Degenerative Disc Disease Treatment Market Size, Share & COVID-19 Impact Analysis, By Type {Conventional Drugs (Non-steroidal Anti-inflammatory Drugs (NSAIDs), Corticosteroids, Opioids, and Others), Novel Therapies (Cell Therapy, Platelet Rich Plasma (PRP), and Others)}, and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

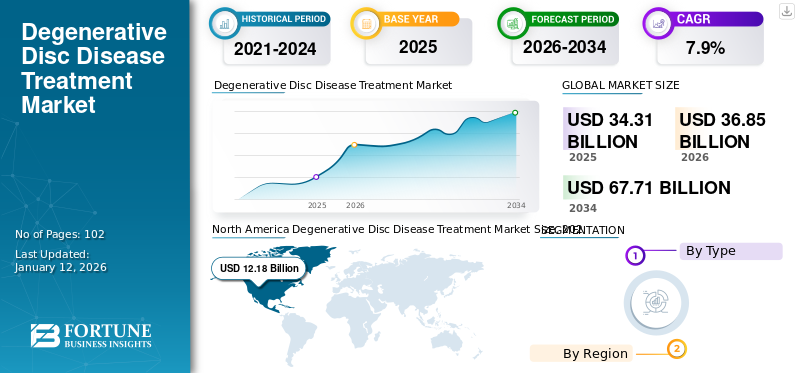

The degenerative disc disease treatment market size was valued at USD 34.31 billion in 2025 and is projected to grow from USD 36.85 billion in 2026 to USD 67.71 billion by 2034, exhibiting a CAGR of 7.9% during 2026-2034. North America dominated the degenerative disc disease treatment market with a market share of 35.51% in 2025.

Based on our analysis, the global treatment market exhibited a slower growth of 6.8% in 2020 than in 2019. The global COVID-19 pandemic has been unprecedented and staggering, with degenerative disc disease treatment experiencing lower-than-anticipated demand across all regions compared to pre-pandemic levels.

Degenerative Disc Disease (DDD) is a condition that is caused by the deterioration of one or more discs between the vertebrae of the spinal column. The damaged spinal disc in that condition causes chronic lower back pain and can even lead to long-term disability in patients. The treatment includes pain relief medications, Non-steroidal Anti-inflammatory Drugs (NSAIDs), steroids, and muscle relaxers. The increasing global prevalence of chronic lower back pain caused by degenerative disc disease among the population, especially in the geriatric population, is one of the major factors contributing to the growing demand for degenerative disc disease treatment.

- According to the 2021 data published by the International Association for the Study of Pain, the point prevalence of Low Back Pain (LBP) was estimated to be about 7.5% of the global population.

Along with this, increasing research and development activities among market players to develop novel therapies and effective drugs for treatment are expected to spur the degenerative disc disease treatment market's growth. However, the limited availability of effective drugs and novel therapies for the treatment of this condition is expected to restrain the growth of the market.

Global Degenerative Disc Disease Treatment Market Overview

Market Size:

- 2025 Value: USD 34.31 billion

- 2026 Value: USD 36.85 billion

- 2034 Forecast Value: USD 67.71 billion, with a CAGR of 7.9% from 2026-2034

Market Share:

- Regional Leader: North America held the largest market share at 35.51% in 2025, driven by the high prevalence of degenerative disc disease, advanced healthcare infrastructure, and increasing demand for innovative treatment options.

- Fastest-Growing Region: Asia Pacific is expected to grow at the highest CAGR during the forecast period, fueled by rising prevalence of chronic low back pain, growing geriatric population, and expanding access to healthcare in emerging countries like China, India, and Japan.

- End-User Leader: The elderly population segment leads the market, due to the increasing incidence of degenerative disc disease and chronic back pain among aging individuals.

Industry Trends:

- Biologics & Regenerative Medicine: Rising adoption of regenerative therapies such as stem cell treatment and platelet-rich plasma (PRP) injections for improved outcomes and reduced side effects.

