Automotive Adaptive Cruise Control Market Size, Share & COVID-19 Impact Analysis, By Component Type (LiDAR, RADAR, and Camera), By Vehicle Type (Passenger Cars and Commercial Vehicles), and Regional Forecast, 2023-2030

KEY MARKET INSIGHTS

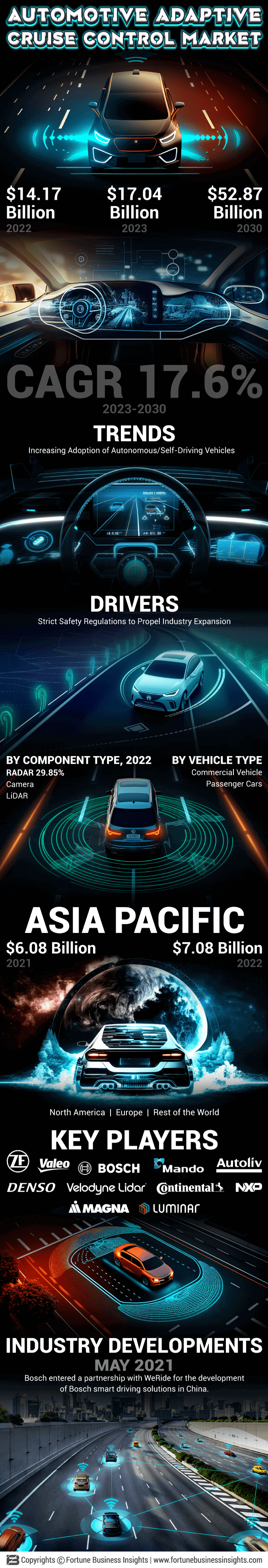

The global automotive adaptive cruise control market size was valued at USD 14.17 billion in 2022 and is projected to grow from USD 17.04 billion in 2023 to USD 52.87 billion by 2030, exhibiting a CAGR of 17.6% during the forecast period. Asia Pacific dominated the global market with a share of 49.96% in 2023. Automotive Adaptive Cruise Control Market in the U.S. is projected to grow significantly, reaching an estimated value of USD 4.09 billion by 2030

Adaptive cruise control is a safety feature that helps the vehicle's cruise control adjust the vehicle's speed to the surrounding traffic conditions. It does not require assistance from surrounding vehicles and does not use road infrastructure or satellites to detect traffic conditions around the vehicle. Instead, it uses LiDAR, RADAR, or laser technology to detect the distance between two vehicles and adjust speed accordingly. A LiDAR/RADAR system in the front of the vehicle continuously records moving traffic around the vehicle. If a slow-moving vehicle is detected before the car, the system automatically applies the brakes to maintain the following distance. If the radar detects no obstacles or vehicles within range of the adaptive cruise control system, the vehicle will automatically accelerate to the cruise control speed. It, therefore, automatically assists the vehicle in accelerating and braking according to the surrounding traffic conditions without any intervention from the driver. Combined with a collision avoidance system, it warns the driver when the vehicle approaches an obstacle and begins slowing.

Strong economic growth in many countries has led to increased disposable income and consumer spending power, which have contributed significantly to the increase in car sales. Increasing investment in the development of the automotive industry in China, the U.S., Germany, India, and South Korea has contributed to the expansion of the automotive adaptive cruise control market share. For instance, in April 2019, the government of India launched the Fame-II scheme to reduce the consumption of conventional fuel and pollution and create battery and Electric Vehicle (EV) manufacturing capacity at a global scale. The Indian government invested USD 1.2 billion in this scheme, and around 85% of the funding was allocated to EV purchasing incentives.

Download Free sample to learn more about this report.

