Commercial Refrigeration Equipment Market Size, Share & Industry Analysis, By Type (Refrigerator & Freezer, Transport Refrigeration, Refrigerated Display Cases, Ice Machines, and Others), By Application (Food & Beverage, Retail Stores, Hotels & Restaurants, Chemicals & Pharmaceuticals, and Others), and Regional Forecast, 2026-2034

COMMERCIAL REFRIGERATION EQUIPMENT MARKET SIZE AND FUTURE OUTLOOK

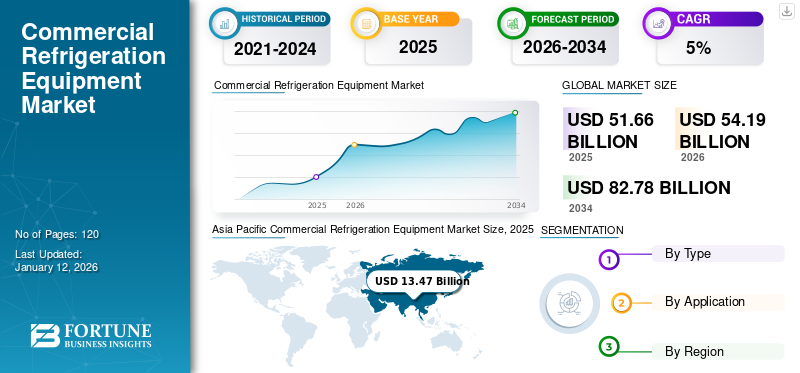

The global commercial refrigeration equipment market size was valued at USD 51.66 billion in 2025. The market is projected to grow from USD 54.19 billion in 2026 to USD 82.78 billion by 2034, exhibiting a CAGR of 5.4% during the forecast period. North America dominated the global market with a market share of 50% in 2025. The commercial refrigeration equipment market in the North America is projected to grow significantly, reaching an estimated value of USD 40.89 Bn by 2034.

Commercial refrigeration equipment serves multiple cooling and freezing purposes. It includes devices, such as freezers, refrigerators, and ice-making machines. Its applications span various industries including, food and beverages, retail, hotels and restaurants, chemicals, and pharmaceuticals. Another category consists of vending machines that are utilized in commercial dining establishments, hotels, supermarkets, and fast food outlets, such as McDonald’s and KFC.

Global Commercial Refrigeration Equipment Market Overview

Market Size:

- 2025 Value: USD 51.66 billion

- 2026 Value: USD 54.19 billion

- 2034 Forecast Value: USD 82.78 billion

- CAGR: 5.4% from 2026 to 2034

Market Share:

- Regional Leader: Asia Pacific is expected to lead in market share with a share of 26.14%, driven by rising demand for frozen and processed food products, increasing supermarket chains, and growing food investments

- Product-Type Leader: Transport refrigeration segment held the largest share and is projected to continue leading through the forecast period

- Application Leader: Food & beverage segment dominated revenue share due to widespread use in restaurants, hotels, supermarkets, and F&B processing industries

Industry Trends:

- Modular and customizable refrigeration solutions are gaining prominence to meet evolving F&B retail needs

- Increasing integration of energy-efficient systems and natural refrigerants to comply with environmental regulations

- Growing uptake of smart, IoT-enabled refrigeration for real-time temperature monitoring and predictive maintenance

Driving Factors:

- Rising investments in the food & beverage industry, including expansion of retail and quick-service restaurant networks

- Consumer demand for fresh, hygienic food products sustained by infrastructure growth and lifestyle changes

- Regulatory mandates encouraging adoption of low-GWP refrigerant technologies and energy-efficient equipment

- Urbanization and expansion of supermarket/hypermarket infrastructure supporting broader refrigeration adoption

The growth of the commercial refrigeration equipment market is consistent due to the reopening of the retail sector after the pandemic and an increasing worldwide demand for carbonated beverages. Moreover, there is a rising need for commercial refrigerators and freezers in supermarkets, hypermarkets, and food retailers to store ready-to-eat products, processed foods, and frozen items.

