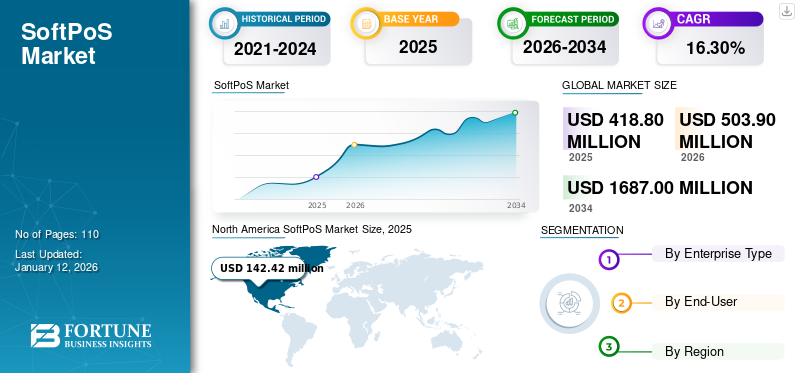

SoftPoS Market Size, Share & Industry Analysis, By Enterprise Type (Small Business and Medium Business), By End-User (Retail, Restaurants/Hospitality, Service Based Business, and Others), and Regional Forecast, 2026-2034

SoftPoS Market Size

The global SoftPoS market was valued at USD 418.8 million in 2025 and is projected to be worth USD 503.9 million in 2026 and reach USD 1,687.00 million by 2034, exhibiting a CAGR of 16.30% during the forecast period. North America dominated the global market with a share of 34.00% in 2025.

SoftPoS is a software-based contactless payment system that uses Near-field Communication (NFC) technology in tablets and smartphones as a POS terminal and allows merchants to accept digital payments cost-effectively to improve consumer experience. These solutions eliminate the need for additional hardware and reduce the complexities and expense of setting up traditional POS terminals. Soft PoS solutions are also known as tap-on-phone or tap-to-phone solutions.

The rising installation of software point-of sale solutions replaces the traditional POS terminal. This enables contactless payment methods across small and large businesses to improve per-day transactions by providing a superior alternative to standard POS terminals for small & medium-sized businesses.

The COVID-19 pandemic drove financial inclusion, leading to a surge in digital payments leading to an increased penetration of contactless and cashless payment methods without any direct or indirect human contact. The rising use of financial services across the world transforming the ways of payments including receipt, borrowing, and saving promotes the digitalization of payment services which considerably helps to boost the financial ecosystem. These key factors propelled the SoftPoS market growth during the pandemic period.

Furthermore, emergence of wearable payment bands, smartphone penetration, and SoftPoS adoption across the SMEs is expected to drive the market in the coming years.

SoftPoS Market Trends

Emergence of Wearable Payment Bands

The emergence of payment bands aims to eliminate the need for traditional hardware devices to carry out seamless contactless payment transactions and to provide mobility advantages over contactless POS terminals. The wearable devices operate on barcode, Near-field Communication (NFC), and Radio Frequency Identification (RFID) technologies to make contactless payments. For instance, in November 2022, BillBox launched a new wearable device, TapTap, for consumers allowing them to perform contactless payments by forming a partnership with Visa and National Securities Depository Limited (NSDL) Payments Bank.

Thus, the usage of wearable payment bands helps to reduce queues and provides a more personalized customer experience with biometric authentication.

Download Free sample to learn more about this report.

SoftPoS Market Growth Factors

Surge in Number of Smartphones to Enhance Product Adoption

SoftPoS converts the latest generation smartphone or tablet into a contactless payment acceptance device. This simplifies and speeds up the retailer's setup process and avoids the costs associated with traditional POS devices. For instance, in March 2022, Nets, a subsidiary of Nexi Group, introduced a new payment solution “SoftPay.io”, which enables Android-based mobile phones of the merchants as a payment terminal to accept contactless payments without any hardware.

The tap-to-phone solution allows merchants to accept digital payments and eliminate the cash-handling overheads. According to MasterCard Poll, around 40% of Americans use Android phones of merchants to run the SoftPoS application for contactless transactions. This results in the rising number of smartphones, propelling the demand for these solutions and offering great opportunities to merchants.

