Frozen Food Market Size, Share & Industry Analysis, By Type (Frozen Ready Meals, Frozen Seafood & Meat Products, Frozen Snacks & Bakery Products, and Others), Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Convenience Stores, and Online Retail), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

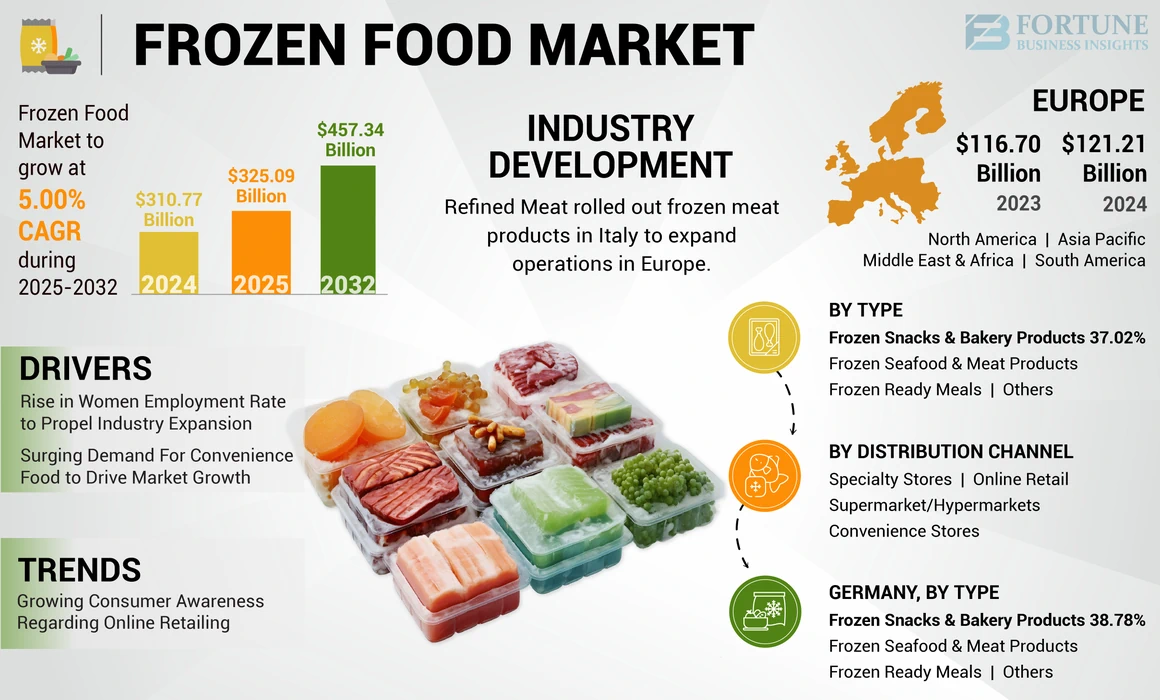

The global frozen food market size was USD 310.77 billion in 2024. The market is projected to grow from USD 325.09 billion in 2025 to USD 457.34 billion by 2032, exhibiting a CAGR of 5.00% during the forecast period. Europe dominated the frozen food market with a market share of 39.% in 2024. Moreover, the frozen food market size in the U.S. is projected to grow significantly, reaching an estimated value of USD 110.23 billion in 2032, driven by the growing importance of higher-shelf life products.

Frozen ready meals, frozen seafood & meat, frozen snacks & bakery, and others such as fruits and vegetables are different types of frozen products available in the global market which are distributed through supermarkets/hypermarkets, convenience stores, specialty stores, and online retail channels.

Countries such as the U.S., Germany, China, France, Spain, and others in Europe and the Asia Pacific region hold a significant share in the market. Furthermore, the demand for frozen ready-to-eat meals is estimated to exhibit substantial growth over the forecast period owing to the rapid growth in urban lifestyle in countries in the Asia Pacific and South America regions.

The global frozen food market experienced a sudden increase in sales due to the panic buying experienced by consumers with the fear of the lockdowns caused by the COVID-19 pandemic. Frozen items and other essentials were the immediate food products sold in the initial days of lockdown due to their longer shelf life.

