Material Handling Equipment Market Size, Share & Industry Analysis, By Equipment Type (Transport Equipment, Handling Equipment, Racking & Storage Equipment, and Others), By Industry (Consumer Goods & Electronics, Automotive, Food & Beverages, Pharmaceutical, Construction, Mining, Semiconductors, and Others), and Regional Forecast, 2026-2034

Material Handling Equipment Market Size

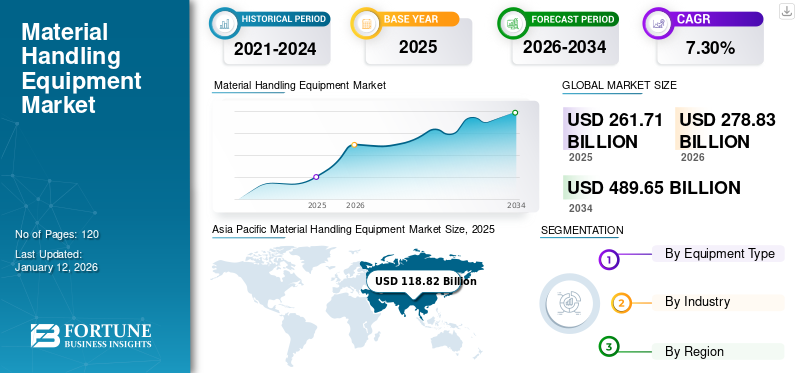

The global material handling equipment market size was valued at USD 261.71 billion in 2025 and is projected to grow from USD 278.83 billion in 2026 to USD 489.65 billion by 2034, exhibiting a CAGR of 7.30% during the forecast period. Asia Pacific dominated the global market with a share of 45.40% in 2025.

Material Handling Equipment (MHE) is mechanical equipment used to transport, store, regulate, and protect materials, commodities, and outputs during the manufacturing, consumption, disposal, and distribution processes. Transportation equipment, positioning equipment, cargo shaping equipment, and storage equipment are the four primary categories of handling equipment available.

The global material handling equipment market is competitive and dynamic, driven by the technological advancements and integration of Industry 4.0 into the warehouse management facilities and logistics infrastructure. Also, changing consumer demands supplemented by e-commerce growth are developing capabilities for last-mile delivery robots. These drivers and trends across the regional dynamics bolstered the demand for material handling systems. Consequently, economic uncertainty rose after the pandemic downfall, and regional geopolitical tension is causing impedance for the market in the short term. However, increasing fast delivery offerings and last-mile delivery growth is mounting the forecast period's global material handling equipment market share.

COVID-19 IMPACT

Economic Uncertainty across Regional Markets Causing Moderate Downfall

Post-COVID-19, major economies globally have experienced a major economic downfall with decreased exchange rates. Leading market players established in the market observed a considerable decline in their revenue and subsequently witnessed a reduction in their profit margins. The cause to abrupt closure of the manufacturing facility affecting the rate of daily output from the production facilities, played a pivotal role in plummeting sales of these market players.

Additionally, the considerable supply-demand gap curtailing reduction in the cash liquidity across the equipment market has compelled manufacturers to reduce investments in the research and development division, causing additional backlogs and restricting the introduction of new products integrated with novel technologies and limiting product diversity. Thus, the COVID-19 pandemic has demonstrated how rapidly material-handling organizations must be prepared to pivot if inventory, sourcing, labor costs, and other factors interrupt operations.

Material Handling Equipment Market Trends

Adoption of Autonomous Mobile Robots (AMRs) and Integration of Data Analytics to Propel the Market Growth

The adoption of robots has reshaped the operations and production processes across the material handling sector. Manufacturing facilities are rapidly adopting automated mobile robots in their production facilities to maximize productivity. Consequently, the high adoption of this equipment across the supply chain vertical maximizes profits for the delivery partners.

Furthermore, with the growing demand for automation and usage of robots grows, demand for more automated products will lead the industry. Thus, automated procedures play an important role in the supply chain industry to react fast and boost productivity.

- For instance, On June 2022, Amazon, an e-commerce giant and technology group, unveiled its first fully autonomous mobile robots for their facilities that will lift package carrying carts.

Download Free sample to learn more about this report.

Material Handling Equipment Market Growth Factors

Increasing E-Commerce and Implementation of AGVs to Bolster the Market Growth

During the global COVID lockdown, a growth in demand for grocery and food items delivery and distribution has given manufacturers higher hopes. Additionally, the growth across e-commerce sector and promotion of online shopping necessitate huge automation. Thus, e-commerce giants operating in the industry such as Amazon, Walmart, Flipkart, and other operational retailers, are gradually integrating automated guided robots, forklifts, and other automated material handling tools in their operations. This added upgradation is helping e-commerce retailers to make more precise, secure, and cost-effective delivery with minimizing labor resources.

Apart from this, improving the manufacturing sector is a major influence in developing the material-handling equipment market. As major manufacturers are facing a labor shortage in their shop floor or work bay, thus need for automated handling equipment’s on their shop floor are business driver, generating profits and minimizing operational costs.

- For instance, in June 2024, ek Robotics completed the solution partnership with the leading automotive manufacturer BMW Group. The new AGVs are implemented in the BMW manufacturing and warehouse application.

RESTRAINING FACTORS

High Initial Investment and Frequent Maintenance are Probable Restraints to the Market Growth

Automation is the need for the current fast-paced logistics and e-commerce sector, and automated handling equipment fits right into it. Although, the high initial investment in integrating material handling equipment across warehouses for procurement, installation, and packaging that involves complex accessories, programming, and other services is restricting the market growth. This constraints businesses, particularly Small and Medium-sized Enterprises (SMEs). As a result of the low-volume manufacturing & delayed Return on Investments (ROI), many businesses need help to raise huge amounts of cash. High maintenance costs are also a stumbling block to the expansion of the global market.

The expense of software upgrades to test and train the automated system to achieve proficiency with minimal accidents on the shop floor requires high costs. Additionally, the replacement of various parts and other devices and rising ownership costs contribute to the market's slowdown, further limiting the demand for material handling equipment.

Material Handling Equipment Market Segmentation Analysis

By Equipment Type Analysis

Transport Equipment Application across Logistics to Depict Highest CAGR

By equipment type, the market is divided into transport equipment, handling equipment, racking and storage equipment, and others (unit load formation equipment, control equipment, identification).

Across the logistics sector, transport equipment segment accounted for 59.83% of the total market share in 2026. The growing transportation industry needs majorly heavy equipment for transferring material between points (for example, transferring pallets from a dock to a storage center). Conveyors, industrial trucks, cranes, & others (hoppers, reclaimers) are some of the major equipment that are being widely adopted across industries.

Whereas position equipment is experiencing major growth in the future. This equipment enables larger productivity in areas that needs just point-to-point movement. It has major applications to orient, load/unload, feed, or otherwise handle items for workplaces requiring smaller movement in the area and transferrin1`g it to process further. This equipment further includes a dock leveler, hoist & others, i.e., rotary index table, lift/tilt/turn table, parts feeder, and balancer.

Furthermore, the growing demand for e-commerce, logistic goods, and other retail stores need improvised and advanced storage equipment, such as automated storage and retrieval system that is witnessing progressive growth in the coming years. Thus, improved storage devices and their use in warehouses reflect a trade-off between source to supplier improving product allocation and decreasing material handling costs by making it conveniently accessible and increasing space usage (or cube). Automatic storage/retrieval systems, selective pallet racks, and others (sliding racks, stacking frames, and push-back racks) are key systems mainly used under storage equipment.

By Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Construction Industry to Have Highest CAGR Owing to Infrastructure Development Activities

The market is distributed by industry into automotive, pharmaceutical, consumer goods & electronics, food & beverages, construction, semiconductors, mining, and others.

Globally construction industry dominated the application of handling equipment in 2026, accounting for 21.26% of the total market share, supported by extensive infrastructure development and increased funding globally. Furthermore, government policies, initiatives, and funds to develop logistic parks, ports, airports, and manufacturing facilities contribute to the demand for material-handling equipment in the construction industry. These projects require equipment such as cranes, conveyors, and forklifts for efficient material movement. Thus, consequently raising material handling equipment market growth for the forecast period.

The rising use of handling equipment in the automotive industry concentrates on improving the assembly process with minimum turnaround time and implementing lean management for on-time delivery of vehicles. Thus, material handling equipment implemented for process optimization increases the equipment's potential in the market.

Additionally, the consumer goods & electronics segment is expected to have a substantial rise over the forecast period owing to growing packaging and safe product delivery. This equipment ensures the quality & integrity of a product & then guides the robotic pick & place of packages.

Additionally, the pharmaceutical industry is anticipated to witness considerable growth owing to the government's increased focus on improving healthcare access. The government’s initiative to develop medical supplies for the growing population under the Public Private Partnership (PPP) module plays a pivotal role for private players.

Furthermore, the semiconductor and mining industries are expected to increase at a moderate rate due to the growing population and rising use of essential metals and electronics materials across the consumer goods sector.

REGIONAL INSIGHTS

The report's scope comprises five major regions, North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

Asia Pacific Material Handling Equipment Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific exhibited strong market growth, with the market size valued at USD 118.82 billion in 2025 and increasing to USD 128.11 billion in 2026. The growth of the Asian market is attributed to the robust economic progress of India, China, and certain countries within ASEAN, with cumulative development of the market in the Asia Pacific. The growing investment in infrastructure development to develop larger logistics parks and delivery centers supporting the e-commerce shoppers entailing the market size in the forecast period. The Japan market is projected to reach USD 30.72 billion by 2026, the China market is projected to reach USD 50.48 billion by 2026, and the India market is projected to reach USD 23.65 billion by 2026.

Furthermore, China is estimated to witness phenomenal growth, with the country’s potential as the manufacturing hub for the equipment industry. The country holds the largest market share with the growing automotive and manufacturing facilities supported by construction activities across the country.

To know how our report can help streamline your business, Speak to Analyst

The North America market is anticipated to have progressive growth during the forecast period owing to the strong presence of prominent companies in the region. Additionally, these companies' indirect attempts in terms of technological advances, strategic alliances, and innovative product offerings are further contributing to the growth of the market for the forecast period. The US market is projected to reach USD 44.7 billion by 2026.

Additionally, the European market is forecasted to grow moderately owing to rising demand for an efficient, streamlined and flexible supply chain structure for better operations. Moreover, government promotional activities for intelligent and automated supply chain infrastructure contribute to the market. The UK market is projected to reach USD 15.31 billion by 2026, while the Germany market is projected to reach USD 20.87 billion by 2026.

Whereas the Middle East & Africa region is witnessing a steady growth in this market. Due to the developing logistics and mining infrastructure projects supported by the government, initiatives to attract foreign direct investment are helping the market grow.

Latin America is projected to grow moderately compared to other regions, owing to less presence of the players in the geography. The construction and supply chain development and management sector have observed slow growth over the past few years, owing to moderate infrastructure investments.

KEY INDUSTRY PLAYERS

Major Players Focusing on Expansion Strategies to Strengthen their Market Positions

Manufacturers are focusing on adopting various marketing strategies such as collaboration and mergers & acquisitions with other logistics solution businesses to attain a considerable position in terms of comprehensive strength. Key players are consistently providing a variety of specialized machines, such as cranes, industrial trucks, and others, and material handling technologies to their end-users across the countries to penetrate into the market deeply.

LIST OF TOP MATERIAL HANDLING EQUIPMENT COMPANIES:

- Daifuku Co., Ltd. (Japan)

- Liebherr Group (Switzerland)

- Schaefer System International Ltd. (Germany)

- Toyota Industries Corporation (Japan)

- Beumer Group (Germany)

- Jungheinrich AG (Germany)

- Godrej Group (India)

- Kion Group AG (Germany)

- Action Construction Equipment Ltd. (India)

- Hyster-Yale Materials Handling, Inc. (U.S.)

- Swisslog Holding AG (Germany)

- Crown Equipment Corporation (U.S.)

- Hyster-Yale Materials Handling, Inc. (U.S.)

- Mitsubishi Logisnext Co., Ltd. (Japan)

- KUKA AG (Germany)

KEY INDUSTRY DEVELOPMENTS:

- February 2024 – Bobcat, one of the prominent material handling products manufacturers, unveiled its expanded product portfolio after its decision to have a strategic integration of Doosan Industrial Vehicle (DIV). The company has rebranded all the equipment such as forklift trucks and related warehouse equipment to come up with a wide range of products and target new customers.

- January 2024 – CLARK Europe GmbH developed green electric forklifts which will pave the way for sustainable logistics. The company also announced its latest invention of a series of electric counterbalance trucks and warehouse technology.

- November 2023 – Hyster Yale launched its new reach truck which is capable of operating in indoor environments and can operate in the outdoor and slightly uneven terrains.

- May 2023 - Toyota Material Handling (TMH) announced the launch of its three electric forklifts. The incorporation of these models in existing portfolio of company will project the company as one of the leaders in terms of provider of material handling solutions and products.

- April 2023 – Crown Equipment Corporation, a global manufacturer and supplier of material handling equipment has launched its newly developed SP1500 high level order pickers with pioneering features such as ergonomically developed operator compartment with customizable controls for quicker and safer order picking.

- March 2023 – KION Group, a leader in the material handling equipment sector has made a strategic alliance with the Li-Cycle, an lithium ion resource leader to strengthen their battery recycling and sustainability offerings position in the industry.

- January 2023 – Crown equipment corporation, expnded its product portfolio with Internal combustion and Electric counterbalance forklifts that can offer a carrying capacity upto 5.5 tons.

REPORT COVERAGE

The research report provides a deep dive analysis of the types, applications, and industries. It provides information about leading companies and their business overview, types, and leading applications of the product. Besides, it offers insights into the competitive landscape, SWOT analysis, current market trends, and highlights key drivers and restraints. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.30% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Equipment Type

By Industry

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market was valued at USD 261.71 billion in 2025.

By 2034, the market is expected to be valued at USD 489.65 billion.

The global market is estimated to exhibit a noteworthy CAGR of 7.30% over the forecast period.

Asia Pacific is expected to hold a major market share in the market. The region stood at USD 118.82 billion in 2025.

Within the equipment type segment, transport equipment is expected to be the leading segment in the market during the forecast period.

Increasing E-Commerce and implementation of AGVs to bolster the market.

Daifuku Co., Ltd., Liebherr Group, Schaefer System International Ltd., Toyota Industries Corporation, Beumer Group, Jungheinrich AG, Godrej Group, Kion Group AG, Action Construction Equipment Ltd., Hyster-Yale Materials Handling, Inc., Swisslog Holding AG, Crown Equipment Corporation, Hyster-Yale Materials Handling, Inc., Mitsubishi Logisnext Co., Ltd., and KUKA AG are some of the top companies in the market.

The construction industry is expected to drive the market.

The transport segment is forecasted to hold the major share in the global market with growing logistic infrastructure.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us