Automated Forklift Trucks Market Size, Share & Industry Analysis, By Type (Pallet Mover, Counterbalance, Outrigger, and Reach Truck), By Navigation Technology (Laser Guided, Magnetic Guided, Vision Guided, and Others), By Application (Transportation & Distribution, Storage & Assembly, and Packaging), By Industry (Automotive, Food & Beverage, E-Commerce, and Others), and Regional Forecast, 2026-2034

Automated Forklift Trucks Market Size

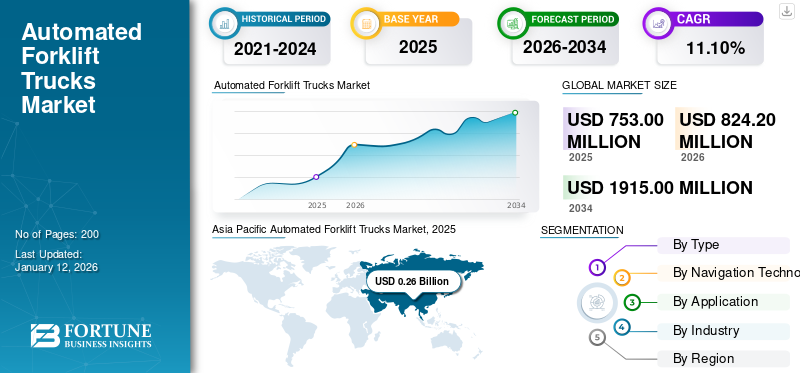

The global automated forklift trucks market size was valued at USD 0.75 billion in 2025 and is projected to grow from USD 0.82 billion in 2026 to USD 1.91 billion by 2034, exhibiting a CAGR of 11.10% during the forecast period. Asia Pacific dominated the global market with a share of 35.80% in 2025.

Automated forklift trucks, also known as autonomous mobile robots (AMRs), are used for material handling and are becoming increasingly popular in various industries due to their ability to improve efficiency, productivity, and safety. These advanced systems are designed to autonomously transport and handle loads within warehouses, manufacturing facilities, and distribution centers. They also help reduce the number of accidents that occur when the truck is driving, during instability when driving downhill with a load, and when transporting unevenly balanced loads. As a result, the adoption of automated forklifts is growing rapidly. In addition, key players are adopting strong business strategies such as selling automated forklifts at lower prices, using laser technology for navigation, and offering slightly smaller storage machines to boost market size.

Moreover, major players such as Toyota Industries Corporation, Dematic, E & K Automation GmbH, and others are engaged in introducing new technologically advanced products for handling and picking pallets for logistics and packaging applications. For instance, in September 2023, Toyota Material Handling Japan (TMHJ), a subsidiary of Toyota Industries Corporation, introduced a new autonomous lift truck for loading applications. It is next generation Artificial Intelligence (AI) based technology that automatically detects the position and location of trucks and loading pallets inside a truck. It is integrated with 3D-Lidar technology that automatically senses the location of pallet trucks. This particular product finds application in warehouses, manufacturing facilities, and logistics automation. Such factor drives the market growth.

Automated Forklift Trucks Market Trends

Increasing Adoption of Industrial Automation and Industry 4.0 Practices

Advanced navigation technologies such as laser guidance, vision guidance, and sensor-based navigation are gaining traction, enabling such products to navigate complex environments with greater accuracy and efficiency. This digital transformation means that computers communicate with each other to make decisions without human intervention. Rising penetration of technologies such as Industry 4.0, the Internet of Things, the Internet of Systems, and the integration of cyber and physical systems in automated forklift trucks are the latest trends in the global market.

Moreover, Industry 4.0 has brought many benefits to the industry, such as optimized supply chain and logistics, robots, additive manufacturing (3D printing), autonomous devices and vehicles, and the cloud and the Internet of Things. The rapid growth of the e-commerce industry is driving the demand for these products in warehouses and distribution centers. There is an increasing adoption of such products in cold storage and freezer environments, particularly in the food and beverage industry. Thus, Industry 4.0 and the increasing spread of industrial automation are expected to create profitable opportunities to increase the share of automated forklifts market.

The COVID-19 pandemic positively impacted the global market owing to rise in the need for automation and contactless operations to ensure continuity and minimize human-to-human contact in material handling equipment.

Download Free sample to learn more about this report.

Automated Forklift Trucks Market Growth Factors

Increasing Adoption of Automation In Warehouses and Manufacturing Facilities to Propel the Market Growth

Many industries face challenges in finding and retaining skilled forklift operators, particularly in regions with tight labor markets. These products can help bridge this gap by reducing the need for human operators, mitigating the impact of labor shortages. The material handling process plays a key role in the smooth running of an industry. It helps in the movement of products and materials from one place to another, making it a primary concern for managers. Streamlining this process through automation and digitization is critical to meeting demand. The introduction of digitization and automation has led to an evolution in the industry, making the material handling process more streamlined and autonomous, which has increased the demand for automated forklifts.

In addition, a change in the material handling procedure has resulted in an efficient and smooth material flow. This has enabled many industries to adapt to just-in-time (JIT) manufacturing processes with fully or semi-automated manufacturing processes. For example, when manufacturing a product, a specific quantity of raw materials is required at certain intervals. With the help of automation and digital data transmission, materials are constantly moving, so the production process does not stop.

Moreover, the rising e-commerce industry and growing automation in logistics sectors, which leads to the rising demand for autonomous products for handling and picking pallets in an effective manner, have created the demand for such products, fueling the market growth. For instance, according to the International Trade Administration (ITA), the global B2B e-commerce sector is anticipated to grow with a CAGR of 14.5% from 2019 to 2026. As a result, the increasing demand for digitization and automation of material handling processes is driving the market growth.

RESTRAINING FACTORS

High Installation Cost and Low Flexibility May Restrain the Market Growth

Automated forklift trucks and associated infrastructure such as navigation systems, charging stations, hardware, and components require high capital investment, which can hinder widespread adoption, especially among smaller businesses or those with limited budgets. The average cost incurred by such products ranges from USD 50,000- 150,000, depending upon plant capacity, load capacity of machine, and enabled technology. However, small or medium level manufacturers cannot bear such a huge capital investment. In addition, automated carts are controlled in system spaces using a predetermined route and product movements. This reduces flexibility in industries that require forklifts for multiple purposes.

Furthermore, there are industries where both forklifts are used, i.e., automated and manned. In these types of industries, operators need special training on how to work with automated forklifts in the same ecosystem. All these factors limit the use of automated forklifts and, therefore, limiting the automated forklift trucks market growth.

Automated Forklift Trucks Market Segmentation Analysis

By Type Analysis

Counterbalance Segment Dominates Owing to Its Various Benefits

By type, the market for automated forklift trucks is classified into pallet mover, counterbalance, outrigger, and reach truck.

As per the analysis, the counterbalance segment dominates the market in terms of revenue with a share of 39.76% in 2026, and the same segment is projected to witness a substantial share during the forecast period. It is owing to various benefits associated with such products, such as robustness, ability to handle heavy loads, increased productivity, and improved safety in material handling applications. Moreover, it finds applications in automotive, warehouses, logistics, and distribution centers.

The pallet mover segment is anticipated to observe a significant share during the forecast period due to the increasing adoption of such products in numerous applications such as food & beverages, automotive, e-commerce, logistics sectors, and warehouses. These trucks are used for multiple applications such as loading, unloading, storage and shipping, and many more. In addition, pallet trucks are comparatively cheaper than counterbalance trucks, making them more affordable for small and medium-scale enterprises (SME’s).

The outrigger and reach truck segments are projected to grow moderately during the forecast period due to the rising demand for efficient and safe handling of oversized and heavy loads across numerous industry verticals, such as manufacturing facilities, warehouses, and distribution centers. All these factors are increasing the global automated forklift trucks market share.

However, these trucks are relatively larger, which requires additional moving space, which limits their applications.

To know how our report can help streamline your business, Speak to Analyst

By Navigation Technology Analysis

Laser Guided Segment Led Owing to Precise Navigation Capability

By navigation technology, the market is segmented into laser guided, magnetic guided, vision guided, and others.

According to the navigation technology, the laser guided segment dominated the market in terms of revenue with a share of 35.06% in 2026, and the same segment is poised to expand at a substantial growth rate during the forecast period. The segment growth can be credited to the deployment of LiDAR (Light detection and ranging) sensors into the technology to offer precise navigation capabilities for automated forklift systems. It is operated in a dynamic environment without the need for physical devices such as magnet wires. In addition, this technology has features such as increased efficiency, improved safety, flexibility, and cost savings.

The magnetic guided segment is projected to register a steady growth during the forecast period, owing to rising demand for automation for material handling operations. It uses magnetic strips to contact with autonomous systems. In addition, it offers various advantages such as improved efficiency and productivity in warehouse applications, reliability, and flexibility. All such factors drive the growth of the segment.

The vision guided segment is anticipated to grow moderately during the forecast period, owing to the increasing adoption of automation by industries for their material handling needs. This technology uses cameras and advanced image processing algorithms to navigate forklifts through devices. It offers high levels of precision and accuracy in navigation, allowing operation in dynamic and complex environments. Moreover, it finds application in warehouses, manufacturing facilities, and the automotive sector.

The others segment include wire-guided inertial navigation systems. This segment is projected to experience decent growth during the forecast period due to rising demand from various industry verticals and the ability to enable safety for manufacturing sectors. All such factors bolster the growth of the segment.

By Application Analysis

Transportation & Distribution Segment Registered Largest Share Due to Growing Demand for Various Applications

By application, the market for automated forklift trucks is categorized into transportation & distribution, storage & assembly, and packaging.

As per the analysis, the transportation & distribution segment dominated in terms of revenue with a share of 40.01% in 2026, and the same segment is projected to record a substantial share during the forecast period. This is owing to rising demand for such products for performing various applications such as loading, unloading, handling, and storage. In addition, these products are used to transport goods within a facility or between different facilities in a distribution network.

The storage & assembly is projected to register steady growth during the forecast period, owing to the rising adoption of such products in warehouses and manufacturing facilities for the storage and retrieval of goods and for assembly line operations.

The packaging segment is projected to grow at decent growth, owing to the rising penetration of such systems in packaging applications due to their efficiency, safety, and accuracy features. These products are used for activities such as material handling, palletizing, and managing inventory. These aforementioned factors drive the growth of the segment.

By Industry Analysis

Food & Beverage Segment Dominated Owing to Reliability Offered by the Product

By industry, the market is categorized into automotive, food & beverage, e-commerce, and others.

According to the analysis, the food & beverage segment dominated the market in terms of revenue with a share of 36.00% in 2026 and is anticipated to witness a substantial share during the forecast period. It is due to the rising adoption of such products in the food & beverage sector owing to features such as efficiency, reliability, and ability to meet stringent hygiene standards. The product is also used for loading, unloading, and storage applications.

The e-commerce segment is projected to expand at a steady growth rate during the forecast period, owing to growth in e-commerce and logistics companies such as Alibaba, Amazon, Flipkart, and others, which, in turn, creates the demand for such products for handling and packaging applications.

The automotive segment is anticipated to grow moderately during the forecast period, owing to product deployment in automotive warehouses and distribution centers to transport material from one location to another and manage inventory during the manufacturing process.

The others segment includes the healthcare and retail sector. This segment is projected to depict decent growth during the forecast period, owing to the product’s applications in performing tasks such as handling and transporting medical supplies, managing inventory in warehouses, and ensuring compliance with regulatory requirements. All these aforementioned factors propel the segment growth.

REGIONAL INSIGHTS

The regional analysis covers North America, the Middle East & Africa, Europe, the Asia Pacific, and Latin America.

Asia Pacific Automated Forklift Trucks Market, 2025

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific region dominated the market with a valuation of USD 0.26 billion in 2025 and USD 0.29 billion in 2026 and is projected to expand at a substantial growth rate during the forecast period. This can be attributed to rising automation in warehouse & logistics, integration of Industry 4.0 practices, and growth in the e-commerce sector across China, Japan, and India, and among others. Moreover, the adoption of automation in industries such as manufacturing, logistics, and warehousing is driving the demand for these products across the region. The Japan market is projected to reach USD 53.5 million by 2026, the China market is projected to reach USD 109.6 million by 2026, and the India market is projected to reach USD 67.5 million by 2026.

China to Dominate Due to Growth in E-Commerce and Rapid Industrialization

China dominates the market in terms of revenue market share. Increasing industrialization, growth in e-commerce, and increasing adoption of automation technologies in warehouse and manufacturing facilities drive the growth of China market. For instance, according to the source of International Trade Administration (ITA), retail e-commerce sales in China are projected to increase by around 130% in 2027 as compared to the year 2023. China's manufacturing sector is rapidly automating to improve efficiency, reduce labor costs, and enhance workplace safety, leading to increased adoption of these products. These factors drive the market growth in the country.

To know how our report can help streamline your business, Speak to Analyst

North America is anticipated to witness steady growth during the forecast period, owing to strong economic growth and growing penetration of automation in numerous industries across the U.S. and Canada. Moreover, the government’s stringent safety regulations are governing the operations of automated forklift trucks. These factors contribute to the North American market growth. The U.S. market is projected to reach USD 0.20 billion by 2026.

Europe region is anticipated to depict a moderate growth during the forecast period. The region is known for its strong manufacturing base, particularly in industries such as automotive, aerospace, and electronics. The need for efficient and reliable material handling solutions has driven the adoption of such products in these industries, fueling the market growth. Moreover, rising growth in the automation sector across Germany, France, and Italy, among others, which in turn, increases the demand for these products, drives the growth of market. For instance, according to the source of OECD, the automotive car market in Germany increased by 7% in 2022 as compared to 2021. Thus, the growth in the automotive sector subsequently drives the growth of the market. The UK market is projected to reach USD 30 million by 2026, while the Germany market is projected to reach USD 43.5 million by 2026.

The Middle East & Africa and Latin America are projected to register decent growth during the forecast period due to rapid industrialization, growing automation in the warehouse & distribution sector, and growth in the logistics sectors.

Key Industry Players

Major Players Are Engaged in Adopting Product Launches to Enhance the Portfolio

Major players such as Toyota Industries Corporation, Seegrid Corporation, E & K Automation GmbH, and Kion Group AG, among others, are engaged in adopting product launch as the key strategic move to improve the portfolio of products across diversified geographic locations. For instance, in 2023, Jungheinrich AG launched an automated pallet stacker, EKS 215A, for warehouse and logistics applications. It has a loading capacity of 3,300 lbs and features such as scalability, flexibility, and robustness.

List of Top Automated Forklift Trucks Companies:

- Toyota Industries Corporation (Japan)

- JBT (U.S.)

- Mitsubishi Caterpillar Forklift America Inc. (U.S.)

- Agilox Services GmbH (Austria)

- Seegrid Corporation (U.S.)

- Kollmorgen (U.S.)

- KION GROUP AG (Germany)

- Hyster-Yale Materials Handling, Inc (U.S.)

- E&K Automation GmbH (Germany)

- Mitsubishi Logisnext Co. Ltd (Japan)

KEY INDUSTRY DEVELOPMENTS:

- December 2023: Linde Material Handling, a subsidiary of KION Group AG, launched a new counterbalance type of forklift truck for warehouse automation. It is integrated with vision guided navigation technology. The product has a load capacity of around 2 to 3 tons. Moreover, it can be used for the transportation of products from one location to another.

- April 2023: Doosan Industrial Vehicle, a subsidiary of Doosan Corporation, signed a partnership with Kollmorgen. The partnership has been made to improve automation in the Kollmorgen. In addition, the main aim of the partnership is to improve the production of automated forklift trucks.

- March 2023: Jungheinrich AG, an exclusive distributor of Mitsubishi Logisnext Americas Group, introduced a new EKX 516Ka autonomous truck for handling and storage applications. It is a high rack stacker and offers features such as environment friendliness, versatility, powerfulness, maximum efficiency, and high productivity.

- November 2022: Linde Material Handling, a subsidiary of KION Group AG, introduced the R-matic autonomous reach truck for warehouse and logistics applications. It has a height of more than 11 meters and load capacity of 1,600 KG. It uses vision guided navigation technology with an innovative 3D camera to detect and maintain the precise loading location.

- March 2022: Otto Motors launched new automated products, such as OTTO 1500 and OTTO 100, for warehouse and manufacturing facility applications. They have a loading capacity of 2,640 pounds and feature laser guided navigation technology. They reduce labor costs, increasing the production capacity of manufacturing sectors.

- April 2022: Seegrid Corporation signed an agreement with Sumitomo Heavy Industries to supply autonomous solutions for manufacturing facilities. The basic aim of the agreement is to improve the manufacturing operations for automated solutions.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The global automated forklift trucks market research methodology and report covers a detailed depth analysis of the type, navigation technology, application, and industry. It provides information about leading players in the global automated forklift trucks market and their business overview, product offerings, investments (R&D and expansions), revenue analysis, types, and leading applications of the product. Besides this, it offers insights into the competitive landscape, SWOT analysis, and current market trends and highlights key drivers and restraints. In addition to the abovementioned factors, the market report encompasses several factors that have contributed to the market's growth in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

| Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 11.10% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type, Navigation Technology, Application, Industry, Region |

|

Segmentation |

By Type

|

|

By Navigation Technology

|

|

|

By Application

|

|

|

By Industry

|

|

|

By Region

|

Frequently Asked Questions

As per the study by Fortune Business Insights, the global market is predicted to reach USD 1.91 billion by 2034.

In 2025, the market value stood at USD 0.75 billion.

Growing at a CAGR of 11.10%, the market is anticipated to exhibit substantial growth during the forecast period.

The Asia Pacific dominated the market share in 2025.

By type, the counterbalance is the leading segment owing to its growing adoption due to various benefits including better stability, control, and storage capacity.

Some of the factors driving the market growth are growing digitalization & automation in the material handling process and the growing e-commerce industry.

The increasing adoption of Industry 4.0 practices and industrial automation is expected to create lucrative opportunities for the market growth.

The high installation cost is the key restraint that hampers the growth of the market.

Some of the key players are TOYOTA INDUSTRIES CORPORATION, JBT, Mitsubishi Caterpillar Forklift America Inc., Agilox Services GmbH, Seegrid Corporation, Kollmorgen, KION GROUP AG, Hyster-Yale Materials Handling, Inc., E&K Automation GmbH, and Mitsubishi Logisnext Co. Ltd.

Europe held 21.20% of market share in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us