Automotive Aftermarket Industry Size, Share & Industry Analysis, By Replacement Part Type (Battery, Brake Pads, Filters, Gasket & Seals, Lighting Component, Body Part (Interior and Exterior), Wheels & Tires, and Others), By Vehicle Type (Passenger Cars and Commercial Vehicles), and Regional Forecast, 2026 – 2034

Automotive Aftermarket Industry Size and Future Outlook

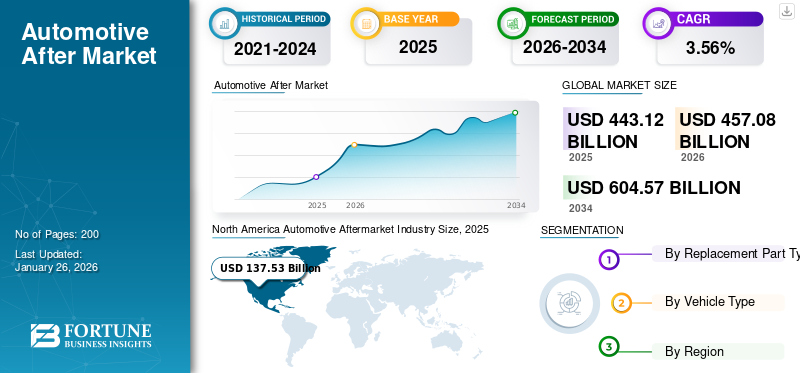

The global automotive aftermarket market size was valued at USD 443.12 billion in 2025. The market is projected to grow from USD 457.08 billion in 2026 to USD 604.57 billion by 2034, exhibiting a CAGR of 3.56% during the forecast period. North America dominated the automotive afternarket with a market share of 31.04% in 2025.

The automotive aftermarket industry pertains to the secondary market that caters to the needs and preferences of vehicle owners, offering a variety of choices beyond those available through the original equipment manufacturers. The aftermarket industry includes a wide range of products and services, such as replacement parts (tires, batteries, brakes, and filters), performance-enhancing components, accessories (car audio systems, navigation systems, and cosmetic upgrades), and vehicle repair and maintenance services.

The aging of vehicles plays a significant role in generating demand for aftermarket parts and services. The anticipated surge in the acceptance of electric and hybrid vehicles, leading to a demand for automotive aftermarket parts compatible with EVs, is poised to propel market expansion during the projected period.

The automotive aftermarket is a large and growing global industry. Prominent companies dominating the automotive aftermarket globally include Robert Bosch GmbH, Continental AG, and ZF Friedrichshafen AG. Leading companies focus on innovation, expanding product portfolios, mergers and acquisitions, and enhancing digital sales platforms to capture market share.

The automotive aftermarket industry is a dynamic sector that involves the manufacturing and distribution of automotive parts, accessories, and services. It is highly competitive, with numerous players operating globally. Market leaders are concentrating on the development and production of aftermarket parts designed to be compatible with the latest vehicle models while simultaneously catering to the needs of the older vehicle market. Prominent entities in the market are dedicated to the development of environmentally friendly products, thereby contributing to global sustainability objectives.

Automotive Aftermarket Industry Trends

Surging E-Commerce Drives Expansion in Industry

The automotive aftermarket market trend of e-commerce dominance refers to the increasing prevalence of online sales and the growing influence of digital platforms in the purchase of replacement parts, accessories, and automotive services.

Consumers are increasingly preferring to conduct their purchases via online platforms over conventional brick-and-mortar stores. This shift is driven by the convenience of online shopping, allowing customers to browse a wide range of products, compare prices, and make purchases from the comfort of their homes.

For instance, in December 2023, Epicor introduced an Automotive B2B ecommerce platform for automotive replacement parts distributors and their customers. Epicor Commerce for Automotive (ECA) is a cloud-based platform designed to provide automotive parts distributors and other users with up-to-date, customer-specific part pricing and availability. This development is contributing to the automotive aftermarket market growth.

Download Free sample to learn more about this report.

MARKET DYNAMICS

Market Drivers

Aging of Vehicles to Fuel Aftermarket Industry Growth

The automotive aftermarket market experiences growth propelled by vehicle aging. As vehicles mature, they necessitate more frequent maintenance and repairs due to component deterioration. This steady demand for replacement parts and services fuels the aftermarket sector. Over time and with usage, components, such as brakes, tires, and exhaust systems, wear out, driving the need for replacements in older vehicles and stimulating market expansion.

According to the latest data from IHS Markit, the average age of Vehicles in Operation (VIO) has steadily increased over the past decade. As of 2021, the average age of light vehicles in operation in the U.S. reached a record high of 12.1 years, up from 11.9 years in 2020. For instance, in 2023, according to ACEA (European Automobile Manufacturers' Association), the average age of cars in the European Union (EU) stands at 12 years. Greece and Estonia having the oldest car fleets, with the average being nearly 17 years. Luxembourg leads with the newest passenger cars at an average age of 7.6 years. Among the major EU markets, Italy claims the oldest van fleet at 14 years, followed by Spain at 13.6 years.

This trend toward older vehicles have significant implications for the automotive aftermarket industry. As vehicles age, they need more frequent maintenance, repairs, and replacement parts to keep them running smoothly and safely. Older vehicles are more likely to require wear and tear on components such as brakes, tires, batteries, and suspension systems, creating opportunities for automotive aftermarket market suppliers and service providers. Furthermore, advances in vehicle technology have contributed to the increased longevity of vehicles. Modern vehicles are built with more durable materials, improved engine technology, and sophisticated onboard diagnostics systems that allow for better monitoring and maintenance. As a result, vehicles can now withstand higher mileage and longer periods of use before requiring major repairs or replacement.

The growing popularity of vehicle ownership and the trend toward keeping vehicles for longer periods also contribute to the demand for aftermarket products and services. With more consumers opting to hold onto their vehicles rather than purchase new ones, the aftermarket sector is poised for continued growth. Overall, the increasing average age of vehicles on the road is a significant driving factor for the global automotive aftermarket industry, creating opportunities for aftermarket suppliers, retailers, and service providers to meet the evolving needs of vehicle owners globally.

Market Restraints

Advancements in Vehicle Technology and Complexity to Impede Market Growth

While the global industry has experienced significant growth, it also faces certain challenges and restraints. One key restraint to the industry's growth is the advancements in vehicle technology and complexity.

Modern vehicles are equipped with increasingly sophisticated technologies and complex systems. While these advancements are beneficial for vehicle performance and efficiency, they pose challenges for the aftermarket industry. Advanced technologies often require specialized knowledge and tools for diagnostics, repairs, and replacements. As a result, independent repair shops, automotive aftermarket distributors, and DIY enthusiasts may find it difficult to keep pace with evolving technologies, leading to greater reliance on Original Equipment Manufacturer (OEM) services or authorized dealerships.

Advanced vehicle systems may require specialized diagnostic equipment and software, limiting the ability of independent repair shops to effectively identify and address issues. Additionally, some manufacturers restrict access to crucial repair and diagnostic information, making it challenging for independent repair facilities to carry out certain repairs and maintenance tasks.

Market Opportunities

Rising Emphasis on Electric Vehicles Creates Opportunity for Automotive Aftermarket Industry to Tap into EV Market

One key growth opportunity for the global automotive aftermarket industry lies in the increasing demand for parts, services, and technologies related to Electric Vehicles (EVs). As the automotive industry undergoes a significant revolution toward electrification, the aftermarket sector can capitalize on several opportunities arising from this shift.

With the rise of electric vehicles, there is a mounting demand for aftermarket components specific to EVs. This includes replacement batteries, electric motors, inverters, and other electric drivetrain components. The aftermarket industry can play a vital role by developing and providing solutions that support the maintenance and repair of EVs.

Furthermore, as the adoption of electric vehicles expands, there is an increasing need for aftermarket services related to charging infrastructure. This includes installation, repair services, and maintenance for charging stations, providing a new avenue for aftermarket businesses to thrive. Overall, the rising adoption of electric vehicles and the resulting demand for aftermarket products and services tailored to the EV industry are expected to significantly boost market growth over the forecast period.

Segmentation Analysis

By Replacement Part Type

Rising Trend of Electric Vehicles Fueled Wheels & Tires Segment Expansion

Based on replacement part type, the market is segmented into battery, brake pads, filters, gasket & seals, lighting component, body part, wheels & tires, and others.

The wheels & tires segment held the largest automotive aftermarket industry share of 39.94% in 2026. The rising trend of electric vehicles has forced manufacturers to develop tires specifically designed for EVs, thereby fueling the segment’s growth. The segment is anticipated to capture 39.8% of the market share in 2025.

- For instance, in February 2025, Yokohama Rubber Co., Ltd. announced that it has been supplying its ADVAN Sport EV tires as original equipment for the new Lynk & Co Z10 sedan launched by Lynk & Co. The ADVAN Sport EV is an ultra-high-performance summer tire developed for premium EVs.

The body part segment held the second-largest share of the market in 2024. The most significant driver for this segment is the consistent need for repairs following accidents or collisions. Cracked bumpers, dented doors, and other body damage often require replacement parts, creating a continuous demand for body components. The segment is likely to hold a CAGR of 3.70% during the forecast period. In July 2023, auto-body and glass repair shops in McLennan County experienced a surge in demand for vehicle repairs due to hail damage from storms that occurred between April and June 2023.

To know how our report can help streamline your business, Speak to Analyst

By Vehicle Type

Higher Wear & Tear of Components Favored Passenger Cars Segment Growth

Based on vehicle type, the market is divided into passenger cars and commercial vehicles.

The passenger cars segment held the largest automotive aftermarket market share of 63.76% in 2026. As urbanization increases, the reliance on passenger cars for daily commuting continues to rise. This leads to higher wear and tear of various components, necessitating more frequent replacements and repairs. An increase in vehicle ownership is one of the driving factors for the market. As economies develop and consumer purchasing power rises, more people are buying cars. For instance, China and India have experienced a surge in passenger vehicle sales over the past decade. This burgeoning fleet of cars directly translates into a higher demand for aftermarket products and services.

The commercial vehicles segment held a considerable automotive aftermarket market share in 2024. Economic growth in industries such as logistics, transportation, and construction continues to drive the demand for medium and heavy-duty commercial vehicles, consequently, aftermarket parts. According to IBEF (India Brand Equity Foundation), road transportation accounted for 66% of freight movement in India in 2024. In June 2024, originating freight loading reached 135.46 MT, compared to 123.06 MT in June 2023. This increase in freight activity has led to higher utilization of commercial vehicles, consequently propelling market demand.

AUTOMOTIVE AFTERMARKET INDUSTRY REGIONAL OUTLOOK

By region, the market is analyzed across North America, Europe, Asia Pacific, and the rest of the world.

North America Automotive Aftermarket Industry Size, 2025 (USD Billion) To get more information on the regional analysis of this market, Download Free sample

North America held the largest automotive aftermarket market share in 2025. North America dominated the global market in 2025, with a market size of USD 137.53 billion. Consumers in the region have a strong preference for customizing and personalizing their vehicles, which drives demand for aftermarket accessories and performance-enhancing products. In October 2023, Gas Monkey Garage, known for its automotive excellence, debuted at SEMA 2023 in Las Vegas. The garage, renowned for the Fast N' Loud TV show, revealed four exceptional customized cars, ranging from classics to innovative Electric Vehicles (EVs). The regional market value in 2024 reached USD 134.91 billion, up from USD 132.54 billion in 2023. The U.S. market is projected to reach USD 96.92 billion by 2026.

The U.S. automotive aftermarket industry holds a significant market share that involves the manufacturing, distributing, and installing automotive parts and accessories after the sale of the vehicle by the Original Equipment Manufacturer (OEM). The industry is witnessing significant growth in e-commerce, with consumers increasingly purchasing parts online for convenience and cost-effectiveness. The U.S. market size is expected to hit USD 94.53 billion in 2025.

Europe held a significant automotive aftermarket market share of the global market in 2024 and has a significant number of vehicles on the road, where the average age of vehicles is relatively high. The Europe region is anticipated to be the third-largest market with USD 119.62 billion in 2025. As vehicles age, the demand for aftermarket products and services, including replacement parts and repairs, increases. The market value in the UK is expected to be USD 15.56 billion in 2025. On the other hand, Germany is projected to hit USD 23.29 billion and France is likely to hold USD 14.98 billion in 2025. The UK market is projected to reach USD 15.87 billion by 2026, while the Germany market is projected to reach USD 23.61 billion by 2026.

For instance, in 2023, according to ACEA (The European Automobile Manufacturers' Association), Trucks in the European Union have an average age of 14.2 years. Greece holds the record for the oldest truck fleet, with an average age of around 22.7 years.

Asia Pacific held a decent market share in 2024. The region is anticipated to account for the second-highest market size of USD 130.28 billion in 2025, exhibiting the second-fastest growing CAGR of 5.80% during the forecast period. The region has witnessed a significant increase in the number of vehicles on the road, driven by economic growth, rising incomes, and urbanization. As the vehicle fleet expands, the demand for aftermarket parts for maintenance and repairs rises. The market value in China is expected to be USD 83.61 billion in 2025. On the other hand, India is projected to hit USD 13.21 billion and Japan is likely to hold USD 11.39 billion in 2025. For instance, according to SIAM (Society of Indian Automobile Manufacturers, India witnessed a rise in total passenger vehicle sales, growing from USD 0.04 million in FY 2022-23 to 0.05 million in FY 2023-24. The Japan market is projected to reach USD 11.82 billion by 2026, the China market is projected to reach USD 88.92 billion by 2026, and the India market is projected to reach USD 13.97 billion by 2026.

The rest of the world held a considerable market share in 2024 and is expected to be the fourth-largest market, with a projected value of USD 55.69 billion in 2025. The level of vehicle ownership and the size of the vehicle fleet in each country play a significant role in shaping aftermarket demand. As the number of vehicles on the road continues to rise, the need for aftermarket products increases, driving market growth across emerging economies.

