Satellite Data Services Market Share, Size & Russia/Ukraine War Impact Analysis, By Application (Scientific, Administrative, and Commercial), By Industry Vertical (Defense & Security, Energy & Power, Agriculture, Environmental, Engineering & Infrastructure, Marine, and Others), By End Use (Commercial, Aerospace, Government, and Military), By Services (Image Data and Data Analytics), By Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

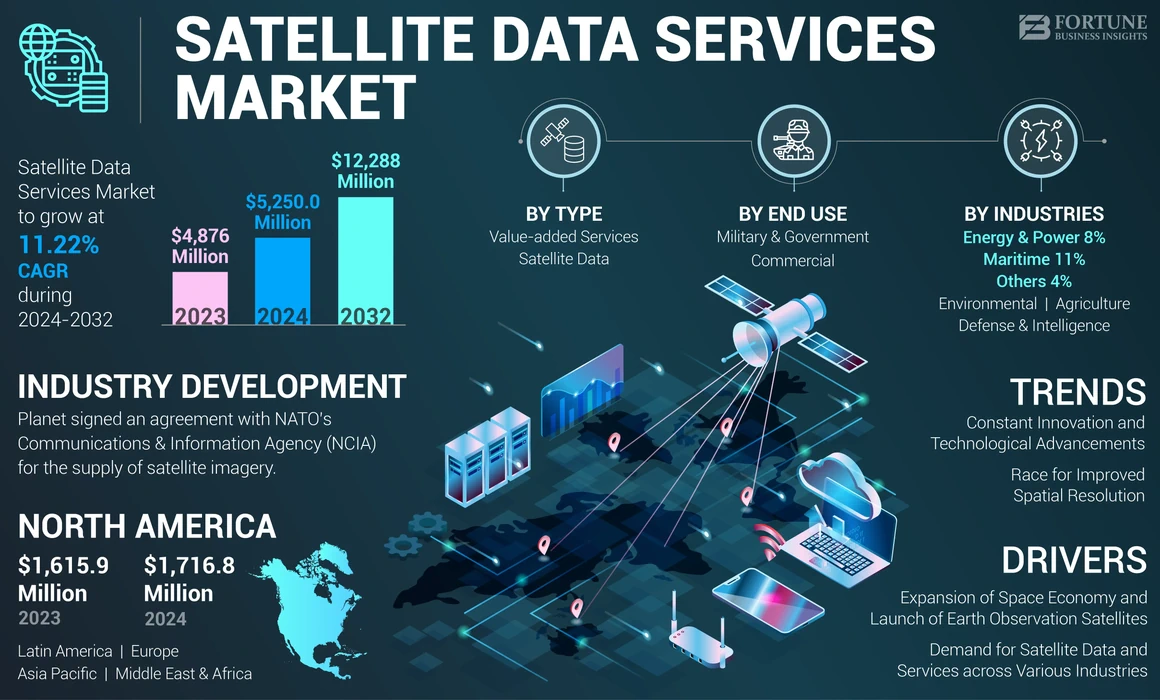

The global satellite data services market size achieved a valuation of USD 4,876 million in 2023, starting from USD 5,250.0 million in 2024 and is anticipated to expand to USD 12,288 million by 2032, exhibiting a CAGR of 11.22% during the forecast period. North America dominated the satellite data services market with a market share of 35.21% in 2023.

Satellite data, often named as satellite imagery, is information collected about the Earth and other celestial bodies by man-made satellites in orbit. The primary application of this data is Earth Observation (EO), which includes monitoring changes in the Earth's surface and weather patterns. The data captured by satellites is important for several purposes, such as environmental monitoring, disaster response, urban planning, and resource management.

Satellite data is generated with the help of two methods: passive remote sensing and active remote sensing. The passive remote sensing technique depends on natural energy sources, such as sunlight. Whereas, active remote sensing makes use of radar waves to measure the signals reflected from the surface of the Earth.

The COVID-19 pandemic negatively impacted the satellite data services market by causing delays in satellite production and launches. Such delays resulted in disruptions in supply chains and project completions, which affected revenue generation. However, as demand for satellite imagery and data surged for crisis monitoring and remote sensing applications post-pandemic, the market began to recover.

