Gaming Market Size, Industry Share & COVID-19 Impact Analysis, By Game Type (Shooter, Action, Sports, Role Playing, and Others), By Device Type (PC/MMO, Tablet, Mobile Phone, and TV/Console), By End-User (Male and Female), and Regional Forecast, 2023-2030

KEY MARKET INSIGHTS

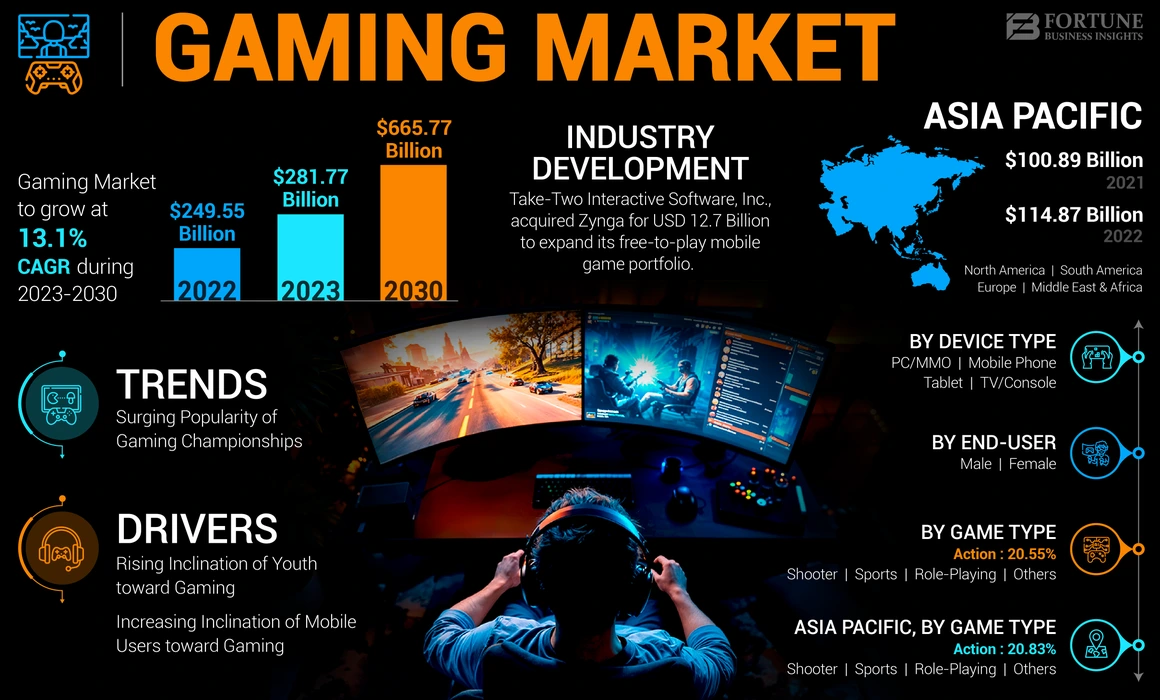

The global gaming market size was valued at USD 249.55 billion in 2022 and is anticipated to grow from USD 281.77 billion in 2023 to USD 665.77 billion by 2030, exhibiting a CAGR of 13.1% during the forecast period (2023-2030). Asia Pacific dominated the gaming market with a market share of 46.03% in 2022.

Large people worldwide are inclined toward gaming as one of their major sources of entertainment. Playing video games offers stress relief, gives the experience of working in a team, and helps provide players with a sense of achievement. Such self-satisfaction and joy are assisting in generating more traction. Additionally, it is an effective tool for calming down playful kids and entertaining older adults considering having more free time. Besides, the escalating expenditure on home entertainment systems worldwide is the driving factor for the gaming industry growth. As per the data published by Digital Entertainment Group (DEG), the U.S. consumer expenditure on home entertainment increased by an annual rate of 8.4%, reaching USD 25.2 billion in January 2020.

