Industrial Lasers Market Size, Share & Industry Analysis, By Type (CO2, Solid-State, Diode, Fiber, and Others), By Power (Less than 1 kW and More than 1.1 kW), By Application (Macro Processing, Micro Processing, and Marking/Engraving), By End-Use Industry (Electronics, Metal Processing, Automotive, and Non-Metal Processing), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

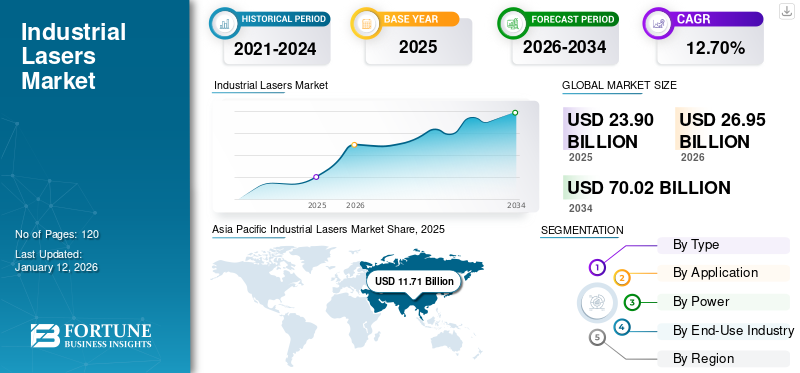

The global industrial lasers market size was valued at USD 23.9 billion in 2025. The market is projected to grow from USD 26.95 billion in 2026 to USD 70.02 billion by 2034, exhibiting a CAGR of 12.70% during the forecast period. The Asia Pacific dominated global market with a share of 49.00% in 2025.

Lasers find their extensive application in manufacturing and machining equipment for precise and efficient production. Laser marking, cutting, surface texturing, ablation, and drilling are a few of their primary applications across diverse sectors. Metal manufacturing, microelectronics processing, defense & aerospace, semiconductor, and additive manufacturing industries’ demand for precise processing will result in the strong market growth over the forecast period. Industrial automation is revolutionizing the manufacturing process across a broad spectrum of industries, driving the demand for automated laser solutions. Robot-based lasers are being deployed across industries for efficient and precise manufacturing processes.

These lasers can outperform traditional manufacturing processes, such as sawing, stamping, and printing with better precision and reliability. These lasers are finding use in semiconductor and consumer electronics manufacturing applications, such as wafer slicing, inspection, drilling, and lithography. Growing demand for electronics devices and semiconductor manufacturing is further driving the market share. Supportive government policies, incentives, increasing investment trends, and high end-user demand will further surge the market growth. For instance, in October 2024, Foxconn, in collaboration with HCL, is set to invest about USD 4.24 billion in an Outsourced Semiconductor Assembly and Test (OSAT) plant in India. Similarly, the Thai government has announced corporate tax exemption policies to promote semiconductor manufacturing in the country. For instance, Thailand attracted about 77 projects within the first half of 2021, bringing in investments worth about USD 1.8 billion.

Temporary shutdown of the manufacturing sector and trade restrictions across borders during the COVID-19 pandemic significantly impacted the demand for these lasers in 2020. However, the market’s growth reached its pre-pandemic levels post-2020 as a result of resumption in production, growing investments, and increasing demand across industries. The industrial laser market will further grow owing to increasing applications, rising automation in industries, and supportive policies.

SUSTAINABILITY

Rising Trend of Sustainable Manufacturing to Propel Market Growth

The global demand for green manufacturing has been growing for the past few years, especially in the post-pandemic period, as a result of government regulations and increased awareness. Industrial lasers with green lasers offer wide range of benefits, such as fewer rejects, minimal raw material usage, and more sustainable manufacturing. Key players in the market are engaging in collaborations to bring innovative solutions for these lasers.

MARKET TRENDS

Industrial Lasers to Benefit Owing to Their Rising Application in Additive Manufacturing

The greater profitability for laser manufacturers is a direct result of the growing demand for additive manufacturing, which offers benefits, such as customization, improved productivity, and faster time-to-market. Additionally, the popularity of 3D manufacturing is on the rise as a result of increasing demand for high efficiency, waste reduction, customization, reduced costs, and errors. The market size is likely to increase due to the 3D printing of machine tool components through laser metal deposition and selective laser melting. The additive manufacturing sector is expected to grow due to the increasing need for optimization in the production process.

Download Free sample to learn more about this report.

MARKET DYNAMICS

Market Drivers

Growing Demand for Efficient Material Processing to Propel Adoption of Industrial Lasers

Industrial laser systems are gaining popularity across varied industries, such as automotive, industrial machinery, semiconductors, and aerospace. These systems are being adopted on a large scale as they offer enhanced flexibility and increased productivity. Increasing use of automation across large and medium-scale manufacturing facilities will further boost the adoption of these lasers. Increasing laser-based applications in LiDAR systems and Augmented Reality (AR) are further propelling the market growth. Laser material processing is also gaining traction in diverse applications, such as metal cutting, laser scanning, and marking. Manufacturers are striving to expand their portfolios through innovations and investment in research and development activities. For instance, Skylark Lasers in October 2023 has raised over USD 5 million to further invest in miniaturizing laser technology. These factors will surge the growth of industrial lasers across diverse regions.

Market Challenges

High Initial Cost to Challenge Market Growth

Initial cost associated with these lasers will significantly impact the industrial lasers market growth. Skilled professionals are required to operate the laser systems, which will further limit the growth of the market. High acquisition cost might also pose a challenge for the market’s growth. However, despite the high initial investment, the operational cost has significantly reduced over time.

Market Opportunities

Growing Trend for Green Manufacturing and Eco-Friendly Practices to Bring Strong Market Opportunities

Industrial lasers in the manufacturing sector are largely being adopted for production processes, such as automotive electronics, batteries, semiconductors, and aerospace. The rising trend of green manufacturing and eco-friendly technology will bolster the market growth across diverse geographies. The increasing adoption of advanced technologies is also creating lucrative opportunities for the market. Manufacturers are integrating advanced features, such as remote operation and automation systems to further improve efficiency and productivity.

SEGMENTATION ANALYSIS

By Type

Fiber Lasers to Hold Largest Market Share Owing to Rising Application in Material Processing

By Type, the market is further classified into CO2, Solid-State, fiber, diode, and other. Others segment include liquid lasers, and gas lasers.

The fiber laser segment is expected to capture a large share of 47.24% in 2026 of the industrial laser market. The growing demand for high-power fiber lasers, driven by the increasing use of lasers in material processing, is contributing to the segment’s expansion. Complex laser applications, such as 3D micro milling, blind hole machining, micro cutting, and additive manufacturing are driving the popularity of industrial lasers. Additionally, the fiber laser's longer lifespan compared to other laser solutions makes it the preferred choice. According to various secondary sources, the diode module of fiber lasers lasts approximately three times longer than that of other laser solutions, with a lifespan of over 30,000 hours, equivalent to about 15 years of use. Moreover, the rising demand for deep marking solutions, which benefit from high power delivery efficiency, is expected to drive the growth of the fiber lasers market. Furthermore, the energy efficiency of fiber lasers is gaining traction in many industries. Compact marking solutions are being increasingly adopted across various industries, including automotive and aerospace.

To know how our report can help streamline your business, Speak to Analyst

By Application

Macro Processing Segment Remained Dominant owing to its Prominent Application in High-Power Processing

By application the industrial lasers market is segmented in macro processing, micro-processing and marking/engraving.

The macro processing segment held the highest revenue market share of 44.01% in 2026 and is expected to experience consistent growth throughout the forecast period. This is due to significant demand for cutting, drilling, plastics, and metal welding across diverse manufacturing sectors. Cutting, ablation for cleaning, and additive manufacturing are all included in high-power processing applications.

The micro-processing application segment is rapidly expanding, with increasing use in industries, such as automotive, electronics, aerospace, and communications. The growing demand for micromachining in the fabrication sector is anticipated to drive the growth of the market. Additionally, advancements in microelectronic components in the semiconductor industry is projected to fuel the market. Rising applications of marking and engraving in electronics, automotive and other sectors to bolster the market growth.

By Power

High-Power Precision Processing to Drive Demand for Industrial Lasers With More Than 1.1 kW Power

By power, the market can be classified as less than 1 kW and more than 1.1 kW.

High-power lasers with more than 1.1 kW will account for the highest revenue market share of 79.85% in 2026. High-power lasers find their application in engraving, cutting, welding, and 3D printing. Moreover, the growing demand for additive manufacturing will further bolster the segment growth. However, lasers with less than 1kW power are experiencing steady growth due to their wide range of industry applications.

By End-Use Industry

Electronics Segment to Dominate the Market Demand as a result of High Demand for Consumer Electronics

By end-use industry, the segment is further classified as electronics, metal processing, automotive, and non-metal processing.

Electronics segment to cater highest revenue share of 42.56% in 2026 by end-use industry in industrial lasers market. Significant capital expenditure, supportive tax reforms, and increasing demand for consumer electronics are surging the demand for lasers in industrial facilities. Electronics manufacturing includes semiconductors, PCBs, flat panel displays, solar cells, batteries, and other hybrid circuits. Increasing demand for these products will further propel the market during the forecast period.

INDUSTRIAL LASERS MARKET REGIONAL OUTOOK

With respect to region, the market covers North America, Europe, Asia Pacific, and the rest of the world.

Asia Pacific Industrial Lasers Market Share, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

The booming semiconductor and electronic manufacturing across countries, such as China, Japan, India, ASEAN, and others are bolstering the industrial lasers market share. Lasers are largely preferred in semiconductor, aerospace, automotive, electronics, and other prominent sectors. Changes in government policy, increasing focus on domestic manufacturing, development of innovative technologies, supportive tax reforms, and rising demand for these lasers across manufacturing sectors are driving the market in Asia Pacific. For instance, India’s Production Linked Incentive (PLI) scheme and Semicon India Program support domestic electronics manufacturing. The Japan market is projected to reach USD 1.53 billion by 2026, and the India market is projected to reach USD 1.1 billion by 2026.

However, China has remained the dominant country as a result of increasing material processing activities. Significant capital investment, increasing semiconductor and display manufacturing, and multiple supportive policies by the government associations are boosting the growth in China. The China market is projected to reach USD 9.14 billion by 2026,

Europe

The European market is expected to surge due to the increasing demand for electric vehicles and rise in metal and non-metal processing activities. Laser technology facilitates efficient battery recycling and the extraction of valuable raw materials, contributing to its growing demand in the region. Additionally, numerous manufacturing companies are aiming to broaden their European operations. For example, on March 20th, Canadian company Laserax bolstered its market presence in Germany by establishing a new test laboratory facility. The UK market is projected to reach USD 1.28 billion by 2026, while the Germany market is projected to reach USD 4.08 billion by 2026.

North America

North America is expected to experience an increase in the demand for industrial lasers due to the rise in capital investment in precision equipment, upgrading of equipment and machines in manufacturing and assembly processes, and supportive government policies. Countries, such as Canada and Mexico are anticipated to witness a surge in the sales of these lasers, driven by steady growth in the semiconductor and microelectronic industries. In October 2024, Foxconn revealed plans to establish a new production facility for NVIDIA’s GB200 Superchips, further contributing to the boost in industrial laser sales. The U.S. market is projected to reach USD 3.67 billion by 2026.

Rest of World

The use of industrial lasers is expanding across the Middle East & Africa and South America in sectors, such as metal and non-metal processing, energy, automotive, and aerospace. The market in these regions is expected to grow due to the increasing focus on industrial automation, higher investments in industrial projects, and adoption of innovative technologies. However, the market in the Middle East might be affected by tensions between countries in the region. In South America, the sales are likely to be boosted by the growing number of industrial projects and increase in semiconductor manufacturing.

COMPETITIVE LANDSCAPE

Key Industry Players

Investment in New Product Launches and Collaboration Strategies to Strengthen Presence of Market Players

The industrial laser market is highly consolidated with the presence of a few players. Manufacturers are focusing on new product launches that offer efficient and improved performance. They are also investing in innovative technologies to meet the increasing demand across various end-use sectors. For instance, Laser Photonics Corporation (LPC) has launched laser systems for cleaning and other material processing applications. It has mobile connectivity and added safety features for the operator. Many players in the market are also expanding their presence through collaborations and joint ventures with local companies to penetrate different markets.

List of Companies Profiled:

- Calmar Laser (U.S.)

- Amonics Ltd. (China)

- TRUMPF (Germany)

- Coherent Inc. (U.S.)

- Newport Corporation (U.S.)

- IPG Photonics Corporation (U.S.)

- Bystronic Laser AG (Switzerland)

- JENOPTIK AG (Germany)

- Lumentum Operations LLC (U.S.)

- nLight Inc. (U.S.)

- ACSYS Lasertechnik Inc. (Germany)

- Han’s Laser Technology Industry Group Co. Ltd. (China)

- Clark-MXR Inc. (U.S.)

- Lumibird SA (France)

- Toptica Photonics AG (Germany)

- Quantel Group (U.K.)

- NKT Photonics A/S (Denmark)

- CY Laser SRL (Italy)

- Apollo Instruments (U.S.)

- Laser Lab India Pvt. Ltd. (India)

KEY INDUSTRY DEVELOPMENTS:

- September 2024: Laser Photonics Corporation (LPC) expanded its presence in diverse sectors, including solar energy, semiconductors, and defense. Acuren, a player in nondestructive testing services and a global oil & gas company has adopted LPC's CleanTech laser systems for maintenance and inspection processes.

- August 2024: BWT launched a 200kW ultra-high-power industrial-grade fiber laser to enhance the efficiency of material processing. The new fiber laser provides high-brightness long-fiber delivery cable and femtosecond laser fiber grating technology for a wide range of industry verticals.

- July 2024: MedWorld Advisors announced the acquisition of ARC Laser GmbH and GNS neoLaser Ltd. to form the MedTech Laser Group. The Group will offer an extensive range of laser technologies focused on medical devices and other treatments.

- October 2023: TRUMPF launched an automated punch laser machine named TruMatic 5000 which allows laser cutting, punching, and forming. The TruMatic 5000 can be easily integrated with a self-contained smart factory for optimal and efficient processes.

- May 2022: Lumentum expanded its product portfolio by adding a new femtosecond laser system named the FemtoBlade. The new high-precision ultrafast industrial laser system provides enhanced flexibility and faster processing in micromachining applications, such as OLED, glass cutting, engraving, and solar cell processing.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product/service types, and leading applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 12.70% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Power

By Application

By End-Use Industry

By Region

Rest of World (By Type, By Power, By Application, By End-Use Industry, and By Country) |

|

Key Market Players Profiled in the Report |

Calmar Laser (U.S), Amonics Ltd (China), TRUMPF (Germany), Coherent Inc. (U.S.), Newport Corporation (U.S.), IPG Photonics Corporation (U.S.), Bystronic Laser AG (Switzerland), JENOPTIK AG (Germany), Lumentum Operations LLC (U.S.), nLight Inc. (U.S.) |

Frequently Asked Questions

The market is projected to reach a valuation of USD 70.02 billion by 2034.

In 2026, the market was valued at USD 26.95 billion.

The market is projected to record a CAGR of 12.70% during the forecast period.

The fiber laser segment is dominating the market.

Growing demand for efficient material processing will propel the market.

Calmar Laser, Amonics Ltd, TRUMPF, Coherent Inc., Newport Corporation, and IPG Photonics Corporation are the top players in the market.

The Asia Pacific dominated global market with a share of 49.00% in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us