Battery Recycling Market Size, Share & Industry Analysis, By Battery Type (Lead-acid Batteries, Lithium-ion Batteries, Nickel-cadmium Batteries, and Others), By Source (Manufacturing Scrap, Transportation OEMs, Consumer Electronics, and Others), By Recycling Method (Pyrometallurgy, Hydrometallurgy, Direct Recycling, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

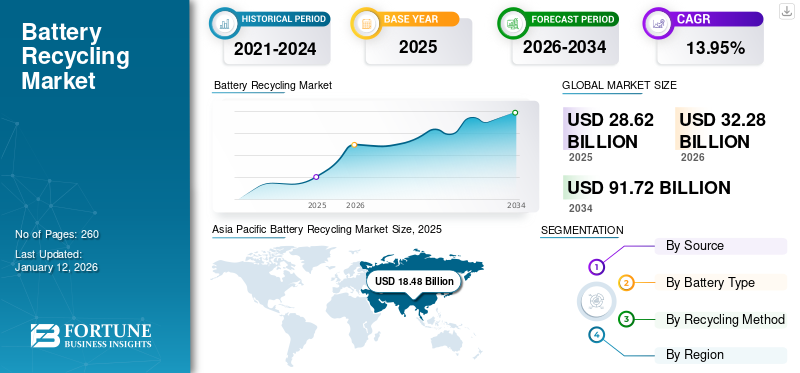

The global battery recycling market size was valued at USD 28.62 billion in 2025. The market is projected to grow from USD 32.28 billion in 2026 to USD 91.72 billion by 2034, exhibiting a CAGR of 13.95% during the forecast period. Asia Pacific dominated the global market with a share of 64.57% in 2025.

The battery recycling process involves recovering valuable materials from used batteries for reuse. It offers economic benefits, facilitates environmental protection, and promotes resource conservation. The market is rising across several countries as it facilitates the recovery of valuable metals, namely lithium, nickel, cobalt, and others, reducing the need for mining and processing new materials. Thus, recycled batteries conserve natural resources and minimize the carbon footprint linked with mining and manufacturing new batteries.

Globally, the battery recycling industry is growing rapidly, with more than 160 million lead batteries recycled in the U.S. every year. Also, in the European Union (EU), almost 48% of portable batteries are recycled annually. The lead battery sector has capitalized on the indefinitely recycling of lead from lead batteries without degrading quality or efficiency. Once they reach the end of their lifespan, lead batteries are divided into three main elements, each fully recyclable: lead, plastic, and acid. These components are converted into the essential raw materials U.S. manufacturers require to produce new lead batteries, utilizing the use-recycle-remanufacture cycle. These factors have been driving the growth of the market in recent years.

Umicore, headquartered in Brussels, focuses on recovering valuable metals from spent rechargeable batteries, mostly those used in electric vehicles and portable applications. Their proprietary process, which combines pyro and hydrometallurgical methods, helps recover key battery metals with high yields, such as nickel, cobalt, and lithium.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Rising Environmental Concerns over Battery Disposal Drive Market Growth

Environmental concerns related to batteries stem from their entire lifecycle, including the extraction of raw materials and their disposal. The production of automotive batteries, particularly for electric cars, requires significant energy and involves sourcing materials such as lithium and cobalt, which can result in habitat damage and environmental pollution. If batteries are not disposed of or recycled properly, they can leak harmful heavy metals into the environment, contaminating soil and water.

Battery recycling is crucial for environmental protection to prevent the hazardous materials present in the batteries from polluting soil, water, and air. Recycling helps lessen the demand for mining and producing new batteries by reclaiming valuable materials from old batteries, conserving natural resources, and reducing the environmental harm linked to those activities. According to Ecobatt, the popular battery recycling company in the U.K., over one year, around 17,386 tons of portable batteries (excluding automotive and industrial batteries) were collected for recycling. This indicates that the U.K. has a battery recycling rate of around 34%. Also, almost half (48%) of portable batteries are recycled annually in the EU.

Increasing Demand for Critical Metals, including Lithium, Nickel, and Cobalt, Drives Market Size

The rise in electric mobility transition toward renewable energy has increased demand for lithium-ion batteries with critical metals such as lithium, cobalt, nickel, and rare earth elements. As the demand for these metals increases, the need to extract and utilize these metals sustainably has increased. It is a crucial part of the circular economy, reducing reliance on primary mining and lowering the environmental impact.