A significant factor contributing to this growth is the increase in disposable income among consumers worldwide, leading to higher expenditures on frozen foods and ready-to-eat meals, which in turn drives the market for overall refrigeration equipment. In addition, the expanding trend of travel has heightened the demand for ready-to-eat meals, which is expected to boost the sales of commercial refrigeration equipment throughout the forecast period.

- For instance, according to the World Tourism Organization (UNWTO), the number of international tourist arrivals increased from January 2022 to July 2022 by around 172% compared to 2019.

The onset of the COVID-19 pandemic significantly affected the demand for commercial refrigeration equipment worldwide in the first and second quarters of 2020. This situation caused the retail chain infrastructure within the industry to unravel, leading to intricate challenges in product delivery to end-users. Consequently, the profit margins for manufacturers producing commercial refrigerators and freezers for diverse applications were reduced.

In contrast, the need to keep medicines and drugs from spoiling led to a surge in demand for commercial refrigerators and freezers. Furthermore, the post-pandemic increase in demand for frozen foods further propelled the commercial refrigeration demand across developing and developed economies. Henceforth, this equipment became a primary need for medicinal storage across pharmaceutical companies and supply networks in the medical sector.

IMPACT OF TECHNOLOGY ON THE MARKET

Rising Importance of Environmental Sustainability to Drive Market Growth

Technological advancements in commercial refrigeration equipment are transforming the food service sector. Innovations, such as energy-efficient systems, intelligent monitoring, environmentally friendly refrigerants, and tailored solutions offer real advantages that enhance operational efficiency, lower expenses, and guarantee food safety.

Minimizing energy usage is an important focus for the food service sector. As awareness of environmental issues increases and energy expenses rise, enhancing refrigeration efficiency has become a major priority. The latest refrigeration systems are equipped with cutting-edge insulation technologies, optimized airflow designs, and intelligent energy management capabilities to lower electricity consumption.

In addition, IoT (Internet of Things) technology is revolutionizing the monitoring and management of commercial refrigeration systems. Advanced refrigeration units come with sensors and remote monitoring features that enable operators to oversee temperature, humidity, and energy consumption in real time.

MARKET DYNAMICS

Market Trends

Modular and Customizable Refrigeration Solutions to Fuel Market Growth

As food service companies expand, their refrigeration requirements are evolving rapidly. Modular refrigeration systems enable businesses to adjust or expand their setups as necessary, providing a flexibility that conventional units often do not offer. Customizable and modular configurations allow restaurants, catering companies, and other food enterprises to customize their refrigeration systems to meet specific needs. Whether it’s enlarging cold storage space or incorporating specialized units for various food types, modular systems deliver scalability and efficiency.

In addition, touchscreen controls and user-friendly interfaces are now commonplace in contemporary refrigeration systems. These intuitive controls simplify the process of adjusting temperatures, tracking performance, and configuring maintenance alerts. Enhanced interfaces make operating complicated refrigeration systems more straighforward, enabling staff to effectively handle temperature controls and other essential features. This shortens the learning process for new hires and minimizes mistakes by users, ensuring that food storage conditions remain at their best.

Download Free sample to learn more about this report.

Market Driver

Rising Investments in the Food and Beverage Industry to Drive Market Growth

Despite challenges such as increasing interest rates, elevated inflation, trade sanctions, and market unpredictability, the demand for food and beverage items stays fairly consistent. The food and beverage refrigeration industry ranks among the topmost industries worldwide, contributing significantly to the global GDP. For instance, India's food and beverage sector ranks among the largest and rapidly expanding industries, comprising various segments and sub-segments. Various projections suggest that the domestic food processing segment is expected to grow from USD 263 billion in FY2021 to USD 470 billion by FY2025. Such investments in the food and beverage sector drive market growth on a global scale.

Market Restraint

High Capital Expenditure and Maintenance Costs to Obstruct Adoption Across Industries

Commercial refrigeration systems are utilized in applications with heavy loads, and due to their extensive use, they must adhere to stricter regulations. These systems operate with commercial-grade refrigerants that have been developed in accordance with government guidelines aimed at reducing carbon emissions and the impact of greenhouse gases. Since this equipment is designed for commercial settings, prices vary based on size and application. Commercial refrigerators and freezers are constructed to occupy large spaces. Consequently, investing in expensive refrigeration systems requires a significant initial expenditure, and the maintenance of such large equipment poses a barrier to adopting these systems across various industries.

