Blast Monitoring Equipment Market Size, Share & COVID-19 Impact Analysis, By Product Type (Blast Monitors, Real Time Dust Monitors, and Visibility Monitors), By End User (Mining, Construction, and Quarry), By Application (Underground Mines, Surface Mining, Demolition, Detonation, Rock Blasting, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

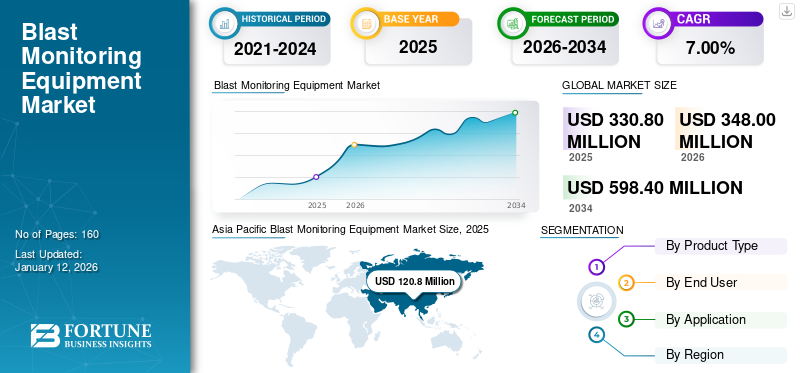

The global blast monitoring equipment market size was valued at USD 330.8 million in 2025. The market is projected to grow from USD 348 million in 2026 to USD 598.4 million by 2034, exhibiting a CAGR of 7% during the forecast period. Asia Pacific dominated the global market with a share of 36.50% in 2025.

Blast monitoring equipment is used to measure and analyze the impact of explosive events, such as explosions, construction or mining blasts, and military exercises. These instruments are essential for ensuring safety, compliance with regulations, and environmental protection. Mining, construction, and quarrying are the applications of blast monitoring. This equipment typically includes air overpressure sensors, noise levels, seismometers, and data loggers to capture and record the data generated during explosion activities. This technology also aids in designing a more efficient blast that does not disturb the surroundings.

Global Blast Monitoring Equipment Market Overview

Market Size:

- 2025 Value: USD 330.8 million

- 2026 Value: USD 348 million

- 2034 Forecast Value: USD 598.4 million

- CAGR (2026–2034): 7%

Market Share:

- Regional Leader: Asia Pacific held approximately 36.50% market share in 2026

- Fastest-Growing Region: Asia Pacific, driven by mining, construction, and infrastructure projects

- Top End-User Segment: The mining sector is the largest user, with strong demand in construction and quarrying

Industry Trends:

- IoT & IIoT Integration: Real-time data collection, remote monitoring, and predictive maintenance through connected sensors

- Tech-Advanced Products: Launch of smart blast monitors, real-time dust monitors, and robust visibility monitors

- Automation & Remote Solutions: Increased adoption of remote monitoring due to safety and labor constraints

- Environmental Compliance: Growing focus on monitoring air quality, noise, and vibration for regulatory compliance

Driving Factors:

- Infrastructure Boom: Rising global investment in roads, tunnels, bridges, and urban development

- Mining Expansion: Growth in mineral and metal production, especially in Asia Pacific and South America

- Safety Regulations: Stringent government mandates for blast safety and environmental protection

- Operational Efficiency: Need for accurate, real-time data to optimize blasting and minimize community impact

Government initiatives taken for stringent safety regulations in industries such as defense, mining, and construction activities are driving the blast monitoring equipment market growth. Furthermore, government concerns about the environmental impact of explosions and blasts have led to increased demand for monitoring equipment. These instruments are essential for assessing and mitigating the effects of blasts on the environment, wildlife, and nearby communities. Furthermore, rising urbanization and infrastructure development projects across the globe have increased the usage of explosives for construction purposes.

For instance, according to the World Bank, Private participation in infrastructure (PPI) reached USD 91.7 million across 263 infrastructure projects, which increased by 23% in 2022, as compared to 2021. Moreover, growth in the mining industry across South America and the Asia Pacific region is driving the demand for the market during the forecast period. In addition, rising foreign direct investment across South America and Europe has created the demand for blast monitoring equipment for measuring overpressure conditions. This factor increases the global blast monitoring equipment market share. For instance, in April 2023, according to the International Energy Agency (IEA), foreign direct investment in South America increased by 13% in 2022 as compared to 2021.

