Hand Wash Market Size, Share & Industry Analysis, By Product (Ordinary Hand Wash and Waterless Hand Wash), End-User (Commercial, Residential, and Industrial), Sales Channel (Pharmacy Stores, Supermarket/Hypermarket, Online Channels, and Others), and Regional Forecasts, 2025-2032

KEY MARKET INSIGHTS

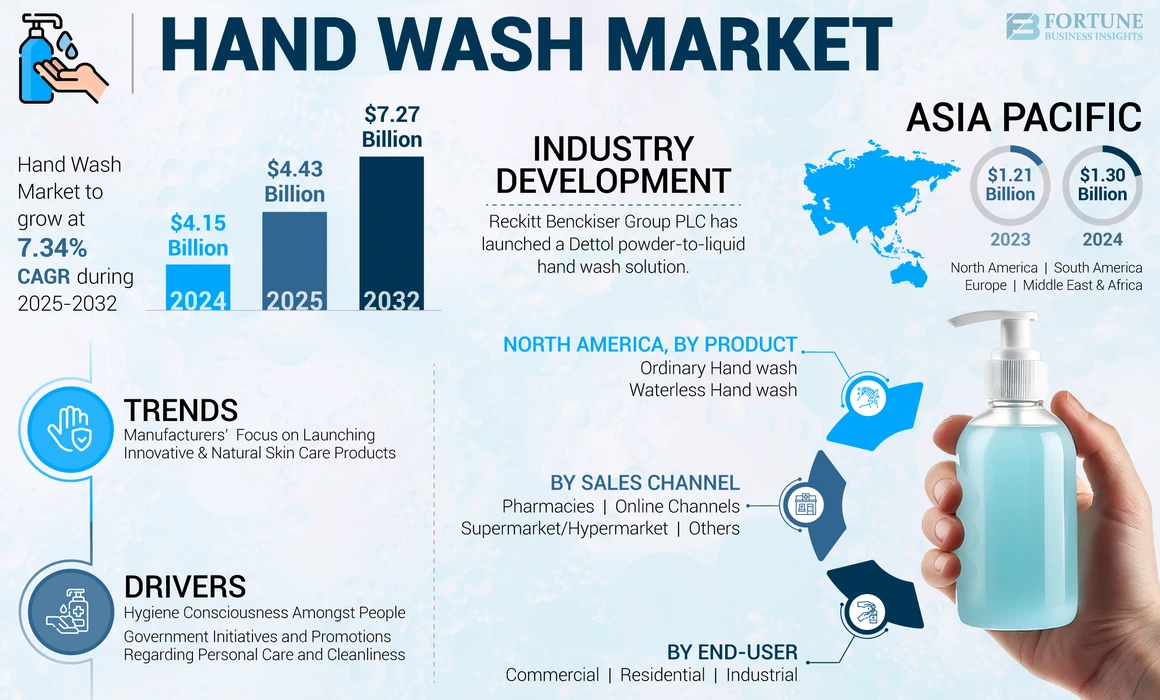

The global hand wash market size was valued at USD 4.15 billion in 2024. The market is projected to grow from USD 4.43 billion in 2025 to USD 7.27 billion by 2032, exhibiting a CAGR of 7.34% during the forecast period. Asia Pacific dominated the hand wash market with a market share of 31.33% in 2024.

Hand wash is a widely popular personal care items as it provides adequate germ protection to the hands. The rising incidence of diseases such as diarrhea, intestinal disorders, and others, coupled with the increasing hygiene awareness among the global population, influences the demand for personal care accessories. Furthermore, increasing dust and environmental pollution problems across the globe give rise to the necessities for skin hygiene and sanitary groceries.

Nowadays, manufacturers are keen to incorporate newer synthetic and naturally available ingredients in the design of the various personal care groceries to provide effective cleaning solutions. Companies have come up with different shapes of bottled sanitary items to attract consumers to purchase. Launching innovative solutions and inventory and supply chain management are crucial factors in developing personal care products.

The rising awareness related to personal hygiene, especially in the rural areas and the uncertain occurrences of COVID-19 pandemic diseases such as COVID-19, SARS, and MERS, are likely to boost the demand for sanitary items. The personal care items helped in the contributing to the prevention of human-to-human infection transmission rates. According to the American Academy of Family Physicians article, April 2020, washing of palm and fingers properly is still a practical tip to safeguard oneself against the spread of coronavirus.

GLOBAL HAND WASH MARKET SNAPSHOT

Market Size & Forecast:

- 2024 Market Size: USD 4.15 billion

- 2025 Market Size: USD 4.43 billion

- 2032 Forecast Market Size: USD 7.27 billion

- CAGR: 7.34% from 2025–2032

Market Share:

- Asia Pacific led the global hand wash market with a 31.33% share in 2024, driven by rising hygiene awareness, population growth, and government sanitation initiatives in China, India, and Southeast Asia.

- By product type, the ordinary hand wash segment dominated the market in 2024 due to its high hydration and bacterial protection properties. These gel and liquid-based products are widely preferred across households and commercial facilities.

Key Country Highlights:

- China: Rapid urbanization and increasing pollution are contributing to greater adoption of personal hygiene products, especially among young, health-conscious consumers.

- India: Government programs like Swachh Bharat and expansion of rural sanitation drive rising demand; growing online availability further boosts accessibility.

- United States: High consumer preference for premium and foaming hand washes; brands like Dettol launched moisturizing variants with Aloe Coconut and Strawberry fragrances.

- United Kingdom: Government infrastructure spending and rising household awareness contribute to expanding market presence.

- Brazil & Argentina: Strong hospital infrastructure and hygiene campaigns in rural areas support growth of personal care usage.

- Europe: Rising tourism and hospitality investments across France, Spain, and Italy are increasing demand for hand hygiene products, supported by leading brands like L'Oréal and Unilever.

Hand Wash Market Trends

Manufacturers’ Focus on Launching Innovative and Natural Skin Care Products is a Vital Trend

Manufacturers are keenly focusing on various innovative products that provide cleanliness and protection from viruses and bacteria and help limit the problems of dead skin, anti-aging, dark spots, and others. For instance, the launch of an anti-aging hand wash from Vaadi Herbals named ‘Anti-wrinkle Olive and Green Apple’ acts as a great opportunity for the market's growth. - new opportunities for the companies to expand their business in the natural personal care segments. Also, increasing demand for the scented skincare items would create newer opportunities in the aromatic skincare category.

- Asia Pacific witnessed hand wash market growth from USD 1.21 billion in 2023 to USD 1.30 billion in 2024.

Download Free sample to learn more about this report.

Hand Wash Market Growth Factors

Increasing Hygiene Consciousness Amongst People to Drive Growth

The growth of the global economy has resulted in a changing lifestyle and a higher standard of living and, thereby, the adoption of a health-conscious approach towards life. This increases the consumption of personal care products for health protection purposes. Nowadays, people are more inclined towards yoga activities and stretching practices to keep their body fit and active during the lockdown period and to increase the immunity of the body to get rid of pandemic diseases such as COVID-19.

Moreover, the large presence of the hospitals and clinical facilities is likely to boost the demand for sanitary items, as various hygiene and personal care groceries are essentially used in hospitals to maintain sanitation and a germ-free environment. Additionally, the growing infrastructural facilities such as schools & colleges, hotels and restaurants, corporates, and residencies are fostering the demand for the products. The continuous product innovations by manufacturers and the adoption of various strategies such as product launches, business expansion, new promotion strategies, and others will further drive market growth. For instance, in October 2021, Reckitt Benckiser Group PLC, which deals in consumer brands such as health, hygiene, and nutrition, launched a foaming hand wash range under the brand name Dettol. The foaming hand wash product keeps the hand moisturized owing to its soothing components and moisture–rich foam and it also ensures 10x better germ protection. Furthermore, the product is available in two variants: Aloe Coconut and Strawberry fragrance.

Thus, a rise in awareness regarding hygiene, an increasing number of hospitals, and the growing product innovation by manufacturers will further boost the product demand.

Government Initiatives and Promotions Regarding Personal Care and Cleanliness to Aid Growth

Various governmental promotions and programs related to personal hygiene and care influence the demand for personal care items, driving the market growth. According to the report ‘Personal Hygiene,’ published by Victoria State Government of Education & Training, the Government of Victoria has launched a personal hygiene care and learning plan to spread awareness regarding hand hygiene products among school students, teachers, and other staff.

Furthermore, the increasing awareness regarding the importance of sanitation with the help of various promotional campaigns through websites, radio, television, social media sites, print media, and others is likely to boost the usage of palm and finger cleansing groceries. For instance, according to the article, ‘Show Me the Science - Why Wash Your Hands?’ published by the Centres for Disease Control and Prevention, in the U.S., handwashing education is estimated to result in the reduction of 23-40% of sickness caused by diarrhea, 16-21% by respiratory infection, and also 29-57% by gastrointestinal illness.

RESTRAINING FACTORS

Higher Cost of Raw Materials and Availability of Substitute Products to Restrain Market Growth

The higher cost of materials used for manufacturing washers such as glycerin, fragrances, sodium lauryl, ether sulfate, and others creates hindrances in the manufacturing process. The raw materials with a higher cost are expected to result in the higher pricing of the products, which is likely to decrease the demand for the products. Additionally, the availability of substitutes such as sanitizers, soaps, hand wipes, and others would also restrain the market growth.

Hand Wash Market Segmentation Analysis

By Product Analysis

Ordinary Segment Dominates Backed by High Bacterial Protection Property

Based on the product, the market is segmented into ordinary and waterless hand wash. The ordinary segment dominates the market as these items provide more hydration and bacterial protection to the skin. Ordinary hand wash items are available in the form of gel and liquid.

However, the waterless segment exhibited significant traction in their demand as they quickly helped dry the palms after applying the foam and spray-based dehydrated items.

To know how our report can help streamline your business, Speak to Analyst

By End-User Analysis

Commercial Segment to Lead Stoked by Rising Cleanliness in Schools and Hospitals

By end-users, the market is segmented into residential, commercial, and industrial.

The commercial segment includes offices, schools, restaurants, hotels, and others. This segment is expected to grow with a major hand wash share market due to the growing necessity for clean and hygienic environments in schools, hospitals, clinics, and other commercial places, giving rise to the demand for cleansing items. Additionally, the thriving commercial sector is further likely to fuel the segmental revenues.

The residential segment showcases the fastest growth owing to the increasing demand for personal care products from households and residencies. Moreover, increasing government support regarding the development of the residential sector enhances the necessities to keep sanitation and hygiene in their homes and thereby fosters the demand for washing items.

According to the report ‘National Infrastructure Delivery Plan 2016-21’, published by the Infrastructure and Projects Authority, the U.K. government’s investments are expected to reach USD 521,920 million for a total of 600 infrastructural projects by 2020-21.

However, the industrial segment is set to experience considerable growth within the forecasted period. The growing numbers of working populations in the manufacturing industries and their increasing demand for skin cleansers would propel the development of this segment. According to the Bureau of Labor Statistics data, 12.7 million people are estimated to be working in the manufacturing industries in the United States.

By Sales Channel Analysis

Supermarket/hypermarket Segment to Dominate Fueled by Availability of Numerous Products

The market is grouped into supermarket/hypermarkets, pharmacies, and online channels based on the sales channel.

The supermarket/hypermarket segment is expected to dominate the market the distribution channel segment owing to the easy availability of a wide variety of products in a single store and the provision of coupons, vouchers, and discounts by the stores, which attract the consumers to shop various products in these stores.

Furthermore, the pharmacies segment is also exhibiting considerable growth as many grocery supplies are getting sold for the hospitals, clinics, and medical facilities for cleanliness purposes.

However, the online channel of distribution is expected to exhibit flourishing growth due to the growing demand for e-commerce and drop shipping businesses across the globe.

REGIONAL INSIGHTS

Asia Pacific Hand Wash Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The North America region is expected to grow with a significant CAGR due to the growing demand for palm cleansing products and also due to an extensive hit of the COVID-19 outbreak in countries such as the U.S. and Canada. According to the data released by World Health Organization (WHO), there have been 103.44 million confirmed cases of COVID-19, with 1.13 million deaths in the U.S. from January 2020 to May 2023. Moreover, the strong presence of various beauty and personal care companies such as Gojo Industries Inc., Hand Sanitizer Inc., and others in the region is likely to foster the supply of sanitary items.

The escalating urbanization rate in developing countries such as China and India would lead to healthier and hygienic routines among the people. Furthermore, the growing manufacturing industries in the countries would increase the dust and air pollution problems and support the demand for the personal care products.

Additionally, various governmental promotions and programs' rising awareness regarding hygiene and cleanliness is set to propel the segment's growth further. According to a report released by the Press Information Bureau (PIB) Government of India, due to the launch of the Swachh Bharat Mission by the government of India, sanitation coverage in rural India rose considerably from 39% in 2014 to 76% in January 2018.

Europe is estimated to be the fastest-growing region during the forecast period because of the presence of giant hand cleaners manufacturing brands such as L'Oréal, Unilever, Avon, and others. These brands utilize more advanced promotional campaigns to attract a large number of consumers in the region. Additionally, the fostering tourism sector in countries such as France, Spain, the U.K., and Italy, along with the growing construction of facilities such as hotels, resorts, restaurants, and others, is likely to increase the demand for the product in the region. As per the Lodging Econometrics (LE) Research's data, in Europe new hotel opening forecast assumes that 424 new hotels with 61,534 rooms will open in 2023, and 396 new hotels with 55,280 rooms will open in 2024.

South America and the Middle East & Africa are also projected to observe substantial growth owing to the increasing practice of attending several programs and campaigns to keep oneself clean and in a hygienic environment. For instance, according to Work 4 Work, Unilever’s Lifebuoy soap brand has established advanced body washing programs in various countries of Latin America and sub-Saharan Africa. Moreover, robust facilities related to the hospitals and clinics in the rural areas of countries such as Brazil and Argentina would increase the consumption of personal hygiene products.

To know how our report can help streamline your business, Speak to Analyst

Key Industry Players

Product Innovation and Promotional Activities Play an Important Role for Key Players for Business Expansion

Key players are keenly working on the innovation in the washing item’s design to provide efficient personal hygiene solutions to the people. This includes using naturally benefitting ingredients such as lemon, strawberry, passion fruit, aloe vera, and others in the product, which helps heal the skin and provides smoothness. Also, the implementations of effective promotional strategies and distribution strategies are important aspects for the key players in the market.

LIST OF TOP HAND WASH COMPANIES:

- Unilever PLC (U.K.)

- Avon Product, Inc. (U.K.)

- Henkel AG & Co. KGaA (Germany)

- Procter & Gamble Company (U.S.)

- Reckitt Benckiser Group PLC (U.K.)

- Vi-Jon, Inc. (U.S.)

- Godrej Group (India)

- 3M (U.S.)

- S. C. Johnson & Son, Inc. (U.S.)

- Amway Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS:

April 2023 - Reckitt Benckiser Group PLC has initiated a new campaign urging customer to use more hand wash liquid instead of soap. The latest, upgraded moisture seal formula softens the hand and provides a pleasant fragrance.

September 2023 - Reckitt Benckiser Group PLC launched a Dettol powder-to-liquid hand wash solution. The launch will help the company increase its product line and customer base.

September 2023 – INEOS has introduced a hand wash product at reasonable prices in Europe and U.S. The new product launch will help the company in increasing its sales and revenue of the company.

October 2021 - Reckitt Benckiser Group PLC has launched a foaming hand wash range of products. The product is available in two varieties - Aloe Coconut and Strawberry fragrance.

REPORT COVERAGE

The market research report includes a detailed analysis of the market and focuses on key aspects such as leading companies, product types, and leading application areas of the product. Besides this, the report offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 7.34% from 2025 to 2032 |

|

Segmentation |

By Product

|

|

By End-User

|

|

|

By Sales Channel

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size is projected to reach USD 7.27 billion by 2032.

In 2024, the market value stood at USD 4.15 billion.

Growing at a CAGR of 7.34%, the market will exhibit strong growth over the forecast period (2025-2032).

The ordinary hand wash segment is expected to lead the market during the forecast period.

The increasing health consciousness of an individual is driving the market.

Unilever and Reckitt Benckiser are the leading players in the global market.

North America dominated the market in 2024 in terms of share.

The introduction of non-toxic products by manufacturers and the increasing awareness of personal hygiene, especially among the rural population, would drive the adoption of hand wash.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us