Industrial Wastewater Treatment Market Size, Share & Industry Analysis, By Type (pH Conditioners, Coagulants & Flocculants, Disinfectants & Biocidal Products, Scale & Corrosion Inhibitors, Antifoam Chemicals, and Others), By End-Use (Food & Beverage, Power Generation, Pharmaceuticals, Pulp and Paper, Petrochemical, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

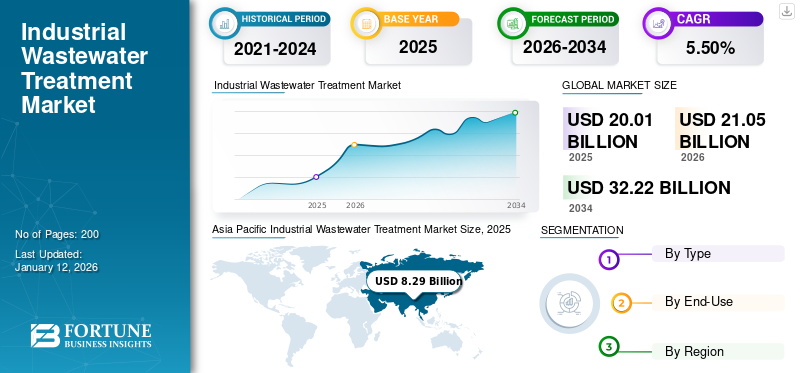

The global industrial wastewater treatment market size was valued at USD 20.01 billion in 2025 and is projected to grow from USD 21.05 billion in 2026 to USD 32.22 billion by 2034 at a CAGR of 5.50% during the forecast period. Asia Pacific dominated the industrial wastewater treatment market with a market share of 41% in 2025.

Industrial wastewater treatment refers to managing and purifying wastewater generated from industrial activities before it is released into the environment or reused. This treatment is essential for protecting public health, preserving ecosystems, and complying with environmental regulations. Industrial wastewater often contains a wide range of pollutants, such as heavy metals, toxic chemicals, oils, organic matter, and suspended solids, depending on the type of industry, such as chemical manufacturing, textiles, pharmaceuticals, food processing, or mining. The treatment process typically involves several physical, chemical, and biological stages. Primary treatment focuses on removing large solids and sediments through screening and sedimentation. Secondary treatment involves biological processes to degrade organic contaminants, such as activated sludge or bio filters. In cases where wastewater contains hazardous or non-biodegradable substances, advanced or tertiary treatment methods such as membrane filtration, chemical precipitation, or activated carbon adsorption are employed to meet stringent discharge standards. In addition, technologies including zero liquid discharge systems and effluent recycling are gaining traction, driven by increasing water scarcity and sustainability concerns.

Rapid industrialization, growing water scarcity, and stringent environmental regulations across developed and developing regions drive the market growth. Increasing awareness about sustainable practices and circular water usage has encouraged industries to adopt advanced treatment solutions, such as membrane filtration, reverse osmosis, and biological and chemical treatments. The market is also shifting towards decentralized and modular treatment systems, which offer flexibility, lower capital investment, and reduced operational complexity. The rise in zero liquid discharge systems, particularly in water-stressed regions, underlines the growing emphasis on resource recovery and environmental compliance. Additionally, digital technologies and IoT integration in treatment facilities enhance operational efficiency and real-time monitoring capabilities. Veolia, SUEZ, Xylem, Ecolab, and Pentair are the key players operating in the market.

GLOBAL INDUSTRIAL WASTEWATER TREATMENT MARKET OVERVIEW

Market Size & Forecast:

- 2025 Market Size: USD 20.01 billion

- 2026 Market Size: USD 21.05 billion

- 2034 Forecast Market Size: USD 32.22 billion

- CAGR: 5.50% from 2026–2034

Market Share:

- Asia Pacific led in 2025 with a 41 % share, rising to USD 8.77 billion in 2026.

- By type: Coagulants & flocculants dominated due to wide use across textiles, chemicals, and food industries.

- By end-use: Food & beverage segment led the market owing to high wastewater generation and strict discharge norms.

- Power generation segment held around 10.2% share in 2024.