RESTRAINING FACTORS

Limitation to Android-based Mobile Phones to Restrain the Product Adoption

The SoftPoS technology enables the mobile phones of merchants to accept contactless payment transactions on Android phones only. Despite gaining traction across small and large businesses, these solutions are limited to Android NFC-enabled mobile phones only with limited transaction amounts. This factor may hamper the market growth. However, NFC- enabled Android phones are not for commercial use and are primarily intended for independent business owners. This results in large-size enterprises using other payment options for contactless payments across the world.

SoftPoS Market Segmentation Analysis

By Enterprise Type Analysis

Rising Product Adoption Among Small Size Businesses Due to Low Setup Cost to Drive the Market Growth

Based on enterprise type, the market is divided into small business and medium business with a share of 51.92% in 2026. Among these, the small business segment is likely to exhibit a substantial growth rate over the forecast period. Due to low cost, user-friendly and complete operational secure nature, the demand for contactless solutions among merchants and small businesses is increasing day by day. Moreover, the small business segment is expected to hold the largest SoftPoS market share during the forecast period. However, medium businesses use different payment gateways due to limited transactions.

By End-User Analysis

To know how our report can help streamline your business, Speak to Analyst

Retail Industry to Exhibit Highest CAGR Owing to Rising Number of Transactions

On the basis of end-user, the market is divided into retail, restaurants/hospitality, service based business (theater and beauty salons), and others (trade people and charity collectors). Amongst these end-users, the retail segment is projected to hold a prominent CAGR during the forecast period with a share of 36.38% in 2026. The large number of transactions and small payments among the retail industry increases the usage of tap-on-phone solutions by merchants through which they can accept contactless payments directly from their mobile devices. Similarly, the solutions used by restaurants help to track the inventory, online ordering, and restaurants' daily operations. Thus, the restaurants/hospitality segment fuels the demand for SoftPoS solutions. This software point-of sales solution is also suitable for delivery and service-based businesses such as plumbers and electricians.

REGIONAL INSIGHTS

The global SoftPoS market scope is classified across five regions, North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America SoftPoS Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

North America is projected to hold the largest market share dominated the market with a valuation of USD142.42 billion in 2025 and USD 169.29 billion in 2026, owing to the presence of a large number of market players and a large number of SoftPoS solution users across the region. According to RBR Global Payment Cards Data, the percentages of contactless transactions in North America excluding the U.S. in years 2020 and 2021 stood at 17% and 24%, respectively along with 3% and 4% in the U.S. alone. The rising development of the retail & e-commerce sector generates demand for the adoption of tap-to-phone solutions to deliver safe and secure payment options to the users present across the region.The U.S. market is projected to reach USD 88.46 billion by 2026.

A surge in usage of NFC-enabled smartphones or tablets and growing awareness of contactless payment methods eliminate the need for additional hardware with a lower cost of tap-to-phone solutions. According to RBR Global Payment Cards Data, the percentages of contactless transactions in 2020 and 2021 were 22% and 23%, respectively. Technological advancements in products, such as controllers, NFC tags, NFC readers, and antennas, are resulting in the highest market growth in Asia Pacific.

The region continues to lead in the use of mobile wallets at the point of sale, with approximately 40% of in-store payments in the region now being processed contactless. Thus, the region is expected to grow with the highest CAGR over the forecast period.The Japan market is projected to reach USD 28.87 billion by 2026, the China market is projected to reach USD 13.63 billion by 2026, and the India market is projected to reach USD 35.86 billion by 2026.

Europe is anticipated to demonstrate a prominent CAGR during the forecast period due to the growing usage of the Buy Now, Pay Later (BNPL) scheme via online shoppers. The U.K. leads Europe when it comes to accepting contactless payments. In Germany, around 71% of people under the age of 40 use digital payment methods and 36% of them use contactless card payment and mobile payment methods. Thus, the massive usage of mobile payment and contactless payment methods is strengthening the market position across Europe.The UK market is projected to reach USD 24.36 billion by 2026, while the Germany market is projected to reach USD 14.18 billion by 2026.

