Deep Learning (DL) Market Size, Share & Industry Analysis, By Component (Hardware (Central Processing Unit (CPU), Graphics Processing Unit (GPU), Field Programmable Gate Array (FPGA), Application-Specific Integration Circuit (ASIC)) and Software), By Application (Image Recognition, Signal Recognition, Data Mining, Video Surveillance & Diagnostics, and Others), By Industry (BFSI, Automotive, Healthcare, Aerospace and Defense, Retail & E-commerce, Media and Entertainment, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

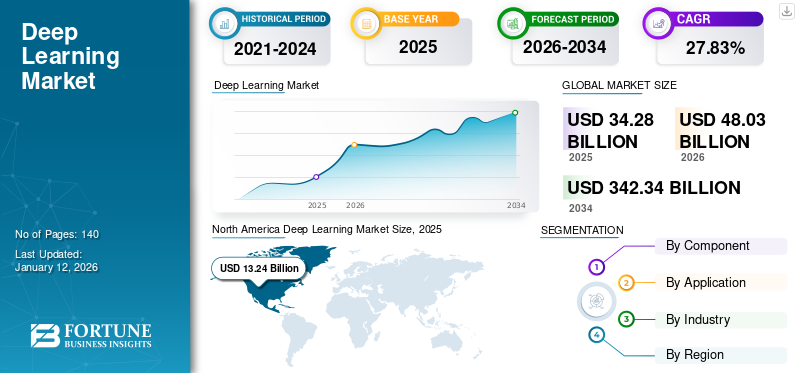

The global deep learning (DL) market size was valued at USD 34.28 billion in 2025 and is projected to grow from USD 48.03 billion in 2026 to USD 342.34 billion by 2034, exhibiting a CAGR of 27.83% during the forecast period. North America dominated the global deep learning (DL) market with a share of 38.61% in 2025.

Neural networks are used in Deep Learning (DL) for tasks such as natural language processing, voice recognition, and machine vision. DL is a subfield of Artificial Intelligence that focuses more on imitating the human brain and machine function. DL is one of the most recent and emerging fields of study and research. The recent improvements in DL are self-driving vehicles, virtual assistance, news accumulation, digital marketing, natural language processing, image & visual recognition, and so on.

According to the State of AI Report 2022, global investment in AI startups and scale-ups is estimated to exceed USD 50 billion in 2023 alone. This brings up huge growth opportunities for DL start-ups and unicorns around the world.

The demand for DL significantly increased during the COVID-19 pandemic. This is due to the growing interest in digital voice assistance among younger generations and increasing focus on virtual reality and augmented reality technologies by various key vendors across regions. For instance,

- In July 2020, a DL-based model that could predict the likelihood of COVID-19 patients with serious illness was presented by Tencent AI Lab and a group of Chinese public health scientists. The method by which the team developed the model using a cohort of 1,590 patients from 575 medical centers in China and additional validation from 1,393 patients was described in detail in Nature Communications. Similar initiatives were undertaken by other tech giants in China to contain the deadly virus. Alibaba, for example, developed a tool with an alleged 90% accuracy rate for institutions to forecast the spread of COVID-19 using ML/DL. According to Baidu, the open-source algorithm for viral structural analysis is said to be 120 times faster than the conventional method.

Deep Learning (DL) Market Trends

Surging Advancements in AI-based Image Generation and Text-based Simulations to Pave the Way for Market Growth

The rapid progress in AI-based image generation and text-based simulation is driving significant growth in the DL market. AI algorithms, particularly those based on generative models, such as GANs (Generative Adversarial Networks), have made remarkable strides in creating realistic images, videos and even audio, permanently setting high standards for design, entertainment and marketing industries. These advancements have enhanced the quality of generated content and accelerated the speed at which it can be produced, reducing the resources and time required for creative tasks.

- According to Adobe, as of August 2023, Dall-E 2 created 916 million AI images, Adobe Firefly generated 1 billion, Midjourney produced 964 million, while the stable diffusion-based models created 12.59 billion images. They collectively amounted to 15.47 billion AI-generated images on the internet.

