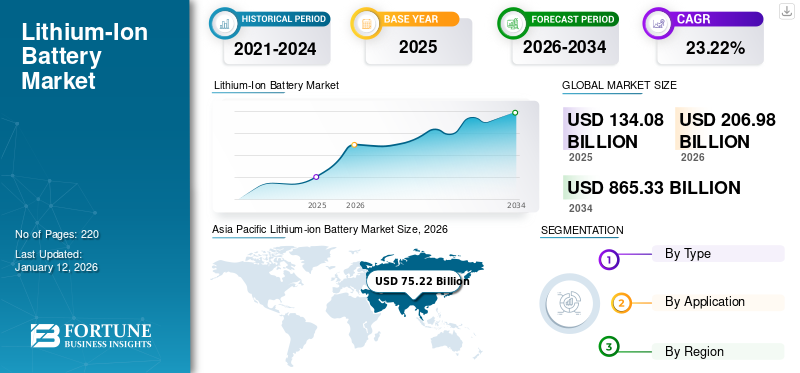

Lithium-Ion Battery Market Size, Share & Industry Analysis, By Type (Lithium Cobalt Oxide, Lithium Iron Phosphate, Lithium Nickel Cobalt Aluminum Oxide, Lithium Manganese Oxide, Lithium Nickel Manganese Cobalt, and Lithium Titanate Oxide), By Application (Consumer Electronics, Automotive, Energy Storage System, Industrial, and Others), and Regional Forecast, 2026-2034

Lithium-Ion Battery Market Size

The global Lithium-ion (Li-ion) battery market size was valued at USD 134.08 billion in 2025. The market is projected to grow from USD 206.98 billion in 2026 to USD 865.33 billion by 2034, exhibiting a CAGR of 22.85% during the forecast period. Asia Pacific dominated the lithium-ion battery market with a share of 56.10% in 2025.

Li-ion battery, or LIB, is a rechargeable battery used in laptops, cellphones, and hybrid & electric cars. Li-ion battery usage is growing across various applications owing to its lightweight and high energy density, which increases battery life and the ability to recharge.

The market is expected to grow significantly due to increasing demand for electric vehicles and global inclination towards adopting renewable energy in various industries.

BYD Company is one of the key players in the market. The company is mainly engaged in the design, production, and distribution of rechargeable batteries catering to automotive and consumer electronics industries.

MARKET DYNAMICS

MARKET DRIVERS

Increased Adoption of Batteries in Power Grid and Energy Storage Systems Plays a Key Role in Market

Implementing strict government regulation to regulate rising pollution levels enhances the industries that use these batteries. The power industry is working to produce and store renewable energy for the future. Low cost, discharge rate, and minimal installation space are key factors driving the adoption of Li-ion batteries in smart grid and energy storage systems. Since these batteries are more resistant to high temperatures, they are ideal for use in remote areas and thermal control applications. For instance, in June 2024, GS Yuasa Corporation received orders for lithium-ion battery storage systems with a capacity of 50 MWh from Tsunokobaru Power Storage Station from Chiyoda Corporation.

Declining Prices of Li-ion Batteries Have Catalyzed their Adoption in Various Sector

Traditionally, the major factor that hampered the adoption of these batteries from 1990 was their prices. Li-ion batteries contain many components, and the main element of any Lithium-ion battery (LIB) is its cell, which accounts for 50% of its cost. However, recent developments by lithium-ion battery manufacturing companies have helped decrease the prices of these batteries, which are also predicted to decline in the coming years. The declining prices of parts and the adoption of advanced technologies to increase battery capacity are key factors that led to the rise in the adoption of lithium-ion batteries.

MARKET RESTRAINTS

Growing Demand for Substitute Batteries is Hindering Market Growth

The increasing demand for other batteries, such as lead-acid batteries, sodium-nickel chloride, flow batteries, and lithium-air batteries, in consumer electronics, electric vehicles, and energy storage systems is projected to hinder the growth of these batteries. Moreover, continuous technological advancement in battery technology threatens the dominance of lithium-ion batteries in the market.

Sodium-ion batteries are emerging as the most promising alternative to lithium batteries. For instance, in November 2024, JAC launched an electric vehicle powered by sodium-ion batteries in China. Furthermore, in May 2024, the Guangxi branch of China Southern Power Grid announced the development of a sodium-ion battery energy storage station with a capacity of 100 MWh while generating 73 million kWh of clean energy per year. Such instances pose a major restraint to adopting lithium-ion batteries in the end-user industries.