- Non-Surgical & Minimally Invasive Approaches: Surge in demand for pain management therapies and non-invasive or minimally invasive surgical procedures.

- Pharmaceutical Innovations: Ongoing research into disease-modifying drugs and long-acting pain relief medications.

- Clinical Trials & R&D: Increased investment in clinical trials for novel therapies, such as allogeneic injectable cell therapies.

Driving Factors:

- Increasing Geriatric Population: Age-related degeneration of spinal discs is contributing significantly to the rising demand for treatment.

- Rising Incidence of Chronic Back Pain: Sedentary lifestyles and occupational strain are leading to increased cases of disc degeneration globally.

- Advances in Therapeutic Technologies: The development of cutting-edge medical devices and targeted therapies is expanding treatment options.

- Government & Regulatory Support: Supportive healthcare policies and funding for research into musculoskeletal conditions are fueling market growth.

COVID-19 IMPACT

Disruption in the Demand and Supply Chain Resulted in Slower Growth Amid COVID-19 Pandemic

The COVID-19 impact on the market growth was minimal during the forecast period. The temporary shutdown of orthopedic clinics’ higher focus of healthcare providers on COVID-19 patients is one of the major factors responsible for the slower growth of the market during the pandemic. Also, there was a slight disruption faced by the market players in the supply chain due to COVID-19 restrictions that resulted in a decline in their product revenues for pain relief medications.

- For instance, the revenue of Medrol marketed by Pfizer Inc., a corticosteroid used for various inflammatory conditions such as arthritis and other joint disorders to manage pain, generated a revenue of USD 402.0 million in 2020 as compared to USD 469.0 million in 2019, witnessing a decline of 14.3% in the revenue.

Additionally, the increasing generic competition in the market for lower back pain caused by DDD is also another major factor responsible for the decline in the revenues of market players for their pain relief medications.

- In 2020, Voltaren, a Non-steroidal Anti-inflammatory Drug (NSAID) for pain and inflammation by Novartis AG, generated a revenue of USD 360.0 million, witnessing a decline of around 13.7% as compared to the previous year.

However, the number of patient visits to hospitals, clinics, and other settings gradually increased in 2021 owing to the resumption of services post-COVID-19 pandemic. This led to an increased diagnosis rate of the condition among the population in 2021, which is expected to fuel the adoption of conventional drugs and therapies among the patient population during the forecast period.

Additionally, the market players witnessed growth in their product revenue in 2021 as compared to 2020 due to the recovery of the market from the COVID-19 pandemic.

- For instance, Pfizer Inc. witnessed a growth of around 7.5% in the revenue of Medrol in 2021 and generated USD 432.0 million as compared to the previous year.

Thus, the increasing prevalence of the condition and the rising diagnosis rate among the population are anticipated to fuel the treatment demand in the market.

Degenerative Disc Disease Treatment Market Trends

Download Free sample to learn more about this report.

Shifting Consumer Preference toward Novel Therapies to Support the Market Growth

There are several medications, including Non-steroidal Anti-inflammatory Drugs (NSAIDs), corticosteroids, and others for the management of pain such as chronic lower back pain caused due to degenerative disc disease and other joint disorders.

The adverse effects associated with the drugs, including nausea, dizziness, sedation, and others, and the non-judicious use of opioids are likely to shift patients’ preference toward novel therapies.

Additionally, the rising focus of market players and other research organizations to develop novel therapies such as cell therapy, platelet-rich plasma therapy, and others for the treatment of the condition is expected to increase patients’ preference toward these therapies.

- For instance, in February 2022, DiscGenics, Inc., a clinical-stage biopharmaceutical company focused on developing regenerative cell-based therapies for degenerative spine disorders, announced positive results from its ongoing phase I/II clinical trial for IDCT, an allogeneic injectable cell therapy for DDD.

Similarly, the increasing focus on novel therapies for the conditions and expanding its product portfolio are some of the major factors contributing to the shifting preference of the patient population.

Also, increasing partnerships and collaborations among market players and research organizations to develop innovative and more effective cell therapies for the condition are expected to support the shifting preference of the patient population toward novel degenerative disc disease treatment therapies.

DEGENERATIVE DISC DISEASE TREATMENT MARKET GROWTH FACTORS

Growing Prevalence of Degenerative Disc Disease Among Population to Fuel Demand for Drugs in the Market

The rising prevalence of degenerative disc disease among the population, especially in the elderly population globally, is a crucial factor leading to an increasing patient population. This is leading to higher demand for drugs and therapies.

- For instance, according to a 2021 article published by the National Centers for Biotechnology Information (NCBI), disc degeneration was about 12.4% in the population aged 18–29 years, whereas the prevalence increased to 98.2% among people aged from 60 to 69 years.

The increasing geriatric population globally and rising prevalence of age-related diseases among the elderly population are presenting a large patient pool suffering from degenerative disc disease. This is anticipated to fuel the demand for drugs and therapies for the condition during the forecast period.

- For instance, according to 2020 data published by World Population Ageing, there were around 727.0 million people globally aged 65 years or above in 2020, which is projected to increase to around 1.5 billion by 2050.

Additionally, other factors, such as sports and back injuries causing tears in the discs among the population, especially young adults, are expected to surge the demand for effective therapy for the condition during the forecast period. Thus, the growing prevalence of lower back pain associated with degenerative disc disease among the elderly population, along with the increasing geriatric population, is expected to exhibit a higher demand for treatment in the market during the forecast period.

Increasing R&D Investments for Innovative Drugs and Therapies to Propel the Market Growth

The rising prevalence of the condition among the population contributes to the growing demand for effective drugs and treatment for the condition. This is resulting in an increasing focus of market players and research organizations to develop and launch innovative therapies for degenerative disc disease treatment.

The rising efforts of the market players in R&D activities to develop novel therapies for the treatment of the condition are expected to exhibit a higher demand for degenerative disc disease treatment in the market during the forecast period.

- For instance, in May 2022, Spine BioPharma, Inc., a biopharmaceutical company, focused on developing non-surgical therapies for the treatment of pain and disability from chronic low back pain caused by degenerative disc disease. The company announced the completion of equity financing of around USD 13.0 million by several market players such as Paira Biosciences and others.

Additionally, increasing support from government organizations to support research activities for the development of effective degenerative disc disease treatment is anticipated to accelerate the approval and launches of regenerative products for the condition.

- For instance, in August 2019, DiscGenics, Inc., a nascent biotechnology company primarily focused on developing regenerative cell-based therapies that alleviate pain and restore function in patients with degenerative diseases of the spine, received the U.S. FDA fast-track designation for its investigational cell therapy, IDCT.

Therefore, the growing support from research organizations toward developing and launching effective therapies for the condition is expected to spur market growth during the forecast period.

RESTRAINING FACTORS

Availability of Alternative Therapies for Pain Management Associated with Degenerative Disc Disease to Hamper Market Growth

The patient population uses several methods for lower back pain relief associated with degenerative disc disease. Some of the procedures include Radiofrequency Ablation (RFA), open surgery, and neurostimulation system implants that are highly adopted by the patient population as pain relief procedures.

- For instance, according to a 2021 article published by the Oxford University Press, there was around 50% reduction in average pain intensity among the subjects with chronic low back pain using radiofrequency ablation, and a majority of them experienced clinically significant improvements in the functional outcomes in pain intensity, disability, and pain interference.

Additionally, surgical procedures, such as discectomy, artificial disc replacement, and others for the treatment of this condition, are some of the common alternatives to the condition recommended by surgeons for patients who do not respond to medication or therapeutic injections. The increasing number of approvals and launches of implants by the market players to cater to the demand from the patient population is another factor restraining the adoption of drugs for the condition. Therefore, the availability of various alternative treatment and pain management methods in the market and continuous advancement in the methods are expected to restrict the degenerative disc disease therapeutics market growth.

- For instance, in September 2021, Camber Spine Technologies, LLC. launched SPIRA-P and SPIRA-T implants in the U.S., indicated for degenerative disc disease.

SEGMENTATION

By Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Novel Therapies Projected to Register Comparatively Higher Growth Owing to Rising R&D Activities by the Market Players

On the basis of type, the market is segmented into conventional drugs and novel therapies. The conventional drugs segment is further sub-segmented into Non-steroidal Anti-inflammatory Drugs (NSAIDs), corticosteroids, opioids, and others; novel therapies are sub-segmented into cell therapy, Platelet Rich Plasma (PRP), and others. The Conventiol Drugs segment is projected to dominate the market with a share of 97.75% in 2026.

The increasing prevalence of chronic low back pain associated with degenerative disc disease among the population and the easy availability of medications for pain relief are some factors leading to the rising adoption of these drugs in the market. Additionally, the rising number of product approvals and launches of generic drugs in the market by key players is another factor contributing to the growth of the segment during the forecast period. The Opioids segment is projected to dominate the market with a share of 86.58% in 2026.

On the other hand, the novel therapies segment is expected to grow at a higher CAGR during the forecast period. Rising research and development activities by the market players aim to develop innovative and effective therapies for degenerative disc disease treatment and chronic low back pain due to DDD.

- According to 2020 data published by NIH U.S. National Library of Medicine, a phase I clinical trial for the evaluation of the safety and efficacy of AGA111 drug sponsored by Angitia Biopharmaceuticals is currently being carried out.

Therefore, the increasing focus of the market players to cater to the unmet demand from the patients of DDD is one of the contributing factors to the growth of the segment.

The Cell Therapy segment is projected to dominate the market with a share of 1.95% in 2026.

REGIONAL INSIGHTS

North America

North America Degenerative Disc Disease Treatment Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the global degenerative disc disease treatment market with a size of USD 12.18 billion in 2025. The region is expected to grow at a higher CAGR during the forecast period. The dominance is attributable to increasing prevalence of the condition in the region. Also, the rising adoption of drugs and treatments among the patient population is increasing the demand for novel therapies in the region. This, along with the rising number of mergers and acquisitions among the market players for the treatment, is expected to fuel the growth of the market in the region. The U.S. market is projected to reach USD 11.51 billion by 2026.

The rising prevalence and diagnosis rate of chronic back pain due to degenerative disc disease among the population in the U.K., Germany, and others are some of the factors expected to augment the market growth during the forecast period.

Asia Pacific

On the other side, the Asia Pacific market is expected to grow at the highest CAGR during the forecast period owing to the rising prevalence of chronic low back pain among the population and increasing diagnosis of the condition in the region is leading to rising demand for the drugs for the treatment of the condition. Moreover, rising efforts of the market players to receive approvals for clinical trials in countries such as Japan, South Korea, and others in the Asia Pacific region are expected to fuel the market growth in the region during the forecast period. The Japan market is projected to reach USD 1.46 billion by 2026, the China market is projected to reach USD 4.92 billion by 2026, and the India market is projected to reach USD 2.61 billion by 2026.

- For instance, in September 2019, FibroGenesis issued a new Hong Kong patent with an aim to strengthen its position in fibroblast cell therapy.

Similarly, the increasing prevalence of the condition among the population in Latin America and Middle East & Africa regions, along with the rising focus of the market players to increase their penetration to cater to the growing demand for the treatment, are expected to augment the market growth in the rest of the world during the forecast period.

- For instance, according to a 2021 article published by the National Center for Biotechnology Information (NCBI), the prevalence of chronic pain originating from the spine was around 46.3% among the study subjects (which is 65,000).

Europe

The UK market is projected to reach USD 2.6 billion by 2026, while the Germany market is projected to reach USD 4.41 billion by 2026.

KEY INDUSTRY PLAYERS

Key Companies including Novartis AG, Pfizer Inc., and Eli Lilly and Company Lead the Market with Strong Focus on their Product Portfolio

The global market is fragmented, with several degenerative disc disease treatment players operating in the market. The major companies include Novartis AG, Pfizer, Inc., and Eli Lilly & Company. The dominance of these companies is attributed to several factors such as a strong market presence, strong focus on research and development for developing disc degeneration treatment drugs, and others.

- For instance, in August 2020, Eli Lilly & Company started a clinical trial for the drug, LY3016859, indicated for chronic low back pain. The drug is currently in the phase II clinical trial.

A few players, such as Teva Pharmaceutical Industries Ltd., Ferring B.V., and others, are increasing their focus on product launches and expanding their product portfolio to cater to the rising demand of the patient population. Teva Pharmaceutical Industries Ltd. is one of the leading pharmaceutical companies with a broad portfolio of more than 3,600 medicines, including generics for various therapeutic conditions.

Additionally, emerging players such as FibroGenesis, DiscGenics, Inc., SpineBioPharma, Regenexx, BioRestorative Therapies, Inc., and others are growing their focus and investment for the development of novel drugs and therapies for the condition, resulting in an increasing number of pipeline candidates for degenerative disc disease treatment. These factors are expected to increase the market share of these companies in the future.

LIST OF KEY COMPANIES PROFILED IN DEGENERATIVE DISC DISEASE TREATMENT MARKET:

- Pfizer Inc. (U.S.)

- Novartis AG (Switzerland)

- Eli Lilly and Company (U.S.)

- DiscGenics, Inc. (U.S.)

- Spine BioPharma (U.S.)

- FibroGenesis (U.S.)

- Ferring B.V. (Switzerland)

KEY INDUSTRY DEVELOPMENTS

- March 2022 - Pfizer Inc. acquired Arena, a clinical-stage company developing innovative potential therapies for the treatment of immuno-inflammatory diseases, with an aim to expand its product portfolio.

- December 2021 - Teva Pharmaceutical Industries Ltd. launched Ibuprofen 800 mg tablets, the generic version of Duexis, indicated for pain management in the U.S. with an aim to increase its product portfolio.

- September 2020 - FibroGenesis entered into a manufacturing agreement with iBiologics, one of the leading CDMO for developing and manufacturing autologous and allogeneic cell and gene therapy products, with an aim to supply its allogeneic fibroblast cells to support the ongoing clinical trials.

- October 2019 - FibroGenesis issued a new Japanese patent, providing broad protection of its fibroblast cell therapy in the Japanese market.

- January 2019 – DiscGenics, Inc. announced that the IDCT passed the initially planned safety review of its Phase I/II trial to evaluate the cell therapy in U.S. patients with mild to moderate degenerative disc disease.

REPORT COVERAGE

The degenerative disc disease treatment market research report covers a detailed market analysis and overview. It focuses on key aspects such as competitive landscape, type, and region. Besides this, it offers insights into the market drivers, key trends, market dynamics, COVID-19 impact on the market, and other key insights. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Type

|

|

By Geography

|

Frequently Asked Questions

According to Fortune Business Insights, the global degenerative disc disease treatment market is projected to grow from USD 36.85 billion in 2026 to USD 67.71 billion by 2034.

North America dominated the market with a share of 35.51% in 2025, attributed to advanced healthcare infrastructure and a high prevalence of degenerative disc disease.

The market will exhibit steady growth at a CAGR of 7.9% during the forecast period (2026-2034).

The conventional drugs segment is anticipated to lead the market, driven by widespread use and established efficacy.

Key drivers include the rising prevalence of degenerative disc disease, increasing diagnosis rates, growing research and development activities, and a shift in patient preference toward non-surgical procedures.

Leading companies in the market include Novartis AG, Pfizer Inc., DiscGenics, Inc., Spine BioPharma, and Eli Lilly and Company.

The treatment types include conventional drugs such as NSAIDs, corticosteroids, opioids, and novel therapies like cell therapy and platelet-rich plasma (PRP).

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us