COVID-19 IMPACT

Disruptions in Supply Chain and Travel Restrictions Hindered Market Growth Amid the Pandemic

The COVID-19 pandemic has severely impacted the automotive industry across the globe. Various countries worldwide have implemented nationwide lockdown norms to prevent the spread of the virus. Auto sales plunged sharply in the second half of 2020 due to the pandemic and strict social distancing regulations. Stringent social distancing norms and nationwide lockdowns had resulted in the complete closure of various OEM manufacturing units, halting the movement of raw materials and directly or indirectly affecting thousands of dependent workers and the industry. Owing to lockdowns, unemployment, and wage cuts have exponentially reduced car needs. This has also significantly reduced the consumer's purchasing power and the demand for luxury cars across the globe. For instance, in 2020, the sale of Lamborghini dipped by 11%, Porsche by 3%, and Ferrari by 10%, respectively, compared to 2019. This severely impacted the market growth.

In the second half of 2021, multiple countries worldwide have implemented large-scale vaccination campaigns to limit the spread of the virus. These factors have gradually increased the demand in the automotive market, boosting the global market demand during the forecast period. For instance, in 2021, the total net sales of Robert Bosch increased by 16% compared to 2021.

LATEST TRENDS

Higher Adoption of Adaptive Cruise Control Systems in Autonomous/Self-Driving Vehicles is Key Market Trend

The self-driving or autonomous vehicles fall under the 4th and 5th levels of automation. These vehicles rely on sensors, radars, cameras, software algorithms, and other advanced driving systems. The ACC system is one of the crucial devices of autonomous vehicles and helps them to function efficiently. The adoption of ACC in autonomous cars is one of the latest trends in the automotive industry. It is an intelligent system that automatically adjusts speed to maintain a safe distance from other vehicles in the same lane. This system comprises a longitudinal control strategy, a lateral control strategy, and an integrated decision unit that controls the speed, maintains the fixed lane, and applies severe brakes to avoid collisions, making it an essential part of autonomous vehicles. The automotive industry is shifting toward autonomous vehicles due to technological advancements in safety systems. The rising demand for greater comfort, high efficiency, and enhancement in safety features is driving the adoption of self-driving or autonomous vehicles across the globe. Moreover, the rates of road accidents are rising day by day. The adoption of autonomous vehicles having such systems will reduce the frequency and severity of road accidents to a great extent, thereby propelling the demand for these systems.

DRIVING FACTORS

Stringent Safety Regulations to Drive Market Growth Over the Forecast Period

Many governments have developed innovative strategies to curb the growing number of road accidents across the globe. Governments worldwide are imposing stringent norms on automakers to improve vehicle safety. Various transport associations and trade unions have issued safety regulations for the installation of ACC systems in vehicles. Top manufacturers are investing heavily in research and development to produce long-range RADAR combined with adaptive cruise control, which adjusts the vehicle's speed to the surrounding traffic conditions.

Growing Consumer Inclination Toward Adaptive Cruise Control Technology to Aid Market Expansion

Increasing consumer demand for advanced collision avoidance systems is one of the major factors contributing to the positive growth of the market. A rise in traffic accidents is expected to boost the demand for ACC systems during the forecast period. Advancements in adaptive cruise control have also increased the market demand. Increasing disposable income and changing preferences for purchasing vehicles equipped with these systems are anticipated to drive the market. Moreover, rising passenger car sales are another factor driving the automotive adaptive cruise control market growth during the forecast period.

RESTRAINING FACTORS

Bad Weather Conditions May Hamper Industry Growth

Regions with extreme weather conditions such as fog, snowfall, and rain are expected to hamper the market growth during the forecast period. Adaptive cruise control is less efficient in areas with extreme climates. Installing these systems and programming the radar system for different regions and extreme weather conditions increases the cost of the system. Each manufacturer produces high-end sensors that are very competitive compared to their competitors, making it difficult for car owners to understand their exact function.

SEGMENTATION

By Component Type Analysis

To know how our report can help streamline your business, Speak to Analyst

RADAR Segment to Dominate Owing to Precise Operation Compared to Cameras and LiDAR Sensors

Based on range, the market for automotive adaptive cruise control is segmented into LiDAR, RADAR, and camera. LiDAR is anticipated to be the dominant segment over the forecast period. The automotive industry's growing inclination toward highly safe and efficient self-driving vehicles fuels the demand for LiDAR technology. LiDAR is a technology that detects the distance between the vehicle and the obstacle with the help of laser-based technology and sends signals to the adaptive cruise control system to lower the vehicle's speed. The rising adoption of this system in passenger cars is helping this segment maintain its dominance. The rising adoption of this technology in commercial vehicles is expected to help maintain its steady growth during the forecast period.

The RADAR segment is expected to be the fastest-growing segment in the market over the forecast period. Increasing demand for the safety of vehicle occupants is fueling the demand for these systems. Various governments have imposed stringent regulations on automotive manufacturers to equip RADAR technology to enhance vehicles' safety. Automotive RADARs are of three types: long, medium, and short-range RADARs. Medium and short-range radars are majorly used in blind spot detection applications. The RADARs can detect obstacles at the vehicle's rear end. Besides, long-range RADARs are used in adaptive cruise control & autonomous emergency braking applications. Their primary function is to detect the distance between the vehicle and the obstacle at its front end. Long-range radars send the signal to the adaptive cruise control system and help to alter the vehicle's speed.

By Vehicle Type Analysis

Passenger Car Segment to Lead Owing to Increasing Vehicle Production

By vehicle type, the market for automotive adaptive cruise control is fragmented into passenger cars and commercial vehicles. The passenger car segment is anticipated to dominate the market during the forecast period. Stringent government regulations to equip vehicles with driver assistance systems that improve vehicle safety are fueling the growth of the passenger car sector. Increasing global vehicle production is also one of the key factors in maintaining the dominance of the passenger car sector. With significant investments in R&D and continued technological developments by automakers, adaptive cruise control systems are becoming more cost-effective and easier to use in all vehicle models. Significant growth is expected in the commercial vehicle sector during the forecast period. The booming e-commerce and logistics industry has increased the demand for commercial vehicles with ACC systems. Driving for long hours can be tiring for commercial vehicle drivers. The ACC system is responsible for maintaining a safe distance to the vehicle ahead and helps prevent driver fatigue by allowing the driver to concentrate on other aspects of driving.

REGIONAL ANALYSIS

Asia Pacific Automotive Adaptive Cruise Control Market Size, 2022 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Geographically, the market is segmented into North America, Europe, Asia Pacific, and the Rest of the World.

The Asia Pacific market was valued at USD 7.08 billion in 2022 and is projected to reach USD 30.48 billion by 2030, at a CAGR of 19.5% over the forecast period. The region is anticipated to dominate the market over the forecast period.

The Asia Pacific region is anticipated to hold the largest market share in the automotive adaptive cruise control industry. The availability of raw materials at a low cost and mass production of adaptive cruise control technology is driving the market growth. The region has made significant advances in automotive technology, including sensors, radar, and artificial intelligence. Automakers and technology companies are working together to develop improved adaptive cruise control systems. For example, in 2020, BlackBerry Ltd. partnered with his StradVision, a leading AI-based camera recognition technology provider. As part of this partnership, StrandVision will utilize the QNX software development platform in several advanced driver assistance systems (ADAS) and autonomous vehicles (AV) from various Korean automakers. High demand for ACC sensors from North America and Europe has led to high sales in the Asia Pacific region. Rising consumer disposable income has changed vehicle purchasing preferences from entry-level to mid-range models.

The European region is expected to show steady growth in the market owing to supporting initiatives such as EuroNCAP, which facilitates the easy integration of safety features into vehicles. Most of the German automotive industry invests almost a third of its turnover in research and development of safety features. With its advanced infrastructure, Germany is expected to hold the largest market share in the region during the forecast period. In addition, major regional players and growing consumer awareness of vehicle safety are expected to drive market growth.

North America is also expected to exhibit significant market growth over the forecast period. Government agencies such as the National Highway Traffic Safety Administration (NHTSA) promote using ADAS in vehicles to curb increasing traffic accidents in the U.S. The region is home to technologically advanced companies working on AI algorithms for ADAS technology and ACC systems.

KEY INDUSTRY PLAYERS

Companies Focus on Partnerships, Acquisitions, and Building Advanced Radar to Gain a Competitive Edge

Some leading companies dominate the global market due to their critical strategic decisions, robust product portfolio, and market share dominance. These include a group of 4-5 key companies with a more extensive geographical presence and persistent R&D, resulting in secure regulatory approvals. For example, in January 2023, Nxp Semiconductors released an advanced automotive RADAR single chip with autonomous driving and advanced ADAS capabilities. A one-chip RADAR comprises a highly integrated HF front end and a multi-core radar processor. Deploying such advanced features can give companies a competitive advantage over their competitors.

LIST OF KEY COMPANIES PROFILED:

- Robert Bosch GmbH (Germany)

- Continental AG (Germany)

- ZF Friedrichafen AG (Germany)

- Mando Corporation (South Korea)

- Denso (Japan)

- Valeo (France)

- Luminar Technologies, Inc (U.S.)

- Velodyne Lidar, Inc. (U.S.)

- Magna International (Canada)

- Autoliv, Inc. (Sweden)

- Nxp Semiconductors (Netherlands)

KEY INDUSTRY DEVELOPMENTS:

- June 2023: Fully autonomous and self-driving developer Plus selected Luminar as its long-range LiDAR provider to support its PlusDrive-assisted commercial vehicle driving system.

- May 2023: Subaru's first-ever electric vehicle, namely The Solterra 2023. The company offers Dynamic Radar Cruise Control, which reduces driver stress levels by assisting with steering, braking, and throttle control in everyday traffic conditions and long-distance vehicle travel.

- February 2023: Mercedes-Benz announced that it will equip its wide range of vehicles with Luminar LiDAR by the second half of 2023. The laser sensor will help power the German automaker's next-generation driver assistance system, enabling hands-free driverless driving on certain highways.

- May 2021: Bosch partnered with WeRide to develop Bosch smart driving solutions in China and WeRide software to offer a more comprehensive automated driving package to potential Chinese OEM customers. This would help adaptive cruise control to work precisely.

- May 2021: ZF partnered with Toyota Motor Corporation to develop advanced driver assistance systems (ADAS) for use on multiple vehicle platforms. With its Gen21 medium-range radar, ZF offers a powerful 77 GHz front-end radar that meets Euro NCAP's 5-star safety rating from 2022 and enables class L2/L2+ autonomous driving capabilities. This radar helps detect pedestrian assistance systems such as automatic emergency braking (AEB) and extends the detection range of systems such as adaptive cruise control at high speeds.

REPORT COVERAGE

An Infographic Representation of Automotive Adaptive Cruise Control (ACC) Market

To get information on various segments, share your queries with us

The report provides a detailed market analysis and focuses on key aspects such as leading companies, vehicle types, and product types. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the market growth in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2030 |

|

Base Year |

2022 |

|

Estimated Year |

2023 |

|

Forecast Period |

2023-2030 |

|

Historical Period |

2019-2021 |

|

Growth Rate |

CAGR of 17.6% from 2023 to 2030 |

|

Unit |

Value (USD Billion) Volume (Thousand Units) |

|

Segmentation |

By Component Type

|

|

By Vehicle Type

|

|

|

By Geography

|

Frequently Asked Questions

A study by Fortune Business Insights shows that the market size was USD 14.17 billion in 2022.

The market is likely to grow at a CAGR of 17.6% over the forecast period (2023-2030).

The passenger car segment is expected to be the leading segment in the global market during the forecast period.

Bosch GmbH, Continental AG, and ZF Friedrichshafen AG are the leading global market players.

The Asia Pacific is expected to hold the largest share in the global market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic