Automated Material Handling Equipment Market Size, Share & Industry Analysis, By Type (Automated Storage & Retrieval System, Automated Conveyor & Sorting System, and Automated Guided Vehicle), By System Load (Unit Load and Bulk Load), By Application (Assembly, Distribution, Transportation, Packaging, and Others), By Industry (E-Commerce, Automotive, Food & Beverages, Pharmaceutical, Aviation, Semiconductors & Electronics, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

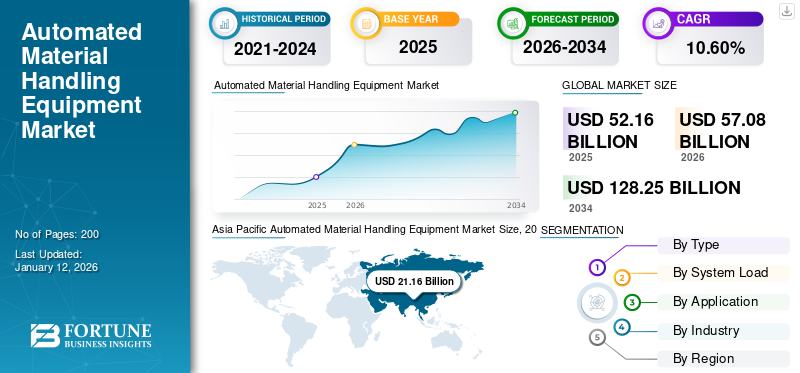

The global automated material handling equipment market size was valued at USD 52.16 billion in 2025 and is projected to grow from USD 57.08 billion in 2026 to USD 128.25 billion by 2034, exhibiting a CAGR of 10.60% during the forecast period. The Asia Pacific dominated global market with a share of 23.45% in 2025.

Automated Material Handling (AMH) equipment includes industrial machines and systems that are used to move and store materials within facilities. This equipment makes use of robotics, technology, and software solutions to deliver material handling efficiency. Automation and Internet of Things (IoT) installations are driving the global market growth across diverse industries, including e-commerce, automotive, etc. Increased demand for rapid handling of products, including storage, sorting, etc., to enable the market growth of automated systems across regions. Increasing online shopping, urbanization, and digital platforms are all surging the growth of the e-commerce and retail sectors. Enhanced online purchases, especially post-pandemic crisis, have resulted in increased inventories and large volume handling, generating huge demand for space optimization and faster delivery of products.

Growing urbanization, increased disposable income, and preference for online purchases are all positively impacting the need for automated systems in warehouses, third-party distribution centers, and ultimately the e-commerce sector. Several other industries, including food and beverages, chemicals, and pharmaceuticals, etc. prefer automated material handling equipment for their large volume of products owing to limited shelf life. Key players in the market, such as Daifuku Co., Ltd., Jungheinrich AG, and Toyota Industries Corporation, are expanding their product offerings to untapped regions.

Download Free sample to learn more about this report.

The COVID-19 pandemic impacted the market significantly, as a result of shutdowns of production hubs and disruptions in the supply chain ecosystem. Also, the temporary blockage in ongoing or upcoming investments financed by various financial institutions for infrastructure development was disrupted. However, in the long term, the market for automated material handling equipment has stabilized as major industries have shifted their focus toward automated material handling solutions to reduce dependency on the workforce on the factory floor and enhance efficiency.

IMPACT OF GENERATIVE AI

Gen AI Influences Operational Efficiency and Equipment Maintenance Across Industrial Process

Generative AI enhances the operational capability of material handling systems. Gen AI helps to determine equipment maintenance and failures to optimize and schedule maintenance. Enhanced operational efficiency and smart inventory management to further minimize the turnaround time across facilities. Integration of advanced technologies, including SLAM (simultaneous localization and mapping), the Internet of Things, and artificial intelligence, has brought a new wave of advancement and is transforming the material handling industry. For instance, in October 2019, HRG company unveiled two automated guided vehicles capable of navigating and producing a 2D map to guide them around the facility.

