Industrial Brakes Market Size, Share & Industry Analysis, By Type (Disc and Drum), By Actuation (Hydraulic Braking System, Mechanical Braking System, Electrical Braking System, Pneumatic Braking System, and Others (Electromagnetic Braking Systems, etc.)), By Application (Manufacturing, Metal and Mining, Marine and Shipping, Construction, Oil & Gas, and Others (Food Processing, Energy, etc.)), and Regional Forecast, 2026 – 2034

Industrial Brakes Market Size

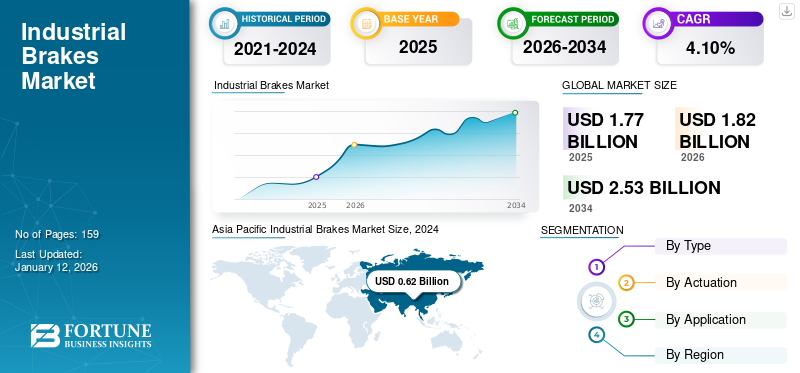

The global industrial brakes market size was valued at USD 1.77 billion in 2025 and is projected to grow from USD 1.82 billion in 2026 to USD 2.53 billion by 2034, exhibiting a CAGR of 4.10% during the forecast period. The Asia Pacific dominated global market with a share of 36.60% in 2025.

Industrial brakes are devices that stop the movement of any object by means of friction, withstand the force of a load and dissipate the resulting energy as heat. In the majority of cases, they must bear an inertial load as they are usually used in conjunction with a shaft to bear extreme inertial loads and work under any climatic conditions. Industrial brakes are necessary to be much more powerful and different from those used in cars. The growing adoption of industrial automation technologies aimed at enhancing productivity levels during manufacturing processes has been identified as a key driver for the global market of these components. Furthermore, manufacturers’ increased attention to implementing intelligent control systems based on advanced materials will support medium-term growth prospects in this sector.

Global Industrial Brakes Market Overview

Market Size:

- 2025 Value: USD 1.77 billion

- 2026 Value: USD 1.82 billion

- 2034 Forecast Value: USD 2.53 billion

- CAGR (2026–2034): 4.10%

Market Share:

- Asia Pacific Share (2025): 36.60%

Industry Trends:

- Growing Demand from Smart Transportation Solutions to Surge Market Growth: Brake systems across railway, heavy equipment, and related industries.

- Industrial Automation Adoption: Increasing automation to improve productivity and efficiency; intelligent control systems based on advanced materials will support medium-term growth.

- Railway Modernization & Infrastructure Investment: Upgrades to rail networks and infrastructure boost demand for robust braking solutions.

- Industry Activity Highlight: Example—Wabtec delivered braking systems for trains to Alstom Transport India in March 2023.

Driving Factors:

- Rising Construction Projects and Manufacturing Activities to Boost Market Growth: Brakes used across cranes, hoists, elevators, earthmoving machines, and more.

- Technology Upgrades: Enhanced durability and efficiency through advanced undercarriage components.

- Global Infrastructure Growth & Urbanization: Demand for durable machine parts to support large-scale projects.

- IoT Adoption: Real-time monitoring and data analytics driving maintenance and performance.

The COVID-19 pandemic had a negative impact, with industrial brake demand across all regions falling steeply but then bouncing back post-COVID, almost doubling it. Moreover, the push for renewable energies by governments concerned about greenhouse gas emissions has raised the need for solar photovoltaic panels (PV), wind turbines, and other such devices in industrial applications.

Industrial Brakes Market Trends

Growing Demand from Smart Transportation Solutions to Surge Market Growth

Brake systems are very important for handling heavy loads, and they can help railway transportation to be more efficient and reliable, which, in turn, increases the demand for industrial brakes and clutches procurement in smart transport. To cut back on maintenance, repair, and other operational costs, railway service providers are looking forward to installing sturdy industrial caliper brakes. There is an increased economic activity due to efforts being directed at infrastructure modernization, supported by growing infrastructure investment. The need for railcars and related components will grow with several new programs and upcoming capital expenditures concentrated on the railway sector.

- For instance, Wabtec Corporation delivered braking systems for trains to Alstom Transport India in March 2023.

Download Free sample to learn more about this report.

Industrial Brakes Market Growth Factors

Rising Construction Projects and Manufacturing Activities to Boost Market Growth

Industrial brakes are used with a wide range of construction equipment, including cranes, hoists & winches, elevators & lifts, earthmoving machines, and others. Their main function is to increase the safety and control of machinery during various construction activities. Brake systems also regulate speeds or accelerations and control component's movements along production lines. Emergency brakes and stop systems are also widely used, thereby ensuring safe and accurate manufacturing processes in case of any contingency situations. Therefore, brakes are installed on different industry to improve their safety efficiency and machines’ performance during production. These factors are anticipated to boost the industrial brakes market growth during the forecast period.

- For instance, in May 2021, Wabtec Corporation announced the supply of advanced brake systems, pantographs, and other components to Alstom for Delhi Meerut Regional Rapid Transport Systems. The total component order is valued at USD 15 million for new rolling stock.

RESTRAINING FACTORS

Environmental Conditions and High Raw Material Prices to Hinder Market Growth

Price volatility and fluctuating raw material prices might further pose considerable challenges to the industrial brakes market. Extreme temperatures, humidity, dust, and other environmental factors can affect the performance and lifespan of industrial brakes. For example, high temperatures can cause brake fade, while moisture and dust can accelerate wear and corrosion. In addition to this, political tensions among countries might bring supply chain disruption and accessibility of raw materials, such as oils and other brake materials for manufacturing companies, indirectly impacting the growth of industrial breaks. Overall repair and maintenance costs likely act as a restraining factor for the industrial brakes.

Industrial Brakes Market Segmentation Analysis

By Type Analysis

Demand for Industrial Disc Braking to Bolster Market Growth

Based on type, the industrial brakes market is categorized into disc and drum type.

The industrial disc brakes segment is expected to grow significantly and capture the largest share of the market as they offer more reliability and better heat dissipation capacity than drum brakes and, therefore, are more efficient when stopping heavy-duty applications. Some industries still use industrial disc brakes due to their cheapness, simplicity, and constant braking needs. Thus, the dominance of disc braking will bolster the industrial brakes market growth in the long term.

By Actuation Analysis

Hydraulic Brake Systems Dominated Market Due to High Performance Capability and Low Maintenance

Based on actuation, the products are classified into hydraulic braking system, mechanical braking system, electrical braking system, pneumatic braking system, and others.

The hydraulic brake systems segment is projected to dominate the market with a share of 42.31% in 2026, having advantages, such as reliability, accuracy to control, and ability to handle heavy loads. They find use in industrial machines and vehicles.

Mechanical brakes are still popular, especially where there may be no other options available, or it would be costly to use hydraulic or electric ones.

Electrical brakes have started gaining ground as technology advances, thereby offering features, such as regenerative braking, among others, while at the same time being able to integrate with electronic control systems.

Industrial pneumatic brakes are used in industries that have compressed air readily available, hence providing simple and robust solutions for braking requirements.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Demand for Reliable Braking in Manufacturing Applications to Dominate Market Growth

Application of industrial brakes is classified into manufacturing, metal and mining, marine and shipping, construction, oil & gas, and others (Food Processing, Energy, etc.)

The application of industrial brakes is dominated by manufacturing industries that require heavy-duty equipment for conveyor hoists, among others, hence creating demand for a broad range of products within this sector.

In metal and mining operations, brake systems are essential in various activities, such as lifting materials shafts.

Specialized ships’ brake systems require stronger brakes that resist rusting in sea areas where ships and offshore dispensers require maximum safety. Additionally, infrastructure machines, such as cranes and excavators, need efficient industrial braking systems within construction sites, such as roads and bridges.

The oil & gas sector needs high-performance disc pack caliper brakes fitted in drilling rigs, winches and offshore platforms to ensure operational integrity under tough environmental conditions.

Energy and food processing industries worldwide use these devices, though not on a large scale, thus creating demand for them internationally.

REGIONAL INSIGHTS

The global industrial brake market is analyzed across regions including North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

Asia Pacific Industrial Brakes Market Size, 2024

To get more information on the regional analysis of this market, Download Free sample

The global braking industry is set to grow progressively as increased population and migration drive the development of commercial spaces, public transportation infrastructure, and residential buildings.

Asia Pacific dominated the market with a valuation of USD 0.65 billion in 2025 and USD 0.68 billion in 2026. Asia Pacific is firmly establishing itself as the global manufacturing center, with numerous global companies rigorously working to invest in the region and set up their manufacturing facilities across developing economies, such as China, India, and other parts of the region. Furthermore, the development supports the application of modern elevator and escalator systems, quick transportation systems, and high-speed mobility solutions, expanding the use of industrial brakes during the forecast period. The Japan market is estimated to reach USD 0.12 billion by 2026, the China market is estimated to reach USD 0.28 billion by 2026, and the India market is estimated to reach USD 0.15 billion by 2026.

China is observed to hold a significant market share owing to its strong industrial and further growing investments across railway infrastructure and massive demand for electric locomotives in public transportation and long journeys. Additionally, the Indian government is investing majorly in the development of railway infrastructure. Thus, the above factors instigate the application of electric locomotives and rail systems in the mobility segment.

North America boasts a robust ecosystem of research institutions, startups, and established companies driving innovation in industrial electric brakes. Breakthroughs in manufacturing technology, electric vehicle manufacturing, and renewable energy generation are making industrial brakes more efficient, affordable, and attractive to consumers. The U.S. market is estimated to reach USD 0.31 billion by 2026.

Europe is growing progressively owing to high investments in electric and hydrogen locomotives. The expansion of renewable energy capacity will also support the growth of the industrial braking system market in the region. The U.K. and Germany are identified as the two driving engines with a decisive market share in the region. The UK market is estimated to reach USD 0.06 billion by 2026, while the Germany market is estimated to reach USD 0.16 billion by 2026.

The Middle East & Africa market will showcase slower growth owing to higher dependencies on the neighboring countries for the sourcing of industrial machinery and heavy equipment. GCC countries will hold a sizable market share owing to their infrastructure competence and ability to have a decent expenditure on market developments.

Niche opportunities for the development of the manufacturing industries, limited presence of global market players in the region, and underdeveloped distribution channels for the market are the factors in South America that dictated sluggish growth of the region over the forecast period.

KEY INDUSTRY PLAYERS

Increased Focus on New Product Launches in Developing Markets to Expand Presence.

Manufacturers are focusing on new product launches with enhanced efficiency and durability. Sustainable and energy-efficient solutions are increasing in demand at industrial facilities, surging industrial brakes market share in the long term. With the advent of new technology and innovative software tools, companies are also introducing aftersales and repair-based software solutions to end users. Manufacturers are striving for new and upcoming projects to expand their market presence across geographies. To expand their offering across industries, market participants are focusing on new deals and contracts in international markets.

- For instance, India’s Pune Metro Rail Development Authority placed an order for brake systems from Wabtec Corporation through Alstom Transport India Ltd in March 2023.

List of Top Industrial Brakes Companies:

- Dellner Bubenzer (Germany)

- AKEBONO BRAKE INDUSTRY Co., Ltd. (Japan)

- AMETEK Inc. (U.S.)

- Danfoss (Denmark)

- Kendrion N.V. (Netherlands)

- Regal Rexnord Corporation (U.S.)

- Sibre Siegerland Bremsen Gmbh (Germany)

- The Hilliard Corporation (U.S.)

- TMD Friction Holding GmbH (Germany)

- Wabtec Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- May 2023– Kendrion has introduced its new manufacturing facility in Suzhou, China. The new manufacturing facility is expected to manufacture products across its business group that include industrial brakes, actuators, and controls.

- March 2023– India’s Pune Metro Rail Development Authority placed an order for brake systems from Wabtec Corporation through Alstom Transport India Ltd. The new braking technology is supposed to enhance the efficiency and safety of rail cars.

- March 2023– Regal Rexnord Corporation completed its acquisition of Altra Industrial Motion Corporation. Altra Industrial Motion deals with several industrial powertrain products, including brakes, gears, and clutches. The acquisition is aimed at expanding Regal Rexnord’s product portfolio and enhancing its market penetration.

- March 2023– Regal Rexnord Corporation completed its acquisition of Altra Industrial Motion Corporation in March 2023. Altra Industrial Motion deals with several industrial powertrain products, including brakes, gears, and clutches. The acquisition is aimed at expanding Regal Rexnord's product portfolio and enhancing its market penetration.

- January 2023– Dellner Bubenzer has expanded its manufacturing facility in the Czech Republic. The facility specializes in manufacturing products for wind turbines, both onshore and offshore, including rotors, yaw, and pitch brakes.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product/service types, and leading applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, it encompasses several factors that contributed to the growth of the market in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.10% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Type, By Actuation, By Application, and Region |

|

Segmentation |

By Type

By Actuation

By Application

By Region

|

Frequently Asked Questions

Fortune Business Insights Inc. says that the market is projected to record a valuation of USD 2.53 billion by 2034.

In 2025, the market was valued at USD 1.77 billion.

The market is projected to record a CAGR of 4.10% during the forecast period.

By actuation, the hydraulic braking system segment is leading the market with its dominant market share.

Rising construction projects and manufacturing activities will boost the market growth.

Dellner Bubenzer, AKEBONO BRAKE INDUSTRY Co., Ltd., AMETEK Inc., Danfoss, Kendrion N.V., Regal Rexnord Corporation, Sibre Siegerland Bremsen Gmbh, The Hiliard Corporation, TMD Friction Holding GmbH, and Wabtec Corporation are the top players in the market.

Asia Pacific generated the maximum revenue in 2025.

The manufacturing industries application segment is expected to record the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us