Healthcare Analytics Market Size, Share & Industry Analysis, By Product (Descriptive Analysis, Predictive Analysis, and Prescriptive Analysis), By Application (Financial Analytics, Clinical Analytics, Operations and Administrative Analytics, and Population Health Analytics), By End-User (Payers, Providers, and Others), and Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

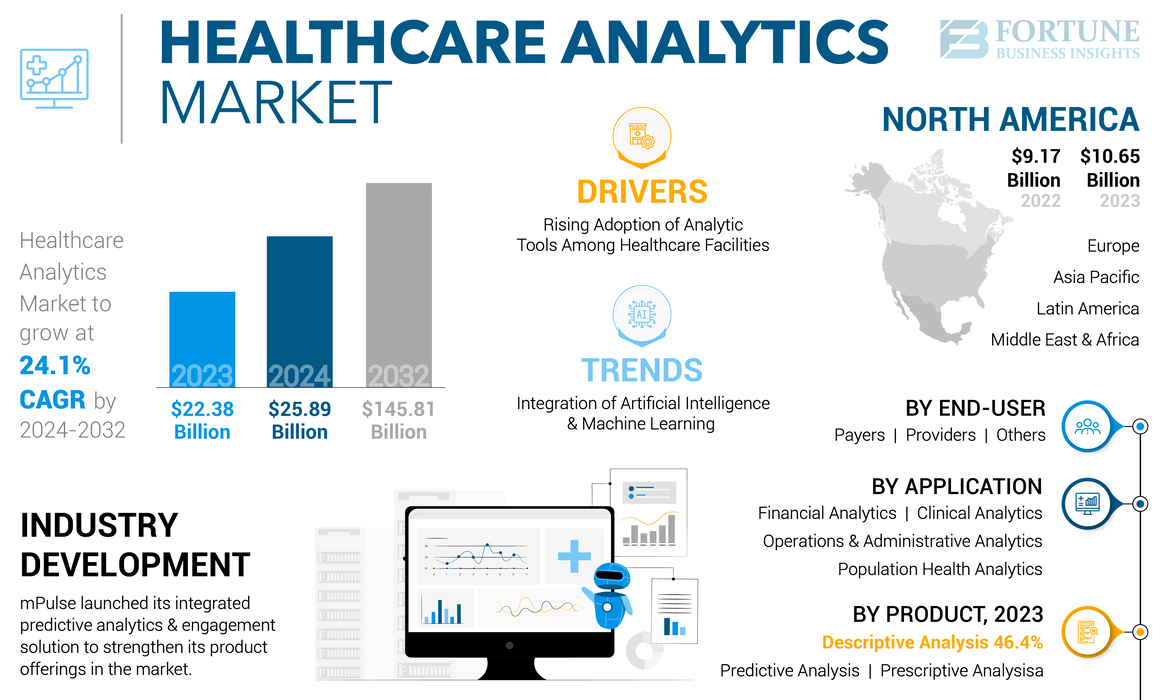

The healthcare analytics market size was valued at USD 22.38 billion in 2023. The market is projected to grow from USD 25.89 billion in 2024 to USD 145.81 billion by 2032, exhibiting a CAGR of 24.1% during the forecast period. North America dominated the global healthcare analytics market with a market share of 47.59% in 2023.

Healthcare analytics is the analysis of relevant healthcare data to improve diagnosis, treatments, and outcomes for patients with the use of several tools and software by the healthcare providers. These tools can be used to analyze current and historical industry data to predict trends and improve the overall management of conditions among the population. The growing demand for these tools and software, along with technological advancements by the key players operating in the market, is driving their adoption among healthcare providers in the market.

In addition, the growing efforts of companies to increase funding for the development and introduction of technologically advanced software and tools are another major factor that is favorable to the growing global healthcare analytics market size.

- In May 2024, Sift Healthcare, one of the leading AI-powered healthcare payment solutions, raised USD 20 million in Series B funding to enhance its technology and service offerings.

The overall COVID-19 pandemic impact on the global healthcare analytics market was negative. The increased focus of healthcare providers on treating COVID-19 patients led to a decreased demand for analytics tools and software in the industry. However, the increased need and preference for these tools among the population during the pandemic resulted in increased adoption of such products in 2021 in the market. The growing technological advancements by the players are expected to further drive the demand and adoption of these tools during the forecast period.

Global Healthcare Analytics Market Snapshot & Highlights

Market Size & Forecast:

- 2023 Market Size: USD 22.38 billion

- 2024 Market Size: USD 25.89 billion

- 2032 Forecast Market Size: USD 145.81 billion

- CAGR: 24.1% from 2024–2032

Market Share:

- North America dominated the healthcare analytics market with a 47.59% share in 2023, driven by the rising adoption of various analytic tools and software among healthcare providers and payers, alongside widespread Electronic Health Record (EHR) system implementation.

- By product, descriptive analysis is expected to retain its largest market share owing to its widespread adoption among hospitals and clinics for patient data interpretation, supported by increasing healthcare infrastructure and patient visits in emerging countries.

Key Country Highlights:

- United States: Adoption of healthcare analytics is driven by increased focus on enhancing revenue cycle management operations and improving patient care coordination through strategic partnerships.

- Europe: Growth is supported by collaborations between analytics software providers and research institutes to enhance clinical trial efficiency and healthcare innovation.

- China: Improving healthcare infrastructure and rising patient volumes are leading to higher demand for analytics tools among healthcare facilities and research activities.

- Japan: Technological advancements in AI-powered diagnostics are fostering the adoption of analytics tools in healthcare institutions for enhanced disease detection and patient care.

Healthcare Analytics Market Trends

Integration of Artificial Intelligence and Machine Learning

The emergence of artificial intelligence in healthcare has been groundbreaking, reshaping the overall workflow of healthcare facilities and patient management. The potential application of AI in hospitals and clinics can be significantly transformational for the healthcare industry by revolutionizing healthcare services.

The integration of artificial intelligence and machine learning in the early diagnosis and detection of potential chronic conditions among the population can help increase the efficiency of the treatment and overall care.

- For instance, According to a 2022 study published by the British Medical Journal, the use of deep learning algorithms to detect breast cancer with mass yielded a sensitivity of 90% compared to 74% for radiologists.

The use of machine learning techniques and other deep learning algorithms is not limited to the early detection of diseases. They also optimize healthcare sources and offer optimal therapy, improving efficiency and workflow.

- North America witnessed a healthcare analytics market growth from USD 9.17 Billion in 2022 to USD 10.65 Billion in 2023.

Download Free sample to learn more about this report.

Healthcare Analytics Market Growth Factors

Rising Adoption of Healthcare Analytics Among Facilities to Drive Market Growth

The growing number of healthcare facilities globally, along with increasing patient data to store, analyze, and interpret, are some of the major factors leading to the growing demand for healthcare analytics tools among these facilities. The increasing technological advancements by players in developing and introducing new features are resulting in the growing adoption of these tools among healthcare providers and payers.

The increased importance of these healthcare analytic tools during the pandemic among healthcare facilities led to significant demand and adoption of various tools in hospitals, clinics, and other healthcare facilities.

- According to a 2021 survey conducted by the American Hospital Association (AHA), nearly 65% of the hospitals planned to enhance the functionality of their new EHR system releases. Additionally, 33% of the hospitals aimed to add substantial new functionalities to their current EHR systems.

Thus, the increasing focus of companies on developing new technical features and tools combined with technological advancements is expected to drive growth in the global market. Additionally, the rising adoption of these tools among healthcare facilities will further contribute to market growth during the forecast period.

RESTRAINING FACTORS

Certain Factors Associated with Privacy Concerns to Hinder Adoption of Healthcare Analytics

Data analytics tools in the healthcare industry are essential tools for improving patient outcomes and driving innovation for healthcare organizations. However, there are certain challenges in the implementation of these tools, such as threats of cyberattacks, data standardization, and data bias, among others.

The data privacy of patient records, limited regulations and guidelines for the adoption and use of these tools, and the high cost of analytics solutions are significant factors anticipated to hamper market adoption. Additionally, the high cost associated with the installation and operational cost of these software and tools will also hamper their adoption during the forecast period.

Healthcare Analytics Market Segmentation Analysis

By Product Analysis

Rising Adoption of Descriptive Analysis Tools Led to Segment’s Dominance

Based on product, the market is segmented into descriptive analysis, predictive analysis, and prescriptive analysis.

The descriptive analysis segment dominated the market in 2023. The growing number of hospitals and clinics, coupled with increasing healthcare expenditure in China, India, and other countries, is leading to improving healthcare infrastructure among healthcare facilities.

- The Descriptive Analysis segment is expected to hold a 46.4% share in 2023.

Along with this, the increasing disposable income among the population is further resulting in a growing number of patient visits to hospitals and clinics for health checkups and diagnosis, fostering the demand for analytical tools among these facilities.

- According to a 2023 article published by the National Medical Products Administration (NMPA), the number of medical visits in China increased from 3.9 billion patient visits in 2021 to 5.11 billion visits in 2023.

The predictive analysis segment is expected to grow at a significant CAGR during the forecast period. The growing data integration of predictive analysis tools in clinical trials by researchers is one of the prominent factors contributing to the growth of the segment. Moreover, the increasing number of clinical trials is another factor supporting the growth of the segment.

- In March 2023, Syneos Health partnered with KX, developer of kdb, which is one of the fastest time series database and analytics tools. The partnership aimed to deliver data-driven predictive analytics, Artificial Intelligence (AI), and Machine Learning (ML) capabilities and improve overall clinical trial efficiency.

The prescriptive analysis segment is projected to grow at the fastest CAGR during the forecast period. This growth is attributed to the growing adoption of various tools and software by hospitals, pharmacies, and other healthcare facilities, along with an increasing focus of companies to launch innovative tools and software.

- In March 2024, Innovaccer launched Provider AI companion, a portable AI software with an aim to offer a prescriptive approach by providing recommendations based on historical data and predictive analytics models.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Increasing Adoption of Analytical Tools by Healthcare Payors Led to Dominance of Financial Analytics

Based on application, the market is segmented into financial analytics, clinical analytics, operations and administrative analytics, and population health analytics.

The financial analytics segment dominated the global healthcare analytics market share in 2023. The increasing penetration of insurance policies owing to growing awareness regarding the policies and benefits and increasing disposable income in developed and emerging countries are key factors contributing to the rising demand for financial analytical tools. These tools help reduce financial fraud and smoothen the workflow.

- In January 2023, UnitedHealth Group partnered with Owensboro Health with the aim of enhancing its revenue cycle management operations and IT services and improving patient care and experience in the U.S.

The clinical analytics segment is expected to grow at a faster rate during the forecast period. The growth of the segment is mainly due to the increasing adoption of analytical tools among hospitals, clinics, and other healthcare providers to improve clinical decisions regarding the diagnosis and treatment of patients.

Additionally, the operations and administrative analytics, along with population health analytics segments, are projected to experience lucrative growth during the forecast period. The increasing demand for analytical tools for database management of population metrics for research purposes is a key factor contributing to the growth of the segment.

By End-User Analysis

Healthcare Payers Segment Leads with Rising Adoption of Healthcare Analytics

On the basis of end-user, the market is segmented into payers, providers, and others.

The payers segment accounted for the largest market share in 2023. The dominance of the segment is majorly attributed to the increasing adoption of these analytic tools and software among healthcare payers to enhance the efficiency of the financial aspects of the institutions and curtail financial fraud.

- In March 2024, Highmark Health collaborated with Epic and Google Cloud with the aim of supporting coordination across payers and providers.

The healthcare providers segment is expected to grow with a considerable growth rate during the forecast period. This growth is attributable to the rising number of hospitals and other healthcare facilities adopting and implementing various analytics tools and software to enhance the overall care and services provided to patients.

REGIONAL INSIGHTS

Based on geography, the healthcare analytics market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America Healthcare Analytics Market Size, 2023 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America, valued at USD 10.65 billion in 2023 dominated the market. The rising adoption of various analytic tools and software among healthcare providers and payers in the U.S. and Canada has significantly contributed to the growing market in the region.

According to 2021 statistics published by the Office of the National Coordinator for Health Information Technology (ONC), the adoption of Electronic Health Record (EHR) systems among hospitals in the U.S. increased from 28% in 2011 to 96% in 2021. Additionally, the adoption of EHR systems among office-based physicians increased from 34% in 2011 to 78% in 2021.

Europe is expected to grow during the forecast period with a nominal growth rate. The rising focus of companies and research institutes on strategic collaboration with providers of analytical tools and software is a key factor driving growth in the region. These partnerships aim to enhance the efficiency of clinical trials and other research activities.

- In June 2024, SAS, one of the leading providers of AI and analytics software, partnered with the Maxwell Centre at the University of Cambridge with an aim to accelerate healthcare innovation, impacting positively on the research projects.

Asia Pacific is projected to witness the highest growth rate in the market during the forecast period. Improving healthcare infrastructure in India, China, Australia, and other countries, along with a growing focus of the companies to expand their services and brand presence in these countries, is expected to boost demand for these tools in the region. Additionally, the increasing use of these tools and services in clinical research activities in the countries is another favorable factor supporting the growth of the region.

- In May 2024, Ibex Medical Analytics, a leading AI-powered cancer diagnostics, and Kameda Medical Center, a Japanese healthcare institute, announced positive outcomes for detecting cancer. This AI-powered platform successfully identified cancer and other pathologies in prostate and breast biopsies.

Latin America and the Middle East & Africa are expected to expand at a steady growth rate during the forecast period. Rising awareness regarding the various healthcare data analytics tools and software is a major factor contributing to healthcare analytics market growth. Additionally, growing adoption of these among healthcare facilities in Saudi Arabia, the UAE, and Brazil is driving expansion in these regions.

KEY INDUSTRY PLAYERS

Robust Focus of the Market Players to Introduce Innovative Products to Support Growing Market Share

The global market is a fragmented market with a wide number of players operating in the market with a vast product portfolio. The growing efforts of companies such as Oracle, Veradigm LLC, UNITEDHEALTH GROUP, and McKesson Corporation are some of the prominent market players. Their efforts to increase their brand presence and strengthen product portfolios through strategic mergers and acquisitions with other companies are major factors fueling the market shares of these companies in the market.

- In June 2022, Oracle acquired Cerner Corporation, one of the leading digital information system providers, with the aim of expanding its product portfolio and customer base in the market.

Several players, such as Health Catalyst, Inc., Epic Systems Corporation, FLATIRON HEALTH, and others, are major players with a wide product portfolio operating in the market. The increasing number of product launches by the companies to increase brand penetration in the market can be attributable to the growth of these companies.

- In May 2024, Health Catalyst, Inc. launched Health Catalyst Ignite, a next-generation healthcare data and analytics ecosystem, with an aim to enhance the workflow of healthcare organizations.

Thus, the growing number of emerging players in the market with innovative and technologically advanced products is expected to fuel the growth of the market.

List of Top Healthcare Analytics Companies:

- Merative (U.S.)

- Health Catalyst, Inc. (U.S.)

- Veradigm LLC (U.S.)

- Oracle (U.S.)

- Epic Systems Corporation (U.S.)

- UNITED HEALTHGROUP (U.S.)

- FLATIRON HEALTH (F. Hoffmann-La Roche Ltd.) (U.S.)

- MCKESSON CORPORATION (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- May 2024 – mPulse, an AI and digital engagement solution provider, launched its integrated predictive analytics and engagement solution with the aim of strengthening its product offerings in the market.

- May 2024 – FLATIRON HEALTH, one of the leading health-tech companies, partnered with Canopy with the aim of streamlining its continuous care management by using Flatiron’s OncoEMR.

- October 2023 – Health Data Analytics Institute (HDAI), an Artificial Intelligence (AI) company focused on empowering clinicians, optimizing care pathways, and improving patient outcomes, announced a USD 31.0 million funding round. This funding is intended to scale its predictive risk analytics platform.

- August 2023 – Kyvos Insights, a next-gen cloud analytics acceleration platform, partnered with Merative, one of the leading data analytics and software technology companies to transform the healthcare industry with innovative products.

- January 2023 – UNITEDHEALTH GROUP partnered with Northern Light Health with the aim of enabling value-based care for patients and healthcare providers with their innovative tools and products.

REPORT COVERAGE

The report provides a detailed market analysis and focuses on key aspects, such as market size, forecast, segmentation based on product, application, end-user, and competitive landscape. It also gives an overview of the regulatory scenario, insights on service penetration, and analysis for significant companies. Besides, the report offers insights into the latest market trends, statistics, and key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the market's growth in recent years.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 24.1% from 2024-2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product

|

|

By Application

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market was valued at USD 22.38 billion in 2023 and is projected to reach USD 145.81 billion by 2032.

The market is slated to exhibit a steady CAGR of 24.1% during the forecast period of 2024-2032.

By product, the descriptive analysis segment led in 2023.

The key driving factors of the market include the rising adoption of analytic tools and software among healthcare facilities, the increasing number of hospitals and clinics, the growing penetration of healthcare insurance among the population, and the increasing R&D focus of the companies.

Oracle, Veradigm, LLC, and Health Catalyst Inc. are some of the major players operating in the market.

North America dominated the global market in 2023.

North America was valued at USD 10.65 billion in 2023.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us