Furthermore, text-based simulations powered by natural language processing models have enabled more nuanced and context-aware interactions in virtual environments. This technology has found applications in gaming, education and virtual assistants, enhancing user experience and enabling more realistic simulations. For instance,

- In February 2024, OpenAI launched Sora, a deep-learning model that garnered significant attention towards AI-based video generation and video simulations. This development augmented deep learning integrations into AI-based simulation models.

With such advancements and increasing adoption across a wide range of industries, the DL-integrated AI-based solution trends have made significant innovations.

Download Free sample to learn more about this report.

Deep Learning (DL) Market Growth Factors

Increasing Applications in the Automotive Sector Likely to Boost Market Growth

Automobile producers, such as Tesla, Journey, AutoX, and others, are utilizing technologies, including machine learning, Big-Data analytics, artificial intelligence, and others to make their vehicles more in line with the requests of their clients. In addition, expert systems, database management systems, AI, and the Internet of Things (IoT) have greatly simplified industrial tasks.

There are numerous automotive use cases for DL technologies. For instance, DL systems have recently made significant progress in computer vision. Observing the input from a camera, a laser rangefinder, and a real driver, Pomerleau, a Canadian company, used neural networks to automatically train a vehicle to drive.

These factors are likely to contribute toward the deep learning market growth.

RESTRAINING FACTORS

Technical Limitations and Lack of Accuracy to Impede Market Progress

The DL platform has a number of advantages that could help the market grow. However, certain parameters of this technology may impede the market expansion. One of the major limiting elements of the DL platform is undeveloped and inaccurate algorithms. In Big Data and machine learning, precision is critical, and flawed algorithms can lead to defective products. To ensure that the system's parameters are set correctly and that the error margin is close or equal to zero, human interaction is required. The market's prospects may be harmed by this factor.

Moreover, the global shortage of skilled DL professionals creates difficulties in delivering reliable and secure services to organizations, negatively impacting the market growth. Additionally, the lack of standards and protocols within the industry often leads to inconsistencies and difficulties when deploying ML/DL platforms, thereby disturbing seamless business operations. These factors are expected to hinder the market development.

Deep Learning (DL) Market Segmentation Analysis

By Component Analysis

DL Software to be Widely Used to Improve Computing Power and Accuracy

Based on component, the market is bifurcated into hardware and software. The hardware segment is further divided into Central Processing Unit (CPU), Graphics Processing Unit (GPU), Field Programmable Gate Array (FPGA), and Application-Specific Integration Circuit (ASIC).

The Software segment is projected to dominate the market with a share of 54.26% in 2026. The software segment is expected to dominate the market during the forecast period. A type of neural network software, the DL software makes use of algorithms to process data and make decisions. Large amounts of data are taken in, analyzed, and used by this kind of software to make predictions or decisions. Neural Designer, H2O.ai, DeepLearningKit, Microsoft Cognitive Toolkit, Keras, and others are among the most widely used DL software.

In addition, Boxx and NVIDIA have developed workstations that are able to handle the processing power required to construct DL models. Users can test and improve their models with NVIDIA's DGX Station, which it claims is comparable to hundreds of traditional servers. With the help of DL frameworks, Boxx's APEXX W-class products claim to offer more powerful processing and dependable computer performance.

By Application Analysis

DL to Find Wide Usage in Image Recognition Applications to Make Useful Online Content

Based on application, the market is segmented into image recognition, signal recognition, data mining, video surveillance & diagnostics, and others (machine translation, drug discovery).

The image recognition segment is set to account for the largest deep learning market share. Stock photography and video websites can use DL to make visual content more discoverable to users. The technology can also be used in visual recognition and search, allowing users to use a reference image to search for similar products or images. Furthermore, DL is primarily utilized in facial recognition for surveillance & security, medical image analysis, and image detection in social media analytics.

- In March 2021, Facebook launched the Self-supERvised DL solution known as SEER. This solution can learn from any random group of unlabeled images on the internet and work independently through the dataset.

By Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Automotive to Lead the Highest Share due to Rising DL Applications in Automotive

By industry, the market is divided into BFSI, automotive, healthcare, aerospace and defense, retail & e-commerce, media and entertainment, and others (manufacturing).

Automotive is currently the leading segment in terms of market share 21.83% in 2026. From Advanced Driver Assistance Systems (ADAS) and autonomous driving to manufacturing, sales, and after-sales processes, DL has demonstrated significant potential in the automotive industry. Diverse investments are being made to enhance the application of DL in autonomous vehicle features. For instance, Wayve, a London-based startup, raised USD 200 million in January 2022. As a result, the organization will be able to develop DL methods for training and developing AI that can handle challenging driving situations with ease.

During the forecast period, the retail & e-commerce segment will experience significant growth. Personalization, data analytics, dynamic pricing, and recommendation engines are all uses of Artificial Intelligence (AI) in retail. For instance, big brands, such as Zalando and Asos are setting up whole departments for DL to learn more about customers as soon as they visit their websites. Additionally, many major e-commerce platforms, such as Adobe Commerce and Salesforce Commerce Cloud, make use of machine learning algorithms to provide superior customer experience (CX) and deeper analytics insights.

Amazon's recommendation engine accounts for 35% of the company's annual sales, and Alibaba's smart logistics program has reduced delivery errors by 40%.

REGIONAL INSIGHTS

The global market scope is classified across five regions, North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

North America Deep Learning Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

The market in North America will account for the largest market share during the forecast period. The availability of an established IT infrastructure and substantial investments in emerging technologies, such as DL and NLP, are expected to drive market growth in the region. In April 2023, an end-to-end electron and scanning probe microscopy image analysis software package inspired by machine learning was developed by researchers at the U.S. Department of Energy's Oak Ridge National Laboratory. The U.S. market is expected to reach USD 13.57 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Asia Pacific is estimated to record the highest CAGR during 2025–2032. Growing interest in identity verification and the precision and reliability offered by DL in machine vision frameworks are key factors contributing to regional market development. The region's emerging economies, including China, India, and the Philippines, have a thriving startup ecosystem supported by a skilled workforce, which will contribute to the expansion of the regional market share. The Japan market is expected to reach USD 1.99 billion by 2026, the China market is projected to reach USD 2.11 billion by 2026, and the India market is anticipated to reach USD 1.66 billion by 2026.

Europe

Over the forecast period, the market in Europe will experience significant expansion. AI technologies are utilized by a variety of EU businesses. Technologies that automate workflows or aid in decision-making (such as AI-based software robotic process automation), machine learning (such as DL) for data analysis, and technologies that analyze written language (such as text mining) were slightly more frequently used. According to Eurostat data, in 2021, each of these three AI technologies was utilized by 3% of businesses in Europe. The U.K. market is projected to reach USD 2.94 billion by 2026, while the Germany market is anticipated to reach USD 3.15 billion by 2026.

The market in the Middle East & Africa has grown as a result of government projects, cloud computing, widespread adoption of data, and technological advancements. The economies of the Middle East, particularly Saudi Arabia and the United Arab Emirates, are expanding rapidly, and their citizens value technology and want to use it in the local Arabic dialect.

Due to the rising number of digital start-ups in Brazil and increased investment by major players, the South American market is anticipated to expand steadily over the forecast period. New AI policies and coherent strategies have been developed by countries in South America, including Brazil, Argentina, and Colombia, to encourage the adoption of cutting-edge technologies, and future market opportunities are anticipated to emerge in this region.

List of Key Companies in Deep Learning (DL) Market

Leading Players Including Google Inc. Seek Product Enhancement to Boost their Market Growth

Automated machine intelligence solutions are offered by businesses in the market to speed up the development of learning models and reduce time to market. H2O.ai, KNIME, and Dataiku, among other newcomers, have also entered the market and are successfully expanding the number of DL use cases across industries.

- In November 2022, by collaborating with Hackensack Meridian Health and other significant providers, H2O.ai expanded its presence in the healthcare AI market. Hackensack Meridian Health's use of Machine Learning (ML) and Artificial Intelligence (AI) for patient care and network operations was aided by H2O.ai's extensive domain expertise.

List of Key Companies Profiled:

- Advanced Micro Devices, Inc. (U.S.)

- Clarifai, Inc. (U.S.)

- NVIDIA Corporation (U.S.)

