Location-based Services (LBS) Market Size, Share & Industry Analysis, By Technology (GPS, Assisted GPS, Enhanced GPS, Enhanced Observed Time Difference, Wi-Fi, Cellular ID), By Application (GIS and Mapping, Navigation and Tracking, Geo Marketing, and Advertising, Social Networking & Entertainment, Fleet Management), By Location Type (Outdoor, Indoor), By End-Users (Transportation & Logistics, Manufacturing, Retail and Consumer Goods, Automotive, Healthcare), Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

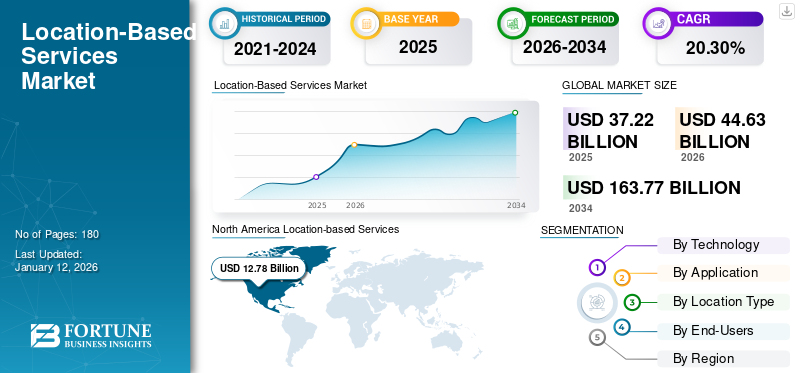

The global location-based services (LBS) market was valued at USD 37.22 billion in 2025. The market is projected to be worth USD 44.63 billion in 2026 and reach USD 163.77 billion by 2034, exhibiting a CAGR of 20.30% during the forecast period. North America dominated the global market with a share of 12.78% in 2025.

Location-based services use IP addresses and real-time geolocation data to provide information relevant to a user's actual location. It ensures that users have access to timely and accurate information on their surroundings while providing businesses with a means of updating customers about the services they use.

As a result of the COVID-19 pandemic, the major market players increased their service portfolio and product capabilities, thus driving the market's growth.

In the post pandemic world, the location-based services market growth is expected to be driven by the growing use of connected devices, such as mobile phones and tablets and the easy availability of GPS. In addition, the market share is expected to be stimulated by a growing use of location-based technologies for promoting applications during the forecast period. For instance, according to the MarTech series 2021, more than 80% of advertisers said location data could lead to more successful campaigns.

Location-based Services (LBS) Market Trends

Increased Integration of Emerging Technologies to Enhance Location Experience is a Major Trend in the Market

A huge amount of data is available to enhance the accuracy and relevance of maps and location services due to the proliferation of mobile phones and IoT devices. Location-based service providers can use information from the internet of things (IoT) in several ways, for instance, to improve accuracy and enhance customer experience. These services are used by organizations to improve the efficiency of their logistics, optimize routes and reduce fuel consumption, enhancing public service effectiveness as well as gaining insight into consumer behavior.

The rise of AR/VR technologies, where location technologies, such as mapping, can help create immersive virtual experiences, is also witnessed by organizations. Thus, the rising demand for augmented reality (AR)/VR technologies and IoT devices is increasing the use of location-based services.

Download Free sample to learn more about this report.

Location-based Services (LBS) Market Growth Factors

Rapid Proliferation of Smartphones and Increasing Location-based Marketing to Aid Market Growth

The use of location-based services has increased rapidly with location-based marketing, rapid uptake of mobile phones, and easy availability of GPS. Organizations are using location intelligence and analytics to serve location-based advertising, contextual advertising, and social media posts based on the footfall patterns of their target audience.

Location technology enables users to share data from a mobile application that allows organizations and search engines to display near restaurants, shopping malls, ATMs, or cinemas according to location and consumer choice. These far-reaching applications and a booming location-based marketing sector will drive growth in this market over the coming years.

RESTRAINING FACTORS

Absence of Consistent Regulation and Higher Costs to Hamper the Market Growth

There is a substantial amount of costs associated with installation, deployment, and privacy concerns that are hampering the market growth. Additionally, the government's laws and regulations regarding privacy pose a major threat to the market players. Consumers are unwilling to share location-based data because there are no clear rules or regulations on data collection, storage, and use by third parties. As a result, high costs and regulation issues could hamper growth during the forecast period.

Location-based Services (LBS) Market Segmentation Analysis

By Technology Analysis

Growing Ease of Accessibility and Convenience of the Wi-Fi Location Technology to Increase the Demand

Based on the technology, the market is segmented into GPS, Assisted GPS (A-GPS), Enhanced GPS (E-GPS), Enhanced Observed Time Difference (E-OTD), Wi-Fi, Cellular ID, and others.

Wi-Fi is expected to grow at a higher CAGR during the forecast period. The segment’s growth is attributed to the ease of accessibility and convenience of the technology. Wi-Fi location-based services use various techniques to determine position, from access point to client device. Moreover, new product launches are driving the demand for Wi-Fi-enabled location technologies. For instance,

- In February 2022, Coolpad, the consumer electronics manufacturer, collaborated with Skyhook Wireless, a leading provider of mobile location technology, to introduce hybrid Wi-Fi location services and emergency warning software into its forthcoming feature phone.

In terms of market share, GPS dominated the market with a share of 24.64% in 2026. This growth is mainly driven by the early adoption of GPS and most services provided by key players related to location technologies. Additionally, lucrative growth opportunities are seen for the market through increasing consumer usage in mapping and navigation.

By Application Analysis

Cost-Effectiveness and Increasing Usage of Powerful Marketing Tools for Geo Marketing and Advertising to Raise Market Growth

Based on the application, the market is segmented into GIS and Mapping, Navigation and Tracking, Geo Marketing and Advertising, Social Networking and Entertainment, Fleet Management, and Others. Geo marketing and advertising are expected to grow at a higher CAGR during the forecast period. The growth of this segment is due to its cost-effectiveness and powerful marketing tool used for consumer behavior. This application allows businesses to target consumers precisely, based on their specific physical location, which leads to increased customer engagement and an increase in customers.

GIS and mapping held a dominated market share with a share of 29.33% in 2026. The growth is due to the increasing demand for goods delivery and imagery solutions across different sectors. Effective tools for developing maps and adding elements such as text, images, or video are available to users through GIS and mapping applications. Users can collect and display valuable location intelligence by implementing GIS and mapping applications.

By Location Type Analysis

Rising Infrastructure Development for Navigation and Mapping Applications by Indoor Location Services to Drive Market Growth

Based on location type, the market is segmented into outdoor and indoor. Indoor is expected to grow rapidly at a higher CAGR during the forecast period. Developing infrastructure, such as shopping malls, parks, schools, and hospitals, provides a lucrative opportunity for indoor location services to be implemented in navigation and monitoring applications. Furthermore, the market will benefit from the growing deployment of home and local area networks, such as Wi-Fi and WLAN, over the forecast period.

As per market share, outdoor dominated the market with a share of 56.25% in 2026. Factors, such as the growing demand for outdoor navigation and mapping applications and the increasing deployment of outdoor location services make up a large part of this segment.

By End-Users Analysis

To know how our report can help streamline your business, Speak to Analyst

Increasing Usage of GPS Trackers to Boost Transportation and Logistics Segment Growth

Based on end-users, the market is segmented into transportation and logistics, manufacturing, retail and consumer goods, automotive, healthcare, government and public, aerospace and defense, and others. Among these, transportation and logistics dominated the market with a share of 22.63% in 2026. The rising demand in this industry is due to the increased use of GPS vehicle trackers and personal trackers and the higher demand for GPS fleet tracking software that monitors performance and increases its operating efficiency.

Healthcare is expected to grow rapidly at a higher CAGR during the forecast period. The sector can benefit from the seamless collection of large amounts of data through location services, which provides improved efficiency and increased profits. Health workers could help identify long-term trends in the health of individuals by integrating location data with location-based technologies. Organizations can track asset locations instantly, reducing possible security risks, improving the management of assets over time, and so on.

REGIONAL INSIGHTS

Geographically, this market is studied across North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

North America Location-based Services (LBS) Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the global market in 2025, with a market size of USD 12.78 billion. owing to the well-crafted 5G infrastructure, the rise in adoption of smartphones among Americans, and, majorly, technological advancements. IoT technology and connected devices have positively influenced the market. Data collected through these points can be easily integrated to be used in accurate location-based services. Moreover, businesses using LBS for marketing fleet management are increasing the relevance of the market across the region. For instance, The U.S. market is projected to reach USD 9.34 billion by 2026.

- In October 2022, Keysight combined a global navigation satellite system and 5G technology to pace up the operation of location-based services.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific is predicted to showcase the highest growth rate during the forecast period. This is due to the increase in 5G infrastructure investments across the region. Moreover, major growth in technological expertise, together with a rise in smartphone penetration and IoT-connected devices, will positively influence the market in the coming years. Along with this, LBS used for geo-marketing, augmented/virtual reality and gaming denotes a high level of demand for LBS solutions. The Japan market is projected to reach USD 2.93 billion by 2026, the China market is projected to reach USD 3.23 billion by 2026, and the India market is projected to reach USD 2.16 billion by 2026.

The UK market is projected to reach USD 2.1 billion by 2026, while the Germany market is projected to reach USD 1.66 billion by 2026.

The Middle East & Africa is subjected to registering the second-highest growth rate during the projected period. The rapidly growing data digitization and innovation in this region has led to the expansion of location-based services technologies.

Key Industry Players

Growing Key Players Focus on Merger & Acquisition, Partnerships, and Product Development Strategies to Drive Market Growth

Leading key players in the market focus on providing secure and flexible solutions and services by shifting to location-based service. The growing focus of these players on acquiring small and local companies to expand their presence globally. Moreover, the partnerships, merger & acquisitions, and leading investments in the advanced technologies helps to raise the market demand.

List of Top Location-based Services (LBS) Companies:

- HERE Technologies (The Netherlands)

- IndoorAtlas (Finland)

- Mapbox (U.S.)

- Esri (U.S.)

- Google LLC (U.S.)

- IBM Corporation (U.S.)

- Cisco Systems, Inc. (U.S.)

- Maxar Technologies (U.S.)

- ALE International (France)

- Qualcomm Technologies, Inc (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- October 2023 – The government of India introduced a CORS (Continuously Operating Reference Stations) survey network across the nation to provide real-time location mapping positioning services.

- June 2023: TomTom, a GPS technology provider, announced the addition of its traffic information to PTV Group's new automated transport modeling solution, PTV Model2Go. The PTV Group used this integration to leverage TomTom's trusted, robust, and efficient origin and destination traffic data to substantially shorten the time and effort it takes to map transport patterns in all major regions.

- April 2023: Maxar Technologies got a requirement for direct broadcast satellite from DISH. This geostationary communications satellite is functioned by DISH and distributes content across North America. The solution helps the user to view high-quality content.

- February 2023: Here Technologies, a location data and technology platform, announced an alliance with Cognizant to deliver real-time location information and analysis. This cooperation with Cognizant customers in retail, ride-hailing, logistics, production, and automotive has occurred. Cognizant can reach and serve clients more accurately by applying location intelligence and analytics.

- December 2022: Mapbox, the map and location services platform, launched new products empowering developers and organizations to make better data-driven decisions and drive intuitive and seamless user experiences with innovative location technologies.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading end-users of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 20.30% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Technology

By Application

By Location Type

By End-Users

By Region

|

Frequently Asked Questions

The market is projected to reach USD 163.77 billion by 2034.

In 2025, the market value stood at USD 31.17 billion.

The market is projected to grow at a CAGR of 20.30% during the forecast period.

Transportation and Logistics is likely to lead the market.

Rapid proliferation of smartphones and increasing location-based marketing to aid market growth.

HERE, IndoorAtlas, Mapbox, Esri, Google LLC, IBM Corporation, Cisco Systems, Inc., Maxar Technologies, ALE International, and Qualcomm Technologies, Inc are the top players in the global market.

North America held the largest market share in 2025.

Asia Pacific is expected to exhibit the highest growth rate during the forecast period.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us