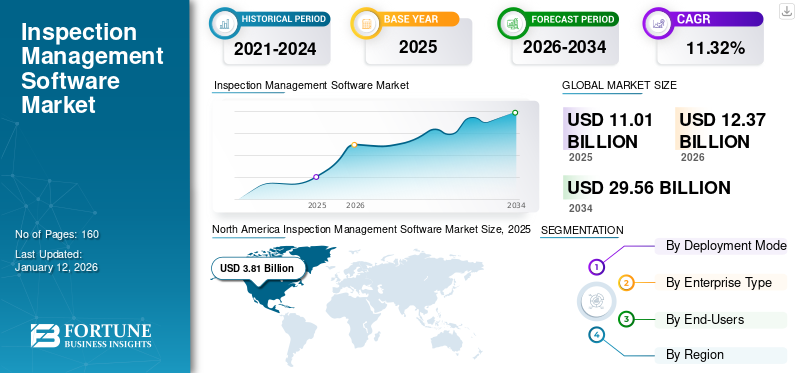

Inspection Management Software Market Size, Share & Industry Analysis, By Deployment Mode (On-Premise and Cloud), By Enterprise Type (Large Enterprises and Small & Medium Enterprises (SMEs)), By End-User (Manufacturing, Aerospace and Defense, Retail and Consumer Goods, Healthcare and Life Sciences, Energy and Utilities, and Others), and Regional Forecast, 2026-2034

Inspection Management Software Market Size

The global inspection management software market size was valued at USD 11.01 billion in 2025 and is projected to be worth USD 12.37 billion in 2026 and reach USD 29.56 billion by 2034, exhibiting a CAGR of 11.32% during the forecast period. North America dominated the global market with a share of 34.62% in 2025.

Inspection management software is a category of digital tools that help to verify the safety of an organization’s facility, consisting of checklists, work order management systems, reports, and analytics dashboards. It ensures that regular audits and inspections of facilities are carried out effectively by organizations of all sizes.

The growth of the inspection management software market is attributed to several factors, such as the rising adoption of the business automation process for seamless inspection and the increasing presence of safe regulatory processes and standards for health, environmental protection, and product safety. The growing demand for convenience inspection methods over conventional inspection methods drives the global market size.

The COVID-19 pandemic added momentum to the inspection management software market as several sectors adopted the software-based program for various operations. Moreover, new changes forced the local governments to invest in cloud computing software that allowed the market players to develop cloud-based inspection solutions and improve the business process.

Inspection Management Software Market Trends

Growing Importance of Strategic Planning to Propel Market Growth

The impact of inspection systems on the business has to be proved by many organizations that operate quality systems either using ISO or another method. As organizations increasingly demand accountability at all levels, specific instances of the efficiency of quality strategies are being provided by their managers. Therefore, to maintain a healthy flow of work, several inspection service providers have been trying to strategize a solution that can be implemented on its own.

Download Free sample to learn more about this report.

Inspection Management Software Market Growth Factors

Rising Adoption of the Business Automation Process for Seamless Inspection to Support Market Expansion

Automated systems embedded with Artificial Intelligence (AI) algorithms that help detect errors and respond to them in real time are particularly important for improving quality control. Compared to the manual operation of an inspection team, visual inspection systems equipped with AI can carry out these tasks more consistently and accurately. With reduced human error, these technologies also help to streamline the production process.

Moreover, using AI in inspection software automatically prioritizes inspection cases based on their level of risk, helping inspectors focus their time on the circumstances and create more effective and efficient inspection management solutions. For instance,

- In August 2023, Bentley Systems acquired Blyncsy, a provider of artificial intelligence services for transportation departments. Through the acquisition, Bentley Systems integrated its iTwin Ventures portfolio with Blyncsy’s disruptive AI services to accelerate infrastructure asset analytics and improve transportation networks.

Decision intelligence could help, contribute, and assist in the automated decision-making of humans through business automation, simulations, and AI. To enhance overall decision-making, organizations are taking advantage of the potential of new-age technology. Therefore, due to the requirement for automated inspection, there is enormous growth in the market.

RESTRAINING FACTORS

High Installation Costs and Need for Professional Expertise to Hinder the Market Progress

As the software installation process is expensive, businesses could find themselves in a financially unfavourable situation when they install inspection management software. The use of work schedules, suitable materials, types of equipment, regular checks, and higher quality design are also contributing to increasing the costs of the whole process. Furthermore, the application of this software requires expert services. The market growth can, therefore, be hindered by problems related to the high cost of installation and the lack of skilled inspection experts.

Inspection Management Software Market Segmentation Analysis

By Deployment Mode Analysis

Complete Control Or Administrative Access Offered By On-Premise-based Inspection Management Software to Boost Segment Growth

Based on the deployment mode, the market is categorized into on-premise and cloud.

On-premise led the market in 54.50% 2026 in terms of market share. The growth of the on-premise deployment is due to the fact that an on-premise installation strategy allows users to keep track of their site with desktops or other systems. The on-premise inspection management systems provide users with complete control or administrative access to their inspection management software when a program is installed at the company premises.

The cloud is set to grow at the highest CAGR over the forecast period. The urgency for companies to manage risks and move into digital transformation is growing as a result of the pandemic. The market players are offering cloud-based inspection software to replace traditional paper-based methods with cloud-based systems, allowing inspection teams to perform quality audits, assessments, and quality control checks efficiently. Companies are broadly adopting cloud-based solutions as they offer customizable checklists, real-time data entry, photo capture, and automated reporting, thus improving accuracy and data integrity, and enhancing the inspection quality.

Users can easily create forms while maintaining a remote workforce through the installation of this software. It enables companies to reduce their IT costs by transferring part or all of their activities to the cloud network. Also, cloud-based technology provides more flexibility.

By Enterprise Type Analysis

Rapid Integration of Inspection Management Software to Enhance the Working Efficiency in SMEs to Support Market Growth

The Large Enterprises segment is projected to dominate the market with a share of 55.51% in 2026. By enterprise type, the market is classified into small & medium enterprises (SMEs) and large enterprises. Small & Medium Enterprises (SMEs) are expected to rise at a highest CAGR during the forecast period. SMEs tend to produce less business data. This has resulted in a reduction in the overall cost of installation of inspection management software. To increase the efficiency of their activities worldwide, numerous SMEs are switching from conventional business operations to digital ones. In addition, the inspection tasks enable SMEs to save a lot of time that can be used for positive interaction with consumers.

According to market share, large enterprises dominated the market in 2024. A digital-first, remote-first business model of large enterprises segment aims to improve employee experience and digitally transform touchpoints with clients and partners to build product experiences. The development of this software is being encouraged by large enterprises that are better able to respond to the needs of remote workers and consumers.

By End-Users Analysis

To know how our report can help streamline your business, Speak to Analyst

Increased Demand for High-quality Standards Boosted Manufacturing Segment Growth

In terms of end-users, the market is divided into energy and utilities, manufacturing, aerospace and defense, retail and consumer goods, healthcare and life sciences, and others.

Among these, manufacturing led the market in 25.99% 2026. Inspection is an essential part of modern production to guarantee that each component meets the highest quality standards. To prevent costly defects and improve overall quality, manufacturers can detect potential faults during the production cycle through the inspection of parts. Moreover, the introduction of self-training software in AI-based visual inspection is expected to be a game changer across the manufacturing sector. This software utilizes the real-time data generated during the inspection process to identify new variations and patterns in product quality. Through the software, manufacturers can select the course of action to be taken on the new variations by detecting the defective products. For instance,

- In July 2023, TireTech developed an AI-enabled tire inspection system that uses 3D technology, scans tires, and collects data regarding the tire’s overall condition as well as its material makeup. Through the system, the company collects information on the tires, and based on that information, the tire is either recycled for automotive use or converted into granular material.

The retail and consumer goods segment is expected to grow at highest CAGR during the forecast period. The demand for high-quality premium goods & services is driven by increased per capita disposable income. To satisfy the need for high-quality products, many retailers are using inspection management software. For instance,

- In May 2023, Procurant, a cloud-based software company, introduced a new voice-enabled rating feature in its Procurant Inspect application to streamline retail inspections while providing real-time data to sellers and buyers.

REGIONAL INSIGHTS

By region, the market is fragmented into South America, North America, Asia Pacific, Europe, and the Middle East & Africa.

North America Inspection Management Software Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

North America accounted for a substantial part in the inspection management software market size in USD 3.81 billion 2025. The market for inspection management systems in the region is expected to grow due to the adoption of cloud technologies, robots, large amounts of data, medical equipment, 3D printers, stainless steel, drilling production materials, and a growing number of major manufacturing facilities and retail chains. In the 22nd annual study on “US spending” conducted by “Quality Magazine and Clear Seas Research”, 98% of American manufacturers report that quality inspection aspect has become more important. Technological innovations and supply chain management activities, such as logistics, warehouses, deliveries, production and transport services, also contribute to the region's market growth.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific is anticipated to grow significantly at the highest growth rate over the projected period. In the Asia Pacific region, automation is enhancing governments and businesses. The market growth in the region is supported by increasing private and public investments in technology infrastructure to counter the usage of automation.

The Middle East & Africa is set to register the second-highest growth rate in the market over the forecast timeframe. The digitization of data and rapid expansion of innovation in the region have led to the adoption of this software.

Key Industry Players

Companies Focus on Partnerships, Mergers & Acquisitions, and Product Enhancement Tactics to Promote Market Development

Key market players are concentrating on providing better quality assurance for the enhanced operational efficiency of businesses. They are acquiring small and regional companies to boost their market presence. In addition, strategic partnerships, mergers & acquisitions, and rising investments in such quality assurance tools for inspection are driving market growth.

List of Key Companies Profiled:

- Dassault Systèmes (France)

- Hexagon AB (Sweden)

- Oracle Corporation (U.S.)

- Wolters Kluwer N.V. (The Netherlands)

- Ideagen (U.K.)

- Autodesk Inc. (U.S.)

- Zoho Corporation Pvt. Ltd. (India)

- Penta Technologies, Inc. (U.S.)

- Intelex Technologies (Canada)

- ComplianceQuest (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- January 2024: Wolters Kluwer launched the Enablon Vision Platform with enhanced analytics and data visualization capabilities for environmental, operations, and safety teams. The platform will empower users for integrated risk management, integrating, streamlining, and automating governance, compliance, risk, environment & sustainability, health & safety, and internal auditing across the organization.

- November 2023: Hexagon launched Nexus Connected Worker, a manufacturing software suite. The software connects manufacturers to real-time data for actionable insights and reporting on maintenance, operations, quality, and audits. It also offers an enterprise-system platform for the digital representations of processes, assets, and production facilities, and supports real-time decision-making.

- August 2023: Benchmark Gensuite, a provider of the inspection management platform, expanded its operations in Mason, Ohio. To provide its customers with a better service at home, globally, and across various operating profiles, its employees have the opportunity to work together in person.

- May 2023, Fulcrum collaborated with Esri, a Geographic Information System (GIS) software company, to integrate Esri’s ArcGIS Maps software development kit into its platform. This integration will offer customers access to Esri’s Geographic Information System (GIS) capabilities in industries, such as water, power, agriculture, telecom, environmental engineering, and others.

- April 2023: Fulcrum announced a strategic partnership with the American Society of Safety Professionals (ASSP), offering its members a special Starter Package of Fulcrum's field inspection management platform at no cost. Up to four fully customizable digital forms, including two reconstructed ASSP safety standard templates, which are available for use from the box, can be easily created by ASSP members.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, and leading end-users of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 11.32% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deployment Mode, Enterprise Type, End-User, and Region |

|

Segmentation |

By Deployment Mode

By Enterprise Type

By End-Users

By Region

|

Frequently Asked Questions

The market value is projected to reach USD 29.56 billion by 2034.

In 2025, the market value stood at USD 11.01 billion.

The market is projected to record a CAGR of 11.32%.

In 2026, the manufacturing segment holds the highest market share.

Rising adoption of the business automation process for seamless inspection to aid market growth.

Dassault Systemes, Hexagon AB, Oracle Corporation, Wolters Kluwer N.V., Ideagen, Autodesk Inc., Zoho Corporation Pvt. Ltd., Penta Technologies, Inc., Intelex Technologies, and ComplianceQuest are the top players in the global market.

North America is expected to hold the largest market share.

Asia Pacific is expected to grow at a highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us