- Google Inc. (U.S.)

- IBM Corporation (U.S.)

- Intel Corporation (U.S.)

- Microsoft Corporation (U.S.)

- Amazon Web Services (U.S.)

- SAS Institute Inc. (U.S.)

- Meta Platforms, Inc. (Facebook) (U.S.)

KEY INDUSTRY DEVELOPMENTS

- February 2024 – Cognitiv launched the first deep learning Advertising Platform, redefining media buying for the cookieless future with advanced AI. The company experienced a 7.5X increase in its client base in 2023, showcasing the effectiveness of its DL ad solutions.

- February 2024 – VantAI partnered with Bristol Myers Squibb to accelerate molecular glue drug discovery, combining Myser Squibb’s knowledge in targeted protein degradation with the company’s geometric deep learning capabilities. The collaboration aimed to develop and discover new small molecule therapeutics for therapeutic targets of interest.

- January 2024 – FairPlay Sports Media acquired Quater4, a deep learning neural network company focused on sporting outcome data and predictions. The acquisition aimed to enhance the company’s brands, such as SuperScommesse, Oddschecker, and others, by integrating new technology and data for players, publishers and operators.

- November 2023 – Sony Interactive Entertainment acquired iSIZE, a tech company specializing in AI, particularly deep learning. iSIZE’s focus on ‘AI-powered solutions to distribute bitrate reserves and quality improvements for the media and entertainment industry’ aligns with the company’s efforts to enhance its offerings and technology.

- October 2023 – Huawei launched OceanStor A310 AI storage models, catering to the demands of large-scale deep learning. This solution offered optimized storage for industrial and basic model training and inference in segmented scenario models.

- June 2023 – Sonic DL, a DL-based technology developed to accelerate image acquisition dramatically in Magnetic Resonance Imaging (MRI), was launched by GE HealthCare following the FDA approval. New imaging paradigms, such as high-quality cardiac MRI in a single heartbeat, are made possible by Sonic DL.

- May 2023 – MVTec Software GmbH, a global programming producer for machine vision, sent off variant 23.05 of the standard machine vision programming HALCON. The new release focuses on DL techniques. Deep Counting, a deep-learning-based method capable of robustly counting a large number of objects, is the main feature in this variant.

- May 2023 – Google improved the open-source TensorFlow tooling to speed up the development of machine learning. The organization has carried out a series of open-source AI (ML) innovation updates and improvements for the evolving TensorFlow environment. The Keras API suite, which adds a set of Python-based DL capabilities to the core TensorFlow technology, is an essential component of the TensorFlow ecosystem. Additionally, Google announced two brand-new Keras tools, KerasNLP for natural language processing and KerasCV for Computer Vision (CV) applications.

- March 2023 – NVIDIA and Amazon Web Services, Inc. (AWS) formed a multi-part collaboration aimed at building generative AI applications and improving the AI infrastructure for training increasingly complex Large Language Models (LLMs).

REPORT COVERAGE

An Infographic Representation of Deep Learning Market

To get information on various segments, share your queries with us

The research report includes prominent regions across the globe to get a better knowledge of the industry. Furthermore, it provides insights into the most recent industry trends and an analysis of technologies that are being adopted quickly on a global scale. It also emphasizes on the market’s drivers and restrictions, allowing the reader to obtain a thorough understanding of the industry.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026–2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 27.83% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Component

By Application

By Industry

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market was valued at USD 34.28 billion in 2025.

Fortune Business Insights says that the market is expected to reach USD 342.34 billion by 2034.

A CAGR of 27.83% will be observed in the market during the forecast period of 2026-2034.

In terms of component, the software segment is expected to lead the market during the forecast period.

Increasing application in the automotive sector is one of the key drivers for the market growth.

Advanced Micro Devices, Inc., Clarifai, Inc., NVIDIA Corporation, Google Inc., IBM Corporation, Intel Corporation, Microsoft Corporation, Amazon Web Services, SAS Institute Inc., and Meta Platforms, Inc. (Facebook) are the top players in the market.

Asia Pacific is expected to record a remarkable CAGR.

By application, the video surveillance & diagnostics segment is expected to record the highest CAGR.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic