Nurse Call Systems Market Size, Share & Industry Analysis, By Technology (Wired and Wireless), By Product (Basic Button Based Systems, Mobile/Smartphone Integrated Systems, IP-based Interconnectivity Systems, and Others), By End-user (Hospitals, Assisted Living and Nursing Centers, Home Care Setting, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

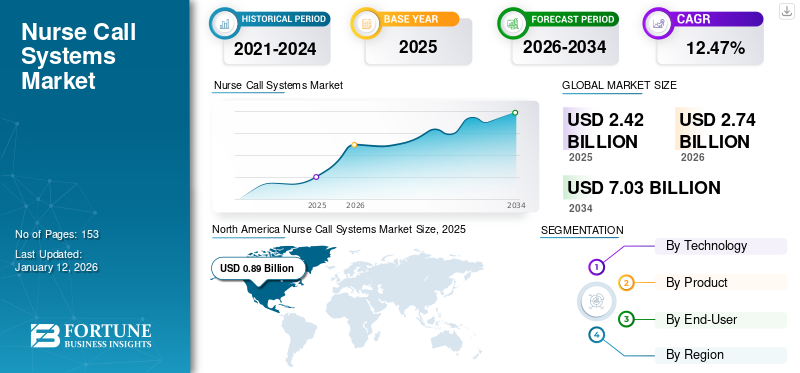

The global nurse call systems market size was valued at USD 2.42 billion in 2025 and is projected to grow from USD 2.74 billion in 2026 to USD 7.03 billion by 2034, exhibiting a CAGR of 12.47% during the forecast period. North America dominated the nurse call systems market with a market share of 36.73% in 2025.

Nurse call systems, also known as nurse call devices, are communication systems that are used in hospitals and nursing homes. These systems are used for various communication and patient monitoring purposes. The major applications of nurse call devices fall under patient monitoring. Recent technologies that offer patient monitoring integration have proven beneficial for the nursing of critical care patients.

In the current global nurse call systems industry scenario, there is a need to increase the awareness of patient monitoring nurse call devices in emerging and underdeveloped countries. The increasing work pressure of nurses and the decreasing number of patient-to-nurse ratio is leading to the increasing demand for nurse call systems in the market. There is a rising requirement of workforce optimization in hospitals and critical care centers which could be tackled by the incorporation of technologically advanced nurse communication systems.

- In December 2023, Navenio partnered with Pavion to integrate infrastructure-free non-invasive technology seamlessly into the nurse call system and other critical clinical and workflow systems in a hospital environment. The first installation for the partnership will take place at a federal hospital and research organization with almost 700 beds located outside of Washington DC.

Moreover, the outbreak of the COVID-19 pandemic impacted the market negatively due to production and supply chain issues and hindered the installation of new systems. In 2021, as the lockdown restrictions were easing, the revenues of market players were slowly increasing due to a surge in the sales of their products including nurse call systems. However, greater adoption of advanced technologies coupled with increasing number of assisted living centers and care centers worldwide is expected to promote further growth over the forecast period.

Global Nurse Call Systems Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 2.42 billion

- 2026 Market Size: USD 2.74 billion

- 2034 Forecast Market Size: USD 7.03 billion

- CAGR: 12.47% from 2026–2034

Market Share:

- Region: North America dominated the market with a 36.73% share in 2025. The region's growth is driven by the rapid acceptance and penetration of these systems in healthcare facilities, a strong geriatric population, a decreasing nurse-to-patient ratio, and high healthcare expenditure.

- By Product: Basic Button Based Systems held the largest market share in 2026, accounting for 40.98% of the market. This dominance is due to their considerably higher adoption rate in emerging countries, providing a fundamental and cost-effective communication solution.

Key Country Highlights:

- Japan: As a key country in the fastest-growing Asia Pacific region, the market is driven by an increasing demand for these systems and the growing importance of accreditation from healthcare regulatory authorities, which pushes hospitals to upgrade their communication and patient monitoring infrastructure.

- United States: The market is fueled by a strong and growing geriatric population, with a high prevalence of neurological disorders such as Alzheimer's. Recent developments include partnerships to integrate advanced non-invasive technology into nurse call systems at major federal hospitals.

- China: Growth is strongly supported by the rapid development of healthcare infrastructure, particularly the surge in the number of private hospitals. As these new facilities are built, they are equipped with modern communication systems to ensure efficient patient care.

- Europe: The market is advanced by the high adoption of newer technologies in countries such as the U.K. and Germany. For example, a major German hospital complex recently signed a multi-million dollar contract to install Ascom's advanced Telligence patient call system.

Nurse Call Systems Market Trends

Development of Healthcare Infrastructure in Emerging Regions to Augment Market Growth

Over the past few decades, there has been a strong surge in healthcare expenditure in emerging countries such as India, and China. For instance, there have been strong surges in the number of hospitals in China, especially in terms of private hospitals. As private hospitals are anticipated to incur greater expenditure in terms of infrastructure, this is expected to lead to greater adoption of these products.

Many health reforms are taking place to address the need of the unmet patient population. Several manufacturers and public organizations have started taking initiatives to fill the gaps in this market through partnerships and policies. The increasing number of hospitals across the globe are prominently expected to drive the growth of the hospital segment in the global market. This, combined with the increasing prevalence of chronic conditions represents huge potential for a higher number of hospital admissions, resulting in an increase in demand for these systems in hospitals.

- For instance, according to BioSpectrum, in 2023, one of the key countries in the global market, India, had an estimated 70,000 hospitals. In emerging countries such as India, hospitals are going to play an important role as they are expected to conduct a significant number of these treatment procedures.

Download Free sample to learn more about this report.

Nurse Call Systems Market Growth Factors

Emergence of Advanced Technologies in Communication Systems to Propel Market Growth

Advancements in communication and information technology have the potential to be applied to a wide variety of development of these systems that facilitates optimized work and patient bed allotment, patient monitoring, the safety of nurse staff, emergency management among others. The developments in advanced technologies, such as internet protocol systems and wireless technologies that include mobile device integration communication systems have significantly influenced the global market growth.

- In April 2023, TeleAlarm Europe GmbH entered a strategic partnership with Skyresponse AB to integrate Skyresponse’s cutting-edge technology with TeleAlarm’s offering. This will provide a reliable and innovative solution for emergency response management in the care for the elderly and those in need of care.

Integration of advanced technologies such as internet protocol-based systems and wireless technologies, with nurse call devices, would lower the number of medical errors and decrease the false positive and negative call alarms by patients. These novel technologies could help identify and grade the severity and nature of the emergency in the patient pool admitted in the hospital or nursing home.

For instance, if a nurse is allocated a certain number of beds, these products would help schedule the visit and manage the patient call and requirements based on the nature of the emergency. Certain systems also come integrated with wandered control and an out-of-bed indication that will alert the nurse if the patient is awake or has left the allocated bed.

Rise in Geriatric Populace Coupled with Increased Prevalence of Neurological Disorders to Drive Market Growth

The increasing need for wanderer control systems and patient monitoring in the geriatric population are projected to fuel the global nurse call systems market growth during the forecast period. Additionally, increasing life expectancy worldwide has led to an increase in the global geriatric population. The geriatric population is significantly higher in countries such as U.S, Germany, Italy, and Japan. This has led to an increase in the demand for these systems in a nursing homes and assisted living centers.

The rising prevalence of the geriatric population suffering from neurological disorders is set to increase the adoption of these devices. Additionally, the rising trend amongst the elderly individuals of preferring long term in-home care treatment and recovery is also estimated to positively drive the global market.

- According to estimates published by the Centers for Disease Control and Prevention (CDC), about 6.7 million Americans aged 65 years or older had Alzheimer’s disease in 2023. Such a strong prevalence of neurological diseases is expected to promote market growth in near future.

RESTRAINING FACTORS

High Costs Associated with Implementation of Nurse Call Systems to Limit Market Growth

In terms of limitations, cost has always been one of the major barriers in terms of implementation despite the various advantages attributed to them in emerging countries especially. The effectiveness of these systems depends on the software, hardware, and staff training levels in healthcare facilities. The purchase price of the system for a fully integrated room is further divided into installation, implementation cost, nurse/caregivers training module cost, base hardware, and software cost.

Also, the healthcare settings that have installed these devices need to pay for the software maintenance (SMA) fee and the average price of these systems varies depending upon the type of room where it has been installed.

Generally, the hardwired system costs up to USD 42,672.7 (GBP 34,607.55), including USD 9,987.2 (GBP 8,099.58) of bedhead trunking product which is used for connection and installation/mounting of the nurse call system to the existing wiring and power provision. Similarly, the Courtney Thorne wireless nurse call system can cost unto USD 25,642.4 (GBP 20,796) in the U.K. It includes all mounting brackets and accessories for the installation/mounting of the nurse call system. Such factors are anticipated to restrain the growth of market in the forecast period.

Nurse Call Systems Market Segmentation Analysis

By Technology Analysis

Wired Segment to Generate the Highest Revenue in 2025-2032 Owing to Higher Penetration in Emerging Economies

Based on technology, the global market can be segmented into wired and wireless technology.

With the advent of newer technological advancements, it is now possible to wirelessly connect to the patients and remotely monitor them. The wireless system offers connectivity to mobile devices like pagers and cordless mobile medical devices. The wired system also incorporates IP-based technology and has wireless components to communicate with staff and patients.

Wired nurse call systems segment enable the nurses and healthcare professionals in hospitals and nursing homes to stay alert and connected to the patients in a foolproof manner. Software solutions for these systems would provide dynamic planning, well-connected system, and monitoring platforms for the nurses, thus augmenting the global market revenue.

The wired nurse call systems segment has captured higher share of 61.93% in 2026, in terms of revenue generation owing to the factors, namely, higher penetration of the technology type in emerging countries, better security, and connectivity compared to wireless, less complex to operate for nurses as well as patients among others.

By Product Analysis

IP-based Interconnectivity Systems to Exhibit a Significant CAGR during the Forecast Period

Based on product, the global market can be segmented into basic button based systems, mobile/smartphone integrated systems, IP-based interconnectivity systems, and others.

The basic button-based systems segment dominated the global market in 2026 with a market share of 40.98% due to its considerably higher adoption rate in emerging countries than other segments. IP-based interconnectivity systems held the second largest market share in the year 2024 and will grow during the forecast period by exhibiting the fastest CAGR. They have a better and enhanced capacity of improving workforce and resource allotment combined with management of patient calls.

The mobile/smartphone integrated communication system segment has held a substantial market share in 2024 as they have improved accessibility of medical assistance with the increase in superior technology coupled with adoption of mobile systems will lead the segment growth at a significant CAGR.

The others segment is estimated to grow at a lower CAGR due to limited product offerings in the nurse call systems.

To know how our report can help streamline your business, Speak to Analyst

By End User Analysis

Strong Adoption of These Systems in Hospitals to Aid Segment Expansion

Based on end user, the global market can be segmented into hospitals, assisted living & nursing centers, home care settings, and others.

Hospitals are projected to generate the highest revenue in the global market during the forecast period. Hospitals are projected to generate the highest share of 77.28% in 2026. In the hospitals, the nurses highly depend on these systems for monitoring, emergency management, and workforce management owing to the larger patient population attending hospitals for various emergency and general health purposes. The increasing number of individuals suffering from chronic disorders leading to hospitalizations is anticipated to drive the demand for these systems from hospitals.

The assisted living & nursing centers segment is anticipated to register the highest CAGR due to the increased adoption of these systems in these settings. The home care settings, and the others segment accounted for a comparatively lower share of the market.

REGIONAL INSIGHTS

On the basis of region, the global market can be segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Nurse Call Systems Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America generated a revenue of USD 0.89 billion in 2025 and is the dominant region in the global market. The rapid acceptance and penetration of these systems and devices by many healthcare facilities such as hospitals and nursing centers would boost the market growth in the U.S. Some of the reasons for the region’s dominance is the strong geriatric populace, decreasing number of nurses to the patient population, and rise in healthcare expenditure. The U.S. market is projected to reach USD 0.92 billion by 2026.

Asia Pacific

The countries of Asia Pacific are projected to experience the utmost growth in the market value across the regional segmentation. Increasing demand for these systems and the increasing importance of accreditation from healthcare regulatory authorities in hospitals are expected to propel the market growth. Domestic manufacturers from India and China are striving to maintain dominance in the parent country to capture a wide domestic consumer base. This has led to increased competition in emerging markets such as the Asia Pacific. The Japan market is projected to reach USD 0.11 billion by 2026, the China market is projected to reach USD 0.15 billion by 2026, and the India market is projected to reach USD 0.08 billion by 2026.

Europe

On the other hand, Europe nurse call systems market is projected to witness considerable growth. The high growth countries, including the U.K., France, and Germany would contribute to the growth of the market in the region. Scandinavian countries like Denmark and Netherlands are on the upsurge of adopting newer technologies and advanced healthcare IT systems and is hence expected to experience higher growth in the region. The UK market is projected to reach USD 0.06 billion by 2026, while the Germany market is projected to reach USD 0.12 billion by 2026.

The rest of the world segment that includes countries of the Latin America and the Middle East and Africa which would witness growth due to the increasing awareness in recent years. The unmet requirement of nurse call devices in countries like South Africa and Brazil could provide lucrative opportunities for leading market players to capture a higher market share in these regions. However, the lack of skilled healthcare professionals may hamper the market growth in the region.

Key Industry Players

Associations with Large Hospitals to Strengthen Market Position of Players Such as Hill-Rom Services Inc., AMETEK. Inc., and Ascom

The introduction of new products combined with a focus on mergers and acquisition has been a key driving factor for the key players operating in the global market to capture higher revenue share. Combined with this, the emphasis on the development and discovery of advanced communication technologies have helped garner a high customer base for these key players. The growth strategies adopted by the dominating companies have facilitated the competition in the market.

Hill-Rom Services Inc. was acquired by Baxter International Inc. in the fiscal year of 2021. This acquisition has facilitated the company to expand its global presence owing to the wider consumer preference of the parent company. Additionally, Hill Rom Holdings is highly dependent on establishing distributor and supply chain channel relations to have a global reach. Ascom focuses significantly on the research and development to launch advanced nurse call systems. Some of the other market players include Stanley Healthcare, Cornell Communications, JNL Technologies, and others.

LIST OF TOP NURSE CALL SYSTEMS COMPANIES:

- JNL Technologies (U.S.)

- Cornell Communications (U.S.)

- Ascom Holding AG (Switzerland)

- Rauland (AMETEK, Inc.) (U.S.)

- Televic (Belgium)

- Jeron Electronic Systems, Inc. (U.S.)

- SCHRACK SECONET AG. (Austria)

- Honeywell International Inc. (U.S.)

- Azure Healthcare Limited (Australia)

- Hill Rom Services Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- May 2023: West-Com Nurse Call Systems partnered with Vitalchat to provide hospital systems and other healthcare facilities nationwide with virtual care solutions using artificial intelligence. This development will satisfy the needs and demands of patients, caregivers, providers, and IT leaders.

- November 2022: Courtney Thorne Ltd launched its CONNECT HEALTH hybrid nurse call system. It is a hybrid wired/wireless approach that is designed to meet the demands of nursing personnel in acute healthcare settings.

- October 2022: Ascom won USD 3.5 million (Euro 3.3 million) contract to install Ascom Telligence patient call system in a new hopsital complex at Germany.

- September 2022: Vayyar Care partnered with Southern Care Maintenance Ltd (SCM), a premium maintenance and service provider for nurse call systems and home care equipment. This partnership aims to deliver best-in-class fall detection solution together with quality installation and support.

- Novemeber 2021: Acurio Health partnered with Rauland-Borg Corporation to deloy its paediatric and maternity facility with Rauland’s nurse call solutions.

- July 2022: Austco Communication Systems Pty Ltd. (UK) launched a new design service for designing Nurse Call systems as per HTM 08-03 compliance.

- May 2020: Aiphone partnered with Amplion Clinical Communications to sell and distribute its nurse call system to the hospital, assisted-living facility, and hospice care industries.

REPORT COVERAGE

The global market report provides qualitative and quantitative insights on the global market and a detailed analysis of global market size & growth rate for all possible segments in the market. The global market is segmented by technology, product, end-user, and geography. Based on the technology, the global market is classified into wired and wireless. By product, the global market is bifurcated into a basic button-based system, IP-based interconnectivity systems, Mobile/Smartphone Integrated Systems, and others. Based on the end-user, the market is segmented into hospitals, assisted living and nursing centers, home care settings, and others. Geographically, the global market has been analyzed across four major regions, which are North America, Europe, Asia Pacific, and the rest of the world, this region is further categorized into countries.

Along with this, the report provides an elaborative analysis of the global market dynamics and competitive landscape. Various key insights presented in the report are the recent industry developments in the global market, such as key industry developments - mergers, acquisitions, and partnerships, the introduction of new products by major players, technological advancements in nurse call systems, key market trends among others.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 12.47% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Technology

|

|

By Product

|

|

|

By End-User

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 2.42 billion in 2025 and is projected to reach USD 7.03 billion by 2034.

In 2025, North America stood at USD 0.89 billion.

Growing at a CAGR of 12.47%, the market will exhibit steady growth over the forecast period (2026-2034).

The wired segment is expected to be the leading segment in this market during the forecast period.

Increasing advancements in information and communication technology are a key driving factor of the market.

Hill-Rom Services Inc., Rauland (AMETEK, Inc.), and Ascom are the leading market players in the market.

North America dominated the market in 2026.

IP based nurse call systems and mobile-based systems would drive the adoption.

Increasing adoption to meet unmet demand in emerging countries, higher preference of the elderly population for home care treatment, and increasing hospitalizations are a few of the trends of the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us