IMPACT OF TARIFFS

Disrupted Sourcing Strategies to Boost the Domestic Market Players’ Share for Automated Systems

Increased tariffs have resulted in supply chain disruptions and enhanced material costs, thereby limiting the demand for automated material handling equipment in the short term. If tariffs continue to rise, the cost of components and raw materials may further increase, limiting market growth. However, the demand for domestically produced material handling equipment is expected to grow as end users and industry participants support local suppliers and localize supply chain operations.

Automated Material Handling Equipment Market Trends

Evolution of Industry 4.0 and Smart Factories is Fueling Product Demand

Advancements in technology, adoption of Industry 4.0, robotic-enabled solutions, and tech-integrated management systems are further boosting the automated material handling equipment market share. The rising trend toward smart factories is anticipated to boost the material handling industry. The manufacturing floor requires monitoring at every level of the process to gauge operational efficiency and reduce wastage, including picking, sorting, and conveying systems. In such a scenario, smart factories integrated with automated systems enable monitoring of every process. Also, various intuitive technologies embedded in material handling systems, such as cloud connectivity and data analytics, improve asset performance and provide actionable information in real-time. Integration of such automated systems installed in facilities further provides wireless remote control systems that help in providing better diagnostics and reducing commissioning time. Owing to the aforementioned factors, the rise of Industry 4.0 and smart factory construction is creating potential room for the market.

MARKET DYNAMICS

Market Drivers

Growing E-commerce Sector, Manufacturing Growth, and Third-Party Logistics are Favoring Market Growth

The e-commerce industry is growing at a rapid pace across the globe, resulting in a huge demand for process automation. Key vendors such as Amazon, Walmart, and others are increasingly integrating automated solutions to carry out operations in a manner that is efficient, precise, cost-effective, and safe. Besides this, the rise in the manufacturing industry is also a major factor supplementing the market growth. Facility owners are focusing on producing and shipping products to their customers at a faster, cheaper rate and with increased quality. Third-party logistics and warehouses are significantly growing in developing nations, including India. Automation across 3PLs allows faster completion of tasks, reduced turnaround time, and efficient inventory management, in addition to cost-efficiency for the end users. Automated material handling systems are expected to further gain traction, owing to similar factors over the forecast period.

Market Restraints

High Integration and Switching Costs to Hinder Market Growth

The challenging factor for the automated material handling equipment market growth is the massive investments required at the initial stage. The associated costs mainly include installation, integration of intelligent sensors and software solutions, after-sales services, and timely maintenance, increasing the overall ownership costs, making it difficult for companies to invest in AMH equipment. Also, small and medium enterprises find it difficult to switch from conventional material handling to automated products, owing to low production output and investment returns, restructuring of existing warehouse facility designs, and others.

Market Opportunities

Growing Microfulfillment Centers and Third-Party Logistics to Bring Strong Market Opportunities

Growing demand for third-party logistics and micro fulfillment centers across emerging Tier II and III cities is expected to boost the market growth for automated systems for material handling. Distribution and logistics centers have witnessed increasing adoption of automation and intelligent material handling systems, generating strong market opportunities. Growing online platforms and enhanced purchasing power across emerging and developing nations are expected to drive the market growth for automated handling solutions.

- For instance, according to Jones Lang LaSalle IP, Inc. in February 2025, India’s warehousing stock accounts for about 18.7% of the total warehousing stock in Tier II - III cities.

SEGMENTATION ANALYSIS

By Type

Automated Guided Vehicle Segment to Grow at Highest CAGR Backed by Technological Advancements

Based on type, the market is further classified as automated storage & retrieval system, automated conveyor & sorting system, and automated guided vehicle.

The automated guided vehicle segment is expected to rise at the highest growth rate over the forecast period, owing to the evolution of various technologies configured in AGV, such as SLAM (simultaneous localization and mapping), artificial intelligence, and the Internet of Things. Furthermore, major players are continuously focusing on developing the existing automated guided vehicles to offer more efficient products in logistics environments.

The automated conveyor & sorting systems account for the highest revenue market share as a result of increasing demand for automation in logistics and effective supply chain management. Conveyor and sorting systems allow increased throughput, enhanced flexibility, and efficient space optimization.

Automated storage & retrieval systems are expected to grow at a moderate rate in the coming years, owing to the increasing warehouses and manufacturing units across developed and developing economies.