KEY INDUSTRY PLAYERS

Competitive Landscape

Major players are Focusing on Developing Eco-friendly Products to Meet Sustainability Objectives

Market leaders are concentrating on the development and production of aftermarket parts designed to be compatible with the latest vehicle models while simultaneously catering to the needs of the older vehicle market. Prominent entities in the market are also dedicated to developing environmentally friendly products, thereby contributing to global sustainability objectives.

Robert Bosch GmbH, Continental AG, and ZF Friedrichshafen AG, are considered to have led the market in 2024. Robert Bosch GmbH Bosch is a multinational engineering and technology company operating across various sectors, including automotive. Bosch is a major player in the automotive aftermarket industry, offering a diverse range of products such as auto parts, diagnostic equipment, and workshop solutions.

LIST OF KEY AUTOMOTIVE AFTERMARKET COMPANIES PROFILED

- Robert Bosch GmbH (Germany)

- Denso Corporation (Japan)

- Magna International Inc. (Canada)

- Continental AG (Germany)

- ZF Friedrichshafen AG (Germany)

- Aisin Seiki Co. (Japan)

- Lear Corp. (U.S.)

- Bridgestone Corporation (Japan)

- Faurecia (France)

- Valeo SA (France)

KEY INDUSTRY DEVELOPMENTS

- October 2025, Valeo, a global leader in mobility technologies and automotive aftermarket services, entered into a strategic collaboration agreement with MOBILIANS, an organization representing the automotive and mobility services sector. The partnership aims to support and guide the transformation of the automotive aftermarket amid the significant environmental and technological changes currently reshaping the industry.

- February 2024: Lumax Auto Technologies, through its aftermarket division, partnered with the German firm Bluechem Group in the automotive car-care space. This partnership would offer domestic customers automotive car-care products for cleaning, service, and maintenance across various domains.

- January 2024: Valeo expanded manufacturing, aftermarket, and R&D operations in Tamil Nadu. Valeo's aftermarket operations would witness substantial growth through expanded distribution networks and additional service centers. This expansion aims to enhance accessibility to Valeo's top-tier automotive products and services, catering to a wider customer base across the region.

- October 2023: CEAT collaborated with Tyresnmore.com to strengthen its presence in the auto aftermarket e-commerce segment. Tyresnmore.com revolutionized the automotive industry by offering end-to-end solutions, from product discovery to doorstep fitment for both four-wheelers and two-wheelers.

- August 2023: ZF Aftermarket broadened its range of automotive components for vehicles in the U.S. and Canada. The expansion included 74 new listings incorporated into its TRW and SACHS branded portfolios. With these additions, the coverage would extend to over 18.7 billion vehicles currently in operation.

- April 2023: Robert Bosch, LLC added 52 aftermarket parts for automotive to its portfolio. This expansion would provide coverage for nearly 22 million vehicles in operation across North America, further solidifying the company's role as a reliable supplier for shops and technicians. The Bosch products, designed for both domestic and European/Asian passenger and commercial vehicles, encompass three braking parts, 16 fuel and water pumps, two ignition coils, 30 sensors, and one fuel injector.

REPORT COVERAGE

The automotive aftermarket industry research report provides a detailed analysis of the market and focuses on key aspects such as leading automotive aftermarket companies, product types, and leading applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, it encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 3.56% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Replacement Part Type · Battery · Brake Pads · Filters · Gasket & Seals · Lighting Component · Body Part o Interior o Exterior · Wheels & Tires · Others |

|

By Vehicle Type · Passenger Cars · Commercial Vehicles |

|

|

By Region · North America (By Replacement Part Type and Vehicle Type) o U.S. (By Vehicle Type) o Canada (By Vehicle Type) o Mexico (By Vehicle Type) · Europe (By Replacement Part Type and Vehicle Type) o U.K. (By Vehicle Type) o Germany (By Vehicle Type) o France (By Vehicle Type) o Rest of Europe (By Vehicle Type) · Asia Pacific (By Replacement Part Type and Vehicle Type) o China (By Vehicle Type) o Japan (By Vehicle Type) o India (By Vehicle Type) o South Korea (By Vehicle Type) o Thailand (By Vehicle Type) o Indonesia (By Vehicle Type) o Malaysia (By Vehicle Type) o Rest of Asia Pacific (By Vehicle Type) · Rest of the World (By Replacement Part Type and Vehicle Type) |

Frequently Asked Questions

As per a study by Fortune Business Insights, the market size was USD 443.12 billion in 2025 and is projected to grow to USD 604.57 billion by 2034.

The market is likely to grow at a CAGR of 3.56% over the forecast period (2026-2034).

By vehicle type, the passenger cars segment dominated the global market in 2026.

In 2025, the market size for North America stood at USD 137.53 billion.

The aging of vehicles is the key factor driving the growth of the aftermarket industry.

Robert Bosch GmbH, Continental AG, and ZF Friedrichshafen AG are the top players in the market.

The North America region led the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us