COVID-19 IMPACT

Halted Construction Activities and Mining Activities During COVID-19 Restrict the Market Growth

The COVID-19 pandemic has had both direct and indirect impacts on the market. Sales of such equipment are directly related to the demand from end-use industries including oil & gas, mining, defense, and construction. However, the market growth was greatly affected owing to supply chain disruptions, import and export restrictions, and border closures during the COVID-19 pandemic. Lockdowns and restrictions on mining and construction activities across the globe affected the demand for such equipment. Furthermore, the construction and mining sectors registered a decline in the net revenue during the pandemic period, which subsequently reduced the sales of such equipment, restraining the market growth. For instance, according to a CRISIL report, the construction sector growth declined by 17% in 2021 as compared to 2020.

In addition, the pandemic accelerated the adoption of remote monitoring and automation technologies. Some equipment providers adapted by offering remote monitoring solutions, which gained popularity due to reduced on-site personnel during lockdowns.

Blast Monitoring Equipment Market Trends

Technological Advancement in Equipment To Trigger Market Growth

Major players such as Orica Limited, Instantel Inc, and Campbell Scientific Inc, are providing tech-advanced products for various applications such as surface mining, underground mining, detonation, and demolition activities, which are driving the growth of the market. The integration of Internet of Things (IoT) technology into blast monitoring equipment has been on the rise. IoT enables real-time data collection and remote monitoring, allowing for better safety and operational efficiency.

The Industrial Internet of Things (IIoT) has opened up new development opportunities for companies seeking blast monitoring, and vibration monitoring operations. By integrating IIoT into existing manufacturing processes, companies can connect multiple sensors such as explosion, vibration, and temperature monitoring to the Internet, allowing real-time asset monitoring. Companies can use IIoT technology to connect and process all data on a single platform. In addition, using IIoT for health monitoring and predictive maintenance can significantly improve the availability of critical assets, especially for equipment with unpredictable failure patterns. In addition, with the help of IIoT, companies can significantly increase the efficiency and reliability of their operations by implementing revolutionary changes in business process automation. In recent years, industries such as manufacturing and oil and gas have adopted IIoT in their operations. The growing use of IIoT presents a potential opportunity in the explosion monitoring equipment market. All such aforementioned factors are the blast monitoring equipment market trends.

Download Free sample to learn more about this report.

Blast Monitoring Equipment Market Growth Factors

Increasing Demand from Construction and Mining Sectors across the Globe to Drive the Market Expansion

The growth of construction blasting has greatly increased the demand for industrial explosives, which are directly related to mining sector. The imbalance between supply and demand for raw materials such as coal (for electricity production), iron ore (for steel production), limestone (for cement production), and aggregates from quarries especially for mining (for use in construction) and infrastructure projects) is huge. Construction activities, such as drilling and blasting tend to increase with rising population density. The growth in mining and construction sectors, which is directly proportional to a blast monitoring system, fuels the market growth. Moreover, the rising number of infrastructure developments such as roads, tunnels, and bridges often involves blasting. For instance, according to Pinsent Masons, in 2021, Europe government planned to invest around USD 339.72 million for the development of roads and the construction sector. All these factors impact the growth of the market during the forecast period.

RESTRAINING FACTORS

Lack of Skilled Operators in Developing Nations to Impede Market Growth

The impact of regulatory codes of practice and the lack of skilled technical resources in data processing further limits the market for explosion monitoring equipment. Furthermore, the market faces challenges related to insufficient knowledge about the long-term maintenance of explosion monitoring equipment. Experienced users often question about the diagnostics capabilities and predictions of these systems, creating problems such as explosion measurements, maintenance failures, and false explosion signals. In addition, workers may resist the new way of planning and maintaining process efficiency, which could impede the implementation of effective explosion protection equipment. The demand for explosion monitoring equipment may also decline due to difficulties in production settings. These settings may include various surfaces where the installation of explosion monitoring equipment and services can be difficult. Liability issues related to the predictive ability of the control system are a significant barrier to industry growth.

Blast Monitoring Equipment Market Segmentation Analysis

By Product Type Analysis

Blast Monitors Segment Dominates the Market Due to Increasing Demand from Construction and Mining Sectors

Based on product type, the market is segmented into blast monitors, real-time dust monitors, dust samplers, and visibility monitors.

The blast monitor segment dominates the market with a share of 46.49% in 2026and is projected to experience substantial growth due to growing demand from construction, defense, and mining sectors. It is an important tool for measuring impacts on environmental structures and nearby communities for compliance reporting purposes. Excessive blast pressure caused by mining or demolition can cause damage to nearby buildings and community complaints. Therefore, blasting can only be done in specific weather conditions and is subject to regulatory restrictions.

Real-time dust monitors and dust samplers segment are projected to grow with moderate growth during the forecast period. Also, these devices are having features such as able to quick and easily analyze the dust control, effective, and long durable. Real-time tracking data can be collected and monitored to show before and after improvements. The dust monitor can be equipped with a video camera, and having smart control. It is used to monitor vibration, and blasting movement generated from seismograph operations.

Visibility monitor segment is anticipated to grow with moderate growth during the forecast period, due to growing demand from construction, mining, and quarry applications. All aforementioned factors contribute to the growth of the market.

To know how our report can help streamline your business, Speak to Analyst

By End User Analysis

Mining Sector Leads the Market Attributed To Increasing Demand From Minerals and Metal Production Activities

Based on the end user, the market is segmented into mining, construction, and quarry.

The mining segment dominates the market with 51.03% share in 2026, and is expected to witness substantial growth during forecast period, owing to the expansion in mining and related sectors. Along with, rising underground mining and surface mining operations across the globe, creates a high demand for such equipment to measure ground variations and frequency.

In terms of revenue and growth, the construction segment holds the second position. This equipment is used in the construction sector for residential sector and non-residential sectors, including tunnels, bridges, roads, and buildings. Monitoring equipment provides real-time data on blast parameters. This data is invaluable for immediate decision-making, as it allows construction teams to adjust their blasting plans as necessary based on the observed data.

The quarry segment is projected to see potential growth during the forecast period owing to the use of blast monitoring equipment in quarry and civil industries. It is used for monitoring overpressure air, automatic detonation detection, and flexible, and easy-to-use operations. Furthermore, during explosion activities, the blast may result in increased noise and dust, posing potential health hazards. So, to control this dust, they can adopt real-time dust monitors for quarrying applications. All such favorable factors drive the market growth.

By Application Analysis

Surface Mining Segment To Grow at the Highest CAGR Owing To Rising Rock Exploration & Mining Activities

Based on the application, the market is segmented into underground mines, surface mining, demolition, detonation, rock blasting, and others.

The surface mining segment dominates the market share of 29.48% in 2026, and is growing with the highest CAGR during the forecast period. This is owing to the rising demand for metal and extracted minerals from surface mining, which fuels the growth of the market.

Underground mines segment is projected to grow with stable growth during the forecast period, owing to rising demand from underground applications. Underground mining involves extracting rocks or minerals underground that cannot be mined from the surface. Tunnels or flats are constructed by blasting activities to remove rocks or minerals from the ground level. However, these blasting activities can generate strong vibrations that can damage adjacent buildings such as other floors, offices, and transportation systems. These strong vibrations can also affect ground structures in metropolitan areas, such as residential buildings, office buildings, and roads.

Demolition and detonation segment is anticipated to grow with moderate growth during the forecast period. This growth is attributed to the demand for such equipment for monitor vibration, and blasting movement. All such factors drives the growth of market.

The rock blasting segment is anticipated to grow with decentgrowth during forecast period. This is owing to the rising demand for geophones, noise monitors, and seismographs for vibration monitoring and ensure safety practices.

REGIONAL INSIGHTS

Geographically, the market is divided into five major regions, including, North America, Europe, Asia Pacific, the Middle East and Africa, and South America.

Asia Pacific Blast Monitoring Equipment Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific region dominated the market with a valuation of USD 120.8 million in 2025 and USD 128.3 million in 2026, owing to factors such as rapid urbanization and government investment in infrastructure development. Moreover, the growth in mining activities across China, India, and Japan, fuels the market growth during the forecast period. The Asia Pacific region, with its significant construction, mining, and quarrying activities, has witnessed a substantial growth in the market. The mining industry in countries such as Australia, Indonesia, and Mongolia is a significant driver for the market. These countries have substantial mineral and resource reserves, necessitating the use of monitoring equipment to ensure safe and efficient mining operations. All such factor drives the growth of the Asia Pacific region. The Japan market is valued at USD 31.2 million by 2026, the China market is valued at USD 50.9 million by 2026, and the India market is valued at USD 17.5 million by 2026.

To know how our report can help streamline your business, Speak to Analyst

China To Dominate Owing To Rising Infrastructure Development and Investment in Mining Sector

In China, the market has witnessed significant growth and development in recent years due to the country's rapid industrialization, construction activities, and mining operations. The mining sector, including coal, metals, and minerals, is a significant driver of the market. China is the world's largest producer and consumer of coal, and the mining industry relies on monitoring equipment to ensure safety and regulatory compliance. All the aforementioned factors contribute to market growth.

The North America market has been experiencing a steady growth due to increased construction, mining, and infrastructure development activities in the region. In addition, growth in the mining industry and the quarrying sector in U.S, Canada, and Mexico, fuels market expansion. For instance, according to the Natural Resources Report, mineral production in Canada increased by 20% in 2021 as compared to 2020. The U.S. market is valued at USD 57.6 million by 2026.

Europe is projected to grow with moderate growth during forecast period, due to government regulation environment across countries such as Germany, France, and Italy, and growth in the construction and mining sectors, fuels the market growth. The European market for blast monitoring equipment has been growing steadily due to infrastructure development, resource extraction, and construction projects. Factors such as urbanization and increased mining activities contribute to the market growth in the European region. For instance, according to EuroMetal, the European government’s investment increased by 4.8% in 2022 compared to 2021. Such factors fuel the market growth. The UK market is valued at USD 17 million by 2026, and the Germany market is valued at USD 28.4 million by 2026.

The Middle East & Africa and South America are projected to have a stable growth. This is owing to number of mining projects and growing investment in infrastructure development driving the demand for such equipment. For instance, according to the Energy and Mines Ministry, in 2021, Peru had 49 mining projects active over Peru with a capital investment of USD 58 million. Such a huge investment in the mining projects subsequently drove the growth of the south American market. According to Leveraging Transparency to Reduce Corruption (LTRC), the Chile government needs an additional investment worth USD 150 million to double copper output by 2050. In addition, Peru is seeking roughly USD 54 million for over 100 mining projects to excavate minerals from underground mining applications. All such factors drive market growth.

KEY INDUSTRY PLAYERS

Key Players Focus on Introducing Technological Advanced Products to Strengthen Their Position

Key players such as Orica Limited, Instantel Inc, and others are introducing new technologically advanced blast monitoring equipment to enhance their market share. For instance, in September 2023, Orica Limited introduced a new lead-free non-electric detonator for blasting and vibration monitoring applications. It has features such as reliable, fast, and secure performance. This type of equipment are used in applications such as surface mining, underground mining, and civil infrastructure sectors. All such factors contribute to the market growth during the forecast period.

List of Top Blast Monitoring Equipment Companies:

- Instantel Inc (Canada)

- Orica Limited (Australia)

- Incitec Pivot Limited (Dyno Nobel Inc) (Australia)

- Campbell Scientific Inc (U.S.)

- Applied Seismology Consulting (Cannon Mining Equipment) (U.K.)

- GeoSIG Ltd (Switzerland)

- MREL (Canada)

- RST Instruments Ltd (Canada)

- Libelium Comunicaciones Distribuidas (Spain)

- Trolex Ltd (U.K.)

KEY INDUSTRY DEVELOPMENTS:

- June 2024: Orica Limited introduced a new series of Fortis Protect Series of explosives, used for reduce leaking of nitrate during blast operation.

- April 2024: Trolex Ltd launched Air XS Silica Monitor to the market. This real time dust monitor equipment was used for construction, and mining activities, known for its robustness, accuracy, and durability.

- April 2021: Blast Movement Technologies, a subsidiary of Hexagon AB launched FED 2.0 vibration monitor. It offered a safer and more convenient solutions for blast monitoring activities with a depth of 12 meters.

REPORT COVERAGE

The global market research report covers a detailed depth analysis of the product type, end user, and application. It provides information about leading players in the market, including their business overview, product offerings, investments (R&D and expansions), revenue analysis, types, and leading applications of the product. Besides, it offers insights into the competitive landscape, trends analysis, SWOT analysis, and current market trends and highlights key drivers and restraints. In addition to the abovementioned factors, the market report encompasses several factors contributing to the market growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2024 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Product Type

By End User

By Application

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 598.4 million by 2034.

In 2025, the market was valued at USD 330.8 million.

The market is projected to grow at a CAGR of 7% during the forecast period.

By product type, the blast monitors segment leads the market.

Increasing investment in construction, and mining sectors which boost the demand for blasting monitors, fuels the market growth.

Instantel Inc, Orica Limited, Incitec Pivot Limited (Dyno Nobel Inc), Campbell Scientific Inc, Applied Seismology Consulting, GeoSIG Ltd, MREL, Libelium Comunicaciones Distribudas S.L., and Trolex Ltd are the top players in the market.

Asia Pacific region holds the highest market share.

By end user, the mining segment dominates the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us