The Middle East & Africa and South American markets showcase slower growth as compared to other regions in the overall market. The major reason holding back these regions is that they are in their developing phase. However, several colossal market players are focusing on expanding their business operations in these regions. For instance,

- May 2023 – OMA Emirates Group LLC completed its collaboration with UnionPay International with the intent of developing Soft POS. This new launch will focus on increasing the acceptance of touch points across the Middle East and Pakistan.

Moreover, the increasing inclination of businesses across these regions to focus on technological advancements and the integration of new-age technologies, such as AI and ML, to digitize payment methods is helping these regions expect a healthy growth rate in the coming years.

Key Industry Players

Key Players Focus on Developing Platforms to Strengthen their Positions

The key players are investing their efforts in the development of SoftPoS solutions to help merchants and other users to accept contactless payment easily and securely. Tidypos AS, CM.Com, Bindo Labs Group Limited, Worldline, Fairbit LLC, Alcineo, Ingenico (Phos), Fime SAS, and others are the prominent players in the market. Advancements to the product portfolio are helping key players maintain their competitive edge. With the growing availability of SoftPOS solutions, businesses can provide their customers an additional seamless, secure, and convenient way to make payments. This not only enhances the payment experience but also opens up new business opportunities for merchants of all sizes and markets. To add to this, companies are also prioritizing relevant business strategies, such as collaborations, partnerships, and others, to make advancements and enhancements in their product offerings.

List of Top SoftPoS Companies:

- Tidypos AS (Norway)

- CM.Com (Netherland)

- Bindo Labs Group Limited (U.S.)

- Worldline (France)

- Fairbit LLC (U.S.)

- Asseco SEE (Payten) (Turkey)

- Alcineo (France)

- Fime SAS (France)

- Ingenico (Phos) (Bulgaria)

- WIZZIT (Pty) Ltd (South Africa)

- EMI Global Corp (M4 Bank) (UAE)

KEY INDUSTRY DEVELOPMENTS:

- February 2024 – PayTabs Group entered into a strategic partnership with Nearpay with the intent of offering an elevated soft POS payment experience. With this partnership, the company intends to offer its end users across Jordan and other company markets in the region an enhanced customer experience.

- March 2023 - Ingenico completed the acquisition of a software-only Point of Sale solutions provider, Phos. With this acquisition, the company aims to expand its offer for merchant payment acceptance through smartphones.

- March 2023 – PAYM8 entered into a partnership with WIZZIT to launch Tap-on-Phone solution. This solution aims to replace traditional point-of-sale devices and is projected to offer frictionless payment by following the Visa and MasterCard requirements.

- July 2022 – TAS introduced SoftPoS solution for merchants and banking operators to accept contactless payments from Android devices. Android devices work as a ready-to-use payment terminal without using any hardware, which makes the payment process simple.

- May 2022 - PayPal Holdings, Inc. launched a new solution named Zettle Terminal with Tap to Pay function with Zettle by PayPal for small businesses operating in the U.K. The solution with a new function helps merchants and small-scale enterprises to accept contactless payments within minutes on their Android devices with no extra hardware or fees.

REPORT COVERAGE

The research report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product types, and leading applications of the product. Besides this, the report offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 16.30% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Enterprise Type, End-User, and Region |

|

Segmentation |

By Enterprise Type

By End-User

By Region

|

Frequently Asked Questions

The global SoftPoS market was valued at USD 418.8 million in 2025 and is projected to be worth USD 503.9 million in 2026 and reach USD 1,687.00 million by 2034, exhibiting a CAGR of 16.30% during the forecast period.

In 2025, the market size stood at USD 418.8 million.

The market is projected to grow at a CAGR of 16.30% over the forecast period.

The retail segment is likely to lead the market.

A surge in smartphone usage is set to enhance the product adoption, driving the market growth over the forecast period.

Tidypos AS, CM.Com, Bindo Labs Group Limited, Worldline, Fairbit LLC, Alcineo, Ingenico (Phos), and Fime SAS are the top players in the market.

North America held the largest market share in 2025.

Asia Pacific is expected to grow with the highest CAGR over the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us