Dialysis Market Size, Share & Industry Analysis, By Type (Products and Services), By Dialysis Type (Hemodialysis and Peritoneal Dialysis), By End User (Dialysis Centers & Hospitals and Home Care), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

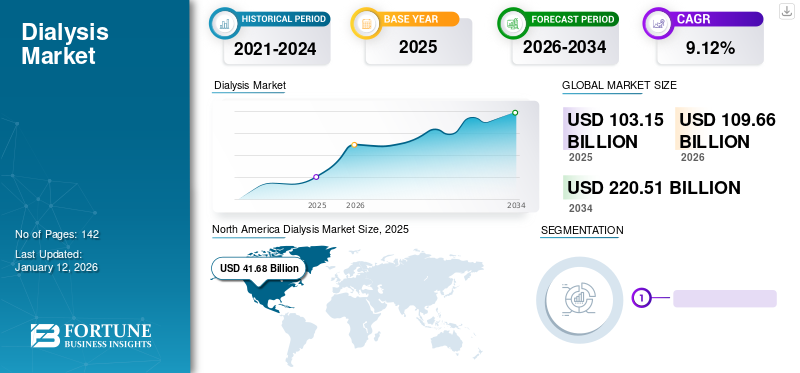

The global dialysis market size was USD 103.15 billion in 2025 and is projected to grow from USD 109.66 billion in 2026 to USD 220.51 billion by 2034, exhibiting a CAGR of 9.12% during the forecast period. North America dominated the dialysis market with a market share of 40.41% in 2025.

The prevalence of chronic kidney diseases is rising at a significant rate, which in turn, has increased patient visits to renal therapy clinics over the last decade. Rise in the number of patients opting for this treatment have increased the demand for products, such as dialysate and hemodialysis machines. As a result of this, key companies are launching new products in the market and expanding their services, thereby accelerating the market growth during the forecast period.

- For instance, in March 2023, Northwest Kidney Centers opened a new outpatient dialysis facility in the Panther Lake area of Kent. The center has 11 dialysis stations that can accommodate approximately 66 patients.

- Also, in May 2022, Diaverum announced the acquisition of booknowmed.com, the world’s leading renal care booking website that allows patients to browse through over 400 dialysis clinics across 54 countries.

- Similarly, in September 2022, Terumo Corporation received approval from the National Medical Products Administration (NMPA), China for its peritoneal dialysis solution.

Such new product launches and the rising prevalence of renal failure and other chronic diseases are expected to increase the patient population seeking this treatment, thereby spurring the market growth.

- For instance, as per the data published by the United States Renal Data System (USRDS) in its 2023 annual report, in 2021, the number of prevalent ESRD patients in the U.S., was 808,536.

The COVID-19 pandemic resulted in the slower growth of the global market. Key players reported a slower, single digit growth in revenues from dialysis products & service offerings owing to a slight increase in the number of patients requiring dialysis during the COVID-19 period.

- For instance, Baxter’s Renal Care segment witnessed a 3.2% increase in its revenue in 2020 as compared to prior year and was valued at USD 3,757.0 million. This growth was attributed to the increased number of peritoneal dialysis patients across the globe.

The market witnessed a comparatively lower growth rate in 2021, 2022, and 2023. However, with the mortality rate reaching to pre-pandemic levels, the market for dialysis products and services is expected to witness considerable growth in the coming years.

Dialysis Market Overview & Key Metrics

Dialysis Market Size & Forecast

- 2025 Market Size: USD 103.15 billion

- 2026 Market Size: USD 109.66 billion

- 2034 Forecast Market Size: USD 220.51 billion

- CAGR: 9.12% from 2026–20324

Market Share

- North America dominated the global dialysis market with a 40.41% share in 2025, driven by the high prevalence of chronic kidney disease (CKD) and end-stage renal disease (ESRD), advanced reimbursement policies, and an established healthcare infrastructure.

- By type, Dialysis Services are expected to retain the largest market share in 2025, due to increasing access to well-equipped renal care centers and rising patient volumes. Additionally, hemodialysis held the dominant position by dialysis type in 2024, attributed to its widespread availability, clinical efficiency, and higher adoption among the aging population.

Key Country Highlights

- Japan: Japan has a rapidly aging population with high incidences of CKD and ESRD, which continues to drive demand for dialysis—especially hemodialysis. Government support and universal healthcare coverage facilitate widespread adoption of dialysis services, particularly in hospital settings. Japanese companies like NIPRO and Asahi Kasei continue to innovate and expand their offerings in both domestic and international markets.

