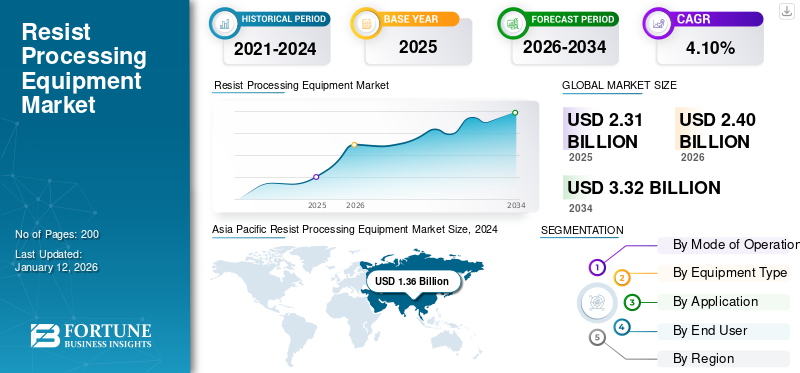

Resist Processing Equipment Market Size, Share & Industry Analysis, By Mode of Operation (Manual and Automatic), By Equipment Type (Photoresist Coating Equipment, Photoresist Developer/Printer, Photoresist Steppers, and Others), By Application (Micro Electromechanical System, Printed Circuit Board, and Others), By End User (Semiconductor and Microelectronics, Photonics, Nanotechnology, and Others), and Regional Forecast, 2026-2034

Resist Processing Equipment Market Size

The global resist processing equipment market size was valued at USD 2.31 billion in 2025. The market is projected to grow from USD 2.40 billion in 2026 to USD 3.32 billion by 2034, exhibiting a CAGR of 4.10% during the forecast period. Asia Pacific dominated the global market with a share of 61.40% in 2025.

Resist processing equipment is a part of semiconductor fabrication equipment. It is used for printing or drawing a circuit design onto semiconductor chips and semicon wafers. In addition, this machinery is used in the application and development of photoresist materials during the photolithography process. It is designed to improve the efficiency and consistency in resist processing.

The increasing demand for advanced electronic devices, such as smartphones, tablets, IoT devices, and high-performance computing systems, drives the need for more advanced semiconductor manufacturing processes. This, in turn, fuels the demand for advanced systems. Moreover, the rising adoption of consumer electronics and the boom in the 5G sector, which subsequently creates the demand for this equipment. For instance, according to the GSM Association, 5G network is expected to cover one-third of the global population, with 1.2 billion connections by 2025. All such factors drive the global resist processing equipment market growth.

Global Resist Processing Equipment Market Overview

Market Size:

- 2025 Value: USD 2.31 billion

- 2026 Value: USD 2.40 billion

- 2034 Forecast Value: USD 3.32 billion

- CAGR: 4.10% (2026–2034)

Market Share:

- Regional Leader: Asia Pacific dominated the market with a share of 61.40% in 2025, driven by semiconductor manufacturing hubs and consumer electronics demand.

- Product-Type Leader: Photoresist coating equipment led in 2024 based on revenue share and is forecast to continue growing most rapidly.

- Application Leader: Micro Electromechanical Systems (MEMS) captured the largest share in 2024 due to their rising usage in consumer and industrial electronics.

- End-User Leader: The semiconductor and microelectronics segment led in 2024, driven by expansion in consumer electronics, IoT, and 5G sectors.

Industry Trends:

- Increasing innovation in resist processing systems—such as automation, Industry 4.0 integration, and AI/IoT—for enhanced throughput, precision, and scalability.

- Focus on high-efficiency, high-throughput equipment optimally aligned with growing demand for small-format semiconductor chips.

Driving Factors:

- Rising global demand from semiconductor and consumer electronics industries, including IoT, 5G devices, and wearable tech.

- Increased use of resist processing in MEMS, PCBs, and photonics for emerging high-density electronics applications.

- Growing need for photoresist cleaning and development equipment to reduce defects and enhance fabrication throughput.

The semiconductor industry relies heavily on global supply chains for raw materials, components, and equipment. The pandemic of COVID-19 led to disruptions in the supply chain, causing delays in the production and delivery of resist processing equipment. This impacted the overall demand for such equipment as semiconductor manufacturers scaled back their operations.

However, major industries such as automotive, electronics, and data centre applications registered a decline in net sales due to halted activities in manufacturing and supply chain bottlenecks, which restricted the market growth. Moreover, key players registered a drop in the net sales of revenue in 2020 as compared to 2019. For instance, the net sales of Tokyo Electron Limited dropped by 9.3% in 2020 as compared to 2019. In addition, some of the key players registered a rise in the net sales of revenue during the same period. For instance, the net sales of SUSS Micro Tec SE increased by 18% in 2020 as compared to 20219. Furthermore, the pandemic accelerated the adoption of certain technologies, such as 5G, cloud computing, and IoT, which have implications for semiconductor manufacturing and are projected to drive the market growth for long termc.

Resist Processing Equipment Market Trends

Technological Advancements in the Equipment to Propel the Market Growth

Key manufacturers operating in the market are introducing products with technological advancements such as 3D integration, integration of Industry 4.0, quantum computing, 5G technology, and artificial intelligence (AI) based systems in resist processing equipment. For instance, in November 2022, EV Group, based in Austria, which deals with semiconductor manufacturing equipment and related machinery, launched a new EVG150 automated resist processing system for coating and photolithography applications. This machine is specially designed for performing coating and printing circuit design on semiconductor chips. This machine is enabled with technologies such as AI, IoT, and Industry 4.0 systems. This system has features such as versatility, a high throughput capacity of 80%, and robustness. All these factors represent the market trends.

Download Free sample to learn more about this report.

Resist Processing Equipment Market Growth Factors

Rising Demand from Consumer Electronics to Bolster the Market Growth

The increasing demand for advanced electronic devices, such as smartphones, tablets, consumer electronics, IoT devices, and high-performance computing systems, fuels the need for advanced semiconductor manufacturing processes and, consequently, the product. The growing integration of the Internet of Things (IoT) and artificial intelligence (AI) in home appliances and wearable devices and the emergence of connected home appliances are proliferating the global market growth. In addition, the rising trend of adoption of silicon semiconductor wafers in 5G devices, telecom, and the automotive sector across the U.S., China, and others fuels the growth of the market.

RESTRAINING FACTORS

High Cost Associated With the Equipment May Restrain the Market Growth

Resist processing equipment is relatively expensive and requires huge capital investment. In addition, fluctuating prices of machines are projected to hamper the market growth. In addition, several key players face certain difficulties while purchasing the raw materials required for machines. The cost of resist processing equipment in the semiconductor industry can also vary widely depending on the type of equipment, its capabilities, and the specifications required for a particular manufacturing process. For instance, the cost of such equipment ranges from USD 0.5 million to 2 million. Such factors are anticipated to restraint the market growth.

Resist Processing Equipment Market Segmentation Analysis

By Mode of Operation Analysis

Automated Segment Dominated the Market Due to Its Higher Throughput Capacity

Based on mode of operation, the market is categorized into automated and manual.

Based on the analysis, the automated segment dominated the market in terms of revenue share in 2024 and is expanding at the highest growth rate. Automated products offer high precision and maintain consistency in various applications. This is crucial in industries such as semiconductor manufacturing, where precise and repeatable processes are essential for quality. In addition, these systems have a higher throughput capacity than manual systems.

The manual segment is projected to witness moderate growth during the forecast period. Manual systems offer greater flexibility, allowing operators to adapt quickly to changes in the production process. This can be advantageous in industries with diverse or customized production requirements. In addition, these systems are less expensive than automated products. They are a more accessible option for smaller businesses as well as medium-scale businesses. All such factors drive the manual segment growth.

By Equipment Type Analysis

Photoresist Coating Equipment Segment Dominated Owing to Surging Demand in Small Semiconductor Chips

Based on equipment type, the market is classified into photoresist coating equipment, photoresist developer/printer, photoresist steppers, and others.

As per the analysis, the photoresist coating equipment segment dominated the market in terms of revenue share in 2024. The same segment is also expected to grow at a significant growth rate during the forecast period from 2025 – 2032. This is owing to the growing demand for such machines for small and medium semiconductor chips.

The photoresist developer/printer and photoresist steppers segments are growing moderately owing to rising innovation in lithography and photoresist development technologies, which drives the demand for more advanced and precise developer devices. Along with this, growth in the semiconductor industry, which in turn, is rising the demand for such equipment for fabrication purpose, fuels the segment growth.

Others segment includes cleaning equipment. The rising demand for cleaning equipment for tools and wafers to prevent defects in the semiconductor chips is driving the growth of the others segment.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Micro Electromechanical System Segment Captured the Largest Revenue Share Owing to Increasing Usage of Resist Processing Technology

Based on application, the market is segmented into micro electromechanical system, printed circuit board, and others.

As per the analysis, the micro electromechanical system segment dominated in terms of market revenue share in 2024. The same segment is also expected to grow at a significant growth rate during the forecast period from 2025 to 2032. This is owing to the rising adoption of such equipment in the fabrication of MEMS systems. This equipment is used to deposit the photoresist, and then the mask is placed over the coated substrate. In addition, there is a increasing demand for consumer electronics, IoT devices, and 5G devices, which enhances the demand for resist processing technology for printing photomasks on semicon chips.

Moreover, growing adoption of such equipment for performing mask aligners and photo masking on printing circuit boards, semiconductor chips, and consumer electronics device, fuels the market growth. The above mentioned factors drive the micro electromechanical system market growth.

By End User Analysis

Semiconductor and Microelectronics Segment Led in 2024 Due to Growing Product Demand in Consumer Electronics

Based on end user, the market is classified into semiconductor and microelectronics, photonics, nanotechnology, and others.

As per the estimates, the semiconductor and microelectronics segment dominated in terms of market revenue share in 2024. The same segment is projected to witness a substantial growth rate during the forecast period. The equipment is largely used in semiconductor fabrication for the production of integrated circuits (ICs), microprocessors, memory devices, and other semiconductor components. This factor is driving the semiconductor and microelectronics segment expansion.

The photonics and nanotechnology segments are growing moderately due to the rising usage of equipment for the fabrication of photonic devices, nanoscale structures, nanodevices, and integrated circuits that are used in consumer electronics, automotive, and healthcare devices.

The others segment includes optoelectronics and lithographic. The equipment is used to fabricate devices for photodetectors, liquid crystal displays (LCD), light emitting diodes (LED), and flat panel displays.

REGIONAL INSIGHTS

The market report provides an in-depth scope and deep-dive analysis of five main regions: North America, Europe, the Asia Pacific, the Middle East & Africa, and South America.

Asia Pacific Resist Processing Equipment Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific dominated the resist processing equipment in 2024 and is expected to maintain its dominance during the forecast period. It is owing to a strong supply chain of integrated circuits, semiconductor chips, logic circuits, and discrete devices in countries such as China, Taiwan, South Korea, and others. Increasing demand for semiconductor devices in industries such as consumer electronics, electric vehicles, and advanced medical devices, which subsequently creates the demand for such equipment for fabrication applications, which accelerates the resist processing equipment market share in Asia Pacific region.

China to Dominate the Market Owing to Growth in Semiconductor Industry

China is a major manufacturing hub for electronic devices, including smartphones, consumer electronics, and other electronic components. The production of these devices often involves the use of resist processing equipment for PCB manufacturing and semiconductor fabrication. The rising demand from consumer electronics, IoT devices, and the 5G industry, which creates the demand for such equipment for fabrication applications, is driving the market growth.

To know how our report can help streamline your business, Speak to Analyst

North America is potentially expected to grow during the forecast period owing to the strong presence of key players such as Lam Research Corporation and KLA Corporation in the U.S., Canada, and Mexico. Government investments in semiconductors and related sectors across the U.S. and Canada, which subsequently drives the demand for such equipment for coating and photo masking applications, further drives the market growth in the region.

Europe is set to observe moderate growth during the forecast period, owing to countries such as Italy, Germany, the U.K., and France which are famous for automotive production. The automotive sector requires several electronic components and semiconductor chips for assembling various modules in the automotive sector. Such factors drive the market growth in the region.

The Middle East & Africa is projected to grow moderately during the forecast period due to a surge in the adoption of electronic devices across various industries, including consumer electronics, automotive, telecommunication, data centres, and healthcare, which is indirectly driving the growth of the market in the region.

KEY INDUSTRY PLAYERS

Major Players are Investing in Semiconductor Materials to Boost the Market Competition

Key players such as ASML Holding N.V., Lam Research Corporation, Screen Semiconductor Solutions Co Ltd, KLA Corporation, and others, are investing in new semiconductor materials and improving the product portfolio of resist processing technology machinery across diversified geographies. In addition, the market is witnessing rising investment by manufacturers in semiconductor materials and related technologies to improve their market share.

For instance, in October 2021, Fujifilm Holdings Corporation invested around USD 4.0 billion in semiconductor materials. In addition, with rising global demand for 5G devices and AI Chips, Fujifilm Holdings Corporation has planned to invest around USD 637.0 million in the semiconductor materials business for 3 years from 2021 to 2024. All such factors fuel the market growth.

List of Top Resist Processing Equipment Companies:

- ASML Holding N.V. (Netherlands)

- Fujifilm Holdings Corporation (Japan)

- JEOL Ltd (Japan)

- EV Group (Austria)

- Lam Research Corporation (U.S.)

- Nikon Corporation (Japan)

- Obducat AB (Publ) (Sweden)

- Screen Semiconductor Solutions Co Ltd (Japan)

- SUSS Micro Tec SE (Germany)

- Tokyo Electron Limited (Japan)

KEY INDUSTRY DEVELOPMENTS:

- December 2023: Tokyo Electron introduced a new Ulucus G thinning system for the fabrication of 300mm silicon carbide wafers. It is used for coating and printing applications. These machines are used to fabricate high-quality semicon wafers, which reduces the manpower needed for mass production capacity.

- March 2023: Obducat Europe GmbH, a subsidiary of Obducat AB (Publ) received an order for supplying of EITRE 3 NIL system for Asian countries. The deal was closed for USD 0.09 million. The deals were made for installing the system in customers’ cleanroom facilities.

- February 2023: Applied Materials Inc. announced the launch of a new Centura Sculpta Patterning technology in EUV lithography, which allows chipmakers to manufacture high-performance semiconductor chips, lowering production costs and reducing complexity in advanced chipmaking applications.

- July 2022: EV Group launched a new Die to Wafer hybrid bonding machinery for making semicon chips and printed circuit boards. These types of machines are used for applications such as microelectromechanical systems, semiconductors, and nanotechnology devices. It is enabled with Artificial Intelligence (AI), augmented reality, and 5G technology.

- July 2022: Lam Research Corporation, Mitsubishi Chemicals Company, and Gelest Inc. signed a strategic collaboration agreement to implement dry photoresist technology for manufacturing next-generation semiconductor devices. This technology offers benefits such as better resolution and reduced production costs.

REPORT COVERAGE

The global market report covers a detailed depth analysis of the research methodology, mode of operation, equipment type, application, and end user. It provides information about leading players in the market and their business overview, product offerings, investments (R&D and expansions), revenue analysis, types, and leading applications of the product. Besides this, it offers insights into the competitive landscape, trends analysis, SWOT analysis, and current market trends and highlights key drivers and restraints. In addition to the abovementioned factors, the market report encompasses several factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.10% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Mode of Operation, Equipment Type, Application, End User, and Region |

|

Segmentation |

By Mode of Operation

By Equipment Type

By Application

By End User

By Region

|

Frequently Asked Questions

A study by Fortune Business Insights Inc. says that the market is projected to reach USD 3.32 billion by 2034.

In 2025, the market was valued at USD 2.31 billion.

The market is projected to grow at a CAGR of 4.10% during the forecast period.

By equipment type, the photoresist coating equipment segment dominated in 2026.

Increasing demand from semiconductor, and consumer electronics application to drive the market growth.

LG Electronics, Stanley Black & Decker Inc, Electrolux AB, Karcher, Panasonic Corporation, Haier Group, and Ecovacs Robotics are major players in the market.

The Asia Pacific market for resist processing equipment is expected to hold the largest share during the forecast period.

By end user, the semiconductor and microelectronics segment dominated in 2024.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us