By System Load

Unit Load Holds Highest Share Due to Rising Concerns for Shortening Lead Times

On the basis of system load, the study is further categorized into unit load and bulk load.

The unit load segment is projected to dominate the market with a share of 59.32% in 2026. This is attributable to the growth in the e-commerce industry, as it allows for handling several goods simultaneously, which helps to achieve shorter order lead times, thereby reducing operational costs.

The bulk load segment is expected to grow at a considerable rate, owing to demand from the food & beverages, pharmaceutical, and other industries for transportation and sorting bulk quantities.

By Application

Distribution Segment Holds Highest Share Backed by Rising E-commerce Industry

Based on the application, the market is categorized into assembly, distribution, transportation, packaging, and others.

The distribution segment is expected to account for 38.59% of the market in 2026, as timely distribution and transportation help to achieve delivery targets. This is owing to the usage of automated material handling equipment such as AGVs, and the adoption of automated storage and retrieval systems that allow carrying the materials and products efficiently and effectively in minimal time. Also, key online vendors are rigorously focusing on achieving on-time delivery by improving the material handling systems.

The packaging segment is expected to grow steadily over the forecast period, owing to increasing demand from the food & beverages, pharmaceutical, and e-commerce industries. Automated packaging is vital as the products are handled by different people and are in transition for a considerable span of time. Effective packaging ensures that the food is protected from internal and external environments.

The assembly segment is expected to be driven by the automobile industry, wherein the assembling of vehicle components is completed.

By Industry

To know how our report can help streamline your business, Speak to Analyst

E-commerce Industry to Lead Due to Rise in Online Shopping

Based on industry, the segment is categorized into e-commerce, automotive, food & beverages, pharmaceutical, aviation, semiconductors & electronics, and others.

The e-commerce segment will account for 46.11% market share in 2026, owing to increasing penetration of online shopping trends, presence of major online suppliers, rising logistics infrastructure, and others. This is further compelling owners of distribution centers and facilities to integrate automation systems in warehouses to efficiently manage the supply chain ecosystem.

Food & beverages, aviation, semiconductors, and automotive segments are expected to grow steadily, owing to increasing demand for durable and non-durable goods, growing trends of precision packaging, transporting semiconductors and their components, and others.

Automated Material Handling Equipment Market Regional Outlook

On the basis of region, the market is classified as Asia Pacific, North America, Latin America, the Middle East & Africa, and Europe.

Asia Pacific

Asia Pacific Automated Material Handling Equipment Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 23.45 billion in 2025 and USD 25.95 billion in 2026, owing to growing demand for manufacturing processes and warehouse units. In addition to this, an increase in manufacturing capacities and the adoption of material handling methods to enhance production capabilities in many regions, mainly South Korea, China, and Taiwan, are propelling the growth of the regional market. For instance, the Coca-Cola company opened warehouses in Singapore valued at around USD 57 million to have automated storage and retrieval systems. The Japan market is projected to reach USD 6.03 billion by 2026, the China market is projected to reach USD 9.97 billion by 2026, and the India market is projected to reach USD 5.14 billion by 2026.

A strong manufacturing base, growing logistics centers, and government-supported industrial facilities have resulted in strong market growth in China. Being a domestic manufacturing powerhouse for several years, China demands optimal and efficient material handling solutions. However, trade tariffs imposed might further fluctuate the market growth across the country. In addition, domestic market participants witness increased growth over the short-term period in the Chinese market.

To know how our report can help streamline your business, Speak to Analyst

North America

North America is anticipated to witness substantial growth over the forecast period, owing to the increase in sales through the e-commerce market and the increase in demand for durable and non-durable goods. This trend will eventually compel manufacturing companies to adopt extensive assembly lines and material handling equipment. The U.S. market is projected to reach USD 9.46 billion by 2026.

The U.S. is expected to dominate the regional market for material handling equipment as a result of large-scale industrial manufacturing facilities, increasing e-commerce penetration, increasing investment in infrastructure development, and robust logistics infrastructure.

Europe

Stringent regulatory policies, an aging workforce, and demand for efficient and mandatory policies supporting green logistics to drive market growth in Europe. Smart factory integration and cost-effective solutions demand across industries, including pharmaceuticals, chemicals, etc., to further steadily enhance the demand for automated systems for material handling. The UK market is projected to reach USD 1.71 billion by 2026, while the Germany market is projected to reach USD 4.15 billion by 2026.

Middle East & Africa

The Middle East & Africa region is expected to grow at a steady rate, owing to the increasing penetration of the e-commerce and retail industry in this region. Moreover, foreign direct investments from online retailers are pouring in to set up warehouse facilities to aim at serving the highly unattended market.

Latin America

Growing investment across the automotive, retail, and logistics sectors to drive product demand across industries. Increasing foreign direct investment and expansion of third-party logistics supported by e-commerce growth to propel the market growth in Latin American countries.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Leading Players to Expand Their Product Portfolio in Logistics Business Solutions

Prominent companies are proactively focusing on serving automated material handling systems for logistics solutions business, owing to increasing needs for more efficiencies at distribution centers following the growth of e‐commerce. Additionally, these players are stressing sales activities to supplement the market for automated material handling equipment. Crown Equipment Corporation, Daifuku Co., Ltd., Jungheinrich AG, and Toyota Industries Corporation are a few of the prominent players in the market, accounting for a considerable revenue market share as a result of a diverse product portfolio, robust dealer and distributor network, and a wide range of industry presence.

Long List of Companies Studied (including but not limited to)

- Daifuku Co., Ltd (Japan)

- Jungheinrich AG (Germany)

- Toyota Industries Corporation (Japan)

- BEUMER Group (Germany)

- Cargotec (Finland)

- Kion Group AG (Germany)

- Crown Equipment Corporation (U.S.)

- Honeywell International (U.S.)

- SSI Schaefer AG (Germany)

- Hytrol Conveyor Company, Inc. (U.S.)

- JBT (U.S.)

- KUKA AG (Germany)

- GreyOrange (India)

- Gridbots (India)

- Addverb (India)

- Dematic (U.S.)

- Aichikikai Techno System (Japan)

- Meidensha Corporation (Japan)

- Rapyuta Robotics (Japan)

- Quicktron (Japan)

KEY INDUSTRY DEVELOPMENTS

- March 2025: Nucor Warehouse Systems deployed its 96-foot-tall Automated Storage and Retrieval Systems (ASRS) cold storage structure in the U.S.

- March 2025: Scott Technology has introduced a next-generation automated guided vehicle (AGV), NexBot, at ProMat 2025. The new AGV is designed for varied industry applications, including warehousing, manufacturing, e-commerce, and logistics.

- December 2024: Coca-Cola has announced an investment of about USD 44 million in Wakefield manufacturing operations, diversifying its storage facilities in the Europacific region.

- October 2024: K.Hartwall partnered with its MTS, spol. s.r.o as a new distribution partner in Slovakia to expand its AGV presence across the Central European region.

- June 2024: AutoStore is a warehouse technology company that doubled its production capacity, debuting in the New Modular Robot Factory.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, type, system load, application, and industry of the equipment. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 10.60% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By System Load

By Application

By Industry

By Region

|

|

Companies Profiled in the Report |

Daifuku Co., Ltd (Japan), Jungheinrich AG (Germany), Toyota Industries Corporation (Japan), BEUMER Group (Germany), Cargotec (Finland), Kion Group (Germany), Crown Equipment Corporation (U.S.), Honeywell International (U.S.), SSI Schaefer AG (Germany), and Hytrol Conveyor Company, Inc. (U.S.) |

Frequently Asked Questions

The market is projected to reach USD 128.25 billion by 2034.

In 2025, the market was valued at USD 52.16 billion.

The market is projected to grow at a CAGR of 10.60% during the forecast period.

The automated conveyor and sorting system to lead the market.

The growing e-commerce sector, manufacturing growth, and third-party logistics are favoring market growth.

Daifuku Co., Jungheinrich AG, Toyota Industries Corporation, BEUMER Group, and Cargotec are the top players in the market.

Asia Pacific holds the highest market share.

By industry, the e-commerce industry to dominate the market during the forecast period.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us