- United States: In the U.S., the number of ESRD patients surpassed 808,000 in 2021, with 71% undergoing dialysis. Programs such as the Advancing American Kidney Health Initiative and increasing investment in home dialysis and wearable artificial kidney technologies are fueling market expansion. Additionally, favorable reimbursement policies, new FDA approvals, and the introduction of digital health solutions such as Baxter’s Sharesource Analytics 1.0 are accelerating the growth of home-based dialysis.

- China: China is witnessing a surge in CKD due to rising rates of diabetes and hypertension. The government is increasing access to dialysis services in urban and rural regions through public-private partnerships. In September 2022, Terumo Corporation received regulatory approval in China for its peritoneal dialysis solution, highlighting growing support for local innovation. The demand for dialysis services is expected to grow further through China's national healthcare reforms and rural healthcare infrastructure upgrades.

- Europe: Europe is the second-largest region in the dialysis market, fueled by an aging population and rising renal disease prevalence. Countries like Italy and the U.K. offer free-of-cost hemodialysis and peritoneal dialysis services through public healthcare systems. In 2022, 46,813 patients were receiving dialysis in Italy alone. The region is also advancing home dialysis adoption, supported by regulatory approvals and government programs promoting at-home care for better quality of life and cost savings.

Dialysis Market Trends

Substantial Shift From In-Center Dialysis to Home Dialysis Identified As Significant Market Trend

In recent years, the concept of home dialysis has gained momentum for the management of chronic kidney diseases. Patients with chronic kidney disorders are required to undergo frequent treatments at hospitals or clinics. The several benefits associated with dialysis at home over hospitals or clinics have resulted in patients shifting their dialysis treatments to homecare settings. Patients opting for at-home hemodialysis are expected to lead more independent lives and may have better chances of survival as compared to those treated at a center. Several studies have demonstrated the improvement in mortality rates in patients receiving hemodialysis at home than those treated at a medical center. Such benefits are expected to increase the adoption of these products in homecare settings.

- For instance, according to an article published by the American Society of Nephrology in November 2021, the use of home dialysis had increased from 14.8% in 2016 to 20% in 2021 among patients with End-Stage Kidney Disease (ESKD).

- Similarly, according to the 25th Annual Report of the U.K. Renal Registry, in 2021, the number of ESRD patients receiving home hemodialysis (HHD) was 1,396. This number increased by 3.4% when compared to that of 2017.

Also, governments in nations, such as the U.S. are engaged in setting up new payment methods to make kidney disease treatments more affordable and accessible, which can increase the preference for low-cost care at home. This factor is estimated to boost the number of patients opting for treatment in homecare settings in the coming years.

Download Free sample to learn more about this report.

Dialysis Market Growth Factors

Rising Prevalence of Chronic Kidney Diseases to Augment Market Growth

The overall burden of ESRD and CKD is one of the highest in terms of healthcare cost. Rising prevalence of chronic kidney diseases and renal failure, coupled with the increasing comorbidity of diabetes and hypertension in a patient, is one of the key factors bolstering this market’s growth. ESRD is the stage when one or both the kidneys permanently stop working properly and the patient needs to undergo long-term renal infusion therapy or receive a kidney transplant. Thus, the rising prevalence of ESRD is increasing the global cost burden of kidney diseases and is one of the key factors increasing the revenue of leading market players.

- For instance, according to the data provided by the National Institute of Diabetes and Digestive and Kidney Diseases (NIDDKD), in September 2021, approximately 786,000 people in the U.S. were living with End-Stage Renal Disease (ESRD), out of which 71% were on dialysis.

- Similarly, according to the 2022 annual report of Fresenius Medical Care, the number of chronic kidney failures across the globe was around 4.8 million in 2022. This number is expected to increase by 3-6% every year.

- Also, according to the 25th Annual Report of the U.K. Renal Registry, in 2021, the prevalence of CKD in the U.K. was 1,176 per million population (pmp) overall. This prevalent population count was 21,334 in 2021.

Furthermore, regulatory authorities are providing approval for the introduction of new products and consumables. With the growing population of dialysis patients, the operating players are focusing on the launch of technologically advanced products to cater for the changing market demands. For instance, in May 2021, the United States Patent Office issued a patent to Victor Gura for a wearable artificial kidney. This device is a miniaturized dialysis machine.

Improved Accessibility to Hemodialysis Centers to Drive Market Growth

The constantly growing number of patients requiring dialysis, especially in low- and middle-income countries, has resulted in a high demand for efficient renal facilities with shorter waiting times. The developed countries have an increasing number of nephrologists, which has, in turn, increased the number of renal care facilities. Moreover, to cater to the rising demand for renal care in emerging economies, investors are focusing more on increasing the network of renal treatment centers in countries, such as India, China, and Mexico. This is expected to increase the market’s revenue in the coming years. The delivery of affordable care in these countries is increasing the number of visits to these facilities.

