Gas Separation Membrane Market Size, Share & Industry Analysis, By Membrane (Polymeric and Inorganic), By Application (Nitrogen Production, Natural Gas Treatment, Hydrogen Recovery, Vapour Recovery, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

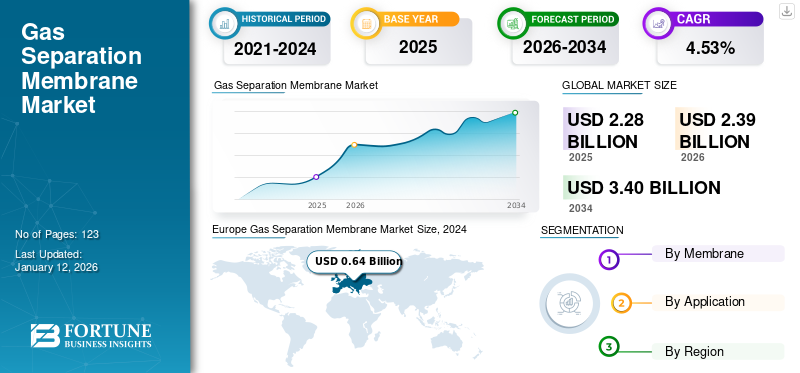

The global gas separation membrane market size was valued at USD 2.28 billion in 2025. The global market is projected to grow from USD 2.39 billion in 2026 to USD 3.40 billion by 2034, exhibiting a CAGR of 4.53% during the forecast period. Europe dominated the global market with a share of 28.31% in 2025.

A gas separation membrane is a device that uses selective permeation to separate gases. One or more components of a gas mixture can be separated using this membrane based on their varying capacities to diffuse across it.

The market is expanding due to the increasing need for effective gas separation technologies, strict environmental restrictions, and the growing need for industrial gases across various industries, including healthcare, manufacturing, and energy.

Evonik is a leading player and holds a major share of the market. The company has made numerous investments in creating high-performance membranes for biogas upgrading and hydrogen recovery.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Emphasis on Sustainability Fosters Market Growth

Globally, governments are acting progressively to combat climate change, and a key component of these initiatives is reducing greenhouse gas emissions. Membranes for gas separation are essential to these sustainability projects. The traditional technique for extracting CO2 from fossil fuels has been amine absorption. However, membrane separation is economical and efficient as it eliminates the need for a gas-to-liquid phase transition. This technique uses less energy and resources to achieve the same objectives.

Moreover, these membranes are suitable for companies concerned about emissions due to their effectiveness and ease of use. By developing cleaner fuels, businesses can cut emissions and the energy required to finish the GHG removal process. This is a key factor in market expansion as more players join initiatives in the battle against climate change.

In October 2023, Evonik announced increased production of gas separation membranes with an investment of tens of millions of dollars in Schörfling and Lenzing, Austria. This expansion is due to the increasing demand for renewable energy-powered sustainable membranes. The shift toward renewable energy is increasing demand for gas separation in the membrane industry.

Rising Demand for Industrial Gases across Diverse Applications Drives Market Growth

Gas separation is essential for many industries, including medical uses such as removing nitrogen and oxygen from the air. Oxygen-rich air is also produced using membrane separation technology. To physically separate oxygen and nitrogen and get oxygen, the technology uses a multi-stage separation process to force air across a membrane that enriches oxygen at a specific pressure. Moreover, this membrane helps in environmental procedures such as carbon capturing, separating carbon dioxide from other gases, and natural gas purification by removing contaminants. The demand for gas separation technology is driven primarily by the food and beverage, electronics, and healthcare industries' growing reliance on industrial gases and the expanding manufacturing sector in developing nations, especially in Asia Pacific. Membrane separation for hydrogen production in petroleum refineries and cryogenic separation for air separation plants, such as those generating oxygen, nitrogen, and argon, are the main beneficiaries.

