Liquid Biofuels Market Size, Share & Industry Analysis, By Type (Ethanol and Biodiesel), By Feedstock (Sugar Crops, Starch Crops, Vegetable Oils, Animal Fats, and Others), By Process (Fermentation, Transesterification, and Others), By Application (Transportation, Power Generation, and Heat), and Regional Forecast, 2025–2032

Liquid Biofuels Market Size

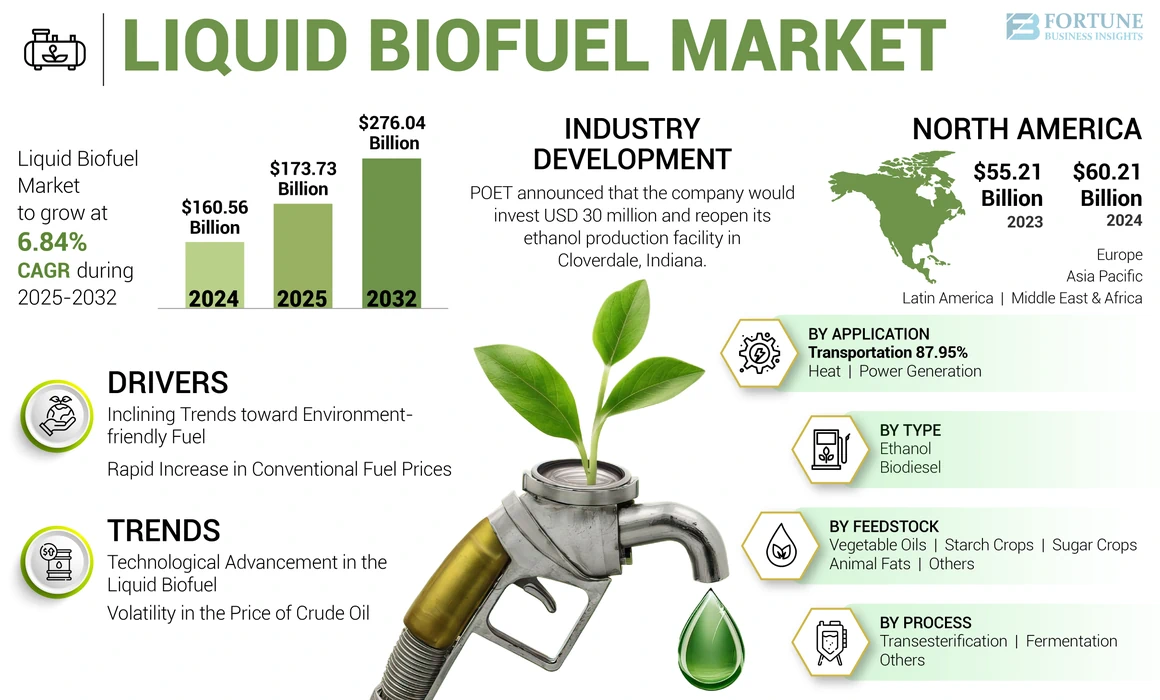

The global liquid biofuel market size was USD 160.56 billion in 2024. The market is projected to grow from USD 173.73 billion in 2025 to USD 276.04 billion by 2032, exhibiting a CAGR of 6.84% during the forecast period. North America dominated the global market with a share of 40.55% in 2024.

Liquid biofuels are fuels derived from organic materials such as plants or waste and can serve as an alternative to fossil fuels in transportation, power generation, and heat. These biofuels are produced using various techniques such as fermentation and transesterification. The most commonly used biofuels include ethanol and biodiesel. Ethanol is typically derived from crops such as corn or sugarcane with high sugar content, while biodiesel is often produced from crops, vegetable oils, and animal fats.

Global Liquid Biofuels Market Overview

Market Size:

- 2024 Value: USD 160.56 billion

- 2025 Estimate: USD 173.73 billion

- 2032 Forecast Value: USD 276.04 billion, with a CAGR of approximately 6.84% from 2025 to 2032

Market Share:

- Regional Leader: North America held approximately 40.55% of the global market in 2024

- Fastest‑Growing Region: Not explicitly specified, but North America is projected to maintain its leading position

- End‑User Leader: The transportation segment is the dominant application area globally

Industry Trends:

- Advancements in consolidated bioprocessing, co-fermentation, hydrothermal liquefaction, and catalytic conversion methods are improving yield and reducing production costs

- Enhanced use of AI and machine learning to optimize biofuel production processes and forecasting

- Growing focus on lignocellulosic and waste biomass feedstocks, including algae and agricultural residues, to diversify raw material sources

Driving Factors:

- Shift toward eco-friendly transportation fuels to reduce CO₂ emissions by substituting gasoline and diesel with ethanol and biodiesel

- Rapid rise in conventional fuel prices, encouraging adoption of cost-effective biofuel alternatives

- Government mandates and blending targets driving large-scale usage, especially in North America and Europe

- Technological innovation in feedstock processing, enabling conversion of diverse biomass into liquid biofuels efficiently

- Mature production ecosystems, with strong infrastructure and major industry players supporting large-scale biofuel production

The unprecedented restrictions on travel, work, and industry due to the COVID-19 pandemic led to the slash of billions of barrels of oil, trillions of cubic meters of gas, and millions of tons of coal from the global energy system in 2020 alone. The production of liquid biofuels is likely to be directly affected by the declining demand for road transport as they are blended with gasoline or diesel under existing blending mandates.

Liquid Biofuels Market Trends

Technological Advancement in the Liquid Biofuel to Drive the Market Growth

Consolidated bioprocessing (CBP) technology enables the simultaneous conversion of various biomass components (sugar, cellulose, and hemicellulose) into biofuels, improving efficiency and yield. Techniques such as co-fermentation and engineered microorganisms are being used to convert diverse feedstocks, including waste biomass and algae, into biofuels. Processes such as gasification and pyrolysis are being optimized to produce valuable biofuels and bioproducts from lignocellulosic biomass.

Hydrothermal liquefaction (HTL) technology is also used in the liquid biofuel market and it converts biomass into bio-oil at moderate temperatures and pressures, potentially offering a cost-effective and versatile approach. Direct catalytic conversion approach directly converts biomass into biofuels using catalysts, bypassing the need for fermentation or thermochemical conversion steps. Artificial intelligence (AI) and machine learning (ML) technologies are being used to optimize biofuel production processes, predict yields, and improve efficiency. Such technological advancements are driving the liquid biofuel market growth.

Volatility in the Price of Crude Oil is One of the Major Market Trends

The prices of crude oil are affected by events that can potentially disrupt the supply of oil and gas. These include geopolitical and weather-related issues. Geopolitical tensions are a major disruptive factor that has created uncertainty about the supply or demand for oil and gas. This can lead to higher volatility in the prices of oil and gas.

The Middle East & North Africa market has a significant presence of oil and gas reserves. It is a highly unstable region due to political and cultural issues. Geopolitical risk and sanctions, U.S. crude inventory draw, speculative positioning by oil producers, and slowing demand growth are some of the factors that have heavily influenced oil prices. For instance, the Russia–Saudi Arabia oil price war, which started in March 2020, resulted in a sheer drop of oil price in April 2020. Such volatility in the prices of oil affects the production of oil and gas. This is expected to propel liquid biofuels consumption in the coming years.

Download Free sample to learn more about this report.

Liquid Biofuels Market Growth Factors

Inclining Trends toward Environment-friendly Fuel to Stimulate Market Growth

The development of advanced manufacturing technologies to produce biofuels along with advanced powertrains has expanded transportation fuel options that will positively impact energy security and the environment while establishing safe, clean, sustainable alternatives to petroleum. Perhaps the important issue neighboring the status of our transportation fuel is that no one knows how long the world’s petroleum resources will last. Adding to our country’s susceptibility, our limited petroleum resources don’t meet the energy needs. Production and utilization of fuels from renewable, domestic biomass resources will help ease our dependence on foreign oil imports while reducing our vulnerability to severe energy disruptions.

The transportation sector greatly contributes to several problems, mainly due to dependence on fossil fuels. Starting from their extraction through their use in automobiles, most steps of the process either are or can be harmful to our environment. Liquid biofuel production and usage for transportation offer substitutions to fossil fuels that can help solve many environmental problems.

Production and usage of biofuels for transportation will help reduce CO2 significantly. By replacing fossil fuels, emissions from fossil fuels can also be avoided, and the CO2 of fossil fuels is permitted to remain in storage. Further cutbacks happen as the plants and trees that assist as feedstocks for biofuels require CO2 to grow, and they absorb what's needed from the atmosphere. Thus, in the foreseeable future, the need to use environment-friendly fuel will contribute to the liquid biofuels market growth.

Rapid Increase in Conventional Fuel Prices to Surge Demand for Liquid Biofuels

Oil refineries are running at their maximum capacity, and with the oil prices soaring, businesses and consumers are looking for alternatives. Biofuels – gasoline and diesel made from various crops are the only non-petroleum energy source ready to use in hundreds of millions of cars and light trucks on the road worldwide.

The rising oil prices have generated new demand for liquid biofuels such as ethanol and biodiesel. But biofuels will play a significant role in replacing petroleum oil in the long run. Exponents of advanced biofuel claim that they are a readily available and best renewable substitute for gasoline and conventional diesel. Biofuel is the only renewable that is a perfect substitute for the liquid fuels that power most combustion engines on the road today.

One of the reasons diesel and gasoline have been difficult to replace is that it's hard to beat them as transportation fuels. They are energy-dense liquids, stable at normal temperature and pressure, and relatively safe to transport and dispense at filling stations. The most significant source of biofuel is ethanol, a liquid distilled from corn or other starchy crops. Over the past five years, demand for ethanol increased as an additive for reformulated gasoline blends to cut air pollution in summer. The government has also expanded tax breaks for small ethanol producers and grants to research new production techniques and loan guarantees to boost ethanol production. These researches will probably present more alternatives to oil and diesel, contributing toward the ongoing growth of biofuels.

RESTRAINING FACTORS

Fluctuation in Raw Material Prices Hampering the Market Growth

The unpredictable raw material prices have a straight negative impact on the overall market's growth. The growing prices of biofuels have caused decreased demands across significant sectors. As a result, these variations will pose a main challenge to the biofuels market growth.

Growing commodity prices have amplified the cost of producing biofuels worldwide. This situation has short-term insinuations for manufacturers, project developers, and policymakers. Higher prices for raw materials of biofuels have overturned the cost reduction drift that the industry has realized for over a decade and may postpone financing some plans already in the pipeline. While increasing input prices have already caused policy changes on biofuels in several countries, demand is wavering now. While vagueness remains regarding how long commodity prices will keep rising, growing material costs on the viability of the renewable energy industry could have long-term insinuations for the cost of clean energy transitions.

Several factors are responsible for this price surge, including increased demand for corn and soybean in China, weather-related impacts, rising shipping costs, and, to some degree, demand for biofuels itself. In response, Argentina, Colombia, Brazil, and Indonesia reduced blending mandates, causing a decline in biofuel demand. However, these effects will likely be temporary if prices decrease in future.

Liquid Biofuels Market Segmentation Analysis

By Type Analysis

Ethanol Segment Held the Large Market Share Due to High Demand for Sustainable Fuel

Based on type, the market is segmented into ethanol and biodiesel. The ethanol segment is projected to lead the liquid biofuels industry. It has been discovered that ethanol can be utilized as a green alternative to fossil fuels and can be blended with gasoline to power vehicles without engine modifications. Therefore, ethanol can be used as a cleaner and more sustainable fuel source, reducing the environmental impact of transportation.

The United States and Brazil are two of the largest ethanol producers globally, accounting for most global ethanol production, representing about 82% of the total. This indicates that these two countries are taking significant steps toward reducing their dependence on fossil fuels and transitioning toward more sustainable energy sources.

By Feedstock Analysis

Extensive Use of Starch Crops as Feedstock to Dominate due to Ease in Availability

Based on feedstock, the market is segmented into sugar crops, starch crops, vegetable oils, animal fats, and others. The use of starch crops as feedstock in the production of biofuel is becoming increasingly popular. Within the biofuel market, the segment of starch crops is projected to be the leading source of feedstock. This is mainly attributed to the fact that corn, the primary feedstock for fuel ethanol production in most countries, is widely available and relatively inexpensive.

In the sugar crops segment, sugar cane and sugar beet are expected to be the primary feedstocks for ethanol production. These crops have high sugar content and can be efficiently converted to ethanol. As a result, they are expected to play a significant role in producing biofuels in the coming years.

By Process Analysis

Fermentation Process to Dominate the Market due to its Advanced Characteristics

Based on process, the market is segmented into fermentation, transesterification, and others. The fermentation segment is projected to lead this market for ethanol production.

Fermentation has been used traditionally for the production of biofuels and is a low-cost and low-capital process, which makes it highly prevalent compared to other methods. This has resulted in the widespread adoption of fermentation in ethanol production. The simplicity and affordability of this process have contributed significantly to the growth of the fermentation segment within the biofuel market.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Rising Adoption of Clean Energy in Transportation Industry will Increase the Demand

Based on application, the market is segmented into transportation, power generation, and heat. The transportation segment is expected to take the lead in the market for alternative fuels, mainly due to the introduction of stringent government regulations on carbon emissions.

According to IRENA's Renewable Energy Roadmap, biofuels, including conventional and advanced forms of ethanol and biodiesel, are expected to account for a 10% share of energy usage in the transportation sector by 2030. This indicates that the transportation segment is expected to grow significantly over the forecast period.

The electricity and heat generation segments are expected to maintain a minimum share during the forecast period. This suggests that biofuels will have a more significant impact on the transportation sector than on other segments. Overall, the shift toward alternative fuels in the transportation sector is a key driving factor for the growth of the biofuel market.

REGIONAL INSIGHTS

North America Liquid Biofuels Market Size, 2024

To get more information on the regional analysis of this market, Download Free sample

The global market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Among all regions, North America holds the largest global liquid biofuels market share and is expected to maintain a steady growth rate. North America is the largest producer and consumer of liquid biofuels. North America has invested heavily in developing biofuel technology and infrastructure, establishing high regional production. This has led to an increased demand for biofuels for the operation. The U.S. is home to several leading companies involved in developing and manufacturing biofuels, driving innovation and growth in the market.

The market is growing in Latin America due to increasing demand for renewable energy sources, rising government initiatives to reduce carbon emissions, and increasing investments in the transmission infrastructure. The government has implemented policies to promote the production and use of biofuels, including tax incentives, mandatory blending requirements, and funding for research and development. These policies have created a supportive environment for the biofuel industry, encouraging investment and innovation. Europe will dominate the market due to expanding industrial infrastructure and increased investment in energy suppliers.

List of Key Companies in Liquid Biofuels Market

Companies Focus on Mergers, Acquisitions, and Partnerships to Gain a Competitive Advantage

Companies in the market are pursuing mergers, acquisitions, and partnerships to enhance their competitiveness and gain an edge over their rivals. By joining forces with other companies or acquiring new technology, resources, or expertise, they aim to improve their products, increase their market share, reduce costs, and accelerate growth. This approach allows companies to expand their reach and capabilities while working together, boosting their overall performance in this market. For instance, In June 2021, POET LLC announced the acquisition of Flint Hills Resources, including six ethanol plants and two terminals.

List of Top Liquid Biofuels Companies:

- ADM (U.S.)

- CropEnergies AG (Germany)

- Bangchak Corporation Public Company Limited (Thailand)

- Enerkem (Canada)

- Renewable Biofuels Inc. (U.S.)

- Chevron Renewable Energy Group. (U.S.)

- POET (U.S.)

- Algenol (U.S.)

- Fulcrum BioEnergy, Inc. (U.S.)

- Emami Agrotech Limited (India)

- Bio-Oils Energy S.A. (Spain)

- Alto Ingredients, Inc. (U.S.)

- Gevo, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- May 2022 - Fulcrum BioEnergy Inc. announced that the Sierra Biofuels plant, the world's first facility to convert landfill waste into renewable transportation fuels, has successfully completed its commissioning and operations phase. They have effectively integrated their feedstock processing facility with operations that transform landfill waste into clean, prepared feedstock.

- May 2022 - POET announced that the company would invest USD 30 million and reopen its ethanol production facility in Cloverdale, Indiana. This investment will improve the efficiency of the plant and will also boost its production capacity.

- April 2022 - Enerkem has revealed its plans to embark on a new initiative in Rotterdam, Netherlands, to manufacture aviation biofuels using sorted urban waste. This process is distinct from the conventional forest biomass method, which is currently undergoing certification for aviation fuel production in U.S., Canada, and European jurisdictions.

- February 2022 - Chevron announced the acquisition of Renewables Energy group, where they have agreed that Chevron will acquire the outstanding shares of REG. This acquisition has combined REG’s growing renewable fuels production and leading feedstock capabilities with Chevron’s commercial marketing position, large manufacturing, and distribution.

- December 2020 - Enerkem proposed a USD 875 million biofuel plant in Varennes, Québec, in partnership with Suncor, Proman, and Shell, with the leadership of the Quebec government and support from the Canadian government.

REPORT COVERAGE

The report provides detailed market analysis and focuses on key aspects such as leading companies, product/service types, and leading product applications. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 6.84% from 2025 to 2032 |

|

Unit |

Value (USD Billion) and Volume (Billion Liters) |

|

Segmentation |

By Type

|

|

By Feedstock

|

|

|

By Process

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per a study by Fortune Business Insights, the market size was USD 160.56 billion in 2024.

The market is likely to grow at a CAGR of 6.84% over the forecast period (2025-2032).

The transportation segment is expected to lead the market due to the development of liquid biofuels globally.

The market size of North America size stood at USD 60.21 billion in 2024.

Inclining trends toward environment-friendly fuel and rapid increase in conventional fuel prices to drive the market growth.

Some of the top players in the market are ADM, Bangchak Corporation Public Company Limited, Renewable Energy Group, Inc., and CropEnergies AG.

The global market size is expected to reach USD 276.04 billion by 2032.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us