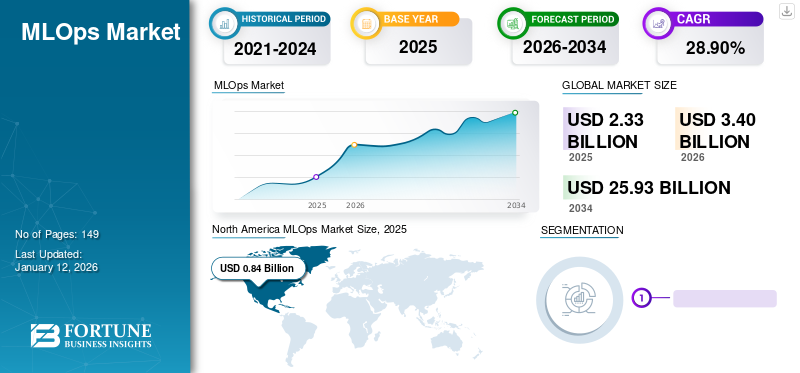

MLOps Market Size, Share & COVID-19 Impact Analysis, By Deployment (Cloud, On-premise, and Hybrid), By Enterprise Type (SMEs and Large Enterprises), By End-user (IT & Telecom, Healthcare, BFSI, Manufacturing, Retail, and Others), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

The global MLOps market size was valued at USD 2.33 billion in 2025. The market is projected to grow from USD 3.4 billion in 2026 to USD 25.93 billion by 2034, exhibiting a CAGR of 28.90% during the forecast period. North America dominated the global mlops market with a share of 36.40% in 2025.

MLOps refers to Machine Learning Operations. It is an essential function of ML engineering, dedicated to simplifying the procedure of taking machine learning models to production and then monitoring and maintaining them. The prominent components of these solutions include model training, model testing and validation, deployment, automated model validation, and continuous delivery and deployment, among others.

Such prominent features and capabilities of these solutions provide engineers, data scientists, DevOps, and others with better scalability, efficiency, and help to minimize risk. Hence, various market players are advancing their solutions to fulfill the users' necessities and demands. For instance,

- In April 2023, ClearML announced the launch of new capabilities for continuous ML for open-source MLOps to satisfy growing demand across global markets. It released a new functionality known as the Sneak Peek application. It allows ClearML enterprise users to deploy an application straight from their development ecosystem.

Download Free sample to learn more about this report.

COVID-19 IMPACT

Change in Data Patterns and Algorithms Amid Pandemic Fueled Market Expansion

The widespread COVID-19 pandemic brought various changes across different industries, shifting everything to online channels and remote working. Due to the enormous changes in economic activities and human behavior resulting from self-isolation, social distancing, lockdown, and other circumstances of the pandemic.

These shifts resulted in continuously changing data patterns, which eventually degraded the predictive capability of machine learning models. They were developed, skilled, and verified on data algorithms that were no longer applicable.

Mechanisms should be in proper form to track and identify errors in an ongoing manner and enable the implementation of predictive models to dynamically changing ecosystems while preserving accuracy. Otherwise, these machine learning models would become outdated and may produce results that are no longer productive or accurate for the enterprises.

Such circumstances and attainment to accomplish efficiency and productivity of machine learning models contributed to the market's growth in demand for such solutions. Various major players also introduced new features and solutions for their customers and delivered better customer experiences. For instance,

- In November 2020, Iguazio and AWS collaborated to offer businesses the advantages of developing on SageMaker and installing AI efficiently, quickly, and seamlessly with the help of Iguazio's machine learning operations platform as a completely integrated solution.

Thus, enormous changes in economic activities, human behavior, and data patterns contributed to the increased demand for these solutions during the pandemic.

MLOps Market Trends

Implementation of AutoML within MLOps Models to Upsurge Market Growth

Automating the entire machine learning pipeline, from data handling to installations, democratized ML makes it accessible to users with less expertise. AutoMl offers several simple and available solutions that don’t involve pre-defined machine learning expertise.

With ML automating most of the data labeling procedure, the probabilities of human error are considerably minimized. It reduces personnel expenses, permitting enterprises to focus more on data analysis.

AutoML attempts to simplify the whole procedure by automating some manually exhaustive steps in training an ML model, which include feature selection, model selection, model tuning, and model evaluation. Various cloud platforms, such as Amazon Sagemaker, Data Robot AI platform, and Microsoft Power BI, provide their exclusive AutoML solutions. For instance,

- In November 2022, Amazon announced the launch of Sagemaker Autopilot straight from within Amazon SageMaker pipelines to mechanize MLOps industry effortlessly. It enables the mechanization of an end-to-end process of developing machine learning models using Autopilot and incorporating models into consequent CI/CD steps.

The advantages of combining AutoML with machine learning operations help enterprises create superior ML models more efficiently, at lower costs, and address the skillset gap.

Such factors propel the implementation of AutoML across such solutions, thereby augmenting the MLOps market growth.

MLOps Market Growth Opportunities

Rising Need to Improve Machine Learning Model Performance to Drive Market Growth

The continuous progression of machine learning mechanisms, mainstreaming of ML-driven solutions, and large-scale production rollouts are gaining momentum swiftly. Various reasons that affect the performance of machine learning models include the experimental and manual testing nature of ML, manual tracking of data dependency, the complexity of models, and hidden ML mechanical debt increase. Such factors affect the efficiency of ML models, which the ML model lacks in executing ML projects. For instance,

- According to industry experts, only 47% of business AI/ML models go into the production stage due to a lack of various machine learning model capabilities.

- As per a survey by Algorithmia, the most frequently cited reason for model failure is data drift, which occurs when the data used in training the model no longer accurately reflects real-world data. It was observed that 60% of data experts spend at least 20% of their time on model maintenance.

Hence, enterprises and data professionals are moving toward these solutions for better efficiency and ensuring that these models operate optimally. For instance,

- According to data specialists across industries, 97% of users who have implemented machine learning operations have observed a significant improvement and better results with greater automation, enhanced robustness, better productivity, and others.

Such factors and the necessity to have enhanced performance drive the growth of these solutions in the market.

RESTRAINING FACTORS

Lack of Ability to Provide Security in MLOps Environment to Impede Market Growth

Machine learning regularly functions on sensitive projects with very critical data. Hence, ensuring that the ecosystem is safe is crucial for the long-term achievement of the project. For instance,

- According to the artificial intelligence (AI) Adoption report of IBM, approximately one in five firms state difficulties in safeguarding data security. Hence, a growing number of data professionals are addressing it as one of the crucial problems.

Often, users are unaware that they have numerous vulnerabilities that signify an opportunity for mischievous attacks. Also, processing out-of-date libraries is the most common issue faced by enterprises.

Moreover, the security downside is associated with the model endpoints and data pipelines not being appropriately secured. These potentially expose publicly accessible, crucial data to third parties that can impact the data security in MLOps environment.

Thus, maintaining security for the machine learning operations environment can be a restraining factor. It can hamper the efficiency and productivity of machine-learning models, impacting enterprises' business.

MLOps Market Segmentation Analysis

By Deployment Analysis

Combined Features of Cloud and On-premise Architecture to Drive Hybrid Segment Growth

Based on deployment, the market is categorized into cloud, on-premise, and hybrid.

The hybrid segment is expected to dominate the market with a leading CAGR during the forecasted period. The concerns over security, cost, and guidelines induce most firms to adopt architecture approaches that include cloud and on-premises data centers. Hence, market players are strategically investing in advancing hybrid solutions. For instance,

- In June 2022, Domino Data Lab introduced a Hybrid MLOps architecture that would future-proof model-powered businesses at scale. It permits enterprises to quickly control, scale, and orchestrate data science work over several computing clusters in various geographic regions, on-premises, and even over multiple clouds.

The cloud segment accounted for the highest MLOps market witha share of 54.89% in 2026. The flexibility and scalability of cloud-based deployment make them the ideal choice for professionals. A multi-cloud deployment aids as a robust foundation for ML business operations. It is owing to its built-in elasticity and the accessibility of low-cost storage, as well as its value as a development environment.

By Enterprise Type Analysis

Easy Availability of Open-source Solutions to Increase the Adoption of MLOps Technology among SMEs

By enterprise type, the market is bifurcated into SMEs and large enterprises.

The SMEs segment is predicted to grow with the highest CAGR during the forecast period owing to the use of machine learning operations among SMEs. Also, various open-source machine learning operations solutions are available and are easily accessible for SMEs, which would contribute toward their market share. Various open-source solutions include Mlflow, Deepchecks, ZenML, Metaflow, and Seldon Core.

The large enterprises segment held the highest market share contributing 54.89% globally in 2026. As large enterprises need to deal with greater volumes of data, the adoption of such solutions among these types of enterprises is higher. It offers large enterprises in-depth analysis and corrections in larger machine-learning model projects. Also, it helps to optimize production development with democratization and better decision-making on a larger scale.

By End-user Analysis

To know how our report can help streamline your business, Speak to Analyst

Higher Implementation of Machine Learning Operations in the Healthcare Sector to Augment the Market Development

By end-user, the market is classified into IT & telecom, healthcare, BFSI, manufacturing, retail, and others (advertising, transportation).

The healthcare segment is leading with the highest CAGR due to implementing machine learning operations in the healthcare sector. As these solutions help streamline various healthcare functions such as drug discovery procedures, aid in the analysis of patients’ treatment reports, personalize the medical care for patients and many more, the usage of these solutions in healthcare is on the rise.

- In November 2023, Philips accelerated deploying AI-driven solutions with the MLOps platform developed on Amazon SageMaker. Philips uses artificial intelligence in several domains, such as diagnostics, imaging, personal health, therapy, and connected care.

The IT & telecom segment accounted for the highest market share in 2022. These solutions help IT professionals improve effectiveness and efficiency by leveraging ML-powered insights. It helps monitor and manage IT architecture while optimizing operations and resource allocations. In the telecom sector, these solutions are used to expand network operations and minimize downtime. The automation allows telecom providers to maintain and deploy ML models easily and quickly identify and resolve service disruptions and network issues.

REGIONAL INSIGHTS

Geographically, the market is studied across North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

North America

North America MLOps Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America held the highest market with a size of 0.84 in 2025. The region accounts for the maximum technological machine learning advancements across various sectors, such as banking, retail, automotive, healthcare, and many more. Also, various pharma and P&C insurance players invest in ML technologies for business innovation. For instance,

- According to industry experts, the banking sector in the U.S. has been an early adopter of machine learning technologies. For example, nine of the top ten banks in the U.S. have selected roles allocated to establish and implement machine learning operations.

Such new business innovations and technological investments are contributing toward the development of market growth in the region. The U.S. market is projected to reach USD 0.71 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

As per Fortune Business Insights, Asia Pacific is estimated to grow with a leading CAGR during the forecast period. Growing investments and deeper adoption of AI, machine learning, and big data have opened up lucrative market opportunities in the region. The growth of ML in South Korea's digital health sector, AI and machine learning implementation in Japan, and rising AI/ML investments in India have contributed toward the region’s market growth. The Japan market is projected to reach USD 0.22 billion by 2026, the China market is projected to reach USD 0.21 billion by 2026, and the India market is projected to reach USD 0.14 billion by 2026.For instance,

- In December 2021, NxtGen, a data center and cloud technologies provider, announced the launch of MLOps as a service offering in collaboration with Katonic.ai. The company aims to offer this platform to data science professionals and data engineers at zero cost and aid in the broader adoption of data science and data analytics practice in India.

Europe

Machine learning operation solutions are promptly gaining revenue shares in European countries, with numerous new initiatives and opportunities to support their development and implementation. The top-level research institutes in Germany offer ample opportunities for data engineers and scientists. Also, the AI/ML spending across various European countries, including France, Germany, Spain, Italy, and the U.K., is driving the market growth in the region.The UK market is projected to reach USD 0.22 billion by 2026, while the Germany market is projected to reach USD 0.24 billion by 2026. The rising number of startups also adds to the demand for machine learning operations solutions in the region. For instance,

- In October 2023, ZenML secured funding of USD 7.3 million to streamline machine learning operations in Germany. The funding comes as strong support and traction for the open-source machine learning operations platform ZenML, which proposes simplifying the procedure of constructing, deploying, and handling ML models.

Middle East & Africa and South America

Numerous factors, such as the entry of machine learning players and the growing implementation of AI/ML technologies across different industries, such as healthcare, banking, retail, and others, in the Middle East & Africa and South America, led to the growth of the market share in the region. Moreover, the technological spending and startup funding on machine learning, artificial intelligence, and many more in these regions contribute to the market progress.

List of Key Companies in MLOps Market

Growing Investments and Collaborations Globally Strengthen Key Players’ Business Position in the Market

The key players are keen on incorporating new ML model technologies across healthcare, BFSI, IT and telecom sectors, and many others. Innovating new solutions with intentive mechanisms to serve numerous large enterprises and SMEs is one of the key strategies key players adopt. Moreover, market key players strategically form partnerships with new product launches and invest in several startups for business expansion globally.

List of Key Companies Profiled:

- DataRobot, Inc. (U.S.)

- Domino Data Lab, Inc. (U.S.)

- Amazon Web Services, Inc. (U.S.)

- Microsoft (U.S.)

- IBM Corp (U.S.)

- Hewlett Packard Enterprise Development LP (U.S.)

- Allegro AI. (ClearML) (Israel)

- Mlflow (U.S.)

- Google (U.S.)

- Cloudera, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- November 2023: DataRobot announced a new alliance with Cisco and introduced MLOps solution for the Cisco FSO (Full-Stack Observability) platform developed with partner Evolutio. The new solution delivers business-grade observability for generative Al and predictive AI, aids in optimizing and scaling deployments, and enhances business value for customers.

- April 2023: MLflow introduced MLflow 2.3, the upgrade to the open-source ML platform with new features and LLMOps support. It is combined with inventive features that expand its capability to deploy and manage large language models (LLM) and incorporate LLMs into the remaining ML operations.

- March 2023: Striveworks partnered with Microsoft to provide the Chariot MLOps platform in the public segment. With the integration, organizations can use this platform of Strivework, Chariot, to accomplish their complete model lifecycle on the scalable infrastructure of Azure.

- January 2023: Domino Data Lab enhanced its partner program with advanced offerings to propel data science innovation. Partner momentum increases with new training, accreditations, and authorized ecosystem assimilations to provide partners with prolonged machine learning operations capabilities and knowledge.

- November 2022: ClearML, in collaboration with Aporia, announced the launch of a full-stack MLOps platform to automate and orchestrate machine learning workflows at scale and to aid ML and data engineers and DevOps teams in perfecting their ML pipelines. With the alliance, DevOps teams and data scientists can use the collective power of Aporia and ClearML to considerably curtail their time-to-revenue and time-to-value by making sure that ML projects are finished successfully.

REPORT COVERAGE

The market report provides a wide-ranging analysis of the market and highlights important characteristics such as leading vendors, product lines, and evolving new solution applications. Furthermore, it provides insights into the latest market advancements and delivers insights on crucial industry expansions. In addition to the aspects stated above, the report combines numerous dynamics that have contributed to the market development in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 28.90% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Deployment

By Enterprise Type

By End-user

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 25.93 billion by 2034.

In 2025, the market was valued at USD 2.33 billion.

The market is projected to grow at a CAGR of 28.90% during the forecast period.

Based on end-user, the IT & Telecom segment captured the highest share in terms of revenue in 2024.

Rising need to improve machine learning model performance is anticipated to drive market growth.

Microsoft, AWS, DataRobot, Inc., IBM, and Domino Data Lab, Inc., among others, are the top players in the market.

North America dominated the global mlops market with a share of 36.40% in 2025.

By deployment, the hybrid segment is expected to grow with a leading CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us