Lithium, nickel, cobalt, and other metals contribute to the overall energy density and storage capacity, which is crucial for electric vehicles and portable batteries. Lithium, nickel, cobalt, manganese, and graphite are key to battery performance, durability, and energy density. Rare earth elements are critical for producing permanent magnets, essential for wind turbines and electric vehicle motors. The electricity sector requires a substantial amount of copper and aluminum, with copper being fundamental to all electricity-related technologies.

The transition to a clean energy system is expected to boost the demand for these minerals significantly, positioning the energy sector as a major player in mineral markets. Until the mid-2010s, the energy sector accounted for a minor portion of the total demand for most minerals. However, as energy transitions accelerate, clean energy technologies are rapidly becoming the fastest-growing demand segment. Considering the goals of the Paris Agreement (as outlined in the IEA Sustainable Development Scenario [SDS]), their share of overall demand is projected to increase considerably over the next twenty years, exceeding 40% for copper and rare earth elements, 60-70% for nickel and cobalt, and nearly 90% for lithium.

MARKET RESTRAINTS

Complex Recycling Processes Associated with EV Batteries Hamper Market Growth

Electric vehicles (EVs) are becoming increasingly popular. Unlike conventional car engines that can be refurbished, an EV battery will inevitably degrade over time. The production of EV batteries demands significant energy and results in greenhouse gas emissions. If not disposed of properly, this could undermine the environmental benefits of using an electric vehicle. Despite ongoing efforts, the recycling rates of EV batteries have remained low over the past ten years. This is largely owing to, even with a clear necessity, the current methods of recycling EV batteries are far from optimal. The challenges include their intricate designs, differing chemical compositions, and no standardized recycling protocols.

The primary obstacle is that the existing recycling process is complicated and expensive. Variations in regional recycling capabilities create logistical challenges, making the entire process inefficient and costly. Taking apart batteries requires specialized facilities and skilled workers, which raises expenses. Moreover, the fluctuating costs of recycled materials often make the extraction of new resources more financially attractive. In the absence of robust economic incentives or regulations to promote recycling, the industry struggles to enhance sustainable battery disposal and recovery. These factors are anticipated to hamper the battery recycling market growth in the coming years.

MARKET OPPORTUNITIES

Increased Investments in Battery Recycling to Generate Excellent Opportunities for Market Growth

Both the public & private sectors are recognizing the importance of battery recycling in terms of economic & environmental values, which has led to increased investments in recycling infrastructure & facilities. For instance, in November 2024, the U.S. Department of Energy (DOE) announced USD 44.8 million in funding for eight innovative projects focused on reducing the costs associated with EV recycling. As the sale of EVs in the U.S. has topped four million, recycling end-of-life batteries has become critical to reduce costs and enhance resource efficiency.

Also, in May 2024, Bosch Ventures, the corporate venture capital unit of the Germany-based Bosch Group, announced significant investments in the recycling sector, directing funds to Pineville, North Carolina-based Li Industries, and Germany-based Cylib. Similarly, in February 2025, Lithium Salvage, the battery recycling firm, secured USD 1.91 million in investment from a funding round led by Northstar Ventures as the company moves forward with plans to develop a lithium-ion battery waste refinery in Sunderland. This investment will lead to the scaling up of Lithium Salvage’s production process and the expansion of its Sunderland site.

MARKET CHALLENGES

Economic Viability and Regulatory Policies Present Challenges for Emerging Industry Players

Although battery recycling helps address climate neutrality and sustainability goals, the high recycling costs, lower recovery rates, and regulatory and policy issues present significant challenges for the market players. For instance, the cost of recycling, which includes collection, transportation, and processing, is high, making the recycling process complex. In addition, varying regulations on battery recycling present across different regions & countries make it difficult to establish a consistent & efficient system.

Moreover, the recycling infrastructure is lagging globally as many countries lack the facilities to process large volumes of spent batteries safely & efficiently. This technology is nascent in developing & underdeveloped countries, owing to which the cost of recycling often outweighs the value of recovered materials. The complexity & diversity of battery designs make the recycling process difficult. The modern battery design, which includes crucial elements, namely nickel, cobalt, and manganese, is intertwined with other less valuable & hazardous materials, which makes the recycling process labor-intensive and costly.

BATTERY RECYCLING MARKET TRENDS

Advancements in Battery Recycling Processes are Current Market Trends

Advancements in the battery recycling processes, namely hydrometallurgy and direct recycling process with the integration of automation & artificial intelligence (AI), present significant opportunities for the market players. In battery recycling, automation & AI are used in robotic disassembly systems, predictive maintenance, AI-driven sorting, and precision recycling processes. AI also facilitates resource recovery & process optimization.