Global Satellite Data Services Market Key Takeaways

Market Size & Forecast

- 2023 Market Size: USD 4,876 million

- 2024 Market Size: USD 5,250 million

- 2032 Forecast Market Size: USD 12,288 million

- CAGR: 11.22% from 2024–2032

Market Share

- North America dominated the satellite data services market with a 35.21% share in 2023, driven by its advanced space infrastructure, presence of major companies like Maxar and Planet Labs, and extensive investments by government agencies such as NASA and the U.S. Department of Defense.

- By type, the Value-Added Services (VAS) segment holds the largest market share owing to the rising demand for advanced analytics that transform satellite imagery into actionable insights for industries such as defense, agriculture, and environmental monitoring.

Key Country Highlights

- United States: Leads global market adoption due to heavy investment in Earth Observation programs, defense surveillance needs, and innovation in high-resolution imaging by companies like Maxar and BlackSky.

- China: Growing rapidly through the Belt and Road Initiative and significant expansion in commercial remote sensing; recent rankings show China surpassing the U.S. in multiple performance metrics for remote sensing.

- India: Investing in cost-efficient small satellite programs and boosting capabilities in agricultural monitoring, disaster management, and national security.

- European Union (ESA): Driving collaborative projects like the ESA–NASA Joint EO Mission Quality Assessment Framework, promoting SAR and optical data quality and sustainability goals under the European Green Deal.

Satellite Data Services Market Trends

Constant Innovation and Technological Advancements

The satellite data services market is witnessing continuous innovation and advancements in satellite remote sensing and hyperspectral imaging. Major companies in the market, such as Maxar, Planet, and BlackSky, which traditionally focused on optical imagery, are now diversifying their capabilities to include a broader spectrum of data types, such as radar, Radio Frequency (RF), and hyperspectral imaging. This shift is driven by an increasing demand for more complex multi-sensor intelligence solutions. Companies are focused on installing various sensor technologies in satellite systems to enhance their offerings. Moreover, some of them are combining optical imagery with Synthetic Aperture Radar (SAR) and RF data to provide a more comprehensive view of the Earth's surface and activities. The increasing demand for geospatial intelligence in the market is driving innovations that enhance decision-making across various sectors, including agriculture, defense, and environmental monitoring.

Larger companies are acquiring different technologies to create integrated solutions that deliver deeper insights into various phenomena. In addition, Maxar, a U.S.-based space technology company, showed its strategies to enhance its capabilities by forming partnerships with startups, such as Umbra for dedicated access to SAR data and acquiring Aurora Insight for RF mapping. Such partnerships will help the company provide advanced multi-source intelligence products that combine high-resolution optical imagery with SAR and RF data.

Race for Improved Spatial Resolution

Spatial resolution is understood as the minimum distance between two objects that can be distinguished in an image. Improvement of spatial resolution in satellite imagery is indeed a significant trend within the industry. New companies are entering the market to provide high resolution imaging. For instance, companies, such as Albedo and EOI Space are targeting resolutions as fine as 10 cm, while established providers, such as Maxar, Airbus, Planet, and BlackSky are developing satellites with resolutions down to 25 cm and even higher-quality imagery of 15 cm or better. Therefore, companies are making such development strategies to grow their presence and increase their satellite data services market share.

Rising interest in high-resolution imagery is fueled by various sectors, including agriculture, urban planning, and environmental monitoring. Higher spatial resolution allows for better identification of smaller features on the ground, which is critical for applications that need detailed analysis. Moreover, satellite data service providers are developing strategies to enhance the spatial resolution of satellite imagery. For instance, in October 2023, Planet Labs partnered with Impact Observatory to enhance global mapping and monitoring capabilities using AI-powered analytics. Thus, Artificial intelligence (AI) is revolutionizing the satellite data services market by enabling advanced analytics that transform vast amounts of satellite imagery into actionable insights.

With this partnership, customers will be able to experience satellite imagery solutions with 10x enhancement in spatial resolution. PlanetScope’s 3.5m spatial resolution enables customers to classify features in public areas, such as roads, buildings, small areas of vegetation, and small waterbodies.

- North America witnessed satellite data services market growth from USD 1,615.9 Million in 2022 to USD 1,716.8 Million in 2023.

Download Free sample to learn more about this report.