Global Gaming Market Snapshot & Highlights

Market Size & Forecast:

- 2022 Market Size: USD 249.55 billion

- 2023 Market Size: USD 281.77 billion

- 2030 Forecast Market Size: USD 665.77 billion

- CAGR: 13.1% from 2023–2030

Market Share:

- Asia Pacific dominated the gaming market with a 46.03% share in 2022, driven by rapid urbanization, growing smartphone penetration, and increasing consumer expenditure on home entertainment systems.

- By game type, the shooter segment is expected to retain the largest market share in 2025, supported by its realistic 3D graphics, tactical missions, and multiplayer functionality that attract a large gamer base.

- By device type, mobile phones are anticipated to hold the dominant share due to rising smartphone adoption and developers’ focus on mobile game creation.

Key Country Highlights:

- Japan: Strong sales of gaming consoles like Nintendo Switch fuel market growth.

- United States: Increasing popularity of gaming among older adults and children, alongside rising home entertainment expenditure, supports market expansion.

- Germany: Government investments in esports development and the gaming sector are expected to boost growth.

- China: Leading position due to large gamer base and investments in gaming technology and virtual reality systems.

- Brazil: Rising internet penetration fuels the popularity of online gaming.

- Sub-Saharan Africa: Increasing smartphone adoption accelerates mobile gaming growth.

COVID-19 IMPACT

COVID-19 Pandemic Resulted in an Increase in Product Demand

A large number of people were forced to spend more time at home due to the precautionary measures adopted by the majority of people worldwide in response to COVID-19. People experienced worry, anxiety, and terror as a result of the pandemic. In addition, social gatherings and outdoor activities were prohibited. All of these factors worked together to boost gaming, which is known to provide relief from a range of mental conditions. According to the World Economic Forum, in September 2020, gaming sales in the U.S. increased dramatically by 37% to reach USD 3.3 billion. These factors supported market expansion during the pandemic.

LATEST TRENDS

Growing Popularity of Gaming Championships to Aid Market Development

Call of Duty, PUBG, and League of Legends video games are widely popular among youngsters due to their high-quality graphic designs and augmented reality-based interactive PC gaming features. The growing popularity of playing championship tournaments in online games will likely increase consumer spending on these games, uplifting the industry’s revenues globally. According to Esports’ data, in 2020, the League of Legends Championship gained a viewership of 3.8 million. In addition, the high price money offered by the video game championship encouraged more people to play a video game, which also acts as a gaming industry trend. For instance, in August 2020, Times Now News declared that PUBG Mobile Global Championship had offered a prize pool of USD 2 million.

Download Free sample to learn more about this report.

DRIVING FACTORS

Inclination of Youth toward Gaming to Favor Market Development

The global youth population increasingly uses video games to occupy their free time, which has played a vital role in enlarging market growth. According to 2020 data from the Entertainment Software Association (ESA), 73% of U.S. parents believe that video games benefit children's education and 66% found better entertainment in family game time. Besides, increasing youngsters’ indulgence in indoor games and other leisure activities, such as painting, crafting, and others accelerates global gaming market revenues.

Increasing Inclination of Mobile Users Toward Gaming to Spike the Product Demand

Due to the increasing adoption of 4G connectivity in smartphones, interactive social media games are becoming more and more popular on mobile devices around the world. Therefore, these games are attracting players from a variety of demographics globally. For instance, in May 2020, data presented by the World Economic Forum.Org mentions that around 48% of the video games industry is contributed by mobile games. Likewise, the booming mobile cellular subscription has also significantly spiked the demand for mobile games. According to data published by the International Telecommunication Union (ITU), in 2022, average global active broadband mobile subscriptions reached 87 per 100 habitats, compared to 78 in 2020.

RESTRAINING FACTORS

Addiction Issues from Intense Gaming to Hamper the Market Growth

The growing number of gamers who intensely play video games, especially among children, is often turned into an addiction. This hampers their studies and gives rise to social anxiety. Thus, such activities repel parents to purchase a gaming system for their children. According to a well-trusted addiction recovery firm called ‘The Recovery Village’ in April 2021, over 2 billion people play video games worldwide and 1–10% of gamers have obsessive addiction issues. In addition to this, addiction to video games can even turn to mental health issues has thus led more parents to repel from purchasing the product for their kids, restraining the market growth.

SEGMENTATION

By Game Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Shooter Segment to Stay at the Forefront Owing to 3D Realistic Graphics

Based on game type, the market is fragmented into shooter, action, sports, role-playing, and others.

The shooter segment is projected to grasp a strong gaming market share over the forecasted period. This is because most shooter games provide 3D realistic graphics, which often come with challenging tactical missions, attractive weapons, and multiplayer game functionality. Therefore, these play a crucial role in helping to attract more gamers to this type of game.

On the other hand, segments such as role-playing, sports, action, and others are also experiencing a decent market enlargement owing to these genres of games being able to meet the desire of a specific target audience, from athletes to women, children, and even the elderly population. The increasing popularity of Game Worlds and other education courses teaching student video gamers about Science, Technology, Engineering, and Mathematics (STEM) education is mainly supporting the Others’ segmental growth.

By Device Type Analysis

Mobile Phones to Hold the Dominant Share Driven by Rising Smartphone Penetration

By device type, the market is divided into PC/MMO, tablet, mobile phone, and TV/console. Mobile phones are anticipated to be dominant owing to rising smartphone ownership. The focus of many game developers is turning to more game creation, especially for mobile devices, which has a big impact on the industry.

However, the PC/MMO, iPad, and TV/console also have strong popularity. Serious gamers frequently choose the majority of these gadgets since they are better able to handle high-definition games, which demand potent processors, graphic cards, and RAM.

By End-User Analysis

Male Segment to Lead Impelled by Availability of a Wide Range of Games

By end-user, the market is bifurcated into male and female. The male segment is estimated to be a bigger market due to the large number of games available, such as action, sports, racing, and others that are designed to be more male-oriented than females. Hence, this plays a significant contribution to male dominance in the industry.

However, the female segment is also increasingly showing a progressive rise, as more females are influenced by online game streaming platforms such as Twitch, where they can gain loyal fans willing to support their channels financially.

REGIONAL INSIGHTS

Asia Pacific is a dominant market shareholder in this market, boasting a size of USD 114.87 billion in 2022. Video gaming consoles observed escalating traction among consumers of this region have played a significant role in the development of this market. For instance, from January 2020 to September 2020, Nintendo Co. Ltd., a Japanese gaming items maker, sold Nintendo Switch 15.6 million units globally. In addition, the rapid growth in the urban population is giving rise to increasing awareness regarding trending video games launched and retailed in the market, which is helping to surge the consumption rate.

Europe is anticipated to show substantial growth owing to the flourishing development of esports, which assists in attracting more people to video games. According to the European Gaming and Betting Association (EGBA) data, e-sports gaming revenues in Europe reached USD 0.1 billion in 2021. Besides, the governmental initiative supporting the development of the newer online games will to fuel its demand among consumers globally. In November 2022, German Games Industry Association invested USD 20.0 million in the development of the German gaming sector.

North America is evaluated to have a robust presence in the market. The growing popularity of playing video games among older adults has spiked product demand. According to data presented by the Entertainment Software Association (ESA), in 2022, 40% of gamers were aged 35 years and above in the U.S. Besides, most of the children in this region carry their smart devices, surging the product's utilization.

South America is demonstrating a substantial rise in the market, which is contributed by the surging growth of internet users in the region. This is favoring the popularity of online games among the South American population. According to data presented by the government of Brazil, number of households with internet connection in Brazil reached 90% of the total households in 2021, up from 84% in 2019.