Manual recovery often leads to low material recovery rates and is linked with potential safety hazards. Also, the regulatory pressures require meeting strict standards for recycled content. Adopting digital tools helps track the battery throughout its lifecycle, automates the sorting & disassembly of battery components, and optimizes the recycling schedule. For instance, cloud-based platforms & blockchain technologies help companies to track & trace the lifecycle of battery materials from collection to recycling and their reintegration into the supply chain. These technologies ensure compliance with environmental regulations, which helps the stakeholders monitor the metal recovery rates and carbon emissions.

IMPACT OF TARIFF

The impact of tariffs on the battery recycling industry will be multifaceted, owing to increased tariffs on imported raw materials and components that can make the recycling process less economically viable. Tariffs on key materials such as lithium, cobalt, nickel, and others will increase the cost of recycling, squeezing the profit margin for recyclers and making the recycling process cost-intensive.

The tariff can disrupt the global supply chain, leading to logistical challenges & delays in the import of necessary equipment and chemicals required for battery recycling. Also, recycling impacts the roll-out of clean energy and related investments owing to rising utility costs. Thus, the impact of tariffs on the battery recycling industry is anticipated to be significant globally.

SEGMENTATION ANALYSIS

By Source

Manufacturing Scrap Dominated Market as It is Readily Available for Recycling Facilities

Based on the source, the market is segmented into manufacturing scrap, transportation OEMs, consumer electronics, and others.

The manufacturing scrap accounted for the highest battery recycling market share 59.45% in 2026 as it is the by-product of production, which is readily available for the recycling facilities. Also, the manufacturing scrap contains valuable metals such as lithium, manganese, cobalt, and nickel, which are essential for new batteries and are recovered easily through recycling.

The transportation OEMs, including recalls, are anticipated to show the fastest growth during the forecast period due to increasing adoption of electric vehicles (EVs), which has led to an increase in demand for valuable battery materials, namely lithium, cobalt, and nickel.

The others segment includes the spent batteries from energy storage systems. As renewable energy sources such as solar and wind become more prevalent, the spent batteries from energy storage systems are being recycled to reduce the reliance on mining and mitigate the environmental consequences linked with improper disposal.

To know how our report can help streamline your business, Speak to Analyst

By Battery Type

Lead-acid Batteries Dominated Market Share Owing to Their High Recycling Rate

Based on battery type, the market is classified into lead-acid batteries, lithium-ion batteries, nickel-cadmium batteries, and others.

Among these, the lead-acid batteries segment accounted for the dominant market share 50.07% in 2026. The lead-acid batteries are widely recycled, owing to the hazardous nature of their components, comprising lead and sulfuric acid, and the economic value of the recycled materials. In addition, lead is a valuable resource, and recycling lead-acid batteries reduces the need for new lead mining. The Battery Council International states that the lead battery’s three major components, lead, acid, and plastic, are 100% recyclable. In addition, in the U.S., the recycling rate of lead-acid batteries is estimated to be around 99%, driven by the closed-loop system where the recycled lead is used to produce new batteries.

Lithium-ion batteries are anticipated to show the fastest growth as lithium-ion battery recycling reduces the need for mining materials such as lithium, cobalt, and nickel can be environmentally damaging, and recycling helps reduce the need for virgin materials. Also, the growing popularity of electric vehicles has led to a rise in demand for lithium-ion batteries, which further results in a large volume of end-of-life batteries that will increase the recycling needs in the coming years.

The others segment comprises nickel-metal hydride, mercury cell, and other batteries. These batteries are recycled as they contain heavy metals, valuable metals, and rare earth elements, namely mercury, nickel, cadmium, and others that can be used for the production of new batteries.

By Recycling Method

Hydrometallurgy Dominated Market Due to Higher Recycling Rates & Low Energy Consumption

Based on the recycling method, the market is divided into pyrometallurgy, hydrometallurgy, direct recycling, and others.

The hydrometallurgy recycling technology dominated the market contributing 49.17% globally in 2026 as this method is widely used due to its higher recovery rates, lower energy consumption, and low environmental impact. The environmental impact associated with hydrometallurgy is low owing to lower greenhouse gas emissions and reduced need for mining virgin materials. Also, hydrometallurgy is estimated to supply more than half of the lithium, manganese, cobalt, and nickel globally by 2040.