MARKET OPPORTUNITIES

Increasing demand for Lithium-ion batteries in the Automotive industry Provides a Huge Opportunity for Market Growth

The rising popularity of electric vehicles powered by lithium-ion batteries is expected to pose lucrative growth opportunities for market players operating in the Lithium-ion battery market. According to the International Energy Association, approx. 14 million new electric cars were registered in 2023, which brought the total number to 40 million electric vehicles globally. Moreover, electric car sales increased by 3.5 million in 2023, a 35% year-on-year increase from 2022. This trend indicates the surging demand for electric vehicles, which is also expected to propel the growth of the lithium-ion battery market shortly.

MARKET CHALLENGES

Scarce Resource Availability is Expected to Create Challenges for the Market

Lithium-ion battery production heavily relies on limited resources such as cobalt, lithium, and nickel, which increases concern about availability and geopolitical risks. The factor mentioned earlier will create a major challenge for lithium-ion battery manufacturers to secure as demand for lithium-ion batteries increases, driven by the introduction new battery technologies in the consumer electronics and automotive industry.

Moreover, scaling up production to meet demand from end-use industries such as renewable energy storage, automotive, and others poses a major challenge for lithium-ion battery manufacturers while catering to market demand and dealing with scarce raw material availability.

LITHIUM-ION BATTERY MARKET TRENDS

Growing Sales of Electric Vehicles to Mitigate Environmental Impact is an Emerging Trend in the Market

Electric vehicles have reduced the impact of climate change compared to internal combustion engines. Government bodies across the globe are approaching greener and pollution-free mobility as a passenger and commercial electric vehicles are changing trends for future transportation, which will certainly boost lithium-ion battery market growth.

According to the International Energy Agency, new electric car registrations were 1.4 million in 2023, witnessing an increase of 40% compared to 2022. Electric vehicle companies, such as Tesla, have adopted these batteries in cars. Europe has strictly imposed emissions regulations & norms and implemented major public electric mobility transportation projects.

Rising Inclination towards Energy Projects to Drive Industry Growth

The growing interest in keeping the environment clean has encouraged the growth of renewable energy projects, such as solar power plants, nuclear power plants, and wind energy projects, contributing to the growing demand for lithium-ion batteries. These batteries are one of the favored options for renewable energy storage. They are widely seen as a main solution to recompense for the intermittency of wind and sun energy. Utilities worldwide have ramped up their storage capabilities using Li-ion supersized batteries, huge packs that can be stored anywhere between 100 to 800 megawatts (MW) of energy. In August 2023, California-based Moss Landing's energy storage facility is reportedly the world’s largest, with a total capacity of 750 MW/3000 MWh.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The COVID-19 pandemic affected the growth of this market during 2020. The outbreak of COVID-19 has restricted the supply of batteries. The key battery component is mainly available in Asia Pacific, but the pandemic has over-exposed the dependency on raw materials in the region. Lithium and cobalt serve as key functional elements in battery cathodes and electrolytes. China dominates the production of components and controls approximately 80% of the global supply chain of these materials. Many countries have imposed travel restrictions, which have impacted the flow of raw materials, and many power plants have been shut down worldwide, affecting the market.

Lithium-Ion Battery Market Segmentation Analysis

By Type Analysis

Lithium Iron Phosphate Batteries are Set to Lead Market

Based on type, the market is segmented into lithium cobalt oxide, lithium iron phosphate, lithium nickel cobalt aluminum oxide, lithium manganese oxide, lithium nickel manganese cobalt, and lithium titanate oxide.

Lithium cobalt oxide accounted for a major share in 2020 due to its wide adoption in mobile phones, laptops, cameras, and other modern electronic gadgets. Lithium iron phosphate batteries accounted for the fastest-growing segment due to their properties such as long life span, lightweight, and providing excellent safety for products. The segment is expected to hold 52.13% of the market share in 2026.

Lithium iron phosphate segment is projected to exhibit a CAGR of 16.70% during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Growing Demand for EV or HEVs to Lead Lithium-ion Battery Market

By application, the market is segmented into automotive, consumer electronics, energy storage systems, industrial, and others.