Satellite Data Services Market Growth Factors

Expansion of Space Economy and Rise in the Launch of Earth Observation Satellites Will Augment Market Growth

According to the Economic Web Forum, the space economy is expected to reach USD 1.8 trillion by 2035 owing to advancements in space-enabled technologies. The growth of the space economy has led to increased investments in satellite technology and infrastructure. Governments and private entities are allocating more resources to develop and deploy EO satellites, which enhances the availability of satellite data.

According to Euroconsult, the global space economy was valued at USD 464 billion in 2022. And the Earth observation segment accounts for only about 4% of this total; this segment is anticipated to experience significant growth. Moreover, the European Association of Remote Sensing Companies (EARSC) report states that the Earth Observation sector is expected to grow at a good rate of 10% per year. As the space economy and earth observation industry expands, new commercial opportunities will arise for satellite data services. Companies are increasingly recognizing the value of satellite imagery for applications in agriculture, urban planning, disaster response, and environmental monitoring.

In addition, the launch of new EO satellites is resulting in the growing demand for satellite data services. These satellites are equipped with advanced sensors that provide high-resolution imagery and multi-spectral data, enhancing analysis capabilities. According to the Union of Concerned Scientists (UCS), there were 1,052 EO or Earth Science satellites in orbit at the start of 2022, which indicates a 13.31% increase during the year.

Surge in Demand for Satellite Data and Services across Various Industries to Propel Market Growth

Satellite data is being increasingly used in numerous sectors, including agriculture, defense, environmental monitoring, urban planning, and disaster management. For example, in agriculture, satellite imagery helps monitor crop health and optimize resource allocation, while in defense, it provides critical situational awareness. Industries are becoming increasingly reliant on real-time satellite data to make informed decisions quickly. This is particularly important in sectors, such as disaster response and environmental management where timely information is necessary and capable of changing outcomes.

As awareness of climate change and environmental sustainability grows, the demand for satellite data to monitor land use changes, track natural disasters, and assess resource management strategies has increased. Moreover, the demand for satellite imagery in agriculture is rapidly increasing as these images provide farmers with real-time data on crop health, enabling them to monitor the growth of their harvest. According to a report by the United Nations Food and Agriculture Organization (FAO), farmers utilizing satellite imagery to monitor their crops experience an average yield increase of 12%. Thus, the overview of the market showcases its different applications across industries and rise in the need for real-time information for decision-making, which will drive the growth of the market.

RESTRAINING FACTORS

High Initial Investment Cost to Hamper Market Growth

One of the primary restraining factors of the satellite data services market growth is the high initial investment costs associated with developing and maintaining satellite infrastructure. The launch of a satellite requires significant expenses, including the costs of the launch vehicle, insurance, and logistics. Depending on the satellite's size and complexity, these costs can range from millions to hundreds of millions of dollars. For many companies, especially startups or smaller firms, such high costs can act as a barrier for expanding their presence in the market.

Satellite Data Services Market Segmentation Analysis

By Type Analysis

Value Added Services Holds the Largest Share Due to Rising Need for Advanced Analytics for Informed Decision Making

On the basis of type, the market is classified into satellite data and value-added services.

The Value-Added Services (VAS) segment is the dominant segment within the market as there is an increase in the need for advanced data analytics services across various industries looking for actionable insights from satellite data. Companies are making use of satellite imagery and detailed analytics tools to derive meaningful information for decision-making. The value added services segment is also expected to grow at a faster pace during the forecast period owing to the development of advanced analytics services on subscription basis model. For instance, companies, such as EOS Data Analytics, Planet Labs, and others provide advanced analytics services, such as EOSDA geospatial analytics solutions and Planet Analytic Feeds for detailed satellite imagery analysis and insights. Value-added services are being increasingly applied in many sectors, such as defense, agriculture, energy, and transportation. In the agriculture industry, satellite data is used for precision farming to monitor crop health and optimize resource allocation. In defense, it aids in surveillance and reconnaissance efforts. The versatility of satellite data applications will drive the demand for tailored value-added services.

- The Maritime segment is expected to hold a 11% share in 2023.

- The Environmental segment is expected to hold a 16% share in 2023.

- The Others segment is expected to hold a 4% share in 2023.

To know how our report can help streamline your business, Speak to Analyst

By Industries Analysis

Defense & Intelligence Segment Held Largest Share Due to Rise in Demand for Surveillance and Reconnaissance

On the basis of industries, the market is classified into defense & intelligence, maritime, environmental, agriculture, energy & power, and others.

The defense & intelligence segment is dominant in the satellite data services market due to the increasing demand for satellite imagery and data for military surveillance. Governments and defense agencies use satellite data for surveillance and reconnaissance purposes. The need for real-time intelligence to monitor borders, track military activities, and assess potential threats has increased the demand for high-resolution satellite imagery in the defense & intelligence industry. Ongoing geopolitical conflicts, such as the Russia-Ukraine war have highlighted the importance of satellite technology in defense operations. The need for accurate and timely information in conflict zones has driven investments in satellite technologies, enhancing situational awareness for military planners.

The agriculture segment is expected to grow the fastest in the market owing to an increase in the use of satellite data for optimizing crop management. For instance, in October 2024, Planet Labs signed a contract with American Crystal Sugar Company, facilitated through its partner SatAgro, to enhance the monitoring of sugar beet crops in the Northern U.S. American Crystal Sugar is expected to use Planet’s high-resolution PlanetScope satellite imagery to obtain near-daily insights to understand the aspects of sugar beet production.

By End Use Analysis

Military & Government Segment Holds Largest Share Due to Rising Adoption of Satellite Data Services for Surveillance & Reconnaissance

On the basis of end use, the market is classified into commercial and military & government.

The military & government segment takes the lead in the market as it is growing significantly as governments of various countries across the globe are encouraging the use of satellite technology and data to support economic development and enhance national security. Such initiatives and support from the government will result in a rise in the demand for satellite data services during the forecast period.

The commercial segment is the fastest-growing segment as numerous companies are utilizing various satellite imagery technologies for purposes, such as tracking vehicle movements, monitoring construction projects, and assessing environmental changes. This trend is particularly evident in sectors like agriculture, where precision farming practices rely heavily on satellite data.

REGIONAL INSIGHTS

The global market is segmented on the basis of region into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America Satellite Data Services Market Size, 2023 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

In 2023, North America emerged as the leading region with a satellite data services market valuation of USD 1,716 million attributed to the region’s deep history of space exploration, advanced technological infrastructure, and rise in the launch of satellite constellations for scientific research and other applications. Investments from government agencies, such as NASA and the Department of Defense are contributing to innovations in satellite technology and Earth observation programs.

Moreover, collaboration between space agencies to ensure the quality of the EO data products is expected to promote the growth of the regional market. For instance, in 2024, the ESA (European Space Agency) collaborated with NASA in Earth Observation (EO), which led to the official signing of the "ESA-NASA Joint EO Mission Quality Assessment Framework – SAR Guidelines" in June 2024. The newly signed framework establishes guidelines for assessing the quality of the EO mission data, specifically tailored for different sensor types, including Synthetic Aperture Radar (SAR) and optical systems.

Asia Pacific is expected to be the fastest growing region in the global market during the forecast period owing to rapid economic development, urbanization, development of small satellites, and advancements in remote sensing technology. Countries, such as China and India are increasingly investing in space programs to enhance their satellite capabilities for applications, such as environmental monitoring, disaster management, and national security. The increasing adoption of satellite data services across sectors, such as agriculture, transportation, telecommunications, and urban planning is driving the market’s expansion in this region.

Moreover, a report titled "Gold Rush: The 2024 Commercial Remote Sensing Global Rankings" reveals that China has surpassed the U.S. in several categories, winning gold in five out of eleven performance metrics compared to four won by the U.S. This highlights the intensifying competition between the two nations in the commercial remote sensing sector. Therefore, such advancements in the remote sensing capabilities are expected to drive the adoption of satellite data services.

KEY INDUSTRY PLAYERS

Key Players Focus On Development of Technologically Advanced Products and Acquisition Strategies to Drive Growth

Prominent market players are prioritizing the advancement of their product offerings. The development of a diverse range of solutions and heightened investment in research and development are key factors contributing to the market dominance of these players. Within the industry, major players, such as satellite operators are embracing both organic and inorganic growth approaches, including mergers and acquisitions as well as the introduction of new products, to sustain their competitive edge.

LIST OF TOP SATELLITE DATA SERVICES COMPANIES:

- ICEYE (U.K.)

- Planet Labs, Inc. (U.S.)

- Capella Space (U.S.)

- Airbus (Netherlands)

- BlackSky (U.S.)

- Maxar Technologies (U.S.)

- Spire Global (U.S.)

- EOS Data Analytics, Inc. (U.S.)

- L3Harris Technologies, Inc. (U.S.)

- Satellite Imaging Corporation. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- September 2024- ICEYE received a contract from NASA for a period of 5 years to provide Synthetic Aperture Radar (SAR) data for its Commercial Smallsat Data Acquisition (CSDA) Program, indefinite-delivery/indefinite-quantity (IDIQ). The data will be used by NASA to support the scientific research, analysis, and application objectives of NASA’s Earth Science Division.

- September 2024- BlackSky Technology received a contract from the Australian startup HEO to provide imagery of space objects, thereby enhancing the capabilities of defense, intelligence, and commercial applications. Under this contract, BlackSky is expected to integrate its high-resolution Synthetic Aperture Radar (SAR) imagery into HEO's non-Earth imaging sensor network. The company will conduct real-time monitoring of space objects, which is crucial for space situational awareness in an increasingly competitive environment.

- September 2024- Capella Space Corp. was awarded a USD 15 million contract by the U.S. Air Force as part of the AFWERX Ventures Strategic Funding Increase (STRATFI) program. This funding was made to drive innovation in the private sector and enhance the capabilities of the U.S. Air Force. This investment is expected to support the development of a next-generation SAR sensor that will provide enhanced resolution and new features.

- August 2024- Planet signed an agreement with NATO’s Communications and Information Agency (NCIA) for the supply of satellite imagery. With this agreement, Planet is expected to provide high-resolution data from its SkySat fleet as part of the Alliance Persistent Surveillance from Space (APSS) program.

- April 2024- Planet Labs announced the debut of the Planet Insights Platform, a new integrated platform that combines Earth-observation datasets with Sentinel Hub's cloud-based analytics and tools. This platform aims to facilitate rapid data analysis, streaming, and distribution for both government and commercial customers.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on important aspects, such as key players, type, industry, and end-users in various regions. Moreover, it offers deep insights into the market trends, competitive landscape, market competition, satellite data services pricing, and market status, and highlights key industry developments. Also, it encompasses several direct and indirect factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Unit |

Value (USD Million) |

|

Growth Rate |

CAGR of 11.22% from 2024 to 2032 |

|

Segmentation

|

By Type

|

|

By Industries

|

|

|

By End Use

|

|

|

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global satellite data services market size was valued at USD 4,876 million in 2023 and is projected to grow from USD 5,250 million in 2024 to USD 12,288 million by 2032, at a CAGR of 11.22% during the forecast period.

Registering a CAGR of 11.22%, the market will exhibit significant growth over the forecast period.

Satellite data services are used in environmental monitoring, disaster response, agriculture, urban planning, defense, and resource management. They provide insights through Earth observation (EO) using high-resolution imagery and geospatial analytics.

Key growth drivers include the rapid expansion of the space economy, increasing launches of Earth observation satellites, rising demand for geospatial intelligence, and widespread applications across agriculture, defense, and climate monitoring.

North America held the largest market share in 2023, accounting for 35.21% of the global revenue, driven by strong space infrastructure, high satellite deployment rates, and robust demand from government and commercial sectors.

Emerging technologies like hyperspectral imaging, synthetic aperture radar (SAR), AI-powered image analysis, and radio frequency (RF) monitoring are significantly enhancing data precision and expanding use cases in the satellite data services market.

The market is segmented into value-added services and data-as-a-service. Value-added services dominate due to their ability to provide actionable insights, visual analytics, and tailored geospatial solutions for industry-specific needs.

Leading companies include Maxar Technologies, Planet Labs, Airbus, BlackSky, and L3Harris Technologies. These firms invest heavily in satellite networks, AI integration, and partnerships to deliver advanced data services globally.

The main challenge is the high cost of satellite launch, maintenance, and data acquisition, which can limit market access for smaller firms. Data privacy regulations and latency in data delivery are also emerging concerns.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us