According to the American Frozen Food Institute (AFFI) and FMI, The Food Industry Association frozen foods were a pandemic powerhouse bringing in USD 65.1 billion in retail sales in 2020, a 21% increase compared to a year ago and is forecasted to grow at a significant CAGR in 2021.

Frozen Food Market Overview & Key Metrics

Market Size & Forecast:

- 2024 Market Size: USD 310.77 billion

- 2025 Market Size: USD 325.09 billion

- 2032 Forecast Market Size: USD 457.34 billion

- CAGR: 5.00% from 2025–2032

Market Share:

- Europe dominated the frozen food market with a market share of 39% in 2024.

- Frozen snacks & bakery products held the major share due to their extensive demand among all age groups.

Key Country Highlights:

- U.S.: Projected to reach USD 110.23 billion by 2032, driven by demand for longer shelf-life products.

- Germany, France, and Spain: Maintain strong market presence in Europe.

- China & India: Rapid growth in urban lifestyle driving demand for frozen ready-to-eat meals.

- South America: Demand for frozen meals rising with changing urban lifestyles.

- Middle East & Africa: Growth driven by advancements in packaging and rising preference for convenience foods.

Frozen Food Market Trends

Rising Consumer Awareness About Online Retailing to Favor Industry Growth

Online retail has shown rapid growth in recent times. This rapid growth is attributed to the rising technological advancements and the resulting launch of new e-commerce platforms and service providers. With the increasing penetration of the internet and rapid growth in smartphone development, the e-commerce industry has shown substantial expansion. In addition, the increasing regulations and support from government bodies to regulate the online shopping industry are expected to contribute toward its rapid growth during the forecast period. For instance, in September 2022, U.S. President Joe Biden announced the National Strategy, which aims to address hunger issues in the country. The strategy plans to promote healthier eating among the U.S. citizens. It includes the development of online grocery shopping and online food label information with assistance from the White House of Federal Nutrition Assistance Programs into the 21st century.

The recent trend among consumers is online shopping. Online retail is one of the major factors fueling the growth of the market. The introduction of various new apps makes it even more convenient for consumers to purchase edible products according to their preferences. There are a variety of products available which attracts the working population as they tend to avoid shopping from retail outlets. According to data published by Eurostat in 2021, around 19.7% of EU enterprises’ e-commerce sales accounted for around 1% of their total turnover.

The growing penetration of smartphone usage and the internet is expected to drive the market growth and to create opportunities for new entrants. In addition, according to the American Frozen Food Institute (AFFI), the vast majority of online retail customers were adding frozen foods to their digital cart. For instance, as per AFFI, in 2020, the household penetration of frozen foods over an entire year of 2020 was 99%, 86% for food items, such as frozen pizza, vegetables or entrees. This trend is expected to sustain in the long run and is expected to boost the market growth during the forecast period. Europe witnessed a growth from USD 116.70 Billion in 2023 to USD 121.21 Billion in 2024.

Download Free sample to learn more about this report.

Frozen Food Market Growth Factors

Increase in Women Employment Rate to Drive Market Growth

In recent years, there has been a significant increase in the women's employment rate. Due to the increasing number of employed women, it has become difficult for them to cook or prepare fresh meals every day. This has resulted in the purchasing of ready meals and frozen meals. According to the U.S. Department of Labor in 2019, womens’ employment rate in China is 43.7%. Similarly, in the U.S., women's employment rate is 46%, and in South Africa, it is 45%. These are among the leading driving factors that are aiding the growth of the market.

According to the International Labor Organization in 2019, the unemployment rate in developed and high-income countries such as the U.S., U.K., Canada, and Germany has fallen drastically. Globally, the 3.3 billion working people are aged 15 and above.

Increasing Demand for Convenience Food to Boost Market Growth

The processed food industry is primarily driven by the convenience offered by ready to eat food products, which attract consumers from every age group. Consumer preference for convenience food and RTE foods has rapidly changed the global market. Packaged foods require less effort and time than cooked items, which is the main factor driving the demand for frozen or convenience food products. Increasing disposable incomes of consumers is another important reason for the market to flourish in the upcoming years.

According to the World Bank, it is estimated that 56% of the world population is expected to live in urban areas and is expected to reach at 68% by 2050. Therefore, the increasing population and hectic lifestyle would fuel the product adoption.

RESTRAINING FACTORS

Rising Consumer Preference for Natural and Fresh Foods to Restrain Industry Growth

Packaged foods, including frozen products, are considered an inferior substitute to fresh foods among certain consumers, which is the major drawback in this market. There is a myth among consumers that edibles stored for more than a year lose its nutrition content. However, these myths were dispelled by the U.S. Food and Drug Administration (FDA) and the IFIC (International Food Information Council). Frozen products can be as good as fresh and natural products. However, consumers in the lower-income group tend to prefer fresh food as they are more concerned about the freshness of the product. As fresh vegetables and fruits are preferred more over the frozen products, this factor may restrain the growth of the market during the forecast period.

Frozen Food Market Segmentation Analysis

By Type Analysis

Frozen Seafood and Meat Products Hold Major Share in Market Due to Rising Frozen Dessert Demand

By type, this market is segmented into frozen ready meals, frozen seafood & meat products, frozen snacks & bakery products, and others.

Among these, the frozen snacks & bakery products segment is expected to hold the major share in the market. This is owing to the extensive demand for frozen snacks including frozen desserts such as ice cream among all age groups. The demand created by developed countries such as Germany, the U.S., the U.K., France, Canada, and developing countries of Asia Pacific and Africa for these products is driving the growth of this segment and is attributed to hold the largest share in the industry. Furthermore, the higher availability of frozen snacks globally and easy access through online sales has boosted the product sales and fueled the market growth.

- The frozen snacks & bakery products segment is expected to hold a 37.02% share in 2024.

An increase in the consumption of French fries and other fast food products such as burgers, pizzas, and wedges is expected to play a significant role in the frozen snacks segment. The frozen meal segment is estimated to grow at a significant CAGR over the forecast period. This is due to the availability and presence of frozen meal products in developing countries. Improved palates and increased disposable incomes are the driving factors for this segment.

To know how our report can help streamline your business, Speak to Analyst

By Distribution Channel Analysis

Availability of Various Products to Promote Sales in Supermarket/Hypermarket

Based on distribution channel, the market is segmented into supermarkets/hypermarkets, specialty stores, convenience stores, and online retail.

The supermarket/hypermarket sector is evolving rapidly and changing the face of retailing industry. Buyers' comfort is the major idea behind the supermarket/hypermarket stores and to capitalize this idea manufacturers are also taking efforts to showcase their products in these stores. As the supermarkets are growing in developing countries, their presence can be seen spreading in tier 2 and tier 3 cities which makes products available in smaller towns. This factor is proving beneficial for the growth of the market in smaller countries and new markets.

REGIONAL INSIGHTS

Europe Frozen Foods Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Europe to Dominate Market due to Increasing Consumer Purchasing Power

Europe is expected to dominate the frozen food market share owing to the rising vegan population in the region, which is expected to drive the sales of frozen veggies. The major growth factors in the region include high consumer purchasing power, economic stability, and change in food preferences. Further, due to hectic lifestyles, the demand for ready-to-eat breakfast products has gained huge popularity. Europe is also one of the most attractive markets in the world, with a high growth potential for baked food products and potato products. The sudden outbreak of COVID-19 increased the sales of frozen edibles in the initial months, which drastically slumped in the following months.

- In Germany, the frozen snacks & bakery products segment is estimated to hold a 38.78% market share in 2024.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific is set to register significant growth over the study period. This is due to the rising consumer adoption of digital retailing platforms. The increasing number of cold chain facilities in various developing countries is also helping regional frozen food market growth. Moreover, an increase in the number of refrigeration facilities in retail shops and increasing availability of preserved foods and free sample offerings through online retails are facilitating the market growth in countries such as India, Japan, and China. Urbanization in various Southeast Asian countries is expected to show tremendous growth in the market.

