Decision Management Market Size, Share & Industry Analysis, By Function (Data Analytics, Business Process & Rule Management, Operation Research, and Robotics), By Deployment (On-Premise and Cloud), By Enterprise Type (Small & Medium Enterprises and Large Enterprises), By Industry (Automotive, BFSI, Healthcare, Manufacturing, Retail, IT & Telecom, and Others) and Region Forecast, 2026-2034

KEY MARKET INSIGHTS

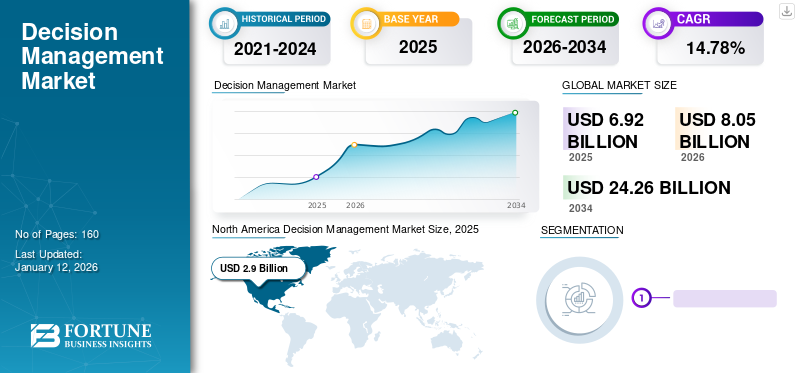

The global decision management market size was USD 6.92 billion in 2025 and is projected to grow from USD 8.05 billion in 2026 to USD 24.26 billion by 2034 at a CAGR of 14.78% during the 2026-2034. period. North America dominated the global market with a share of 41.85% in 2025. Decision management is the method of designing, building and managing automated decision-making systems. It is a business process incorporating advanced analytics and business rules to automate organizational decision-making. Several businesses can use these solutions to support supplier, customer, and consumer interactions. Using decision management, companies change the way they approach their workflow.

Global Decision Management Market Overview

Market Size:

- 2025 Value: USD 6.92 billion

- 2026 Forecast Value: USD 8.05 billion

- 2034 Forecast Value: USD 24.26 billion

- CAGR (2026–2034): 14.78%

Market Share:

- Regional Leader: North America held around 41.85% share in 2025.

- Fastest-Growing Region: Asia Pacific is expected to register the highest growth during the forecast period.

Industry Trends:

- Large enterprises dominate adoption, especially in BFSI, healthcare, manufacturing, retail, automotive, and IT & telecom.

- Integration of AI, analytics, and business rule engines is enhancing automated and scalable decision-making.

- Functional segmentation includes data analytics, business process and rule management, operations research, and robotics-based systems.

Driving Factors:

- Rising demand for operational efficiency and faster decision-making across industries.

- Increasing adoption of automated solutions for financial trading, compliance, and risk management.

- Growing complexity of business decisions, supported by advancements in AI and machine learning.

In the global management decision market report scope, we have included functions offered by companies including Equifax, Inc., Experian PLC, Moodys Investors Service, Inc., SAS Institute Inc., Fair Issac Corporation and Salesforce, Inc., and others.

COVID-19 IMPACT

Increased Initiatives and Advancements by Key Players during the Pandemic Led to Market Growth

The COVID--19 pandemic forced businesses and consumers to adapt to the virtual working environment with minimal physical contact. The two most impacting trends, along with remote working, were using digital tools for consultations, collaboration, and transactions and adopting AI technologies and automation in the workflows. To have automation and AI-driven organizations is one of the top priorities of enterprises today, especially after the pandemic. And hence, these enterprises are more responsive and resilient to the customer's shifting demands. For instance,

- According to a Gartner forecast survey, more than 33% of businesses are predicted to have decision intelligence analysts by 2023. Thus, aiding business leaders with better decision-making capabilities.

Although the deployment of AI and automation took time to accelerate during the pandemic, the economic downturn caused due to the pandemic reduced the technological investments of enterprises.

Such initiatives and advancements by key players help to spread awareness for the deployment of technology in small and medium-sized enterprises and thus fuel the growth of management decision solutions in the market.

LATEST TRENDS

Download Free sample to learn more about this report.

Analytics and Artificial Intelligence Implementation in Decision Management Software Accelerates the Decision Management Market Growth

Decisions made by human beings are based on ethics, principles, and experience. Thus, there is a possibility of biases in such decisions. Whereas machines provide exploration, analytics, alerts, and support for the decision-makers. Gartner's article in 2021 states that 65% of business decisions have become more complex compared to the last two years, as it involves choices and stakeholders. Hence, decision-making capabilities must be improved in a risk-conscious, adaptive, consistent, scalable, and personalized method. Technologies make autonomous decisions through numerous predictions, regulations, optimizations, and other AI capabilities.

AI-based decision automation uses predictive and prescriptive analytics for better scalability, consistency, and speed for making decisions. With decision augmentation, AI offers multiple alternatives for decisions and swiftly analyzes large volumes of data and their complexity. Thus, technological advances, developments and advancements further contribute towards market growth.

