Rayon Fibers Market Size, Share & Industry Analysis, By Product Type (Viscose, Modal, Lyocell, and Others), By Application (Apparel, Home Textiles, Healthcare & Hygiene, and Others) and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

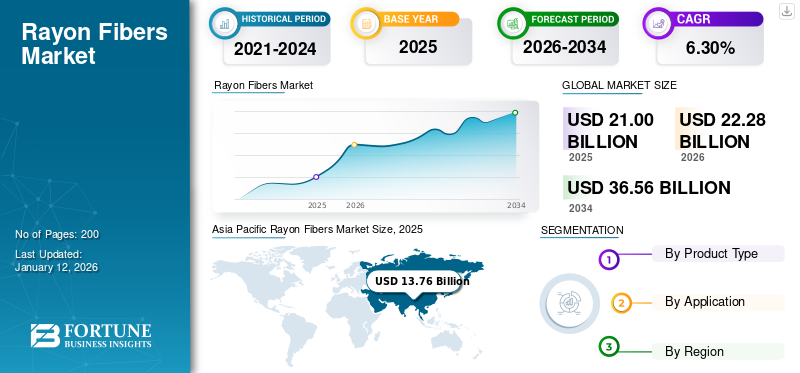

The global rayon fibers market size was valued at USD 21 billion in 2025 and is expected to grow from USD 22.28 billion in 2026 to USD 36.56 billion by 2034 at a CAGR of 6.30% during the forecast period. Asia Pacific dominated the rayon fibers market with a market share of 66% in 2025.

Rayon fiber is a manmade cellulosic fiber that is derived from wood pulp or cellulose of trees, making it a sustainable fiber compared to other types. As it is plant-based in nature, it is a renewable and climate-friendly material, making it an ideal fiber in the textile industry. It is considered to be the first manmade semi-synthetic fiber. The product is also known as artificial silk due to its similarities with silk in texture and appearance. Its exceptional softness, breathability, and draping qualities make it a perfect alternative to cotton, silk, and linen. In addition, the product has various unique properties, such as super absorbency and excellent color retention, which are why it is utilized in many applications, including personal clothing, household textiles, and personal hygiene products. Moreover, super-absorbent products are an excellent choice for summer fabric, and their high absorbency applies equally to dyes, offering deep and rich colors. It can also be blended with other fibers, such as cotton, spandex, and polyester fibers, to create application-specific desired fibers. Furthermore, its several advantages and versatile nature is expected to drive market growth during the forecast period.

GLOBAL RAYON FIBERS MARKET OVERVIEW

Market Size & Forecast:

- 2025 Market Size: USD 21 billion

- 2026 Market Size: USD 22.28 billion

- 2034 Forecast Market Size: USD 36.56 billion

- CAGR: 6.30% from 2026–2034

Market Share:

- Asia Pacific dominated the market in 2025 with a 66% share, growing from USD 13.76 billion in 2025 to USD 14.65 billion in 2026.

- By product type, viscose rayon led due to its silk-like texture and wide textile applications.

- Lyocell is projected to be the fastest-growing segment, driven by sustainable production methods.

- By application, apparel held the largest share with 32.76% in 2026, driven by demand for soft, breathable fabrics.

- Rayon’s high absorbency and blendability make it popular across personal clothing, home textiles, and hygiene products.

Key Country Highlights:

- China: Apparel segment is estimated to account for 10.81% of the market in 2026.

- India & Southeast Asia: Major manufacturing and export hubs, boosting regional consumption.

- Europe: Demand rising for eco-friendly fibers; moderate growth expected.

- United States: Fast fashion trends support rayon usage, particularly in loungewear.

- Middle East & Africa / Latin America: Growth driven by expansion in home textiles and healthcare sectors.

COVID-19 IMPACT

Hampered Textile Material Consumption amid Lockdown Measures Decreased the Demand for the Product

The outbreak of COVID-19 forced almost every government to impose lockdowns to limit its impact on large populations. Amid the lockdown, business activities were halted, resulting in lower industrial production. The outbreak also created various short-term and long-term impacts on the rayon fiber industry. The suspension of viscose production and lower demand from end-users decreased sales of the textile materials in the market. Major consumer industries, such as textile, were among the most affected industries during the lockdown measures. Nearly three-fourths of the worldwide textile companies reported a negative impact on their sales, resulting in low demand for these fibers. Furthermore, rayon fiber manufacturing companies also experienced low sales in 2020 by 10 to 20 % compared to 2019. However, post ease of lockdowns, demand rose rapidly, generating huge sales for companies operating in the market.

