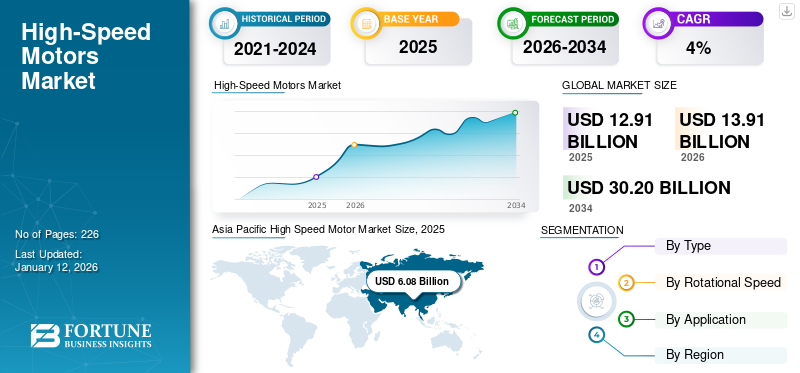

High Speed Motor Market Size, Share & COVID-19 Impact Analysis, By Type (AC Motor and DC Motor), By Rotational Speed (3,000 to 6,000 RPM, 6,000 to 10,000 RPM, 10,000 to 15,000 RPM, and Above 15,000 RPM) By Application (Industry Machinery, Aerospace & Transportation, Power Generation, Automotive, Household Appliances, Medical Equipment, and Others) and Regional Forecasts, 2026-2034

High Speed Motor Market Size

The global High Speed Motor Market size was valued at USD 12.91 billion in 2025 and is projected to grow from USD 13.91 billion in 2026 to USD 30.2 billion by 2034, exhibiting a compound annual growth rate of 10.17% during the forecast period. Asia Pacific dominated the global market with a share of 47.10% in 2025. The High-Speed Motors market in the U.S. is projected to grow significantly, reaching an estimated value of USD 5.33 billion by 2032, driven by the growing adoption of automation & robotics in manufacturing and other industries.

The global COVID-19 pandemic has been unprecedented and staggering, with the market experiencing lower-than-anticipated demand across all regions compared to pre-pandemic levels. Based on our market analysis, the global market growth exhibited an average growth of 3.0% in 2020 compared to 2019.

Electric motors are integral to residential, commercial, and industrial processes required to convert electrical energy into mechanical energy. The electromechanical device includes various components such as a rotor, stator, windings, bearings, commutators, etc. The motors are available in numerous configurations, segregated based on their uses and areas of application, to provide desired power ranges, speeds, and efficiencies for operation. Consequently, this motor also includes specialized systems to deliver high speeds and regulated torque, operating at low and high voltage to operate fast-moving machinery effectively.

COVID-19 IMPACT

Halt in Industrial Activities & Travel Restrictions Slowed Down Market Growth during the Pandemic

Various developing and developed countries such as U.S., Germany, France, Italy, India, and many others, have observed a significant rise in the total number of COVID-19 cases in the 2020 period. For instance, as per the Our World in Data database operated by the Global Change Data Lab, an associate of the University of Oxford, the total confirmed COVID-19 cases across the U.S. was about 1.79 million on 1 June 2020, and it reached over 5.99 million by August 2020. The influenced population has increased by around 235% in three months, expressing great danger for people and industrial operations.

Accordingly, the global market of high-speed motors is also affected by the consequences of this unprecedented situation as several countries experienced total lockdowns. Industries in all nations have also experienced a sizeable operating loss as governments restricted the ability of all sectors to function except the essential sectors. In addition, the unavailability of skilled labor combined with long-term shutdowns of motors and limited industrial applications such as, oil & gas exploration, closure of manufacturing units, and others.

However, to maintain business operations and counterbalance the losses incurred by the global pandemic, various organizations operating in the industry have adopted effective plans with a positive outlook. For instance, in March 2020, Emerson Electric, a U.S.-based motor manufacturer, announced the deployment of its automated solutions offerings following the guidelines from health agencies such as the U.S. Center for Disease Control (CDC) and the World Health Organization (WHO), among others. The company further stated to strategically focus on essential services, including essential municipal and industrial infrastructure comprising many verticals such as manufacturing units for pharmaceuticals, power, refining, water and wastewater, medical supplies, energy, and many others.

High Speed Motor Market Trends

Download Free sample to learn more about this report.

Paradigm Shift towards Adoption of Low-Emission Vehicles to Transform Market Outlook

The growing inclination of customers toward utilizing low-emission vehicles is an emerging prospect for the motor market. The demand for electric vehicles including battery electric vehicles and plug-in hybrid electric vehicles is increasing significantly due to their advantages, such as higher efficiency, less polluting by-products, cost-effectiveness, and energy security. Various technological developments to improve the operational performance and efficiency of the engines and open further new opportunities for the global high speed motor market growth.

For context, in September 2022, Engineers from the University of New South Wales (UNSW) built a new high-speed engine that has the potential to successfully exceed the maximum power and speed of 100,000 rpm achieved by this novel engine and the existing high-speed record of laminated interiors to double permanent magnet synchronous motors (IPMSMs), making it the world’s fastest IPMSM ever built with commercialized lamination materials. In addition, the engine can generate a very high power density and significantly reduce the use of rare earth materials, saving weight and construction costs.

High Speed Motor Market Growth Factors

Rapidly Developing Industrial Infrastructure Coupled with Rising Energy Demand to Propel Demand for Product

The increase in global electricity demand along with the development of power generation, transmission & distribution (T&D) facilities to meet the growing demand is expected to increase the pace of the industry.

In addition, an increase in spending across construction, production, mining, refineries, oil & gas, and other industrial sectors has prompted various public as well as private entities to increase their efforts to meet peak-time energy consumption through energy-efficient alternatives. For instance, per Eurostat, a statistics division under the European Commission, motor vehicles and transport equipment accounted for about 17% of sold production in the European manufacturing industry in 2019. Moreover, the organization also stated that process industries, such as food, beverages, tobacco, machinery & equipment have accounted for 17% and 10% of the regional output.

Furthermore, the growing setup of new infrastructures is also projected to boost the energy requirements across various verticals, propelling the need for various speed motors to run different systems.

One recent example of this context occurred in August 2021, when Aker Solutions chose MAN Energy Solutions to supply five subsea compression units for the Chevron-operated Jansz-Io Compression (J-IC) Project offshore Western Australia. The scope of services from MAN Energy Solutions for the Jansz-Io project includes the delivery of five underwater HOFIM compressor units. The hermetically sealed & oil-free system is coupled with a high-speed motor, resulting in less component requirement.

Favorable Government Initiatives to Install Energy-Efficient Systems and Diminish Carbon Footprint

Carbon emissions contribute to climate change, which reflects severe consequences for humans and the environment. Hence, various governments and organizations across the globe have increased their focus to deploy energy-efficient alternatives, which can significantly impact direct and indirect greenhouse gas (GHG) emissions and diminish the system’s carbon footprint.

According to the International Energy Agency 2021, the total energy-related carbon dioxide emissions globally are set to reach about 33 gigatons (Gt) in 2021, rising from 31.5 Gt in 2020. The organization further stated that the majority of this increase is likely to be accounted for by the emerging economies totaling over two-thirds of the worldwide discharge.

Furthermore, numerous state and federal governments have also introduced rigid emission regulation standards and financial support plans to support the transition towards greener systems. For instance, in August 2015, the Australian Government committed to reducing emissions by 26 to 28 % below 2005 levels by 2030 with an investment of USD 660 million.

Besides, the growing demand for high-power Heating, Ventilation, and Air Conditioning (HVAC) equipment to accommodate the boost in the construction of new establishments is set to fuel the industry growth.

RESTRAINING FACTORS

High Initial Capital Costs and Availability of Other Motor Systems to Hinder Market Growth

The requirement of a considerable amount to purchase a new motor with a high-speed design coupled with a substantial operating & maintenance fee may obstruct the global market. Additionally, constraints in the availability and prices of expensive raw materials such as metals may also be a barrier to product placement.

Furthermore, various players across the industry have developed cost-effective low-speed/high torque (LSHT) motors with gearbox designs to alter their speeds as per requirement. The new units are fabricated to provide additional benefits, including low operational vibrations and noise and optimized energy efficiency. For instance, in February 2021, the U.S.-based electric mobility solutions provider BorgWarner Inc. presented its new 800 V electric motor series, High Voltage Hairpin (HVH) 320, designed for commercial vehicles. The units are set to be integrated into electric and hybrid vehicle applications and are high-torque motors with high power density and about 97% peak efficiency.

High Speed Motor Market Segmentation Analysis

By Motor Type Analysis

AC Motor Type to Hold Dominant Share Due to Its Major Adoption in Wide Range of Applications

The global market is segmented into AC and DC motors based on type. AC motor is set to dominate due to their adoption in diverse applications across a broad spectrum of industries, such as pumps, HVAC, and other industrial operations, resulting in the dominance of AC motors. Based on this factor, the AC Motor segment dominates the global High Speed Motor Market share of 64.27% in 2026.

Following the AC motor, the DC motor demand is anticipated to increase in the forecast timeframe owing to quick operational response and easy installation and maintenance.

By Rotational Speed Analysis

3,000 to 6,000 Rotational Speed Dominants Market Due to Its Major Adoption in Wide Range of Commercial & Residential Applications

Based on the RPM rating, the global market is segmented into 3,000 to 6,000 RPM, 6,000 to 10,000 RPM, 10,000 to 15,000 RPM, and above 15,000 RPM.

The rapid rate of urbanization, construction of new residential and commercial establishments, and propelling demand for consumer electronics are set to favor the 3,000–6,000 RPM segment and result in its dominating market share of 44.86% in 2026.

Furthermore, high-speed motors with a speed rating of 6,000–10,000 RPM are projected to lead the significant market share for the global industry size. The demand is primarily driven by the expansion of low-carbon automobiles such as electric vehicles, where a motor with speeds ranging from 8,000 to 21,000 are widely used for power transmissions.

The 10,000–15,000 RPM segment size is set to account for a significant market share of the market in the forecast timeframe owing to the setup of large-scale aerospace component manufacturing facilities and other heavy-duty industrial establishments.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Industrial Machinery Application to Dominate Due to the Use of High-Speed Motor in Heavy-Duty Operations

Based on application, the global market has been segmented into industrial machinery, aerospace & transportation, power generation, automotive, household appliances, medical equipment, and others.

The use of high-speed based motors in industrial machinery applications plays a vital role in operating medium and heavy-duty machines and is significantly incorporated with the system to boost the electrical performance of significant types of machinery such as loaders, pavers, boom lifts, mixers, compactors, and many more. With the increase in industrial operations, industrial machinery is likely to dominate share for the global market.

In addition, the demand for the high-speed based motor is expected to be one of the fastest growing in the automotive applications segment due to the increasing tendency to introduce low-emission vehicles such as electric vehicles and hybrid vehicles, in which the high-speed motor plays one of the crucial roles in power transmission.

Subsequently, with the growth of new manufacturing locations for various aviation components coupled with propelling the adoption of advanced technologies such as unmanned aerial vehicles (UAVs) and high-speed railways across multiple regions, the aerospace & transportation high-speed motor industry is set to grow.

REGIONAL ANALYSIS

Asia Pacific High Speed Motor Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific to Dominate the Market Owing to the Presence of Key Players

The market is studied across major regions, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific is likely to lead the way for the demand for high-speed motors over the forecast period, owing to various factors such as rapidly increasing energy demand, urbanization, the establishment of new infrastructure, and the setup of different high-speed rail networks, among many other parameters. The Japan market is projected to reach USD 1.23 billion by 2026, the China market is projected to reach USD 3.47 billion by 2026, and the India market is projected to reach USD 1.16 billion by 2026.

North America is also anticipated to hold a significant position due to continuous investments in the research & development of electric vehicle systems and infrastructure, coupled with regular investments in heavy-duty industrial operations. The U.S. market is projected to reach USD 2.93 billion by 2026. Furthermore, stringent emission reduction regulations, encouraging energy-efficient systems demand a positive outlook for electric vehicle deployment, and growing aerospace component manufacturing capabilities are key factors propelling the European market. The UK market is projected to reach USD 0.36 billion by 2026, while the Germany market is projected to reach USD 0.49 billion by 2026.

KEY INDUSTRY PLAYERS

Key Participants Are Concentrating On Enhancing their Business Capacities to Deliver Efficient Products

The global market is considerably fragmented, with various players operating at the national, regional, and global levels. The key players in the global market significantly focus on developing high-performance motor systems with enhanced operational characteristics to fortify their foothold in the industry.

ABB Group is expected to generate significant market share due to its increasing focus on delivering induction and permanent magnet motors for various applications. The company has also gained strong brand value primarily by providing an extensive range of efficient and advanced traction motors with optional customized delivery across the globe.

Nidec Corporation has also exhibited significant potential and is striving to expand its horizons by successfully delivering its motors & other products for various applications. For instance, in April 2021, the company’s 100kW E-Axle model of traction motors is set to be integrated into the new Aion Y electric vehicle model to be launched by the China-based Guangzhou Automobile Group Co., Ltd.

Other key participants operating in the industry include Hitachi Ltd., Mitsubishi Electric Corporation, Eaton Corporation, Allied Motion, Emerson Electric, GE, and many other small, medium, and large players. These organizations continuously focus on expanding their product offering and reach across the market.

LIST OF TOP HIGH SPEED MOTOR COMPANIES:

- ABB (Switzerland)

- Hitachi (Japan)

- Nidec Corporation (Japan)

- Siemens (Germany)

- Meidensha Corporation (Japan)

- Regal Rexnord Corporation (U.S.)

- Toshiba International Corporation (U.S.)

- Mitsubishi Electric Corporation (Japan)

- Emerson Electric Corporation (U.S.)

- Fuji Electric Co., Ltd. (Japan)

- SKF Group (Sweden)

- Turbo Power Systems Limited (U.K.)

- Eaton Corporation (Ireland)

KEY INDUSTRY DEVELOPMENTS:

- October 2022 – Toshiba Electronic Devices & Storage Corporation has released a 3-phase brushless type DC motor driver namely, IC "TB67B001BFTG" which is equipped with a high-speed control. The control device is used with motors such as server fans, and cleaning robots. The device is also equipped with a function that helps in detecting an abnormal rotational frequency that exceeds the maximum rotation frequency.

- January 2022 - Fuji Electric has announced the “Plant Systems Center” establishment at the Tokyo Factory (Hino City, Tokyo). The “Plant Systems Center” has been newly established at Tokyo Factory to strengthen the plant system development and production system.

- December 2021 - ABB invested CA USD 16 million in its Installation Products Division manufacturing facility in Pointe-Claire, Canada. This enables ABB’s production capacity to expand to meet customers' growing needs.

- October 2021 - Regal Beloit Corporation has merged with Rexnord Process and Motion Control (PMC) to become Regal Rexnord Corporation. The new company will comprise four distinct business segments: motion control solutions, climate solutions, and commercial and industrial systems.

- March 2021 - Hitachi Rail SpA has announced its contract with Trenitalia for a high-speed fleet of 59 trains for integrated logistics support. The contract will support and provide management for the repair and maintenance of the train components with optimized inventory stocks, allowing increased availability and efficiency of high-speed operations in Italy.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The market research reports present a comprehensive industry assessment by offering valuable insights, facts, industry-related information, and historical data. Several methodologies and approaches are adopted to make meaningful assumptions and views to formulate the market research report.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 10.17% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type, By Rotational Speed, By Application, and By Region |

|

Segmentation |

By Type

|

|

By Rotational Speed

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

The Fortune Business Insights study shows that the global market was USD 12.91 billion in 2025.

The global market is projected to grow at a CAGR of 10.17% over the forecast period.

The market size of Asia Pacific stood at USD 6.08 Billion in 2025.

Based on the motor type, AC motor type holds the dominating share in the global market.

The global market size is expected to reach USD 30.2 Billion by 2034.

The key market drivers are the adoption of clean energy and the growing industrial infrastructure

The top players in the global high speed motor market are ABB, Eaton Corporation, Toshiba Corporation, Siemens, and others.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us