In January 2025, Arkema and OOYOO signed a Memorandum of Understanding (MOU) to collaborate on developing membrane technology. With a primary focus on Pebax elastomers, which are made with specialized molecular channeling technology to provide high selectivity, chemical stability, and exceptional mechanical strength, ARKEMA will introduce its cutting-edge expertise in polymer synthesis and material type design.

MARKET RESTRAINTS

High Capital Expenditure and Operational Costs are Expected to Hamper Market

Advanced gas separation technologies, such as membrane separation and pressure swing adsorption (PSA), have high upfront costs and operating expenses. For startups or sectors with narrow profit margins, large upfront expenditures are needed for infrastructure, equipment, and facilities (CAPEX), which eventually restricts and inhibits competitiveness and innovation. Furthermore, companies find it more difficult to reinvest in R&D and expansion due to persistent operating costs, including labor, energy, maintenance, and regulatory compliance (OPEX), which can reduce profit margins. As a result, large and established players are frequently favored in high CAPEX and OPEX contexts, which may result in market consolidation and less dynamism. This is expected to hinder the gas separation membrane market growth in the coming years.

MARKET OPPORTUNITIES

Established and Emerging Hydrogen Applications Present New Growth Prospects

The bulk of hydrogen is obtained using steam methane reforming and other traditional techniques, which are highly carbon-intensive and require hydrogen purification before ready usage. As a result, researchers and major players are working to create effective and sustainable processes for producing and purifying hydrogen. It has been demonstrated that membrane-based gas-separation technologies are more effective than traditional ones. In the solution diffusion mechanism, the membrane may be hydrogen-selective or hydrogen-rejective, depending on the affinity of the polymer substance. Hydrogen sensors also employ polymeric membranes as a selective and protective layer. Moreover, these sensors are essential for the hydrogen economy to guarantee worker safety throughout the production, purification, storage, and use of H2.

In March 2025, H2SITE, one of the leading hydrogen separation technology and hydrogen transportation solution providers, announced a collaboration with SNAM to create a cutting-edge project centered on the separation of hydrogen and natural gas mixtures. H2SITE has created a Pd-alloy membrane separator as part of this project that can extract hydrogen in quantities ranging from 2% to 10%. With the ability to separate hydrogen at low concentrations and achieve high recovery rates, this unit will be its largest installation when constructed.

MARKET CHALLENGES

Development of Membranes with High Permeability with High Selectivity Poses a Challenge for Market

The gas flow rate is determined by permeability, while the membrane's capacity to distinguish between different gases is determined by selectivity. Innovative materials and designs involving intricate polymer chemistry or complex nanomaterial integration are needed to develop membranes that overcome this trade-off relation, where boosting one property decreases the other. This restriction must be removed for gas separation procedures to be effective and economical, especially in hydrogen purification and carbon capture.

Defect control in raw graphene monolayers, precise tuning of the nano-channels between stacked 2D graphene sheets, or regulating the pore size and attaining high porosity with large-area graphene membranes, provides significant technological obstacles. Therefore, such materials cannot be employed for industrial, large-area membranes without significant advancements in large-scale, consistent manufacturing.

Gas Separation Membrane Market Trends

Development of Mixed Matrix Membranes for Intrinsic Separation is a Key Market Trend

Mixed Matrix Membranes (MMMs) are the most recent membrane morphology to emerge with potential for future uses with their organic polymer and inorganic particle phases. Inorganic particles, which can be zeolite, carbon molecular sieves, or nanoparticles, are also widely used. With the addition of the inorganic particles and their intrinsically better separation properties, MMMs are capable of achieving higher selectivity, permeability, or both in comparison to the current polymeric membranes. At the same time, a flexible polymer can be used as a continuous matrix to eliminate the inorganic membranes' intrinsic fragility.

For instance, in June 2024, in a study published in the Journal Science, Zhang and his colleagues described a novel kind of porous material that is composed of easily accessible, everyday elements and can hold and separate a wide variety of gases. Furthermore, combining stiffness and flexibility enables size-based gas separation at a significantly lower energy cost.

Download Free sample to learn more about this report.

IMPACT OF TARIFFS

The gas separation membrane industry may suffer from the latest tariffs issued by the U.S., as it will reflect in the price hike of components and raw materials imported from the tariffed nations, especially China. Manufacturers of membranes may witness an increase in production costs, which may make them less competitive in both home and foreign markets. Furthermore, U.S.-based membrane companies may have fewer export options if other nations impose retaliatory tariffs. Additionally, the unpredictability of trade policy may deter business innovation and investment.

SEGMENTATION ANALYSIS

By Membrane

Polymeric Membrane Dominates Market Due to Low Cost and Ease of Bulk Manufacturing

Based on the membrane, the market is segmented into polymeric and inorganic.

Polymeric membrane is the leading segment in the market with a share of 87.01% in 2026. This membrane type is widely preferred due to its lower cost, ease of manufacturing at scale, and versatility in adapting to various gas separation applications.

Inorganic membrane type is the emerging segment in the market with moderate growth. The inorganic membrane has high thermal and chemical stability, making it suitable for application in a harsh environment, which is expected to create demand for this membrane in the forecast period.

By Application

To know how our report can help streamline your business, Speak to Analyst

Nitrogen Production Led Market Due to Cost-Effectiveness and Reliability

Based on application, the market is segmented into nitrogen production, natural gas treatment, hydrogen recovery, vapour recovery, and others.

Nitrogen production held the largest gas separation membrane market share 39.74% in 2026, as nitrogen is widely used in various industries, such as food packaging, electronics, pharmaceuticals, and others. This high demand is catered to with cost-effective and reliable nitrogen generators using membrane technology.

Natural gas treatment is the second leading segment in the market. The growing demand for pipeline-quality natural gas and stricter environmental regulations regarding CO2 and H2S levels fuel the need for membrane-based gas sweetening and separation processes. These factors drive the demand for these membranes for natural gas treatment.

Hydrogen recovery is an emerging segment that is anticipated to depict the fastest growth. The rising demand is due to an increasing focus on hydrogen as a clean energy carrier and the need to recover hydrogen from industrial processes such as refineries and ammonia plants.

Vapour recovery is a niche application and is used in some developed countries, mostly due to its high cost. Stringent regulations regarding VOC emissions from industrial operations and the economic benefits of recovering valuable solvents drive growth in this segment, although its share remains smaller than others.

The others segment includes biogas upgrading, air separation, and other similar gas separation applications.

GAS SEPARATION MEMBRANE MARKET REGIONAL OUTLOOK

Based on region, the market has been segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Europe

Europe Gas Separation Membrane Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Strict Environmental Laws Drive Membrane Demand in Europe

Europe dominates the market due to its strict environmental regulations, driving demand for clean gas processing technologies such as membranes for gas separation. The European Green Deal's strict environmental laws, which include carbon reduction and emissions control, are driving up demand for this membrane in Europe. The need for membranes that can effectively separate CO2 from flue gas is being driven by the increased focus on carbon capture and storage (CCS) systems.

These membranes are used by the chemical and pharmaceutical industries to generate high-purity gases needed for various applications. Furthermore, Europe is anticipated to witness increased hydrogen innovations over the forecast period. In June 2024, under EU State assistance regulations, the European Commission authorized a German plan worth an estimated USD 3.2 billion to help build the Hydrogen Core Network. This hydrogen transmission infrastructure is required to promote the use of renewable hydrogen in industry and transportation by 2030. The legislation will help the EU meet the goals of its Hydrogen Strategy and the Fit for 55 packages.The UK market is projected to reach USD 0.14 billion by 2026, while the Germany market is projected to reach USD 0.19 billion by 2026.

North America

Increasing Application of Gas Membranes in Gas and Food Industries is Driving Demand

Gas separation membranes for natural gas processing, including the removal of CO2 and H2S, are gaining popularity, especially in Canada. Effective purification technologies are required due to the nation's extensive natural gas reserves and export operations. The food and beverage sector also observes increased demand for membrane-based nitrogen-generating systems. In February 2020, the wholly-owned natural gas pipeline systems of TC Energy Corporation approved two major expansion projects totaling USD 1.3 billion. Natural gas from the Western Canadian Sedimentary Basin (WCSB) is to be transported to Alberta markets via the NOVA Gas Transmission Ltd. under the USD 0.9 billion NGTL Intra-Basin System Expansion project.The U.S. market is projected to reach USD 0.53 billion by 2026.

U.S.

Membrane Focus in Energy and Hydrogen Projects Influencing Market Expansion

The U.S. industry is mature due to its well-established petrochemical and natural gas processing industries, but it still has opportunities. Reducing energy usage and increasing the efficiency of current processes are the main goals. The increased focus on renewable energy sources has also increased interest in membrane-based hydrogen separation and purification. In addition, the U.S. is working on numerous pipeline projects for hydrogen. For instance, in December 2022, Gulf Run Transmission LLC, a subsidiary of Dallas-based Energy Transfer LP, announced that it had been approved by the FERC to put the Gulf Run pipeline into service. This pipeline aims to deliver domestically produced natural gas from major U.S. producing regions to meet the rapidly increasing demand from the Gulf Coast and international markets.

Asia Pacific

Rising Membrane Applications in Electronic and Refining Industries are Driving Demand in Asia Pacific

The need for membranes in gas separation is rising in Asia Pacific, particularly in India, Japan, and Southeast Asia. Due to their reliance on a supply of high-purity gases, these countries require gas separation technology for their semiconductor and electronics industries. To address domestic energy demands, India is concentrating on growing its petrochemical and refining sectors, which has resulted in increased investments in gas separation technologies. Additionally, wastewater treatment and air filtration applications are expanding in these regions, driving the Asia Pacific membranes market.The Japan market is projected to reach USD 0.07 billion by 2026, the China market is projected to reach USD 0.28 billion by 2026, and the India market is projected to reach USD 0.1 billion by 2026.

China

China Leads in Membrane Technology Growth as Pollution Control and Cost Efficiency Drive Market Expansion

China is witnessing the fastest market growth, driven by its extensive industrial base and strict environmental restrictions. The need for membrane-based solutions is driven by the need to control air pollution from chemical operations and lower CO2 emissions from power plants. Moreover, China is investing in domestic membrane manufacturing, which reduces costs and boosts the nation's adoption of gas separation membranes, which also covers advancements in carbon capture. In May 2024, China Petroleum and Chemical Corporation, also known as SINOPEC, and TotalEnergies signed a strategic cooperation agreement to expand their partnership, particularly in the field of low-carbon energy. By utilizing their areas of expertise, both companies aim to expand their alliance businesses and specifically intend to pool their R&D resources in biofuels, green hydrogen, CCUS, and decarbonization.

Latin America

Rising Membrane Use in Oil & Gas Sector Drives Demand in Latin America

The market in Latin America is moderate but expanding, especially in Brazil and Mexico, where demand is driven by industries such as oil and gas, which use membranes for dehydration and gas sweetening. The manufacturing sector is also becoming more interested in industrial gas separation and air purification in this region, increasing its demand.

Middle East & Africa

Huge Gas Potential in Middle East Drives Demand for Advanced Gas Separation Membranes

Due to its massive gas and oil output, the Middle East has a high demand for these membranes. They are used in the manufacturing of petrochemicals, improved oil recovery (EOR), and natural gas processing. Gas separation membrane technology is widely used due to the need to reduce gas flaring and the expansion of natural gas production and processing in North Africa, particularly Algeria and Egypt.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Competitive Landscape Defined by Innovation and Dominance of Regional Companies

The market for this market is fragmented due to the presence of specialist regional businesses and well-established international players. Some of the major players include Evonik, Air Liquide, Air Products & Chemicals, Inc., and Linde PLC. With their vast portfolios and well-established distribution networks, these major international corporations compete primarily in large-scale industrial applications and provide various membrane materials, inorganic and polymeric. Some other companies, such as UBE Industries, Toray Industries, Membrane Technology and Research (MTR), and others are producers that concentrate on specific applications and cutting-edge membrane technologies such as assisted transport membranes.

List of Key Gas Separation Membrane Companies Profiled

- Evonik (Germany)

- Air Liquide (France)

- Air Products & Chemicals, Inc. (U.S.)

- Linde PLC (U.K.)

- UBE Corporation (Japan)

- Parker Hannifin Corporation (U.S.)

- Pentair (U.K.)

- Toray Industries (Japan)

- FUJIFILM (Japan)

- Compact Membrane Systems (U.S.)

- Delta Engineering BV (Netherlands)

- Borsig (Germany)

- Membrane Technology & Research Inc. (U.S.)

- Generon IGS, Inc. (U.S)

- SPG Steiner (South Korea)

KEY INDUSTRY DEVELOPMENTS

- September 2024: Evonik introduced the SEPURAN Green G5X 11 biogas membrane, its recent offering. The membrane is specifically constructed to maximize sustainability and efficiency gains in biogas upgrading projects, along with upgrading biogas to renewable natural gas (RNG) in large landfills, agricultural, organic waste, and wastewater treatment projects.

- May 2024: Air Products announced the introduction of the new PRISM GreenSep liquefied natural gas (LNG) membrane separator to manufacture bio-LNG. When producing bio-LNG, PRISMGreenSep LNG membrane separators remove the need for intermediate purification methods such as amine scrubbing or thermal swing adsorption, increasing bio-LNG yield while lowering energy and operating costs.

- April 2024: Air Liquide is further increasing its capacity in biomethane, which is also referred to as Renewable Natural Gas (RNG) in the U.S. The circular economy in waste management will be promoted by these production units, which will generate biogas from manure feedstock in an anaerobic digester with a total production capacity of 74 GWh and return the digested waste for the farmers' requirements. After being converted into RNG using Air Liquide's exclusive gas separation membrane technology, the biogas will be fed into the natural gas grid.

- November 2020: Evonik Industries, a specialty chemicals firm, and Linde Engineering partnered to create membranes that allow for the energy-efficient processing of even CO₂-rich natural gas.

- January 2020: Linde established a new unit in operation at its Dormagen location to separate hydrogen from the natural gas network. The membrane technology created by Evonik is the central component of the plant.

Investment Analysis and Opportunities

- Investments in the gas separation industry offer numerous investment prospects due to the growing need for sustainable and effective separation technologies in sectors such as hydrogen production, petrochemicals, and natural gas processing.

- Investors and major players are focusing on developing advanced membrane materials and module designs. Moreover, investments in manufacturing high-performance, low-cost solutions for certain gas separation problems create numerous growth opportunities.

- For instance, in May 2025, Borna Membrane Solutions (SCD), a well-known clean-tech company in Canada, announced plans to invest USD 40 million to build a plant that will produce gas separation technologies, carbon separation technologies, flare gas recovery systems, and reinjection solutions for the Egyptian natural gas network. As the Canadian government considers the Egyptian market with enormous growth potential, it encourages businesses seeking to make new investments.

REPORT COVERAGE

The global gas separation membrane market report delivers a detailed insight into the market and focuses on key aspects such as leading companies. Besides, the report offers insights into the market trends & technology and highlights key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.53% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Membrane

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 2.28 billion in 2024.

The market is likely to grow at a CAGR of 4.53% over the forecast period.

The nitrogen production segment is the leading application of the market.

The market size of Europe stood at USD 0.64 billion in 2025.

Increasing emphasis on sustainability and rising demand for industrial gases across diverse applications drive demand for gas separation membranes, driving market growth.

Some of the top players in the market are Evonik, Linde plc, and Air Products & Chemicals, among others.

The global market size is expected to reach USD 3.40 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us