Aluminium Sheet Market Size, Share & Industry Analysis, By Product (Flat Sheets and Coiled Sheets), By End-Use Industry (Building & Construction, Automotive, Aerospace, Packaging, Electronics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

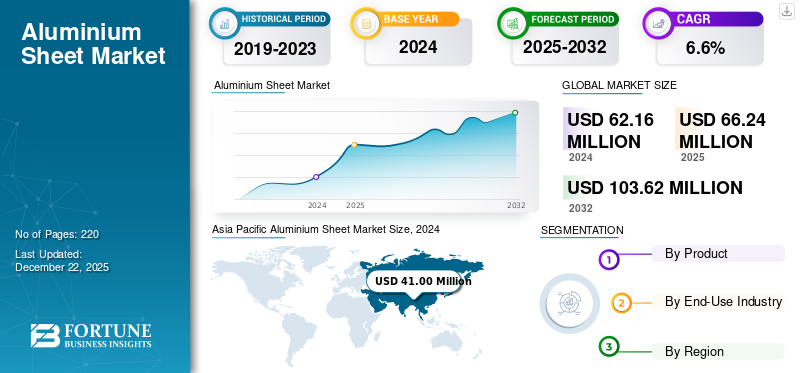

The global aluminium sheet market size was valued at USD 66.24 billion in 2025 and is projected to grow from USD 70.6 billion in 2026 to USD 117.74 billion by 2032, exhibiting a CAGR of 6.6% during the forecast period. Asia Pacific dominated the aluminium sheet market with a market share of 66% in 2025.

Aluminium sheet is a flat-rolled product made from aluminium alloy, known for its lightweight, corrosion resistance, and high malleability. It is widely used in construction, automotive, aerospace, packaging, and electronics industries due to its ability to provide strength while reducing overall weight. The market is experiencing steady growth due to rising demand for lightweight materials, especially in the infrastructure and automotive sectors. Increasing investments in renewable energy projects and the growing electric vehicle industry are also driving demand. Additionally, the shift toward sustainable and recycling packaging further supports market expansion. The major manufacturers operating in the market include Aalco Metals Limited, Henan Chalco, JW Aluminum, Constellium, and Hindalco Industries Ltd.

MARKET DYNAMICS

MARKET DRIVERS

Rapid Industrial Growth and Urban Infrastructure Expansion to Boost Product Demand

The rapid pace of industrialization and urban infrastructure development significantly drives the demand for the product. As cities expand and industries modernize, the need for durable, lightweight, and energy efficient materials increases across construction, transportation, and manufacturing sectors. It plays a critical role in enabling modern infrastructure through its application in building facades, transport systems, and energy projects. Their recyclability and strength-to-weight ratio make them ideal for sustainable development. Additionally, advancements in fabrication technologies and increased focus on smart, eco-friendly construction practices further accelerate product adoption. As a result, these development efforts are expected to drive the global aluminium sheet market growth.

MARKET RESTRAINTS

High Energy Consumption and Raw Material Costs to Restrain Market Expansion

The market faces a significant hurdle due to the high energy intensity and rising costs associated with aluminium production. The extraction and processing of bauxite and energy-intensive smelting operations make aluminium manufacturing highly sensitive to fluctuations in electricity and fuel prices. Additionally, the rising costs of key raw materials further add to manufacturing expenses. These cost pressures can reduce profit margins, limit production capacity, and increase end-user prices. As a result, volatile energy markets and raw material price instability continue to be major restraints on the market's sustained growth.

MARKET OPPORTUNITIES

Rising Demand for Sustainable Packaging Solutions to Support the Market Expansion

The growing shift toward eco-friendly packaging is creating strong growth potential for the market. As industries like food and beverage, and personal care seek alternatives to plastics, aluminium sheets are gaining traction due to their recyclability, lightweight nature, and ability to preserve product quality. Increasing environmental regulations and consumer demand for sustainable packaging are further accelerating demand. Additionally, advancements in the processing are helping manufacturers meet sustainability goals without compromising on performance. These factors are expected to boost market demand significantly in the coming years.

MARKET CHALLENGE

Stringent Environmental Regulations and Rising Competition from Substitutes Challenge Market Growth

The market faces growing challenges due to strict environmental regulations and increasing competition from substitute materials. Aluminium production is highly energy-intensive and contributes significantly to carbon emissions, attracting regulatory pressure to adopt cleaner, more sustainable practices. Meeting these environmental standards often demands substantial investments in low-emission technologies and greener energy sources. Additionally, the emergence of alternative materials such as composites and engineered plastics is intensifying market competition. These challenges are pushing manufacturers to innovate and improve both the sustainability and performance of their products to stay competitive.