- For instance, the total installation cost required for the walk-in cooler is around USD 3,000 to USD 9,000. Additionally, it requires additional maintenance costs of USD 100 to USD 325 for commercial refrigeration equipment such as refrigerators and freezers.

Market Opportunity

Growth in Quick Service Restaurants (QSRs) and Supermarkets to Offer Ample Growth Opportunities

Quick-service restaurants have significantly changed how people globally spend their time, money, and calorie consumption. This sector has experienced rapid expansion, with industry estimates suggesting that the growth of the QSR industry will continue as convenience increasingly becomes a key priority. The U.S. has one of the largest QSR markets in the world. Currently, there are 201,865 quick-service restaurants in the country, showing nearly a 1% increase in the first quarter of 2023, with 37% of Americans eating fast food daily. As more consumer reliance on QSRs grows, there is a growing demand for reliable refrigeration systems.

In addition, advancements in technology and economic shifts have made supermarkets the preferred shopping option over local corner stores. Since 2018, sales at supermarkets and grocery stores in the U.S. have been increasing almost 3% annually. Expanding supermarkets demand high-performance and energy-efficient refrigeration equipment, creating an opportunity for manufacturers to customize their products as per the demand.

SEGMENTATION ANALYSIS

By Type

Transport Refrigeration Segment to Lead Owing to the Urbanization In Developing Regions

Based on type, the market is classified into refrigerator & freezer, transport refrigeration, refrigerated display cases, ice machines, and others.

Transport refrigeration is likely to dominate the commercial refrigeration equipment market share of 29.56% in 2026 during the forecast period due to the upsurge in online grocery shopping, which has increased the demand for refrigerated vehicles to deliver perishable goods. In addition, as reported by the UN Conference on Trade and Development (UNCTAD), urbanization is advancing more rapidly in developing nations, particularly within the Asia Pacific and Oceania regions. The urbanization rate in these areas rose from 44% in 2012 to 50.6% in 2022. As urbanization increases in developing economies, the demand for temperature-controlled vehicles is expected to expand, resulting in increased demand for commercial refrigeration equipment.

Refrigerator & freezers to grow with the highest CAGR during the forecast period. A wide range of frozen food products, including frozen meats, snacks, vegetables, and more, are quickly becoming one of the most rapidly expanding categories in ready-to-eat foods. Lately, there has been a notable increase in consumer interest in frozen foods, driven by fast-paced lifestyles that creates a demand for convenient meal options. This trend increases the demand for refrigerators & freezers, as they provide essential storage solutions to maintain freshness over extended periods.

By Application

To know how our report can help streamline your business, Speak to Analyst

Food & Beverage Dominated the Market Due to the Increasing Demand for Ready-to-Eat Products

Based on application, the market is segmented into food & beverage, retail stores, hotels & restaurants, chemicals & pharmaceuticals, and others.

The food and beverage sector holds the largest market share of 32.72% in 2026, driven by a growing consumer interest in healthy and convenient ready-to-eat meal options worldwide. Ready-to-eat food is a popular option for individuals seeking convenience in today’s fast-paced world. With a wide range of options available, these meals have become a preferred choice for people who cannot dedicate their time in the kitchen. Ready-to eat meals require proper refrigeration to maintain their taste and quality.

The chemical & pharmaceuticals sector is projected to reach a CAGR of 5.50% during the forecast period (2025-2032), due to the increasing demand for the storage of chemicals, pathology samples, and medicines, which expands the uses of commercial refrigeration.

Furthermore, retail outlets in developed nations are providing frozen and processed food products to their customers, which is anticipated to contribute to gradual market expansion.

The hotels & restaurants sector shows a consistent growth trajectory as consumers increasingly favor both full-service and quick-service dining options and their associated food offerings.