The direct recycling segment is growing at a significant rate, as this method preserves the structural integrity of the battery components so that they can be reused in new batteries with minimal degradation.

The others segment includes the mechanochemical recycling, which is gaining popularity as it is a highly energy-efficient method that is widely used on an industrial scale.

BATTERY RECYCLING MARKET REGIONAL OUTLOOK

The market has been studied geographically across the main regions: North America, Europe, Asia Pacific, and the Rest of the World.

Asia Pacific

Asia Pacific Battery Recycling Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Increase in Adoption of Electric Vehicles & Consumer Electronics is Expected to Drive Market Growth

Asia Pacific is the dominating region, owing to the increase in the adoption of electric vehicles, which has led to a rise in the demand for lithium-ion batteries and the need for recycling. The Environmental Protection Agency (EPA) stated that electric car production in Asia Pacific countries, excluding China, reached about 1 million. Most of the region's electric car sales are attributed to Japan’s Toyota and Korea’s Hyundai. As the adoption of electric vehicles and consumer electronics increases, the demand for recycling will increase further.

China

Presence of Electric Car Manufacturing Hub Fostered Market Expansion in China

China is the leading electric car manufacturing hub, accounting for more than 70% of the global production in 2024, as stated by the IEA. The Chinese OEMs accounted for over 80% of domestic production, up from two-thirds in 2021. The strong demand for batteries in EVs and consumer electronics, and robust government regulations, have increased battery recycling demand. For instance, CATL is a global leader in EV battery production and plays a role in battery recycling. In addition, BYD is another major EV battery manufacturer in China that also engages in battery recycling, particularly through its network.

Europe

Rise in Sustainability Initiatives Drives Market Expansion

Europe is growing at a significant rate due to increased demand for resource recovery and environmental benefits in this region. The European Union (EU) has implemented several regulations to boost battery collection & recycling across several countries. As stated by the European Union, nearly half (46%) of portable batteries and accumulators sold in the EU were collected for recycling in 2022. Also in 2022, 244,000 tons of portable batteries were sold in the EU, and 111,000 tons of used portable batteries were collected for recycling. For instance, in Belgium, the collection rate of portable batteries and accumulators in 2022 was 59%.

North America

Rise in Lead Acid Battery Recycling Rates Drives Market Share

North America is a prominent region for battery recycling, as in this region, the lead-acid batteries are widely recycled, with a recycling rate accounting for 99%. According to the National Recycling Rate Study, these batteries are the most recycled consumer product in the U.S. According to the Battery Council International, North America has +206 GWh lead battery manufacturing capacity, +165 GWh in the U.S. In North America, there are 14+ recycling facilities, 10 in the U.S. According to Call2Recycle, Inc., the battery recycling program active in the U.S., in 2023, over 8 million pounds of batteries were collected for recycling in the U.S., including more than 5.4 million lbs of rechargeable batteries and over 2.6 million lbs of primary batteries.

Rest of the World

Transition toward Sustainable Energy Solutions to Boost Market Growth

The demand for renewable energy storage is increasing in the rest of the world, which has led to an increase in battery recycling demand. Brazil, Chile, Argentina, and Colombia are some of the key countries actively involved in driving the battery recycling demand. Also, the large amount of lithium reserves and concerns over water-intensive lithium mining in Latin America are driving market expansion in this region. The increase in e-waste generation and the need to reduce reliance on imported raw materials drive the market demand in the Middle East & Africa. The UAE is making significant strides toward creating a sustainable life cycle for electric vehicle batteries through two primary initiatives. The Beeah project, in collaboration with the Ministry of Energy and Infrastructure and the American University of Sharjah, aims to build the first recycling facility for used EV batteries.

The second initiative involves Witthal Gulf Industries, which, in partnership with Kezad Group, will set up a lithium battery recycling plant capable of handling 5,000 tons of battery waste per year. These initiatives to lower greenhouse gas emissions and prevent EV batteries from ending up in landfills align with the UAE’s goal of achieving Net Zero by 2050.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Investments and Business Expansion Present Significant Growth Opportunities for Market Players

The battery recycling market is undergoing significant advancements that present attractive investment opportunities for the market players, owing to growing demand for sustainable resource utilization and an increased number of electric vehicles. Major players, including Call2Recycle, Inc., Li-Cycle Corp, Contemporary Amperex Technology Co., Limited, Umicore, EnerSys, and others, compete through collaboration, business expansion, and investments. For instance, on June 13, 2025, Altilium, a U.K.-based clean technology group, planned to invest USD 34.69 million in an EV battery recycling facility. This recycling facility, the ACT 3 facility, will open in late 2026 and is located in Plymouth. ACT 3 is estimated to recover cobalt, nickel, and lithium from 24,000 electric vehicles (EVs) annually.