Key Country Highlights:

- China: Enforcing stricter wastewater discharge norms and expanding power generation capacity.

- India: Rapid industrialization and water scarcity drive adoption of zero-liquid discharge systems.

- United States: Growth driven by Clean Water Act regulations and smart water infrastructure investments.

- Germany: Focused on circular economy and membrane bioreactor adoption for sustainable treatment.

- Brazil: Rising investments in mining and agriculture wastewater management.

- UAE & Saudi Arabia: National sustainability goals (Vision 2030) boosting advanced wastewater treatment adoption.

Impact of COVID-19

The COVID-19 pandemic had a mixed impact on the global market. Initially, the industry faced disruptions due to factory shutdowns, supply chain interruptions, and reduced industrial activity, especially in manufacturing, textiles, and chemicals. This led to a temporary decline in demand for industrial wastewater treatment solutions. However, the pandemic also heightened awareness around hygiene, environmental sustainability, and the need for stringent wastewater management to prevent public health crises. Governments and industries increasingly emphasized water reuse, safe disposal of contaminated water, and adherence to environmental regulations. Pharmaceutical and food processing sectors, which operated continuously during the pandemic, witnessed steady demand for treatment solutions. Post-pandemic, the market began to recover rapidly, driven by increased investment in sustainable infrastructure and stricter environmental norms. As industries resumed operations, the need for efficient and automated wastewater treatment systems surged, ultimately reinforcing the market’s long-term growth trajectory.

Industrial Wastewater Treatment Market Trends

Rising Technology Integration and Digitalization to Boost Market Growth

Advanced digital tools such as the Internet of Things (IoT), artificial intelligence (AI), machine learning, and cloud computing are increasingly being adopted by industries to optimize wastewater treatment processes. These technologies allow for continuous monitoring of water quality parameters, predictive maintenance of treatment equipment, and automated control of complex systems, thereby reducing human error and operational costs. Smart sensors and IoT-enabled devices facilitate real-time data collection and remote diagnostics, empowering industries to detect anomalies promptly and take corrective actions swiftly. Moreover, digital twins and AI-based analytics help simulate treatment processes and optimize chemical usage, energy consumption, and resource recovery, contributing to environmental compliance and cost efficiency. Block chain technology is also being explored to ensure data transparency and regulatory compliance across wastewater operations. As industries face stricter environmental regulations and growing pressure to reduce their ecological footprints, the demand for digital solutions is surging. Governments and environmental bodies promote digital water initiatives through funding and policy support, encouraging industries to adopt smart treatment systems. Asia Pacific witnessed a industrial wastewater treatment market growth from USD 7.46 billion in 2023 to USD 7.85 billion in 2024.

Download Free sample to learn more about this report.

Market Dynamics

Market Drivers

Industrial Growth in Emerging Economies Aims to Drive Market Growth

Countries such as China, India, Brazil, and Southeast Asia continue to experience rapid industrialization, and the volume of wastewater generated by industries including chemicals, pharmaceuticals, textiles, pulp and paper, and food processing has increased substantially. While crucial for economic development, this expansion poses serious environmental challenges due to the discharge of untreated or inadequately treated effluents into natural water bodies. Governments in these regions are increasingly enforcing stricter regulations and wastewater discharge norms to address water pollution and promote sustainability. This regulatory pressure is compelling industries to adopt advanced wastewater treatment technologies and solutions.

Moreover, emerging economies face acute water scarcity issues due to population growth, urbanization, and climate change, prompting industries to reuse and recycle water through efficient wastewater treatment practices. Initiatives such as India’s “Namami Gange” and China’s “Water Ten Plan” are examples of government-led efforts to clean polluted water bodies and support industrial wastewater treatment infrastructure. Additionally, foreign investments in manufacturing sectors in these regions further increase the need for reliable and sustainable water management solutions. The demand is also being supported by the rising adoption of zero-liquid discharge systems, membrane bioreactors, and other advanced technologies to improve treatment efficiency and environmental compliance.

Market Restraints

High Installation and Operating Costs Constraints Limit the Market Growth

The initial capital required for setting up advanced treatment facilities, including technologies such as membrane filtration, reverse osmosis, and advanced oxidation processes, is considerably high. These systems require specialized equipment and significant infrastructure, including civil construction, piping, power supply, and control systems. Furthermore, operating these systems involves substantial recurring expenses, such as energy consumption, chemical usage, skilled labor, and routine maintenance. For example, membrane-based systems, while effective, have high operational costs due to frequent cleaning and membrane replacement. Additionally, the cost of compliance with stringent environmental regulations and the disposal of hazardous sludge further adds to the operational burden.

Market Opportunities

Decentralized Wastewater Treatment Will Create Significant Growth Opportunities

Unlike centralized systems that require extensive infrastructure and capital investments, decentralized solutions offer flexibility, cost-effectiveness, and scalability for remote industrial facilities, small-scale operations, and rapidly urbanizing areas. These systems treat wastewater close to the source, reducing the need for complex sewage networks and minimizing transportation costs. For industries such as food and beverages, pharmaceuticals, and chemicals that generate high-strength and site-specific effluents, decentralized treatment systems allow for tailored solutions that ensure regulatory compliance and environmental sustainability. Moreover, industries in water-stressed regions are increasingly adopting on-site treatment to recycle and reuse water, aligning with corporate sustainability goals and reducing dependence on municipal supplies.

Market Challenges

Rise in Regulatory Fragmentation May Hurdle the Market Development

Countries have their unique environmental standards, discharge limits, and permitting requirements. For example, while the European Union enforces relatively stringent and harmonized wastewater discharge regulations under directives such as the Urban Waste Water Treatment Directive, countries in Asia or Africa may have more lenient or inconsistently enforced policies. This lack of global standardization complicates compliance for multinational companies, which must tailor wastewater treatment technologies and processes to meet varied local requirements. Additionally, frequent changes or ambiguities in regulations can delay project implementation and increase design, monitoring, and reporting costs. Smaller firms may struggle to navigate these regulatory hurdles due to limited financial and technical resources. Furthermore, regulatory discrepancies may discourage investment in advanced or innovative treatment solutions, as firms might prioritize compliance with the least stringent requirements rather than pursuing best-in-class environmental performance.

Trade Protectionism and Geopolitical Impact

Countries increasingly focus on protecting domestic industries, tariffs, and import restrictions on essential treatment equipment, chemicals, and advanced membrane technologies, which have increased costs for wastewater treatment projects, especially in emerging economies that rely on imports. For instance, trade disputes between the U.S. and China have disrupted the flow of critical components such as pumps, filters, and sensors, delaying infrastructure upgrades in both countries and creating uncertainty for multinational water treatment firms.

Geopolitical tensions in regions such as the Middle East, Eastern Europe, and parts of Asia also affect cross-border collaboration and joint ventures in industrial wastewater treatment. Sanctions and export controls, especially on high-tech filtration or energy-efficient systems, can hinder technology adoption in regions most demanding modernization. Political instability in certain areas also slows industrial development and infrastructure investment, reducing demand for wastewater solutions.

Research And Development (R&D) Trends

The sector is undergoing rapid transformation driven by R&D in advanced technologies, process integration, and resource recovery. A major focus is combining biological treatment with advanced methods such as membrane bioreactors, reverse osmosis, ultrafiltration, nanofiltration, and advanced oxidation processes to achieve stringent discharge standards and support reuse and zero‑liquid discharge systems. Electrochemical techniques, including electro‑oxidation and electro‑coagulation, are gaining traction for their ability to mineralize persistent organic contaminants (e.g., dyes, pharmaceuticals), often as polishing steps following conventional treatment. Simultaneously, R&D into anaerobic ammonium oxidation (Anammox) enhances energy-efficient nitrogen removal in industrial effluents, while microbial electrolysis carbon capture merges wastewater treatment with CO₂ mitigation and hydrogen generation. Nano remediation with nano‑scale zero‑valent iron continues to advance from pilot to field scale for contaminant remediation. Supercritical water oxidation systems are being commercialized to destroy hazardous organics and PFAS with near‑complete efficiency (>99 %). Alongside these technical innovations, digitalization is accelerating with AI, IoT, and digital‑twin platforms, enabling smarter process control, predictive maintenance, and energy optimization in Asia, Europe, and North America.

Segmentation Analysis

By Type

Coagulants & Flocculants Segment Dominated the Market Owing to Its Treatment Techniques

Based on the type, the market is classified into pH conditioners and coagulants & flocculants, disinfectants & biocidal products, scale & corrosion inhibitors, antifoam chemicals, and others.

The coagulants & flocculants segment is expected to account for 43.56% of the market in 2026, and is expected to experience substantial growth, primarily driven by the extensive use in industries such as textiles, chemicals, oil & gas, and food processing, where high contaminant levels are common. Increasing industrial discharge regulations, particularly in emerging economies, drive demand for effective clarification and sludge management technologies, boosting the adoption of organic and inorganic coagulants and flocculants. Innovations such as biodegradable flocculants and low-sludge-generating coagulants are gaining traction due to environmental concerns. The growing need for cost-effective and high-efficiency water reuse systems drives the segment’s growth.

The pH conditioners segment is projected to experience significant growth in the coming years. The growing adoption of biological wastewater treatment and membrane technologies drives the segment's growth, further supporting pH balancing needs and ensuring system stability. Rising regulatory pressure and the demand for zero-liquid discharge solutions are increasing the use of automated pH control systems.

By End-Use

Food & Beverage Segment Dominates the Market Due to Extensive Use of the Product in the Industry

Based on the end-use, the market is segmented into food & beverage, power generation, pharmaceuticals, pulp and paper, petrochemicals, and others.

The food & beverage segment is projected to dominate the market with a share of 31.83% in 2026. The growth is attributed to high organic loads, grease, oils, and suspended solids in effluents. The industry requires tailored solutions such as dissolved air flotation, membrane bioreactors, and anaerobic digestion to meet strict discharge norms and reclaim water for reuse.

- The Power Generation segment is expected to hold a 10.2% share in 2024.

The pharmaceuticals segment is also registering positive growth in the market. Pharmaceutical wastewater is among the most complex, often containing high levels of active pharmaceutical ingredients, solvents, and toxic chemicals. Treatment in this segment necessitates combining physico-chemical, biological, and advanced oxidation processes to degrade micro pollutants effectively. Stricter environmental regulations in the EU and the U.S. are prompting companies to invest in cutting-edge treatment infrastructure. Additionally, global concerns over antimicrobial resistance caused by untreated pharmaceutical discharges are spurring innovation in this segment.

To know how our report can help streamline your business, Speak to Analyst

Industrial Wastewater Treatment Market Regional Outlook

By region, the market is segmented into North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Industrial Wastewater Treatment Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominates the market and is projected to register the highest CAGR over the forecast period. Rapid industrialization, urbanization, and water scarcity issues drive the industrial wastewater treatment market growth in the region. Due to environmental concerns, countries such as China and India implemented stricter wastewater discharge norms. Massive manufacturing bases in textiles, chemicals, and electronics further drive demand. The Japan market is projected to reach USD 1.37 billion by 2026, the China market is projected to reach USD 3.31 billion by 2026, and the India market is projected to reach USD 2.59 billion by 2026.

- In China, the Power Generation segment is estimated to hold a 10.3% market share in 2024.

To know how our report can help streamline your business, Speak to Analyst

North America

The North America market is witnessing growth driven by stringent environmental regulations such as the U.S. Clean Water Act and growing emphasis on sustainability across industries such as oil & gas, pharmaceuticals, and food processing. Technological advancements and early adoption of smart water management systems further bolster market growth. Additionally, increased investment in upgrading aging water infrastructure and a strong presence of leading players in the U.S. and Canada contribute to robust market expansion. The U.S. market is projected to reach USD 6.57 billion by 2026.

Europe

Europe is also a positive contributor to the market. The region is focused on achieving net-zero emissions and circular economy goals, leading to the widespread adoption of advanced treatment technologies including membrane bioreactors and zero-liquid discharge systems. Countries such as Germany, U.K., and Netherlands are at the forefront due to their proactive industrial sustainability initiatives and strong governmental support for green infrastructure. The UK market is projected to reach USD 0.62 billion by 2026, while the Germany market is projected to reach USD 0.8 billion by 2026.

South America

South America shows growing potential in countries including Brazil, Argentina, and Chile, where industries such as mining, agriculture, and oil & gas are major contributors to wastewater generation. Additionally, regulatory bodies, promoting industries to invest in advanced treatment technologies such as membrane filtration, biological treatment, and zero-liquid discharge systems. Moreover, the emphasis on sustainable water management practices, including water reuse and recycling, boosts demand for efficient wastewater treatment solutions.

Middle East & Africa

The forecast period is expected to see a positive pace of growth in the Middle East & Africa market, driven by increased demand for industrial wastewater treatment solutions due to acute water scarcity and the growing need for water reuse in arid environments. Countries including the UAE and Saudi Arabia are investing in advanced treatment facilities as part of Vision 2030 and other national sustainability strategies.

Competitive Landscape

Key Market Players

Key Players Adopted Expansion Growth Strategy to Maintain Their Dominance in the Market

The competitive landscape of the global market for wastewater treatment is highly fragmented and is slowly consolidating, with key companies, such as Veolia, SUEZ, Xylem, Ecolab, and Pentair, building a diverse portfolio to capture a significant share of this market and build an operational efficiency. On the other hand, the focus of the domestic players is to develop strategic partnerships with industries to provide them with wastewater treatment services and maintenance solutions.

List of Top Key Industrial Wastewater Treatment Companies

- Veolia (France)

- SUEZ (France)

- Xylem (U.S.)

- Ecolab (U.S.)

- Pentair (U.S.)

- Kurita Europe GmbH (Germany)

- Ion Exchange India Ltd (India)

- BASF SE (Germany)

- Kemira Oyj (Finland)

- Air Products and Chemicals, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- October 2023: Solenis, a global producer of specialty chemicals for water-intensive industries, acquired CedarChem LLC. In this acquisition, CedarChem offers a full suite of water and wastewater treatment products for industrial and municipal markets, primarily in the southeastern U.S. The acquisition aligns with Solenis’ direct go-to-market strategy to provide customers with improved chemical and wastewater treatment product and service offerings.

- March 2023: Aquatech International partnered with Fluid Technology Solutions, Inc., a cutting-edge producer of sophisticated membranes and separation technologies. Together, they aim to develop next-generation solutions for enhanced brine concentration, advanced separation, and water reuse.

- January 2023: Xylem Inc. agreed to acquire Evoqua in an all-stock deal with an indicated enterprise value of roughly USD 7.5 billion. The merged business will be uniquely positioned to create and deliver a more comprehensive range of cutting-edge solutions by building on Xylem’s global leading position in water solutions and Evoqua’s specialty in offering advanced treatment systems and services.

- April 2022: To assist the creation of cutting-edge water and industrial innovations, Xylem announced investments in venture capital funds Burnt Island Ventures and The Wastly Group’s Funds. These investments aimed to strengthen Xylem Innovation Labs’ open innovation network and its dedication to quickly and widely commercialize the most significant advancements in water technology.

- December 2021: Ecolab Inc. closed its previously announced acquisition of Purolite, a leading and fast-growing global provider of high-end ion exchange resins for separating and purifying solutions for pharmaceutical and industrial applications.

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects, such as leading companies, types, and compositions used to produce these product types and end-users. Besides this, it offers insights into the market and current industry trends and highlights key industry developments. In addition to the abovementioned factors, it encompasses several factors contributing to the market's growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 5.50% from 2026 to 2034 |

|

Segmentation |

By Type

|

|

By End-Use

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 20.01 billion in 2025 and is projected to record a valuation of USD 32.22 billion by 2034.

In 2025, the Asia Pacific market value stood at USD 20.01 billion.

Recording a CAGR of 5.50%, the market will exhibit steady growth during the forecast period.

In 2024, food & beverage led the segment in the market, by end-use.

Growing demand from the food & beverage industry is a key factor driving the growth of the market.

Asia Pacific is poised to capture the highest market share during the forecast period.

Veolia, SUEZ, Xylem, Ecolab, and Pentair are major players in the global markets.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us