Baby Food Market Size, Share and Industry Analysis, By Product Type (Infant Formula, Snacks, Purees, Cereals, Juice & Smoothies, and Others), Demography (Infant, Toddler, and Pre Schooler), Nature (Organic and Inorganic), Distribution Channel (Supermarkets/Hypermarkets, Grocery Stores & Pharmacy Stores, Online Stores, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

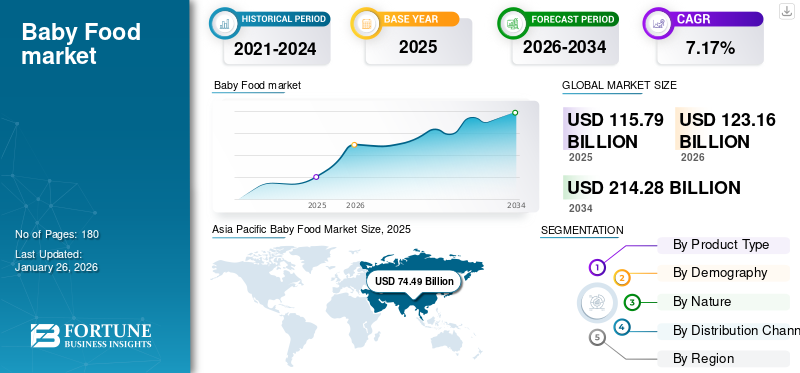

The baby food market size was USD 115.79 billion in 2025. The market is projected to grow from USD 123.16 billion in 2026 to USD 214.28 billion by 2034, exhibiting a CAGR of 7.17% during the 2026-2034 period. Asia Pacific dominated the baby food market with a market share of 64.35% in 2025. Moreover, the baby food market size in the U.S. is projected to grow significantly, reaching an estimated value of USD 16.72 billion by 2032, driven by high awareness about the benefits of high-quality baby nutrition products among the regional population.

Baby food is any soft or easily consumed food other than breast milk, which is primarily intended for consumption by babies to provide necessary nutrients and energy essential for their growth. The demand for such products is evolving at a higher pace due to the rising numbers of working women, surging parental concerns about infant nutrition, and time constraints globally. Moreover, the high susceptibility rate of foodborne illnesses is posing a constant pressure on parents regarding the infant's health. Thus, all such instances further augment the demand for complementary food across the globe. According to a research paper by the “National Library of Medicine,” 2022, around 62.5% of infants (3-5 months) were introduced to weaning foods such as blended or mashed potatoes, purees and juices, and water at three months of age.

The global market witnessed a sudden disruption in its growth due to the extensive spread of the COVID-19 virus globally. During the year, 2020, the global lockdown and stringent governmental regulations posed a significant imbalance in terms of production and sales of infant foods. However, demand for baby food products remained high in the market during the COVID-19 phase, but the pandemic crisis adversely affected the transportation as well as import & export facilities, which in turn, limited the growth. Thus, the prominent players in the market such as Nestle S.A., Abbott, and Danone S.A. worked toward maintaining food quality as well as food security by keenly following all the necessary protocols to curb the widespread of pandemic.

Baby Food Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 115.79 billion

- 2026 Market Size: USD 123.16 billion

- 2034 Forecast Market Size: USD 214.28 billion

- CAGR: 7.17% from 2026–2034

Market Share:

- Asia Pacific dominated the baby food market with a 64.35% share in 2025, driven by rising women workforce participation, urbanization, and increasing demand for convenient and nutritious infant products in countries like China and India.

Key Country Highlights:

- United States: The baby food market size in the U.S. is projected to reach USD 16.72 billion by 2032, supported by growing awareness of infant nutrition and product innovation.

- India: Increased birth rates and a rising number of working women are creating significant demand for ready-to-consume baby food solutions.

- China: Rapid urbanization and high disposable income among young parents are fueling growth, along with investments from global players in infant nutrition.

- Germany: The growing popularity of vegan and organic baby food is enhancing market potential, driven by increasing consumer interest in clean-label and sustainable offerings.

Baby Food Market Trends

Rising Number of Working Women Professionals is driving the Demand for Baby Food

The last decade and a half has seen a noticeable growth in the working women segment globally and so the demand of convenience goods has grown in recent years. According to the “India Spend,” a nonprofit organization, the percentage of rural women’s labor force increased from 32.2% in 2019-20 to 35.8% in 2020-21. In addition, factors such as the growing number of working couples, rising per capita, hectic work schedules, and changes in lifestyle is further influencing the purchasing behavior of working women, thereby turning them toward ready-to-eat products. Thus, such scenarios further shift the focus of a few mothers toward convenience or packaged foods such as dried baby food (powdered formula) as it saves time and effort and also helps in maintaining a work-life balance along with the routine chores.

Download Free sample to learn more about this report.

Baby Food Market Growth Factors

Growing Rate of the Infant Population Augments the Market Potential of the Infant Food Industry

The increasing infant population rate is considered to be a big factor in driving the infant food category growth. According to the “National Centre for Health Statistics,” 2021, the number of birth rate rose by 1% in the U.S., with 3,659,289 in the year 2021. The demand for infant food is expected to grow in the forecast period, as toddlers need most of the energy for their overall physical and cognitive development, which in turn, contributes to the expansion of global market size. Thus, the manufacturers are keenly focusing on expanding their business line by introducing different range of infant-related food products. Furthermore, the rising disposable income, growing parental concern regarding child’s well-being, and escalated demand for convenience foods further boosts the momentum of the infant food market.

Innovations in Infant Products as well as Packaging is also Driving the Market’s Growth

The surging changes in the manufacturing and packaging industry, owing to innovations and changing consumer preferences, has remarkably transformed the infant food industry. While launches are rapidly growing across all the categories, infant foods/milk formulas are still prominent with new product innovations in terms of flavors and packaging. Furthermore, progress in pediatrics and nutritional science is helping the producers to develop new baby formulas that can effectively meet the needs of the growing infants. For instance, in April 2022, Gerber launched its latest range of “carbon neutral plant-based toddler” food range across the U.S. market. The product contains plant-based baked snacks, produced from Non-GMO ingredients.

Moreover, in August 2023, Sresta Natural Bioproducts, one of India's pioneer brands in organic food, launched baby and children's food, snacks, and frozen foods. The baby and children food products are available for the age groups of six months to four years and up to 10 years. Apart from this, sustainable packaging also plays an important role in captivating the customer’s attention. For instance, in July 2022, Organix, a U.K. based toddler brand, is promoting eco-friendly packaging by selling its products in recyclable pots, which are 100% recyclable, reusable, and can be resealed. Additionally, in August 2021, The Kraft Heinz launched a “mono-material” infant food pouch, which is easily recyclable.

RESTRAINING FACTORS

Shifting Preferences of Parents Toward Homemade Food Restrains the Global Baby Food Market Growth

Complementary feeding practices and adherence to health recommendations are often influenced by a range of different interrelating factors such as socio-economic and cultural factors. The feeding transition from breast milk to solid foods is generally suggested at 6 months of age, and thus parents are choosing the option of homemade food as it is the most natural and hygienic method to provide fresh, tasty, and nutritious ingredients to their babies. This sudden shift of parents towards homemade food may pose a negative impact on the global market growth. Moreover, the potential presence of heavy metals in the infant food produced by certain prominent companies is further impeding the growth of packaged baby food. According to the “U.S. House of Representatives,” 2021, a lower chamber of U.S. Congress, more than 25% of Nurture (Happy BABY) baby products were tainted with 100 ppb inorganic arsenic, which further contributes to the dipping growth of the overall infant food market.

Baby Food Market Segmentation Analysis

By Product Type Analysis

Infant Formula is the Leading Segment Owing to the Richest Source of Proteins

On the basis of product type, the market is segmented into infant formula, snacks, purees, cereals, juice & smoothies, and others. The infant formula leads out of all other categories due to its tremendous use in numerous applications. The infant formula segment is forecast to represent 63.99% of total market share in 2026. Infant formula including powdered formula and ready-to-eat formula, are important sources of energy at the age of six months when exclusively breastmilk is no longer sufficient to fulfill the nutritional requirements of the toddlers. Moreover, infant formulas add convenience to the diet and are recognized as an alternative way to feed a baby if the breastfeeding option is unavailable. Besides this, infant formula is easily digested by infants, thus making them an excellent choice for babies. Manufacturers have been coming up with new products to meet the growing demand for infant formulas. For instance, in September 2023, Danone S.A., a French multinational food-products corporation, launched a new infant formula that contains milk droplets closely mimicking the structure found in mother’s milk.

Cereals is also gaining popularity among children as it is considered as an excellent source of energy, which imparts essential nutrients such as Vitamin B6, calcium along with carbohydrates. Growing new product launches and developments in the segment further propel the market growth. For instance, in September 2022, Nestlé India Limited, an Indian subsidiary of Nestlé, launched a new cereal called CEREGROW Grain Selection. The new product is made from mixed fruits, ragi, and ghee.

To know how our report can help streamline your business, Speak to Analyst

By Demography Analysis

Toddler Holds Maximum Share due to the High Consumption of Complementary Foods

On the basis of demography, the market is distributed into infant, toddler, and preschooler. Out of all, the toddler segment holds the prominent position in the market owing to the rising consumption of weaning foods such as cereals, purees, juices, and others. The toddler segment is poised to account for 42.72% of the market share in 2026. The toddlers of the age group (2-3 years) require an extra source of energy and nutrients, which is not provided by breastfeeding, and thus complementary foods, are introduced to promote health and development in children.

Infant segment is also witnessing a rapid growth as the children ranging between 0 to 1 years of age are also introduced to other weaning foods in order to bridge the nutrient gaps.

By Nature Analysis

Inorganic Products is a Dominant Category Due to Easy Affordability

Based on nature, the market is bifurcated into organic and inorganic. The inorganic segment secured the leading position by holding the largest share of 78.52% in 2026. The consumption of inorganic products is increasing at a higher pace due to their easy availability and affordability, thus boosting the inorganic segment’s growth. Moreover, inorganic products require minimal investment in production as compared to organic products, which further escalates the production capacity.

Organic products are also growing in demand across the market as health-conscious consumers are gravitating more toward organic products than conventional products due to the rising concerns about artificial ingredients and the effect of pesticides as well as antibiotics. For instance, in April 2022, Gerber Products Company, an American purveyor of baby food and baby products, launched their first plant-based baby food line, dubbed Plant-tastic. The new product line consists of organic plant-based toddler foods made with whole grains, nutrient-dense beans, and veggies.

By Distribution Channel Analysis

Supermarkets/Hypermarkets Evolve as the Go-To-Option for Purchasing Owing to Convenient Shopping

On the basis of distribution channel, the market is distributed into supermarkets/hypermarkets, grocery stores & pharmacy stores, online stores, and others. Supermarkets/hypermarkets have emerged as one of the easiest purchasing options globally due to their convenience and availability of different branded and local products. The Supermarkets/Hypermarkets segment is forecast to represent 72.13% of total market share in 2026. This one-stop shopping experience is highly convenient for individuals who need to purchase multiple items. Moreover, supermarkets such as Walmart and DMart offer discounts on bulk purchasing which further captivates the consumer’s attention.

Grocery Stores or pharmacies are also witnessing a strong growth due to their easy accessibility, proximity and availability, which further boosts the segment’s growth.

REGIONAL INSIGHTS

Asia Pacific Baby Food Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific is the prominent player in the infant food market and was valued at USD 74.49 billion in 2025. The Asia Pacific market is recognized as the highest contributor to the infant food market due to the rising women workforce and fast-paced lifestyle, which is expected to improve the regional market's growth. Moreover, the rising infant population and surging disposable income in the countries such as China and India, is expected to boost the demand for infant products. According to the “Australia Bureau of Statistics,” 2021, an increment of 5.3% was observed in birth rates across Australia. Thus, the trusted brands are keenly investing in manufacturing safe quality infant food, which helps in the overall growth and development of the children. For instance, in October 2022, Nestle announced the launch of its latest infant formulas containing a novel nutrient blend in China after its launch in Hong Kong. The Japan market is projected to reach USD 4.09 billion by 2026, the China market is projected to reach USD 55.09 billion by 2026, and the India market is projected to reach USD 3.69 billion by 2026.

North America

North America holds the second position in the infant food market, as parents are highly concerned about the health and nutrient intake of their children, irrespective of the cost of the product. Moreover, due to the rising standards of living and consumers awareness regarding the benefits of infant products is further contributing to the growth of market. For instance, in June 2022, a U.S. pioneer, Beech Nut, has opened its baby food production facility in New York, which in turn has fulfilled the rising consumer demands across the region. The U.S. market is projected to reach USD 11.27 billion by 2026.

Europe

Europe is also experiencing a rapid growth in the infant food market and is expected to grow massively in the upcoming years. Factors such as growing concerns related to food safety, the rising number of working women rate, and surging new product launches as well as business expansion are further anticipated to boost the regional growth in the forecast period. For instance, in August 2021, I Love You Veggie Much, a Berlin-based startup, has finally launched their vegan baby food products in their organic baby food segment. Such launches are thus expected to drive the market growth among vegetarian and vegan families in the country. The UK market is projected to reach USD 2.02 billion by 2026, while the Germany market is projected to reach USD 2.46 billion by 2026.

South America and Middle East & Africa

The market in South America and Middle East & Africa is growing at a slow pace and is anticipated to accelerate in the upcoming years. Factors includes the growing numbers of migrants settling in the UAE and Turkey, rising number of infant population as well as the surging number of retail shops are likely to improve the market potential of the global baby food market trends.

To know how our report can help streamline your business, Speak to Analyst

Key Industry Players

Key Players Are Launching Innovative Products to Attract the High Consumer Base

Some of the prominent players operating in the infant food market includes Danone S.A., Hero Group, Nestle S.A., Abbott among others. The companies are extensively focusing on increasing their customer base, by collaborating with other large business stakeholders, or via joint ventures, helping in expanding the profit income. In addition, the determined focus on introducing novel and sustainable products with essential nutrients, further enhances the growth of the infant food market. For instance, in April 2021, The Kraft Heinz Company launched its plant-based products for the newborns, thus successfully maintaining its plant based food line. Products include Saucy Pasta Stars with beans and carrots, potato baked with green peas & sweet garden peas and risotto with chickpeas and pumpkin are widely available in local and retail shops across the globe.

List of Top Baby Food Companies:

- Nestle S.A. (Switzerland)

- Hero Group (Switzerland)

- Danone S.A. (France)

- Abbott (U.S.)

- ASAHI GROUP HOLDINGS, LTD. (Japan)

- P.Z. Cussons (U.K.)

- The Kraft Heinz Company (U.S.)

- Kewpie Corporation (Japan)

- HiPP GmbH & Co. Vertrieb KG (Germany)

- Alter S.L. (Italy

KEY INDUSTRY DEVELOPMENTS:

- June 2023: Nature’s Path Organic Foods, a privately held, family-owned producer of certified organic foods, acquired Love Child Organics, a Canadian-based organic baby food and children's snack brand. The acquisition would enable Nature’s Path Organic Foods to expand Love Child Organics' baby food products in the U.S. market.

- December 2022: Mother Nurture launched its brand new range of around 12 parent-tasted baby-approved range of infant foods in the market. The products include Baby King Kong’s Pudding, Jumping Jack Rabbit Only Carrots and many more. Moreover, these products claim to be highly nutritious, preservative free as well as proven to be wholesome for the infants.

- November 2022: Hero Group, a Switzerland-based baby food maker has invested approximately USD 16.5 million in a new factory in Spain for baby food. The 6,000 square meter plant located at Hero’s existing premises in Alcantarilla in the Murcia region of southern Spain, is anticipated to be completed by next year.

- July 2022: Gerber is working toward broadening its product ranges by launching its first-ever puree line, especially for the infants. The company offers two puree flavors such as “Corn,” and “Mango,” which are made from nutrient dense fruits and vegetables, thus fulfilling the satiety levels of babies.

- June 2022: Abbott Laboratories, one of the leading U.S. based company, announced its restart of Similac infant formula production at its Sturgis manufacturing plant in Michigan in order to fulfill the nationwide infant formula shortage.

REPORT COVERAGES

The market report includes quantitative and qualitative insights into the market. It also offers a detailed analysis of the market size and growth rate for all possible market segments. Various key insights presented in the report are an overview of related markets, competitive landscape, recent industry developments such as mergers & acquisitions, the regulatory scenario in critical countries, and key industry trends.

Request for Customization to gain extensive market insights.

REPORT SCOPE AND SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.17% over 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

|

|

By Demography

|

|

|

By Nature

|

|

|

By Distribution Channel

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size stood at USD 123.16 billion in 2026.

The market is projected to grow at a CAGR of 7.17% during the forecast period (2026-2034).

The infant formula is expected to be the leading product type in the global market.

Growing number of infant population, the market potential of the infant food industry, and innovations in infant products and packaging drives the market growth.

Danone S.A., Nestle S.A. and Abbott are a few of the top players in the global market.

China is expected to hold the highest market share throughout the forecast period.

Shifting preferences of parents toward homemade food impedes the growth of the market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us