Rayon Fibers Market Trends

Momentum toward Tree-free and Environment-Friendly Fibers to Propel Market Growth

Rayon fibers are generally considered environment friendly due to their plant-based nature; however, deforestation and carbon-intensive production processes reduce its sustainability. In response, companies have shifted their focus to more sustainable production processes and other alternatives to align themselves with the green trend. Companies such as Grasim and Lenzing AG have invested to improve their production process and reduce their carbon footprint. For instance, in 2021, Lenzing launched carbon-neutral lyocell and modal fibers under the TENCEL and Veocel brands for textile and nonwoven applications. In order to leverage the massive potential of this market to solve sustainability issues, new companies have entered the market. For instance, in an investor presentation published in April 2021, Nanollose Company mentioned that it is developing a scalable revolutionary technology to create tree-free fibers and fabrics. This technology addresses major issues attached to traditional rayon fiber production, such as deforestation, the use of harsh chemicals, and high consumption of energy during the production process. Efforts mentioned above made by companies are expected to shape the market in the future. Asia Pacific witnessed a rayon fibers market growth from USD 12.20 billion in 2023 to USD 12.95 billion in 2024.

Download Free sample to learn more about this report.

Rayon Fibers Market Growth Factors

Growth in Textile Industry to Drive Market Growth

The global textile industry is growing due to the increasing demand for apparel, home textile, and industrial nonwoven applications, leading to increased demand for various fibers, including rayon. Continuous research and development are focused on enhancing the properties of rayon fibers, such as increasing their strength and overall performance to meet the diverse needs of different markets. In addition, changes in consumer behavior, especially post-pandemic, are influencing the demand for specific types of clothing, such as loungewear and comfortable yet stylish attire. These fibers are exceptionally soft and thus provide super comfort, meeting the growing demand for active and breathable wear. Moreover, the global textile market is projected to grow at a CAGR of 3% during the forecast period, creating a progressive environment for the market. In addition, the product is an ideal ingredient in the production of personal wipes. Thus, the growing demand from a wide range of applications is expected to drive the consumption of rayon fibers over the assessment period.

RESTRAINING FACTORS

Negative Impacts Associated With Rayon Fibers Production May Limit Market Growth

Rayon fibers are made from renewable raw materials, so they are biodegradable and environmentally friendly. However, the manufacturing process does have a negative impact on the environment, which is mainly due to its raw material. Its raw material, wood cellulose, is obtained by cutting down trees, causing deforestation, which is a major environmental problem. In addition, its production requires large amounts of water, depleting one of our natural resources. Apart from this, harmful chemicals such as hydrogen sulfide can be found in exhaust gases around production facilities. In terms of environmental friendliness, it is superior to synthetic fibers and not to pure natural fibers. These negative points associated with this type of fiber production have raised concerns about its usage. In addition, the product faces stiff competition with synthetic fibers such as polyester, which are cheaper and often more durable, and natural fibers including cotton, linen, and silk. Its high dependency on wood for raw materials and its chemical-dependent manufacturing process may further create various challenges for the market growth.

Rayon Fibers Market Segmentation Analysis

By Product Type Analysis

Viscose Rayon to Lead the Market Owing to its Ability to Mimic Feel and Appearance of Silk

Based on product type, the market segmentation includes viscose, modal, lyocell, and others.

Viscose is extensively utilized in the textile and apparel industry making it the largest product type in the global market share of 71.81% in 2026. It is known for its softness, breathability, and excellent drape. Moreover, viscose fabrics are used in clothing such as shirts, dresses, skirts, and blouses. Its ability to mimic the feel and appearance of natural fibers such as cotton and silk makes it a popular choice for both casual and formal wear. It is also used in curtains, draperies, upholstery, bed linens, and decorative textiles.

The lyocell segment is projected to expand at the fastest growing rate over other segments during the forecast period, owing to its most sustainable production process.

Modal fibers are blended with other fibers such as cotton, polyester, and spandex to create fabrics for various clothing items such as lingerie, loungewear, dresses, and others.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Apparel Industry to Account for the Largest Share of the Global Rayon Fibers Market

Based on application, the market is segregated into apparel, home textiles, healthcare & hygiene, and others.

Rayon fibers find extensive applications in the apparel segment due to their versatility and various desirable qualities. The soft and comfortable feel of rayon makes it an ideal material for nightwear, undergarments, and hosiery. It provides a luxurious feel against the skin, making it a preferred choice for apparel, thus accounting for the major global rayon fibers market share.

- The apparel segment is expected to hold a 32.76% share in 2026.

The product also finds applications in home textiles for various purposes, such as for making bed sheets, pillowcases, duvet covers, and blankets. Moreover, rayon drapes and sheen make it a choice of material for curtains and drapes. The fabric changes elegantly and can be blended with other materials to achieve different aesthetics, offering various options for interior decor.

REGIONAL INSIGHTS

By region, the market is divided into Europe, the Asia Pacific, North America, the Middle East & Africa, and Latin America.

Asia Pacific Rayon Fibers Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

The market size in Asia Pacific stood at USD 13.76 billion in 2025. The region is a hub for the textile sector, with China, India, Indonesia, and Vietnam being major textile manufacturing and exporting centers. As a result, the region is the world's largest textile producer, accounting for over half of the global production in 2024. Rayon fiber is primarily utilized in the textile industry, which has driven its demand in this region during the historical period and also makes this region the largest consumer in the market. The Japan market is valued at USD 0.46 billion by 2026, the China market is valued at USD 10.81 billion by 2026, and the India market is valued at USD 1.8 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Europe

Europe is projected to grow moderately over the forecast period. The region is witnessing a rising demand for sustainable and eco-friendly materials. Rayon, primarily when produced using environmentally friendly methods, aligns with this trend, attracting consumers looking for sustainable textiles. The UK market is valued at USD 0.55 billion by 2026, while the Germany market is valued at USD 0.87 billion by 2026.

The U.S. market is valued at USD 2.13 billion by 2026.

Moreover, the trend of fast fashion in the North America region is poised to bolster the product's demand during the forecast period.

Latin America and Middle East & Africa

Latin America and the Middle East & Africa markets are projected to grow moderately during the assessment period. Substantial growth in industries such as home textiles and healthcare is poised to drive the product demand in these regions.

KEY INDUSTRY PLAYERS

Rapid Capacity Expansion to Become the Key Strategy to Cater to the Growing Demand for Sustainable Products

Nanollose, Lenzing AG, Grasim Industries Limited, Sateri, Asia Pacific Rayon Limited, and Zhejiang Fulida Holding Co., Ltd. are identified as major companies in the study of the market. Market leaders such as Lenzing AG and Grasim have invested in exploring new sustainable production methods to tap the growing opportunities in the go-green market trend. In addition, companies are investing in recycling plants to meet the increasing demand for sustainable products in home textile and apparel applications.

List of Top Rayon Fibers Companies:

- Asia Pacific Rayon Limited (Indonesia)

- Eastman Chemical Company (U.S.)

- Goonvean Fibres Ltd (U.K.)

- Grasim Industries Limited (India)

- Kelheim Fibres GmbH (Germany)

- Lenzing AG (Austria)

- Nanollose (Australia)

- Sateri (China)

- Zhejiang Fulida Holding Co., Ltd. (China)

- Zhong Tai International Development (HK) Limited (China)

KEY INDUSTRY DEVELOPMENTS:

- September 2023: Lenzing Group announced the plans to expand its production capacity for its Lenzing Ecovero and nonwoven Veocel textile brands in Asia Pacific.

- November 2021: Asia Pacific Rayon Limited launched its ten-year sustainability vision, APR2032. Under this vision, the company will produce rayon fibers with 20% recycled textile content and plans to achieve net zero emissions from land use through vertical integration.

- August 2021: Lenzing AG planned to invest more than USD 200 million in its existing production sites in Indonesia and China to improve its traditional production capacity into sustainable specialty fibers.

- July 2021: Sateri launched three zero-carbon fiber products named EcoCosy, Lyocell, and FINEX. All these products are carbon-neutral certified and accelerated Sateri’s journey into the green trend.

- January 2021: Nanollose and Grasim Industries Limited (Grasim) filed a joint patent application for a Tree-Free lyocell fiber made from Microbial Cellulose.

REPORT COVERAGE

The research report provides a detailed market analysis and focuses on crucial aspects such as leading companies, product types, and applications. In addition, it provides quantitative data regarding volume and value, market analysis, research methodology for market data, and insights into market trends and highlights vital industry developments and competitive landscape. In addition to the above-mentioned factors, the report encompasses various factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) and Volume (Kilotons) |

|

Growth Rate |

CAGR of 6.3% during 2025-2032 |

|

Segmentation |

By Product Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 22.28 billion in 2026 and is projected to reach USD 36.56 billion by 2034.

By application, in 2026 the apparel segment is expected to lead the market.

The increasing demand for the product in the textile industry is poised to fuel the market growth.

China held the largest share of the market in 2026.

Lenzing AG, Grasim Industries Limited, and Sateri are among the top players in the market.

The increasing demand for personal wipes may create remunerative opportunities for players operating in the market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us