Bakery Products Market Size, Share & Industry Analysis, By Type (Bread, Cakes and Pastries, Biscuits and Cookies, and Others), By Product Range (Specialty {Gluten-free, Organic, and Others} and Conventional), By Form (Frozen and Fresh), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Convenience Stores, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

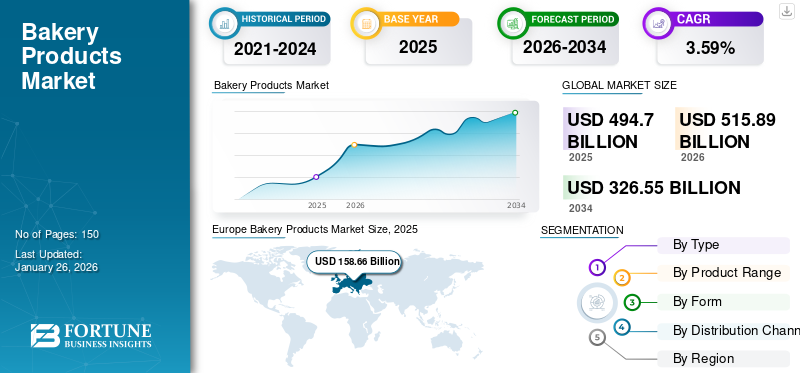

The global bakery products market size was valued at USD 494.7 billion in 2025 and is projected to grow from USD 515.89 billion in 2026 to USD 326.55 billion by 2034, growing at a CAGR of 3.59% during the forecast period. Europe dominated the global market with a share of 32.07% in 2025.

Bakery products include cakes, pastries, bread, biscuits, cookies, and other bakery items that are distributed through several distribution channels, including supermarkets/hypermarkets, specialty stores, convenience stores, and other channels. These products can also be segmented based on their ingredient and production methods, such as specialty and conventional, where the specialty products include gluten-free, organic, and others. Whether the product type is a specialty or conventional, it is sold either fresh or frozen, with fresh products holding a significant market share. Moreover, the global bakery products market is witnessing a strong surge in plant-based offerings as consumers increasingly prefer vegan, dairy-free, and clean-label alternatives.

The market is dominated by key players, including Mondelez International, the Kellogg Company, Associated British Foods, General Mills, and Grupo Bimbo, and others. These companies continue to expand frozen bakery facilities globally to support foodservice operations and international supply chains.

MARKET DYNAMICS

Market Drivers

Rise in Demand for Convenient Food Products to Fuel Market Growth

The bakery industry is driven significantly by the higher convenience offered by these products. The increase in fast-paced lifestyles owing to rapid urbanization, along with an increase in working-class people and dual-income households, has been shaping consumer preferences toward convenient food products, such as ready-to-eat and ready-to-bake. Furthermore, the increase in spending capacity and fast-paced lifestyle also drive the demand for food products such as doughnuts, which are one of the staple foods in the U.S. and are often consumed as a snack.

- According to the Center for American Progress and the Ford Foundation, over 60% of the U.S. labor force (more than 93 million people as of 2023) is considered working class, defined primarily by not holding a four-year college degree.

Market Restraints

Fluctuating Raw Material Prices and Supply Chain Vulnerability to Impede Market Growth

The bakery industry is highly sensitive to fluctuations in the prices of key ingredients such as wheat, flour, sugar, butter, and vegetable oils. Climate change, geopolitical instability, and supply disruptions have caused volatility in global grain markets. For instance, the Food and Agriculture Organization Food Price Index recorded sharp spikes in cereal and oil prices during 2022–2024, directly impacting bakery production costs. In developing regions, high price elasticity of demand in developing regions restricts manufacturers’ ability to pass on increased costs to consumers.

Market Opportunities

Advanced Freezing Technologies to Provide New Growth Opportunities

Advances in modified atmosphere packaging (MAP), vacuum sealing, premium cartons, and frozen logistics have significantly enhanced shelf life and product stability. These innonvations are reshaping bakery distribution globally and opening new opportunities for cross-border trade and e-commerce retail. Moreover, advanced freezing technologies such as blast freezing and cryogenic freezing help preserve taste, texture, and nutritional value, making frozen bakery products comparable to fresh ones.

- For instance, in November 2025, Matlinga, a frozen bakery and convenience food company, partnered with Starfrost, one of the leading providers of cooling solutions for the global food processing industry, and installed a Helix Spiral Freezer, which significantly boosts freezing capacity and operational efficiency. This latest installation allows the bakery to freeze a total of 68 tons of bakery products daily across its production sites, including in Lithuania, thereby enhancing its ability to meet rising global bakery products market demand.

Bakery Products Market Trends

Advancement in Technology to Boost Industry Growth

The bakery sector has been substantially advancing with the adoption of new and advanced technology in the production and supply of bakery products. Automation in the manufacturing process is one of the leading trends. The artisanal and innovative bakery goods industry has showcased significant growth, which is a significant factor driving the demand for automation. In addition, automation has further contributed to multiple benefits, such as higher output, faster production, and others that contribute to the overall bakery products market growth.

As a result of these benefits, significant number of manufacturers are planning to invest in new machinery and are focused on automation. For instance, as per Statistics Canada’s Survey conducted in 2022, the baking industry is on the verge of embarking on automation, with around 46% of participants of the survey inclined toward investing in new machinery and innovative products. In addition, around 32% are inclined toward investing specifically in automation.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Type

Bread Segment Dominates Owing to Its High Consumption

On the basis of type, the market is segmented into bread, cakes and pastries, biscuits and cookies, and other bakery products.

Bread is projected to account for 44.47% of the total market share by 2026, primarily due to its high consumption among consumers across varied age groups. Its nutritional value, price, and convenience are primary factors that increase bread consumption in Western diets. Moreover, bread is now available in various categories, such as gluten-free, whole grain, and high-fiber products. The availability of these new offerings is likely to boost consumption among consumers who prefer to consume healthy diets.

The biscuits and cookies segment is expected to grow significantly during the forecast period, with a CAGR of 6.89% in 2025.

To know how our report can help streamline your business, Speak to Analyst

By Product Range

Conventional Segment to Dominate Due to Higher Availability of Diverse Product Portfolios

On the basis of product range, the market is segmented into specialty and conventional.

Conventional products are expected to dominate the market, representing 90.11% of the total share by product range in 2026. The segment holds a dominant share owing to the wide availability of diverse product portfolios in the market. Conventional bakery products such as bread and other staples are widely consumed in Germany, the U.S., and several other countries, thus further contribute to their higher share in the global market.

The specialty segment is expected to grow significantly, with a CAGR of 6.73% during the forecast period.

By Form

Convenience and Modern Consumers’ Busy Lifestyles Fostered the Frozen Segment Growth

On the basis of form, the market is segmented into fresh and frozen.

The frozen form is anticipated to hold 89.70% of the market share in 2026. Frozen bakery products offer quick, hassle-free meal solutions, aligning with modern consumers’ busy lifestyles. Ready-to-bake and ready-to-eat frozen bakery items allow consumers to enjoy freshly baked goods with minimal preparation time, supporting on-the-go consumption and time savings. The freezing process also preserves bakery products for extended periods, significantly reducing spoilage and retail waste. This appeals to both consumers and retailers, enhancing cost efficiency and sustainability.

The fresh segment is anticipated to grow at a highest CAGR of 5.90% during the forecast period.

By Distribution Channel

Supermarkets/Hypermarkets Segment Dominated the Market Due to Availability of Wider Product Range

On the basis of distribution channel, the market is segmented into supermarkets/hypermarkets, specialty stores, convenience stores, and others.

Specialty stores are forecast to account for 34.16% of the total market share by distribution channel. This dominant share is credited to the proximity, accessibility, and affordability these retail formats offer to customers. Furthermore, the dedicated shelf for bakery products in this segment further contributes to their higher sales.

The convenience stores segment is anticipated to grow at a high CAGR of 6.38% during the forecast period.

Bakery Products Market Regional Outlook

By region, the market is analysed across North America, Europe, Asia Pacific, South America, the Middle East & Africa.

Europe Bakery Products Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Europe

Europe dominates the global bakery products market with a value of USD 154.34 billion in 2024, projected to grow to USD 192.82 billion in 2031. Europe holds the dominant revenue share in the global market owing to the higher demand for baked goods in Germany, France, Italy, the U.K., and other countries. Products such as cakes, bread, pastries, and others are staple foods in these countries, resulting in higher per capita consumption. In addition, the region is expected to showcase rising demand for gluten-free and organic product ranges owing to the increasing focus on health and wellness food products. The UK market is projected to reach USD 26.50 billion by 2026, while the Germany market is projected to reach USD 28.10 billion by 2026.

North America

North America is the second-leading region, with a CAGR of 5.37%. One of the prominent factors driving demand in the region is the convenience offered by the product. Market leaders such as Mondelez International, General Mills, and Grupo Bimbo are focused on the development of new product ranges focusing on health and wellness, owing to increasing consumer awareness of healthy bakery consumption, which is expected to fuel market growth. The U.S. leads the regional market owing to the high consumption of bread, cakes, and pastries, while Mexico's heavy reliance on bakery products makes it the fastest-growing country in the region. The U.S. market is projected to reach USD 103.49 billion by 2026.

Asia Pacific

Asia Pacific is expected to experience the fastest growth, with a CAGR of about 5.81%, which is significantly driven by the rapid growth in the participation of women in the workforce, increasing dual-income households, and urbanization. These factors fuel the demand for convenient food products, resulting in increased consumption of products such as bread. The region's high growth is further supported by the increasing adoption of Western diets in China, India, and other Southeast Asian countries. The rising number of working women and growing disposable incomes also support market growth. Moreover, the growing healthy living trend in China and Japan boosts the demand for reduced sugar and low-carb bread, cakes, and pastries. The Japan market is projected to reach USD 42.75 billion by 2026, the China market is projected to reach USD 48.43 billion by 2026, and the India market is projected to reach USD 13.98 billion by 2026.

Brazil leads the bakery market in South America owing to the high inclusion of bakery items in its daily diet. The Brazilian market is a prime contributor to the region, with a value of USD 30.83 in 2024. In Brazil, Argentina, Chile, and Colombia, bakery food consumers are increasingly seeking packaged bread with healthier ingredients. Moreover, snacking trends influence the consumption of biscuits among adults and children.

The Middle East & Africa bakery products market is anticipated to grow at a CAGR of 4.46% from 2025 to 2032. In the Middle East & Africa, the market is propelled by rising consumption of packaged foods due to their convenience. In Africa, the growing middle-class population also supports region's growth. Turkey is a key market for bakery food products in the region, with sales are driven by high demand in local and foreign markets.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Launching Innovative Bakery Products to Gain Key Market Share

Major players, which include Grupo Bimbo SAB De CV, Mondelez International, the Kellogg Company, Associated British Foods, and General Mills operating in the global market. With the rising health concerns, major players are focusing on launching innovative and healthy baked products. For instance, in June 2025, General Mills, in partnership with Mott’s (a subsidiary of Keurig Dr Pepper), launched a new line of soft-baked snacks called Mott’s Soft Baked Apple Filled Bars. These bars are made with apple puree, wrapped in a chewy whole wheat flour exterior, and come in three flavors: apple, strawberry, and blueberry. The product targets families looking for a healthy, portable snack option and is positioned as part of Mott’s expanding Soft Baked bar portfolio.

Key Players in the Bakery Products Market

|

Rank |

Company Name |

|

1 |

Kellogg Company |

|

2 |

Associated British Foods |

|

3 |

General Mills |

|

4 |

Grupo Bimbo |

|

5 |

Mondelez International |

List of Key Bakery Products Companies Profiled

- Mondelez International, Inc. (U.S.)

- Associated British Foods plc (U.K.)

- The Kellogg Company (U.S.)

- Grupo Bimbo, S.A.B. de C.V. (Mexico)

- Yamazaki Baking Company, Ltd. (Japan)

- Campbell Soup Company (U.S.)

- Britannia Industries Limited (India)

- General Mills, Inc. (U.S.)

- Dunkin' Donuts LLC (U.S.)

- Flower Foods (U.S.)

KEY INDUSTRY DEVELOPMENTS

- July 2025: Reese's and Oreo launched a sweet collaboration featuring two new products: the Reese's Oreo Cup and the Oreo Reese's Cookie. The new product is a peanut butter cup coated in milk chocolate and white crème, filled with crushed Oreo cookie pieces.

- February 2025: Bonn Group of Industries, one of India's fastest-growing food companies, launched TRUE ZERO MAIDA Wholewheat Brown Bread as a premium healthy bread option designed for health-conscious consumers.

- February 2024: Base Culture, one of the well-known frozen bakery goods manufacturers, announced the launch of its new Simply Bread line to expand its gluten-free product range. The new product line is positioned as a clean-label and gluten-free offerings.

- June 2023: Arva Flour Mills, one of North America’s prominent commercial bakery mills, announced the acquisition of the Full of Beans gluten-free products brand. The company aimed to launch a gluten-free product range under the Arva Flour Mills to expand its consumer base.

- April 2023: Britannia, one of the prominent bakery product manufacturers in India, announced the launch of its millet bread, which does not contain refined flour. With this launch, the company became the first to introduce a health-focused organic bread in the regularized bread market in India.

REPORT COVERAGE

The global bakery products market industry report analyzes the market in depth and highlights crucial aspects such as global bakery products market trends, market dynamics, prominent companies, investment in research and development, and end-use. Besides this, the report also provides insights into the global bakery products market analysis and highlights significant industry developments.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

|

|

Unit |

Value (USD Billion) |

|

Segmentations |

By Type, Product Range, Form, Distribution Channel, and Region |

|

Segmentation |

By Type

|

|

By Product Range · Specialty o Gluten Free o Organic o Others · Conventional |

|

|

By Form · Fresh · Frozen |

|

|

By Distribution Channel · Supermarkets/Hypermarkets · Specialty Stores · Convenience Stores · Other retail channels |

|

|

By Region · North America (By Type, Product Range, Form, Distribution Channel, and Country) • U.S. (By Type) • Canada (By Type) • Mexico (By Type) · Europe (By Type, Product Range, Form, Distribution Channel, and Country) • Germany (By Type) • Spain (By Type) • Italy (By Type) • France (By Type) • U.K. (By Type) • Rest of Europe (By Type) · Asia Pacific (By Type, Product Range, Form, Distribution Channel, and Country) • China (By Type) • Japan (By Type) • India (By Type) • Australia (By Type) • Rest of Asia Pacific (By Type) · South America (By Type, Product Range, Form, Distribution Channel, and Country) • Brazil (By Type) • Argentina (By Type) • Rest of South America (By Type) · Middle East & Africa (By Type, Product Range, Form, Distribution Channel, and Country) • South Africa (By Type) • Turkey (By Type) • Rest of the MEA (By Type) |

Frequently Asked Questions

Fortune Business Insights says that the global market was USD 494.7 billion in 2025 and is anticipated to reach USD 326.55 billion by 2034.

At a CAGR of 3.59%, the global market will exhibit steady growth over the forecast period.

By type, the bread segment leads the market.

Europe holds the largest market share in 2025.

Rise in demand for convenient food products drives market growth.

Mondelez International, the Kellogg Company, Associated British Foods, General Mills, and Grupo Bimbo are the leading companies in the market.

Advancements in technology is a key market trend.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us