DRIVING FACTORS

Ample Use of Decision Management Solutions in Financial Trading Enhances the Market Growth

Applications of software in the finance sector are gaining popularity with the implementation of digital technologies. Firms can make tailor-made enterprise solutions with a platform-based approach to the system. These solutions help financial organizations in customer retention, compliance, risk management, and customer acquisition.

With the increasing requisites for credit resources, related risk also increases. Hence, financial vendors require high-tech solutions to maintain their credit portfolio growth. Various key players in the market are augmenting their product portfolios with new technological advancements. For instance,

- In May 2022, FICCO introduced the FICO Score 4 Suite to expand its financial presence in Mexico. The company has redeveloped the FICO score model with machine-learning mechanisms to extract the existing developments and predict future consumer credit risks.

RESTRAINING FACTORS

Excessive Load of Information on Automation Software Affects the Software Utilities to Hinder the Market Growth

Decision management solutions support systems are incorporated into business operations to make faster and more effective business decisions. But too much information and data in the system can result in an information overload. Such an overload of data puts the user in a dilemma regarding what to consider and what not to consider.

Not every element of the information is required while making decisions, as it becomes difficult for the user to identify the priority-based information. Such overloaded information also affects the system as it faces issues in analyzing indefinable or intangible data. Thus, it affects the overall productivity of the system.

SEGMENTATION

By Function Analysis

Growing Awareness of Data-Driven Analytics by Enterprises to Boost the Segmental Growth

Based on function, the global market is analyzed in data analytics, business process & rule management, operations research, and robotics.

The data analytics segment is projected to hold a significant market position, accounting for 39.14% of the total share in 2026, owing to the growing awareness of data-driven analytics and decision-making among enterprises. For instance, In January 2023, Deutsche Bank developed a Robotic Process Automation (RPA) program by announcing a multibank Data Processing and Reconciliation Solution. The RPA tool aims to provide management with real-time data and actionable insights for decisive strategies.

However, business process & rule management is expected to hold the highest CAGR during the forecasted period. According to IDC, around 8.0% of the AI spending in Asia Pacific is attributed to business processes and automation. By 2026, AI spending on automation and augmentation can reach up to USD 18.5 billion.

By Deployment Analysis

Increasing Adoption of Cloud-based Solutions by SMEs to Lead Market Dominance

The global market is categorized into on-premise and cloud-based by deployment.

The cloud-based deployment model is expected to dominate the market, contributing 67.87% of the market share in 2026 due to their popularity among SMEs and start-ups. Also, many key international players are entering the cloud offerings market. For instance, in January 2023, AWS launched a second cloud infrastructure region (data centres) in Australia. Moreover, cloud-based solutions are expected to grow with the highest CAGR in the forecasted period. As per a study by NASSCOM, Indian enterprises are moving to the cloud for workplace productivity, and around 34% of enterprises use a hybrid cloud.

By Enterprise Type Analysis

Increased Product Portfolios by Large Enterprises to Lead the Market Growth

The global market is bifurcated by enterprise type into large enterprises and SMEs.

Large enterprises are anticipated to represent the leading organization size segment, accounting for 60.63% of the total market share in 2026, owing to various decision management product portfolios offered by large enterprises. These enterprises are entering various markets to expand their global footprint. For instance, in 2022, Etiometry, a clinical decision-support software provider, obtained the CE Mark under the European Union's medical device regulation. However, SMEs are expected to grow potentially with the highest CAGR in the forecast period. In 2022, the European Innovation Council Fund made 42 investment decisions into core technology start-up companies for a total of USD 352.4 million. These factors encourage more SMEs to implement management decision software and services at a rapid pace.

By Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Increased Access Control Over the Autonomous Vehicle Across Automotive Industry to Boost the Market Growth

Based on industry, the market is segmented into automotive, BFSI, healthcare, manufacturing, retail, IT & telecom, and others (government, energy & utilities, etc.).

The BFSI sector is forecast to remain the largest end-use industry, capturing 24.98% of the market share in 2026. Most of the BFSI companies deal with critical credit management for financial operations, which helps to grow decision management in the banking sector. The automotive industry is estimated to grow with the highest CAGR during the forecast period. Owing to increased access control over the autonomous vehicle and the need for a decision-making process regarding fleet management.

REGIONAL INSIGHTS

North America Decision Management Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market has been segmented into five major regions: North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America

North America will likely dominate with the highest decision management market share in 2025. Major players in North American countries are engaging in partnerships, mergers and acquisitions with small businesses to strengthen their businesses and expand their customer base. Moreover, the North American market is highly diverse due to significant players' increasing investment and adoption of advanced technologies such as cloud intelligence and Artificial Intelligence (AI) for automating business processes. For instance, In November 2022, Informatica, a cloud data management provider, announced the availability of an intelligent data management cloud platform for local and state governments. The platform aims to process over 44 trillion monthly transactions in the cloud, enabling government agencies to deliver timely and efficient public services. These factors are contributing to the region’s market growth. The U.S. market is projected to reach USD 1.74 billion by 2026.

Europe

Europe is expected to grow with a notable CAGR during the forecast period. The market is driven by EU-wide digital initiatives that have fostered vibrant regional transformations. Countries are mainly focused on creating a digital sphere with high levels of security. Moreover, many European firms invested in digitalization during the pandemic leading to wider recognition of the importance of the digital transformation. According to July 2021 EIB Investment Survey (EIBIS), more than 46% of the firms in Western and Northern Europe took action to become more digital. The UK market is projected to reach USD 0.33 billion by 2026, while the Germany market is projected to reach USD 0.27 billion by 2026.

Asia Pacific

The Asia Pacific management decision market is expected to grow exponentially during the forecast period. Companies in the region are innovating new decision management products and re-inventing existing products to cater to customer needs. The products are now infused with advanced AI algorithms and data analytics driving better business operational efficiency. Moreover, government and political initiatives and policies are key influencers in organizations' shift towards a digital-first world. The Japan market is projected to reach USD 0.27 billion by 2026, the China market is projected to reach USD 0.32 billion by 2026, and the India market is projected to reach USD 0.31 billion by 2026.

Additionally, the Middle East & Africa (MEA) and South America regions are expected to grow considerably during the forecast period. The region’s growth is accelerated by shifting technological trends such as the Internet of Things (IoT), cloud computing, 5G, Artificial Intelligence (AI) and big data analytics. Key regional players are shifting their focus towards industry 4.0 strategies for creating a digital sphere with advanced technologies.

KEY INDUSTRY PLAYERS:

FICO Issac Corporation Focus on Partnership and Expanding their Product Offerings

FICO Issac Corporation is focused on advancing its network capabilities by partnering and adopting emerging technologies such as machine learning and advanced analytics. In February 2022: FICO partnered with Advanced Financial Solutions (AFS) to increase automated decision management in the Middle East. The partnership aids businesses across the region with access to the tools and firms to make projects effective.

List of the Key Companies Profiled:

- Experian PLC (Ireland)

- Equifax, Inc. (U.S.)

- Moody’s Investors Service, Inc. (U.S.)

- Meridian Link (U.S.)

- Fair Issac Corporation (U.S.)

- CGI, Inc. (U.S.)

- Pega Systems, Inc. (U.S.)

- Sapiens International (Israel)

- SAS Institute, Inc. (U.S.)

- Salesforce, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- February 2023: CGI has announced that it will enter into a nondisclosure agreement with CDPQ to repurchase USD 3.3 million of its stock held by CDPQ. The company delivers excellent results to its shareholders, and its share buybacks are creating an opportunity to monetize a portion of its clients' investments for the benefit of depositors.

- February 2023: Equifax has announced that it has acquired The Food Industry Credit Bureau – Profile Credit, Canada's leading food industry provider. The acquisition increases the breadth of small business insights available to Equifax clients in Canada and worldwide.

- January 2023: SAS and Microsoft partnered with Erasmus MC to develop data-driven innovations to improve healthcare. Through this collaboration, the three parties will implement, develop and monitor data-driven applications across hospitals, bridging the gap between innovation and implementation.

- April 2022: Experian announced the product launches of its new PowerCurve strategy management solution to accelerate business decisions. The launch of PowerCurve, a new cloud-based strategy management solution, enables companies to make better decisions and adapt to dynamic business conditions more quickly and effectively.

- October 2022: Pega System Inc. announced the latest version of its Pega Infinity software suite to transform organizations to deploy apps faster, build smarter workflows, and provide better experiences for employees and customers. With this new capability, brands with enterprise-wide AI increase efficiency, accelerate innovation and improve customer interactions for optimal results.

REPORT COVERAGE

An Infographic Representation of Decision Management Market

To get information on various segments, share your queries with us

The Decision Management market research report highlights leading regions across the world to offer a better understanding to the user. Furthermore, the report provides insights into the latest industry growth trends and analyzes technologies that are being deployed at a rapid pace at the global level. It further offers some drivers and restraints, helping the reader gain in-depth knowledge about the market.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 14.78% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

Function, Deployment, Enterprise Type, Industry, and Region |

|

By Function |

|

|

By Deployment |

|

|

By Enterprise Type |

|

|

By Industry |

|

|

By Region |

(By Function; By Deployment; By Enterprise Type; By Industry, and By Country)

|

Frequently Asked Questions

According to Fortune Business Insights, the global size market is projected to reach USD 24.26 billion by 2034.

In 2025, the market value stood at USD 6.92 billion.

The market is projected to grow at a CAGR of 14.78% during the forecast period.

Based on deployment, the large enterprise is expected to be the leading segment in the market.

Ample use of decision management solutions in financial trading enhances the market growth

Equifax, Inc., Experian PLC, Moodys Investors Service, Inc., and SAS Institute, Inc., among others, are the top players in the market.

North America is expected to hold the highest market share.

Asia Pacific is expected to grow at the highest CAGR during the forecast period

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic