The 77 GHz frequency segment is projected to remain dominant, accounting for 79.78% of the global market share in 2026. 24 GHz is expected to occupy the second-largest position in the market. 24 GHz frequency is similar to 77 GHz but less used in modern automotive applications. One of the biggest advantages of 24 GHz is its lower cost than high-frequency radar systems. As with high-frequency, 24 GHz can be integrated with other sensor technologies such as cameras and LiDAR. This sensor fusion allows for a more comprehensive awareness of the vehicle's surroundings, improving safety.

Automotive RADAR Market Size, Share & Industry Analysis, By Range (Short-Range Radar, Medium-Range Radar, and Long-Range Radar), By Frequency (24 Ghz and 77 Ghz), By Application (Adaptive Cruise Control (ACC), Autonomous Emergency Braking (AEB), Forward-Collision Warning System (FCWS), Blind Spot Detection (BSD), and Intelligent Parking Assistance), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

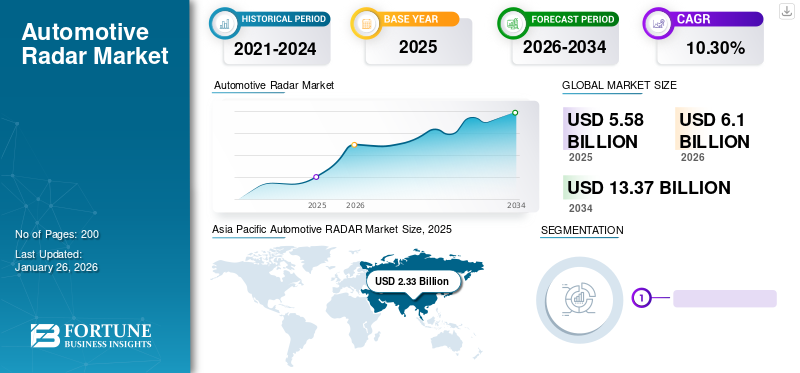

The global automotive radar market size was valued at USD 5.58 billion in 2025 and is projected to grow from USD 6.10 billion in 2026 to USD 13.37 billion by 2034, exhibiting a CAGR of 10.30% during the forecast period. Asia Pacific dominated the automotive radar market with a market share of 41.70% in 2025.

Radar is a well-known technology that relies on the transmission and reception of electromagnetic waves to measure, detect and locate environmental obstacles. It is particularly useful for automotive applications because vehicles are excellent at reflecting electromagnetic waves, allowing accurate measurement of vehicle distance, position, and speed.

Global Automotive RADAR Market Overview

Market Size:

- 2025 Value: USD 5.58 billion

- 2026 Value: USD 6.10 billion

- 2034 Forecast Value: USD 13.37 billion, with a CAGR of 10.30% from 2026–2034

Market Share:

- Asia Pacific held the largest market share in 2024, driven by growing vehicle production and integration of advanced safety systems.

- Europe is expected to grow at the fastest rate during the forecast period due to increasing regulatory mandates and early adoption of ADAS technologies.

- North America also remains a significant contributor due to increasing adoption of radar-based systems in both passenger and commercial vehicles.

Industry Trends:

- Expansion in application of radar across safety systems such as Adaptive Cruise Control (ACC), Autonomous Emergency Braking (AEB), Blind Spot Detection (BSD), Forward Collision Warning System (FCWS), and Intelligent Parking Assistance.

- Growing adoption of long-range radar sensors, with detection capabilities up to 250 meters, supporting enhanced ADAS and autonomous driving features.

- Emergence of modular and scalable radar platforms combining long-range and short-range capabilities in a single integrated system.

- Collaborations such as Veoneer and Arbe (2022) reflect growing focus on cost-effective radar modules for mass-market autonomous vehicles.

Driving Factors:

- Rising demand for vehicle safety and automation technologies, particularly in emerging economies.

- Increasing number of government safety regulations mandating systems like automatic emergency braking and collision avoidance.

- Rapid growth in passenger car sales in countries like China, India, and South Korea.

- Ongoing R&D and innovation efforts by key players such as Robert Bosch, Continental AG, Denso Corporation, Veoneer Inc., Aptiv, and ZF Friedrichshafen AG.

Economic factors such as rising disposable income and low-interest rates have contributed significantly to the increase in car sales. Increasing investments in the development of the automotive industry in Japan, the U.K., China, India, Germany, and the U.S. contributed to the growth of this market. Introducing advanced driver assistance systems in passenger vehicles may impact a significant growth opportunity for the market. The advanced driver assistance system radar enables comprehensive insight into the vehicle's surroundings, helping occupants proactively identify potential hazards.

Government driver and vehicle safety regulations will also boost the automotive radar market growth. Advanced driver assistance systems in passenger cars ensure vehicle safety and road safety. In Europe, comprehensive pedestrian protection is compulsory according to the Euro NCAP rating (European New Car Rating Programme). A new car must have at least one assistance system. Automotive Radar is presumed to provide safety features such as forward collision warning, lane departure warning, collision detection, warning notification, adaptive cruise control, automatic emergency braking, blind spot detection, parking assist, and rear cross-traffic warning. End-user awareness of these safety features will drive the market demand during the forecast period.

The global automotive industry faced significant challenges due to the COVID-19 pandemic. Strict social distancing measures and nationwide lockdowns led to the complete shutdown of numerous OEM manufacturing facilities, disrupting the flow of raw materials and adversely impacting the industry as a whole. The lockdowns also affected revenue streams designated for research and development, hindering the adoption of new technologies such as automotive RADAR.

Automotive RADAR Market Trends

Emergence of Automotive Radar for Autonomous Driving Advances the Market

Autonomous vehicles require highly sophisticated sensor systems to recognize their surroundings accurately and make well-versed decisions in real time. Automotive radar plays a crucial role in providing essential data about the vehicle's environment, including the detection of objects, pedestrians, vehicles, and road infrastructure. (ADAS) Advanced Driver Assistance Systems heavily rely on radar sensors for functions such as adaptive cruise control, emergency braking, lane-keeping assistance, and object detection. Thus, the integration of radar sensors into these systems boosts the demand for automotive radar solutions and drives market expansion. For instance, in November 2023, NXP invested in and forged a collaboration with Zendar Inc. aimed at enhancing radar systems' resolution and performance for autonomous driving (AD) and ADAS. Zendar's Distributed Aperture Radar (DAR) solution expands the radar aperture, enhancing angular resolution to achieve performance comparable to LiDAR. Original equipment manufacturers (OEMs) stand to gain from streamlined system solutions, decreased complexity, and a reduced radar footprint.

Download Free sample to learn more about this report.

Automotive RADAR Market Growth Factors

Stringent Government Regulations Regarding Vehicle Safety to Drive Industry Growth

Road accidents are the leading cause of death of people worldwide; the alarming number of death caused by road accidents have forced governments to impose strict rules on automobile industries. Hence, ruling organizations worldwide have developed stringent regulations to minimize the number of road accidents and death tolls. Therefore it has become mandatory for companies to manufacture vehicles with safety features installed in them. Many automotive companies are developing a technologically advanced RADAR system that makes driving safer. For instance, in December 2021, Europe made automatic emergency braking mandatory in all cars from the start of 2022. Therefore stringent government regulations is responsible for automotive RADAR market growth over the forecast period.

Rising Sales And Demand For Passenger Vehicles Is Expected To Propel Market Growth

Rising sales and demand for passenger vehicles in developing countries are anticipated to drive market growth during the forecast period. Developing countries like India, China, Japan, and South Korea are expected to boost the demand for passenger vehicles. Increasing investments in R&D by key players in this region are anticipated to drive the global market amid the installation of the technologically advanced radar system in passenger vehicles. Growing disposable income of users and inclination towards safe and efficient driving is expected to propel the market.

RESTRAINING FACTORS

Limiting Robust Machine Vision to Hamper the Growth of the Market

Radar has a strong ability to detect the trajectory of dynamic objects and view things. However, the irregular nature of radio waves limits their ability to classify objects and locate vehicles. Advance driver assistance system (ADAS) applications typically use gigahertz frequencies between 70 GHz and 90 GHz, resulting in very narrow bands that compromise the angular resolution of radar devices. Additionally, the use of transmitter and receiver antennas makes it bulky and difficult to mount. In general, the classification, resolution, and sizing challenges appear to be difficult for manufacturers to solve, as solving one challenge adversely affects other parameters. For example, if the development focuses on improving resolution, the need for more transmitters will grow, increasing the sensor's overall size.

Automotive RADAR Market Segmentation Analysis

By Range Analysis

Medium-Range Radar Segment Dominates the Market Owing to its Lower Cost and Precise Operation

Based on the range, the market is segmented into short-range radar (SRR), medium-range radar (MRR), and long-range radar (LRR). Medium-range radar accounting for 58.81% of the global market share in 2026, owing to the increasing inclination of consumers towards applications such as Adaptive Cruise Control (ACC), heading distance indicator, Autonomous Emergency Braking (AEB), and rear cross-traffic alert. The medium-range radar comprises digital beamforming (DBF) and 3-4 receive channels. This helps medium-range radar to be configured with independent receive channels for different directions, which increases the measurement accuracy of MRR.

