Electric Vehicle Battery Market Size, Share & Industry Analysis, By Battery Type (Lithium-ion, Lead Acid, Nickel Metal Hydride, and Others), By Vehicle Type (Battery Electric Vehicles (BEVs), Plug-In Hybrid Electric Vehicles (PHEVs), and Hybrid Electric Vehicles (HEVs)), and Regional Forecast, 2026-2034

EV BATTERY MARKET CURRENT & FORECAST MARKET ANALYSIS

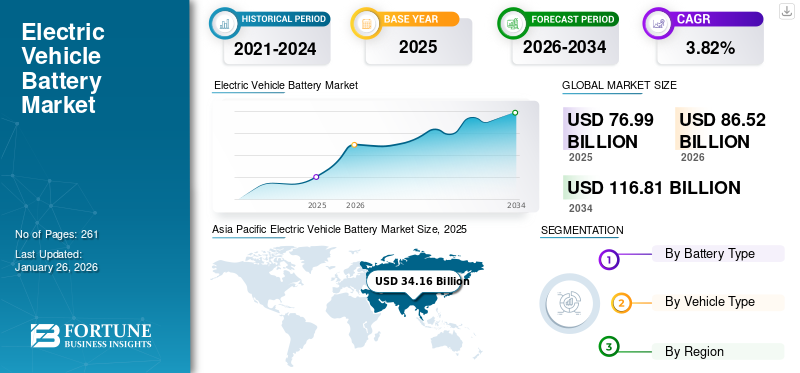

The global electric vehicle battery market size was valued at USD 76.99 billion in 2025. The market is projected to grow from USD 86.52 billion in 2026 to USD 116.81 billion by 2034, exhibiting a CAGR of 3.82% during the forecast period. Asia Pacific dominated the global market with a share of 44.37% in 2025.

Increased demand for Electric Vehicles (EVs) across the globe is boosting electric vehicle battery sales. Government focus on rapid electrification to reduce the dependence on imports of fossil fuels and to fight climate change are some of the major factors influencing the adoption of electric vehicles globally. Additionally, environmental concerns among the populace globally are influencing the adoption of green mobility, further driving the adoption of e-vehicles, which is anticipated to accelerate global market growth during the forecast period.

Download Free sample to learn more about this report.

Global Electric Vehicle (EV) Battery Market Overview

Market Size:

- 2025 Value: USD 76.99 billion

- 2026 Value: USD 86.52 billion

- 2034 Forecast Value: USD 116.81 billion, with a CAGR of 3.82% from 2026–2034

Market Share:

- Asia Pacific dominated the market in 2024, owing to the presence of leading EV battery manufacturers and high EV production in countries like China and Japan.

- Lithium-ion battery segment held the dominant share by battery type in 2024, attributed to their high energy density and long cycle life.

Industry Trends:

- Declining battery costs are enhancing EV affordability, thereby expanding the market base globally.

- Increasing focus on battery recycling and second-life usage to improve sustainability in the battery supply chain.

- Investments in solid-state battery technology as a next-gen alternative to lithium-ion, promising higher energy density and safety.

Driving Factors:

- Surge in EV adoption due to environmental concerns and government incentives is driving battery demand.

- Advancements in battery technology improving range, charging time, and lifespan.

- Expansion of EV manufacturing infrastructure across Asia Pacific and Europe.

- Supportive regulatory environment, including emission reduction targets and electrification mandates by governments.

A wide range of batteries are used in electric vehicles, depending on their function and type. Batteries used in electric vehicles include lithium-ion, lead acid, nickel-metal hydride, and other batteries. The emphasis of the leading automakers on rolling out new vehicles with long-range and high battery capacities for the early development and adoption of their EVs is anticipated to surge the electric vehicle battery demand worldwide.

Despite the downfall of the automotive industry during the COVID-19 pandemic, the demand for e-vehicles continued to increase due to supportive regulatory frameworks provided by governments globally. Even before the pandemic, many countries were strengthening key policies such as CO2 emission standards and zero-emission vehicle (ZEV) mandates. Till 2021, over 20 countries announced bans on the sales of conventional cars or mandated all new sales to BEVs. Therefore, increasing e-vehicle sales during the COVID-19 pandemic fueled the global market growth.

Electric Vehicle Battery Market Trends

Rising Mega-Trend for Electrification to Drive Market Growth

Rapid electrification is one of the ongoing trends in the market. Governments’ focus on establishing a strong network of EV charging stations and the EV ecosystem to drive the adoption of emission-free mobility is anticipated to influence the global electric vehicle battery market growth. In addition, OEMs' emphasis on embracing electrification more widely is also influencing the global market.

For instance, 18 of the 20 largest automakers (in terms of vehicles sold in 2023), which together will account for around 90% of the new car sales worldwide in 2023, have concrete plans to boost production of the current electric line-up and increase the number of available models. The exponential increase in Battery Electric Vehicles (BEVs), which are equipped with large lithium-ion batteries, and Plug-In Hybrid Electric Vehicles (PHEVs) operating on the road will necessitate the implementation of high-power charging infrastructure in the next decade. These factors will influence the adoption of EVs and, in turn, the demand for EV batteries in the major markets.

Market Dynamics

Market Drivers

Declining Electric Vehicle Battery Cost to Augment Market Growth

The cost of electric vehicle batteries has been declining over the past decade. For instance, as per the Global Change Data Lab, the cost of lithium-ion batteries has dropped by nearly 97% in the past 30 years. Lithium-ion batteries are one of the most highly utilized batteries in electric vehicles; therefore, the declining cost of these batteries is anticipated to influence the adoption of EVs, creating lucrative revenue growth opportunities for market growth in the coming years. The declining cost of lithium-ion batteries, which are a predominant technology in EVs, is a significant driver for market growth. Economies of scale, improvements in manufacturing processes, and increased competition among battery manufacturers contribute to the downward trend in battery prices. Lower battery costs make electric vehicles more affordable for consumers, thereby expanding the market for EVs and driving the demand for batteries.

MARKET RESTRAINTS

Potential Raw Material Shortages May Hamper Market Growth

China delivers three-quarters of all lithium-ion batteries, 70% of production capacity for cathodes, and 85% for anodes. In addition, Europe is responsible for over one-quarter of global assembly, but it has a tiny supply chain apart from cobalt processing at 20%. Moreover, the South Korean and Japanese economies have considerable shares of the supply chain downstream of raw material processing, particularly in the highly technical production of cathode and anode materials.

The rapid increase in EV sales during the pandemic tested the resilience of battery supply chains. Closed battery manufacturing facilities during COVID-19 and political disputes between economies that are part of the battery supply chain. They are anticipated to create a shortage of raw materials, further restraining market growth.

Market Opportunities

Rise in Electric Vehicle Sales Drives Market Growth

Electric vehicle sales growth is the primary driver of the EV battery market. The demand for lithium-ion batteries and other types of batteries is set to increase supported by a surging demand for EVs. Each electric vehicle requires a battery pack, which makes up 30-40 % of the vehicle cost. Thus, the manufacturers focus on scaling battery production and investing in gig factories. Higher sales also encourage R&D in solid-state and fast-charging battery technologies. This devolvement drives the market growth during the forecast period.

Segmentation Analysis

By Battery Type

Lithium-ion Batteries Led the Market Due to Their Lightweight Nature

Based on battery type, the market is segmented into lithium-ion, lead acid, nickel-metal hydride, and others.

The lithium-ion segment held the largest electric vehicle battery market share 97.38% in 2026 and is expected to continue its dominance in the near future. Increasing demand for electric vehicle batteries with lightweight and high energy density for efficient operations is likely to drive the lithium-ion segment growth during the forecast period. Moreover, currently, all pure electric vehicles and the majority of hybrid electric vehicles utilize lithium-ion batteries as the main power unit. Furthermore, manufacturers' focus on conducting research and using various chemistries of lithium-ion to improve the energy density of the electric vehicle battery is likely to generate lucrative revenue growth opportunities in the coming years.

The lead-acid segment held the second-largest market share in 2024. All electric vehicles utilize lead-acid batteries as auxiliary power units to power secondary functions such as headlights, steering wheels, and others. Therefore, increasing EV sales are also driving the adoption of auxiliary power units, further influencing segment growth. However, energy solutions providers such as Tesla are developing lightweight lithium-ion batteries to use as auxiliary power units. This may hamper the segment's growth in the coming years.

The nickel metal hydride segment held a considerable market share in 2024. Various hybrid vehicle manufacturers, such as Toyota, Honda, and others, prefer nickel metal hydride batteries. Therefore, increasing demand for hybrid vehicles among the populace in emerging economies is likely to drive the segment growth during the forecast period.

The other segment includes sodium-ion batteries that are currently under development and are expected to enter mass production post-2025. Sodium-ion batteries are a low-cost alternative to lithium-ion batteries. Therefore, the expected surge in demand for batteries made from sodium-ion chemistry is anticipated to influence segment growth in the coming years.

To know how our report can help streamline your business, Speak to Analyst

By Vehicle Type

Battery Electric Vehicles (BEVs) Dominated the Market Owing to Their Low Operating Costs

Based on vehicle type, the market is segmented into Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), and Hybrid Electric Vehicles (HEVs).

The BEVs segment held the largest market share 88.75% in 2026 and is anticipated to continue its dominance with the highest CAGR during the forecast period. Increasing demand for zero-emission vehicles across Europe and other emerging economies to fight climate change and reduce fossil fuel dependency is anticipated to drive segment growth over the forecast period. In addition, the growing popularity of BEVs among developing economies for their low operating costs is also expected to influence segment growth in the near future.

The PHEV segment held the second-largest market share in 2024. PHEVs can be charged from an external power source. Additionally, they also consist of an IC engine to power the vehicle. Therefore, PHEVs fill the gap between HEV and BEV, further providing a significant travel range and battery capacity along with fossil fuel-powered IC engines as an additional power source to drive the vehicle during low charging conditions. Therefore, the increasing popularity of PHEVs among the populace is driving segment growth.

The HEVs segment held a considerable market share in 2024. Increasing demand for hybrid vehicles in economies with a lack of charging infrastructure is anticipated to propel the segment’s growth. Moreover, automakers such as Toyota, Honda, and others that are focused on developing new-generation hybrid vehicles are likely to create lucrative revenue growth opportunities in the coming years.

ELECTRIC VEHICLE BATTERY MARKET REGIONAL OUTLOOK

Geographically, the global tallow balm market analysis covers North America, Europe, Asia Pacific, and Rest of the World.

Asia Pacific

Asia Pacific Electric Vehicle Battery Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 34.16 billion in 2025 and USD 39.59 billion in 2026. Asia Pacific dominated the global electric vehicle battery market share in 2024 and is expected to retain its position throughout the forecast period. Surging EV sales in China is one of the major drivers of market growth in the region. Therefore, increasing demand for electric vehicle batteries in China to cater to the surging sales is likely to drive market growth in the region. Moreover, China is one of the major parts of the global electric vehicle battery supply chain; therefore, increasing localized manufacturing of battery raw materials, parts, and components in China and other economies across Asia Pacific, such as India, Japan, and South Korea, is likely to accelerate the market growth.

Europe

Europe held the second-largest market share in 2024. An increasing number of emission control norms and stringent regulations to fight climate change is expected to boost the adoption of electric vehicles in the region, further driving the demand for batteries. Moreover, a favorable regulatory scenario coupled with the subsidies, incentives, and tax benefits offered for the adoption of EVs across European economies is likely to accelerate market growth in the region.

North America

North America held a considerable market share in 2024. Increasing demand for BEVs in the U.S. is driving market growth. The U.S. government is highly focused on reducing its dependency on China for the supply chain. Therefore, rising government investment to accelerate localized component manufacturing and strengthen the EV supply chain is likely to propel market growth in the region.

COMPETITIVE LANDSCAPE

Key Industry Players

CATL’s Focus on Strategic Partnerships with EV Battery Makers for Technological Advancements to Drive the Competition

The first leading major market player in the EV battery market is Contemporary Amperex Technology Co. Limited (CATL). CATL dominates the market due to its extensive production capacity, technological advancements, and strategic partnerships with major automakers. In 2024, CATL installed 339.3 GWh of EV batteries, marking a significant increase from the previous year. Its batteries are used by prominent OEMs such as Tesla, BMW, Mercedes-Benz, and Volkswagen, showcasing its global reach and reliability. CATL's product portfolio includes a range of lithium-ion battery solutions tailored for electric vehicles, offering high energy density and safety features. Its innovative battery technologies, such as the sodium-ion battery, further enhance its competitive edge in the market. CATL's dominance is also attributed to its diversified production bases across China, Germany, and Hungary, allowing it to supply batteries to both domestic and international markets efficiently. The company's commitment to R&D and its ability to adapt to evolving market demands has solidified its position as a leader in the EV battery sector.

BYD is notable for its integrated business model, where it not only manufactures batteries but also produces electric vehicles. In 2024, BYD installed 153.7 GWh of power batteries, reflecting a substantial year-over-year growth. BYD's success is driven by its competitive pricing and diverse vehicle portfolio, which appeals to both domestic and international markets. The company is rapidly expanding its market presence beyond China into Asia and Europe, further securing its position as a key player in the EV battery market. BYD's electric vehicle sales reached approximately 4.14 million units in 2024, with plans to increase this number to 6 million in 2025. This growth trajectory underscores BYD's significant influence in the EV sector.

List of Key Electric Vehicle Battery Companies Profiled

- CATL (China)

- LG Energy Solutions (South Korea)

- Panasonic Corporation Pvt. Ltd. (Japan)

- BYD Motors Inc. (China)

- Samsung SDI Private Limited (South Korea)

- Amara Raja Batteries Limited (India)

- Exicom Tele-Systems Limited (India)

- EXIDE INDUSTRIES Ltd. (India)

- Okaya Power Pvt. Ltd. (India)

- Tata AutoComp GY Batteries Pvt. Ltd. (India)

- Toshiba Pvt. Ltd. (Japan)

KEY INDUSTRY DEVELOPMENTS

- In March 2025, Belcor, a European company, developed nonwoven-based thermal and fire protection solutions. Belcor has filed a patent application for a new technology that integrates its Belcotex fibers with Svenska Aerogel’s Quartzene material. Its latest innovation aims to improve safety and thermal management in electric vehicle (EV) batteries.

- In March 2025, Japanese automaker Toyota teamed up with the oil giant Idemitsu Kosan to construct a large-scale lithium sulfide plant to supply raw materials for Toyota’s all-solid-state EV battery production line. This will provide a reliable supply of the material to create the EVs of the future.

- In March 2025, CATL and the German automaker the Volkswagen Group’s China business unit, agreed to strengthen their collaboration in the areas of battery research and development, new materials applications, and component development.

- In February 2024, Panasonic Energy signed a seven-year offtake agreement with Nouveau Monde Graphite Inc. (NMG) for the supply of natural graphite. The battery company has also expressed its intent to invest in NMG, starting with an initial investment of USD 25 million. The partnership is seen as a key development in Panasonic Energy's expansion of its EV battery production in North America.

- In January 2024, Panasonic Holdings Corp. announced that it plans to roll out the newest iteration of its electric vehicle battery cells with improved capacity as early as this calendar year. A revamped version of its 2170 cells will begin production at its manufacturing plant in Nevada sometime during 2024 or 2025.

REPORT COVERAGE

The electric vehicle battery market analysis report focuses on key aspects such as leading companies, products, and leading applications of the products. Besides this, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 3.82% from 2026 to 2034 |

|

Unit |

Value (USD Billion) & Volume (Thousands of Units) |

|

Segmentation |

By Battery Type

By Vehicle Type

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market was valued at USD 76.99 billion in 2025 and is projected to reach USD 116.81 billion by 2034.

The market is expected to register a CAGR of 3.82% during the forecast period (2026-2034).

Declining electric vehicle battery cost to augment market growth.

Asia Pacific led the global market in 2025.

By battery type, the lithium-ion segment led the market in 2026.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us