ALUMINIUM SHEET MARKET TREND

Accelerated Adoption of Digital and Automated Technologies in Aluminium Sheet Production

The market is witnessing a steady shift toward digital manufacturing and automation to enhance productivity and maintain consistent quality. Companies are implementing advanced rolling techniques and integrated digital systems to streamline operations, monitor production in real time, and reduce manual errors. These advancements are helping manufacturers optimize material usage, lower operational costs, and meet the rising demand from industries such as automotive, construction, and packaging. The trend reflects a broader move toward smart, data-driven manufacturing environments that support scalability, efficiency, and sustainable growth.

Download Free sample to learn more about this report.

Segmentation Analysis

By Product

Rising Demand for Coiled Aluminium Sheets Growth in Key End-Use Industries to Drive Segment

Based on product, the market is segmented into flat sheets and coiled sheets.

The coiled sheets segment held a dominant global aluminium sheet market share in 2024, primarily due to its widespread use in the automotive, construction, and manufacturing industries. These sheets offer flexibility in processing and are ideal for mass production, making them suitable for applications like roofing, cladding, insulation, and body panels in vehicles. The segment's growth is further supported by increasing demand for lightweight and high-strength materials. Additionally, advancements in rolling and coating technologies have made coiled sheets more accessible and cost-effective.

The flat sheets segment also holds a significant share, driven by its applications in appliances, signage, packaging, and consumer electronics. Flat aluminium sheets are known for their excellent surface finish, corrosion resistance, and ease of fabrication. The rising demand for sustainable packaging solutions and durable materials in industrial machinery is contributing to segment growth. Moreover, the shift towards recyclable and energy efficient materials is prompting manufacturers to adopt aluminium flat sheets as a preferred alternative.

By End-Use Industry

Building & Construction Segment to Lead Owing to Rapid Urbanization and Infrastructure Development

Based on the end-use industry, the market is segmented into building & construction, automotive, aerospace, packaging, electronics, and others.

The building and construction industry segment held a dominant global aluminium sheet market share in 2024. This is primarily due to the increasing use of product in roofing, cladding, facades, windows, and doors. Their lightweight nature, corrosion resistance, and ease of fabrication make them ideal for modern architectural designs and energy-efficient buildings. Rapid urbanization, rising real estate investments, and government initiatives for infrastructure development are further fueling the demand for aluminium sheets. The growth of green buildings and smart city projects is also contributing to the increased adoption in the construction sector.

The automotive industry is witnessing significant growth due to the rising demand for lightweight vehicles aimed at improving fuel efficiency and reducing emissions. They are widely used in vehicle body panels, hoods, trunk lids, and heat shields due to their strength-to-weight ratio. With the growing popularity of electric vehicles (EVs), manufacturers are increasingly turning to aluminium to meet weight reduction targets without compromising safety and performance. Technological advancements in forming and joining processes have further facilitated the integration of aluminium sheets in vehicle manufacturing.

The aerospace segment also holds a substantial share of the market. They are essential in the aerospace industry due to their strength, lightweight properties, and resistance to corrosion at high altitudes. They are used in fuselage skins, wings, interior panels, and structural components. The global rise in air travel, aircraft fleet expansion, and increased defense spending are driving the segment's growth. Additionally, the ongoing trend toward fuel-efficient and lightweight aircraft designs is further accelerating the demand for high-performance aluminium sheets in the aerospace industry.

Aluminium Sheet Market Regional Outlook

By geography, the market is categorized into Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Aluminium Sheet Market Size, 2025 (USD Million) To get more information on the regional analysis of this market, Download Free sample

Asia Pacific region dominates the global market with a valuation of USD 43.97 billion in 2025 and USD 47.15 billion in 2026, driven by rapid industrialization, urbanization, and robust growth in key end-use sectors such as construction, automotive, and electronics. Countries like China, India, Japan, and South Korea are witnessing increased infrastructure development, high-rise buildings, and smart city initiatives, contributing to rising product consumption. Additionally, the expanding automotive manufacturing base and growing adoption of electric vehicles are boosting demand for lightweight materials. Government investments in transportation, renewable energy, and industrial development further accelerate the market growth in the region.

North America

The growth of the market in North America is driven by increasing demand for lightweight, durable, and energy-efficient materials across various applications. Infrastructure upgrades, urban redevelopment, and a strong focus on sustainability are key factors driving market expansion. Government investments in modernizing public facilities, promoting clean energy, and encouraging advanced manufacturing in countries like the U.S. and Canada are further boosting the use of aluminium sheets. Additionally, rising consumer preference for recyclable and high-performance materials, along with technological advancements in production processes, continues to support the market growth across the region.

Europe

In Europe, the market is growing steadily due to strict environmental regulations, a strong push for sustainability, and increasing demand for lightweight, recyclable materials. The region's emphasis on energy-efficient construction and the renovation of aging infrastructure is contributing to higher adoption of the product. Ongoing investments in smart city projects and advanced building technologies further support market expansion. With countries like Germany, France, and U.K. prioritizing eco-friendly and high-performance materials, Europe continues to be a key market for the product.

Latin America

In Latin America, the market is expanding steadily, supported by growing industrial activity, infrastructure development, and increasing demand for lightweight and durable materials. Countries like Brazil and Mexico are witnessing rising investments in construction, transportation, and manufacturing, where aluminium sheets are used in various applications. The region is also experiencing a gradual shift toward sustainable and energy-efficient materials, which further supports regional market growth.

Middle East & Africa

In the Middle East and Africa, the market is witnessing growth driven by ongoing infrastructure development, industrial expansion, and increasing demand for modern, lightweight materials. Countries like the UAE and Saudi Arabia are leading demand with large-scale construction projects, transportation upgrades, and urban development initiatives. The region's strategic focus on modernization and energy-efficient solutions continues to enhance the demand for aluminium sheets across the various sectors.

COMPETITIVE LANDSCAPE

Key Industry Players

Continuous Investments by Key Companies in R&D to Introduce New Products to Maintain Their Dominating Positions

The global aluminium sheet market is highly competitive, with key players focusing on technological advancements, mergers & acquisitions, and capacity expansion to increase their market presence. Global companies include Aalco Metals Limited, Henan Chalco, JW Aluminum, Constellium, and Hindalco Industries Ltd. These companies compete based on purity levels, cost-effective processing techniques, supply chain integration, and regional dominance while investing in sustainable extraction technologies to address environmental concerns. While global leaders dominate in developed markets, regional players are expanding aggressively in emerging economies, intensifying competition in the industry.

LIST OF KEY ALUMINIUM SHEET COMPANIES

- Aalco Metals Limited (U.K.)

- Henan Chalco (China)

- RusAL (Russia)

- JW Aluminum (U.S.)

- Metalco Extrusions Global LLP (India)

- UACJ Corporation (Japan)

- Constellium (France)

- Aleris International, Inc. (U.S.)

- Hindalco Industries Ltd. (India)

- AMAG Austria Metall AG (Austria)

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.6% from 2026-2034 |

|

Unit |

Value (USD Billion) and Volume (Kiloton) |

|

Segmentation |

By Product · · Flat Sheets · Coiled Sheets |

|

By End-Use Industry · Building & Construction · Automotive · Aerospace · Packaging · Electronics · Others |

|

|

By Region · North America (By Product, By End-Use Industry, and By Country) o U.S. (By End-Use Industry) o Canada (By End-Use Industry) · Europe (By Product, By End-Use Industry, and By Country) o Germany (By End-Use Industry) o U.K. (By End-Use Industry) o Italy (By End-Use Industry) o France (By End-Use Industry) o Russia (By End-Use Industry) o Spain (By End-Use Industry) o Poland (By End-Use Industry) o Rest of Europe (By End-Use Industry) · Asia Pacific (By Product, By End-Use Industry, and By Country) o China (By End-Use Industry) o India (By End-Use Industry) o Japan (By End-Use Industry) o South Korea (By End-Use Industry) o Indonesia (By End-Use Industry) o Rest of Asia Pacific (By End-Use Industry) · Latin America (By Product, By End-Use Industry, and By Country) o Brazil (By End-Use Industry) o Mexico (By End-Use Industry) o Rest of Latin America (By End-Use Industry) · Middle East & Africa (By Product, By End-Use Industry, and By Country) o UAE (By End-Use Industry) o Saudi Arabia (By End-Use Industry) o Bahrain (By End-Use Industry) o Egypt (By End-Use Industry) o Iran (By End-Use Industry) o Rest of Middle East & Africa (By End-Use Industry) |

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 70.6 billion in 2026 and is projected to reach USD 117.74 billion by 2034.

In 2025, the market value stood at USD 43.97 billion.

The market is expected to exhibit a CAGR of 6.6% during the forecast period.

The key factors driving the market are infrastructure projects and industrial growth.

Aalco Metals Limited, Henan Chalco, JW Aluminum, Constellium, and Hindalco Industries Ltd. are the top players in the market.

Asia Pacific dominated the market in 2025.

Rising demand for lightweight and recyclable materials, increasing usage in the automotive and packaging industries, and the shift toward sustainable and energy-efficient manufacturing practices are some of the key factors expected to favor the product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us