List of Key Battery Recycling Companies Profiled

- Call2Recycle, Inc. (U.S.)

- ACCUREC Recycling GmbH (Germany)

- Aqua Metals, Inc. (U.S.)

- American Battery Technology Company (U.S.)

- Li-Cycle Corp (Canada)

- Fortum (Finland)

- Ecobat (U.S.)

- Contemporary Amperex Technology Co., Limited (China)

- East Penn Manufacturing Co. (U.S.)

- EnerSys (U.S.)

- Exide Industries Ltd. (India)

- Gravita India Ltd. (India)

- Umicore (Belgium)

- Neometals Ltd. (Australia)

- Elemental Resources (U.S.)

KEY INDUSTRY DEVELOPMENTS

- May 2025- Mobec Innovation, a top provider of mobile electric vehicle charging and energy storage solutions in India, has launched a new national strategic partnership framework to speed up lithium battery recycling in crucial sectors. This initiative responds to the growing need for sustainable energy storage options in both the electric vehicle and solar sectors while contributing to India’s larger Net Zero objectives.

- March 2025- A premium German car manufacturer, Porsche, is repurposing high-voltage batteries to extract valuable materials after they have been utilized in vehicles. Porsche intends to evaluate a potential closed-loop system for raw materials and tackle the increasing significance of recycled battery materials. In the future, the car manufacturer aims to establish a recycling network for high-voltage batteries with external collaborators.

- January 2025- BMW Group announced a new collaboration with SK to recycle electric vehicle batteries throughout Europe, thus enhancing its closed-loop recycling initiative that started in China in 2022. The project aims to recover valuable materials such as cobalt, nickel, and lithium from used batteries for reintegration into new battery manufacturing.

- January 2025- JSW MG Motor India has joined forces with LICO Materials to create a new Battery Energy Storage System (BESS) that repurposes batteries from MG ZS electric vehicles. Announced on January 30, 2025, this initiative is the fourth under the Project Revive program and offers storage options ranging from 18kWh to 300kWh.

- November 2024- The U.S. Department of Energy (DOE) revealed a significant investment of USD 70.8 million to enhance the country's electric vehicle (EV) ecosystem. This financial support is intended to foster innovation in the recycling of EV batteries, strengthen manufacturing capabilities, and advance the U.S. toward its clean energy objectives.

Investment Analysis and Opportunities

Battery recycling presents a favorable investment opportunity due to the growing demand for electric vehicles and the rising volume of end-of-life batteries, particularly lithium-ion batteries. The market is anticipated to expand significantly, with recycling technologies offering cost savings and environmental benefits compared to virgin materials.

- In May 2024, Bosch Ventures, the corporate venture capital branch of the Bosch Group, announced two major investments in the battery recycling industry within a week, representing an important advancement toward sustainable technology growth. Bosch Ventures' investment in Li Industries was announced. Li Industries is poised to tackle significant challenges in the Li-ion battery's circular supply chain with innovative, scalable solutions. Also, German cylib raised a USD 62.87 million round less than 24 months after the start of operations.

- In May 2024, Mitsui & Co., Ltd. reached an agreement to establish a new joint venture focused on lithium-ion battery recycling in collaboration with VOLTA INC. ("VOLTA," headquartered in Fujinomiya City, Shizuoka Prefecture, Japan, led by President Kenta Imai) and Miracle Eternal PTE LTD.

REPORT COVERAGE

The global battery recycling market report provides a detailed market analysis. It focuses on key market aspects such as key players, various battery recycling methods, battery types, and their sources. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 13.95% from 2026 to 2034 |

|

Unit |

Value (USD Billion), Volume (Thousand Tons) |

|

Segmentation |

By Source

By Battery Type

By Recycling Method

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 28.62 billion in 2025.

The market is likely to grow at a CAGR of 13.95% over the forecast period (2026-2034).

By source, the manufacturing scrap segment led the market.

The market size stood at USD 18.48 billion in 2025.

Growing demand for critical battery materials and rising environmental concerns over battery disposal are driving market growth.

Some of the key players operating in the market are Call2Recycle, Inc., ACCUREC Recycling GmbH, Aqua Metals, Inc., American Battery Technology Company, and others.

The global market size is expected to reach USD 91.72 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us