To know how our report can help streamline your business, Speak to Analyst

The Middle East & Africa region has been assessed to have a considerable presence in the market. The booming growth of smartphone penetration is assisting in hiking the number of people playing mobile games. Therefore, this is helping to accelerate the consumption rate. According to the Mobile Economy report published by The GSM Association, in 2021, smartphone adoption in sub-Saharan Africa reached 64% of the total population in the region. As per the report, the percentage is expected to increase to 75% by 2025.

KEY INDUSTRY PLAYERS

Key Players Depict Growing Inclination Toward Virtual Reality

The market's key players are progressively focusing more on producing a virtual reality gaming system. Such systems are expected to positively impact the gaming market growth in the coming years as they offer a more realistic experience of playing the game. For instance, in February 2020, Sony shared plans regarding its launch of a virtual reality headset for PlayStation 5. In addition, key companies are also constantly moving toward improving the display and graphics of video games for various devices.

LIST OF KEY COMPANIES PROFILED:

- Microsoft Corporation (U.S.)

- Nintendo Co., Ltd (Japan)

- Rovio Entertainment Corporation (Finland)

- Nvidia Corporation (U.S.)

- Valve Corporation (U.S.)

- PlayJam Ltd (U.K.)

- Electronic Arts Inc (U.S.)

- Sony Group Corporation (Japan)

- Bandai Namco Holdings Inc. (Japan)

- Tencent Holdings Ltd. (China)

- Activision Blizzard, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- July 2022 – Sony Corporation, a Japanese electronics giant, invested USD 3.6 billion to acquire Bungie, Inc., a video gaming company, to compete with its rival Microsoft Corporation in the U.S., U.K., and South Korean markets.

- January 2022 – Microsoft Corporation invested USD 68.7 billion to acquire Activision Blizzard, Inc., an American video gaming company, and expand its global cloud gaming industry presence.

- January 2022 - Savvy Gaming Group, a Saudi Arabian gaming company, invested USD 1.08 billion to acquire ESL Gaming Co. and merge it with esports platform FACEIT.

- May 2022 - Take-Two Interactive Software, Inc. invested USD 12.7 billion to acquire Zynga, the social game developer’s FarmVille franchise, and expand its presence in free-to-play mobile games.

- November 2020: Microsoft Corporation declared the launch of the next-generation Xbox video game console. The flagship would be launched along with its cheaper counterpart Xbox Series S.

REPORT COVERAGE

The market research report provides a detailed analysis of the industry and focuses on critical aspects such as major companies, end-users, and leading product types. Besides this, the report offers insights into the current market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors contributing to the market growth over recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

|

Study Period |

2019-2030 |

|

|

Base Year |

2022 |

|

|

Estimated Year |

2023 |

|

|

Forecast Period |

2023-2030 |

|

|

Historical Period |

2019-2021 |

|

|

Growth Rate |

CAGR of 13.1% from 2023 to 2030 |

|

|

Unit |

Value (USD Billion) |

|

|

By Game Type |

|

|

|

By Device Type |

|

|

|

By End-User |

|

|

|

Segmentation |

North America (By Game Type, Device Type, End-User, and by Country)

Europe (By Game Type, Device Type, End-User, and by Country)

Asia Pacific (By Game Type, Device Type, End-User, and by Country)

South America (By Game Type, Device Type, End-User, and by Country)

Middle East and Africa (By Game Type, Device Type, End-User, and by Country)

|

|

Frequently Asked Questions

Fortune Business Insights states that the market size was USD 249.55 billion in 2022 and is projected to reach USD 665.77 billion by 2030.

In 2022, the Asia Pacific market value stood at USD 114.87 billion.

Growing at a CAGR of 13.1%, the market will exhibit moderate growth in the forecast period (2023-2030).

The mobile phone segment is the leading segment in this market during the forecast period.

The youth population being progressively inclined toward video games drives the market growth.

Rovio Entertainment Corporation, Nvidia Corporation, and Valve Corporation are some of the major players in the market.

Asia Pacific dominated the market share in 2022.

The growing number of people owning a smart device are expected to drive the adoption of the market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us