North America is expected to hold the third-largest market share owing to high consumer awareness regarding the benefits of such eatables. Various regulations have been imposed by the FDA which minimizes the usage of harmful chemicals such as trans fats. Prepackaged foods require minimum cooking as these products are already prewashed, precut, and then frozen, making them portable and giving them an extended shelf life. These factors help aid the growth of the market in the region.

South America and the Middle East & Africa (MEA) are expected to grow at a moderate CAGR over the analysis period and increase its share of the global market. This is owing to increasing advancements in the packaging of packaged foods and beverages. Due to increasing consumer preference toward convenience foods and fast food consumption, the market is expected to display promising potential in the forecast years.

KEY INDUSTRY PLAYERS

Kraft Heinz Co. to Focus on Filling Demand and Supply Gap

Kraft Heinz, a leading market player, is focused on filling the supply and demand gap caused by the COVID-19 outbreak. The company is currently focusing to ensure continuous supply to retail outlets, especially supermarkets/hypermarkets. For instance, in March 2020, the company announced that it is undergoing various seismic changes to fill the demand and supply gap.

Other key players in the market such as McCain Foods, Wawona Frozen Foods, ConAgra Foods, Inc., General Mills, Inc., Bellisio Foods, Nestle S.A., Grupo Bimbo, S.A.B. de C.V., and others are focusing on new product developments, innovations, and partnerships to strengthen their presence in the market.

List of Top Frozen Food Companies:

- General Mills Inc. (U.S.)

- Nestle SA (Switzerland)

- Conagra Brands Inc. (U.S.)

- The Kellogg Company (U.S.)

- Grupo Bimbo S.A.B. DE C.V. (Mexico)

- Lantmannen Unibake International (Denmark)

- The Kraft Heinz Company (U.S.)

- Unilever PLC (U.K.)

- Wawona Frozen Foods (U.S.)

- Tyson Foods, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- February 2024 – Stouffer’s, one of the leading brands known for its frozen foods, announced the launch of its all-new Stouffer’s Single-Serve White Cheddar Mac & Cheese. The newly launched products are designed to increase convenience in cooking with five new ways, including a boil-in-bag, microwave, pizza oven/impinger, rapid-cook oven, and steamer.

- December 2023 – Anthony Mangieri of Una Pizza Napoletana, one of the most well-known chefs, announced the launch of an all-new frozen pizza line called Genio Della Pizza. The product is baked on a woodfire and includes natural Italian ingredients. The aim was to cater to the growing demand for Italian pizza. The launch consists of different flavours, such as plum tomatoes, buffalo mozzarella, basil, sea salt, flour, and oregano.

- May 2022 – Redefined Meat, a known plant-based meat company, announced the launch of its frozen meat products in Italy to expand its operations in the European region owing to its major global market share.

- April 2022 – Prasuma, one of India’s leading Frozen meat brands, announced an expansion in its product portfolio with the launch of its new frozen snacks. The new product launch includes frozen chicken nuggets, frozen veg and chicken spring rolls, and other snack products.

- February 2022 – Seara, a food brand known for its high quality frozen food products, announced its new innovation in the frozen food category with new products. This new product was called Seara Shawaya. The new innovation of Shawaya chicken for roasting filled the gap in market where no other product was available.

REPORT COVERAGE

The market research report provides a detailed analysis of the industry and focuses on key aspects such as leading companies, types, and key distribution channels of the product. Besides this, the report offers insights into the frozen food industry trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market over recent years.

Report Scope & Segmentation:

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 5.00% from 2025-2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Distribution Channel

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 310.77 billion in 2024.

The market is likely to grow at a CAGR of 5.00% over the forecast period (2025-2032)

The frozen snacks and bakery products segment is expected to be the leading type segment in this market during the forecast period.

The rising demand for convenience food products is the key market driver.

Nestle S.A., Kraft Heinz, and General Mills are the major players in the market.

Europe dominated the market share in 2024.

Rising urbanization is expected to drive the adoption of frozen food items globally.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us