Wound Care Devices Market Size, Share & COVID-19 Impact Analysis, By Product Type (Negative Pressure Wound Therapy (NPWT), Hyperbaric Oxygen Therapy (HBOT), Extracorporeal Shock Wave Therapy (ESWT), and Others), By Indication (Diabetic Foot Ulcers, Pressure Ulcers, Surgical Wounds, and Others), By End User (Hospitals, Clinics, Homecare Settings, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

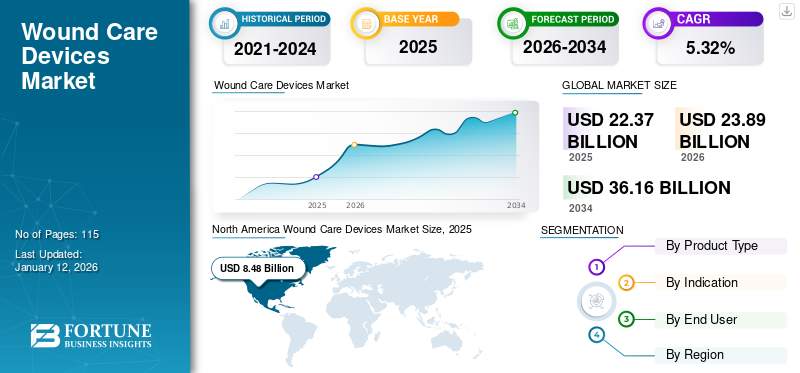

The global wound care devices market size was valued at USD 22.37 billion in 2025. The market is projected to grow from USD 23.89 billion in 2026 to USD 36.16 billion by 2034, exhibiting a CAGR of 5.32% during the forecast period. North America dominated the wound care devices market with a market share of 37.90% in 2025.

According to the National Health Service (NHS), an estimated 4.5 million people in the U.K. are suffering from diabetes. The prevalence of diabetic foot ulcers among diabetic patients is estimated to be around 10%. Statistics also revealed that hard-to-heal grade- IV diabetic foot ulcers lead to an estimated 7,000 foot amputations each year in the U.K. alone. These devices are designed specifically to provide effective treatment for high-grade wounds such as diabetic ulcers, pressure ulcers, and surgical wounds.

Globally, the growing geriatric population, along with an increase in the incidence of chronic diseases and acute wounds, is responsible for the higher demand for advanced devices in the market. For instance, according to the data published by the National Center for Biotechnology Information, in the U.K., the incidence of pressure ulcer is five to seven times high among people of age 65 - 70 years. Additionally, the increasing number of patients undergoing surgeries has resulted in a vast patient population suffering from surgical wounds.

COVID-19 Pandemic: Limited Adoption of Devices to Prevent Transmission

The outbreak of COVID-19 has a negative impact on this market of wound care device, due to the exclusion of wound care from the essential procedures list in many countries. Additionally, healthcare facilities, including hospitals and clinics, have temporarily shut down their wound care department to prevent COVID-19 transmission. These facilities are only accepting emergency cases. This has resulted in a significant drop in the adoption of these devices.

Several medical organizations and healthcare professionals are promoting the use of virtual consultation and wound dressings among patients suffering from mild to moderate wounds. The adoption of these devices is also affected by the disruption in the supply chain as a result of the lockdown in many countries, coupled with the requirement of professional assistance during their usage, which is not suitable for the current scenario. Thus, such trends are anticipated to harm the adoption of wound healing devices in 2020.

Global Wound Care Devices Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 22.37 billion

- 2026 Market Size: USD 23.89 billion

- 2034 Forecast Market Size: USD 36.16 billion

- CAGR: 5.32% from 2026–2034

Market Share:

- Region: North America dominated the market with a 37.90% share in 2025. This is due to a higher demand for wound care devices from a large patient population, coupled with the presence of adequate reimbursement policies in the region.

- By Product Type: Negative Pressure Wound Therapy (NPWT) accounted for the largest market share. The segment's dominance is attributed to its high efficiency in exudate management and its ability to reduce the healing duration of wounds.

Key Country Highlights:

- Japan: The market is driven by growing awareness among the general population about advanced wound care, coupled with increasing healthcare expenditure, which supports the adoption of new technologies.

- United States: Market growth is supported by a large patient population requiring advanced wound care and a strong focus on innovation, as demonstrated by the U.S. launch of Smith & Nephew's new PICO 14 single-use NPWT system.

- China: As part of the fast-growing Asia Pacific region, the market is expanding due to increasing awareness of advanced wound care products and rising healthcare spending, which is improving access to modern medical devices.

- Europe: The market is propelled by an increasing number of patients suffering from chronic wounds and the introduction of advanced devices by key players. For instance, the launch of the PICO7 system in the European market by Smith & Nephew has enhanced the availability of innovative wound care solutions.

LATEST TRENDS

Download Free sample to learn more about this report.

Launch of Innovative Devices to Fulfil Unmet Needs in Wound Management

Wounds such as high grade pressure ulcer, diabetic foot ulcers, and surgical wounds are difficult to heal. Currently, prominent players are focusing on introducing technologically advanced devices in the market in order to cater to the unmet demand of the patient population. For instance, in March 2020, Smith & Nephew announced the U.S launch of its new PICO 14 single use negative pressure wound therapy system (sNPWT) which has a pump duration of up to 14 days. Thus, the growing investments by major players in product developments are resulting in the introduction of novel wound healing devices in the market.

DRIVING FACTORS

Growing Popularity of Devices Such as NPWT to Thrive Market Growth

The distinct benefits offered by devices such as reducing healing time, being effective in urgent exudate management, and comparatively lower cost than the active therapies are some of the key factors resulting in its high popularity among patients and healthcare providers across the globe. This, along with the constant focus of renowned players in introducing advanced technology in the market is generating a high demand for wound healing devices for the management of chronic and acute wounds. For instance, in May 2019, KCI, an Acelity Company, received the U.S. FDA approval for DERMATAC Drape, a silicone-acrylic hybrid drape that provides both clinical and operational benefits and is used as an accessory to KCI’s negative pressure wound therapy (NPWT) system.

RESTRAINING FACTORS

Presence of Unfavorable Reimbursement Policies in Emerging Countries to Restrict Adoption

The cost associated with the use of devices is limiting their adoption in emerging countries such as China, India, and others. This is primarily happening due to the lack of adequate reimbursement policies for devices in these countries, which is leading to higher out-of-pocket payments for patients. For instance, according to a study published by the International Surgery Journal (ISJ), it was estimated that in India, the total cost incurred for patients using NPWT for a period of 15 days was USD 11.16 per patient per year. But, the cost of the other patients using conventional wound dressings was USD 10.41 per patient. Thus, comparatively higher cost of devices than wound dressings, along with inadequate reimbursement, are some of the major factors that may restrict the use of wound care products and devices in emerging countries.

SEGMENTATION

By Product Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Negative Pressure Wound Therapy Segment to Be Dominant, Backed by its High Efficiency

Among product type, the market is segmented into negative pressure wound therapy (NPWT), hyperbaric oxygen therapy (HBOT), extracorporeal shock wave therapy (ESWT), and others. The negative pressure wound therapy segment accounted for the largest Wound Care Devices Market share in the global market 44.27% in 2026. The dominance of the segment is due to the high efficiency in exudate management and its capability to reduce the healing duration of the wound.

However, the hyperbaric oxygen therapy (HBOT) and extracorporeal shock wave therapy (ESWT) segments are anticipated to register a CAGR during the period of 2025-2032.

By Indication Analysis

Diabetic Foot Ulcers Segment to Lead Owing to Rising Cases of Diabetes Worldwide

Based on indication, the wound care devices market is segmented into diabetic foot ulcers, pressure ulcers, surgical wounds, and others. The diabetic foot ulcers segment dominated the market 0% globally in 2026. The dominance is attributed to the higher prevalence of diabetes globally along with the rising incidence of foot ulcers among diabetic patients. The surgical wounds segment is expected to grow at a significant CAGR during the forecast period due to the increasing number of surgical procedures across the globe.

Also, the pressure ulcers segment is anticipated to grow at a significant CAGR during the forecast period, owing to the increasing prevalence of pressure ulcers among the geriatric population.

By End User Analysis

Hospitals Segment Generates Largest Share Fueled by Higher Adoption of Wound Care Devices

In term of end-user, the market is segmented into hospitals, clinics, homecare settings, and others. The hospitals segment is expected to dominate the market during the forecast period, accounting for 0.04% market share in 2026. The dominance of this segment would occur due to the higher adoption of these devices in large and mid-sized hospitals.

Besides, the home care settings segment is anticipated to register a higher CAGR during the forecast period. The growth is because of several initiatives taken by the market players to offer portable devices with rental schemes. It is further boosting the adoption of wound care devices in home care settings.

REGIONAL INSIGHTS

North America Wound Care Devices Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

The market size in North America stood at USD 1.23 billion in 2024. The dominance of this region is attributed to the higher demand for wound care devices from the large patient population in the U.S combined with the presence of adequate reimbursement policies. The U.S. market is projected to reach USD 7.89 billion by 2026.

Europe

The market in Europe is expected to grow at a significant CAGR during the forecast period owing to the increasing number of patients suffering from wounds and introduction of advanced devices by market players in this region. For instance, in February 2018, Smith & Nephew announced the launch of PICO7 in the European market. The UK market is projected to reach USD 0.85 billion by 2026, while the Germany market is projected to reach USD 2.13 billion by 2026.

Asia Pacific

The market in Asia Pacific is anticipated to register higher CAGR due to the growing awareness among the general population about wound care, coupled with the increasing healthcare expenditure. Latin America & the Middle East & Africa are expected to project a comparatively moderate CAGR during the forecast period. The limited penetration of wound care devices, combined with higher preference for low-cost wound dressings among healthcare providers and patients, is limiting the demand for devices in these regions. The Japan market is projected to reach USD 1.29 billion by 2026, the China market is projected to reach USD 2.46 billion by 2026, and the India market is projected to reach USD 0.38 billion by 2026.

KEY INDUSTRY PLAYERS

Leading Players are focusing on enhancing portfolios & Innovating their Products

The current market scenario is consolidated with major players such as Smith & Nephew, DeRoyal Industries, Inc., and 3M accounting for the maximum share of the market in 2019. Diverse product offerings combined with their constant focus on innovating wound healing devices are primarily attributed for the dominance of these players in the global wound management devices market.

For instance, in January 2020, Smith & Nephew announced the positive results for the clinical trial that evaluated the efficacy of PICO single use NPWT system in reducing wound area depth and volume in comparison with the traditional NPWT system in patients with lower extremity ulcers. However, the other key players operating in the market are Cardinal Health, Talley Group Ltd, ConvaTec Inc., Devon Medical Products, BSN Medical, and Medela AG.

LIST OF KEY COMPANIES PROFILED:

- Smith & Nephew (London, U.K.)

- 3M (Minnesota, U.S)

- Cardinal Health (Dublin, Ohio)

- Talley Group Ltd (Romsey, U.K)

- ConvaTec Inc. (England, U.K.)

- DeRoyal Industries, Inc. (Powell, U.S)

- Devon Medical Products (King of Prussia, U.S)

- BSN Medical (Hamburg, Germany)

- Medela AG (Baar, Switzerland)

- Other Players

KEY INDUSTRY DEVELOPMENTS:

- October 2019 – 3M acquired Acelity, Inc. and its subsidiaries, intending to strengthen its position in the wound care and specialty surgical products market.

- October 2018 – ConvaTec Inc. received the U.S FDA approval for AVELLE. The product is a negative pressure wound therapy system equipped with the benefits of hydrofibre technology.

REPORT COVERAGE

The wound care devices market report provides a detailed analysis and Industry forecast and focuses on key aspects such as leading companies, product types, and leading indications of the product. Besides this, the report offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market over the recent years.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD billion) |

|

|

By Product Type

|

|

By Indication

|

|

|

By End User

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global wound care devices market size was USD 23.89 billion in 2026 and is projected to reach USD 36.16 billion by 2034.

In 2025, the market value in North America stood at USD 8.48 billion.

Registering a CAGR of 5.32%, the market will exhibit steady growth in the forecast period (2026-2034).

The negative pressure wound therapy (NPWT) segment is expected to be the leading segment in this market during the forecast period.

The increasing demand for advanced devices such as NPWT among patients and the growing prevalence of chronic wound and acute wounds are major factors driving the growth of the market.

Smith & Nephew, 3M, and DeRoyal Industries, Inc. are the major players in the global market.

North America dominated the market in terms of share in 2025.

The launch of advanced devices by market players such as ESWT, portable or single use NPWT is driving their adoption in the global market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us