval superiority and technological advancement. The extraordinary research, innovation, and fleet modernization investments of the U.S. Navy, including adding airborne SONAR for ASW and maritime reconnaissance, are major growth drivers.

Europe

Europe is the second-largest market due to mounting geopolitical tensions, upgrading naval fleets, and collaborative defense actions by NATO and EU nations. For example, Britain, France, and Germany are upgrading next-generation airborne SONAR systems to upgrade ASW capabilities and secure strategic sea lines. There is also a well-developed maritime industry and engagement in scientific and environmental surveillance, and in defense and civil use of airborne SONAR within the region.

Asia Pacific

Asia Pacific is projected to be the fastest-growing region, with a high CAGR over the forecast period. This region is undergoing the fastest emerging market with escalating defense spending, border disputes, and increased focus on sea power security, the South China Sea, and the Indian Ocean in particular. China, India, Japan, and South Korea are all going big on airborne SONAR systems to boost naval power and guard sea interests. Growing commercial shipping and offshore exploration businesses in the region also facilitate demand for high-end sonar systems.

Rest of the World

The market in the rest of the world region is expected to witness considerable growth in the near future. The Latin American market is also expanding due to increasing crime and political unrest. Law enforcement agencies and security companies are investing in protective gear to counter rising violence. Spend by the militaries of nations such as Brazil and Mexico on new products is driving growth. The Middle East & Africa market is being driven by sustained warfare and increased security threats. Governments are buying advanced products to armor troops. Increasing application by private security companies and individuals working in high-risk environments also drives market growth.

COMPETITIVE LANDSCAPE

Key Industry Players

Continuous Development and Introduction of New Products by Key Companies Resulted in Their Dominating Market Positions

The market is competitive and dynamic, combining defense conglomerates and protection equipment specialists. Major players such as DuPont de Nemours Inc., Honeywell International Inc., BAE Systems plc, and 3M Company dominate the market with huge R&D capabilities and excellent connections with the military and law enforcement agencies. They maintain their positions in the market by following strategic alliances, continuous research and development, and adherence to rigorous quality norms.

LIST OF KEY AIRBORNE SONAR COMPANIES PROFILED

- ASELSAN A.Ş. (Turkey)

- ATLAS ELEKTRONIK INDIA Pvt. Ltd. (India)

- DSIT Solutions Ltd. (Israel)

- EdgeTech (U.S.)

- FURUNO ELECTRIC CO., LTD. (Japan)

- Japan Radio Co. (Japan)

- KONGSBERG (Norway)

- Lockheed Martin Corporation (U.S.)

- L3Harris Technologies, Inc. (U.S.)

- NAVICO (Norway)

- Raytheon Technologies Corporation (U.S.)

- SONARDYNE (U.K.)

- Teledyne Technologies Incorporated. (U.S.)

- Thales Group (France)

- Ultra (U.K.)

KEY INDUSTRY DEVELOPMENTS

- March 2025: Authorities of the Naval Sea Systems Command in Washington reported plans to arrange a contract with Serco for anti-submarine warfare (ASW) advancement for undersea systems.

- March 2025: Lockheed Martin Corporation's LMT unit, Rotary and Mission Systems, clinched an adjustment contract to exercise choices for the procurement of hardware spares to bolster the U.S. Navy's Sonar systems. The grant has been advertised by the Naval Sea Systems Command, Washington, D.C., estimated at USD 12.3 million, and the contract is anticipated to be completed by September 2030.

- January 2025: Thales signed a contract with the French defence procurement agency (DGA) to supply the French Naval force with over a hundred SonoFlash sonobuoys. Made in France in collaboration with French SMEs, the SonoFlash sonobuoy fortifies France's vital and capability aspirations within the field of anti-submarine warfare.

- May 2024: The German MAWS GbR, a consortium comprising ESG Elektroniksystem- und Logistik-GmbH, HENSOLDT Sensors GmbH, and Diehl Resistance GmbH & Co. KG, was granted a contract on April 25, for the moment national supplementary ponder related to the Franco-German Maritime Airborne Warfare System (MAWS) project.MAWS aims to set up a system of frameworks for networked maritime reconnaissance, submarine hunting, and oceanic target engagement utilizing manned and unmanned platforms in coordination with ground stations..

- April 2023: Airborne anti-submarine warfare (ASW) experts at the Thales Group announced to build AN/AQS-22 Airborne Low Frequency Sonar (ALFS) systems for the U.S. Navy MH-60R helicopter under terms of a USD 31 million contract announced late last month. The company is supposed to build an airborne low-frequency sonar system (ALFS) for the Navy's MH-60R helicopters.

REPORT COVERAGE

The global airborne SONAR market analysis provides market size & forecast by all the segments included in the report. It includes details on the market dynamics and market trends expected to drive the market over the forecast period. It offers information on the prevalence of malocclusion in key regions/countries, key industry developments, new product launches, details on partnerships, mergers & acquisitions, and services provided in key countries. The report covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 3.51% from 2025-2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Application

|

|

By Solution

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 833.4 million in 2024 and is projected to reach USD 1,141.4 million by 2032.

In 2024, the market value in North America stood at USD 261.5 million.

The market is expected to exhibit a CAGR of 3.51% during the forecast period of 2025-2032.

The defense segment led the market by application.

Rising defense budgets to lead to substantial market growth.

Major companies such as Thales Group, Lockheed Martin Corporation, and L3Harris Technologies, Inc., dominate the market.

North America holds the largest share of the market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us