COMMERCIAL REFRIGERATION EQUIPMENT MARKET REGIONAL OUTLOOK

The market covers five major regions, mainly North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

ASIA PACIFIC

Asia Pacific Commercial Refrigeration Equipment Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific market dominates with a value of USD 13.47 billion in 2025, and is anticipated to expand with the highest CAGR of 6.05% during the forecast period (2025-2032), owing to the rising demand for frozen food items in countries, such as India, China, South Korea, and Japan. India is projected to reach a market value of USD 2.82 billion in 2026, while Japan is expected to be valued at USD 3.41 billion. Food manufacturers across the region are concentrating on creating frozen alternatives to local food specialties, which is aiding market growth. According to the Organic Trade Association (OTA), the organic food sector is projected to experience the most significant growth within the food industry. Consumers are increasingly leaning toward healthier and nutritionally rich organic food products, leading to a greater reliance on the cold chain process and associated refrigeration equipment. Additionally, the growing number of supermarkets and hypermarkets is likely to further propel the Asia market.

China Set to Dominate the Market Due to the Rising Urbanization and Growth in Middle Class Population

According to various estimates, approximately 1.2 billion individuals in China are expected to belong to the middle class by 2027, constituting about a quarter of the global total. The increasing urban population in China and the rise in disposable income have resulted in increased shopping and access to fresh organic produce. The demand for high-quality food has driven the need for commercial refrigeration systems across various sectors. China is estimated to be worth USD 4.34 billion in 2026. Additionally, the presence of numerous local manufacturers for commercial refrigeration applications is generating significant market opportunities for China to export commercial refrigeration equipment worldwide.

To know how our report can help streamline your business, Speak to Analyst

North America

North America dominated the market in 2025 with a value of USD 25.84 billion and USD 27.22 billion in 2026. Growing investments in the food and beverage sectors across North America to enhance the growth of the regional market. Companies are heavily investing in research and development (R&D) while engaging in strategic partnerships, acquisitions, collaborations, and joint ventures, which are key drivers of market advancement. Additionally, the fast-paced lifestyle and higher disposable incomes of consumers lead to increased spending on ready-to-eat meals and frozen foods, thereby boosting the demand for commercial refrigeration equipment and promoting market growth in North America. TThe commercial refrigeration equipment market in the U.S. is projected to grow significantly, reaching an estimated value of USD 28.08 Bn by 2032, driven by the growing demand of frozen and processed food across U.S.

- For instance, according to the U.S. Department of Agriculture, in 2021, 72% of Americans purchased ready-to-eat products and frozen foods due to their busy lifestyle.

Europe

The Europe is the third largest market and is poised for substantial growth with a value of USD 9.00 billion in 2026, due to the presence of major food and beverage manufacturers. The U.K. market continues to rise and is estimated to reach a market value of USD 1.68 billion in 2026. The rising number of quick-service restaurants, fast food outlets, and cold chain facilities are key factors driving market growth in Europe. Food and beverage companies are investing in state-of-the-art refrigeration systems to ensure the freshness and safety of food items. Additionally, the enforcement of strict food safety regulations by European governments is generating a significant demand for these technologies to ensure hazards free food products. Germany is projected to encounter a market share of USD 1.90 billion in 2026, while France is predicted to be worth USD 1.34 billion in the same year.

- For instance, in 2021, according to the Irish Food Board, there were 2,380 Subway counters, 900 KFC outlets, and 1,247 McDonald’s outlets in the U.K. Such rising number of stores is driving the demand for commercial refrigeration.

Middle East & Africa

The Middle East & Africa is the fourth largest market anticipated to hold a value of USD 2.38 billion in 2026, this growth is largely fueled by the expanding travel and tourism industry. Furthermore, substantial infrastructure investments and improved living standards in the UAE, Saudi Arabia, and other countries support market development. These advancing economies require cutting-edge commercial refrigeration solutions for the preservation and storage of frozen foods, meats, and ice creams, which will contribute to market advancement in the region. In addition, the South African government's increased initiatives to minimize food waste are expected to drive the growth of the regional market throughout the forecast period. GCC is poised to hold the market share of USD 0.79 billion in 2025.

- For instance, as reported by STR Inc., the Middle East and Africa saw a 2% rise in the number of hotels from September 2021 to September 2022, reaching a total of 243,613.

Latin America

Latin America market is expected to experience steady growth due to the rising number of urban regions in Brazil and Mexico. Increased investments in high-quality food items such as bakery products, are further supporting the market’s expansion.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Focused on Strengthening their Market Position with Continuous Developments

The global market for commercial refrigeration equipment is consolidated by leading players such as Carrier Global Corporation, Danfoss, GEA Group Aktiengesellschaft, Daikin Industries, Ltd., Johnson Controls, Nor-Lake, Inc., The Middleby Corporation, Imbera, AB Electrolux, among others. These companies in the market are expanding their operations by adopting strategies such as mergers, acquisitions, product launches, collaborations, and partnerships.

- For instance, in August, 2022, Carrier Corporation launched an energy-efficient supra refrigeration unit. This unit offers precise temperature control for temperature-sensitive perishables while delivering high efficiency, lower fuel consumption, and reduced carbon emissions.

List of Key Companies Studied

- Carrier Global Corporation (U.S.)

- Danfoss (Denmark)

- GEA Group Aktiengesellschaft (Germany)

- Daikin Industries, Ltd. (Japan)

- Johnson Controls (Ireland)

- Nor-Lake, Inc. (U.S.)

- The Middleby Corporation (U.S.)

- Imbera (Mexico)

- AB Electrolux (Sweden)

- Welbilt (U.S.)

- Ali Group S.r.l. (Italy)

- AHT Cooling Systems GmbH (Austria)

- Hillphoenix, A Dover Company (U.S.)

- Excellence Industries (U.S.)

- Illinois Tool Works Inc. (U.S.)

- Lennox International Inc. (U.S.)

- Minus Forty Technologies Corp. (Canada)

- Panasonic Corporation (Japan)

- Whirlpool Corporation (U.S.)

- Standex International Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- October 2024: Carrier Global Corporation, a leader in smart climate and energy solutions announced the sale of its commercial refrigeration unit to its long-term joint venture partner, Haier for USD 775 million. This sale includes roughly USD 200 million in net pension liabilities.

- March 2024: Voltas Limited, a part of the Indian multinational conglomerate TATA Group launched its latest range of 5-star Glass Top models, Convertible models, and Hard Top Deep freezers, along with the new Floor Standing Water Dispenser Models in the Spring Series.

- February 2023: Frigoblock, a leading transport refrigeration manufacturer and a brand of Thermo King, began testing and delivering electric multi-temperature vehicles that are energy-efficient and gaining prime preference across the industry.

- September 2022: Frigoblock introduced the new EK Whisper, an under-mount split refrigeration system that delivers lower noise, high performance, and better serviceability due to its compact design.

- February 2022: Honeywell International Inc. introduced a new refrigerant that is non-flammable and suitable for medium-temperature commercial refrigeration uses, exhibiting a GWP of under 150.

REPORT COVERAGE

The commercial refrigeration equipment market analysis report provides an in-depth analysis of the industry dynamics and competitive landscape. The report also provides market estimations and forecasts based on type, application, and geographical regions. It also provides various key insights into recent industry developments, such as mergers & acquisitions, macro and microeconomic factors, SWOT analysis, and company profiles.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.4% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type, Application, and Region |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per a Fortune Business Insights study, the market was valued at USD 51.66 billion in 2025.

The market is expected to reach USD 82.78 billion by 2034.

The market is projected to grow at a compound annual growth rate (CAGR) of 5.4% during the forecast period.

The transport refrigeration segment is expected to lead the market over the forecast period.

Rising investments in the food and beverage industry is a key factor driving market growth.

Carrier Global Corporation, Danfoss, GEA Group Aktiengesellschaft, Daikin Industries, Ltd., Johnson Controls, Nor-Lake, Inc., The Middleby Corporation, Imbera, and AB Electrolux are the leading companies in this market.

Asia Pacific region is expected to show highest CAGR during the forecast period due to the rising demand for frozen and packaged foods as well as a growing number of supermarkets and hypermarkets.

Modular and customizable refrigeration solutions are the key trends in the market.

Based on application, food & beverage led the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us