The automotive sector is expected to be the dominating application for Li-ion batteries. The segment held the dominant position in the market by contributing 42.52% of the revenue share in 2026. The rising awareness about the benefits of battery-operated vehicles and increasing prices of petrol and diesel, specifically in Asia Pacific, North America, and Europe, have attracted consumers to these electric or hybrid vehicles. The consumer electronics sector is considered to be the fastest-growing application for lithium-ion batteries. The continuous development in the consumer electronics sector has led to an increase in the adoption of lithium ion batteries in these applications. They offer multiple advantages such as high power capacity, reduced pollution, and increased safety.

LITHIUM-ION BATTERY MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific

Presence of a Large Automotive Sector in the Region to Drive Market Growth

Asia Pacific is expected to dominate the lithium-ion battery market share during the forecast period. The regional market value was held at USD 75.22 billion in 2025, and in 2024, the market size was USD 58.55 billion. China and Japan are considered the world's largest markets for electric vehicles. The automotive sector is widely adopting lithium-ion batteries. In addition, the growing demand for smartphones, laptops, and other electronic devices in various countries, such as China, India, Japan, and Singapore, is expected to expand the market in the region.

Asia Pacific Lithium-ion Battery Market Size, 2026 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

China

Favorable Regulatory Landscape Leads to Market Growth in the Country

China poses a lucrative market for lithium-ion battery manufacturers as the country has the world’s largest electric vehicle registration base. Moreover, China’s regulatory landscape also indicates promising growth opportunities for the lithium-ion battery market. In November 2024, the Chinese government passed its first energy law to achieve carbon neutrality by adopting renewable energy over traditional energy sources and storage systems. The aforementioned factors are expected to propel the demand for lithium-ion batteries in the country over the forecast period. The market in China is estimated to be USD 56.23 billion in 2026. Meanwhile, India is likely to hit USD 12.13 billion and Japan’s market is expected to reach USD 9.94 billion in 2025.

North America

Rising Prominence of Renewable Energy Adoption in the Region Contributes to Market Growth

North America is anticipated to account for the second-highest market size of USD 35.7 billion in 2026, exhibiting the second-fastest growing CAGR of 19.06% during the forecast period. The North American lithium-ion battery market is growing with technological advancements and new policies to adopt renewable energy. Lithium-ion batteries pose a high potential for energy storage in off-grid renewable energy. In November 2023, Our Next Energy (ONE) and GE Vernova announced a collaboration to advance battery energy storage solutions in the U.S. Moreover, the partnership will focus on integrating ONE’s lithium iron phosphate (LFP) cells in GE Vernova's Solar & Storage Solutions business projects nationwide. The growing focus of North American energy storage market players towards integrating lithium-ion batteries in their energy storage systems is expected to foster the demand for lithium-ion batteries over the forecast period in the region.

U.S.

Rising Adoption of Electric Vehicles Drives the Demand for Lithium-Ion Batteries in the U.S.

The U.S. has been experiencing a significant surge in electric vehicle registrations. According to the International Energy Agency, the U.S. witnessed a 20% increase in electric car registrations in 2023 from 2022, with total electric car registration of 1.4 million, which signifies the rapid growth in demand for lithium-ion batteries. Moreover, government initiatives such as clean vehicle tax credits also contribute to the growing demand for electric vehicles, which is expected to drive the demand for lithium-ion batteries in the country in the coming years. The U.S. market size is estimated to be USD 34.23 billion in 2026.

Europe

Increasing Focus of Government Bodies on Greenhouse Gas Emissions in Europe has Supported The Market Growth

Europe is expected to be the third-largest region with a size of USD 29.37 billion in 2026. Several countries in the region, such as Germany, Argentina, France, and others, have set their target of having zero emissions of CO2 by 2050. This has boosted the usage of Li-ion batteries in the region. In June 2021, the European Commission and the Batteries European Partnership Association have launched a public-private partnership to encourage research into smart battery technology in Europe, which is expected to impact the lithium-ion battery market in the upcoming years positively. The market value in U.K. is expected to be USD 4.99 billion in 2026.

On the other hand, Germany is projecting to hit USD 7.14 billion and France is likely to hold USD 2.75 billion in 2026.

Latin America

Growing Focus of Key Market Players on Innovations in the Battery System in the Region Leads to Market Growth

The battery system market players in Latin America are mainly focused on integrating lithium-ion batteries to support the adoption of renewable energy. In July 2023, AES Andes announced the development of the largest battery storage project in Antofagasta, Chile. The project is equipped with five-hour duration lithium batteries with a capacity of 560 MWh, which is co-located with 180MW of Solar PV Capacity. More such projects will increase the demand for lithium-ion batteries over the forecast period.

Middle East & Africa

Countries' Increasing Interest in Renewable Energy is Expected to Offer Considerable Opportunities for Market Growth

The Middle East & Africa is expected to be the fourth-largest market with a size of USD 3.14 billion in 2026 and to grow substantially as many countries are going through massive construction activities and cities are developing at a larger scale. This, in turn, leads to the growing need for industrial and construction power tools that use Li-ion batteries. Key nations actively operating in the region are South Africa and Gulf Cooperation Council (GCC) countries. The GCC market size is estimated to be USD 1.30 billion in 2026.

List of Key Companies in Lithium-Ion Battery Market

Market Players are Mainly Focused on Increasing Production Capacity to Sustain the Competition

This market is highly competitive, with many players operating in multiple regions. Moreover, market players are expanding activities through production innovation and enhancement of production capacity. For instance, in January 2025, Neuron Energy launched a lithium-ion battery manufacturing facility covering an area of 5 acres located in Pune, India. Furthermore, prominent manufacturers such as Saft Group S.A., BYD Company, LG Chem, and A123 Systems have well-established supply chains and distribution networks that help these major players hold a noticeable position in the market.

List of Key Company Profiled:

- BYD Company (China)

- LG Chem (South Korea)

- Contemporary Amperex Technology Co. Ltd (CATL) (China)

- Samsung SDI (South Korea)

- Panasonic Corporation (Japan)

- BAK Power (China)

- Clarios (Germany)

- Toshiba Corporation (Japan)

- Hitachi (Japan)

- Automotive Energy Supply Corporation (Japan)

- A123 System (U.S.)

- Saft Group S.A. (France)

KEY INDUSTRY DEVELOPMENTS:

- In January 2025, International Battery Company (IBC) announced plans to commence lithium-ion battery production in Bengaluru, India, by the end of 2025. The company aims to export 20% of its production.

- In January 2025, Urja Mobility and Eastman announced a strategic partnership to develop and deploy lithium battery technologies in India's electric vehicle industry.

- February 2024 – Panasonic Energy Co., Ltd., a Panasonic Group Company, announced an agreement with H&T Recharge for the supply of lithium-ion battery cans in North America to increase its production of safe EV batteries.

- November 2023 – Toshiba Corporation announced the development of a new lithium-ion battery using a cobalt-free 5V-class high-potential cathode material. This battery can operate in various applications, from power tools to electric vehicles.

- June 2023 – Samsung SDI announced that the company has become the first lithium battery maker to accept carbon footprint labels from Carbon Trust. Carbon footprint measures greenhouse gas GHG emissions throughout a product's life cycle from production, raw materials, and distribution to disposal.

Investment Analysis and Opportunities

Investment in this market acts as an opportunity for the lithium-ion battery sector by fueling research & development for better battery technology and expanding production capacity to meet growing demand from EVs, energy storage, and other applications. This is expected to eventually leads to lower costs and increased accessibility, further accelerating market growth.

- In May 2024, Maxvolt secured an investment of USD 1.5 million to expand its lithium-ion battery production and research & development. Moreover, the company also announced that this investment will foster its sustainable energy solutions and strengthen its market reach by introducing lithium-ion batteries in the near future.

- In May 2024, Exide Industries announced an investment of USD 116.63 million in lithium-ion cell manufacturing projects in India. The project's first phase, with a capacity of 6GWh, is expected to be completed by 2025.

REPORT COVERAGE

The global lithium-ion battery market report delivers a detailed insight into the market and focuses on key aspects such as leading companies in Lithium-ion. Besides, the report offers insights into the market trends & technology and highlights key industry developments. In addition to the factors above, the report encompasses several factors and challenges that contributed to the growth and downfall of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

| ATTRIBUTE | DETAILS |

| Study Period | 2021-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Period | 2021-2024 |

| Growth Rate | CAGR of 22.85% from 2026 to 2034 |

| Unit | Value (USD Billion) and Volume (KWh) |

| Segmentation |

By Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 134.08 billion in 2025.

The market will likely grow at a CAGR of 22.85% over the forecast period.

The market size of Asia Pacific stood at USD 26.69 billion in 2025.

Rising efforts to reduce the effects of high carbon emissions are the key factors driving market growth.

Some of the top players in the market are LG Chem, BYD Company, Samsung SDI, and others.

The global market size is expected to reach USD 865.33 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us