- For instance, in May 2023, Life Healthcare announced that it had acquired the operations of renal dialysis clinics of Fresenius Medical Care in Southern Africa. Through this acquisition, the company gained operational rights to 51 renal dialysis clinics, thereby expanding its services in the region.

- Similarly, in July 2020, NIPRO CORPORATION acquired NIPRO RENAL CARE PRIVATE LIMITED, an Indian dialysis service provider. This strategic acquisition was made due to India's increasing population of 1.36 billion, with an estimated number of dialysis patients of 180,000 in 2019.

RESTRAINING FACTORS

Risks and Complications Associated with This Procedures to Slow Down Market Growth

Even though the number of patients receiving this treatment is constantly increasing, there are a few factors that may restrain the market growth over the forecast period. One of them is the risks and complications associated with these procedures.

Several side effects and complications are associated with hemodialysis. Also, the creation of access for this therapy is a tedious process that requires accuracy and perfection. The complications associated with hemodialysis access may result in lower adoption. The imbalance of fluids and electrolytes in the body impacts the heart function and blood pressure, resulting in serious complications.

- For instance, according to a study published in BMC Nephrology in August 2020, risk factors for elderly hemodialysis patients include cardiovascular diseases, type of the access, therapy initiation time, and others. Presence of other chronic diseases in the body further increases the risk of mortality in hemodialysis patients.

Furthermore, according to the National Health Services (NHS), Peritonitis (bacterial infection), increased risk of developing a hernia, weight gain, and others are some of the side effects associated with peritoneal dialysis.

Dialysis Market Segmentation Analysis

By Type Analysis

Dialysis Services Gained Momentum Owing to Increasing Prevalence of Chronic Kidney Diseases

Based on type, the market is segmented into products and services.

The services segment is projected to dominate the market, accounting for 77.84% of the total share in 2026 due to the emergence of well-equipped renal care facilities for chronic and acute care across the globe and rising burden of kidney diseases. Due to these factors, the demand for chronic and acute-dialysis services has surged significantly.

- For instance, in August 2024, Innovative Renal Care opened a new state-of-art dialysis center, NCG Piedmont, at Covington to expand its dialysis service offering in the region.

- Moreover, according to the data published by the European Parliament in February 2022, around 100 million people in Europe were suffering from kidney diseases. Patients suffering from these ailments require dialysis to support their kidney health. The increasing prevalence of kidney diseases will increase awareness about the availability of dialysis services, thereby supporting the segment's growth.

Moreover, the products segment is expected to witness healthy growth in the coming years owing to the rising number of local and regional market players to cater to the growing demand for advanced products and consumables.

- For instance, in February 2020, Fist Assist Devices LLC received the CE Mark and began marketing its Fist Assist device for vein enlargement in the European Union and other CE Mark countries. This device increases the vein diameter before fistula placement and assists in fistula vein dilation for hemodialysis in End-Stage Renal Disease (ESRD) patients.

To know how our report can help streamline your business, Speak to Analyst

By Dialysis Type Analysis

Hemodialysis to Gain Traction Owing to Higher Adoption of This Modality

By dialysis type, the global market is categorized into hemodialysis and peritoneal dialysis.

The hemodialysis segment is expected to lead by type, contributing 89.38% of the market share in 2026 and is expected to remain dominant in terms of revenue throughout the forecast period. Inadequate training provided for peritoneal treatment in developed as well as developing countries has reduced the preference for peritoneal dialysis. Moreover, the clinical benefits associated with hemodialysis, such as lesser time and adoption of arteriovenous (AV) fistula are propelling the demand for this procedure. Additionally, the increasing incidence of severe CKD among the geriatric population is augmenting the number of patients requiring hemodialysis treatment.

- For instance, according to an article published in the Journal of Nephrology in September 2020, the incidence rate of stage IV CKD increases with age, hence the demand for hemodialysis treatment is growing.

The peritoneal dialysis segment is expected to witness strong growth over the forecast period. Increase in the preference for peritoneal dialysis over hemodialysis in developed countries is expected to drive the segment's growth during the forecast period. Additionally, demand for at-home peritoneal dialysis treatment is expected to increase in the coming years, thereby accelerating the segment’s growth.

- For instance, according to data published by the NCBI in June 2022, Peritoneal Dialysis (PD) offers numerous benefits over hemodialysis (HD) including cost-effectiveness, increased patient independence, better quality of life, and preservation of residual kidney function, thereby increasing its adoption.

- Also, according to the Hennepin Healthcare Research Institute in Minneapolis, home dialysis use increased from 14.8% in 2016 to 20.0% in 2021 in end-stage kidney disease (ESKD) patients, with peritoneal dialysis accounting for more than 90%.

By End User Analysis

Dialysis Centers & Hospitals to Increase Product Use Owing to Rising Number of Patients Requiring Renal Care

Based on end-user, the market is segmented into dialysis centers & hospitals and home care.

Dialysis centers and hospitals are anticipated to remain the primary end users, representing 83.13% of the total market share in 2026. This is due to factors, such as favorable reimbursements provided by renal facilities & hospitals for renal therapies, rising number of patients suffering from CKD & ESRD, and increasing healthcare expenditure by the population. The segment is also expected to dominate the market throughout the forecast period.

- For instance, in January 2023, six dialysis centers in the UAE’s Al Dhafra region upgraded their services by installing the latest medical equipment and hiring professionally trained medical staff. These factors will increase the number of patients served by the dialysis centers, further driving the segment’s growth.

Homecare is anticipated to be the fastest-growing segment during the forecast period, recording a considerable CAGR. The growth of this segment is attributed to the fact that homecare dialysis is a cost-effective therapy to treat End-Stage Kidney Disease (ESKD). Similarly, the launch of next-generation products for home dialysis will further augment the segment’s growth during the forecast period.

- In June 2021, Baxter launched the next-generation Sharesource Analytics 1.0, a digital health module to enhance the clinical management of home-based Peritoneal Dialysis (PD) patients.

REGIONAL INSIGHTS

On the basis of region, the global market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America Dialysis Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America accounted for a dominant part in the dialysis market share and generated a revenue of USD 38.73 billion in 2023. The region is projected to dominate the market during the forecast period as well. High prevalence of CKD and ESRD in the U.S. and Canada and a higher treatment rate in these countries are the key factors estimated to boost the expansion of the regional market during the forecast period. The U.S. is also projected to witness growth in the demand for dialysis services and products due to the increasing incidence of coronavirus infections that may cause renal failure in some infected patients. The U.S. market is projected to reach USD 40.67 billion by 2026.

- According to an article published by the U.S. National Institutes of Health (NIH) in September 2021, 1 in 7 adults, which is an estimated 786,000 people, in the U.S. were living with end-stage kidney disease.

Europe

Europe is expected to emerge as the second-largest region in this market in terms of size, recording moderate growth in the long run. The region’s robust growth is due to the increasing percentage of the geriatric population suffering from renal disorders. Additionally, the number of patients receiving any form of dialysis therapy has increased over time throughout the region. The UK market is projected to reach USD 4.77 billion by 2026, while the Germany market is projected to reach USD 6.4 billion by 2026.

- According to data published by the NCBI in November 2022, an estimated 46,813 patients were on dialysis treatment in Italy. Both hemodialysis (HD) and Peritoneal Dialysis (PD) therapies provided by renal care units in public hospitals/structures are free of cost to Italian citizens.

Asia Pacific

Moreover, Asia Pacific is expected to witness relatively higher growth in the global market. Funding by public organizations to improve the accessibility of renal care is likely to augment the regional market’s expansion during the forecast period. Also, the increasing accessibility of dialysis services in various regions including remote areas of Asia Pacific countries will further propel the market growth. The Japan market is projected to reach USD 6.04 billion by 2026, the China market is projected to reach USD 7.84 billion by 2026, and the India market is projected to reach USD 3.12 billion by 2026.

- For instance, in March 2022, the Sathyalok free dialysis center was launched with the installation of 10 dialysis machines. The launch was funded by the Rotary Club of Chennai. This facility offered free dialysis to 18,000 people in 2022.

Furthermore, Latin America is expected to witness strong growth over the forecast period. In Brazil, the rising incidence of CKD among the elderly population is boosting the adoption of dialysis products and services.

- For instance, the number of patients on dialysis in Brazil was 148,363 as per the Brazilian Dialysis Survey published in July 2021. This number was higher by 2.5% as compared to that in July 2020.

The Middle East & Africa is estimated to reflect significant growth during the forecast period due to the delayed diagnosis of chronic CKD and ESRD, and growing presence of key players in this region to offer innovative products and services.

- For instance, in May 2023, Rockwell Medical, Inc. collaborated with Global Medical Supply Chain LLC for the distribution of Rockwell's hemodialysis concentrate products in the UAE.

List of Key Companies in Dialysis Market

Diligent Efforts by Leading Companies to Introduce Novel Products Strengthened Their Market Position

The market’s competitive landscape is semi-consolidated, with key players, such as Fresenius Medical Care, DaVita Inc., and Baxter capturing a significant share in 2023. These companies are adopting various strategies, such as focus on getting regulatory approvals and expansion of geographic presence through partnerships & collaborations to expand their customer base.

- For instance, in April 2023, Fresenius Medical Care AG & Co. KGaA expanded its collaboration with DocGo, Inc., with an aim to gain data insights from DocGo, Inc.’s chronic condition management solution.

- Additionally, in April 2022, Fresenius Medical Care North America received the U.S. FDA 510(k) clearance for its VersiPD Cycler System, which is a portable automated peritoneal dialysis system.

- Similarly, in July 2020, Baxter announced a partnership0020with Ayogo Health Inc. to provide digital health solutions for home dialysis. The aim of this strategic partnership was to deliver advanced digital health solutions that train and empower patients with kidney failure.

Apart from these players, other prominent companies, such as B. Braun SE, Medtronic, Asahi Kasei Medical Co., Ltd., and others are also undertaking various strategic initiatives, such as launch of new & innovative products and increasing R&D expenditure to strengthen their market presence.

- For instance, in March 2022, B. Braun acquired Intermedt Medizin & Technik GmbH, a company that prepares dialysis concentrates. With this acquisition, Intermedt’s product portfolio was permanently integrated into B. Braun's comprehensive range of products and services for dialysis therapy.

LIST OF KEY COMPANIES PROFILED:

- Baxter (U.S.)

- B Braun SE (Germany)

- Fresenius Medical Care AG & Co. KGaA (Germany)

- Medtronic (Ireland)

- DaVita Inc. (U.S.)

- NIPRO (Japan)

- Asahi Kasei Medical Co., Ltd. (Asahi Kasei Corporation) (Japan)

- Diaverum (Sweden)

- Kimal (U.K.)

- BD (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- October 2023: Northeast Georgia Health Ventures (NGHV) and Dialyze Direct signed a strategic collaboration to provide home dialysis services to skilled nursing facilities (SNFs) in Georgia.

- August 2023: Fresenius Medical Care partnered with Sarah Bush Lincoln, a regional health system in Illinois, to provide dialysis services to rural patients. Through this partnership, an on-site dialysis program was launched.

- June 2023: NephroPlus, an Indian dialysis service provider, introduced an innovative container dialysis unit in collaboration with Shri Vamshi Hospital. This launch was aimed at providing real-time monitoring, consultation, and other related services to dialysis patients.

- June 2023: Rockwell Medical, Inc. and B. Braun Medical Inc. signed a three-year co-promotion services agreement. Through this agreement, B. Braun was designated as an independent, non-exclusive representative for the promotion of Rockwell’s hemodialysis concentrate products in the U.S.

- May 2023: Life Healthcare announced that it had acquired the operations of renal dialysis clinics of Fresenius Medical Care in Southern Africa.

- November 2022: Fresenius Medical Care North America announced that it had received the FDA clearance for its AquaA water purification system for hemodialysis.

- March 2022: NIPRO announced the commercial launch of its SURDIAL DX Hemodialysis System in the U.S. The device was developed to offer patient-focused features for optimal performance, efficiency, and ergonomics.

REPORT COVERAGE

The market report offers qualitative and quantitative insights on the products and services offered and a detailed analysis of the market’s size & growth rate for all possible segments. Along with this, the report provides an elaborative analysis of the market’s dynamics, emerging trends, and competitive landscape. Key insights offered in the report include the prevalence of CKD & ESRD in key countries, recent industry developments, such as partnerships, mergers & acquisitions, new product launches, reimbursement policies, regulatory scenario, and key industry trends.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2025-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.12% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Type

|

|

By Dialysis Type

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 103.15 billion in 2025 and is projected to reach USD 220.51 billion by 2034.

In 2024, the market value stood at USD 41.68 billion.

The market will exhibit steady growth at a CAGR of 9.12% during the forecast period of 2026-2034.

Currently, the services segment was leading in the market by type.

Growing prevalence of chronic kidney diseases, introduction of technologically advanced products, and government initiatives offering increased access to dialysis are the key drivers of the market.

Fresenius Medical Care, Baxter, and DaVita Inc. are the major players operating in the market.

North America dominated the market in 2025.

Surge in the demand for effective treatment of chronic kidney diseases, increased adoption of technologically advanced systems, and a large patient population base are some of the factors expected to drive the adoption of these products.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us