MRR gives accurate information about users' blind spots and traffic coming forward from the rear side of the vehicle. Long Range Radar (LRR) is expected to be the fastest-growing segment in the market and helps detect objects from meters to hundreds of meters away. This sensor provides information on objects' relative position, speed, and size around the vehicle. LRR has greatly contributed to improving vehicle safety and enabling the development of autonomous driving technology. By feeding real-world data to decision-making algorithms, vehicles can better understand their surroundings and make informed driving decisions.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Adaptive Cruise Control Segment to Lead the Market Strict Vehicle Safety Norms

By application type, the market is fragmented into Adaptive Cruise Control (ACC), Autonomous Emergency Braking (AEB), Blind Spot Detection (BSD), Forward-Collision Warning (FCW), and Intelligent Parking Assistance. Adaptive Cruise Control (ACC) is expected to drive the market owing to stringent government regulations to avoid collisions on the road. Adaptive Cruise Control (ACC) helps the vehicle to adapt the speed according to the surrounding vehicles. RADAR equipped at the vehicle's front end helps detect the vehicle's speed ahead and adjusts its speed accordingly. If the forward vehicle reduces speed, ACC detects the change and slows down the vehicle to maintain a gap between them. If ACC detects that the vehicle ahead is no longer in the Range, it again accelerates to the speed set by the user. Automating and de-accelerating the vehicle are done automatically without the user's interference. Intelligent parking assistance holds the second-largest position in the market. The intelligent parking assistance system parks the car by itself without the need for a human driver and with high accuracy and less time than the experienced driver. This system uses a combination of cameras and sensors for its precise operation. This factor is expected to maintain the second-largest position of the intelligent parking assistance system over the forecast period.

By Frequency Analysis

77 Ghz is Expected to Drive the Market Owing to High Resolution and Accurate Object Detection and Tracking

By Frequency type, the global market is fragmented into 24 Ghz and 77 GHz. The 77 GHz frequency is the most common frequency for these systems. It has advantages like wide bandwidth, high resolution, and accurate object detection and tracking. 77 GHz is used for various applications such as Adaptive Cruise Control (ACC), Forward Collision Warning (FCW), Automatic Emergency Braking, Blind Spot Detection, Lane Departure Warning, and Parking Assistance. Modern 77 GHz systems often have multimode capabilities, allowing them to operate in different modes, including a long-range mode for detecting objects at great distances and a short-range mode for accurate object detection at close Range.

REGIONAL ANALYSIS

Geographically the market is divided into North America, Europe, Asia Pacific, and the Rest of the World.

Asia Pacific Automotive RADAR Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

The Asia Pacific region is anticipated to show lucrative growth and holds the largest share in the market. Asia Pacific accounted for USD 2.33 billion in 2025. The OEMs operating in this region offer next-generation technologies for improving traffic congestion and the transport's overall convenience. Manufacturers in this region focus more on developing high-end applications to attract more consumers and have a leading edge over their competitors. These factors will fuel the growth of the market in this region. The Japan market reaching USD 0.71 billion by 2026, the China market reaching USD 1.39 billion by 2026, and the India market reaching USD 0.07 billion by 2026.

Europe

The Europe market was valued at USD 2.06 billion in 2024 and is projected to reach USD 4.72 billion by 2032, at a CAGR of 11.1 %, and is anticipated to dominate the market over the forecast period. and is anticipated to dominate the market over the forecast period. The region will dominate this market over the forecast period. Europe is expected to show a considerable growth owing to supporting initiatives like EuroNCAP, which is encouraging the ease of fitment of the safety features in the vehicle. Most automotive industries in Germany invest almost one-third of their revenue in research and development. Hence, with advanced infrastructure, Germany is expected to hold the largest market share in this region during the forecast period. The rapid growth of autonomous cars will also support the market's growth. The UK market reaching USD 0.23 billion by 2026 and the Germany market reaching USD 0.89 billion by 2026.

North America

North America will also show profitable growth in the market over the forecast period. The automotive manufacturers' technological development of RADAR sensors in this region towards the ADAS system will drive the market. The adoption of sensor-based technologies is increasing in the automotive sector, and the demand for the advanced driver assistance system with combined RADAR capabilities will also grow. The U.S. market reaching USD 0.52 billion by 2026.

List of Key Companies in Automotive RADAR Market

Companies are Focusing on Partnerships, Acquisition, and Building Advanced Radar to Gain a Competitive Edge over Others

Some leading companies dominate the global market due to their critical strategic decisions, robust product portfolio, and dominance of market share. These include a group of 4-5 key companies with a more extensive geographic presence and persistent R&D, resulting in secure regulatory approvals. For instance, in March 2021, Bosch partnered with Global Foundries to develop a RADAR chip for automotive ADAS applications. It identifies dangerous situations on the road ahead, ensures the car is in the correct lane, warns of a potential collision, initiates emergency braking, and assists with parallel parking.

LIST OF KEY COMPANIES PROFILED:

- Robert Bosch GmbH (Germany)

- Continental AG (Germany)

- Denso Corporation (Japan)

- Aptiv (Ireland)

- Autoliv Inc. (Sweden)

- Veoneer (Sweden)

- Valeo SA (France)

- NXP Semiconductors NV (Netherlands)

- Texas Instruments Incorporated (U.S.)

- ZF Friedrichshafen AG (Germany)

- Infineon Technologies AG (Germany)

- Renesas Electronics Corporation (Japan)

KEY INDUSTRY DEVELOPMENTS:

- July 2022: Bosch, the world's leading automotive supplier, has announced a partnership with the Swedish technology company Gapwaves to develop high-definition radar antennas for automotive applications. Gapwaves will provide support with its antenna know-how and Bosch with its radar sensor and autonomous driving know-how.

- August 2022: Renesas Electronics announced that it has entered into an agreement to acquire Steradian Semiconductors Pvt Ltd. The acquisition of Steradian's radar technology will enable Renesas to expand its reach in the radar market and expand its range of sensor solutions for the automotive and industrial sectors.

- October 2022: Veoneer partnered with Arbe to co-develop automotive radars. Modular in design, highly reliable, and affordable, radar sensors provide both redundancy and rich data, critical for automotive-grade safety and autonomous feature deployments.

- October 2022: Veoneer and Arbe Robotics jointly developed high-resolution 4D imaging radars for automotive safety and autonomous features. Veoneer integrated two radars based on Arbe's designs: one with 48x48 RF channels for long-range sensing and one with 24x12 RF channels. The radar operates effectively in challenging weather and lighting, distinguishing real threats from false alarms for safer roads. It is modular, reliable, and cost-effective, providing redundancy and diverse data, which is crucial for automotive safety and autonomy.

- November 2022: Infineon Technologies AG pioneered the introduction of the world's inaugural 77 GHz automotive radar chip, which was based on SiGe technology developed in 2009. Infineon unveiled the RASIC CTRX8181 transceiver, representing the first product in a series of cutting-edge 76 to 81 GHz radar MMICs built on 28-nm CMOS technology. The enhanced signal-to-noise ratio and linearity of this transceiver significantly elevate system-level performance and durability. Moreover, the user-friendly radar transceiver provides a scalable platform for various sensors, including corner, front, and short-range capabilities, while also offering adaptability for emerging software-defined vehicle architectures. This breakthrough facilitates the deployment of 77 GHz automotive radar applications while minimizing development expenses.

- December 2022: ZF announced that SAIC Motor Corporation would introduce imaging radar technology for its R-series vehicles in China. This technology provides high resolution in four dimensions: Range, velocity, azimuth (horizontal), and altitude (vertical). Adding elevation helps create enhanced 3D images of traffic conditions enriched with speed information, resulting in an "ultra-dense, digitally-enhanced environment model."

- January 2023: NXP Semiconductors has released its SAF85xx single-chip automotive radar SoCs, the industry's first 28nm RF CMOS devices for safety-critical ADAS applications such as blind spot detection and automatic emergency braking.

REPORT COVERAGE

The market report provides a detailed analysis and focuses on key aspects such as leading companies, vehicle types, and product types. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the market's growth in recent years.

An Infographic Representation of Automotive Radar Market

To get information on various segments, share your queries with us

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 10.30% from 2026 to 2034 |

|

Unit |

Value (USD Billion) and Volume (Thousand Units) |

|

Segmentation |

By Range

|

|

By Application

|

|

|

By Frequency

|

|

|

By Geography

|

Frequently Asked Questions

A study by Fortune Business Insights shows that the market size was USD 5.58 billion in 2025.

The market is likely to grow at a CAGR of 10.30% over the forecast period (2026-2034).

The application segment is expected to be the leading segment in the global market during the forecast period.

Bosch GmbH, Continental AG, and Denso Corporation are the global market players.

Asia Pacific is expected to hold the highest global market share.

Seeking Comprehensive Intelligence on Different Markets?Get in Touch with Our Experts

Speak to an Expert

Download Free Sample

Automotive & Transportation

Clients

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic