Emotion Detection and Recognition Market Size, Share & Industry Analysis, By Component (Software and Hardware), By Technology (Facial Recognition, Speech & Voice Analysis, Text-based Emotion Detection, Multimodal Emotion Recognition, and Physiological Monitoring), By End User (Healthcare, Automotive & Transportation, Retail & e-Commerce, Education, Media & Entertainment, IT, Government & Public Safety, BFSI, and Others) and Regional Forecast, 2026 – 2034

EMOTION DETECTION AND RECOGNITION MARKET SIZE AND FUTURE OUTLOOK

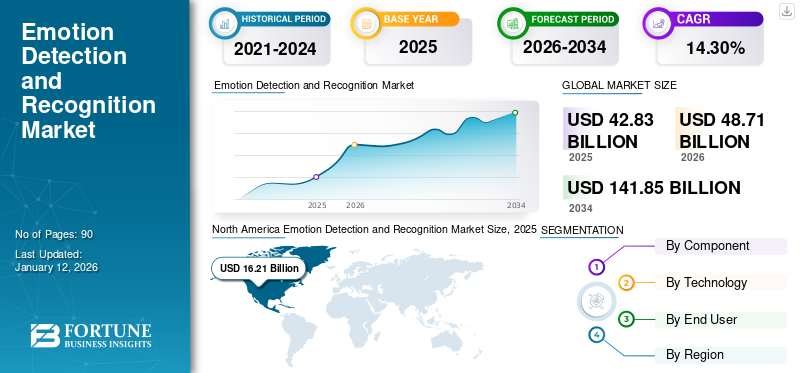

The global emotion detection and recognition market size was valued at USD 42.83 billion in 2025. The market is projected to grow from USD 48.71 billion in 2026 to USD 141.85 billion by 2034, exhibiting a CAGR of 14.30% during the forecast period. North America dominated the global market with a share of 34.00% in 2025.

Emotion detection and recognition refers to a comprehensive system or framework designed to identify, analyze, and classify human emotions from various data sources. This solution typically integrates multiple technologies and methodologies to effectively interpret emotional states, enabling applications across various fields such as healthcare, customer service, entertainment, automotive, security, and others. Emotion detection & recognition systems include hardware and software components that analyze and interpret emotional data.

As a part of their growth strategy, companies such as SmartEye, Realeyes, Visage Technologies, and Emotiv aim to engage in collaboration, partnership, mergers, and acquisitions (M&A) activities to expand their business and geographical presence.

IMPACT OF GENERATIVE AI

Increasing Adoption of Generative-AI for a Better Understanding of Human Emotion will Contribute to Market Growth

Generative AI is significantly impacting emotion detection by allowing for the creation of more nuanced and emotionally aware content, enabling machines to understand better and respond to human emotions through features such as facial expression analysis, voice tone interpretation, and text sentiment analysis. This will lead to applications in fields such as customer service, education, healthcare, and marketing, where tailoring interactions based on emotional cues is crucial. Emotion AI helps to improve customer satisfaction by 25% through sentiment analysis in customer support interactions. For instance,

- According to IBM, Integrating emotion AI into HR processes has led to a reported 20% boost in employee satisfaction.

MARKET DYNAMICS

Market Drivers

Rising Demand for Emotion AI (Affective Computing) in Healthcare Industry Drives Market Growth

Emotion AI has the power to transform the way healthcare facilities are provided and patients are treated. It helps in tracking patient emotions and mental health to modifying treatment regimens and improving caregiver relationships. For instance,

- Affectiva's AI-powered emotion recognition technology is used in hospitals to assess patient discomfort or anxiety during treatments. By analyzing subtle facial micro-expressions and voice modulations, the system helps healthcare providers identify pain levels in non-verbal patients, such as those with autism or post-stroke impairments. This allows for timely intervention, personalized care, and improved patient outcomes by ensuring emotional states are accurately understood and addressed.

Emotion AI solutions for controlling, tracking, and promoting emotional wellness are becoming popular as mental health and well-being become extensively recognized. Emotion AI is being used to give insights and solutions and help those dealing with mental health issues through everything from virtual mental health aides to apps that measure mood.

Market Restraints

Increasing Privacy Concerns and Data Breaches in Emotion Detection and Recognition to Impede Market Growth

Emotion detection systems rely on various types of biometric data, such as facial expression, voice tone, body language, and even physiological responses (e.g., heart rate). These data points are deeply personal and can reveal private aspects of an individual’s emotional state, which can sometimes be unintentionally revealing about their mental health, stress level, or other sensitive conditions. For instance,

- In August 2024, As per a digital ethics and privacy survey, biometric data, including behavioral and physical identifiers, offers improved security but poses significant privacy risks.

The above factors could hamper the emotion detection and recognition market growth in the coming years.

Market Opportunities

Rising Internet of Things (IoT) Technology will Help to Recognize Emotions and Create Potential Opportunities for Market

"IoT and Emotion Detection" refers to the integration of emotion recognition technology with the Internet of Things (IoT), allowing devices connected to the network to analyze human emotions through various sensors such as cameras, microphones, and wearable devices, enabling real-time understanding of emotional states in various applications such as healthcare, customer service, security, and smart environments.

Further, emotion detection in IoT would present a significant opportunity in the coming years, with the potential to transform many areas, including healthcare, automotive, customer service, and smart homes. By incorporating emotion recognition into IoT systems, users can create more personalized, responsive, and efficient technologies.

As emotion detection continues to evolve, IoT integration presents a significant opportunity for many industries to stay compliant and enhance operational efficiency.

Emotion Detection and Recognition Market Trends

Increased Human-Machine Interactions Considered to be Major a Market Trend

Human-machine interaction refers to the way in which humans communicate and interact with machines or computer systems. This interaction can range from voice recognition to facial expression, gesture, and even brain-machine interfaces. Advances in human-machine interactions aim to make machines more intuitive, user-friendly, and responsive to human emotional states. With the explosion of AI chatbots, intelligent personal assistants, conversational platforms, and virtual agents, the ability to mitigate frustrations and recognize human emotions has become increasingly important.

Download Free sample to learn more about this report.

These systems are invented to interact with humans constantly through natural language and, in many cases, are personal to individual users. For the interactions to be relevant and deliver a good user experience over a long period, platforms need to understand the user's mental and emotional state. As users shift toward digital-first strategies, it presents a significant revenue opportunity to the market, driving long-term industry growth and innovation.

SEGMENTATION ANALYSIS

By Component

Surge in Demand for High-Resolution Cameras Accelerated Hardware Segment Growth

Based on components, the market is divided into software and hardware.

The software was further studied through AI-powered Emotion Analytics Platform, Sentiment Analysis & Natural Language Processing (NLP) Engines, Facial Expression Recognition API & DKs, and Behavioral Analytics Software. This segment is set to grow at the highest CAGR of 16.83% during the forecast period (2025-2032). At the same time, hardware was further studied into Cameras (2D/3D, Infrared, RGB), Sensors (EEG, GSR, Eye Tracking, Wearables), and IoT Enabled Devices.

Hardware captured a larger share of the market with a share of 55.21% in 2025, as high-resolution cameras with infrared or 3D imaging are used for capturing micro-expressions. High-definition cameras with AI chips enable real-time facial emotion analysis. As per industry analysis, in 2023, around 55% of new cars were equipped with emotion-sensing hardware to enhance driver’s safety.

Software is expected to register the highest CAGR during the forecast period. AI-powered emotional analytics platforms provide immediate insights into emotional responses, allowing organizations to react quickly to changing sentiments, whether in customer service scenarios or real-time marketing.

By Technology

Speech & Voice Analysis Led the Market as It Transform Industries by Enhancing Efficiency, Accessibility, and Security

Based on technology, the market is divided into facial recognition, speech & voice analysis, text-based emotion detection, multimodal emotion recognition, and physiological monitoring.

Speech & voice analysis dominated the emotion detection and recognition market with a share of 35% in 2024. Speech and voice recognition is revolutionizing industries by boosting efficiency, accessibility, and security. The technology helps to analyze tone to gauge user mood. As per industry analysis, in 2023, around 72% of businesses started using voice-based emotion tools to improve customer satisfaction.

Multimodal emotion recognition is estimated to grow with the highest CAGR during the forecast period. Multimodal emotion recognition revolutionizes emotion detection by combining diverse data streams for accuracy and contextual insight. As per IEEE, multimodal systems achieve 85% to 95% accuracy, compared to 60%–75% for traditional systems.

By End User

To know how our report can help streamline your business, Speak to Analyst

Increasing Emotion Detection Algorithms in Healthcare Companies Boosted Segment Growth

Based on end user, the market is divided into healthcare, automotive & transportation, retail & e-commerce, education, media & entertainment, IT, government & public safety, BFSI, and others.

Healthcare dominated the market in 2024 and is expected to encounter a share of 22.28% in 2025. The WHO reports an increase in anxiety and depression since 2020, driving demand for tools to monitor emotional well-being. As per JMIR, AI-powered emotion detection identifies symptoms of conditions such as PTSD and depression with 80% accuracy, enabling timely interventions. According to Accenture, hospitals use facial expression analysis and voice tone detection to assess patient discomfort, reducing misdiagnosis rates by 35%.

BFSI is estimated to grow with the highest CAGR of 17.76% during the forecast period (2025-2032), as banks use emotion detection to analyze customer interactions (calls, chats) and modify responses. According to Deloitte, in 2023, around 65% of financial institutions reported 20%–30% higher customer satisfaction with emotion-aware chatbots.

EMOTION DETECTION AND RECOGNITION MARKET REGIONAL OUTLOOK

By region, the market is studied across North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America

North America Emotion Detection and Recognition Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America led the global market with a valuation of USD 11.92 billion in 2023 and USD 13.16 billion in 2024, due to the increasing adoption of advanced technologies. The region leads in AI research, with companies such as Affectiva and IBM pioneering emotion detection algorithms. According to the National Science Foundation, the federal government is expected to spend around USD 3.3 billion on AI research and development.

Companies in the region are leveraging emotion detection better to understand consumers' responses to their ads and products, allowing for more targeted marketing strategies that resonate with specific emotions and behaviors.

North America Emotion Detection and Recognition Market Size, 2019-2032 (USD Billion)

The U.S. dominated the market in 2024 and is estimated to grow with the highest CAGR during the forecast period. The growth of emotion detection and recognition in the U.S. has been significant, driven by technological advancements and increasing adoption across various sectors. In 2022, the U.S. Customs and Border Protection (CBP) agency processed over 100 million travelers through facial recognition. Facial recognition has also gained widespread adoption in consumer devices, particularly smartphones and laptops. For instance, in 2022, Amazon’s Ring doorbell, which includes facial recognition, has been used in more than 2 million U.S. homes to enhance safety. The U.S. market is set to be valued at USD 12.14 billion in 2025.

Download Free sample to learn more about this report.

Europe

Europe is the second largest market, set to grow at a CAGR of 12.78% during the forecast period (2025-2032) and market valuation of USD 10.77 billion in 2025. Emotion detection and recognition in Europe has been a topic of significant debate, with countries taking varied approaches to its use, regulation, and impact on privacy. The U.K. market is expanding, projected to be valued at USD 1.90 billion in 2025. With growing concerns over privacy, Europe is likely to witness tighter restrictions on the use of emotion detection & recognition. This will involve both strict enforcement of GDPR and the potential introduction of a new EU AI Act. The EU is adopting this EU AI Act which is now implemented by its member states. The AI Act bans emotion recognition systems in workplaces and educational institutions unless used for medical or safety reasons. Germany is poised to reach a market value of USD 1.82 billion in 2025, while France is expected to be valued at USD 1.70 billion in the same year.

Asia Pacific

Asia Pacific is the third largest market with a valuation of USD 10.52 billion in 2025. Governments in the Asia Pacific have taken the lead in adopting technologies in various sectors, and governments in countries including India, Malaysia, Singapore, and others are focusing on investing in AI. China is expected to be worth USD 3.56 billion in 2025. Countries in the region are investing heavily in smart cities, where facial recognition is integrated into urban infrastructure, including transportation, utilities, and public safety systems. China has invested significantly in smart city initiatives, incorporating facial recognition into public transportation, airports, and retail. India is estimated to encounter a share worth USD 1.36 billion, while Japan is anticipated to reach a market value of USD 2.14 billion.

Middle East & Africa

The market is experiencing significant growth in the Middle East with a value of USD 4.18 billion in 2025, due to the increasing demand for enhanced security, improved operational efficiency, and a more seamless user experience. Countries such as Saudi Arabia and UAE are leading the way in embracing this technology, with strong government support for its development. Gulf nations such as the UAE and Saudi Arabia have invested USD 1.2 billion in AI and emotion recognition under initiatives such as UAE’s National AI Strategy 2031 and Saudi Vision 2030. GCC market is poised to be valued at USD 1.77 billion in 2025.

South America

The demand for emotion detection and recognition (EDR) technologies in South America is rising due to digital transformation and industry-specific needs. The demand for emotion detection & recognition is witnessing a surge in South America due to increasing e-commerce growth in the region. E-commerce in South America grew by 25% in 2023, with 45% of retailers investing in AI for customer insights. Malls in Brazil and Argentina deploy facial recognition to estimate shopper sentiment.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Collaborations & Partnerships among Key Players to Propel Market Growth

Market players are developing customized emotion detection tools for specific sectors such as healthcare (patient sentiment analysis), retail (customer feedback), and education (student engagement). For instance,

- In July 2024, Suki announced its collaboration with several Community Health Centers and Federally Qualified Health Centers (FQHCs), including PrimeCare Health. Suki’s voice AI Assistant is helping clinicians to improve efficiency by cutting back administrative work hours and being more present during visits.

List of Key Emotion Detection and Recognition Companies Profiled:

- SmartEye (Sweden)

- Microsoft Corporation (U.S.)

- Google (Alphabet, Inc.) (U.S.)

- IBM Corporation (U.S.)

- Amazon.Com, Inc. (U.S.)

- Tobii AB (Sweden)

- Realeyes (England)

- Visage Technologies (Sweden)

- EMOTIV (U.S.)

- Noldus Information Technology BV (Netherlands)

- VIER GmbH (Germany)

- CIPIA Vision (Israel)

- Morphcast (Greece)

- Siena AI (U.S.)

- Opsis (Singapore)

- Audeering GmbH (Germany)

- Symanto (Germany)

- Cogito Corp. (U.S.)

- VoiceSence (Israel)

…and more

KEY INDUSTRY DEVELOPMENTS:

- January 2025: Neuro XR and Emotiv announced the launch of Emotional Heatmapping Technology, combining Emotiv’s EEG devices with NXR’s analytics software. This partnership revolutionizes behavioral and emotional analysis, proposing real-time insights into user engagement.

- January 2025: Emotiv announced the new generation EEG Active Noise-Cancelling Earphones. These smart headphones improve personal health by integrating advanced EEG technology to provide information about sound quality and cognitive performance.

- October 2024: Noldus Information Technology announced a new collaboration with Blackrock Neurotech, a global provider of advanced tools for neuroprosthetics and neuroscience research and brain-computer interface (BCI) technology. This collaboration integrates Blackrock’s electrophysiology systems with Noldus’ EthoVision XT behavioral tracking software to create a powerful, unified platform for neural and behavioral research.

- June 2024: Azure announced Face API services SDKs for Liveness Detection. The liveness solution integration comprises two separate components: an app server/orchestrator and a frontend mobile/web application.

- February 2024: Kantar partnered with Realeyes to implement Realeyes identity recognition software that verifies anti-fraud software QubedAI.

INVESTMENT ANALYSIS AND OPPORTUNITIES

The continuous development of AI and machine learning has significantly improved the accuracy, speed, and scalability of emotion detection and recognition systems. Key players in the market, such as Affective, Realeyes, and Beyond Verbal, are leveraging advanced AI and deep learning models to accurately detect and classify human emotions from various input data (facial expression, voice, etc.). Their algorithms have improved over time, enhancing the accuracy of emotion detection. Increasing user adoption of AI and Cloud platforms will create great opportunities for key market players in the coming years.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product types, and leading applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, it encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 14.9% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component

By Technology

By End User

By Region

|

|

Companies Profiled in the Report |

SmartEye (Sweden), Microsoft Corporation (U.S.), Google (Alphabet, Inc.) (U.S.), IBM Corporation (U.S.), Amazon.Com, Inc. (U.S.), Tobii AB (Sweden), Realeyes (England), Visage Technologies (Sweden), EMOTIV (U.S.), and Noldus Information Technology BV (Netherlands) |

Frequently Asked Questions

The market is projected to record a valuation of USD 141.85 billion by 2034.

In 2025, the market was valued at USD 42.83 billion.

The market is projected to grow at a CAGR of 14.30% during the forecast period.

By technology, the speech and voice analysis segment led the market in 2025.

Rising demand for Emotion AI (affective computing) in the healthcare industry drives the market growth.

SmartEye, Realeyes, Visage Technologies, Emotiv, and Noldus Information Technology BV are the top players in the market.

North America held the highest market share in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us